If you’re here to start a blog, congratulations!

Starting my first blog was one of the best decisions I ever made, and the people I’ve reached (not to mention the money I’ve made) are just a couple of the benefits I’ve experienced over the years.

Knowing where to begin with your first blog is challenging.

But, what if you don’t have a clue what a domain is, or how the heck a host works?

Even if you don’t have one iota of experience with content writing or starting a website, I promise you can do it.

With this guide, you will be crafting your first post about a topic you love, on a fully functioning website you own, in just one hour.

Ready?

Then read on, future blogger.

I’m going to walk you through everything you need to know to get your blog started and earning a side income.

Why You Should Start a Blog

If you’re like most of the others who come across this page, you’re here because you want to use a blog to help you earn a side income, or even become a passive income source.

Of course, there are more benefits to owning a blog than earning money.

Let’s take a closer look at what a blog allows you to do:

- Get creative. Nothing gets your creative juices flowing like writing a blog post on a subject that intrigues you. As you write more content it will lead you to answer more questions inside your chosen niche. For many bloggers they find that they grow more creative with every post.

- Have a voice. A blog lets you talk about what matters to you. Whether you’re a self-proclaimed political pundit, a passionate fashionista, or a financial advisor like me, move beyond the treacherous minefields of Facebook comment threads and say what you need to say in your own space. Be LOUD. Be quiet. Be formal. Don’t. The beauty of a blog is that it reflects your personality and your ideas, from the font to the pictures to the words on the page.

- Do what you love. Creating a blog is one of the best ways to learn more about your hobbies, enjoy yourself, and pursue your passions, too. If not a single person read your blog (they will, promise!), you’d still be gaining so much in the self-fulfillment department as you learn for yourself and educate others.

- Make connections. Everyone has a passion, and blogging has a unique way of connecting you with people who care about the same things you do. It adds your voice to a global conversation, with endless possibilities for advancing in your profession, making friends, and growing your blog’s reach.

- Make a difference. One of my favorite parts of blogging is positively impacting people. People are looking for information and you are able to provide them with an honest opinion that can really make their lives better. Whether it’s unlocking a new hobby, simplifying their life, helping them get out of debt, or restoring a relationship, blogging truly helps you reach people. It’s such a rewarding experience to hear from a reader who’s benefited from content I wrote even years ago.

- Make money. Generating a profit on your blog might be slow-going at first, but hang in there! With the right tools in hand, you can start making money with your posts through ads, sponsorships, and/or affiliates. No need to worry about exactly how those work just yet. Just know, in time, your site can be a major moneymaker if you do the right things over a long period of time.

- Grow your business. Blogging doesn’t just profit you in the immediate sense. The longer you blog, the more connections you make, and the better your content gets, the more your street cred improves. You can establish yourself as an expert through blogging, get published, and further the success of your business.

Those are just a few of the benefits of starting a blog.

I could go on and on.

But let’s go ahead and get you started.

Choose your Niche

Don’t skip this step unless you are sure you’ve got a plan already laid out.

In just a moment, I’ll show you how to purchase a host and domain, but first you need to pick a subject area for your blog.

While your ideas can change down the road, you need a clear direction before you create your site so you can start building a strong brand and avoid abandoning your blog down the road.

You might see a blog that’s doing really well, with an abundance of hardcore followers, major monetization, and top Google rankings.

Does that mean you should automatically follow that writer’s lead and create a blog in the same niche?

Not necessarily.

You have to ask yourself a few questions before you get started.

And as you work your way down the list, you’ll probably see a clear topic for your blog emerge.

Get out a pen and some paper, and let’s dive in.

- What do you love?

Raise your hand if you chose a major or career you didn’t love based on salary or similar features.

Fake it till you make it might work in some fields, but personal blogging isn’t one of them, trust me.

You need to be certain the niche you choose to write in matters to you, or at least interests you.

Why?

- Because it shows. When you genuinely love the subject you’re writing about, the passion will be evident in every word on the page. Conversely, write on a topic you have zero cares for and your content might suffer (and so will your readers).

