الأربعاء، 12 سبتمبر 2018

Protecting what you send over Wi-Fi, in public and at home

Source Business - poconorecord.com https://ift.tt/2N5vFS5

This Company Will Actually Pay Someone $2K to Watch TV for 100 Hours

No, seriously.

Video service HowtoWatch.com has posted a job that pays $2,000 — including $500 upfront — to watch 100 hours of TV this fall.

And you can watch whenever and wherever you want.

But don’t start planning that “Game of Thrones” binge session just yet — you’ll have to distribute your viewing hours across the seven streaming platforms you’ll get for free during your employment.

The company is specifically seeking a social media influencer with knowledge of TV streaming platforms, including the ability to analyze picture quality, load times and buffering, according to HowtoWatch.com spokesperson Cosette Jarrett, who responded via email.

The job requires you to rate each service’s quality using a score sheet, and you‘ll need to share your experience on social media. Which means you’ll have to own up to watching “90 Day Fiance” — again.

And while the company specifically mentions there’s no drug test involved, it does want a motivated self-starter with an attention to detail. So maybe you should put off that “Adventure Time” marathon.

Applications are due by midnight on Oct. 4 and the company will announce the job recipient by Oct. 11, according to Jarrett.

The start date is flexible, but you need to finish watching by Nov. 1.

Ready to start your screen, er, dream job? Fill out the application here — bonus points for including a YouTube video.

Tiffany Wendeln Connors is a staff writer at The Penny Hoarder. Editorial Assistant Adam Hardy contributed to this article.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2MrUySG

BOOM: Small Business Index Soars to Highest Level Since Reagan, Middle-Class Income Sets New Record

Source CBNNews.com https://ift.tt/2x9m9T9

Hazy on Investing? You Can Invest in Cannabis for as Little as $5

You’re finally making some green. You know your money needs to do more than just supply you with fun memories and Cheeto-dusted fingers. Heck, your parents have been hounding you to start investing.

But you don’t just want to invest. You want to invest in an industry you believe in. One that could take off and make money.

You want to invest in cannabis, and now you can.

Stash is an app that lets you start investing with as little as $5 and for just a $1 monthly fee for balances under $5,000. It only takes two minutes to get started. Need a nudge? We’ll even front you $5 to get started!

What’s All the Buzz About Cannabis Investing?

In case you’ve been under a rock, there’s big news in the cannabis industry.

It’s not just for Cheech and Chong wannabes hanging out and listening to Phish songs anymore.

It’s big business.

Currently 29 states allow doctors to prescribe cannabis for medical purposes. This is big news for patients with chronic pain, those receiving chemotherapy and for a number of other medical issues.

Cannabis use is gaining popularity outside of medicine as well. Industrial uses, such as producing hemp for fabrics and textiles, are helping to keep the market flowing.

Cannabis retail sales in the United States are expected to hit nearly $10 billion this year, reports Marijuana Business Daily. That number could billow up to as much as $22 billion by 2022.

The budding industry needs cultivators, packagers and dispensaries for medical marijuana. That’s just a small part of what keeps this industry puffing along.

All of these emerging businesses could provide opportunities for investors looking to boost their portfolios.

We can’t ignore the elephant-shaped smoke cloud in the room: This business is still illegal in some of the country. Cultural attitudes and political battles make its future a bit uncertain. Add that to the potential risk of any investment, and, well, you just have to weigh your options wisely.

Plant the Seeds of Your Financial Future

Maybe you’ve thought about investing, but it always seemed a bit out of reach. A rich man’s game.

But you don't have to have tons of money to invest in the cannabis industry. Using a microinvesting app like Stash, you can invest in increments as little as $5.

Stash curates investments from professional fund managers and investors and lets you choose where to put your money. It offers more than 40 exchange-traded funds, including one for those who are already seeing green on the cannabis horizon.

But it leaves the complicated investment terms out of it. You just choose from a set of simple portfolios reflecting your beliefs, interests and goals.

Once you sign up with Stash, take a look at the app’s portfolio options, including one cannabis-related ETF, to find an investment blend that meets your goals. You can be as conservative or aggressive as you need to be.

It’s your future; invest the way you want to invest and put your money in the markets you think will help it grow like a weed.

Tyler Omoth is a senior writer at The Penny Hoarder who loves soaking up the sun and finding creative ways to help others. Catch him on Twitter at @Tyomoth.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2CKDY0O

Target’s Car Seat Trade-In Event Saves You Money and Reduces Waste

Spoiler alert for the childless: Car seats are super expensive. Also, your growing child will cycle through various car-seat stages. Take it from me, a father of two.

These days, the average convertible car seat price is roughly $175 — although it ranges from $75 to $400 or more, depending on your needs, taste and budget.

One way to save money here is to take advantage of car seat trade-ins.

