Lending Club has been sweeping the investment world and the borrowing universe at the same time. And why not? It’s an amazing service!

Who wouldn’t be interested in a financial institution that enables investors to earn more than the going rate on their money while borrowers pay less? To help you get a better picture I put together this Lending Club review for investors and borrowers.

Who wouldn’t be interested in a financial institution that enables investors to earn more than the going rate on their money while borrowers pay less? To help you get a better picture I put together this Lending Club review for investors and borrowers.

I’ll start off this Lending Club review by explaining what it is and how it works for investors and borrowers. Later, I’ll walk you though an example of how you can invest in Lending Club by investing some of my own hard-earned dollars.

Additionally, I’ll cover what you might expect to earn from Lending Club as well as Lending Club fees. It’s important to understand how Lending Club defaults work, so I’ll cover that as well. Let’s begin!

What is It? and Is Lending Club Legit?

Lending Club is an online peer-to-peer (P2P) lending platform that takes the banker out of banking. Investors lend money directly to borrowers through the website, enabling both to benefit from the rate of interest established for each loan.

And just as important, the entire transaction happens online, eliminating the need for sometimes embarrassing face-to-face meetings common with bank loans. It’s a win-win as both the investor and the borrower benefit from the Lending Club process.

As of December 31st, 2015, Lending Club has facilitated loans totaling well in excess of $15 billion. This includes more than $2.5 billion issued in just the last quarter.

Lending club is legit for both investors and borrowers. This Lending Club review, unlike some others, will review the service from both sides of the deal. Make sure to read about my experience below before you invest or borrow with Lending Club.

Investing Through Lending Club Review

With interest rates on safe, fixed income investments sitting generally at below 1%, Lending Club offers a real opportunity to get dramatically higher returns. In fact, you can get average returns of between 5.06% and 8.74% (do I have your attention now?).

With interest rates on safe, fixed income investments sitting generally at below 1%, Lending Club offers a real opportunity to get dramatically higher returns. In fact, you can get average returns of between 5.06% and 8.74% (do I have your attention now?).

Those are attractive rates, but just so we’re clear, there are more risks with Lending Club investments than there are with bank certificates of deposit. Plus, there are certain requirements you have to meet as an investor. Remember, the higher the potential reward, the higher the risk.

Investor Requirements

Notes are not available in all states. As of this initial writing, they are not available to residents of Kansas, Maryland, Ohio, Oregon and the District of Columbia.

Depending on which state you live in, there are income requirements to invest in Lending Club. In most states it’s a minimum of $70,000 per year, though it may be higher in some states. Generally, the income requirement does not apply if you have a minimum net worth of $250,000. The platform also requires you invest no more than 10% of your net worth in Lending Club notes.

The minimum opening account with Lending Club is $25, which is also the minimum requirement to invest in any single note.

Lending Club IRA

You can also hold Lending Club investments as part of an individual retirement account (IRA). You can do this through a Lending Club self-directed IRA. Lending Club will pay the annual IRA fee if you open the account with a minimum of $5,000 and keep that balance level for a minimum of 12 months.

After the first year, they will continue to pay the fee as long as you maintain a minimum invested balance of $10,000 in Lending Club notes.

Lending Club IRAs come in two flavors, Traditional IRA or Roth IRA. As you know, I’m a big fan of the Roth IRA. This is just one more way you can invest in your future. But, I wouldn’t keep all of your retirement money there. Roth IRAs aren’t for everyone, so be sure to speak with a financial advisor before you sign up for this specific type of investment.

Choosing Notes to Invest In

There are two ways to invest with Lending Club. Manual investing is where you browse available loans and choose which ones you’ll invest in one at a time. But you can also use automated investing in which you set investment criteria, and notes are selected automatically based on that criteria.

While you can invest in individual loans, it’s generally best to buy them in fractions (which are referred to as notes). You can purchase notes in increments of $25. At the very least, you can purchase a fractional interest in 200 loans with a total investment of $5,000. This will enable you to minimize the risk involved in investing in any single loan.

Collecting Investment Returns

It’s important to understand the notes you’re investing in are not like certificates of deposit. Each note represents a loan which will be repaid to you over the term of the loan. These payments will include both interest and principal.

