الجمعة، 14 ديسمبر 2018

Douglass in great spirits after surgery

Source Business - poconorecord.com https://ift.tt/2BmTJqM

The Best Dropshipping Companies

Dropshipping is when you sell a product that’s shipped directly from the manufacturer to your customer. It is never held by you in a warehouse or a spare bedroom, and you’re not responsible for the packaging or shipping. Your dropship partner takes care of all that.

Sounds dreamy, right? No warehouse rent to pay, no upfront investment in purchasing inventory, and no shipping work on your end. Those are the perks.

But those are also the drawbacks. You don’t have the inventory in your warehouse, so you don’t have control of a customer ordering something that’s out of stock. There’s no shipping work on your end, so you can’t control the shipping speed, or the packaging. Long ship times = canceled orders. Weird packaging = bad reviews. And, you’ll still need upfront money for advertising, building your website, and all the other steps you’ll need to take to start your business.

And, because you’re basically outsourcing those storing and shipping tasks to your dropshipper, you may not have as great of margins that you would if you took that all in house.

Like any business partnership, before you get involved you need to do your research on who you’re working with, what it’s going to cost you, and what you’re expecting to get out of it.

What’s the best dropshipper?

Trying to find the best dropshipping company is a little bit beside the point. It’s like asking for the best eBay seller or the best store on Etsy.

There are things that make dropshippers great, and they’re a lot of the same things that make an eBay or Etsy seller great: They’re super communicative and have fast shipping. The product arrives as promised. It looks like the listing and it arrives in one piece in packaging that looks nice and not chewed up by an alligator.

Just like an eBay seller, the best dropshipper for you is the one selling what you’re interested in buying. They will reliably, communicatively, and quickly shipping the product you’re after at the price that’ll be profitable for you — that’s your best.

Dropshipping suppliers, databases, and tools

It can be hard to break into dropshipping because most dropshipping businesses don’t like to share their items or their suppliers. The thinking is: you’ll just replicate their shop and eat into their market.

Many dropshippers use a Shopify store and an automation app like Oberlo or Spocket. This is a quick way to get set up in minutes.

Shopify dropshipping apps and tools

- Oberlo is a plugin service that works with Shopify stores. You’ll browse the Oberlo directory (which includes suppliers verified by Oberlo) to find inventory you’d like to sell in your store. You’ll be able to see how many pageviews, sales, and star-rankings each item and seller has. Once you make a sale, you’ll use Oberlo to order the item to be shipped to your customer. Oberlo has a forever-free plan, though you’ll need to pay for a Shopify subscription, too. Oberlo has 4.7 out of 5 stars from 2,258 reviews in the Shopify app store.

- Spocket is a database app of dropship items that you can sort by country and simply upload into your Shopify store. Spocket makes it easy to find US and EU items that’ll ship within your country rather than from China, cutting down on slow ship speeds. The Basic plan (25 products with unlimited orders) is forever free, and upgrading to Pro is $39 / month for 250 products and branded invoicing. The Empire plan unlocks unlimited products for $99 / month. The app has 4.8 out of 5 stars from 1,008 reviews in the Shopify app store.

- Dropified is a Shopify app for populating your store with items and automate your orders on AliExpress, including customer shipping address. There’s no Dropified marketplace, but rather a browser plugin that’ll let you pull from anywhere on the web. You can set up margin parameters and rules for changing the price points in your store. There’s a free 14-day trial; after that it’s $47/month for the Builder plan. The app has 4.8 out of 5 stars from 98 reviews in the Shopify app store.

- Dropwow is like Oberlo or Spocket, but has more negative reviews. The tool claims to automate your orders and help you locate dropshippers located in the US and elsewhere. However, with only 3.8 out of 5 stars from 108 reviewers on the Shopify app store, and a monthly subscription of $29/month, we don’t recommend it.

Dropshipping databases and software solutions

- SaleHoo – A $67 yearly membership grants you access to this database of wholesalers and dropshippers. There are currently 8,000+ suppliers on the site, and they’re all screened by Salehoo before they’re added to the directory. There’s a 60-day free trial period, and the customer service gets high marks: 9.6 out of 10 with 239 reviews on TrustPilot.

- Doba – This 2 million product database doesn’t just bring a number of suppliers into one marketplace — you’ll also place your customer orders within Doda as well. That being said, it’s not cheap and we’ve read a number of negative reviews, many of which mention that the prices aren’t low enough to profit. Doba has a 14-day free trial, so you can log in and run the numbers to see if a membership (which ranges from $29–249/month) is right for you.

- Wholesale2B has a variety of plans: sell its products on eBay, Amazon, on a Wholesale2B site, or your own WooCommerce / Shopify / Magento / BigCommerce site. Any one of these options costs about $20–30/monthmonth. Handle the orders yourself by becoming a registered reseller with each supplier or pay Wholesale2B a 3% fee to handle that for you.

- Worldwide Brands – For $299, you can get a lifetime subscription to this database of wholesalers and dropshippers.

- Wholesale Central – This free directory lists suppliers you can work with individually to order products from. There’s nothing fancy about it — it’s like a phone book — but has useful information to use as you do your research.

- Sunrise Wholesale Merchandise – A $99 yearly fee gets you access to Sunrise’s selection of goods. It’s a bit smaller than other databases, but there the shipping times are pretty quick: typically 5–7 days. Packages arrive to your customers with a receipt from “Customer Service” that’s not branded.

- Megagoods – A California-based warehouse and will dropship your goods under your packaging and branding, typically in less time than it’d take to ship from an overseas supplier. Check the added fees to make sure that your margins are good.

- Inventory Source – An automation tool that allows you to either sync the suppliers products with your page (inventory automation) or to sync the entire customer purchase flow so that your orders are automatically placed with your supplier (full automation). Inventory automation is $50/month and full automation is $150/month.

- Dropship News – This free online directory of suppliers is worth sifting through. We found some great US-based suppliers. Most of each supplier’s dropshipping information is on their profile, which saves you some clicking around.

- National Dropshippers – This site is free for the first 7 days, but its products are hard to find and search for, and the returns and shipping policies aren’t favorable. You can give a try to see if there’s a product that’s only available here, but if you can find it elsewhere you’ll probably be better off going with the alternative.

- DropshipDirect.com – This site makes some enticing claims: 100,000 items in its inventory, a SaaS-approach to data, and quick shipping from its Michigan warehouses. However, the sign-up form is in private mode and the company seems to be on a year-long hiatus. We’ll keep an eye on Dropship Direct and report back.

Online marketplaces

- AliExpress is a Alibaba’s online retailer. It’s based in China, but doesn’t sell products to anyone in mainland China. The site has lots of user reviews and analytics that are super useful during the product research phase.

