الخميس، 18 أبريل 2019

Detour has nursery in weeds

Source Business - poconorecord.com http://bit.ly/2IFH4oh

Do It for Mother Earth: How Working From Home Can Help You Help the Planet

Need another reason to work from home?

Do it for the planet.

According to a study published by FlexJobs and Global Workplace Analytics, 10 million cars — or approximately the entire New York State workforce — would leave the road each year if every U.S. worker who could and wanted to telecommute actually did.

“There is no single solution that offers as large of a potential environmental impact and reduction in greenhouse gases than having people work at home,” says Kate Lister, president of Global Workplace Analytics. “It is the biggest part of our burden on the planet.”

Pro Tip

By becoming even a half-time remote worker, you’ll gain back an average of 11 days a year that would have otherwise been spent commuting.

By cutting their commutes, the current U.S. work-from-from population keeps the equivalent of 600,000 cars off the road each year.

How much could dropping your commute do to save our planet?

Figure Out How Much Pollution Your Commute Contributes

Your actual contributions can vary based on a number of factors, including your commute time and driving conditions, but you can get a general idea of your personal output with this tool from the Environmental Protection Agency, which calculates your vehicle’s average mileage and CO2 output.

To figure out how much CO2 your commute produces annually:

- Determine the number of miles you travel to and from work each day. For example, let’s say you drive 20 miles each way to work for a total of 40 miles.

- Multiply that number by the number of days you drive to the office for the total number of miles you drive each year. Let’s assume you head to the office five days a week and get two weeks off for vacation: 40 x 250 = 10,000 miles

- Multiply that number by your car’s CO2 output for your total. If your car produces 261 grams (or 0.575407 pounds) of CO2 per mile, then your commute results in 10,000 x .575407 = 5,754 pounds, or 2.877 tons of carbon annually.

Earth Day Tips to Help Remote Workers

Even if working from home isn’t always an option, every day you cut your commute can help, according to Brie Reynolds, senior career specialist at Flexjobs.

“When you’re able to work from home even one day a week, you’re reducing your commute by 20%,” Reynolds says. “Sometimes people think it’s all or nothing, but it can be some kind of compromise.”

Pay Attention to the Thermostat

In addition to cutting the commute, remote work can help reduce the environmental cost associated with working in office buildings, according to Reynolds.

“Energy consumption goes down across the board when you’re able to stop using office space,” she says. “When people work from home, they have more control over their environment — I know a lot of remote workers who pay very close attention to their thermostats.”

By opting to dress in layers or use fans around the house, you can control the comfort level of your space without wasting resources on heating and cooling, Reynolds notes.

Bonus: You can retire that office sweater you wore in your aggressively air-conditioned cubicle.

Pro Tip

Energy consumption goes down across the board when you’re able to stop using office space.

Choose Essential Office Equipment

In addition to the building, an office’s high-volume equipment often requires additional energy to operate and cool, according to Reynolds. Most remote workers can get by on a less equipment, which saves energy and money.

“If you are largely in a role that doesn’t require a lot of extra office equipment, you can get by on pretty much a laptop,” Reynolds says, adding that less equipment also means less of it ending up in landfills.

Reduce Use of Office Supplies

When you use your own office supplies, your cost-cutting tactics can also help the earth. Think: How many sticky notes do you use in the office vs. when you work from home?

“When you’re at home and you are the one responsible, you’re a little more hesitant to print something you don’t really have to,” Reynolds says. “Individual choice and individual consumption is a key piece of the environmental benefits of remote work.”

That’s a win for your employer, you and the environment.

Happy Earth Day!

Tiffany Wendeln Connors is a staff writer for The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2UL2vvc

These 8 Apps Will Help You Save Money — No Matter How Tight Your Budget

Saving money is oftentimes filed under personal finance 101.

It’s easy, they say. You’ve just got to do it! Stay focused! Quell spending temptations!

Honestly, that’s just not the case.

In the United States, only 15% of us can come up with $2,000, according to a Penny Hoarder analysis of Federal Reserve survey data.

If saving money were that easy, that percentage would be a lot higher.

But here’s the thing: There are plenty of money-saving tools out there that’ll make the task way easier. Some of them will even help you grow your stash with that sweet, sweet interest.

We Reviewed ’Em: The 8 Best Money-Saving Apps of 2019

There are so many personal finance apps, which is great, but it can quickly become overwhelming. To help you decide what’s best for you and your financial goals, we rounded up our favorite savings apps (in no particular order).

1. Aspiration: A Free Account With Built-In Savings

A simple way to save money is to open an account that offers a side-by-side spending account and a savings account, like the online-only Aspiration Spend & Save account.

When you open an account, you’ll receive a cash-back debit card that’ll get you 0.5% cash back on all purchases. You’ll also gain access to a high-yield savings account, which will get you 2.00% APY — as long as you deposit $1 a month.

If you’re new to this whole “saving money” thing, it might take some time to strike the right balance between your spending and savings accounts, but Aspiration makes it super easy to shuffle money back and forth.

Best for those looking to open a new, fee-free account and want to earn some extra money with cash back and interest. You only need $10 to open an account.

Cost: Free

Available via desktop, Apple iOS and Android.

Find out more in our Aspiration review.

2. Digit: A Mindless Way to Hit Your Savings Goals

If you have trouble determining just how much money you can afford to put away each month, turn to Digit, an innovative mobile app that’ll do the work for you.

First, download the Digit app, and connect your bank account. (This is where the app will pull money from to go into savings.)

Then set up your savings goals. For example, you can set a goal of $2,000 for a rainy day fund and then $500 for a weekend getaway.

Now, Digit will use its smart algorithms to analyze your income and spending habits to determine just how much you can afford to save. It’ll automatically pull small amounts of money (it promises no overdrafts!) into its FDIC-insured Digit account.

It’ll even send you real-time daily notifications, so your balance is never a surprise. You can pause or tap into your savings at any time — it’ll take one business day for the funds to roll back into your checking account.

Best for those who have a hard time figuring out how much they can afford to save and want to lean on automatic savings.

Cost: Free for the first 30 days, then a monthly fee of $2.99

Bonus: Penny Hoarders will get an extra $5 just for signing up. Additionally, you’ll receive a 1% savings bonus on your average daily balance every three months.

Available via Apple iOS and Android.

Read how one Penny Hoarder mindlessly saved $4,300 in our Digit review.

3. Acorns: A Virtual Piggy Bank Turned Investment Account

If you want to dip your big toe into investing while also stockpiling money, Acorns is a micro-investing mobile app that allows just that.

Download the app, then link up your checking accounts, credit cards and/or debit cards — go wild. (This is all protected, by the way, and your investment portfolio is insured for up to $500,000.)

Now, turn on its round-up feature, and Acorns will act like a virtual piggy bank, rounding up your transactions to the nearest dollar and depositing the spare change into your Acorns account. Then it does all the heavy lifting for you.

You can even earn cash back through Acorns. For example, if you’ve wanted to sign up for Blue Apron, it’ll give you $30 to invest. Or if you book your next Airbnb through the app, you’ll snag 1.8% cash back to go toward your investments.

Best for those who are interested in investing their savings and are willing to take a little risk.

Cost: $1 a month for account balances under $1 million

Bonus: Pocket $5 when you sign up.

Available via Apple iOS and Android.

Check out our Acorns review, and read how Penny Hoarder Dana Sitar was able to save at a rate of $420 a year.

4. Qapital: A Fun (Almost Addicting) Way to Save Money

If you want to, you know, spice things up while saving, look into the Qapital app.

I initially tried Qapital out back in 2016, when I’d just secured my first full-time job and was having a hard time putting any money away. It helped me sneak away $700 in about five months.

