الأربعاء، 10 أكتوبر 2018

Dow Industrials Sink 831 Points as Tech Companies Plunge

Source CBNNews.com https://ift.tt/2pMKdbj

Your Pharmacist Can Now Tell You If You’re Overpaying for Prescriptions

On Wednesday, President Donald Trump signed legislation lifting contract clauses that have prevented pharmacists from informing patients they could pay less for prescription drugs by not using insurance, and paying the retail rate instead.

More than two dozen states had already enacted laws aimed at the “gag clauses,” as they’re referred to, according to the National Conference of State Legislatures’ Prescription Drug Resource Center. The clauses were included in contracts between pharmacies and some health insurers and pharmaceutical benefits managers to penalize pharmacists for speaking up.

The law Trump just signed was passed by Congress earlier this year with bipartisan support.

“It’s a matter of what’s fair for the patient,” said Will Edmiston, a pharmacist at Big Country Pharmacy in Abilene, Texas. “That’s what it should be about. Individuals have a right to know if there are cheaper alternatives.”

One word of caution: Just because pharmacists will now be able to give patients more information doesn’t mean they’ll all offer it up. It’s important for consumers to ask questions and advocate for themselves.

Millions of Americans Have Been Overpaying for Prescriptions

The University of Southern California’s Center for Health Policy and Economics found this year that in 23% of the claims it studied, patients overpaid. That’s 2.2 million cases of overpayment.

Another study by researchers at the Center for Health Policy and Economics and the University of Southern California, Los Angeles, found that in the first six months of 2013, Americans with Medicare coverage overpaid a total of $135 million, or $10.51 each.

Pharmacies collect patients’ copayments and forward them to pharmaceutical benefit managers, who reimburse the pharmacies at a negotiated rate. When a patient overpays, it means the copayment was larger than the negotiated reimbursement rate — sometimes more than the total cost of the drug.

The pharmaceutical benefit manager keeps the difference, and gag clauses in many pharmacists’ contracts prevented them from informing patients, researchers and consumer advocates say. Pharmaceutical benefit managers oversee most prescription drug benefits for insurers, employers and Medicare, according to AARP.

The overpayments contribute to people suffering medically as well as financially, the USC study found.

According to the USC study, “Many US patients struggle to afford their out-of-pocket healthcare expenses, and cost-related medication non-adherence is common, leading to higher medical expenditures and poorer health outcomes.”

Susan Jacobson is an editor for The Penny Hoarder. She also writes about health and wellness.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2pNp54v

Thank a First Responder by Telling Them They Eat Free at Macaroni Grill

And when natural disasters strike — like Hurricane Michael, which is bearing down on the Florida Panhandle as I type — it’s first responders who will be there to help those in need during the aftermath.

This month, Macaroni Grill is showing first responders some well-deserved love and appreciation with some good ol’ comfort food.

How First Responders Can Score Free Food at Macaroni Grill

If you’re a police officer, firefighter, paramedic or hospital medical staffer, grab your proof of service and head over to Macaroni Grill for free spaghetti and meatballs now through Oct. 31.

And this isn’t just any old spaghetti and meatballs. This is Mom’s Ricotta Meatballs and Spaghetti, featuring house-made veal, beef, pork and ricotta meatballs over capellini with Pomodorina or Bolognese sauce and topped with Romano cheese.

Ricotta cheese in the meatballs? Yum.

To get your free spaghetti and meatballs, all you have to do is mention the special and show a valid ID to your server. And if you bring your whole family on a Monday or Tuesday, kids 12 and under get a free kids meal with the purchase of an adult entree.

Be sure to share the love and pass this thank you from Macaroni Grill to all of the first responder heroes in your life, so they can enjoy some free spaghetti and meatballs after a long day of keeping us all safe and healthy.

Jessica Gray is an editorial assistant at The Penny Hoarder.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2RH75Wr

How B2B Audiences Engage with Business Content Online

As a B2B company, you need to learn how to properly market your brand to the right audience.

That’s because your target market doesn’t consume content the same way as the average consumer does. Following the habits and trends of a typical consumer won’t help you.

This is especially important for businesses operating as B2B as well as B2C companies. You need to be able to segment your content for each audience.

If your company is strictly a B2B operation, the content creation process should be even easier for you. You won’t have to worry about consumer content at all.

But regardless of your situation, to do this effectively, you need to understand how B2B audiences engage with content.