- Because passion drives motivation. You might be able to churn out some content on one of those topics, but don’t assume you’ll have the long-term motivation to sustain a thriving blog.

- Because you’ll be researching it… a lot. I had an English teacher who always advised the class to carefully weigh their research topics against their interests.

Brainstorming, she would say, was the time to change your mind multiple times. Once you submitted your topic, though, you were married to it.

Do you love your blog topic enough to marry it, to dedicate hundreds or thousands of hours getting to know it?

If that mental image gave you major anxiety, you may want to reassess your blog idea.

It’s harder for some people than others to identify their passions, so here are a few questions to ask yourself if you’re still in the dark (but often times, the first few ideas which pop into your head are truest to your heart):

- What high school or college classes pique(d) your interest?

- Now turn to the media. What kinds of news stories interest you? Sports? Politics? Technology? Literature? Art? Scroll through your search history or peek at the pages you follow on social media for more insight.

- Look at your hobbies. What do you dedicate your time, resources, and energy to? Maybe you love antique shopping, hiking, or planning awesome vacations for your family. What you do for fun is a great focal point for what you write.

- You know that one topic you’re always talking to your friends or family about, the one that both excites and interests you? Hint, that’s your passion. Pursue it!

- What’s your job? If you are passionate about your profession, consider writing about it! You can offer both passion and expertise, which all of the best blogs do.

- What’s your dream job? If you didn’t have any financial cares in the world, what would you be doing with your life? The answer to that question is a great place to start your blog.

- What Do You Know?

Experience goes hand-in-hand with your passion.

While you certainly won’t have all the answers starting out, it’s important to write on a subject you’re knowledgeable about.

Because I guarantee your top competitors will be.

Again, look at your career, your hobbies, and your life experience to choose a niche, and pick a topic you can provide your own unique insight to.

- How Specific Is Your Niche?

The pendulum swings both ways here, as there are pros and cons to writing for a really broad category of people as well as for a super-specific niche.

The key, once again, is research.

Did you know you can find out what people are searching for in your niche right now?

With a simple keyword search tool (which we’ll introduce you to later), you can pinpoint users’ top searches surrounding your subject area, which can help you decide the overall structure and content of your blog.

Maybe you’re a yoga instructor who wants to write solely about your art.

Instead of branding your site as one of many in the niche of health and wellness, make it a sub-niche exclusively targeting others who love yoga.

On the other hand, you could find yourself with a wealth of financial information (like me), and choose to build a blog around a variety of fiscal topics.

Remember the idea of marrying your topic. 10 years from now, will you be content solely posting in your niche?

If not, you may want to expand it a bit.

In addition to knowing how specific your subject area should be, you need to know your audience.

- Who do you want to come to your site?

- How will you pull them in?

- What questions will they have that your blog answers?

Going in with a specific niche in mind will help you plan your content and design.

- Where’s the Money?

If your goal is just to express your thoughts and expertise, you may not care about monetizing your site; however, most bloggers have a desire to do both.

Who wouldn’t mind money coming in passively from content you posted long ago?

And, while your blog might not be an overnight moneymaker, you can create one as a side hustle which could grow to a full-time gig.

I did it, and I’ve written multiple posts to show you how you can make serious bank with your blog, too.

The fact of the matter is, some niches are more profitable than others.

There are some surefire strategies to make money in any niche, but if you’re seriously considering blogging as a business venture, you need to research it thoroughly to assess the level of competition in your niche and the potential for profit.

Here’s some pre-blog practice in creativity.

You’ve got that paper and pen handy, right?

Here’s what I want you to do…

First, jot down each of the blog categories you’re considering.

Got those down?

Now, for each of those categories, give yourself a set amount of time, maybe 3-5 minutes, and come up with as many blog post topics as you can.

I’m not saying the longest list of topics should automatically win here, but the subjects you were able to crank out lots of ideas for may be your best bets!

And the niche where you struggled to string two sentences together may need to go.

Now, Let’s Talk Blog Names!

Once you know your niche, you get to keep flexing those creative muscles and come up with a name for your blog.

