Every online marketer knows that the Internet is an insanely skeptical place.

It’s with good reason.

Let’s be honest.

Our space is littered with faux gurus and hyped up promises.

You’ve seen them:

“Make $500 000 with your first online course launch.”

“Give me 15 minutes, and I’ll give you a profit generating machine!”

Okay, I’m exaggerating a bit, but you get the drift. Your prospects don’t know you well, and they don’t trust you yet.

Social proof can change that.

Think about the last time you bought a product without looking at the reviews first or without a recommendation from someone you know.

Never happened, right?

That should give you an idea of how integral social proof is to easing the minds of your customers.

There is one question I get asked a lot.

People want to know where on their websites they should display proof elements.

The answer?

Everywhere.

Social proof should be splattered across your website.

The key is to have the right kind of proof on the right pages.

In this post, I’ll describe different types of social proof you can use and where on your website you can display them for maximum effect.

Sound good? Let’s start.

What is social proof?

Do you know what the herd mentality is?

It describes the way people are influenced by their peers to behave in a certain manner.

That’s the basis of social proof.

You see a bunch of people doing the same thing. You assume it’s the right thing to do. You do it too.

Now, it’s way more comforting to believe we are all independent thinkers and we take actions on our own volition.

Not true.

Of course, the pack mentality doesn’t apply to every area of life.

In business, however, you can bet it’s always at play.

And that’s good news.

It means you have the methods to ease your prospects’ anxieties and push them to make that final purchase decision.

Best of all, social proof makes your customers feel confident about their decisions.

Here’s the thing though.

Not all proof elements are created equal.

Some are more persuasive and impactful than others. Even the placement of that proof can have an impact.

I’ll give you the most compelling types and ways you can incorporate them so you have proof elements on every single page.

1. Case studies

This is by far one of the most powerful types of social proof.

Why?

It tells a complete story (if done well).

And as you know, a success story is the best kind of story in this case.

With case studies, you get a holistic view of your customer’s journey. You get to learn:

- what their life was like before they invested in you

- what prompted the purchase decision

- the obstacles they had on their way to a better outcome

- how you helped them overcome these obstacles

- the exact moment they experienced transformation

- what life looks like in the aftermath of this transformation.

Does your case study need all these elements?

Yes.

It’s way more effective than simply having a customer say

I had a great experience working with Jane, and I highly recommend her.

There is a place for that kind of proof, and I’ll talk about that later.

Where should you display case studies?

They’re so powerful they can stand on their own. I always recommend having a separate page to feature your success stories.

Like this:

Here’s another example:

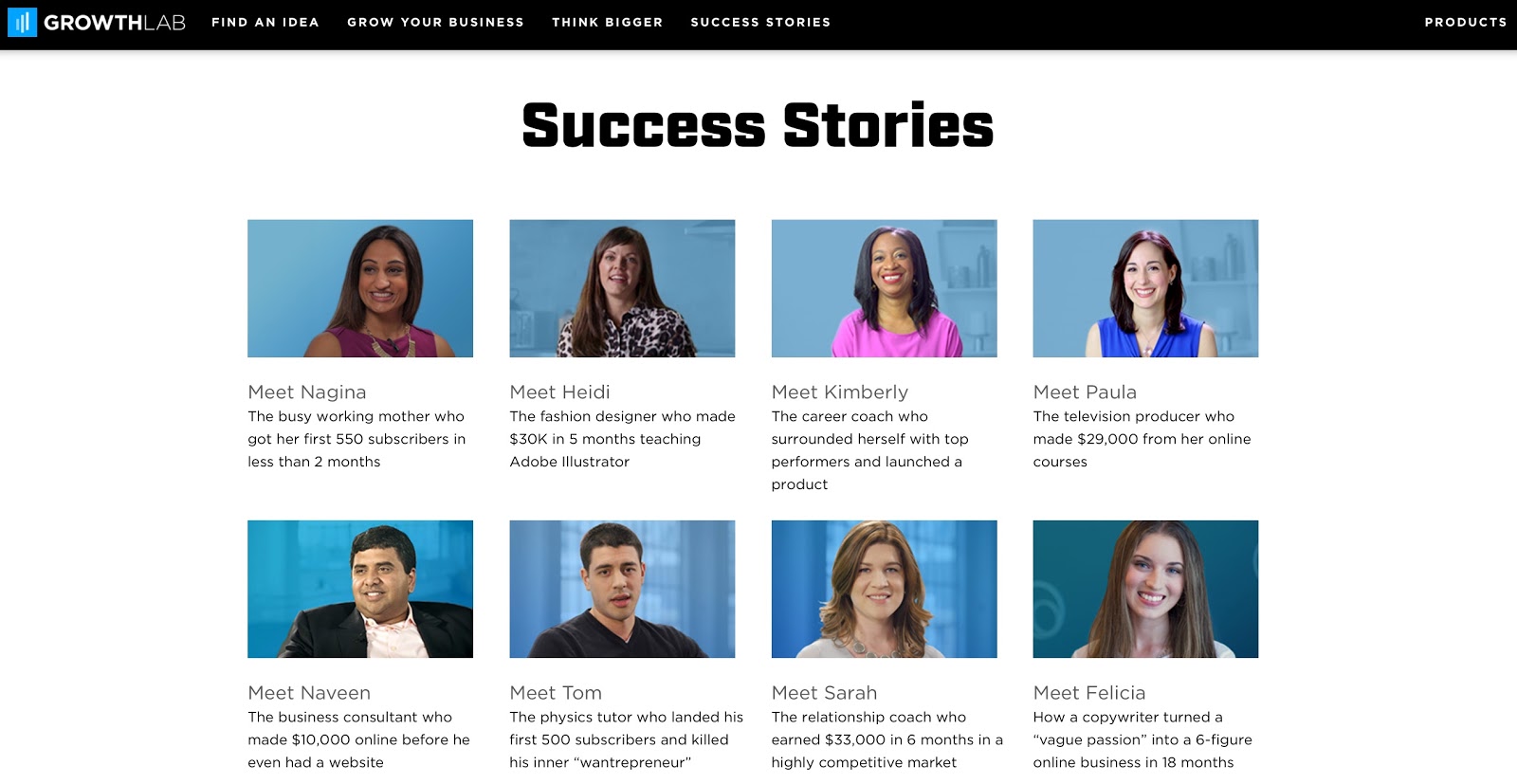

Ramit Sethi executes this kind of social proof perfectly in his GrowthLab:

While you can have these on a separate page, you should also include product- or service-specific case studies on your sales pages.

You can do it in a number of ways:

- strategically embed video case studies into your sales page;

- use case studies as a response to questions on your FAQ page;

- condense the success story into a testimonial and have a “read more” link so prospects can access the full case study from your sales page.

These are just a few ideas.

2. Customer testimonials

These are much easier to put together than case studies.

Simply ask people with whom you’ve worked (and have had success) to write you a testimonial.