- DHgate – There are over a million Chinese suppliers on DHGate. Best practice for buying off DHgate: check user ratings and feedback. Just like you would when buying something off of eBay, be wary of anything that could be a knock-off or imitation, and be prepared for slow shipping and nuances like new-with-box items arriving with their boxes unassembled.

4 Steps to start your dropshipping company

1. Find items to sell

Find your niche.

There’s lots of chatter on the internet about finding your dropshipping niche, but this is just a trendy buzzword for product-market fit: are there people who want to buy your product? From you?

If not, you won’t have a successful business.

You’ll have the most success dropshipping a product if there’s an audience that wants to buy it and doesn’t have an easy way to access it. That’s where you come in.

Some ways to find your niche: brainstorm rabid fan groups or audiences with a common need or interest (dog lovers, anime fans, parents who love to dress up their kids in matching outfits, sailors, very tall people, people who love 90s throwback tees). These are purchase-ready populations looking to love and buy things that they’re interested in.

See what’s trending on Facebook.

Doing a quick search of a phrase like “Get yours here” or “Buy now” and look at the videos featuring items for sale that are getting traction. This can give you a sense of which products are interesting people on Facebook right now. Look for a high number of views in a short period of time, then search for the item at a dropship supplier like Oberlo or AliExpress. Consider the price-point of the item in the video and the assets you can create for it. Can you replicate — or improve on — the current trending video? If so, you may have an item worth dropshipping.

Don’t sell anything dangerous or copyrighted.

If you’re a beginner, don’t start with something that goes in or on a person’s body. If you do not know the quality and source of the ingredients, and something goes wrong, do you have coverage for that liability?

Also, if there’s a celebrity or character from a movie franchise on the item, it could get you in trouble. Steer clear of mice with big round ears.

Look at seller’s reviews and order a test product.

How long has the seller been selling? What feedback have they been getting. When you order a test product, does it meet your expectations? What do you need to tell your customers so they’ll be happy when they receive the product?

Consider dropshipping only some items.

Just because you’re dropshipping some things doesn’t mean you need to dropship everything. Perhaps it makes sense to use dropshipping for large, bulky, high-priced niche items.

Say, for example, you have an online store that sells nautical gear. You may want to personally store and ship some items, but dropship the anchors. For items like this, your customers may also be more accommodating to longer shipping times since it’s a large and more considered purchase. Same goes for home goods: perhaps you keep small items in stock, but dropship the couches. You can increase your inventory breadth very simply this way.

Go directly to a supplier and build a dropshipping relationship with them.

This is a killer plan: there’s guaranteed to be less competition. You’re basically creating a new audience for an under-marketed product that’s not getting seen by a ready-to-buy audience. If you use a database, every single other subscriber is using that same database.

2. Nail the basics

Invest in a good domain name.

We buy all our domain names from Namecheap. (You can read our full review on the best domain registrars.) They come with free privacy protection. Skip all of the upsells — you don’t need them.

Set up your website.

If you go with Shopify, you’ll be up in minutes. Lots of dropshippers recommend the Shopify Brooklyn theme with a good font choice. You can also use another ecommerce option. Here’s our review on the best ecommerce platforms, if you’re interested in exploring.

Get a professional logo.

You can get one for a reasonable price (and no design expertise) with 99Designs.

Use a professional email address.

It should be a sensible start (help@, support@) with your own domain name. We recommend getting G Suite for $5 a month per user. There’s nothing to trust about emailing a customer service that’s at yahoo.com or gmail.com.

Give your customer strong trust signals.

You can do this with high quality photos and unique item copy, a real and robust About Us page, and thoughtfully using things like discounted prices and pop-ups.

Ask yourself: Would I buy from this store? Would I feel comfortable suggesting it to a friend or family member? You’ll need some trust logos and some FAQs at minimum.

Set shipping time expectations.

Most dropshipped items aren’t going to get to the customer very quickly — and in world where Amazon Prime has set the standard at two days, that means dropshipments of 30 days feel extremely slow. If you don’t prepare your customers they’ll be very unhappy. We’ve seen very straightforward copy, like: All our items ship directly from our suppliers in China. Shipments are processed the day of your order and arrive in 25–30 days.

Make sure your orders go through.

Bundle credit card orders so your bank doesn’t cancel your numerous orders. Let your bank know what types of orders and in what quantities you’ll be placing, so they’re not flagged as fraudulent. There is no pain so rich as having to reorder orders you’ve placed. (You do have a business credit card, right?)

Prepare for returns and cancellations.

How will you deal with unhappy customers? What’s your return policy and how will you chargeback customer payments? Will returned items be shipped to you, or to your distributor? How will that work? Like with anything in business, it’s important to set it all up from day one like it’ll be a huge success.

Set aside money to pay taxes.

If you’re using Shopify as your payment gateway, once you get to a certain sales threshold, Shopify will automatically report your sales to the government. You’ll want to make sure you have money available to pay applicable taxes. We also recommend getting an accountant and a lawyer (we’ve heard good things about UpCounsel and LegalZoom) and setting up Quicken.

3. Differentiate yourself

Make your store listings and ads unique.

Remember, if you can quickly and easily set up a dropshipping order for a specific product, it’s likely another store will be able to do the same. You will need to find an edge: why would someone order from you, or find your store selling the product, and not your competitor?

Take your own pictures. Write your own copy. Shoot unique social videos. Really put thought into how to best convey the product and why a person would want it: What problems does it solve? Can it make them feel joy?

Import user reviews.

If you’re using AliExpress, you can import the user reviews. No one likes being the first to buy something.

Consider offering free shipping.

Do all orders have free shipping or only when a certain order spend is hit? What threshold or minimum spend works best?

Market your store.

Make sure people know about your store. This can be through word of mouth, social media ads, viral memes, influencer programs, SEO, a newsletter. You’re going to need visitors to make sales.

4. Iterate iterate iterate

Use ads to test and gather data.

We’re assuming that you’ll be buying ads. If you do, buy and use the data to test what’s working. What gets traction? Double down on it. What doesn’t? Trash it. This may lead you to changing your products, your ad style, your audience. Following the early traction means you head toward what’s working and away from what’s not.

Analyze your sales.

What’s selling well? What’s not selling at all? Is there any common theme in the items? Replicate what you can. Stop what’s not working.