And just in time for National Baby Safety Month, Target is holding a nationwide car seat trade-in event through Sept. 22.

That means you still have a 10-day window to bring in your old car seat and get a coupon for 20% off a new car seat, booster, base or travel system. You can use the coupon in stores or online until Oct. 6.

What happens to the car seats that Target collects? It has teamed up with recycling company TerraCycle to have them recycled. Target and TerraCycle have kept more than 4.6 million pounds of car seat materials out of landfills since the program started in 2016.

If you’re a Penny Hoarder like I am, you’re always looking for ways to save money. Saving on car seats is no exception as long as my child’s safety is not compromised.

The Car Seat Cycle of Life

These car seat trade-ins are especially useful, because there will come a time when your child outgrows their current car seat or it expires.

The federal government offers car seat guidelines, along with a handy calculator to help you determine which seat is right for your child’s age, weight and height.

Consumer Reports has a few good tips on when to trade in your car seat:

- When your baby is a year old.

- When your baby gets too big for their infant seat.

- When your car seat expires. Yes, car seats have expiration dates. Check your car seat’s manufacturing label. They’re typically good for six years. After that, you can’t resell them on Craigslist or at a consignment store.

- The car seat has been involved in a crash.

- The car seat is damaged.

- It’s simply time for the next step.

Mike Brassfield (mike@thepennyhoarder.com) is a senior writer at The Penny Hoarder. He has two little kids, and just writing this story is making his wallet bleed.

Tyler Omoth, a senior writer at The Penny Hoarder, also contributed to this post.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2y5SpWM

Augmented Reality SEO: What to Expect in the Future

Augmented reality. It sounds like a term that should be used to describe a science fiction movie.

But augmented reality (AR) has become a force to be reckoned with in 2018.

By definition, AR uses technology to superimpose computer-generated visuals on the user’s view of their real-world surroundings, which creates a composite view.

It sounds a bit complicated, but as you’ll see shortly, it’s actually a pretty basic concept you might be familiar with.

Although this technology is seemingly still in its infant stages, as marketers, we need to keep a close eye on how augmented reality can affect our brands.

The most successful businesses stay informed on the top marketing trends each year. AR is a topic that needs to be on your radar.

You need to take AR into consideration when devising your search engine optimization strategy.

SEO and AR?

Yes, on the surface these two ideas may not seem to be related, but they are. I wanted to explain why. That was my inspiration for writing this guide.

If you aren’t familiar with augmented reality, I’ll explain where this technology is now and how it’s being used.

I’ll also show you some plans and predictions for the future and how you can apply this technology to your business.

The basic concepts of augmented reality

Before we talk about the future of AR and how it will impact your SEO strategy, I want to make sure you really understand it works.

In short, augmented reality uses technology to overlay visuals onto surroundings in the real world.

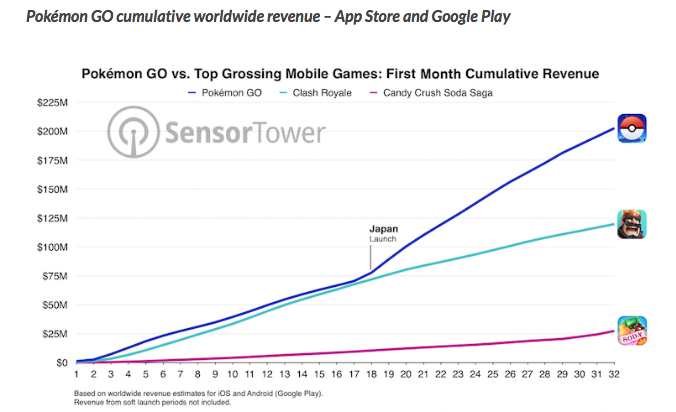

A great example of this technology used in popular culture is the Pokemon Go app. Users find fictional cartoon characters in real-world locations surrounding them.

Look at the image above.

Obviously, this character isn’t actually standing in the grass. If the phone wasn’t there, all you would see is the grass, road, water, and a bridge.

Furthermore, if the user turned and looked to their left or right, the character wouldn’t be there either.

It’s a really cool concept that helped Pokemon Go become one of the most popular and successful gaming apps of all time. But we’ll talk more about that later.

Augmented reality isn’t just used for games. Social media apps Snapchat and Instagram both have AR features.

This technology is increasing in popularity and users are growing to accept its application in their lives.

Understanding the differences between AR and VR

Augmented reality and virtual reality are two terms that often get confused. That’s because we don’t use either of them every day, at least not yet.

AR and VR are similar because they both allow you to experience something you normally wouldn’t see in your life without the use of technology.

That said, augmented reality and virtual reality are very different.

Virtual reality has a much deeper impact on the user experience. Basically, an entirely new world is created using VR technology.

New sounds, images, video, and senses are all part of the VR experience that gets generated by computers.