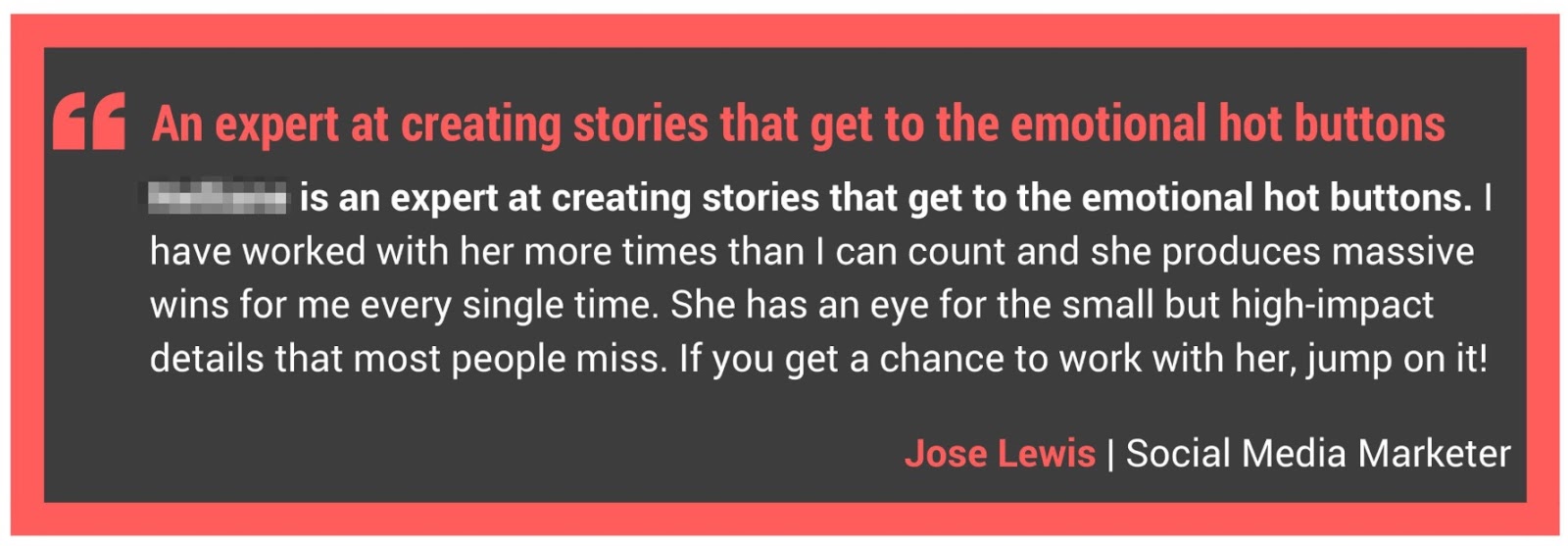

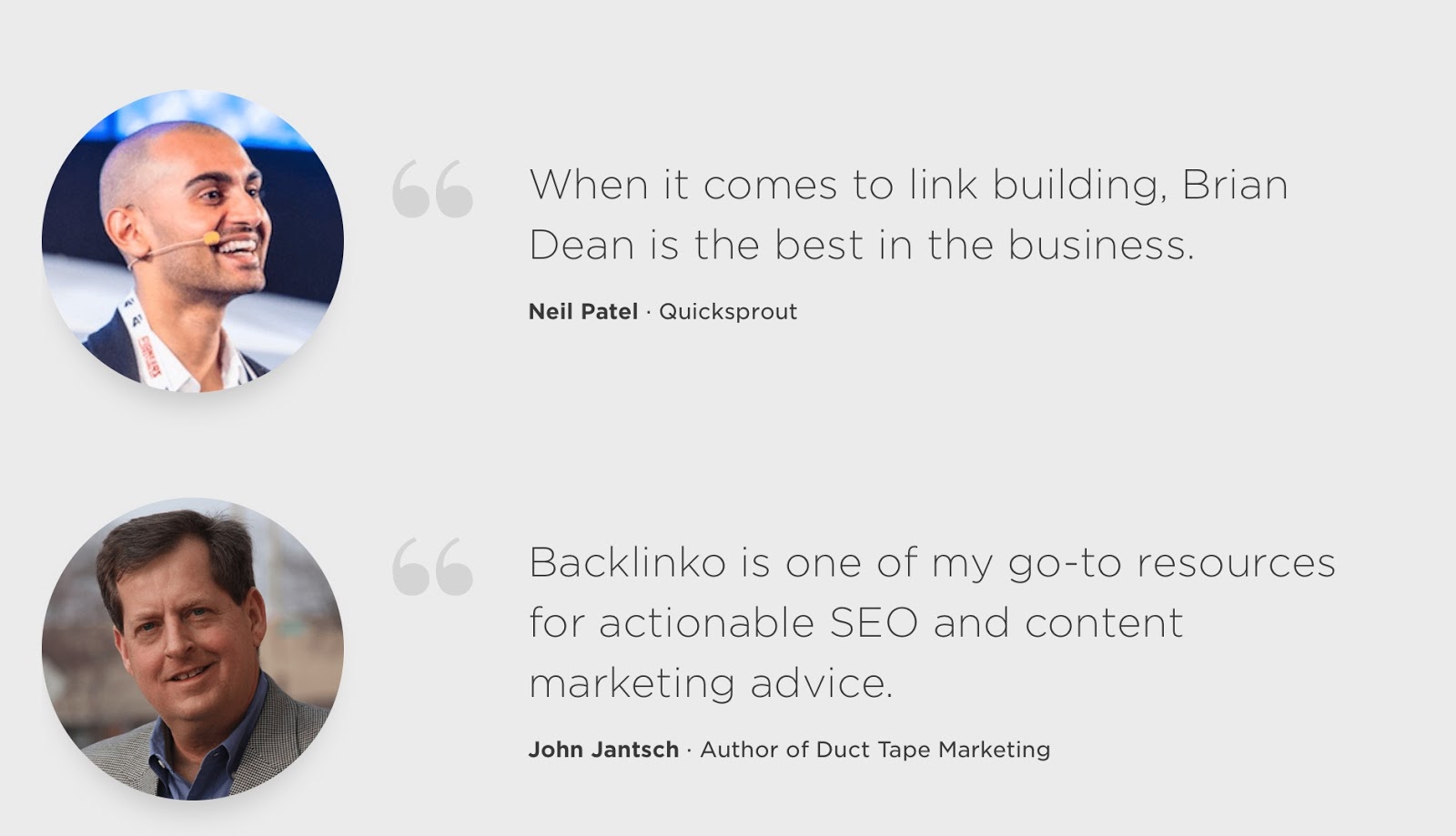

Like this:

Unlike with case studies, I don’t recommend you hoard all your testimonials on one page.

Why?

A testimonial doesn’t tell a whole story.

That means it won’t have much impact standing on its own. It needs to be backed by something else.

Here are some ideas for placement:

- next to a contact form

- next to a call-to-action button

- on an order form

- on a sales page, right after you’ve given the benefits of your product/service

- on a newsletter opt-in form. This is excellent for those who don’t have a large number of subscribers to use as social proof.

- on your About page.

I recently stumbled upon a site that places testimonials in a sidebar. This way, they appear on every website page.

It’s genius!

3. Strength in numbers

You’ve likely seen this one used a lot.

It works.

The most common use of this type of social proof is to have social sharing buttons on your blog posts.

It tells people this is a quality blog post that should be read.

It has the same effect as comments.

Check out this post by Brian Dean:

It has 871 comments! Now, that’s social proof.

Here’s the thing though.

Be aware of negative social proof.

If you have zero comments and zero social shares on a post, you may want to keep it to yourself.

Most social sharing tools allow you to shut off displaying the share count if it doesn’t clear a certain threshold.

Some other ways you can show strength in numbers:

- number of users

- number of downloads for software, tools, or resources

- number of subscribers

Displaying subscriber count is powerful proof.

Considering how important list-building is in business, if you have the right numbers, make use of them.

4. Endorsements from influencers

4. Endorsements from influencers

Influencers are people with massive authority in your niche.

Everyone knows them, likes them, and trusts their opinions.

Imagine getting an endorsement from one of the big players in your space. It can make your business.

How do you land such an endorsement?

- Zone in on an influencer.

- Get on their radar by engaging with their content.

- Make contact via email.

- Do something spectacular for them.

- Ask for an endorsement.

I know, it’s easier said than done. But that’s the general path you need to take.

Don’t want to take this route?

You can also pay to play.