Dropshipping vocabulary

Arbitrage – The simultaneous buying and selling of an item to take advantage of a difference in price for the same asset. Say there’s a board game for sale at Walmart for $20, but the lowest price on Amazon is $45. Arbitrage is listing the game for sale on Amazon and buying the Walmart game. For every sale you make on Amazon, you take advantage of a $25 price difference. If your arbitrage is online to online, with free shipping, the math suggests you could simply sell on one site, buy and ship from the other, and pocket all the profit. This does not take into account any hiccups: returns, merchandise not accurate, merchandise no longer in stock, price changes in either market, etc.

Dropshipping (DS) – The supply chain system in which a seller does not keep items in stock, but rather transfers orders directly to a manufacturer, supplier, or wholesaler who ships the item directly to the consumer.

Minimum Advertised Price (MAP) – Some sellers set a floor to how low you can advertise or display your product for sale. This is not the same as the price you can sell it for. So, the MAP price does not take into account coupon codes or sales, or other tricks like offering a gift card with a purchase, offering rebates, or doing things like showing an even lower price in the cart.

Dropshipping examples and press

You may have seen the posts we’ve seen — the ones about people starting dropshipping businesses and raking in the sales. We’re talking five-figures in a single day, six-figures every month. What is this magic sauce, we wonder.

The magic sauce is the same sauce as any other business: it’s a math equation based on margins. How big are your margins? How big is your customer base? What’s the conversion rate? How stiff is the competition?

Welcome to a little-known corner of the e-commerce world, where small entrepreneurs use social-media ads and hip virtual storefronts to entice people into buying products listed on online marketplaces such as Alibaba Group Holding Ltd.’s AliExpress.

The process often involves online storefronts transferring customer details to an AliExpress seller, which ships the goods directly to the customer; the storefront bills the customer. Called dropshipping, it is a twist on a fulfillment technique that major online retailers also use to send goods directly from their manufacturers to the customer.

The entrepreneur profits by charging a high markup, betting shoppers are unlikely to stumble upon the less-expensive goods on a marketplace site. AliExpress is the most popular such marketplace, but some entrepreneurs order from sellers on other marketplace sites like Amazon.

—“The Mystery of the $70 Hoodie That’s All Over Facebook,” Wall Street Journal

The mystery of the $70 hoodie is also not a mystery: it’s a one-time sale that’s not going to turn into repeat business. It’s a simple equation:

high price + low product quality + poor customer experience ? repeat business

Dropshipping seemed cool because it made starting an eCommerce seem easy: I didn’t need to buy products in advance; I didn’t need to have space to hold them, and it didn’t require extra time and effort to ship the orders myself. Dropshipping does have disadvantages, but it really appealed to me, so I continued my online search.

There are numerous ready-to-use eCommerce platforms like Shopify, BigCommerce or Squarespace. Most of them start at around $20 per month, which seemed like a good deal for a first-time entrepreneur like myself.

It took me two days to set up the store the way that I wanted it to look. Shopify is totally non-programmer friendly. All you need to do is open an account, select a look for your store, and that’s it – you’re ready to sell.

When I set up my store, I had no definite idea of what I should sell. I wasn’t sure if I should pick a product I was passionate about or just a random product I was able to find in dropshipping databases like WholesaleDirect.com or the like.

“This Guy Made $12K In One Month While Working Full-Time,” Huffington Post

“This guy” is Justin Wong, and he made his business work by studying Instagram marketing, set up affiliate partnerships with influencers, and matched his product with his marketing technique. And, he’s not confused about the pros and cons of that marketing strategy: when the posts age on a influencers feed, his sales go down.

My name is Jacky Chou. With my partner, Albert Liu (albeliu on Reddit), we launched a home decor dropshipping site that went from negative 3k to 250k a month in 8 months at 30-40% margins. We’re both first generation Asian-Canadians who moved from Vancouver to Berlin to work in marketing.

We started our dropshipping store as a ‘practice what you preach’ case study, as we’re both working as digital marketing consultants (Albert as a freelance Facebook consultant and I’m a founder of an SEO agency, Indexsy).

— “We made 250k USD last month with our dropshipping side hustle. Oberlo / Shopify reached out to us to do a success story. AMA!,” Reddit

Further reading

- Buzzfeed News “Small American Businesses Are Struggling Against A Flood Of Chinese Fakes”

- Wall Street Journal “‘Drop Shipping’ Looks Set to Go Mainstream as More Retailers Get on Board”

- Racked “The Fake News of E-Commerce”

- Vox “Why an ad for bootleg Hallmark socks is one of the most ubiquitous of the holiday season”

- Inc. “Why Weebly’s CEO Is Saying No to the Hottest Trend in E-Commerce”

- Entrepreneur “Why It’s Nearly Impossible To Stop This Amazon and eBay Scheme”

- The Atlantic “The Strange Brands in Your Instagram Feed”

- Reply All “The World’s Most Expensive Free Watch”

- Inc. “How to Earn Money While You Sleep: A Step-By-Step Guide to Building a Drop-Ship Side Hustle”

- Vox “Here’s why Trump threatened to pull out of a 144-year-old postal treaty”

- Today.com “‘Drop-shippers’ reveal the hard work behind the legitimate work-from-home model”

Source Quick Sprout https://ift.tt/2QSiyEN

17 Ways to Save Money When You Live in a Big City (It’s Actually Possible!)

I know I don’t have to tell you this, city dwellers: Living in a big city is expensive.

I was slapped with that cold reality when I moved to Denver. After living in two relatively rural college towns, I was used to paying a rent I could almost afford; groceries that were, well, normally priced; and a night out with friends that never remotely creeped close to $50.

Then there were those times I visited New York City and San Francisco for long weekends… Don’t get me started.

Anyway, kudos for making it work — but I know it’s got to get difficult sometimes. That’s why we put together a list of ways to save money when you live in a big city.

1. Save Money on Any Debt You’ve Already Accumulated Â

Moving in general is expensive, but moving to a big city and adjusting to that new cost of living is difficult.

If you accumulate any credit card debt in the process that’s still lingering, consider refinancing or consolidating it to find better interest rates.

A good resource is Fiona, a search engine for financial services, which can help match you with the right personal loan to meet your needs.

Fiona searches the top online lenders to match you with a personalized loan offer in less than 60 seconds. Its platform can help you borrow up to $100,000 (no collateral needed) with fixed rates starting at 4.99% and terms from 24 to 84 months.

2. Get $3 Pantry Essentials Delivered to Your Door

Groceries tend to be more expensive in big cities. Goods in New York City are 10% higher than average U.S. prices, according to data from the U.S. Bureau of Economic Analysis.

The task itself also tends to be more difficult, depending on how far away you live from the closest store.

A great way to save money is to order the essentials online — where prices are more likely to be the same nationwide.