Virtual reality typically requires special headsets or goggles in addition to headphones if users are experiencing it on their own, such as a virtual reality game.

But games aren’t the only way to experience VR. It’s also used in movies, concerts, and education. Amusement parks have virtual reality rides. The military uses virtual reality to put soldiers in combat scenarios.

What else do AR and VR have in common? They both have a bright future.

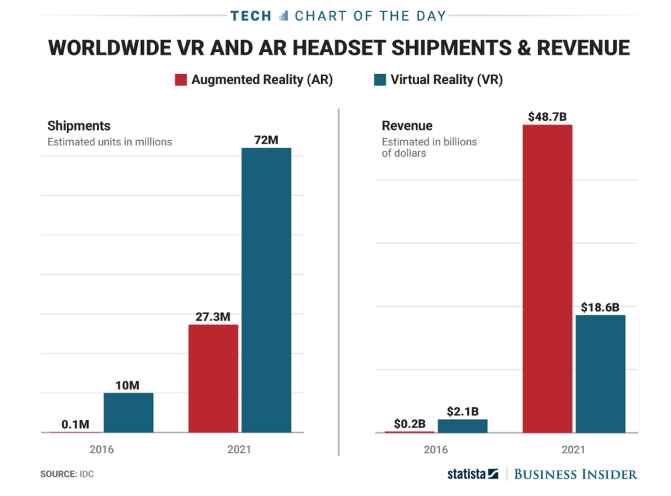

As you can see from this graph, experts are predicting shipments of AR and VR equipment to astronomically skyrocket over the next few years.

This will result in high revenues for businesses in these industries.

Now, take a look at this graphic more carefully.

VR equipment is expected to ship more than double the units of AR equipment by the year 2021. However, the AR revenue is expected to be two and half times higher on those units.

That’s what makes augmented reality so appealing. You can get a high ROI on this technology because the equipment isn’t as cost-intensive and cumbersome as that of VR.

How augmented reality affects search engines

Now let’s dive into the SEO aspects of augmented reality.

All of the major search engines have algorithms for displaying search results. That’s how websites get ranked based on what terms people are searching for.

Many factors go into these algorithms so the content that gets displayed is relevant to the searcher. Search engines use bots, also known as crawlers, to analyze your website content so that your pages can be ranked accordingly based on searches.

With the growing popularity of augmented reality, we can expect these search engines to adjust their algorithms accordingly.

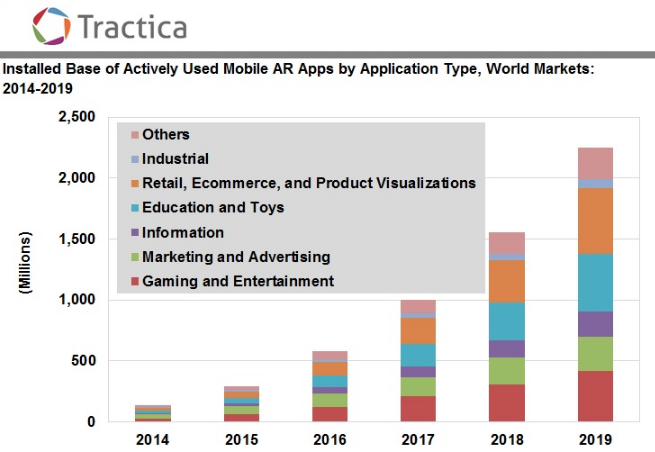

As you can see from the graph, augmented reality has been implemented in a wide variety of industries. Each year, the number of installed AR apps has been increasing.

I’m not expecting to see this trend slowing down in the near future. In fact, I’m expecting it to grow exponentially.

So offering AR content could potentially improve your search ranking.

Furthermore, these search engines themselves could employ augmented reality features to improve the search experiences of users. I’ll show you some examples of this later on.

If you want to stay on top of the latest technological advancements, you need to keep your eye on augmented reality trends.

Right now, SEO marketers use all different types of visuals to improve their content and search ranking. That includes:

- images

- videos

- infographics

As a marketer, you may also want to consider ways to implement augmented reality into your content strategy. This is especially important if you’re targeting users browsing from mobile devices.

AR is a feature that can help improve the profitability of your small business mobile app.

Local SEO and augmented reality

For starters, you need to recognize how AR can impact local SEO.