While naming your blog might seem even more intimidating than choosing a subject, it doesn’t have to be.

Have fun with this step!

Here are few pointers to get you started.

Unless you’ve been sitting on a brilliantly creative and incredibly unique name for your blog since the idea to start one struck, you’re going to need some strategic planning here.

- Do your research. Luckily, you did a lot of the work for this step when you researched your blog topic. When you choose a name, you need to think carefully about your niche and your target audience.

- You want the name of your site to encompass how in depth your niche is. For example, I give financial advice on a lot of topics. The name of my site reflects that.

- You also need to scope out the competition. Which ones are thriving? You can’t copy their actual names, but you can copy their techniques.

- Do more formal and technical terms work better for your niche, or can you have some fun with your name?

- Then, think about the content. What kinds of words do you associate with your site and the kind of info it will provide.

- If you need a little help, try a keyword search. Tools like Google’s SERPS show you the top keywords users are searching in your market. Make note of them.

- Be creative. In addition to the considerations above, think about your voice and brand.

- What do you want your title to say about you and your blog? Do you want a catchy and intriguing title people have to click to understand? Or a straightforward one that will help establish you as a credible informational source?

- Now take those keywords you jotted down and play around with them. If you have a hard time recalling synonyms on the fly, pick up a thesaurus and find some there.

- Another great tool? Alliteration. Your moniker can be a monumental moneymaker. (See what I did there!?) If there’s any room for a play on words or slang that might appeal to your audience, add it to the list.

- Another great go-to? Your name. Lots of authors focus their brand around their name, and it could be a great way to brand your blog and set you up as an authority.

- Be practical. While it’s true witty, creative names are some of the biggest winners, remember what your goals are.

- If you want to drive people to your site, be a top-ranking source in your niche and make money, your name needs to contribute to those goals.

- Having a name that’s easy for new followers to type, search, and remember can go a long way.

- And it helps to show some connection to your blog’s subject, especially if it’s a really specific sub-niche.

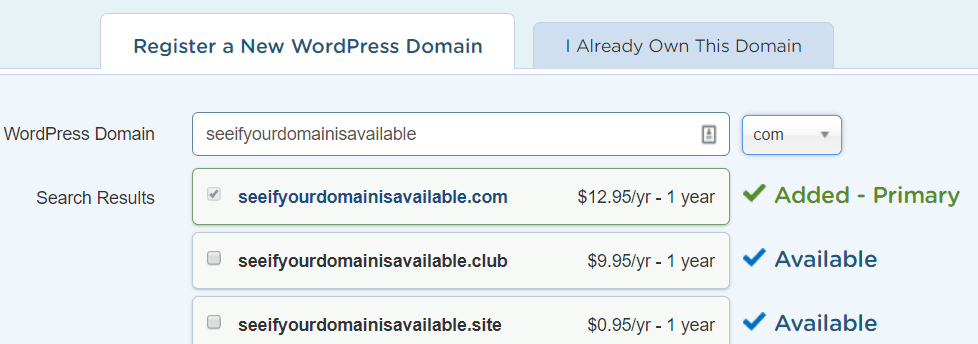

- Search availability. We’ll get into domains in greater detail in a moment, but here’s the gist.

- You know that frustration you run into when a site asks you to create a password then tells you the one you entered is already taken?

Or when Instagram rejects the handle you entered, because there are apparently more you’s out there than you realized.

Did you throw in the towel and decide Instagram wasn’t worth the trouble?

Of course not.

You soldiered on, tapped into that crazy creativity deep inside, and devised an awesome new name your followers love.

Same thing with the blogging world. There are literally hundreds of millions of blogs online today, and depending on how popular your niche is, the name game might be a competitive one.

With sites like GoDaddy, you can enter your name and see if it’s available. If not, go back to the drawing board, try some of the creative approaches above, and see what your alterations bring up.

Getting Your Site

You’ve done your homework and landed on the perfect niche that combines your passion, expertise, and profit potential.

And you have an idea for an available name.

Now what?

You’ll want to go ahead and start looking to see if it’s available.