When you download the Qapital app, you’ll link up your bank account and set savings goals. Under each goal, you’ll set rules. This is where it gets fun.

For example, if you’re really excited about saving for your trip to the Bahamas, set Qapital to transfer $5 into your Qapital account each time you hit your daily step goal. Or maybe you’re always stopping by Starbucks. Tell Qapital to funnel $1 into your savings each time you go.

(Since I used Qapital, it’s evolved to offer banking and investment services, too, but I’m still keen on its core: saving.)

Best for those who like a good challenge and want turn goal-setting into a game.

Cost: $3 a month for the basic version after a 30-day free trial.

Available via iOS and Android.

5. Twine: A Simple Way for Couples to Band Together to Hit Mutual Goals

If you’re looking for a way to save toward a joint goal with your better half, you’ll want to use the Twine app.

Say you and your honey want to save for a long weekend in the Bahamas. Or maybe you’re looking to buy a home in a few years and want to save for a down payment. Whatever it is, Twine allows you both to work toward that goal.

The app offers two options: You two can save your money in a free joint account with a 1.05% variable interest rate, or you two can invest your money and potentially earn some interest. (That option costs 25 cents per $500 invested.)

To get started, you and your partner will each create Twine accounts, and link your individual bank accounts — this is how you’ll fund your savings. Then, set your goal (vacation, down payment, emergency fund, you name it) and select your monthly deposit amount.

Then, watch your savings grow together.

Best for those who want to make saving money a joint affair.

Cost: Free for saving.

Bonus: Pocket $5 when you sign up.

Available via desktop, Apple iOS and Android.

6. Varo: A Savings Account That Offers Above Average APY

If you’ve got your savings strategy down pat but need a safe place to stash your money, look into an iOS banking app called Varo Money.

Here’s our favorite part: Pair your Varo Bank Account with a Varo Savings Account where you’ll earn 2.12%* Annual Percentage Yield (APY) with the opportunity to earn up to 2.80% APY on up to $50,000 in savings. That’s 31 times — repeat, 31 times — the average savings account, based on a 0.09% average reported by the FDIC.

To qualify for the 2.80% rate, you’ll need to have payroll or government direct deposits of $1,000 or more and authorize at least five purchases with your Varo debit card each month.

Varo goes easy on the fees, too. As long as you use one of the more than 55,000 Allpoint® ATMs in its affiliated network across the world, you won’t pay ATM fees.

Additionally, the minimum balance to open the account is just a penny; you’ll pay no monthly service fees, no minimum balance fees, no foreign transaction fees and no cash replacement fees. You’ll just pay any fees charged by out-of-network ATMs and cash deposit fees if you deposit cash in-store through the Green Dot® Network.

Best for those who need a separate, hands-off account to stow their money and to take advantage of compound interest.

Cost: Free

Available via Apple iOS.

*Varo disclosure: APY is accurate as of January 29, 2019. This rate is variable and may change. No minimum balance required to open account. Balance in savings must be at least $0.01 to earn interest. Deposits are FDIC insured to at least $250,000 through The Bancorp Bank; Member FDIC.

7. Stash: A Choose-Your-Own-Adventure Investing App

If you’re interested in investing your savings, all you need is your phone, an app called Stash and $5 to start.

This app offers all the tools you need to turn investing into a totally passive activity.

You can opt to round-up your purchases and invest the spare change, set Stash to withdraw money on a set schedule or rely on its Smart-Stash feature, which will analyze your income and expenses to determine how much you can afford to invest.

Stash your money into more than 150 ETFs and individual stocks. Because these are micro-investments, you don’t have to invest a ton of money to get started.

Best for those who want to automate their savings stash — then invest it.

Cost: $1 a month for accounts with balances under $5,000; balances of $5,000 or more cost 0.25% a year*

Bonus: The Penny Hoarder has teamed up with Stash to give you a $5 sign-up bonus after you make your first investment.

Available via Apple iOS and Android.

Get more information in our comprehensive Stash app review.

*Clients may incur ancillary fees, charged by Stash, its custodian or both, that are not included in the monthly Wrap-Fee.

8. Chime: A Bank That’ll Do All The Hard Work For You

If you’re looking to combine a number of options on this list into one easy-to-use app, turn to Chime.

When you sign up for Chime, you’ll gain access to an online checking and savings account. Because they’re connected, it’s easy to transfer money back and forth.

But more than that: Whenever you make a transaction with your Chime debit card, it’ll round up your purchase automatically and dump the change into your savings. You can schedule automatic transfers into your savings account, too.

It takes all of about five minutes to open your Chime account.

Best for those who are sick of downloading new apps and simply want their financial institution to take care of the whole saving thing for them.

Cost: Free

Available via Apple iOS and Android.

We wrote even more about Chime’s saving options in our review.

Need More Help? Find Your Perfect Budgeting App

If you’re still struggling to save money, you might need to go back to the basics with a budgeting app. By setting up a budget and tracking your expenses, you’ll be able to find exactly where you’re overdoing it and how you can better achieve your financial goals.

One we suggest starting with is Clarity Money*, a free app that helps you see, organize and take control of your finances.

The way it works is simple. You just download the app, connect your existing accounts, and get ready to learn more about where your money’s disappearing to… and how to keep more of it.

Clarity Money analyzes and uses your spending history to provide budgetary insights. It’ll show you exactly how much you spend in different categories, like bars and restaurants, as a percentage of your total expenses.

But it’s not just a recap of your weekend spending with pretty graphics.

It also gives you the tools and information you need to start making better financial choices. And they’re all super-easy to use, and accessible right inside the app.

Disclosure: Clarity Money compensates us when you download the app using the links we provide.

If you want more money-management tools, check out eight of the best budgeting apps, which includes everything from Mint to You Need a Budget (YNAB).

Carson Kohler (carson@thepennyhoarder.com) is a staff writer at The Penny Hoarder. She’s all for automated savings.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2v8mpRK

The Power Of Emotional Marketing

Consumers think with both their rational and emotional brains. Study after study says that when we buy, it’s for emotional reasons. Logic comes into play when we try to justify the money we have (or are about to) spend — especially when we’re giving into our wants.

Here is what one Psychology Today article says about our shopping habits.

- fMRI neuro-imagey shows that when evaluating brands, consumers primarily use emotions (personal feelings and experiences) rather than information (brand attributes, features, objective facts).

- Advertising research reveals that emotional responses to an ad has greater influence on a consumer’s intent to buy an ad (more so than the ad’s content).

- According to the Advertising Research Foundation, ‘likeability’ is the measure that best predicts whether an advertisement will increase a brand’s sales.

- Positive emotions toward a brand have far greater influence on consumer loyalty than trust and other judgments.

- Emotions are one reason why we gravitate toward brand name products over generics — big brands pump a steady stream of advertising dollars into branding initiatives.

Okay. The findings make sense. In fact, they’re common sense and have been instrumental to marketers for years. But how can businesses harness emotions to connect with their consumers? Harness the following example tacts. We’ll show you how.

Positive Emotions = Long-Term ROI

Emotions are the key drivers behind our everyday decisions. They’re what keep us motivated to get up and go to work at 6 AM. It’s how we convince ourselves to run that extra mile on the treadmill. Similarly, emotions are what convince us to do business with the brands that stand out to us.

The problem is that marketers are on a completely different wavelength. What makes us happy? Clicks, pageviews, time on site, and high conversion rates.

What marketers need to keep in mind is that conversion optimization is a process, not a moment. It’s the whole marketing funnel — not just the five minutes that it takes for your customers to sign a contract or commit to a sale.