That means at the end of the loan term, the loan will be completely extinguished (including 100% of your original principal invested). For this reason, you will need to reinvest payments received on a continuous basis as you receive payments.

Lending Club Loan Types and Loan Grading

Loan terms are either 36 months or 60 months, and are fixed-rate. More than 80% of the loans are taken to refinance existing loans and credit card balances. Borrowers are evaluated – and loans are priced – based on credit and credit scores, debt-to-income ratios (DTI), the length of your credit history, and your recent credit activity.

Each loan is assigned a loan grade, ranging from “A” (the highest) to “G” (the lowest). The higher the grade, the lower the rate. For example, when initially checked, a A-grade loans had an average rate of 7.51% while G-grade loans had an average rate of 25.13%.

Within each letter grade, Lending Club also assigns a numerical rank of between 1 and 5 (A1, A2, A3, A4, A5). These numeric sub-grades adjust for other factors, such as loan size and loan term. For example, a loan amount of $5,000 would be seen as low risk, and actually result in an improvement in the sub-grade. By contrast, the maximum loan of $35,000 is a higher risk, and could turn a B1 grade into a B4 or B5 grade, resulting in a slightly higher interest rate.

Buying and Selling Notes Before they Mature

Lending Club offers their Note Trading Platform through Folio Investing where you can sell the remaining portion of a note under certain circumstances. This is a marketplace where investors can buy and sell Lending Club notes to one another.

In order to participate in this marketplace, you must also open a Folio Investing trading account through Lending Club. There are no fees if you buy notes on the trading platform, but there is a 1% fee charged if you sell a note.

Risks

It’s important to realize investments held through Lending Club are not bank assets, and as such they are not insured by the FDIC. Individual loans can go into default, and if they do, you will lose that portion of your investment.

In addition, a missed payment by a borrower means you will not get the payment on that loan in that particular month. Lending Club does use “best practices” to collect payments from delinquent borrowers, but some will default nonetheless.

When a payment is past due, you as an investor will pay a collection fee of 18% if the loan is at least 16 days past due but no litigation is involved. If litigation is required, you will be required to pay 30% of an attorney’s hourly fees, plus attorney costs.

If collection efforts fail, and it is apparent the borrower cannot repay the loan, the loan will be charged off once it is 150 days past due. When that happens, the remaining principal balance of the note will be deducted from the investor’s account balance. Any funds subsequently recovered on the defaulted loans will be returned to the investors on a pro-rata basis. This is a known risk if you invest in Lending Club, and you rarely see it come up in any complaints that people have about the site.

Minimizing Investment Risks

Just as is the case when you’re investing in a portfolio of stocks and bonds, there are ways you can invest in Lending Club that will reduce your overall risk. The most obvious strategy, of course, is to spread your investment over many different loans – hundreds if you’re in a position to do so.

You can minimize your risk by setting certain loan requirements. For example, you may decide to set a credit score that is some number higher than what is required by Lending Club (currently 660). You can also emphasize loans in which borrowers are refinancing existing debt, rather than taking on new debt. Employment stability is also a factor. A person who has been employed in their field for a number of years is likely to be more employable than one who is just starting out.

A low DTI is also a positive factor. For example, you can make sure the borrowers whose loans you invest in have a DTI of less than, say, 30%. This means their fixed monthly expenses, including their housing expense, the new loan payment, and any other fixed payments do not exceed 30% of their total gross monthly income.

Investor Fees

There are fees charged to investors with Lending Club. However, the fees are collected only when you receive a payment from a borrower. For example, there is a 1% service fee collected on each payment received.

Investing through Lending Club can provide you with excellent high income diversification in a fixed income portfolio. Just by investing a portion of your fixed income allocation in Lending Club notes can increase the overall yield on your fixed income investments.

Open an Investment Account with Lending Club

Borrowing Through Lending Club Review

Not only can you invest with Lending Club, you can borrow with Lending Club as well! Truly, whatever your needs are, you can get a fantastic deal through Lending Club.

You can typically get lower interest rates on loans through Lending Club than you can at a bank. You can also apply for a loan without ever leaving your home. Everything is done online through the website, virtually eliminating the need for an uncomfortable face-to-face meeting at the bank offices. And if your loan is approved, your funds will arrive within a few days.