HostGator, for example, has a nice little search feature. Check it out here.

Keep in mind while some offers might look appealing now, they may not be the best money in the long run.

And if you’re the prospective blogger I mentioned earlier who really has no idea what those terms even mean, no worries.

As promised, I’ve got you covered!

What’s a host?

First things first, let’s define what a host is.

You can build out an awesome website chock full of content, but in order for other people to be able to access it on the Internet, you need a host.

A hosting service basically books you space on a server, which is the place where websites are stored.

I like to compare hosts and servers to real estate. In the world of virtual real estate (the web), your host is the land you purchase to build your home (your website).

Whenever you type in a web address, let’s say GoodFinancialCents.com, you’re being connected to my server and shown my content, all because I have a host.

Make sense?

Good. Let’s move on to domains.

What’s a domain?

Here’s the simple breakdown:

As you now know, the host is the virtual location housing your site.

The website, then, is the blog itself.

The URL, on the other hand, is the address, i.e. the full web address you see in the search bar at the top of a site.

And the domain is just the name that follows the http:// portion of the URL.

People tend to get these terms confused, when they’re actually unique and pretty easy to understand.

Let’s plug those definitions into (hopefully) your favorite financial site.

Good Financial Cents is the website you’re perusing right now.

The URL is https://ift.tt/2ppyodo and the root domain is goodfinancialcents.com.

So, when I talk about choosing and purchasing your domain, I’m referring to your site’s name.

And just like your site’s space, you have to purchase the name before you can use it.

Types of Hosts

You might be itching to buy your domain first if it checked out in your domain name search, but I’m going to recommend you start with your host.

Here’s why.

A lot of hosting services out there offer you the opportunity to register your domain with them as well, sometimes for free, or otherwise offering domain promotions with your hosting registration.

And where and how you choose to host will play a bigger part in steering your site’s success than where you buy your domain will.

When it comes to hosting services, there are ultimately two types:

- Free Hosted Platform

- Self-Hosted Blog

Understanding the differences between the two is key.

Free Hosted Platforms

There are a ton of free services who will allow you to start your blog right away. They make it really easy to get going, but, ultimately, you lose a lot of control by going this direction.

This loss of control frequently includes:

- Not being able to generate income from the blog on day one

- Difficulty moving your content to another platform

- Not having a domain that you own

- Limited options for the design of your blog

In the long run you are going to be much happier if you start by spending a few dollars, a little extra time, and establish your blog up with the best foundation possible. That leads us to…

Self-Hosted Blogs

The main difference between hosted and self-hosted sites is a matter of real estate.

But there’s so much more to a self-hosted site than having your own server.

If you still aren’t convinced, here are even more pointed reasons you should self-host your blog:

- You get your own domain (which looks more legit). Instead of owning a sub-domain on someone else’s site (example.blogspot.com), you truly own the domain you want to represent your brand (example.com).

- You can customize everything. One of the best parts of a self-hosted blog is how it allows you to make your site your own. There are thousands upon thousands of themes to choose from (many of which are free), and far more functions and features to add to your site.

- You make more money. Seriously. Not only can you customize the look and feel of your blog, but also optimize its performance. With a self-hosted site, you can place ads the way you want them, learn and implement SEO (search engine optimization) strategies, and make a bigger impression on Google.

- You get more for your money. If you’re serious enough about blogging to buy a domain through your free blog host and pay for a theme, you’re far better off advancing to an affordable self-hosted site.

You can spend money on your externally hosted site all day, and you’ll still never come close to matching the functionality or results of a self-hosted site.

I’m all about purchases that make good financial sense, so this one is a no-brainer.

How To Set Up Your Self-Hosted Blog

Ready to get your site launched?

Here’s what you need to do:

Step 1: Choose your host

Most self-hosting bloggers choose to manage their sites through a third-party system like HostGator.

For a basic package, you could be spending around $3-$7 a month (which sometimes includes a free domain!) with a plethora of free themes and software installations at your disposal.

