Google is a treasure trove for marketers.

Currently (2017), it “processes over 40,000 search queries every second!”

This “translates to over 3.5 billion searches per day and 1.2 trillion searches per year worldwide.”

And just look at how much Google use grew between 2000 and 2012:

It’s ridiculous!

And this all means one thing.

Google can generate valuable data like it’s nobody’s business.

There’s arguably no other resource in history that compares to it.

Another thing I love about the search engine is the arsenal of free tools it offers for gaining insights.

There’s the Google Search Console, Google Analytics, the Google Keyword Planner and Google Alerts, just to name a few.

These are all ideal for providing you with the data you need to better understand the behavior of your audience and improve your marketing.

And as we all know, data is a marketer’s best friend.

Without data, I wouldn’t know what direction to take, making it much more difficult for me to reach my demographic.

In this post, I’m going to cover an extremely important aspect of marketing.

It’s this: how to discover your customers’ biggest frustrations and how to solve them.

I’ve found that Google is perfect for finding out what irks my audience, and you can implement the same methods too.

Here are several techniques you can utilize.

Autocomplete

Let’s start with an incredibly simple yet effective feature: autocomplete.

I’m sure you’re familiar with it.

With the insane amount of data Google has accumulated and continues to accumulate, it offers autocomplete to streamline user searches and help people find the information they’re looking for quicker.

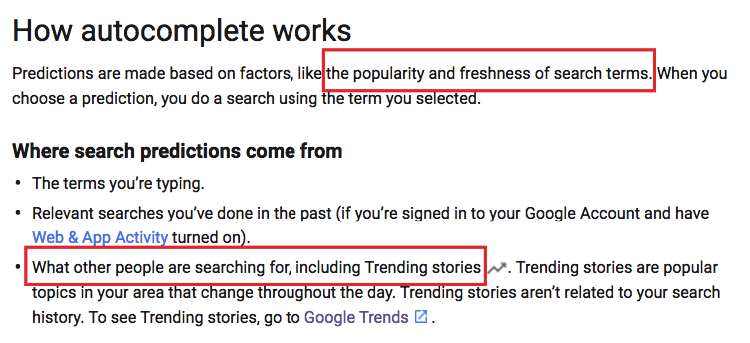

Here’s a screenshot that summarizes how this feature works:

Notice I highlighted two key points.

Autocomplete predictions factor in the popularity/freshness of search terms and terms other people are searching for.

Using autocomplete can provide you with valuable intel on what your customers are searching for and, more importantly, what their collective frustrations are.

Let me give you an example of how you can use it.

Type in a broad keyword phrase that relates to your industry, niche or product you’re selling.

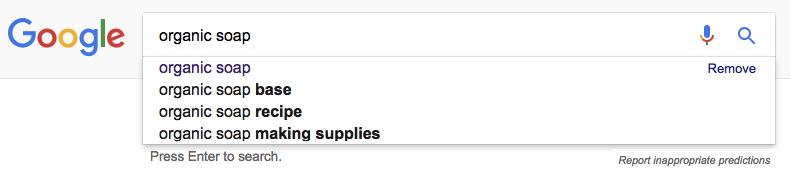

I’ll use “organic soap” as an example.

Here’s what pops up:

Just like that, I can tell what some of the most popular search terms are.

It’s obvious people are interested in organic soap bases, recipes and organic soap-making supplies.

Therefore, this user base has questions and concerns about these topics.

So this is a good starting point.

I recommend recording these popular searches for future reference because you’ll want to create content around those topics.

Performing a question-based search

Another easy way to understand your average customer’s frustrations is to figure out what types of questions they’re asking regarding your niche/product.

You can do this by typing in search phrases such as “what is,” “why is,” “how to,” etc., followed by a broad keyword.

Here’s an example:

Within seconds, I can get a pretty good idea of which aspects of the organic soap topic people are curious about.

Remember, if it pops up on Google autocomplete, you know a large number of people have entered that search phrase.

So, you’re dealing with a high volume of searches.

Again, you’ll want to record those search phrases because you can target them later on.

Performing a problems search

Let’s take it one step further.

Type in your broad keyword followed by the word problems:

Here are some of the results I got:

I also highlighted some frustrations, concerns and questions people have.

Considering the fact these are all on page one of this Google search, it’s safe to say there’s a significant number of people who share these frustrations.

As a result, these are all potential topics I could cover.