Then, you can adjust your B2B marketing strategy accordingly to reach these people.

The majority of B2B marketers believe that their content marketing strategy is still in the early stages.

Further, 91% of B2B companies use content marketing to promote their brands and reach their audiences.

But as you can see from the metrics above, the maturity levels of their marketing efforts are all over the board. Unless you’re in that top 9% who believe their strategies are sophisticated, it’s safe to say you could use some improvement.

That’s why I created this guide.

I’ll tell you exactly how B2B audiences engage with content. Then you can take this information to tailor your content strategy accordingly.

As a result, you’ll be able to generate more leads for your B2B company. Here’s what you need to know.

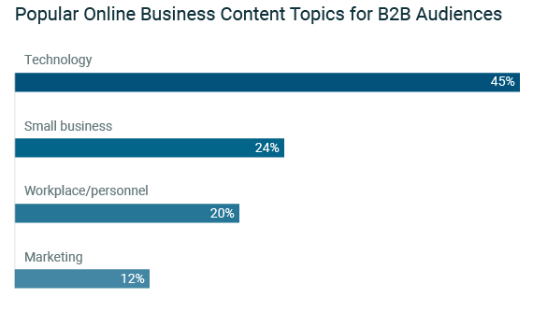

Focus on technology advancements

Your company needs to create business content that’s related to technology.

The best way to approach this is by discussing and showcasing new technological advancements your company has to offer.

Whether it’s new software, hardware, or other equipment, you’ll be able to offer exactly what your audience is looking for.

In fact, research shows that technology is the most popular business topic consumed by B2B audiences online.

This makes sense. Just think about it.

What is your B2B audience trying to accomplish?

Just like you, they want to improve their businesses. They’ll be researching the latest and greatest technology.

Even if your company hasn’t released new technology, you can still create content on the subject. Discuss industry updates and other advancements you’re anticipating.

Maybe you are developing something. You don’t need to wait until it’s released to share that information.

Learn how to build hype for a new product launch before the release.

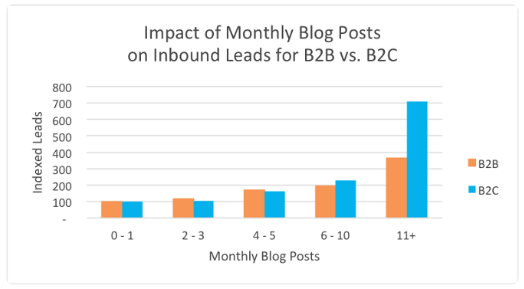

Blog content

You know you need to create content focusing on new technology. But how do you distribute it?

You need to put lots of effort into your blogging strategy.

We know that 76% of B2B marketers publish blog posts. And 73% publish case studies.

You should do the same or risk falling behind your competitors. B2B marketing is a competitive field. Once a client builds a relationship with another company, it could be difficult for you to get their business.

But running a credible, informative, and resourceful blog will give you an edge.

That’s because 96% of B2B buyers say they want to consume content from industry leaders.

You can become that industry leader. Just make sure you publish content frequently to establish credibility. This will make it easier for you to get your target audience to engage with your content.

Plus, blogging is one of the best types of content that gets your audience into the conversion funnel.

If they’re reading your blog, it means they are on your website.

And that means they are more likely to convert, especially if you offer them actionable content.

After all, you’ve become an industry leader. The people reading your blog will be more inclined to use your products and services.

Furthermore, the publishing frequency of blog posts has a direct impact on website traffic.

This statement holds true for both B2B and B2C companies.

Simply put, the more blog posts you publish, the more inbound leads you’ll get.

Blogging will help improve your SEO strategy, which will result in expanding your reach through organic traffic.

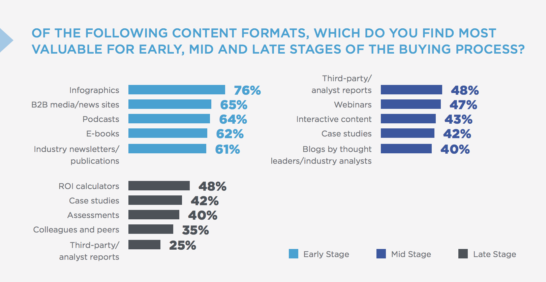

Infographics

Right now, your content might be good. But who wants to be good? That just isn’t enough.

You need to find ways to make your content great. Figure out how to stand out and speak to your B2B audience in ways they understand.