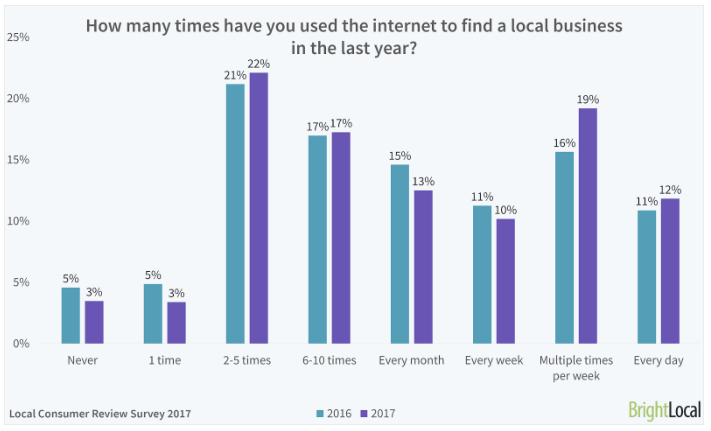

Last year, 97% of consumers searched for a local business online.

These types of local searches are different.

For example, if you search for an electrician in Florida, your results will differ from those of someone who searches for an electrician in California.

There are different factors in search algorithms that go into these local rankings. You need to plan for potential changes that augmented reality could bring in the future.

Mobile apps used for rating or reviewing businesses could start to employ AR technology. The same goes for Google business listings.

Here’s how it could potentially work. A consumer walks by your store. Rather than searching for the name of your business, they just open their mobile app that has AR features.

Now they can see reviews of your business just by pointing their mobile device in the direction of your store.

Your listings need to be accurate and up to date. Plan accordingly for this type of feature because it’s coming in the future.

You’ll also want to make sure that the details of your business are SEO friendly on all devices.

People will be browsing on phones, tablets, and computers.

The application of this AR concept would look something like this:

Users would see the star ratings of your business and be able to read customer reviews and testimonials that increase your brand credibility.

They’ll see your contact information and be able to make a reservation or set up an appointment directly from these AR platforms.

Google is already testing AR features

When you’re trying to predict the future of new technology, it’s always a good idea to see how giant corporations are planning to implement new features.

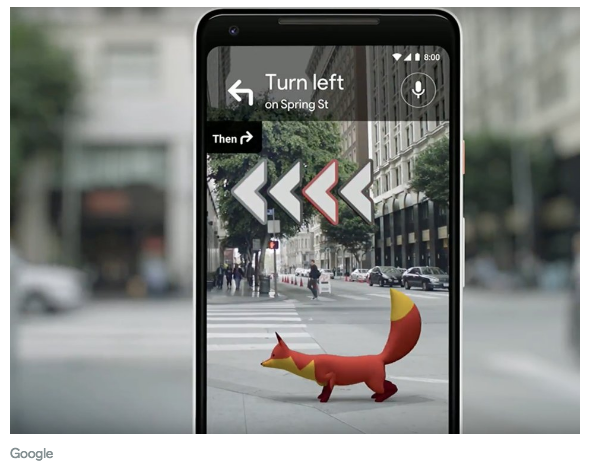

Google plans on making changes to improve Google Maps using augmented reality.

This image is a prototype of what this AR feature could look like.

There is no release date on this update just yet. It might be something the company is just experimenting with.

That said, don’t be surprised to see some version of this AR feature coming to its app soon.

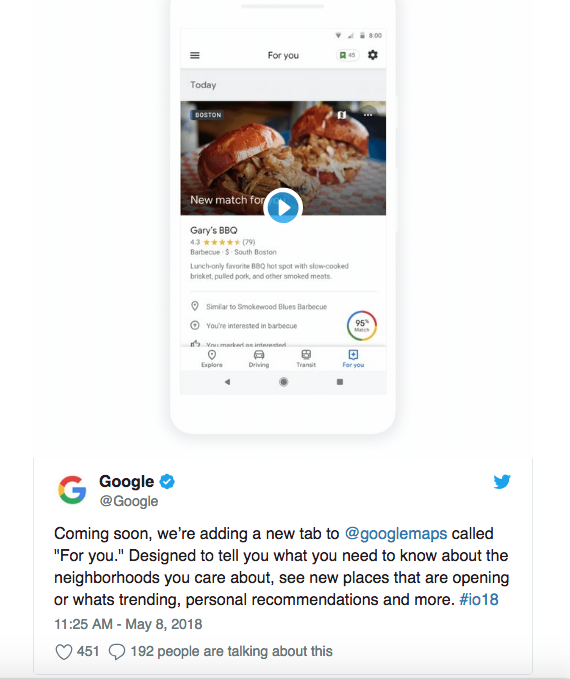

Google is also planning to release another new feature for its maps app that’s going to offer recommendations to each user.

This “for you” feature is something that Google actually plans to implement, as you can see with the tweet confirming this from earlier this year.

Who knows, maybe Google is planning to pair this update with the AR features it’s been experimenting with as well.

Social media SEO

Does social media relate to search engine optimization?

This is a tricky question. Marketers have been trying to determine this for a while, but there haven’t been concrete answers.