With Brandless, you can stock up on all your grocery essentials for $3 each. Yup — everything’s $3. And you’ll get $5 off your order when you sign up with your email address.

Better yet, Brandless carries organic, gluten-free and vegan options. You could spend hours perusing the virtual aisles, but here are a few examples:

- An 8-ounce jar of organic, 100% pure honey: $3

- Organic aged white cheddar popcorn: Two for $3

- Roasted and salted almonds: $3

- Organic, fair-trade, light-roast ground coffee: $3

You can also stock up on Brandless cleaning supplies, household essentials and clean beauty supplies.

Shipping is free when you spend $39 or more.

3. Claim Cash Back on Drinks and Takeout Orders

Life tends to be a bit more stressful in the big city, and it’s important to take time to unwind. Whether you prefer to do that with alcohol or takeout, claim cash back.

Traditionally, Ibotta is known for its cash-back offers on groceries, but it’s also available for restaurants, bars and food-delivery services.

For example, we’ve seen deals for:

- 10% cash back for new DoorDash users.

- $5 back on two bottles of Stella Artois.

- $2 back on a glass of Cupcake Wine.

Just download the app for free, then select “Find Offers.†When you claim your first cash-back offer, you’ll pocket a $10 bonus.

4. Ease the Pain of Those Higher Car Insurance Rates

The good news is big cities typically have public transit systems, so sometimes you can get away with selling your car and living that car-free life.

If you still need your car, though, you’ll probably face higher car insurance rates.

Here are three options to help alleviate the pain associated with those high costs:

- First, find a pay-per-mile insurance policy. If you live in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia or Washington and drive less than 200 miles a week, consider getting insurance through MetroMile, a company that lets you pay for insurance by the mile. I you only drive 5,000 miles per year, you could save $500, according to MetroMile’s calculations. Find out if it could help you save by snagging a free quote.

- If you still drive quite a bit, take a few minutes to compare rates from other providers. A service called Gabi will do it for you, and you don’t even have to fill out any forms. Simply link your insurance account and provide your driver’s license number, and Gabi will go to work. Gabi says it finds an average savings of $720 per year for its customers.

- Help offset big-city costs by renting your car out when you’re not using it. With the Getaround app, you can safely rent out your car to people in your community and neighborhood. The company insures your car for each trip, offers 24/7 roadside assistance and screens drivers for a safe driving record.

5. Count Your Many Steps and Turn ’Em Into Cash

Whether you walk to work or take public transit, you tend to spend more time on your feet in big cities.

Go ahead and reward your barking feet with the Achievement app.

Achievement connects to your phone’s health apps and runs in the background, so it works passively. Many users report being happily surprised when logging on and checking their progress.

Once you earn 10,000 points, you’ll score $10, which you can deposit directly into your bank account.

Pro tip: Achievement connects to more than 30 Android and iOS health-related apps, including MyFitnessPal and Garmin. The more apps you connect, the more earning opportunities.

6. Negotiate Your Monthly Bills (or Have This Bot Do It)

A great money-saving tactic when living in a big city is to negotiate your bills. Some may be more difficult to negotiate than others (you can even try negotiating your rent), but we suggest starting simply with a free negotiation tool.

Download TrueBill, an app that’ll negotiate your bills, cancel unwanted subscriptions and refund your bank fees.

After downloading the app, create an account and link your bank account and/or credit cards. Turn on the bill negotiation and outage protection features. Boom. TrueBill is already searching for potential refunds — it might get you a refund even when you didn’t know an outage occurred.

On average, Truebill says it helps customers save more than $700 a year by lowering their bills, canceling necessary subscriptions and getting refunds.

Signing up and using the service is free, though there are some paid premium services that are totally optional — but could totally be worth it.

7. Set up Your Big-City Budget

If money’s tighter than you’d like, it’s important to keep a budget.

Budgeting can be a little scary, but it doesn’t have to be. The first step is to find out how you’re doing now. Luckily, you can have a financial assistant right in your pocket to help you out.

The Empower app is a powerful budgeting tool that can help you figure out how you’re spending your money and develop a budgeting plan to keep you on track.

Link the app to your bank accounts, and it will track your spending. It will also categorize your spending so you can see exactly where you are overdoing it. That’s right: It will show you just how many times you went out for dinner because you didn’t want to do the dishes.

Set a monthly spending limit and the app will show you a graph that can tell you in one snapshot just how you’re doing for the month. Are you over the line or under it? It’s that simple to see how you’re doing so you can adjust your spending accordingly.

8. Declutter Your Space — and Earn Some Extra Cash

Affordable apartments tend to be small, so if you’re feeling a bit cluttered in your space, clean stuff out.

You can sell virtually anything on Letgo. This easy-to-use app lets you snap a photo and upload your item in less than 30 seconds. It removes a lot of the hassle of selling things online, and it’s 100% free to use.

If you’ve got old technology lingering (think: phones, CDs, DVDs or video games), download the Decluttr app, and start scanning the barcodes on your media to get immediate quotes. It’s completely free to use, you won’t pay listing or seller fees, payment is super fast and even shipping is free.

Plus, enter FREE5 at checkout to get an extra $5 for your trade-in order!

9. Entertain Yourself on Your Commute (and Win Cash)

While you’re swiping around on your phone and wasting time on your commute, go ahead and download the Lucky Day app

You could win up to $10,000 playing digital scratch-off tickets or even a whopping $100,000 in the daily lotto. You’ll also have a lot of chances to win gift cards to cool places like Amazon, Walmart, Dunkin and Target.

It’s all free to play, with no in-app purchases. The company has already awarded more than $3 million in prizes to winners since 2014.

Try to resist an embarrassing happy dance on the subway if you win money.

10. Create an In-Case-of-Emergency Fund Without Thinking

When you have to spend a lot of money just to get by day to day, the task of saving money will easily fall to the wayside.

Don’t let that happen. Digit allows you to save money without even noticing.

This innovative app automates saving for you. Simply link it to your checking account, and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

Bonus: Penny Hoarders will get an extra $5 just for signing up! Additionally, savers will receive a 1% bonus every three months.

Using this set-it-and-forget-it strategy, one Penny Hoarder saved $4,300 without noticing — read his Digit review.

If you need that money sooner than expected, you’ll always have access to it within one business day.

Digit is free to use for the first 30 days, then it’s $2.99 per month afterward.

11. Dress up to Big-City Standards Without Credit Card Debt

There’s something about living in a big city where there’s more pressure to dress like, well, a real human. Fashion trends are actually timely, and you want to look professional when walking into your skyscraper of an office.

But just because you have pressure to look trendy doesn’t mean you have to rack up credit card debt.