Learn how to enhance your content by building infographics.

Your brain processes images 60,000 times faster than words alone. Plus, 90% of information transmitted to your brain is visual. And 65% of people are visual learners.

That’s why infographics are so powerful, especially for B2B audiences.

As you can see from this data, 76% of B2B buyers said that infographics were a valuable part of the buying process.

This ranked higher than any other type of content from each buying stage.

As a B2B marketer, you need to create infographics to cater to your audience’s needs.

This can work in conjunction with your blogging strategy, discussed previously.

To make your posts more appealing, add custom infographics to them. As you can see from reading my content, I use images, graphs, and infographics in my blog posts all the time.

I believe in this strategy, and you should as well if you want to reach your B2B target market effectively.

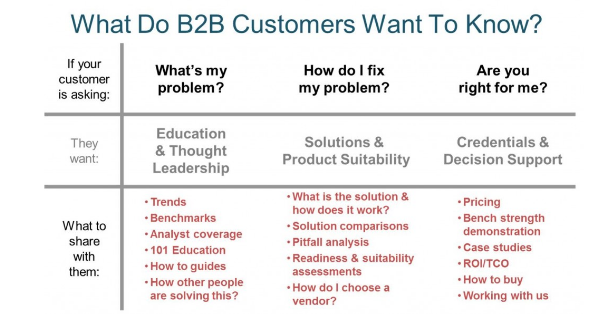

Make it easy to find solutions

Your B2B company needs to offer solutions to your target audience.

For example, let’s say you manufacture goods. Once an order is placed, you promise to ship within three business days.

That could be the differentiating factor giving you a competitive edge over companies that may not ship for two weeks.

If a prospective B2B client is searching for a manufacturer that can deliver goods faster than their current supplier, your company would be a viable option.

However, you won’t be able to acquire these customers if it’s too difficult for them to find solutions on your website.

Keep these questions in mind when you’re designing your site:

Prospective clients need to find solutions to their problems. If you can create content that shows your qualifications, they’ll be more likely to use your services.

In addition to displaying information properly on your website, you need to take this strategy to the next level.

Share content on social media, which I’ll discuss in greater detail shortly.

You also need to offer excellent customer service. Make it easy for people to contact you online, over the phone, through email, or potentially in person.

Consider implementing live chat to provide better customer service as well.

This will make it much easier for your audience to find solutions when they’re consuming your content.

Social media

As I just said, you need to market your company through distribution channels outside of your website. Social media is a must.

Your B2B audience is active on social media.

Just like you, they probably have profiles on these platforms to promote their own businesses as well.

But they don’t consume content the same way as B2C consumers do. You can’t expect them to scroll mindlessly through Instagram to engage with business-related content.

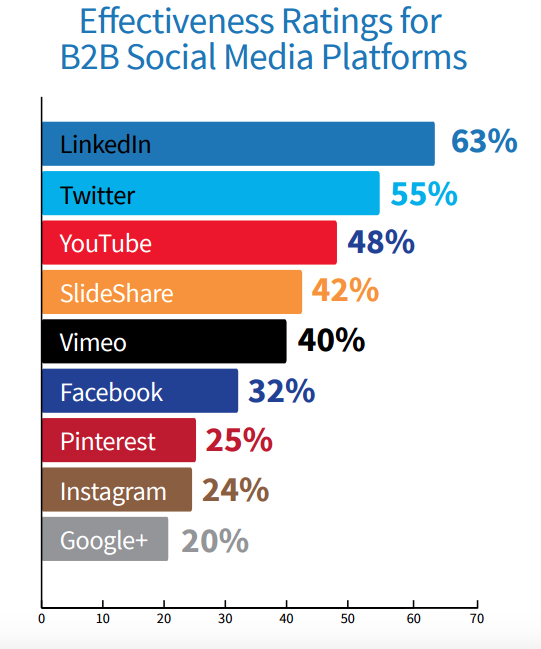

Instead, B2B marketers have greater success on other platforms.

LinkedIn, Twitter, and YouTube are the three most popular platforms for consuming B2B content online.

Your company needs to have an active presence on all three of these if you want to be successful.

Am I saying you don’t need Facebook? Absolutely not.

You should definitely have a Facebook page for your B2B company. It just shouldn’t take priority over your LinkedIn strategy.

Don’t waste your marketing dollars on Facebook ads that won’t get seen by your audience.