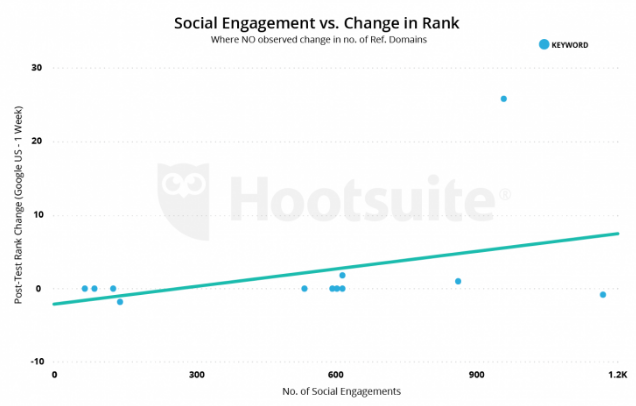

Google says your social engagements don’t have an impact on your SEO ranking.

However, a recent study from Hootsuite suggests otherwise.

This research suggests there is a correlation between social engagement and change in search ranking.

As engagements increase, search ranking rises.

Let’s bring this back to AR. Social media platforms have been using augmented reality features.

Your business needs to start taking advantage of those features on your social channels as well.

This will increase your social engagement and, in theory, improve your SEO ranking.

Some examples of basic social media features that have AR technology elements include Instagram stories, Facebook 360-videos, and Snapchat filters.

While these applications of augmented reality are very simple, I’m expecting more in-depth forms of this technology to come in the future.

Using augmented reality to improve ASO

Unlike VR, AR depends on your location in the real world. I discussed this concept earlier, giving examples.

Pokemon Go characters won’t be the same everywhere. It depends on where you are located specifically.

The same holds true for Google local listings and the potential implications for the future of those apps.

Now it’s time for you to use this information to your advantage. Implement AR in your mobile app and combine it with geofencing technology.

Come up with a strategy unique for your business. Encourage your app users to use your augmented reality features.

Give them incentives or rewards for using AR. These features will help your app grow in popularity and ultimately improve the ranking of your business mobile app.

App store optimization, or ASO, is not quite the same as SEO. However, the two concepts are definitely in the same family.

Just look at how the AR app Pokemon Go was able to succeed in the first month after its launch compared to the other top grossing mobile games:

This app was this successful because people love the AR features.

Adding AR to your app will help your ASO. Ultimately, improving your ASO will help with SEO because of the improved brand exposure and increased traffic to your website.

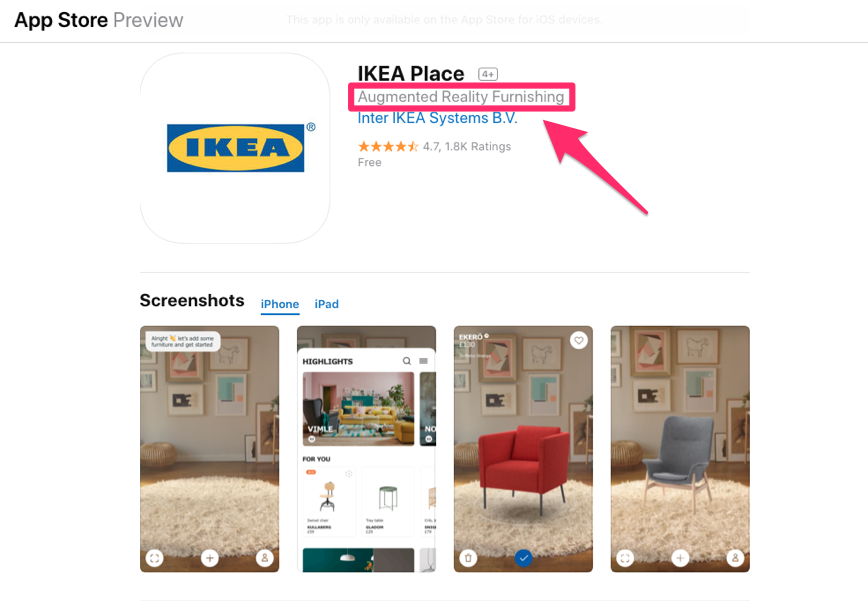

You don’t need to use social media or have a gaming app to use AR on your mobile app. There are apps out there right now taking advantage of this feature.

A great example of this is the IKEA Place app:

This app uses augmented reality to show users what different pieces of furniture would look like in rooms of their homes.

This drastically improves the user experience since they can have an idea what their rooms will look like without having to buy and build the furniture first.

Geotargeting with AR features

You can also expect geotargeting to be combined with augmented reality in the future.

Marketers are already using location-based services to target consumers. AR will bring this concept to the next level.

Here’s a futuristic look at how AR might be used with geotargeting:

In fact, 32% of consumers are already using augmented reality apps.

The writing is on the wall. They’re ready for changes to be made.

It shouldn’t be difficult for marketers to show proof of concept once they launch campaigns and app features like the hypothetical example shown above.