Instead of shopping online at any ol’ retailer or signing up for a clothing subscription service, check out flash-sale site Rue La La first.

It offers top brands for up to 70% off. How? When retailers have excess product, Rue La La takes it and sells it at a hefty discount — but each sale is only available for a limited time.

Just sign up for free with your email address. (It’s an exclusive site — discounts are for members only.) Then search your favorite brands, or browse the boutiques to see what’s available.

12. Protect Your Abode and Belongings With Affordable Insurance

If you’re renting, you know some cities and states require renters insurance. It might seem like a pain at the time, but it can really save you in the long run.

For example, when my boyfriend lived in Denver, a hail storm hit and destroyed his complex’s roof, causing water to flood into his apartment. After his deductible, his renters insurance paid for him to move into a hotel near his workplace for about three months. If any of his items had been damaged, it would have covered those expenses, too.

If you don’t yet have renters insurance — or want to shop around for a better rate — start by getting a free quote. We recommend the online insurance company Lemonade, through which renters insurance starts at $5 a month.

Beyond affordable rates, Lemonade adds a layer of transparency you don’t often see in the insurance world. Instead of profiting extra when it doesn’t have to pay out claims, the company keeps a set 20% of your premium for itself, and 80% goes into a pool for paying claims. Money left over after paying claims each year goes to a cause of your choice.

That also means Lemonade isn’t going to be super stingy about granting customers the claims they deserve — ’cause the money isn’t going into its pockets.

13. Find a Side Gig (Opportunities Abound)

Big cities are basically playgrounds for side gigs. If you’re struggling to make rent or are racking up credit card debt, consider increasing your income, even if only temporarily.

Here are some of our favorite side-gig options for folks in the big city:

- It’s no secret big cities attract more tourists, and that’s good news for you. If you have a spare room, try earning some extra money by listing it on Airbnb. If you’re a good host with a desirable space, you could add hundreds — even thousands — of dollars to your savings account with Airbnb.

- If you’re looking for a flexible, independent way to earn money — and you love hanging out with dogs — Rover might be your perfect gig. The online network connects dog walkers and sitters to local dog owners through its 4.9-star-rated app, so you don’t have to staple flyers on every utility pole across town. Rover says sitters can earn as much as $1,000 a month.

- Need a fun, flexible way to earn money while also meeting lots of new people? Try driving with Lyft. To be eligible, you’ll need to be at least 21 years old with a year of driving experience, pass a background check and own a car made in 2007 or later.

14. Call it Quits With Your Expensive Cell Phone Provider

If you’re sick of of paying your cell phone carrier hundreds of dollars each month, look beyond the so-called Big Four and into the discount carrier Twigby.

That’s what Zak Wilson did. He’d been paying Verizon Wireless about $180 a month for two lines. So he tried Twigby. For both phones, he’s now paying $60 a month.

Plus, new customers get 25% off the first six months of service.

Pro tip: Big cities mean big Wi-Fi opportunities. Whenever you can, tap into free Wi-Fi to save on data.

15. Snag Cash Back — Even From Your Favorite Local Deli

Cash-back apps are great, but many of them don’t cater to your favorite local haunts — like that unsuspecting deli on your block or your favorite coffee pitstop on your way to work.

But don’t worry. We found an app that’ll reward you for keeping any receipt.

As seen on Shark Tank, CoinOut is a shopping rewards app. You’ll earn cash when you snap a photo of a receipt — any receipt, from any retailer, featuring any item. (Similar apps are a lot pickier.)

We put it to the test: A couple of Penny Hoarder staffers dug out receipts — a $5 Wendy’s order and a salad from a local sandwich shop. One collected 5 cents, the other 4 cents. The better condition your receipt is in, the more you’ll earn back, so resist crumpling it into a ball.

You can also earn cash back when you shop online with one click through the CoinOut app. Featured retailers include Walmart, Overstock and Warby Parker.

You can cash — ahem, coin — out once a week for an Amazon gift card or funnel the money right into your bank account or PayPal.

16. Don’t Let Laundry and Dry Cleaning Shrink Your Budget

Laundry’s a big expensive chore in big cities. And dry cleaning? Don’t even get us started…

You’ve probably already invested in that magical Febreze Fabric Refresher spray (if you haven’t, just trust us), but now it’s time to tackle the costs of dry cleaning.

For some fabrics, it’s totally necessary. But for others (even if the tag says dry-cleaning only), it’s not.

Dive into your guide to saving money on dry cleaning. It just might change your life (or at least your budget).

17. Find Fun (and Free!) Weekend Activities

All right. We’ve addressed all your big recurring bills, but you’ve got to have some fun, too. After all, you live in a city where there’s tons to do and explore.

Look into your neighborhood’s farmers market, check out free museum passes from your local library, take a hike (genuinely), plan a picnic or window-shop.

Get some inspiration from our list of free things to do in Orlando.

Carson Kohler (carson@thepennyhoarder.com) is a staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2QVyN4a

How to Avoid a Plateau by Avoiding These 8 Business Mistakes

Mistakes happen.

If you’ve been in business for a while, you know by now that mistakes are just part of the process. New businesses and startup companies are slowly learning this.

Nobody is perfect, but some mistakes happen on a larger scale than others.

But here’s the thing, lots of these mistakes can be avoided.

That was my inspiration for writing this guide. There are certain common business mistakes that I see people making all of the time.

Brands are only making these mistakes because they don’t realize it until it’s too late.

Realistically, there are hundreds of mistakes that different businesses make each day.

However, I wanted to focus the attention on specific types of mistakes.

Your business always needs to be growing. If sales start to plateau or even drop off, it’s going to be a major problem for your company.

But you can prevent a plateau by avoiding these common mistakes that I’ve identified.

Use this guide as a reference to correct any of the mistakes that you’re currently making, or you can avoid them completely in the first place.

1. Not focusing on sales

Shockingly, this is a major issue that I see all of the time.

You would assume that generating more sales would always be a priority for a company, but sometimes brands start to lose sight of exactly why they are in business.

You’ve got to be making money. This money stems from sales, period.

That’s the best way to make sure your company will grow and ensure that you won’t stall in a plateau.

When I’m consulting with businesses, they’ll show me all of these other metrics that they’re focusing on, which is fine. But what are your sales?

If what you’re doing doesn’t translate to conversions and transactions, it’s not helping you out.

Don’t get me wrong. It’s great if you’re getting more email subscribers, social media followers, and website traffic.