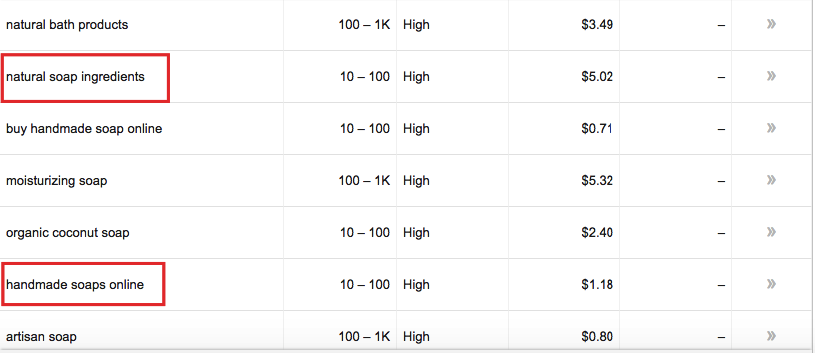

Using the Google Keyword Tool

You probably already use this tool for performing keyword research for SEO.

But it can also be useful for finding your customers’ pain points as well.

Here’s what you do.

Type in your broad keyword in the search box:

Then scroll down to see what people are most interested in.

The main thing you’ll want to take into consideration is the number of average monthly searches.

Here are some highly searched keywords that let me know what types of questions and frustrations customers have:

Using Google Trends

I absolutely love Google Trends.

It’s one of the best ways to get a quick snapshot of the popularity of something and see how interest has either grown or declined over time.

I also like to use it to generate graphs for great looking visuals for my content.

To use it in this context, just type in your search phrase:

Then scroll down to “Related queries.”

You can view related queries as either “Top” or “Rising.”

“Top” lets you know what’s most popular over time in the grand scheme of things.

“Rising” lets you know what’s most popular at the moment and what’s trending upward.

Use this information to spot any potential frustrations your customers might be having that you may want to address.

Identifying top blogs in your niche

Here’s one last technique.

Do a Google search that combines your broad keyword and the word blogs.

You’ll get results like this:

Then click on one or more of the results.

This one looks good to me:

Now, I can get a glimpse of the types of topics the top blogs are covering, which are indicative of what your average customer is most interested in:

I can get quite a bit of information by just looking at the description of each blog.

But, of course, I can learn a lot more by actually clicking on a specific blog and scanning through the posts.

This should fill in the gaps in terms of discovering the average customer’s frustrations and can give me even more ideas for content.

Solving those frustrations

Okay, so I’ve discussed several different ways to gain an understanding of what’s irking your customers.

As you can see, Google is pretty much a be-all and end-all tool for this.

But how do you solve those frustrations?

It’s simple.

You want to create robust, comprehensive content that exhaustively answers these questions and addresses these frustrations.

I recommend writing down a list of topics based on your research and prioritizing them in terms of importance.

For instance, I found people were interested in:

- what organic soap is made of

- how to make organic soap from home

- how to make organic soap without lye

- toxic soap ingredients to avoid

and so on.

Now I can start creating content that covers those topics.

More specifically, my goal is to create content that outranks the competition.

Skyscraper it

As you may already know, I’m a huge proponent of the skyscraper technique: producing content that betters and outperforms your competitors’ content.

If you’re unfamiliar with this concept or need to brush up, this guide from Backlinko will tell you everything you need to know.

By following this formula and addressing the unique concerns of your customers, you’ll quickly be on track to generate traffic, build trust and “scratch their itch.”

Diversifying your content

I’ve mentioned many times before that interactive content significantly outperforms conventional static content.

Here are a few stats from Impact Marketing that show the importance of creating interactive content:

When you break it all down,

interactive content drives 2x the number of conversions as passive content like blogs and eBooks.

Here’s what I suggest.

Look for ways to create different types of content your competitors have overlooked or ignored.

Rather than writing your standard 800-word blog post, write a long-form, 2,000-word post full of visuals, including relevant videos, graphs, stats, etc.

Or if there’s a pervasive question your customers have, try creating an infographic that succinctly answers it step by step.

In other words, think outside the box and be willing to go where your competition doesn’t.

This should kill two birds with one stone because you’re solving your customers’ biggest frustrations and providing them with incredibly helpful information while offering a level of depth your competitors are not.

It’s a win-win situation.

Conclusion

It’s amazing the insights you can gain from Google.

It’s a godsend for doing market research and will provide you with a wealth of valuable intel if you know how to use it correctly.

And the longer people use Google, the bigger the data pool becomes.

The best part is that it’s completely free.

As you’re probably aware, every demographic has its own specific pain points.

Your job as a marketer is to identify these frustrations and provide an effective solution.

By using the techniques I mentioned, you can do this in a very streamlined manner.

From there, you’re in a much better position to create content that hits its mark and can provide your audience with the answers they crave.

This, in turn, translates into a host of benefits including increased traffic, more leads and bigger profits.

Do you have any other suggestions for using Google to discover customer frustrations?

Source Quick Sprout http://ift.tt/2t3Fk0y