How the Lending Club Loan Process Works

This is a simple multi-step process that looks something like this:

- Complete an application on LendingClub.com.

- Your application is evaluated and your credit score is pulled (this is a “soft inquiry” that will not have a negative impact on your credit score).

- As described in the preceding section, you are assigned a risk grade of somewhere between A1 (highest grade, lowest rate) and G5 (lowest grade, highest rate). Once again, this grade is based on a combination of your credit score and credit history, employment, income, and your debt-to-income ratio (DTI).

- Your loan is given an interest rate based on your risk grade.

- You are presented with a variety of loan offers.

- Investors will review your criteria and loan grade and decide if they want to invest in it.

- Once all parties agree to the transaction, the loan goes through and your funds are available within a few short days.

If you’re concerned about privacy during the application process, you don’t need to be. Lending Club investors will never know your identity so you’ll be able to borrow on a completely anonymous basis. The site also promises it will never sell, rent, or distribute your information to third party websites for marketing purposes.

Lending Club Loan Terms and Rates

You can borrow any amount up to $35,000, and while the loans are typically used for refinancing debt or debt consolidation, you can also borrow for other purposes, such as unsecured home improvement loans. Current terms are fixed-rate loans of either 36 months or 60 months.

Interest rates on personal loans range from a low of 5.49% for A1 risk grades to a high of 28.69% for G5 risk grades. Origination fees range between 1% and 5% of the initial loan amount. There are no application fees involved in the process.

Lending Club also offers business loans in amounts as high as $300,000, and fixed-rate loan terms ranging from one to five years. There are specific requirements based on the size and nature of your business, and I’ve seen advertising rates as low as 5.90% and origination fees of between 0.99% and 5.99% of the initial loan balance.

In order to keep interest rates as low as possible, Lending Club sets up your loan with automatic draft payments from your bank account. In the event you need to pay by check, they will charge a $15 check processing fee per check.

Best of all, there are no prepayment penalties should you decide to pay off your loan early.

Lending Club Personal Solutions – Medical Loans

This is a loan type whose time has truly come!

Given that health insurance deductibles and co-insurance provisions are increasing, Lending Club Personal Solutions gives you an option to finance uncovered medical expenses. And here’s something even more interesting: the loan can even be used for procedures such as hair restoration, weight loss surgery, fertility, and dental – procedures that are typically excluded under most health insurance plans.

Lending Club offers two types of loans for this purpose:

- Extended Plans – You can get a loan for between $2,000 and $50,000, at rates that range between 3.99% and 19.99% per year, depending on the size of the loan and your credit history. The terms can be 24-, 36-, 48-, 60-, 72-, or 84-months. This loan can be used to pay for fertility, dental, hair restoration, and weight loss surgical procedures.

- True No-Interest Plans – This loan program offers 0% APR for terms of 6-, 12-, 18-, or 24-months, and for loan amounts ranging from as little as $499 up to $32,000. After the no-interest term expires, a variable rate of 22.98% APR applies on the remaining balance (this arrangement is similar to the one offered by CareCredit, but at a lower rate of interest after the initial 0% interest period). And if you can pay off the loan within the 0% interest term, you can get funds for medical procedures without having to add interest to the cost of an already expensive operation.

These loans from Lending Club can really come in handy when you’re out of options.

Open an Borrower Account or Business Borrower Account with Lending Club

How I’m Investing Using Lending Club

What I really want to do today is walk you through how I am investing with Lending Club. While we’ve already covered details on how to invest and borrow with Lending Club, I thought I’d show you a little bit of my personal experience with investing using the peer-to-peer lender.

I have been investing with Lending Club for a few years now. I don’t have a whole lot invested, and you’ll actually see that here in a minute because I really didn’t understand it and I wanted test it out first. I wanted to test-drive it before 1) I put more money into it and 2) before I recommended people take a look at it.

Below, you’ll see a screenshot of the website. I went ahead and logged in so you can see where I’m at right now. Right now, I have invested a total of $2,200, so not a big investment by any means.