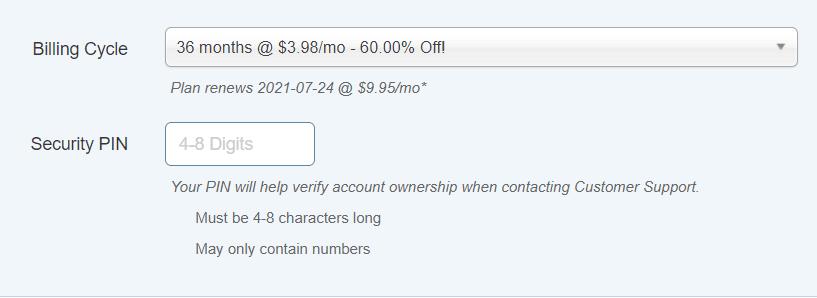

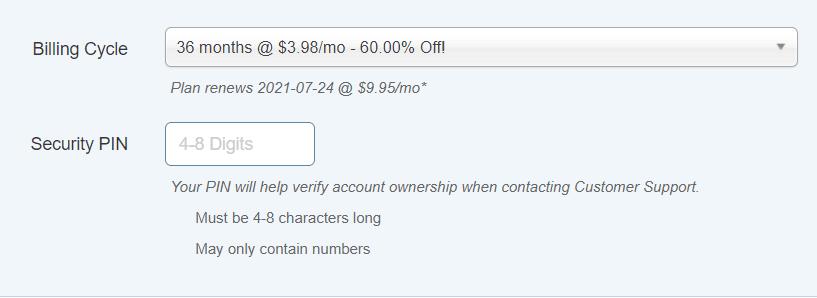

Step 2: Choose your plan

At this stage, you get to choose what features you want your site to have and you can add or remove features down the road.

Generally, a basic plan will offer you standard features and the tools you need to successfully start your new blog, and an upgraded package will offer you unlimited versions of those same features plus added security benefits.

Let’s take a look at some key features you’ll get with most popular hosting sites.

Websites

Most hosting sites offer you 1 website with their basic package. As you upgrade, you can host more sites.

For instance, Bluehost’s plus plan, which costs $2 more a month, allows you to host unlimited sites with your subscription. You may need to pay more for those additional domains, though.

Domain

As I said earlier, you should be able to obtain your domain from your hosting site. You usually get one domain with a basic package, sometimes more, if you upgrade.

You should also look to see if your hosting site offers any free parked or subdomains.

While your main domain is the key way users get to your site, these alternate domains account for slight differences in URLs, directing them all to your site.

Usually, you’ll pay around $9.99 a year to register a .com domain, which you then renew annually.

Bandwidth

Bandwidth has to do with your site’s speed, specifically how quickly data can be transferred over your internet connection.

If you have a site that’s saturated with multimedia, bandwidth matters.

The good news is that sites like Bluehost and HostGator offer unmetered bandwidth, meaning it should be substantial for all of your sites and you won’t be charged more based on how much you need.

Storage

Hosting sites usually measure your space in GBs, and you’ll notice that a lot of standard plans offer 50 GB.

Is that enough space for your site?

Chances are, yes.

Blogs don’t take up much digital storage, and the amount should be plenty to house your blog for quite some time.

SSL

Short for a Secure Sockets Layer, an SSL certificate safeguards you and your readers by guaranteeing the data between their browser and your server stays encrypted.

Do me a quick favor.

Look at the top of your address bar and you’ll find a little lock icon, followed by the term secure in this case.

Click the lock and you can see the site’s certificate and settings and learn more about how your information is being protected.

Platforms like Bluehost offer a shared SSL with their lower-end packages and a private SSL unique to your domain with upgraded packages.

If you’re planning to process people’s debit or credit card payments through your site, a private SSL is crucial.

Luckily, with HostGator, this is free:

Do note, however, a shared SSL might result in a pop-up security warning on your site.

Email

One of the most convenient benefits of a self-hosting site is email. Most platforms offer you a certain number of email accounts tied to your blogging business, often granting you unlimited emails with an upgraded account.

There also may be some limits to email storage, so make note of this as you shop around. In addition to the convenience they add, official email accounts linked to your blog work to build your brand and establish your professional credibility.