Know your audience’s business hours

If you’re going to use social media to attract B2B audiences, which you should, you need to understand when these people are active.

Post content during the hours when they’re online. This is different from targeting a B2C audience.

As a business owner, your company is on your mind 24/7. But that’s not always the case with your B2B audiences.

Your audience may not necessarily be other business owners. The people who have the buying power for other businesses could be managers or employees who get paid hourly or receive a salary.

When they go home after work, they aren’t thinking about their jobs.

Don’t share content on a Saturday afternoon when these people are not at work. They don’t consume business-related content when they’re not on the clock.

Email communication

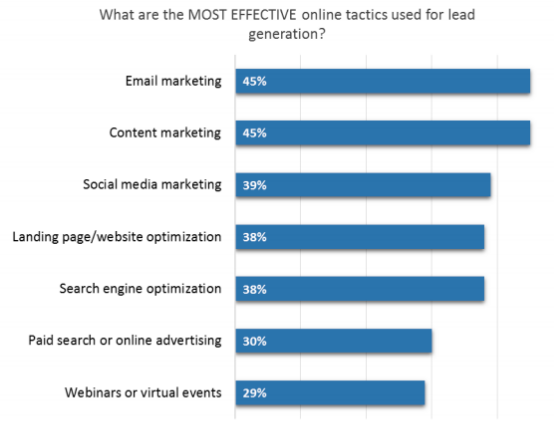

Email marketing is another effective way to reach your B2B target market.

In one day, the average office worker receives 121 emails. Your content needs to be impressive to stand out from the other hundred messages in their inbox.

Otherwise, your message could go straight to the trash folder.

Although office workers get many emails, 77% of B2B consumers still say they prefer to have business communication through email.

That’s why B2B marketers name email as the most effective tactic for generating new leads.

Since you know this is how your audience is engaging with content, and it’s how they want to consume it, you need to focus on building quality email lists.

This will be different from a B2C email list building strategy.

When targeting consumers directly, you’ll have much larger email lists. Yes, obviously it’s better if those email addresses are qualified, but you won’t be as picky.

But with B2B email lists, qualified leads are an absolute necessity.

In addition to sending out newsletters and content, your B2B email strategy might require a bit more work.

You may want to consider sending individual messages to your current and prospective clients as opposed to using email software for mass distribution.

Depending on the size of your company, this won’t be unreasonable. Some of you may have only a dozen clients or so.

This strategy is unrealistic for B2C brands with thousands of subscribers on their email lists.

Prioritize organic search

I briefly mentioned SEO when I discussed your blogging strategy. But it’s worth talking about in greater detail.

If you want to successfully reach your B2B audience, your SEO strategy needs to be a priority.

Think about the way you personally consume content.

You are not only a B2B marketer but also a B2B consumer. Your habits should be similar to the habits of your target audience.

When you’re looking for information online, I bet you start with a Google search.

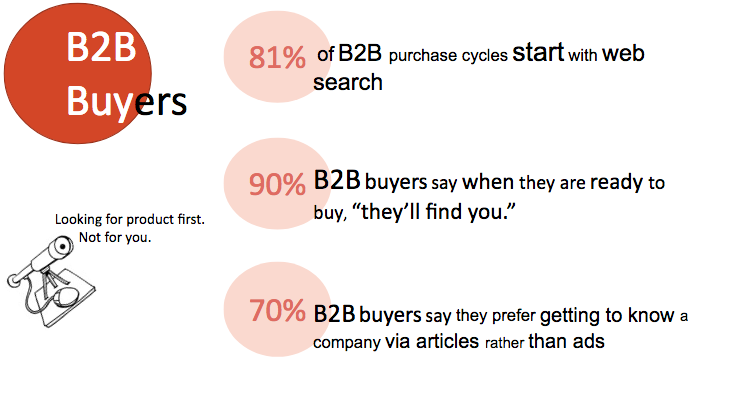

In fact, 81% of B2B purchases start with search.

As you can see, B2B audiences want to get to know companies from articles instead of paid ads. That’s why your blogging strategy is so important.

Not only will it help you with SEO, but it will also give your audience content they want to consume.

I’m not saying you shouldn’t pay for ads or run PPC campaigns. You can still generate leads from those.

But as you can see from those numbers above, organic traffic is more important.