Your company needs to prioritize long-term relationships above sales.

Researchers at the University of Michigan wanted to find out how positivity could affect a negotiation scenario. In the study, participants had to coordinate the final arrangements of booking a catering service for an upcoming wedding reception. The business manager of this catering company (a professional actor), explained that the quoted price of $14,000 would need to be increased by close to $3,000 due to market pricing fluctuations.

The study revealed that even a subtle change in pitch could dramatically impact the outcome of the conversation. People who heard a positively toned pitch were twice as likely to accept the deal as people who heard a negatively toned pitch.

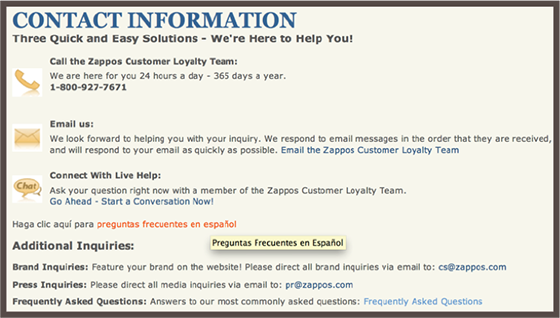

Zappos is a brand that thrives on positive energy. The company aims to make its customers extremely happy — and it’s not just to get them in the door. Zappos wants to keep people happy through the entire sales cycle.

Zappos transformed what most companies consider to be a cost (call centers) into a positive customer experience. Zappos reps are not required to follow a rigid script. Instead, they’re encouraged to live in the moment and let their personalities shine through.

Zappos is famous for sending customers flowers, granting surprise upgrades to overnight shipping, and staying on the phone with some customers for hours.

“Sometimes people just need to call and talk”, said Shaea Labus, the employee who was on a call with a customer for almost 10 hours. “We don’t judge, we just want to help”.

Make your customers happy, and you’ll win their business for life. Your competition won’t stand a chance.

Engaging the Senses

Visual communication is the heart of online marketing. That doesn’t mean, however, that your company is limited to two-dimensional communication.

One way to harness the senses is to appeal to your audience’s imagination. Help them imagine an experience with your company’s products. One option? Sound. Talk to your customers by producing a branded explainer video or by hosting a webinar.

You don’t need to create something expensive or overly complicated, either. When Spotify launched in the U.S., the company created a very simple visual and soundtrack:

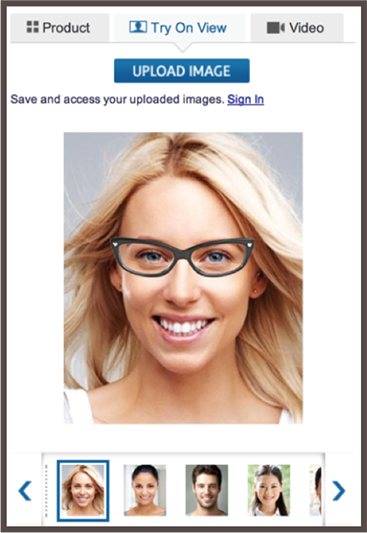

Coastal, an ecommerce store that sells contact lenses and glasses, has a ‘try-it-on’ feature that helps customers see what they’d look like in new glasses.

Brand Personality

A personality is something that we usually give our friends, family members, coworkers, and acquaintances. These are qualities that form a person’s distinctive character.

Personalities are in the eye of the beholder. We love people because of their personalities. We hate people because of their personalities. We find some personalities wonderful — and others, we find horribly obnoxious.

It’s weird to think that brands can have a personality. And yet, we talk about ‘brand personalities’ all the time.

What Is A Brand Personality?

A brand personality is the set of attributes that give an organization a distinct character. Some brands have incredibly strong and unique personalities. Others have weaker personalities (or no personalities at all). Usually, these personalities revolve around a distinct set of attributes.

Great personalities don’t happen by accident. They’re planned well in advance.

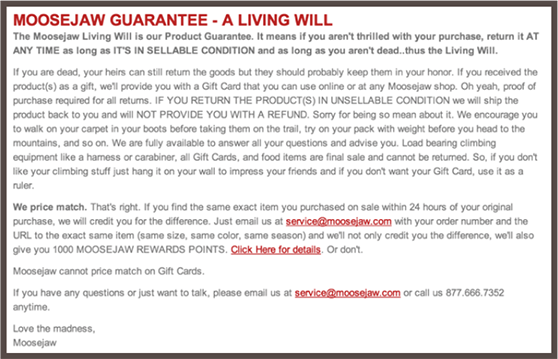

Moosejaw is a great source of inspiration. This sports and outdoors goods retailer is fun-loving, experimental, adventurous, and has an amazing sense of humor. Their marketing team takes the time to try new branding initiatives (like mystery gifts and freebies) and also deploys subtle tactics of making fun of the company’s own legalese. Check out the company’s return policy, for instance. It’s hilarious. It’s a “living will”.

Where Do Brand Personalities Come From

A brand personality can be whatever its leadership wants it to be — fun loving, serious, professional, or any combination of characteristics.

What’s most important is that the company defines it up front. This process should capture the entire time — not just a select few managers within the organization.

The reason why is that it’s your team members — at the ground level — who will ultimately put this carefully designed personality into action. These individuals will plan new product features, business development tactics, and customer service offerings around this extremely important identity.

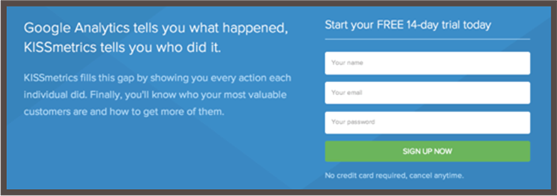

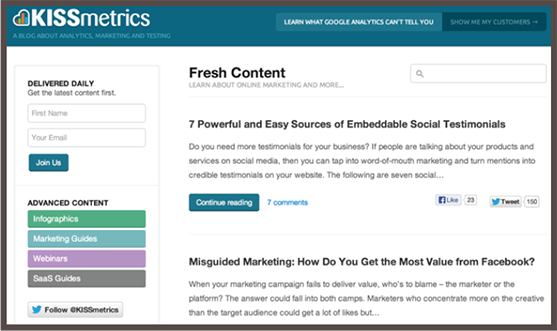

As an example, take a look at KISSmetrics. The company strives to be analytical, educational, helpful, to-the-point, metrics-driven, aggressive, and (kind of nerdy). These core brand personality traits are readily apparent throughout the site — on the homepage and especially on the blog where the company is sharing tips, how-tos, and detailed best practices in web analytics.

Who Is Responsible For Your Company’s Brand Identity?

he short answer? Everyone.

The personality that you assign to your brand should touch every aspect of your business from marketing copy to social media, customer emails, and product descriptions. Every single person on your team — executive leaders, mid-managers, and entry level team members should be able to clearly define and embody who your brand is.

In many ways, your team members are your company’s brand identity. In building out your team (hiring) and forming strategic partnerships, you need to hire people who live and breathe your brand’s core values. When your team is committed to a shared and focused set of values, your company will have an easier time.

Culture, marketing, and design are elements that go hand-in-hand. For these disparate business goals to converge, a clear strategy needs to be defined from the top-down.

How Do You Define Your Company’s Brand Identity?

A brand identity isn’t something that will materialize into thin air. The process takes careful planning and consideration. You’ll need to hire a team, and if you have the funds, you may need to hire a consultant. This core business asset will unify your product, marketing, design, and customer communication. In other words, it’s really important. You’re not wasting time by overthinking it.