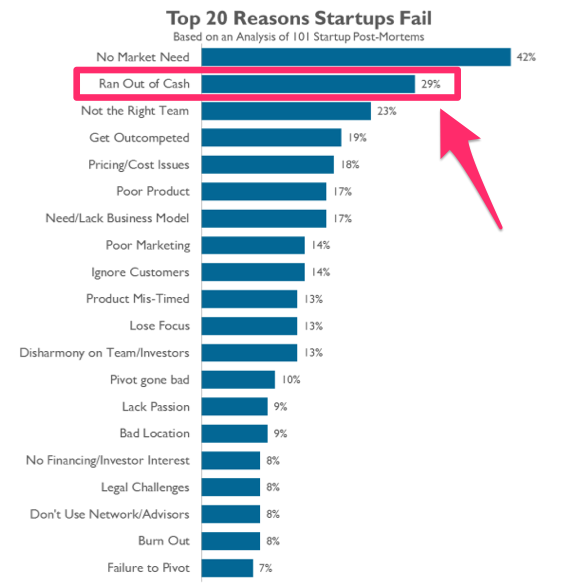

But running out of cash is one of the top reasons why startups fail.

If you can focus on new ways to generate sales, you’ll always have a steady cash flow.

I understand that you have so many other areas of your company that require your attention. However, you need to have priorities.

You can’t let sales to a back seat to anything, or it’s going to be a problem for you in the future.

2. Forgetting about the customer

Your business will live and die by your customers.

All of your decisions need to be profitable.

These two statements don’t always add up. But you need to find a balance between both of them if you want to grow. Here’s what I mean.

On the one hand, a decision you make could reduce your operational costs and ultimately drive up your profit margins.

But if that cost reduction impacts the quality of your products and services, it’s not going to benefit your customers.

As a result, sales will start to drop, which is much worse than a plateau.

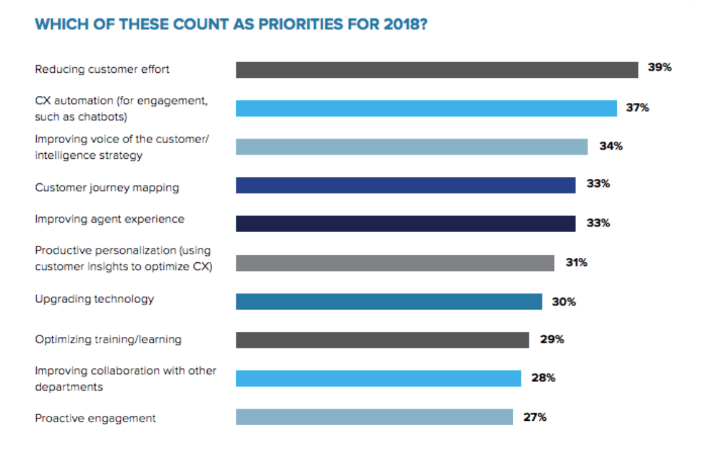

Let’s take a look at these priorities for businesses in 2018.

Do you see some commonality here?

Nearly everything on this list will help improve the customer experience. That’s what you need to prioritize.

Clearly, other businesses have recognized this and are acting accordingly.

So if you forget about your customers, it will be easy for them to just leave and go to one of your competitors instead.

If you put more emphasis on making your customers happy, the rest will take care of itself. Don’t cut corners just to turn a higher profit.

3. Ignoring data

Earlier I explained how some people focus on too many metrics that they forget about sales.

But another issue that I see all of the time is companies that just ignore these metrics completely.

I’m talking about things like:

- website traffic

- conversion rates

- click-through rates

- ROI

These are just a handful of the top metrics every marketing manager needs to track.

Without this data, how can you know if your campaigns are successful? How will you know what which decisions to make?

Another issue that I see is business owners who are clinging to the wrong data.

Here’s an example to show you what I mean.

Let’s say your business has website traffic that is increasing exponentially. You can’t just assume that it means your company is successful.

If your sales and conversions aren’t increasing at the same rate, you’re not actually growing, which should be a major concern for you.

That’s why you need to track your data and know how to analyze it properly as well.

4. Not analyzing your competitors

Your business doesn’t operate in a vacuum. There are outside factors that will have a direct impact on your success.

You need to keep an eye on your competitors.

Otherwise, they’ll steal your customers before you even realize what happened.

Compare yourself with them to see how you stack up. The easiest way to do this is with a SWOT analysis chart.

It’s simple but very effective.

That’s because it forces you to see where your business stands on paper. Just saying things like “we’re really good at what we do” doesn’t give you any benefit.

When you put things in writing, any glaring mistakes or areas where you can improve will be more obvious.

You can also take advantage of helpful tools to monitor your competitors.

One of the first things you need to do is identify who you’re competing with. You’ll want to analyze competitors locally, regionally, and online as well.

Compare your prices to them. Look at their website.

Check out their advertisements and social media campaigns.

What’s working for them? What needs improvement?

Then, you can apply what’s working for your competition to your own business. Avoid their mistakes.

See what customers are saying about your competitors online. We’ll talk more about online reviews in greater detail shortly.

5. Avoiding new technology

Adapt or die.

This theory can be applied to nature, as well as business.

If you’re resistant to change, it’s going to be the downfall of your company. That’s why you need to educate yourself about new technology trends.

- live chat

- artificial intelligence

- automation

- machine learning

- beacon technology

These are all things that can help your business grow.

I see so many business owners that are stuck in their old ways. But just because something worked for you back in 2005, it doesn’t mean that strategy will work in 2019.

To be successful in the future, you need to look beyond today, tomorrow, and next year.

You need to be prepared for technology advancements coming in 2022 or 2025.

Keep up with the latest trends. You don’t necessarily need to apply everything right away, but you have to start somewhere.

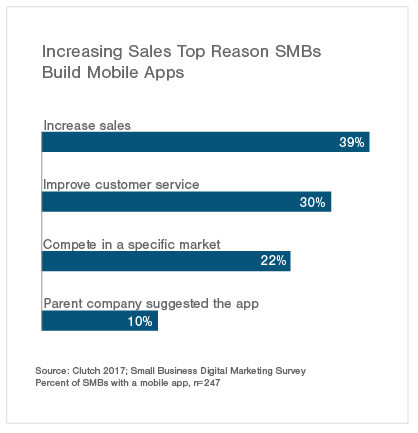

For example, you can start by building a mobile app for your business.

Why haven’t you developed an app yet? Don’t let the costs associated with this venture scare you away.

22% of business owners say that mobile app development is too expensive.

An additional 23% don’t think they can run a business and maintain an app at the same time.

This type of mentality is what’s going to cause a plateau, and eventually a decline. Find ways to make this happen, especially if you’re in the retail business.