It’s a win on every level!

Email Management

If you pay a little extra for a premium account, you might encounter email management systems.

For example, Bluehost utilizes SpamExperts, a software which archives your messages and filters out spam for you.

It’s not necessary but convenient if you anticipate some major traffic in your blog’s inbox.

Dedicated IP

You may encounter the term dedicated IP as a feature of upgraded hosting plans.

What in the world is it and do you need it?

First, an IP address is used to pinpoint the actual location of your site.

With a shared IP address, your site is stored on a shared server.

On a private IP, has its own unique address.

So how does that difference impact your blog?

For the most part, it shouldn’t. Much like an SSL certificate, a dedicated IP is primarily needed for a business handling commerce.

Marketing Credit

Host sites may offer you promotional advertising credit when you sign up. For instance, Bluehost offers credit for Google AdWords and other pay-per-click ad services.

Essentially, you create an ad with some carefully chosen keywords that Google features atop or beside people’s search results.

When people click those ads and enter your site, Google gets paid, hence the name pay per click.

If you choose a package which offers these promotions, you can use your sign-on credits as a starting point for marketing your blog.

There you have it.

Although some self-hosting sites offer more features and some offer fewer, you should have an ample amount of information to decide on a plan.

Weigh your blog’s needs, your expectations, and your budget to decide what kind of plan is best for your blogging venture.

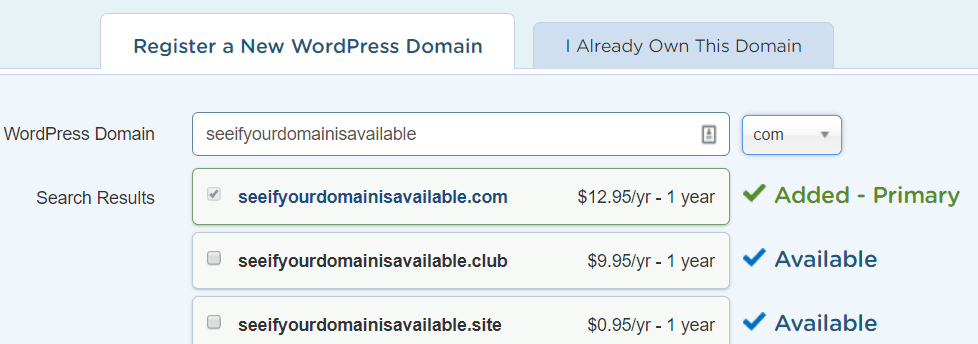

Step 3: Choose Your Domain Name

If you’ve followed the steps in this post, you should already have your domain name locked and loaded.

At some point in the registration process, you’ll be prompted to enter your domain name, which will either be accepted or rejected based on its availability.

If circumstances have changed in the time since you brainstormed your domain name and it’s no longer on the table, no need to worry!

That’s why you compiled a list of multiple options.

Plug in another and see if it’s available.

Continue the process until you land on one which doesn’t already exist.

Pro Tip: If you want to purchase additional parked domains with different extensions, more power to you. If you think you may build out an entire brand, definitely do it now.

But for the primary domain name, choose a .com extension.

Not only are they the most popular among bloggers and familiar to users, but they tend to do better business in terms of SEO (search engine optimization), which means more money and followers for you.

Step 4: Build your site

With a plan purchased and domain name registered, you’re ready to get started!

At this stage, you need to decide what type of software is going to meet your skills as a designer, your site budget, and your needs for the site.

There are quite a few options on the market for building your self-hosted blog, like WordPress.

Wait, back up.

Didn’t I discourage you from starting a WordPress blog earlier?

That statement needs a little clarification.

Understanding the Difference Between WordPress.com and WordPress.org

When people talk about using WordPress for their blogs, they could be referring to two different tools.

There’s the WordPress I referred to earlier, which is WordPress.com, a free hosting site.

And there’s WordPress.org, a site where you can download software to build your self-hosted blog.

So when I suggest you utilize WordPress to build your blog, I’m referring specifically to the site-building software, not the free host.