Here are step-by-step guidelines to help you get started:

- Come up with a big list of keywords that represent your brand image (right now). Invite your entire team to participate in this process. You can use a whiteboard, Google doc, or spreadsheet to sketch out the details — whatever you think is most effective — to share ideas.

- Come up with a big list of keywords that describe how you’d like your brand to be perceived. Repeat the process of involving your entire team. Compare your two lists and examine the gaps between who you are now and who you want to be.

- Trim down the big list of keywords to 2-3 key phrases. This process will be excruciating, but there is no way that you can rely on dozens of words to describe your brand. At the end of the day, human beings will be processing this information. If you overwhelm folks with more information than they can handle, you’ll end up wasting time.

- Create a message architecture. A what? This is a hierarchy of communication goals that clarify your brand’s most high-impact attributes. These attributes and terms reflect a broader discussion to establish concrete, shared terminology (not just abstract concepts). There is no cookie-cutter approach to crafting your brand’s message architecture. Pick an approach that best aligns with your company’s goals. Just make sure that you’re communicating (and organizing) your brand’s identity clearly.

- Create a style guide. This document will translate all of your ideas into a concrete set of instructions for your marketing team. This (short and sweet) document will unify your company’s brand messaging. It takes a few sentences to keep your company on the same page.

Here is an example of a simple brand styleguide:

The concept is just that simple. The less information your team has to filter through, the more they can focus on creating a cohesive marketing strategy.

Avoiding Cheesiness

Emotions can easily transition from effective to downright cheesy. It’s a fine line. One moment, your brand is doing a great job building a rapport. The next moment? Audiences are making fun of your company’s over-the-top marketing message.

How do you avoid this?

- Embrace honesty within your organization. Make it easy for your team to deliver blunt and honest perspectives.

- Collect feedback from a variety of audiences. Don’t just listen to your organization’s baby boomers. Ask your Gen Xers and Gen Yers to share ideas too.

- Face test your marketing message with a group of customers that you trust. Ask this ‘focus group’ to deliver blunt and honest feedback.

- Remember the needs of your audiences. Baby boomers, for instance are more receptive to cheesy marketing messages than other groups. Gen Yers? They’ll tear your marketing apart.

Cheesiness is in the eye of the beholder. The best way to connect with your audience is to put your marketing team in their shoes.

Creating Viral Campaigns

Some brands make viral marketing look so darn easy. Dollar Shave Club, for instance, used a hilarious marketing video to build a customer base. Overnight. Literally.

The thing is, viral marketing campaigns are more formulaic than they look. While performance isn’t guaranteed, brands can optimize their chances of success by striking an emotional chord with their customers.

In a Harvard Business Review article, Kelsey Libert and Kristin Tynski explain how marketers can increase the chances of a creating a viral campaign:

- Make people care (and share). Engage them with a powerful message — without trying to sell your brand. Heavy use of branding can push viewers away. They’ll jump to disregard the content as spammy and quickly lose interest. Don’t manipulate your audience’s emotions. Respect them, and make an effort to understand their core needs.

- Understand the emotions that drive the success of viral content. Patterns are a core part of human nature. That’s why Libert and Tynski conducted a study of 30 of the top 100 images of the year from imgur.com (as voted on the top social sharing site Reddit). Negative emotions were less commonly found in viral content than positive emotions. However, viral success was still positive when these negative emotions came with an element of anticipation and surprise. Certain emotions were common in viral content (and others were uncommon). Common emotions included: curiosity, amazement, interest, astonishment, uncertainty, and admiration.

- Build your brand into an emotional message without being salesy. The key is to think about how your company, products, and services relate to your target audience. Make sure to select a topic that underscores the position of your brand.

- Pay attention to the public good.

The world is bigger than your brand. Focus on adding value to the world, and your customers will notice.

The Unspoken Power Of Delight

Delight is a force that is infinitely more powerful than any marketing message. It’s the experience of watching a toddler use a smartphone for the first time. It’s what happens when you walk into your favorite boutique (after a tough day) and are surrounded by racks of beautiful items and great music. It’s when Zappos surprises you with overnight shipping.

Some leaders stereotype delight as something fluffy. The thing is, it’s not. It ties directly into your company’s bottom line. It’s probably true that you can’t measure the correlation between exposure to purple lighting in the Virgin Airlines check-in area and profitability. But honestly, who cares? We know that delight influences sales. It’s a waste of time to chase numbers and micromanage the details. Focus on growing your business by creating delightful brand experiences.

Delight doesn’t happen on accident. It’s carefully crafted into the core functional areas of your business:

- Product

- Marketing

- Account management/client services

- Aesthetics

Delight can strike a chord with the following emotions:

- Humor

- Inspiration

- Admiration

- Awe

- Surprise

The problem with delight is that it is — by definition — a nebulous concept. Your finance and revenue teams will second guess your pitches around the topic. Your sales and marketing teams might be on board, but your number crunchers? Not so much. When asked about your plans, you need to distill your goals into a set of tangible steps. Here are the steps needed to create a delightful brand experience:

- Evaluate your customers’ pain points. Examine their online and offline behavior, research what they need, and piece together the touch points that illustrate their unique conversion paths. Talk to them directly, and build brand personas around the answers that you receive.

- Define your brand. Take the research that you did in step 1, and translate the information into a concrete set of action items. Distill what you’ve learned into one or two sentences about your company.

- Start brainstorming action-items that deliver your intended brand experience.

Branding is something that your company should measure on the macro-level. Pay attention to general trends in your customer data:

- Repeat Customers: How many customers are coming back to do repeat business with your company?

- Word of Mouth Recommendations: Shares through social media can help you quantify this important concept. It’s not a perfect 1:1 relationship; however, shares are a strong proxy for how many people are engaging with — and ultimately recommending your brand.

- Average Order Values: Take a look at how much customers are spending with each individual transaction. A positive sign is when you see growth over time.

- Lifetime Customer Values: Are your marketing initiatives increasing the worth that your company is generating over the long-term?

- Market Share: How does your brand compare to its top competitors? Are customers sticking with your company or making the jump to other organizations?

Delight is something that you can craft in tandem with your brand’s personality. Delight is the customer-centric piece, and personality is the brandcentric piece.

Staying Ethical

There is a fine line between courting and manipulating customers. Remember that emotions can make us vulnerable. No matter how strong we think we are, we’re still very complex. In appealing to emotions, brands are constantly walking the line. It is extremely important to treat your customers with the utmost respect.

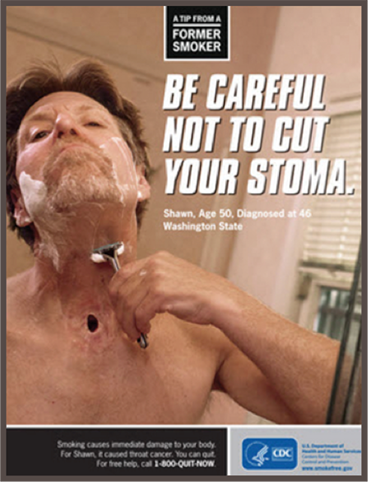

Fear is one example of a powerful yet heavily abused emotion.

In some instances, fear is appropriate. Especially when it comes to vital health concerns, companies/brands/nonprofits have an obligation to inspire emotion. This ad from the CDC, for instance, is designed to stop people from smoking:

The main element that influences whether a person is likely to take action to avoid a threat is efficacy — a person’s perception as to whether or not they can do anything about the threat.

Marketers and business owners can literally scare their customers into making a purchase. But is it ethical? Probably not — if you’re using fear tactics, then definitely no. If you’re communicating something truthful (and possibly saving your customers from a big problem), then fear is ok.

The key is to give your brand a value test. Is your marketing message adding or extracting value from the world? If you’re extracting value (like a leech), you should probably change your approach.