Since the consumers are primed for this technology, you and your business need to be ready to adapt as well if you want to survive.

Conclusion

Augmented reality is here.

It’s time for your business to start planning for the implementation of this technology in the future.

Don’t get me wrong: I’m not saying you need to drop everything you’re doing right now and start focusing on AR. We’re not quite there yet.

But as you’ve seen from the research, trends, and examples I’ve covered in this guide, the daily use of AR is right around the corner.

Augmented reality is going to affect all of us when it comes to SEO.

It might not be this year or next year, but it’s coming. Those of you who are ready to adapt to these changes will have a huge advantage over your competitors.

How is your business preparing for the future of augmented reality?

Source Quick Sprout https://ift.tt/2OaVug1

Starting College Savings When Your Children Are Older

It’s common sense if you know much at all about investing and personal finance. If you intend to save for your children’s college education, the best thing you can do is start early – as early as possible.

The reason is simple – it’s all about the power of compound interest. When you save money for the future, it earns a return, and if you’re choosing to reinvest those returns, it accelerates.

If you put away $100 at 7% interest, for example, it turns into $107 after a year, but after another year you have $114.49 – you earned $7.49 instead of $7 in that second year. After year three, you have $122.50 – in that third year you earned $8.01 instead of $7.49. It keeps going and going like that, growing year after year – during the eighteenth year, it earns $22.11 on its own, just sitting there.

If you put aside $100 at 7% annual return and do nothing else but wait 18 years, it’ll be worth $338 when you go to withdraw it.

But what happens if you can’t – or don’t – start saving for your child’s college education when they’re really young? What if you don’t start saving until age 10, giving them only eight years until college?

Well, if you put aside $100 at 7% annual return and do nothing else but wait 8 years, it’ll be worth just $171.80.

See the difference? Just waiting 10 years to put away that $100 costs your child $166.20 in investment income.

It’s obviously a great idea to start saving young if you’re going to save, but what do you do if that’s not an option?

What if you just realized that your kid is eight and hitting high notes on their standardized tests and bringing home stellar report cards and you’re realizing that college probably needs to be in this kid’s future and how are you going to pay for it?

What if your kid is 10 and you finally got a good job, a real good job, and you now have the breathing room to save for things like college for the first time?

What do you do if you don’t have the advantage of all of that compound interest time?

Here’s the game plan.

Save What You Can, Starting Now

Open up a 529 college savings plan for your child (here’s a great comparison of various plans) and start saving now rather than later. Do it today, seriously.

Just open up that account, set your child as the beneficiary, then set up that account to automatically withdraw a little from your checking account each month. Even $20 is fine – whatever you can afford. Just start now.

It doesn’t have to be a lot. It just needs to be whatever you can afford, and it needs to start as soon as possible.

Start Putting Some ‘Gifts’ Into That Account

When it comes time for gift giving, make sure that at least some of their gift is an additional contribution to that account.

You can do this in a fun way so that your children realize what they’re being given. For example, you can give them an enlarged photocopy of a $20 or a $50 or a $100 bill and write on it, “This was put into your college savings,” and then wrap that sheet up in a shirt box with some tissue paper. While it won’t be something they’re incredibly excited about right now, they will remember those gifts later on when they realize they have a student loan that’s thousands of dollars less, and they’ll continue to remember it when they’ve got much smaller student loan payments when they’re an adult.

You can also encourage other relatives to do the same thing. Let relatives know that you’ve opened up a college savings account for your child and give them the information needed for them to contribute. Invite them to do the same thing – they can physically give the child a photocopied $10 bill or whatever along with some modest gift they’ll enjoy right now.

Lean Into Other Funding Options

It’s important to remember that paying for college isn’t just a mix of what you’ve saved up and student loans. There are many other options that your child can utilize when they’re ready to go to school.

For instance, many schools offer grants and scholarships of various kinds to incoming students based on financial need and merit. If you’re in a situation where it is a real struggle to save, you may find that the school offers your child a grant that takes care of some of the cost of school. Don’t assume that everything will be in the form of loans.

At the same time, your child can apply for scholarships independently. Again, if you are in a need-based situation, which is a common reason for struggling with college savings, there are many scholarships for which your child might be eligible.

Your child might also want to divert some portion of any income they earn in high school to their own collegiate future. While they’re at home, you’re likely taking care of expenses such as food and shelter and functional clothing, so they should be able to channel some of their income to college savings.

Look at Other Education and Career Options

If you’re starting savings at a late date and if you can’t contribute large amounts, you should still save, but you should keep your eyes on other options besides a traditional four-year college experience, where the money you are able to save will have a bigger impact.

For starters, your child may want to explore attending a community college for a year or two where they take care of general education requirements and really hone in on what they want to do with their life before switching to a four-year school to finish their education. Credits at the community college level are inexpensive and they usually transfer directly to many four year colleges and universities. It’s a great way to cut the cost of college while still earning that four-year degree.