My net annualized return is 10.83%, so right off the cuff you can see I’m already making more than the average investor at Lending Club is making – almost a full percentage point more. That’s not because I am a uniquely great investor. I’m actually very passive in the way I choose my notes, which I’ll show you here in a minute.

I currently have $525 sitting in cash in my Lending Club account that I need to invest, and that’s exactly what I’m going to use today to show you how to invest.

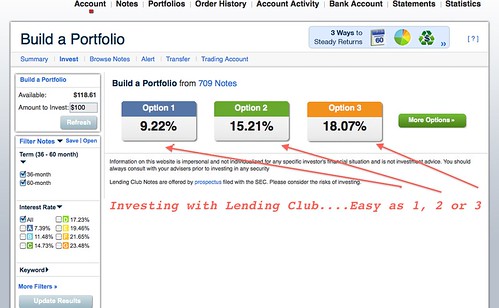

I love Lending Club because they keep things simple. For the people who don’t like to spend a lot of time doing research, they make it very, very simple in that you can choose option one, option two, or option three. Let’s just assume you have a high tolerance for risk and you are looking at the 17% figure. You look at that number. You’re drooling over it. You want it. That’s how much you want to make.

By quickly clicking that option, they will show you where you are investing your notes (the agreements you have with people you’re lending your money to). They’re ranked similarly to that of a report card or a bond.

Initially, you’ll notice by going the more aggressive direction you do not have any of the A- or B-type investors. These are your higher credit score people. They are less likely to default on their loan, so this is definitely more of a high-yield approach when it comes to peer-to-peer lending.

Of that $525 I have to invest, $100 is going into C notes, $200 is going to D notes, $150 going to E, and $75 going to F. Immediately, Lending Club breaks it down for you automatically. And I can’t tell you how much I love that! That’s actually my strategy. I don’t select the third option. I typically select option one, but immediately they break down the notes for you.

They also show you your average interest rate on that is 17.9% (in this example), but because some of those folks are going to default on their loans, they are estimating you’ll lose 4.42% based on default.

Then there is Lending Club’s charge of 0.52%, so your projected return after it’s all said and done is going to be approximately 12.25%. And that’s approximately. Maybe all of those people do pay you back where you’re all good and you actually make more, but that should just give you an idea.

Lending Club Notes

Let’s just go to the next step real quick. Here is another area where you can start seeing what some of these loans are used for. For example, you might see listed: credit cards, debt consolidation loans, small business loans, and more. You can actually see what these notes are.

Note: You should know I’m going through this process in real time, so I can make sure to show you my thought process along the way using Lending Club as I move from screen to screen.

The amount left is how much more that person needs to borrow to take care of the debt. If you want to take it one step further you now can see more about the individual, their gross income per month, if they’re a homeowner or not, their length of employment, their current employer, where they are located, their debt-to-income, and their credit score range. It just gives you a lot more details about the borrower.

Even more, if you want you can ask them questions if you’re not confident or just need some reassurance. Here’s an example of an asked question:

“What type of business are you starting?”

They said:

“We are purchasing an existing flight school and looking for help with a short-term loan to assist with the down payment.”

Lending Club actually gives you some direct questions to ask. They did change that a little bit over the past few years (I think because of a privacy act), but they give you a lot of the good basic questions to ask.

One thing I didn’t mention is that of the $525 I have to invest, typically only $25 of that is going toward each individual note, so that’s where the diversification comes into play where you’re not putting all your eggs in one basket.

I am going to try option one. I’m much more comfortable with that option. My projected rate of return is going to be lower, but as you can see I’m actually doing better than what was predicted. I think I might have done some high-risk investing in the beginning, but typically I have stuck with option one. You can see I have a lot more of the B borrowers and none on the F and G side. I’m not much on the high yield. I like to be a little bit more conservative with this aspect. Immediately they break it down and it looks like I’m doing some overlap of my last entry so let’s see if we can get that straightened out.

Note: Lending Club’s minimum investment is only $25. That’s it.

The other thing too is you could actually choose the term of the note. Lending Club initially just started out with a 36-month, three-year note. They now offer a 60-month note so that’s actually a little bit more of a return on that one, but you are locked into your own money. You can also sell these notes too, so if you are not wanting to hold it for the maturity you can find a buyer – just like selling stock on the open market.