Logitech is an example brand that strikes this balance well. Here is an ad for a home video security system — it’s based around the questions that parents are already asking. In speaking to its audience’s fears, the marketing message is comforting because it shows worrisome parents that they are not alone in their fears.

Logitech also ran a “busted” video campaign to expose prospective customers to credible, real threats. Unethical? Not so much. But the campaign may make you consider buying a Logitech camera.

Here’s an example of an ad that takes fear too far. The ad reads “If you aren’t totally clean, you are filthy”.

The ad is questionable because it’s unreasonable. Yes, our hands are covered in germs. But are we covered in disgusting cockroaches, and are we allowing those nonexistent cockroaches to crawl all over our children? Probably not.

The thing is, many people have phobias for cockroaches and other insects. They are likely terrified and jolted after looking at this very unrealistic ad.

A point that we emphasized earlier is that emotions expose our greatest vulnerabilities. Marketers should treat carefully and thoughtfully. You never know who you’ll possibly make very, very angry.

Build Emotions Into Your Brand Community

Social media is a great way to encourage customers to talk about how they’re thinking and feeling — especially about your company. It’s important to keep this dialogue open — you’ll promote word of mouth marketing around your brand. A potential issue arises, however, when customers are angry about a negative experience.

Many companies will jump to deleting negative comments or moving all customer communication into a private forum.

Don’t do that.

Instead, if a problem arises, use the opportunity to show that there is a real person behind your brand. Apologize, make the situation better, and try to offer an amicable solution. Don’t let a complaint or negative review scare you away from the experience of talking with your customers in a public forum. Instead, be authentic and show that you care. Reciprocate emotions with emotions, and stay calm — even if the conversation gets heated.

FedEx did a great job striking this balance with this summer, a video of a careless package delivery driver went viral on YouTube. The company released an official video statement to basically say, “I’m sorry. We’re on it”.

Own your mistakes. If all else fails, make it a point to show that you care.

Key Takeaways

- Consumers buy because of what they’re feeling — not necessarily what they’re thinking.

- Emotions are valuable for marketing. Marketers and business owners need to make sure that they’re connecting with audiences on a human-to-human level.

- Emotions are difficult to quantify. Diehard finance people will be skeptical of your marketing initiatives. If you listen to them, however, your company will miss out on valuable relationship-building experiences.

- A company should take the time to establish its brand personality upfront, from the top down. Style guides and message architecture templates can help your organization create a centralized workflow for all of your company’s marketing channels.

- Remember that your company’s culture will also define your brand. Your teammates are the people who will execute your company’s brand strategy at the ground level — in every aspect of your business from customer communication, sales, and social media. Make sure that you’re hiring the right people who embody your company’s core traits and values.

- You can measure delight, brand loyalty, and customer happiness by looking at macro-level ROI metrics including long-term customer value, average order value, company market share, and social media mentions.

- Emotions make us vulnerable. Don’t be a jerk. Be considerate of the fact that there are highly public consequences to your actions as a brand.

- Social media is a platform for your customers to share what they are thinking and feeling. Don’t inhibit this very healthy dialogue. It’s perfectly normal for customers to feel frustrated and angry sometimes. Don’t feel pressure to squash what they’re saying. Focus on solving the problem, discussing the problem openly, and connecting with your audiences in a very human way.

Source Quick Sprout http://bit.ly/2Zov9Bl

These 7 Eco-Friendly Tips Will Help You Save the Planet — and Your Wallet

The first thing we noticed when we moved into our new home was that the hot water was burning us.

Fortunately, I fixed it by simply adjusting the temperature setting on the hot water heater. No more burns — and using less electricity or gas to heat the water is good for the environment.

7 Ways to Go Green and Save Money

But it was also good for our bank account. I figure we’ll save $40 per year by keeping the setting lower.

You can save more, too. Here are seven habits for saving money while going green.

1. Use the Sun to Save Money

Heating and cooling costs make up nearly half your energy bill — about $1,000 a year, according to the Environmental Protection Agency.

You don’t need expensive equipment to do a little solar heating.

Just open the curtains on the south side of the house during winter days to let the sun shine in. And open the drapes on east-facing windows in the morning (if they’re not shaded).

Of course, the opposite is true when you need to keep the house cool. Use light-blocking drapes on the sunny side to keep out sunlight.

2. Drink Tap Water

I was so happy to taste the tap water when we recently moved back to Colorado from Florida. It’s delicious!

We immediately ended our $250-per-year bottled water habit — and we’d been drinking the cheap bottled water.

Pro Tip

Don’t like the taste of your tap water? Buy a water filter pitcher for less than $20 and enjoy fresher-tasting water without wasting bottles.

What about the environmental impact? The Water Project says:

- It takes three liters of water to package one liter of bottled water.

- Water bottles can take 1,000 years to biodegrade, and if incinerated, they produce toxic fumes.

- Making water bottles for U.S. demand alone takes more than 1.5 million barrels of oil.

If you can, drink from the tap. We also keep a bottle of tap water in the fridge to take with us when we drive anywhere.

3. Develop Green Laundry Habits

There are a number of ways to save money doing your laundry — and almost all of them are also environmentally friendly.

Here are some of the best green and frugal habits, along with the potential annual savings:

- Wash in cold water ($40)

- Replace the old washer ($135)

- Keep the dryer lint trap clean ($34)

- Line drying your clothes (savings vary)

- Run full loads (savings vary)

4. Hunt Down and Put an End to Energy Vampires

The U.S. Department of Energy says energy vampires — electronics and appliances that keep using power when turned off — can add 10% to your electrical bill.

For example, phone chargers keep sucking down power even when you’re not charging, and a digital cable box can add to your bill if you don’t unplug it between uses.

Pro Tip

Always forgetting to turn off your power strip to save on energy? Invest in smart power strips, which automatically cut the power to devices that go into standby mode.

But who wants to run around unplugging things all the time?

Instead, plug electronics into power strips that have an on/off button so you can easily cut the power to the TV and DVD player with the flip of a switch.

5. Use Alternatives Transportation to Cars

When we lived in Tucson, Arizona, my wife and I bought unlimited bus passes for $40 per month, and we went without a car for a while.

A car certainly costs more than the $80 we spent for monthly transportation.

Even if you own a car, you can save money using public transportation. Take the bus or train on longer cross-town trips that would eat up more gas, or to avoid paying for parking.

And if the store is nearby and you only need to carry a few things, just walk or bike.

All options allow you to significantly reduce your car-related expenses — and you’ll put a lot less pollution into the air.

6. Get an Energy Audit

A home energy audit can identify easy-to-correct energy waste issues in your home, and many utility companies offer them for free or a small charge.

If the cost of a professional audit or assessment is too high for you, just do it yourself. The U.S. Department of Energy has a page that walks you through the process.

7. Stop Those Water Leaks

The average household wastes nearly 10,000 gallons of water every year due to leaks, according to the EPA.

Pro Tip

If you’re going on vacation, shut off your water at the main supply before you leave the house to save money — and avoid the unwelcome surprise of a burst pipe or an overflowing toilet.

Using common household tools — and maybe a trip to the hardware store — you can fix most of these leaks without professional help (or at least with a YouTube tutorial video):

- Worn toilet flappers

- Dripping faucets

- Leaking valves

Steve Gillman is the author of “101 Weird Ways to Make Money” and creator of EveryWayToMakeMoney.com. He’s been a repo-man, walking stick carver, search engine evaluator, house flipper, tram driver, process server, mock juror, and roulette croupier, but of more than 100 ways he has made money, writing is his favorite (so far).

