Numbers don’t lie.

When it comes to the popularity and overall value of your business, it’s important to have a solid Alexa Ranking.

Why? It’s a common metric that potential business partners, investors, etc. will use to determine the state of your business.

They’ll use it to gauge your business’s health and whether it’s trending up or down.

The lower your Alexa Rank, the better, and vice versa.

This is why so many business owners agonize over their Alexa Rank and work tirelessly to improve it.

In this post, I’d like to discuss two key things.

First, I’d like to talk about the factors that Alexa assesses when determining rankings.

Second, I’d like to offer a tangible strategy you can use to improve your Alexa Ranking in 30 days or less.

Let’s hit it.

What’s an Alexa Rank?

Just to be sure we’re on the same page, allow me to formally define an Alexa Rank.

According to Avangate,

“It’s a ranking system set by alexa.com (a subsidiary of amazon.com) that audits and makes public the frequency of visits on various web sites.

Alexa’s support section clarifies matters even more by explaining how its traffic rankings are determined:

“Alexa’s traffic estimates and ranks are based on the browsing behavior of people in our global data panel which is a sample of all Internet users. Alexa’s Traffic Ranks are based on the traffic data provided by users in Alexa’s global data panel over a rolling 3 month period.”

Here’s what Google’s Alexa Rank looks like at number one:

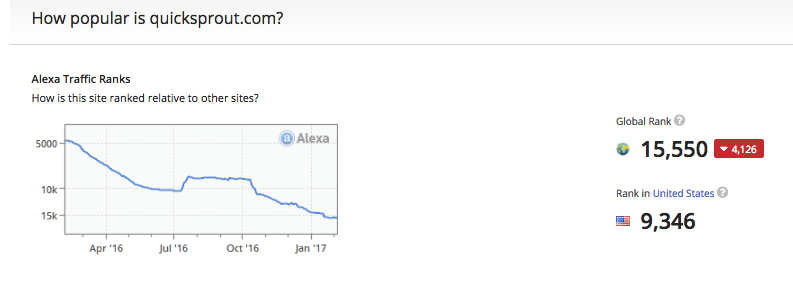

And here’s what Quick Sprout looks like at the moment:

Not nearly as good as Google but solid nonetheless, considering the fact that the lowest ranked website is somewhere around 30 million.

Which factors does Alexa analyze?

Before we can formulate a game plan, it’s important to understand what Alexa is looking at when assigning a ranking to websites.

Fortunately, Alexa is very upfront about how its data is calculated.

According to the Alexa Blog, “Every day, Alexa estimates the average daily visitors and pageviews to every site over the past 3 months. The site with the highest combination of visitors and pageviews over the past 3 months is ranked #1.”

“The site with the least is ranked somewhere around 30 million. If no one in our measurement panel visited a site over the past 3 months there is no rank at all for that site.”

They also provide a couple of graphs to illustrate this:

Of course, Google receives more traffic than any other site on the Internet.

It gets more daily visitors and pageviews, so it sits at the top of the mountain.

Alexa also points out the fact that the closer you get to the top of the plot, the harder it gets to move up a rank.

While it may be fairly easy for a site ranking 24,500,132 to move up to, say, 20 million, it’s significantly more difficult to climb from 50 to 40.

The main takeaway is that it’s all about two key factors: (1) average daily visitors and (2) pageviews over the last three months.

That being said, here’s what you need to do in order to improve your Alexa Ranking quickly.

Certify your site metrics

If you don’t mind making a small investment, it’s a good idea to use Alexa’s Certified Site Metrics.

This will give you an Alexa Certified Code, which will directly measure your site’s traffic.

It offers several advantages:

- You get a more accurate Alexa Rank

- You have access to more in-depth analytics reports (there’s a private dashboard)

- You can closely monitor your site’s performance

- You also have the option of displaying unique visitors, pageviews, and ranks publicly

Here are the different pricing options:

It’s also important to note that you get a free monthly SEO audit with the “Insight” plan and a full site audit with the “Advanced” plan every two weeks.

This is just something to keep in mind when choosing a plan.