Choosing Note Options

All right, let’s see if I can finally get this figured out. I just want to invest. I should’ve started with the option one to begin with. Let’s start over. Sorry about that.

Let’s go with option one. I can actually go in there and select notes by themselves. I can add more money to one note, take some money away from another note, etc. You have that ability! You also have the ability to build your own portfolios from scratch, so if you want to go through all of the different available notes, you can do that as well. I personally don’t have interest in that so I don’t. So, with $525 I’m going to invest into 21 different notes and my average rate of return will be approximately 9.58%. A quick look at the notes and we are going to place the order.

You can then give your portfolio a name. I haven’t done a very good job of managing this so I’m just going to assign it to “portfolio 10” and we can go from there. I will soon get a confirmation.

One notable thing is that I’ve just invested $525 into 21 individual notes. Most likely, not all of those notes will get the entire funding. In some cases you won’t get the investment you initially were after. In that case, you would get a refund. From there, you can go out and find some new notes. It most likely will happen, just so you know.

That is it as far as how to invest with Lending Club. It’s so simple! As far as who I would recommend this to – this is not a savings account replacement. This is not a certificate of deposit replacement. Even though you can get a three-year or five-year note you might think of that as a three-year or five-year CD.

There is definitely more risk involved with investing this way so do not make this an apples-to-apples comparison.

How Lending Club Fits in My Overall Portfolio

How do I view Lending Club in my overall investment portfolio? Well, we already have our emergency fund and we have our savings account – this is just something to complement what I’m doing in my stocks. Like I said, I only have a small investment now but we are planning on shifting some more money there.

We were building a house, had some other improvements we were doing, were having a third child, so we wanted to have more in cash then we probably should, but we just felt more comfortable doing that. Now that we have some of those things out of the way I am definitely a lot more comfortable moving some more cash into Lending Club and start making some more interest.

I should also say I have never had any notes default on Lending Club up to this point. I’ve been doing it for just over two years, and I believe and have not had a default yet. I’m not saying I won’t, but I haven’t had one yet. If I do I will definitely report it.

If you have any more questions let me know. You’ll find an affiliate link, so if you do click and open an account I do earn a bit of money for you doing that. You can also go to LendingClub.com directly. I won’t get the commission and that’s fine by me as well.

If you have more questions on my Lending Club review or if you have any experiences, please share. I’d love to hear more about it as this becomes more of a mainstream investing approach for a lot of people.

Lending Club Alternatives

There are other P2P lending platforms popping up all over the web. But Lending Club has become the gold standard for the entire industry. Whether you are an investor looking for an above average rate of return, or a borrower looking for more affordable loan programs, you’ll find what you’re looking for at Lending Club.

This company has continued to grow and prosper over the years. We can expect even better things from Lending Club going forward. And it’s probably not an exaggeration to say that Lending Club just might be the banking platform of the future.

While you can always invest using a more traditional investment platform or borrow money through a bank or credit card, there are only a few other options in the peer-to-peer lending world. The most prominent competitor to Lending Club is Prosper.

These two are the heavyweights in the peer-to-peer lending marketplace – so much so that we put together an in-depth Prosper vs. Lending Club comparison. You can learn more about all the features on Prosper with our Prosper review.

Check out everything Lending Club has to offer, and see if you can’t get a better investment – or a better loan – than what your bank is offering you.

Hey, by the way, if you’re looking for a way to invest your money for the short-term and you’re not really sure if Lending Club is right for you, be sure to read my article: The 11 Best Short-Term Investments for Your Money. It’s packed full of information on how you can invest your money with little risk to swallow.

Remember, only you can make the determination of what’s right for you when it comes to peer-to-peer lending. I wouldn’t recommend putting all your eggs in the Lending Club basket, but it’s certainly an appropriate choice for well-established investors or borrowers needing some money.

Take a look at Lending Club today and see if it’s right for you!

Please note: This article contains affiliate links that may result in providing me with a commission for you signing up for the services listed. Still, my opinions are my own and I wouldn’t steer you wrong.

Source Good Financial Cents http://ift.tt/1F8XY1E