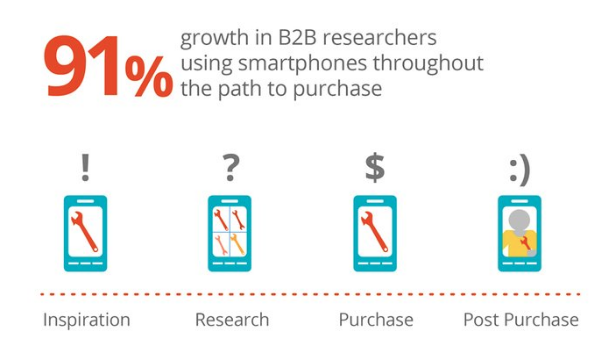

Optimize content for mobile devices

One area where B2B audiences and B2C audiences have similarities is with the devices they use.

The days of business content being consumed only on desktop computers in the office are over.

Smartphones and tablets have penetrated the workplace.

Companies are getting more relaxed. They are not forcing their employees to sit in a cubicle for 40 hours a week.

With mobile devices, people can be productive on the go. They can work from homes, coffee shops, or even public transit.

People will work anywhere where they can be productive. If they finish their work for the day, they’ll be able to go home.

That’s probably why we’re seeing such a major growth in smartphone usage throughout the B2B buying process.

At the very least, your website needs to be optimized for mobile devices.

But you can take that strategy one step further. Your email content should be mobile-friendly as well.

Depending on the size of your company, you may even want to consider building a mobile app to reach your B2B target audience.

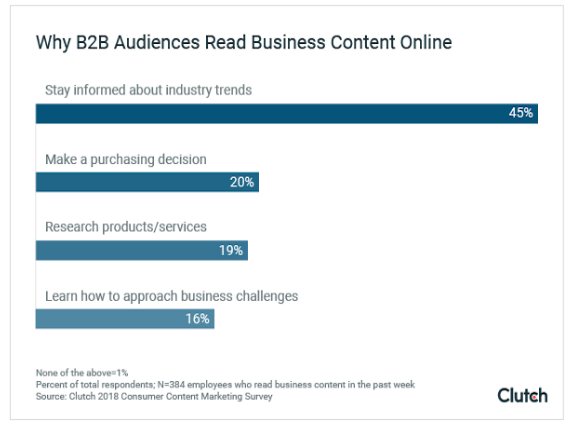

Industry trends

B2B audiences need to stay up to date with the latest industry news and trends.

In fact, 45% of B2B audiences read business content online to stay informed about industry trends.

You can become a resource for that information. Consider using this topic to your advantage with your blogging and email strategies.

Publish blog posts about what to expect in your industry.

Send out email newsletters with breaking news stories.

If you can master this strategy, you can become the primary resource of industry information for your target audience.

Conclusion

B2B audiences don’t consume content online the same way as B2C consumers do.

You need to recognize this and adjust your content strategy accordingly.

Publish content about technological advancements. Keep your audience informed on industry news and trends.

Establish yourself as a credible resource through your blogging strategy.

Enhance your content with infographics.

Build a quality email list. Personalize your messages.

Stay active on social media. Just make sure you’re prioritizing the right distribution channels.

Know the days and times when your B2B audience is consuming content.

Recognize the devices people are using to engage with content. Make sure your website is optimized for mobile searches.

Once you understand how your target audience consumes business content online, you’ll be able to improve your overall B2B marketing strategy.

What type of online content is your company producing to reach prospective B2B clients?

Source Quick Sprout https://ift.tt/2EkLMHg

Lessons from a Six-Year-Old Credit Card Statement

Yesterday’s article, The Financial Noise, was originally a very, very long draft that included several specific stories from my own life where I talked about the realization of the negative financial impact of “noise” in my life. Although it didn’t really fit in the article, I wanted to share this particular story on its own, because this one experience has really highlighted for me the value of cutting through the “financial noise.”

Recently, while cleaning out our filing cabinet, I came across a six-year-old credit card statement. I had opened it and paid the bill, but it looked like it had been opened just once and barely examined before being stuffed back in the envelope and put aside.

Ordinarily, I’d just toss such things right in the recycling bin, but for some reason, I opened up the bill and looked through it. I was curious as to how I was spending my money six years ago.

What I found rather disappointed me. Even though, at the time, I considered myself pretty frugal, it was kind of rough to read through it.

Why? A large portion of the charges on there were both unnecessary and unremembered. They were for silly things in the moment, like a purchase at a convenience store that was probably a snack I didn’t need. They were for hobby items that, frankly, blur in with many, many other hobby items, completely indistinct in the big scheme of things. There were a number of meals eaten out at completely forgettable places.