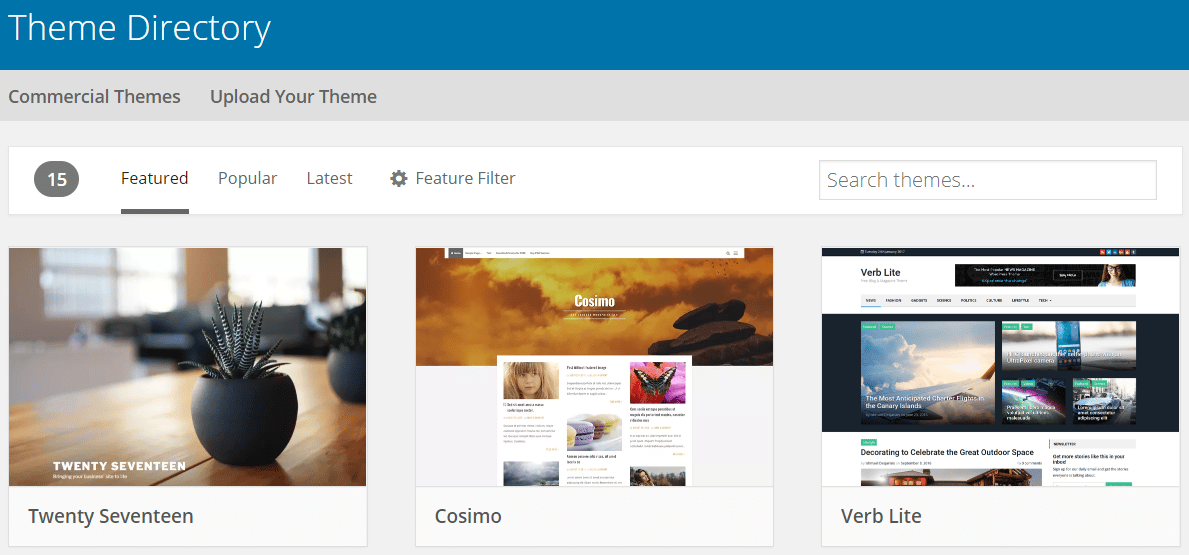

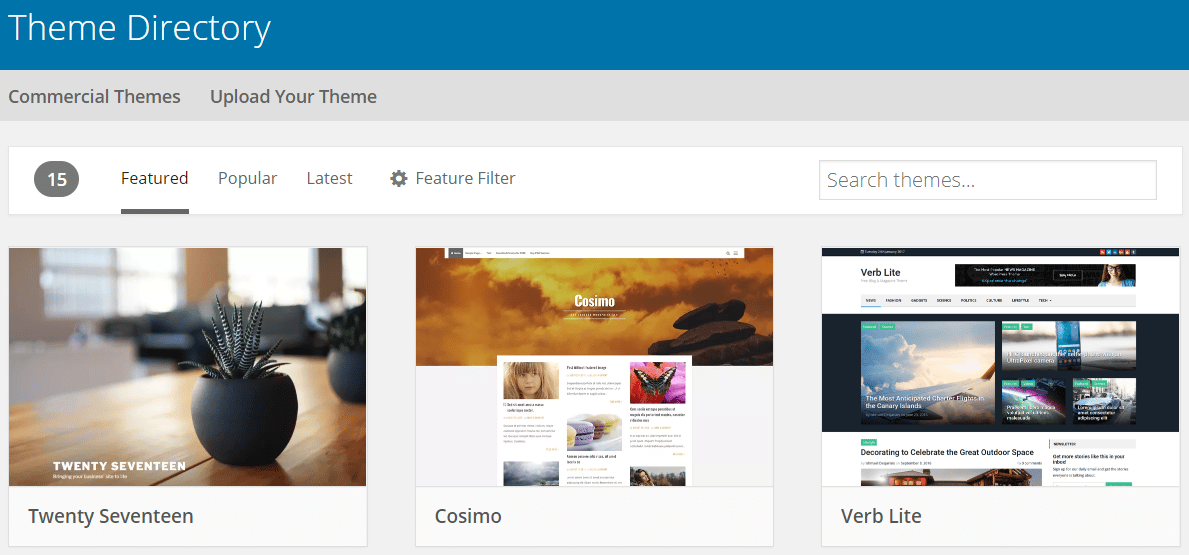

Choosing a Theme

While WordPress is by far the most popular choice among users, it’s one of several optimized for use with a self-hosting site.