Mobile apps have triple the conversion rate compared to mobile web browsers.

Product views per user are 4.6x higher, and the add to cart rate is 2.5x higher.

Building a mobile app for your small business is just one example of implementing new technology, and it’s not even that new.

If you’re resistant to change, it’s going to stunt your business growth. So have an open mind moving forward, especially when it comes to technology advancements.

6. Ignoring customer reviews

I briefly mentioned this before when we talked about monitoring your competitors.

In addition to reading what people think about other companies, you need to see what customers are saying about your business online.

There are lots of different places you need to check, such as:

- reviews on your website

- third-party sites like Yelp or Google

- social media comments

Respond to reviews.

Take notes about what customers are saying. Make the necessary changes based on this information.

Group common reviews together. If all of your customers are having the same problem, and you don’t make an adjustment, it’s basically just a slap in their face.

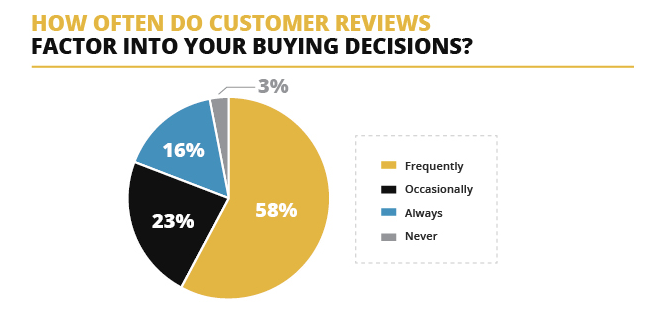

In addition to harming your relationships with existing customers, online reviews will have a direct impact on future sales as well.

92% of people read a review before making a purchase online.

88% of consumers say they trust an online review as much as a recommendation from someone that they know. This impacts their buying decisions.

Furthermore, 35% of people are less likely to buy if no online reviews are available.

This means that you need to take this strategy to the next level.

Not only do you need to read and monitor reviews, but you also need to encourage your customers to write reviews to improve your online reputation.

If you’re ignoring this, it’s a mistake that will be costly for your business.

7. Not accepting more payment methods

This relates back to what we talked about earlier in terms of forgetting about the customer.

I realize that it’s more expensive for you to accept certain forms of payment compared to other options. However, everyone has different preferences.

The days of just accepting credit and debit cards are over.

So if you’re still not taking every major credit card, it’s probably unlikely that you’re allowing customers to pay with digital payment methods.

But as I said before, you need to adapt to new trends and technology. Digital payments are becoming the way of the future.

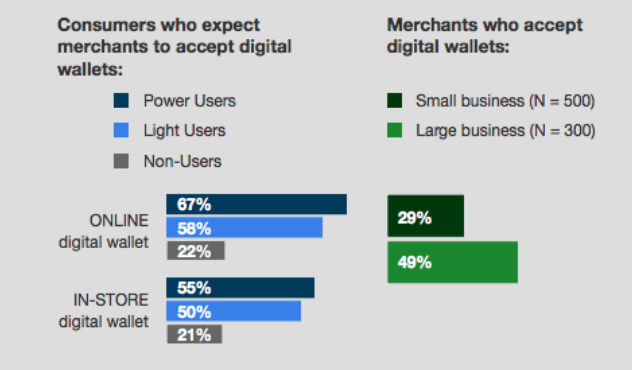

19% of consumers are using digital wallets.

About half of the people who use digital wallets expect merchants to accept those payment forms. But here’s something else that you need to keep in mind. More than one-fifth of users who don’t use digital wallets still expect businesses to accept digital payment methods.

Again, if you have integrated new technology into your business, this won’t be a problem.

The last thing you want is for a customer to decide they want to buy something, but change their mind because you don’t accept their preferred payment method.

Don’t expect them to just reach for another card. Instead, they’ll go find what they’re looking for from another business.

8. Never offering value

Why should people buy from your business?

It may sound like an odd question but think about it for a minute. You need to create a highly effective value proposition.

This will make it clear to everyone why they should buy from your business.

You need to understand the wants and needs of your customers.

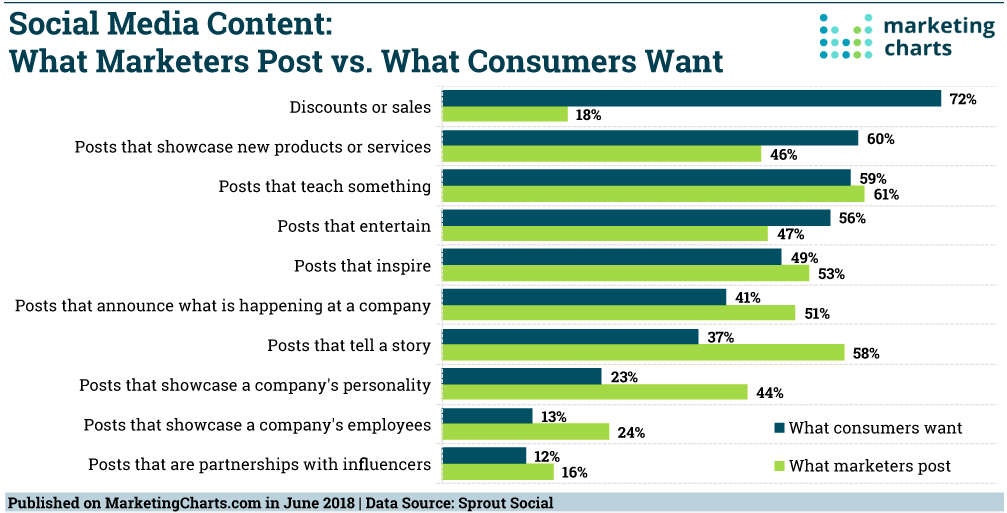

There’s a big difference between what consumers want and what marketers want.

As you can see from the graph, 72% of consumers want to see posts from brands on social media related to discounts and sales.

However, just 18% of marketers post those things.

There is obviously a major discrepancy here.

Even if you don’t want to offer discounts all of the time, you still need to come up with ways to add value to your brand. Otherwise, consumers won’t have a reason to buy from you, and sales will eventually decline.

Conclusion

Nobody is perfect. Every business makes mistakes.

You’re going to continue making mistakes in the future as well.

However, you reduce the chances of making these errors if you know what to look for before it happens.

Some of you may already be doing some of the things that I’ve covered on this list. But now you can identify those mistakes and make changes before they get out of hand.

If you can stay clear of the blunders that I’ve outlined above, it will help your business avoid a plateau or a decline.

What types of mistakes does your business need to fix in order to stimulate growth?