Why couldn’t I have just checked out those books from the library?

Why couldn’t I have just eaten at home?

What on earth did I spend $248 on at Target?

I can’t even remember what almost all of these expenses even were – it’s completely forgettable. I assume that some small portion of those purchases were actually necessary and I just don’t remember them, but an awful lot of the purchases listed on that credit card statement come off as completely purposeless.

My life would be strictly better today if I hadn’t made most of those purchases. There’s no question about it. It’s not just the money saved on that bill, but the fact that the same phenomenon is likely true for every credit card bill from that year and from the years around it. So many of those expenses are basically useless in hindsight, and having that money today would push me much closer to actual life goals and big meaningful experiences instead of small, forgettable stuff.

Here’s the thing to remember: This isn’t about beating myself up for the mistakes of the past. The past is gone. I can’t rewrite it. There’s nothing to be gained from being hard on myself for those past mistakes.

Rather, those past mistakes should be used to inform my spending behavior today. That old credit card statement is a big clue as to how I should be spending my money right now.

In short, this credit card statement is showing me the importance of considering my “future self” when evaluating purchases I want to make right now.

What will I think of this purchase I’m about to make when I look back on it in hindsight in six years? Will I look at that credit card statement and not even remember it at all? Or, if I do remember it, will I wonder why on earth I spent my money that way? If that’s the case, then I should rethink this purchase because it’s not adding any long term value to my life.

That’s not to say that the long term perspective should always win. The issue is that the short term perspective – buying what I want in the moment with no long-term consideration – wins too much. In most of the purchases on that statement, I’m pretty confident in saying that I didn’t even consider the long term impact of that purchase. I didn’t even think of what I would think about that credit card statement five years from now.

My solution to all of this is simple. I’ve been doing an 30 day challenge for the month of October where, for every single thing I’m purchasing, I’m simply asking myself what would I think of this purchase looking back on it five years from now?

In a lot of cases, I’m finding that I respond by thinking, “You know what? This is a pretty useless purchase,” and I put the thing back on the shelf or empty out my online shopping cart. Often, this convinces me to find another approach to the problem. I’ll see if a book is available from the library, or I’ll ask my local tabletop gaming group if anyone has a copy of it, or

Sometimes, it is readily apparent that I will care about this in five years – this is particularly true when something is filling a need, like basic food items.

Then there are a few things that I know are short term oriented that I’ll find myself arguing on behalf of rather strongly. Often, it’s something that I feel will have lasting impact, or it’s something that’s part of something deeply important to me, like visiting a roadside attraction with my kids or a dinner with an old friend. I probably won’t remember the specifics of those things five or six years from now, but they’ll be a part of the fabric of something I hold dear – my relationship with my children, or my connection with a lifelong friend.

Thinking of that “future self” might seem like a bother, like that “future self” is a nag sitting on your shoulder. Whenever I feel like that, I just think back to how I felt as I was reading through that credit card statement and looking at all of the expenses I couldn’t remember, the meaningless purchases that really added nothing to my life, and I realize that my life is strictly better when I get rid of those things entirely.

I’m not perfect with it, nor will I ever be. Like most things on our life’s financial journey, it’s trying to hit a constantly moving target. I like to think of it as a spiral of constant improvement, where you’re aiming for a target and sometimes you shoot a little off to the left or a little high, but each time you’re getting closer and closer to exactly where you want to be.

When you’re thinking about purchases this month, take some time to consider your future self in that equation. Imagine sitting down and looking at your credit card statement six years from now and this expense is on that statement. How would you feel about it? If you wouldn’t like that expense, then maybe it’s not really a worthwhile expense at all.

More by Trent Hamm:

- The Dance Between Your Present Self and Your Future Self

- Why Keeping Careful Track of Your Spending Behavior Is So Valuable

- Defeating the Most Common Life Regret

The post Lessons from a Six-Year-Old Credit Card Statement appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2OelCe1

10 Common Blogging Mistakes That Can Hurt Your Blog’s Earning Potential

When I started blogging back in 2009, I had a good idea of how I wanted to monetize my site, what I was going to write about, and how I planned to execute it all. But even though I had a clear-cut plan in place, I still made a lot of rookie mistakes. Not only did […]

The post 10 Common Blogging Mistakes That Can Hurt Your Blog’s Earning Potential appeared first on The Work at Home Woman.