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2ZkdqLd

These 13 Apps Will Help Side Hustlers Stay on Task and Be Productive

Jimmy Chan prefers to go mobile when running his side business.

On weekends, the 36-year-old computer engineer from Montreal runs a wedding photography business called Pixelicious. As a wedding photographer, he has to bring a lot of gear with him to the assignment, usually three cameras, three flashes, more than four lenses and enough memory cards and batteries to get him through the day.

The last thing he needs to lug around is a laptop. That’s why he tries to do as much as he can using his smartphone.

With his Android, he sends contracts for clients to sign, keeps track of his expenses and responds to calls and messages as clients expect things to be done as quickly as possible.

“You gotta be quick,” he says. “You’ve got to deliver that level of customer service, that responsiveness, as quickly as possible. That’s what clients demand nowadays, so it’s really by necessity that it has to be through the smartphone.”

As many gig economy jobs include some form of driving or remote work, having a smartphone that can do everything is a great way to operate more efficiently. Several smartphone apps can help a side hustler run their business using programs such as mileage tracker, document scanners and productivity tools. With that in mind, here are 13 apps to consider to make life easier.

13 Side Hustle Apps to Make Life Easier

Below is a list of smartphone apps that can help make life in the gig economy easier. These apps are broken down into categories to aid in time management, organization and record keeping, taxes, mileage reimbursement and gas savings programs.

Time Management Apps

Time is in short supply when juggling a side hustle with a full-time job. So figure out a time management strategy to get the most out of your free time. These apps will help keep you on task and minimize distractions.

1. Focus Keeper

Focus Keeper is a time management app that follows the Pomodoro technique, a method that involves working for 25 minutes before taking a short break. After completing four work cycles, you take a longer break.

The app has a clean, simple layout with customization options to change the length of the work cycles and break periods. An optional pro version offers more customization features for $1.99.

Purpose: Stay focused when working on your side hustle

Platform: Apple

Price: Free, $1.99 (Pro Version)

2. Forest: Stay Focused

Do you easily get distracted by your phone while working on your side hustle? This app might help.

Forest: Stay Focused turns staying off your phone into a game. You set a timer for how long you want to work without distraction. Once you hit start, leave the app open and watch a digital tree grow.

Whenever you exit the app to check your text messages, social media updates or whatever, the tree will wither. Over time, your digital forest will reflect the hard work you’ve put into working on your gig.

Purpose: Become more productive by staying off your phone

Price: $1.99

3. ATracker

How much time do you spend watching TV in a given week instead of working on your side hustle? You can find out with the ATracker time management app.

This app allows you to quickly toggle between different customizable activities, such as watching TV, housework, driving and more. You can see in pie-graph form a breakdown of how you spend your time outside your day job.

Purpose: Track how much time you’re spending on each task

Platforms: Apple and Android

Price: Free for the basic version, $4.99 for Apple Pro version and $2.99 for Android IAP Upgrade

Organization and Record-Keeping Apps

One of the most significant benefits of going digital is that you can stay organized on the go. With cloud-based to-do lists, camera scanners and plug-in document signers, you can quickly respond to customers remotely while creating digital backups.

4. Scannable

There’s no need for the large office scanner thanks to this app from Evernote. Scannable is a mobile image scanner that uses your iPhone camera to capture documents, receipts and business cards and saves them as camera roll images or PDFs. Another feature automatically saves business card information as a LinkedIn contact.

Purpose: Scan papers, receipts, documents, business cards into instant PDF images

Platform: Apple

Price: Free

5. Adobe Fill & Sign

With Adobe Fill & Sign, there is no need to print out documents to sign them — it can all be done through your phone. The app allows you to fill in the proper information on forms, such as your name and contact information and use your finger or stylus to create a signature.

Purpose: Autofill documents and copy/paste or sign your signature with your finger

Platform: Apple and Android

Price: Free

6. Google Apps

You don’t have to have a Pixel phone to have access to your Google accounts. The Google Apps — Drive, Docs, Sheets, Slides and Gmail — are available on Apple and Android for free. These apps will allow you to create, edit and share files on the go.

Purpose: Have access to your Drive, Docs, Sheets and other Google apps on your phone

Platforms: Apple and Android (you can find the full list of links to download here)

Price: Free

7. Wunderlist

While most smartphones have to-do lists built in, they might not be so intuitive in their design. Wunderlist gives you the ability to fully customize your lists with due dates, notes, reminder notifications and share them with whoever you want.

Each version of Wunderlist is explicitly built for the device, iPhone, iPad, Desktop, Android, etc. For example, the iPhone version includes a swipe down feature to quickly access your to-do list and the Android version includes a quick Add Widget feature.

Purpose: A digital to-do list for your phone

Price: Free

Apps for Taxes

Thinking about taxes can cause dread for side hustlers. The thought of not knowing how much money to set aside or which expenses are deductible can make people’s heads spin. Luckily, there are apps for that.

8. IRS2Go

IRS2G is the official mobile app of the Internal Revenue Service. The app features include a ways to check the status of your refund, make a mobile-friendly payment to IRS Direct Pay or get free tax help.

If your taxes are going to be more complicated than expected, you can also access free tax software or information on how to get help in-person.

Purpose: Make payments to the IRS and get tax help from your phone

Platforms: Apple and Android

Price: Free

9. QuickBooks Self-Employed

QuickBooks Self-Employed is built for freelancers, independent contractors and sole proprietors in mind. The app has a built-in scanner to keep track of receipts on the go, as well as a mileage tracker, expense tracker and invoice generator. That way you’re prepared come April 15.

Purpose: Keep track of your expenses and taxes on the go.

Price: Free to download, $5 per month for the first six months, then $10 per month after.

Gas Apps

Everyone loves saving money at the pump. If your side hustle requires making frequent stops at a gas station, then every little bit helps. Also, don’t forget to see if your local gas station has a rewards program.

10. GetUpside

GetUpside is a gas rebate app that lets you save money on every gallon of gas you pump.. Once you select a nearby gas station, you’ll have four hours to pump your gas and upload a photo of your receipt. Savings can range from a couple of cents to a quarter per gallon.

GetUpside is available at select locations in 25 states and the District of Columbia.

Purpose: Get money back when purchasing gas

Platforms: Apple and Android

Price: Free

11. GasBuddy

If you’re not interested in going the rebate route to find cheap gas, then check out GasBuddy. This app aggregates the gas prices of stations in your area so you can see the least expensive fuel available. Plus, get a discount card from GasBuddy to automatically save 10 cents per gallon on your first purchase (and 5 cents per gallon after that).

Purpose: Find the cheapest gas in your area.

Price: Free.

Mileage Tracker Apps

If you’re a rideshare driver, delivery driver, or use your vehicle to do your side hustle, mileage tracking is one of the most critical deductions to record for your taxes. Some people opt to keep a log of their miles traveled for work using the classic pen and paper method. But there are digital options available, too. If these don’t interest you, we’ve got more mileage tracker apps to choose from.

12. MileIQ

For rideshare or delivery drivers who might be forgetful when logging mileage by hand, it might be worth giving MileIQ a shot. This app, included with Microsoft Office 365 Business Premium Subscriptions, automatically tracks your trips while running in the background. Users can swipe the trip left or right to classify each drive as a business trip or a personal trip.

The basic version of MileIQ is free to download which tracks up to 40 drives per month. The unlimited version costs $5.99 per month or $59.99 annually.

Purpose: Mileage tracking

Price: Free for the Basic version, $5.99 monthly or $59.99 annually for the Unlimited version

13. Hurdlr

With income, expenses, mileage and those quarterly estimated taxes, a spreadsheet doesn’t always cut it. Instead, use Hurdlr, a free app dedicated to helping self-employed entrepreneurs track and streamline their money — and taxes.