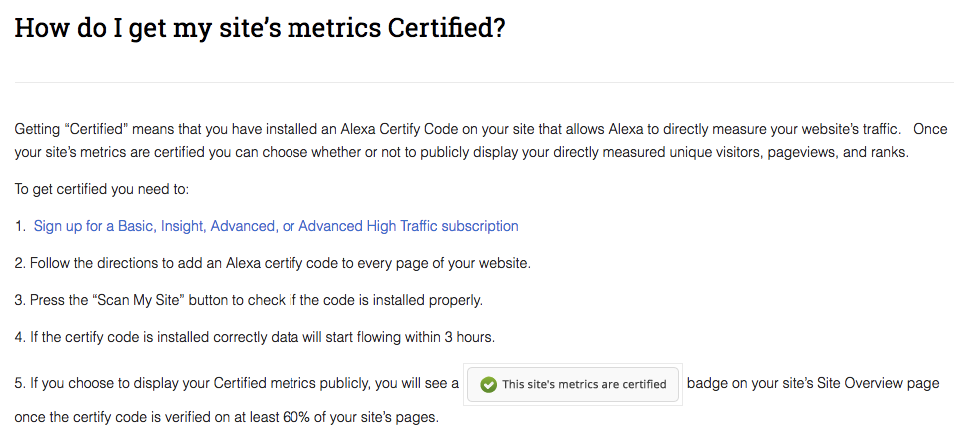

Here’s a screenshot from Alexa support, explaining how to get your site certified:

The bottom line is that certifying your site metrics gives you an advantage over other websites.

You can gain a clearer perspective on the health of your site and are equipped with tools to improve your ranking.

Produce epic content

Sorry if I sound like a broken record with the whole “epic content” thing.

But when you break it all down, it’s an essential component of online marketing on many levels.

I’m not going to bore you with all the gory details, but it’s extremely important to create A+ content that genuinely satisfies your audience.

Check out this guide I wrote on Neil Patel for pretty much everything you need to know on the subject.

This will be a necessity for boosting your Alexa Ranking.

Get quality backlinks

What are two critical factors that Google takes into account when assigning a ranking to your website?

Trust and authority. In fact, “Domain trust/authority represents 23.87% of Google’s ranking algorithm.”

One of the most straightforward ways to increase your site’s trust/authority is to obtain quality inbound links.

You know the drill. They need to be from reputable, relevant websites.

I realize this is obviously easier said than done.

I wish it was as easy as putting out a few decent blog posts and having multiple big name publications chomping at the bit to link to you.

Of course, it’s a fairly arduous process.

But at the end of the day, it all goes back to creating great content.

In fact, I like to adhere to the 90/10 rule of link building, where “90% of your effort should go into creating great content, and 10% into link building.”

And when it comes to the process of link building, there’s one technique that outshines all the rest: guest-posting.

Now, I’m not going to rehash what I’ve already written about this topic here. But you can learn the essentials from this guide on Quick Sprout.

If you can get even a few guest posts published on reputable websites, this should result in an improved Alexa Ranking within a month.

Analyze your competitors’ keywords

Here’s a question for you.

What’s your motivation behind wanting to improve your Alexa Ranking?

I bet it’s to have a better ranking than your primary competitors. Right?

Of course, you’ll want to outperform the competition. But how do you go about it?

One of the best ways to gain an edge with your Alexa Rank, and with SEO in general, is to analyze your competitors’ keywords.

You’ll want to know which keywords are bringing them the most traffic, generating backlinks, and so on.

Once you know which keywords are driving the bulk of traffic to their websites, you can optimize your site for those keywords and build momentum.

It’s like killing two birds with one stone. Not only will your Alexa Rank improve, your overall SEO rankings should improve as well.

But how can you analyze their keywords?

I recommend using Google’s Keyword Planner.

There are a lot of tools out there, but this is perhaps the most universal. Besides, Google is usually the go-to source for Internet data.

Here’s what you do.

Go to your Keyword Planner dashboard.

Click on “Search for new keywords using a phrase, website or category.”

Under “Your landing page,” type in the URL of a competitor.

I’ll just use quicksprout.com as an example:

Click on “Get Ideas” at the bottom, and your screen will be populated with a list of competitor keywords.

Here are just a handful that popped up from my search:

The great thing about using the Keyword Planner is that you can instantly determine the volume of monthly searches and the level of competition for each keyword.

Creating better content that outperforms your competitors is a great way to gradually boost your SEO and at the same time improve your Alexa Rank.

But in order to see a significant improvement within 30 days, I would suggest first going after the “low hanging fruit,” meaning keywords with minimal competition and a lot of searches.

Focus on those initially for a surge in your ranking.

Conclusion

In many ways, your Alexa Rank directly affects the health and progress of your business.

It’s something that key stakeholders will often look at when determining whether or not your company is worth doing business with.

Therefore, achieving a favorable ranking (at least in the top 100,000) should be a priority.

If you follow this formula, I can pretty much guarantee that you will see at least a reasonable improvement fairly quickly.

However, if your site ranks really poorly, it may take awhile to get to the point where your business is attractive to stakeholders.

And because your Alexa Rank is such an important metric, I recommend making your efforts at improving it ongoing.

How big of a factor has your Alexa Ranking been in terms of business partnerships and opportunities?

Source Quick Sprout http://ift.tt/2l1ogna