Source The Work at Home Woman https://ift.tt/2OOReGr

Online Shopping Is Too Convenient — So I’m Making It Harder on Myself

While I normally live a very frugal lifestyle, I have a sad confession to make: During the month of September, I spent over $250 on Amazon.com.

I did pick up a new bed for my dog (necessary), so that’s good. I also bought some regular stuff that was probably justifiable — an air filter for our car, some Command strips to hang pictures on my walls, and a package of mechanical pencils so my kids will stop saying we don’t have any.

The real shame here is all the other stuff I bought: an Echo Dot because my kids left our other one out in the rain, new face cream, a $30 DVD player to replace a broken one we barely use, and an $11 set of Thirstystone coasters. I also blew $75 on a Halloween costume even though I haven’t dressed up for the last 10 years. Gasp!

This situation isn’t the end of the world, and it’s not a disaster for our finances, either. We’re free of all debt, including a mortgage, after all. And we’ve already exceeded our savings and investing goals for the year. Finally, the $250 we spent on Amazon did fit into our monthly budget into our “miscellaneous spending” category, so it’s not even like we went over our budget.

Still, there’s a part of me that wants to make sure this doesn’t happen again. Spending $250 last month is a one-time fluke I can live with, but we all know that $250 per month is $3,000 per year! I do not want to be spending $3,000 a year on random things I probably don’t need in the first place.

That’s why I disconnected all our credit cards from my Amazon account last night. Having the ability to order almost anything I want with a single click is just a little too convenient and enticing. If I’m going to buy something through Amazon, I’m going to force myself to enter my credit card details every time. No excuses!

How to Avoid Overspending Online

If you’re struggling to avoid the temptation of buying things you don’t need online, I suggest you take similar steps to make the process more difficult. Here are some other ways to avoid letting the convenience factor of online shopping ruin your finances this year.

Delete Apps That Entice You to Shop, and Unsubscribe From Retailer Email Lists

I never had the Amazon app on my phone, and I’m not huge on apps in general, but I would delete any rewards or shopping apps from my phone if they were causing me to overspend on a consistent basis. This includes apps for stores you shop at and even rewards or cash-back apps like Dosh or Ibotta.

Apps can make our lives easier, but you may not want shopping to be so easy you can buy something on your smartphone while you’re waiting in line at the grocery store or watching television on your couch. Delete apps from your phone and force yourself to shop the hard way (in person or at least on a laptop), and you are a lot more likely to avoid unnecessary spending.

The same goes for email lists: If your inbox is bombarded daily with tempting new flash deals, free shipping offers, and half-off sales you just can’t seem to resist, it’s time to unsubscribe.

Track Your Spending

Another way to make sure you don’t overspend — in any area of your life — is through expense tracking. You don’t have to go through any elaborate steps to track where your money is going each month if you don’t want to. Really, all you need to do is log into your bank account and credit card accounts a few times per month to tally up how much you spent in important categories like dining out, entertainment, and transportation.

Tracking your spending is important for a few reasons. First, it forces you to come to terms with the reality of how you’re spending — not just wishful thinking. If you think you’re being frugal, tracking your spending is a smart way to know for sure.

Tracking your spending can also help you stay on track with certain spending goals. If you hope to spend less than $600 per month on groceries, for example, tracking your purchases each month is the only way to know whether you’re meeting your goal or not.

Start Using a Budget Each Month

While tracking your spending is a good idea, you can take it up another notch by using a monthly budget. Budgeting may have a bad rap, but a solid budget is really nothing more than a plan for the money you work so hard to earn.

My favorite form of budgeting is the zero-sum method because it forces you to “spend” each dollar you earn on paper each month with some of your funds going toward savings and investments. However, there are many other types of budgets to consider, including the envelope budget and the 50/30/20 budget. You can also use budgeting software like Tiller.com or You Need a Budget to create a custom spending system that works for you.

Whatever type of budget you use, you can also rest assured that you don’t have to be super-strict. In my home, we have a “miscellaneous” spending category each month that’s normally used for dining out, birthday presents for family members, or other expenses I forgot to plan for explicitly.

Set a Waiting Period for Each Purchase

If you don’t want to remove shopping apps from your phone or delete your payment information from your favorite online shopping accounts, another strategy to consider is simply instituting a waiting period before you buy anything for your home or yourself. Forcing yourself to wait even 24 or 48 hours before you hit that “buy” button could be all it takes for you to figure out you don’t really need something or you already have an item you could use instead.