On sites like Bluehost and HostGator, WordPress and other site builders are integrated into the platform.

With one click, you could be working with WordPress through your hosting site to build out and edit your blog.

WordPress offers thousands of free themes in Bluehost, one of which could be perfect for your blog.

WordPress is appealing to both technically savvy bloggers who work to customize their sites on the back end and novices looking for clean, free templates to manage with ease.

Remember, you’ll get better at designing and navigating whatever software you choose as you spend more time with it.

And you can find a ton of resources online to help you learn how to build and customize your site.

(I highly recommend you choose to build your site on WordPress. The site you’re reading right now is!)

Free Vs Premium Themes

If you’d like to move beyond free themes, other theme shops offer thousands of templates available for purchase, some more technologically advanced than others.

The possibilities are endless, all depending on the look, feel, and functionality you want your site to possess.

Free templates can be a great starting point for your blog, but they may have some limitations.

Aside from being unique, premium templates usually offer features like additional color choices, more layout options, and shortcodes (which simplifies normally time-consuming and complex coding tasks).

Beyond the aesthetic of your site, you also want to consider how the site-building software functions.

Some tools are prime for users who want what’s known as a drag-and-drop interface where they can visually build their site from a user’s perspective, dragging and dropping content directly onto the page, exactly where they want it.

If you aren’t a designer but want a blog which really looks professionally built, you might want to check out all your options and even install a few to test them out before finalizing your decision.

Shop around, try out some templates, and get to work!

Bottom Line

Setting up your blog is not difficult.

You can add starting a blog to your mental list of tomorrow’s to-dos (never to be touched), or you can set aside 1 hour, right now, to make your dream a reality.

With a little creative brainstorming, research, and your new blogging terminology in hand, you can confidently launch your self-hosted blog today.

Write what you love, impact readers, and start making money today!

I promise you won’t regret it!

Next Steps

I’ve walked you through getting your blog up and running, so what’s next?

Once you’ve determined your niche, purchased your domain and host, and selected a theme, it’s time to start writing!

Here are the steps you need to take to get your blog off the ground and into the stratosphere of success.

Your First Pages

The first pages you want to have on your blog are going to be about your mission (the “home” page) and about you (an “about” page).

Your “home” page should be something which tells the user about what your site is for, and allows them to navigate the main topics of your blog.

The “about” page is a page specifically to talk directly to your audience, and tell them who you are. Build trust here, don’t “sell them” on your brand.

This makes it clear to the person coming for the first time what the site is all about and why you are the right person with the right answers.

Plan Your Content

When I first started my blog I wrote a big list of all the topics I thought would be great to help educate people on their finances.

It wasn’t nearly long enough, but it got me started and excited about my topic.

The one thing I learned over time was I needed to have a plan of where to take people once they reached my site.

So if the started on a retirement planning article, they would then have the option to read more relevant content.

Make sure your articles are taking people on a journey with you not just coming for info and leaving.

Build Your Brand

Congratulations! You are now an Internet sensation!

Your brand can always look bigger than you really are.

Just make sure to set up all the social media accounts to go with your brand and take the time to connect with people. People are amazingly loyal if you make them feel a part of your tribe.

Be Diligent

You may hit a hot topic, have it go viral, and be an overnight success, but more likely, you will build your following over time.

So keep at it!

As Dave Ramsey once said, “It took us 15 years to become an overnight success.”

The great thing about the Internet is that things move faster than when Dave was building his following.

Happy Blogging!

The post How To Start A Blog And Make Some Cash While Doing It appeared first on Good Financial Cents.

Source Good Financial Cents https://ift.tt/2LkcTFG