Source Quick Sprout https://ift.tt/2S6n405

Personal Finance 101: A Thorough Guide to Price Comparisons while Shopping

Mindy writes in:

Is there a simple trick to doing price comparisons at the store? I feel like I am almost always turning to my calculator to see what option is cheapest and then it takes forever to shop.

This started out as a mailbag question and, as they often do, the answer grew and grew and grew until it was clearly a post of its own.

To put it simply, there are a healthy handful of “tricks” for price comparisons while shopping. Using them all together makes most price comparisons really quick, at least for me, but it does take some time to really get them.

Before we get started, it’s worth noting that the best tool for quick comparison shopping in the grocery store is to simply have a strong grasp on basic mental arithmetic, particularly multiplying two single digit numbers together and dividing a two digit number by a one digit number in your head. If you can, being able to divide a three digit number by a one digit number is really useful, too.

This is one of those real world situations where the things pounded into our heads in grade school and middle school really pays off in adulthood. Those multiplication and division tables and flashcards can really pay off if you retain that skill.

Let’s dig into some strategies.

Focusing on the Price Per Unit

Whenever you buy something nonperishable – meaning it won’t go bad in any realistic timeframe just sitting in your home – perhaps the most valuable point of comparison is the “price per unit.” It’s basically a nice way of saying “How much will this item cost each time I use it?” Obviously, you want that to be as low as possible.

Some stores post the price per unit right on the sticker or on the shelf where the item is found. You would think that would be convenient, but it’s generally a bad idea to trust the store’s “price per unit” without looking closer. Why? Stores in some states will often use different units with different products when showing you a “price per unit.”

In short, price per unit is really useful for comparing things, but only when the unit is the same. You have to figure out the consistent unit that the two items are using, first and foremost. Usually, it’s easy, but not always.

Let’s break down what that all means.

Let’s say you want to buy some laundry soap. There are a bunch of different brands and a bunch of different sizes. How do you determine which one is the right one to buy?

Some brands clearly indicate how many “loads” that you’ll get out of that jug. Other brands focus on how many ounces are in the bottle.

The first step is to have a consistent “unit” of comparison. Since an ounce of one soap won’t necessarily clean as much as an ounce of another soap, you’re better off looking for how many “loads” that each container claims to be able to wash. “Loads” are your unit.

What you do then is divide the price of that container by the number of loads. So, if a jug of soap costs $17.99 and claims to wash 90 loads, you’d divide $17.99 by 90 and get $0.20 per load. Another jug costs $24.99 and claims to wash 120 loads. There, you’d divide $24.99 by 120 and get $0.21 per load. Yep, the first brand is a better deal.

In other words, if you make sure the unit is the same among different products, then it’s just divide the price of each option by the number of units in that option and compare those results.

Again, if you’re strong with the mental arithmetic, the only tricky part about this is making sure the units are the same and doing a bit of quick estimation so that the multiplication is easy.

Quick Estimations

When I’m actually doing this in practice, I’m almost always using some quick estimations rather than pulling out the calculator. I’ll look at the price, look at the number of units, and estimate.

Rule #1: Always round anything ending in 8 or 9 up to the next dime or dollar or ten. If something is $29.99 round it up to $30. If something is $24.99, round it up to $25. If something is $3.99, round it up to $4. If something is $2.49 round it up to $2.50. This makes the math a lot easier and makes no meaningful difference when determining what product to buy in virtually all situations.

Rule #2: Always round the number of units so that you only have one digit to worry about. For example, if you’re looking at a box of 68 trash bags, round it to 70, or if it’s 72, round it to 70. However, if something only has 8 items in the package, just stick with 8. When I do this and find things are very close in terms of the final price per unit, I give the nod to the one with more items, particularly if I rounded it down.

Rule #3: Add up the smaller packages until they equal the big package. Quite often, a comparison becomes easy if you just add up three or four of the small packages to see how it compares to the big. For example, if you’re comparing a package of 6 rolls of toilet paper to a package of 24, think of how many packages of 6 you’d have to buy to equal the pack of 24, which you can figure out by multiplying (that mental math again) or just counting by 6s. You can literally do the same thing with the price, especially if it’s a single digit price and it’s easy to count. So, if the 6 count package is $1.99 and you used the above rounding rules to round it to $2, you can just count by twos four times to see that four 6 count packages would cost $8. Compare that to the price of the 24 pack to see what the better deal is.

Rule #4: Do a side by side comparison of the numbers before actually dividing. Once you have a round dollar amount and a round unit amount, you can usually figure out pretty quickly which is the better deal just by comparing things.

For example, the other day, I needed trash bags and noticed that there was a box of 20 bags for $4.99 and a box of 72 bags for $15.99. Looks like a lot of digits. So, I did some quick estimations. I turned the price of the box of 20 bags into $5 and the box of 72 bags into 70 bags and the price of the bigger box into $16. So, now I’m looking at 20 bags for $5 or 70 bags for $16. Real quickly, I can tell that if I buy three boxes of the 20 bag box (getting me 60 bags), it’ll cost me $15 but if I buy four of them (getting me 80 bags), it’ll cost me $20. However, I can get 72 bags for $16 – compare that to 60 bags for $15. Going for the big box gets me 12 more bags for $1! Without doing any real math – just counting by 2s and counting by 5s – I can tell the 72 bags are the cheaper option.

It Becomes Instinctive Over Time

These little steps become more and more instinctive over time as you do them more and more often. You become really adept at quick rounding and quick multiplication of single digit numbers, and you learn that the result of that quick comparison virtually always points you to the best price per unit.

The only part that takes time is making sure you’re actually comparing the same units, which means you have to glance at the package itself. I’ve found that price per unit numbers on the store shelf stickers are occasionally misleading, so I ignore them.

Another advantage is that once you figure it out one time, you can rely on that outcome for quite a while. I generally stick with the results until I happen to notice that the version I usually buy has gone up in price, then I do the comparison again. I don’t do such a comparison every time I’m in the store, as I’m usually just snagging the item I already figured out was the best bargain at the price I’m familiar with. It’s when the price has changed or the item has changed that I take notice.

Learning this little skill will save you a lot of money over time without a lot of effort. It’s all about estimation and quick mental math.

Good luck!

The post Personal Finance 101: A Thorough Guide to Price Comparisons while Shopping appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2QwG7Ux

Why the U.S. Yield Curve Inversion Has Recession Watchers Worried

Source Business & Money | HowStuffWorks https://ift.tt/2SLqQvx

Why the U.S. Yield Curve Inversion Has Recession Watchers Worried

Source Business & Money | HowStuffWorks https://ift.tt/2SLqQvx