Instituting a waiting period for your online shopping is also easy thanks to online “carts” that can hold your purchases while you wait it out. Whenever you discover you want or need something online, add it to your cart… and then wait for a designated length of a time to see if you still want it or need it. If you find you can live without it — or even forget about it entirely — remove it from your cart and move on.

Final Thoughts

The online world has made our lives easier in so many ways. These days, you can order groceries, renew your driver’s license, or even shop for a new home mortgage without leaving your home.

But you know what? Sometimes the internet can make our lives a little too convenient. When you can spend hundreds of dollars on “stuff” without even realizing it, convenience can start working against your goals.

Unfortunately, it’s up to us to track our spending, see where we could make improvements, and set firm limits for ourselves. We all know online retailers want us to spend more and more regardless of the consequences, and only we have the power to look at our spending and say enough is enough.

Holly Johnson is an award-winning personal finance writer and the author of Zero Down Your Debt. Johnson shares her obsession with frugality, budgeting, and travel at ClubThrifty.com.

More by Holly Johnson:

- Why Meal Kit Delivery Services Like Blue Apron Are a Waste of Money

- Can You Score Better Travel Deals Using VPN?

- Why I’m Only Focusing on One Half of ‘FIRE’

- Beam Review: Can You Really Earn Up to 4% With This Online Savings Account?

The post Online Shopping Is <em>Too</em> Convenient — So I’m Making It Harder on Myself appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2NtYCm5

10 Amazon Prime Perks That Make the $119 Membership Fee a Total Steal

They definitely had a point. What’s a membership worth if you aren’t getting all the perks?

The 10 Best Amazon Prime Benefits

In a recent “Money Girl” podcast episode, host Laura Adams reviewed 10 of the best benefits of Amazon Prime. Whether you’re considering shelling out $119 for Prime or you’re wondering if you’re making the most of your membership, you’ll want to check out the list.

Here are the quick-and-dirty details.

1. Free 2-Day Shipping

Of course, we have to mention that lighting-fast delivery service. Instead of having to wait until your cart tallies up to $25 to get free shipping, you can throw items in your cart whenever you need them and they’ll be zapped to your door.

2. Free Same-Day Delivery

If two-day shipping isn’t fast enough, you can get free two-hour delivery on orders of $35 or more. If you’re willing to pay a delivery fee, you can have the order on your doorstep in one hour. Prime Now is available in 40 cities and includes delivery from Whole Foods.

3. Discounts at Whole Foods

Prime members can take an additional 10% off sale items and receive select item discounts at Whole Foods stores around the country.

4. Free Movies and TV

Sit back and relax with unlimited streaming of TV shows and movies in the Amazon library. Amazon’s original show “The Marvelous Mrs. Maisel” just scooped up all those Emmy Awards, so check it out if you need something to binge-watch.

5. Music-Streaming Options

Prime Music features more than 2 million songs, and your membership comes with a 20% discount on Amazon Music Unlimited subscriptions. Go ahead — play those new releases on repeat.

6. Free Audiobooks

You probably know that Amazon owns the audiobook company Audible, but you may not have tried Audible Channels yet. This Prime benefit has audiobooks, original audio series and playlists packed with spoken-word entertainment.

7. Free Books and Magazines

You don’t need a Kindle to access free books and magazines, because the Kindle app is free on any device. You can even turn on Audible Narration to switch easily between reading and listening.

8. Easy Alexa Voice Shopping

Goodbye, shopping list you scribbled on a piece of junk mail. If you love your Amazon Echo, you can ask Alexa to make Amazon purchases for you. Alexa can even make product recommendations and let you know when a delivery has arrived.

9. Extra Savings With the Prime Rewards Credit Card

Eligible members can get the Amazon Prime Rewards Visa Signature Card, which doesn’t charge an annual fee. It even gives you 5% back on Amazon and Whole Foods purchases.

10. Photo Storage

Prime members get 5 GB for videos and documents, plus unlimited storage for photos. You can upload them to Amazon’s cloud from any device.

Listen to the full podcast for more details on these 10 tips for making the most of your Amazon Prime membership. Plus, find tips for saving on your pumpkin spice lattes in a quick segment from me!

Lisa Rowan is a senior writer at The Penny Hoarder.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2pIM5Sh