You can file your taxes through the app or send your reports directly to your CPA. It’ll also help you maximize your income by identifying all available deductions.

Purpose: Mileage tracking

Platforms: Apple and Android

Price: Free

Matt Reinstetle is a former staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2UGIN3K

The Intersection Between Skills and Luck in Your Professional Life (and Elsewhere)

Connie writes in:

Liked your article about competence and mastery. Did you see this piece from MIT Tech Review about luck’s role in all of this? I think it would make a good follow up article.

You’re absolutely right, Connie. That article does address a lot of good points about the role of luck in terms of skill and how they combine to form your income level.

Before I dig into this, a bit of review is in order.

Last week, I published an article entitled The Value of Competence and Mastery. In it, I argued that there’s a lot of benefit, financially and otherwise, to reach a level of competence in a lot of skills, and that if you can couple it with mastery in a few skills, that’s even better. I defined “competence” as being a level of ability with a particular skill such that you have no need to pay someone else to do it for you (outside of situations of pure convenience), whereas “mastery” is a level of skill where people will pay you just to perform that one skill.

The core idea of the article is that many people make a living by combining a few competencies in a unique way that gives them a set of skills that’s really valued. If you have a lot of competencies, then you have a lot of unique mixes that may be the source of a career or at least a nice-paying job for a few years. Masteries are even better, but they require a much more intense level of investment in a single skill; often, people who can combine a mastery or two with a number of competencies set themselves up for a high level of earning in their life.

What that means in a practical sense is that you should be spending at least some of your time in self-education, but that doesn’t have to be about building a new mastery or honing one you already have; rather, there’s a lot of value in building up more competencies and figuring out how to combine competencies you have.

For example, I would describe my father as being someone with a ton of different competencies. That’s why, during his life, he started several successful side gigs in completely different areas and was always able to make some money when he needed it. I wouldn’t describe him as having mastered any particular skill, but he could grow a garden, catch fish at a commercial level, befriend almost anyone, fix a car, fix almost any small mechanical device, do basic woodworking and carpentry, handle most plumbing tasks, run and troubleshoot computer-robotics interfaces… the list goes on and on. Often, he was able to combine those competencies to do certain things incredibly well.

So, what does all of this have to do with luck? The MIT Tech Review article that Connie shared, If You’re So Smart, Why Aren’t You Rich? Turns Out It’s Just Chance, makes an interesting argument. Their argument is that if you have a reasonable competence in a particular skill, the biggest factor that determines whether or not you are able to make a lot of money with that skill is luck, because opportunities essentially randomly fall on people’s laps:

And yet when it comes to the rewards for this work, some people do have billions of times more wealth than other people. What’s more, numerous studies have shown that the wealthiest people are generally not the most talented by other measures.

What factors, then, determine how individuals become wealthy? Could it be that chance plays a bigger role than anybody expected? And how can these factors, whatever they are, be exploited to make the world a better and fairer place?

Today we get an answer thanks to the work of Alessandro Pluchino at the University of Catania in Italy and a couple of colleagues. These guys have created a computer model of human talent and the way people use it to exploit opportunities in life. The model allows the team to study the role of chance in this process.

The results are something of an eye-opener. Their simulations accurately reproduce the wealth distribution in the real world. But the wealthiest individuals are not the most talented (although they must have a certain level of talent). They are the luckiest. And this has significant implications for the way societies can optimize the returns they get for investments in everything from business to science.

In other words, the study that’s being referred to here indicates that given that a person has a certain level of skill in a particular area, their success in that area is largely based on luck. If you’re competent at a skill, your success and failure has a ton to do with being in the right place at the right time, not your ability or lack thereof.

There are two ways to look at that idea.

On the one hand, it can feel depressing. You can work very hard building up some skills, only to never be able to do very much with them because you weren’t in the right place at the right time.

On the other hand, it can feel enormously motivating. Even if you’re not superbly gifted at a particular skill, you can find lucrative work with that skill if you put in the effort to be lucky.

What do I mean by be lucky? Luck is a mix of random chance and the choices you make in life. Opportunities float through the air all the time and some will, by chance, land in your lap. However, there are a lot of things you can do to make it much more likely for those opportunities to land on your lap rather than drifting away.

This is a topic I’ve written about in the past, in a more general sense. Ten Tactics for Improving Your Luck described some methods for improving your luck in your all-around life, while Designing a Lucky Life added ten more tactics to the list.

Here are those twenty tactics, for a refresher course:

1. Keep a notepad and a pen in your pocket at all times.

2. Keep a reasonable amount of cash on you at all times.

3. Don’t get into a desperate debt situation.

4. Be social.

5. Establish relationships with many people who share your interests.

6. Help others out when they need it.

7. Shop at places where extreme bargains might be found.

8. Have confidence that you can do something challenging.

9. Know the actual value of lots of items in a particular specialty.

10. When you need something significant, tap your social network instead of buying blindly.

11. Do the task in front of you as well as you can, no matter how mundane it is.

12. Never eat alone.

13. Never speak negatively of others.

14. Cultivate skills during your spare time.

15. Ask questions.

16. Get involved in the community.

17. Know your neighbors.

18. Be humble.

19. Be generous.

20. Don’t spend time or money on events of pure chance.

That’s a pretty solid list of strategies to live your daily life by, and they will definitely open you up to a lot of opportunities that might have been closed to you before.

Here, though, I’m more interest in specific tactics you can use to improve your luck in your career. If luck is at least as important as skill (above a basic skill threshold), what can you do to maximize luck in your career?

If there’s one thing I’ve done right throughout my professional life, it’s that I’ve done a lot of positive things to allow myself to be as lucky as possible in professional situations. I don’t view myself as highly skilled at anything, but I do think I’m good at finding opportunities or, more accurately, having them fall right in my lap at the right moment. Here are seven tactics that really accentuate this.

1. Always work hard on the task at hand and produce quality results, regardless of whatever it is that you’re doing.

It doesn’t matter how simple the task before you is or how complex it is. What matters is that the results you produce are of the highest quality you can produce in a reasonable timeframe.

The reason that this helps with your “luck” is simple: your quality work becomes a calling card for you. At some point, someone will look around and notice it and start looking for who is pumping out the quality work. It might happen tomorrow. It might happen in five years. It might never happen.

On the other hand, if you don’t do your best to do efficient, quality work, someone will look around and wonder who’s not doing their job very well. It might happen tomorrow. It might happen in five years. It might never happen.

Most people get comfortable doing the bare minimum to not get noticed for bad work. As a result, it is really easy for good work to stand out.

The “luck” part of this equation is someone noticing the quality work. You can’t make someone notice your quality work. All you can do is produce quality work and hope someone notices it over time.

I’ll give you an example. When I was an undergraduate, I spent years working in a public computer lab, fixing minor computer problems and helping users. A lot of the other lab workers did the absolute bare minimum to collect a paycheck. I spent a lot of my time doing things like wandering around and checking on things, cleaning up messes, helping people if I could see they were struggling, and so on. This got me no recognition at all for a good year, but then one day a professor stopped in and said that they had heard that I had went out of my way to help one of their graduate students. This wound up leading to a job, the first in a series that put me on a path to my long term career.

Sure, I spent a year working hard when I could have sloughed off, but because of that work, an opportunity fell on my lap that would have never been there otherwise.

2. Be humble about your own skills and contributions and give lots of credit to others.

If you do good work, there will eventually come moments of recognition of some kind or another. Someone will compliment your work, or you may even receive a commendation for it.