Your child may also want to consider trade school. Trade schools offer a path directly into a trade of some kind, which typically offers an avenue into a well-paying career path for your child without the expense of a four-year school. Many careers center around a trade school program, including electrical work, plumbing, construction management, airplane maintenance, machining, HVAC work, and many other fields.

Trade school generally takes far less time than a four-year university and usually places people directly into some kind of apprenticeship program where they learn the ins and outs of plying the trade professionally. The total cost of trade school is far less than a four-year school, too, and 529 savings can usually be applied to trade school tuition.

They may also have other opportunities directly after high school, particularly if they have a solid job and haven’t figured out quite what they want to do. If they choose to wait a year or two before beginning their education so that they’re certain of what they want to do (a “gap year”), this gives their college savings another year to grow.

Don’t fall into the mindset that the only acceptable path after high school is directly into a four-year school.

Be Supportive During College

Another method of reducing the need for savings during the college years is to encourage your child to attend a school near where you live and then provide the “room and board” portion of the college expense directly. Your child continues to live at home and you continue to provide food, clothing, and other basic needs. This way, the only expenses for college are tuition and educational materials.

Obviously, this isn’t a perfect solution for all families. It nudges students to choose a school that’s closer to home out of financial expedience rather than the absolute best choice for their educational future.

Basically, the more of the day-to-day expenses of living as an independent college student that you can take on as a parent for your child, the less student loans they’ll have to deal with and the less of a problem your late start to college savings will be.

Final Thoughts

The big thing to remember is this: It is never too late to start saving for college for your child. You can always start saving, even if the date is late, and every dollar counts.

Your help with college doesn’t begin and end with how much you’ve saved, either. There are many ways to make a big financial difference with their post high school educational and career choices.

Good luck!

More by Trent Hamm:

- Education vs. Job Training and Preparing Your Children

- Avoiding the Trap of Financially Dependent Children

- Straight Talk on 10 Common Personal Finance and Career Questions

The post Starting College Savings When Your Children Are Older appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2OaVOva

These Folks Retired in their 30s and 40s: Can You Do It Too?

Source Business & Money | HowStuffWorks https://ift.tt/2MnQhQb

These Folks Retired in their 30s and 40s: Can You Do It Too?

Source Business & Money | HowStuffWorks https://ift.tt/2MnQhQb

Six Signs Your Balance Transfer Could End in Disaster

The average credit card balance was $6,354 at the end of 2017, and American consumers now hold more than $1 trillion in collective revolving debt, most of which is on plastic. These numbers probably sound scary, but they can’t be that surprising. After all, many of us have a penchant for using credit for rewards or convenience but lack the discipline to pay our balances off each month.

If you find yourself struggling with credit card debt or other unsecured debts, you may be wondering if a balance transfer could be the answer to your money woes. Many of the best balance transfer cards offer 0% APR for up to 21 months, after all, which could provide you with a long enough timeline to get out of debt for good.

You’re probably aware that zero-interest cards don’t provide a perfect solution, particularly since many charge upfront balance transfer fees of 3% to 5%. But, that isn’t the only problem with balance transfer cards — not even close.

If you move forward with a balance transfer without thinking it through, or you don’t have the discipline to stick to a repayment plan, a balance transfer could leave you exactly where you started in the end — or even worse off than where you are now.

Six Signs Your Balance Transfer Might Go Off the Rails

That introductory 0% APR can only help you if you’re ready to help yourself. Here are six signs a balance transfer might be the last thing you need:

#1: You can’t promise you’ll pay more than the minimum payment.

Some balance transfer credit cards offer the opportunity to pay down your debt at 0% APR for up to 21 months, but the average is between 12 and 18 months. During that time, every penny you pay toward your debt goes directly toward your balance and not toward interest charges. As a result, the introductory 0% offer you receive is the ideal time to attack your credit card debt with fervor. The more you can pay down now at 0% APR, the less interest you’ll pay when the introductory offer ends, and the closer you’ll be to becoming debt-free.

The problem is, nobody’s going to make you pay more than the minimum payment on your credit card, which is usually somewhere between 2% and 5% of your total balance. If you’re tempted to pay only the minimum payment, you won’t make nearly as much progress as you could.

If you’re considering a balance transfer offer to avoid interest for a while but aren’t dedicated to paying as much as you can while you have that 0% APR, you’ll wind up right back where you started when your card’s introductory offer ends. Remember that 0% APR cards offer zero interest for a while but not forever. And when your card’s introductory offer is over, your credit card’s interest rate will reset back to normal, which is currently over 17% on average.

#2: You want to keep using credit cards for regular spending and bills.

To get the most out of a balance transfer credit card, you have to use it strategically and with a plan in place. If you have $5,000 in credit card debt and think you could qualify for a card that offers 0% APR for 15 months, you should run the math. If you can pay a little over $333 per month during that time, you’d find that you could use the balance transfer introductory timeframe to work your way out of debt altogether.

But, you’ll face a huge problem if you also want to use credit cards for spending while you pay down debt. Not only do you run the risk of charging more than you’re paying off each month, but you could face an even scarier crisis if you plan to use your balance transfer card for purchases, too.

While some balance transfer cards offer 0% APR on balance transfers and purchases for a limited time, not all do. If you use a 0% APR card that doesn’t extend the offer to purchases, you’ll start paying interest on those charges as you continue tackling your transferred balance that’s at 0% APR.

Even worse, carrying a balance on that credit card means you could lose your grace period. As a result, you’ll begin accruing interest on your purchases from the date you make them.

#3: You’re looking for a balance transfer card that also offers rewards.

Balance transfer offers can help you save a ton of money if used wisely. Rewards credit cards, on the other hand, can be insanely lucrative if you pay your balance each month and always spend responsibly. The thing is, these worlds should never collide. Sure, some balance transfer cards offer rewards, but you should never try to take advantage of them.

Remember, you’re trying to pay down debt — not continually rack up more. A travel or rewards card that offers points or miles could wind up enticing you to spend and spend to earn more points. That’s exactly the opposite of what you should be focusing on when you sign up for a balance transfer card.

#4: You haven’t taken the time to figure out a repayment timeline that could leave you debt-free.

As we mentioned already, you need to spend some time figuring out a plan of attack before you sign up for a balance transfer card. Not only should that involve figuring out exactly how much debt you have to pay off, but you should also sit down to create a monthly budget so you know how much cash you can allocate toward debt each month.

You may also need to look for ways to cut your spending to get out of debt faster. While you’re paying off debt, you could eat more dinners at home, cut cable television, or walk to work, for example. Anything you could do to cut your expenses could help you free up cash to pay down debt faster.

If you haven’t taken the time to think through any of these details, chances are good your balance transfer won’t end well. You need to have a plan if you want to use a balance transfer to your advantage, and that plan requires some upfront legwork.

If you decide to “wing it” instead, you’re not doing yourself any favors.

#5: You transferred balances from one card to another in the past without ever paying off your debt.

If you’ve already transferred a balance from one card to another in the past and it’s still with you, you’re already off to a tragic start. Old habits die hard, and it’s far too easy to transfer debts from one card to another to get 0% without making much progress at all.

If you want this time to be different, you must do things differently. For most people, that means taking some of the steps we’ve described above — creating a budget, coming up with a debt payoff plan, and cutting your spending to make the most of your 0% APR introductory period.

You should also avoid using credit cards while you’re paying down debt. Credit cards may be convenient, and they do offer perks and important consumer protections, but using plastic while you’re trying to reduce what you already owe isn’t going to help.

#6: Your credit score isn’t that great.

Finally, don’t forget that the best balance transfer credit cards require good or excellent credit. This typically means a FICO score of at least 670 or higher, although different issuers have their own rules.

If you have poor credit or fair credit, you’ll probably have access to a different set of credit cards that don’t offer 0% APR or many perks. With that in mind, it makes sense to spend some time building up your credit score before you apply for a balance transfer card.

Make sure to get a free copy of your credit score so you know where you stand, then look for simple ways to improve it over time. For starters, make sure you’re paying all your bills on time, keep your credit balances as low as possible, and don’t open too many new accounts. Also strive to keep old credit accounts in good standing open; they could be helping your credit score by lengthening your average credit history — even if you don’t use them.

The Bottom Line

Balance transfer cards can be valuable tools if you have a plan in place and the mindset required to get out of debt. But, if you’re not disciplined or you haven’t put much thought into it, there’s a good chance avoiding interest for a while won’t change your situation much.

Before you sign up for a balance transfer card, ask yourself a few tough questions: Are you serious about getting out of debt? Are you ready to make a lifestyle change? Or, are you simply trying to prolong your misery by scoring a lower monthly payment for a while?

Be honest with yourself, and only apply when you’re truly ready. Otherwise, you’re treading water instead of making the long swim toward the shore. If you want your freedom, you have to take off the floaties and swim.

Holly Johnson is an award-winning personal finance writer and the author of Zero Down Your Debt. Johnson shares her obsession with frugality, budgeting, and travel at ClubThrifty.com.

- Related: Best Balance Transfer Credit Cards

More by Holly Johnson:

- How to Save Money and Get Out of Debt With a Balance Transfer

- Seven Signs Your Debt Is Out of Control (and What to Do About It)

- The Upside-Down Reason So Many Americans Are Broke

The post Six Signs Your Balance Transfer Could End in Disaster appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2Mox68W