Whatever happens, remember this: the person complimenting or commending you already thinks highly of your work and your skills, so there is zero benefit in patting yourself on the back further. You only look arrogant by doing so. You don’t have to insult or minimize your own efforts, but you don’t have to talk up or embellish what they’re already impressed by.

Rather, this is an opportunity to be humble. The easiest way to practice humility, if you can, is to share credit with others. If someone is complimenting you on your work, mention the person that mentored you or taught you your job. Mention your supervisor or others who have given you good advice. Mention anyone and everyone on your team who played any role on the task. Talk up what those people contributed. This is a great thing to do any time you’re called upon to present your work – give lots of credit to others throughout and at the end.

Another good practice is to simply say something like “it was my pleasure.” Again, this avoids the trap of self-criticism as well as the trap of boasting while acknowledging the comment. This is a good route to follow when you can’t think of anyone else to acknowledge.

Remember, you’re only receiving compliments and getting opportunities because the other person already thinks highly of you. Don’t burn that by being arrogant or self-serving; rather, build upon it with some humility while also, if possible, giving a positive rub to the people who helped you get there.

3. Put yourself in lots of situations where you’re interacting with lots of people in your field.

Go to workplace meetings. Go to conferences. Go to conventions. Go to local meetups. Join professional organizations and go to their meetings. Involve yourself in social media in a purely professional context. Most importantly, be actively involved in those things. Volunteer to present your work or your company’s work. Spend every spare moment you can at these meetings getting to know people and building those relationships. You should be learning (about your field or about the people in your field) or building relationships with every spare moment at those meetings.

This requires turning on your social side more than you might otherwise be comfortable with. I know that’s true for me. Whenever I have gone to such an event, I usually find myself socially burnt out, and when I feel that way, I do retreat somewhere quiet to socially recharge and I do feel utterly spent at the end of the day. That’s okay.

The goal of such meetings for you should be to meet a lot of people, start building some relationships, and share what you’re working on and what you’re about so that others know you. If you’re willing to do that, go to as many meetings as possible and participate in professional social media in your career path.

Yes, this does include meetings at work. People often “zone out” during those meetings and avoid any sort of active participation and look for any excuse to run out the door. Don’t treat meetings that way. Treat them as an opportunity to build relationships with the people in the room – people below your professional level, at your professional level, and above your professional level. Nothing in your workplace should be treated as a full waste of time or else you’re just saying, “No, I don’t want opportunities.”

4. Jot down ideas and contact info as soon as they come into your mind, and process them regularly.

Whenever you have an idea or learn something that you want to investigate further or want to remember again in the near future, write it down immediately. Don’t hesitate.

Whenever you meet someone and you’re clicking at all with that person, jot down their information before you forget it. A first name, an email, a social media handle, and the reasons and things you might want to follow up with them about.

I keep a little notebook and a sturdy pen in my pocket at all times for just those situations. It probably accumulates 10 to 15 such notes a day. Once a day or so, I go through all of those new notes and process them one at a time, doing something meaningful with them.

If it’s a piece of contact information, I contact the person, following up on whatever I jotted down, and adding the person to my contacts and/or social media.

If it’s something I need to do, it goes on my to-do list.

If it’s an idea of some kind, it either goes into my professional idea folder or I investigate it right away.

That covers almost everything I jot down. As I deal with each one, I cross it off.

This ensures that I start the follow-up process with everyone I meet in a meaningful way, which starts building a new relationship. It also ensures good ideas, which are an opportunity in and of themselves, don’t fall through the cracks.

5. Take on new challenges constantly, especially when they allow you to build new competencies along the way.

As noted earlier, one of the surest ways to be able to have luck work in your favor is to have at least a basic level of skill in that area. Thus, if you want to have lots of luck, have lots of competence.

How does an adult build a lot of competence? They do it by taking on challenges constantly, trying to do new things for themselves rather than just letting someone else do it for them (or paying someone to do it).

Need some food? Make a meal yourself and learn the basics of short order cooking. Having some plumbing issues? Hit up Youtube and start figuring out what’s wrong. Need to write some software that’s over your head? Start with what you do know and start working toward what you don’t know. Yes, it’s probably scary, and that’s okay. Overcoming the fear is part of it. This logic is true for every challenge life throws at you. The goal is to build up new competencies, as many as possible.

Doing things this way opens the door to a lot of opportunities in your life. There are new working opportunities. There are new opportunities to build relationships. There are more opportunities to create a great impression with your skills, as someone who can just handle an unexpected event always creates a great impression. You can only do this by becoming competent in lots of things, and you can only do that by taking on challenges as a matter of routine in your life.

6. Don’t speak negatively of others unless criticism is specifically requested of you (and even then, focus the criticism well).

There is almost zero benefit to talking badly about someone and there is often negative consequence to doing so, consequences you don’t often directly see. Often, word of your negative talk gets back to the person you were criticizing, or you look like an arrogant and callous person when you do it face to face. The blowback you get, either directly or indirectly, makes negative talk almost always not worth it.

That doesn’t mean criticism isn’t something valuable that you should sometimes do. You should just choose the right context to do it.

For example, if you’re going to criticize someone, the best way to do it is in a one-on-one situation with no onlookers. Do it in a way that also reinforces what’s good about the person and what they can do to overcome what you are criticizing.

If you’re going to criticize an idea or a thing, do it in a way that isn’t personal toward anyone and, again, also point out the positives and potential good directions forward.

Never, ever do this kind of criticism behind someone’s back. It almost always hurts you in the long run.

For most people, this applies most strongly in an “office politics” situation. Don’t get involved in tearing down other people, because when you do, you create an easy invitation for others to tear you down. Don’t get involved in tearing down the work of others, either. You should only be doing this if you’re in a supervisory role and are doing it with care or you are specifically asked for criticism, and it’s done with the suggestions above.

There’s almost nothing you can do that’s more effective at making opportunity fly away from you than being a negative person who criticizes and tears things down constantly.

7. Thank people in a genuine fashion when they help you.

If someone gives you genuine help in your professional life, whether it’s an interview or some great advice or an opportunity or an exceptional helping hand or whatever, thank that person in a genuine way.

My preferred method for this is to write a simple handwritten thank you note, which simply states what it is that they did for me (showing that I actually remember it) and how that has impacted me. This doesn’t have to be long and complicated – a few sentences will do.

The reason this is so beneficial is that it holds up the “peak-end rule” in a positive fashion. Most people, when they recall an event or an interaction with someone, remember the “peak” of that event or interaction – the moment of greatest intensity – and the “end” of that event or interaction – whether it ended on a positive note or a negative one. A thank you note basically guarantees that the “end” element is a positive one. They’re going to see that note and feel good about it and it’s going to create a positive “end” for your interaction.

Get a bunch of simple thank you notes with blank insides and envelopes and give them out generously. If someone stepped up far beyond what was needed to help you with a project, thank them with a note. If someone invited you to speak, thank them with a note. If someone gave you great advice, thank them with a note. If someone gave you an opportunity, such as an interview or a job offer, thank them with a note. You’ll be adding a bunch of positivity to the “end” of your interaction with them, and that will leave them out in the world with a positive view of you, one that will often invisibly lead to them being a positive force for you in the world which will inevitably increase the chances for more opportunities to fall in your lap.

Final Thoughts

Having a lot of skills and competencies is great, but you also need to open your life as much as possible to opportunity. Opportunities come along randomly and they can often feel like pure luck, but you can do a lot of things under your own control to make it much more likely that opportunities will find their way into your lap.

Luck is a vital element in career success. Make yourself as lucky as you can.

The post The Intersection Between Skills and Luck in Your Professional Life (and Elsewhere) appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2Dn20gc