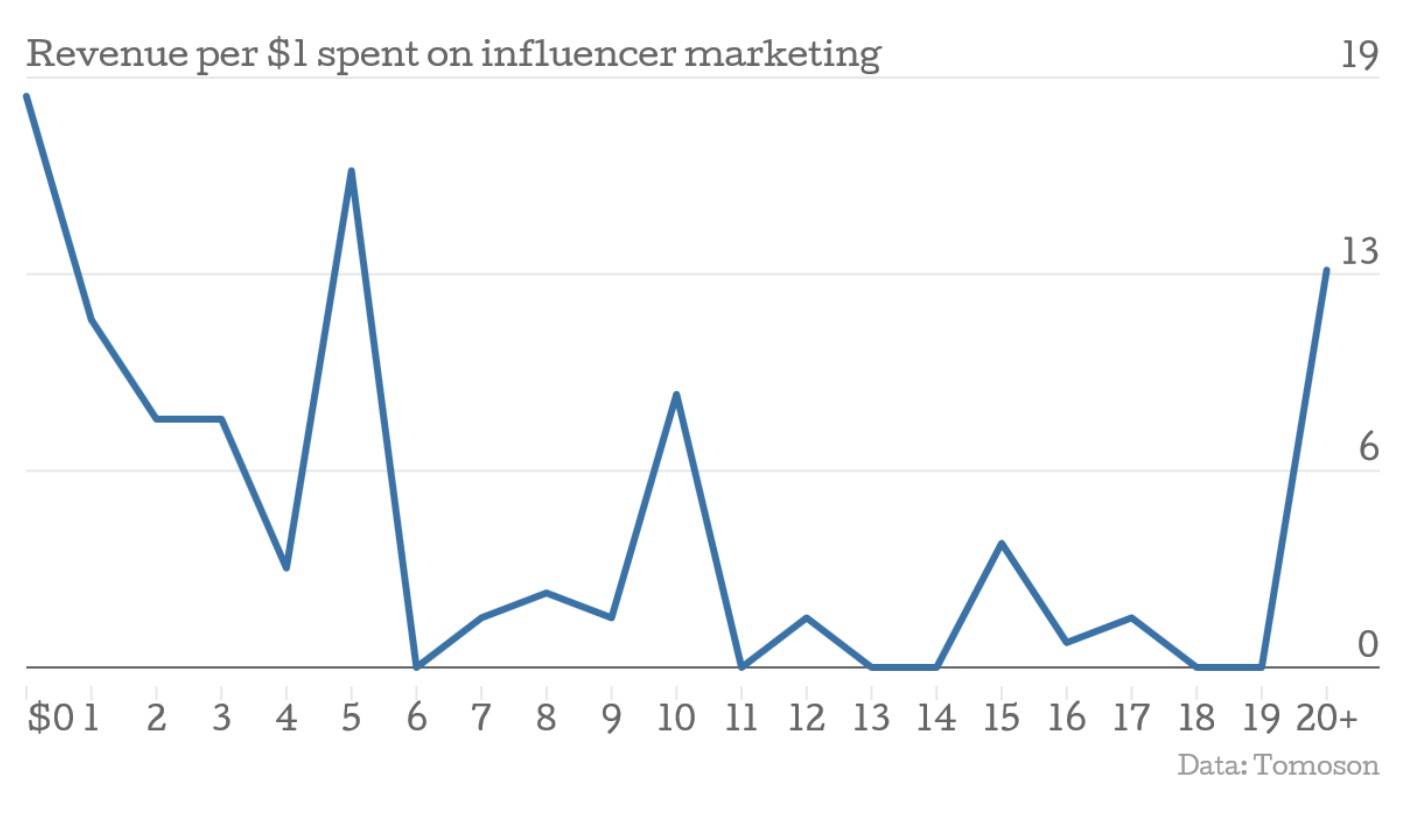

In other words, you can hire influencers to endorse your brand or products.

If you have the funds, it can be quite profitable.

It’s reported that for every $1 businesses spend on influencer marketing, they get $6.50 back. Those in the top 13% get $20 back.

Now, that’s what I call rock solid ROI.

After you’ve got your endorsements, you can display them on your website.

The Home page and About page are prime real estate for this kind of proof:

It tells website visitors you’re a big deal, and you’re worth listening to.

That’s what you want, right?

If someone prominent has praised you, show it off.

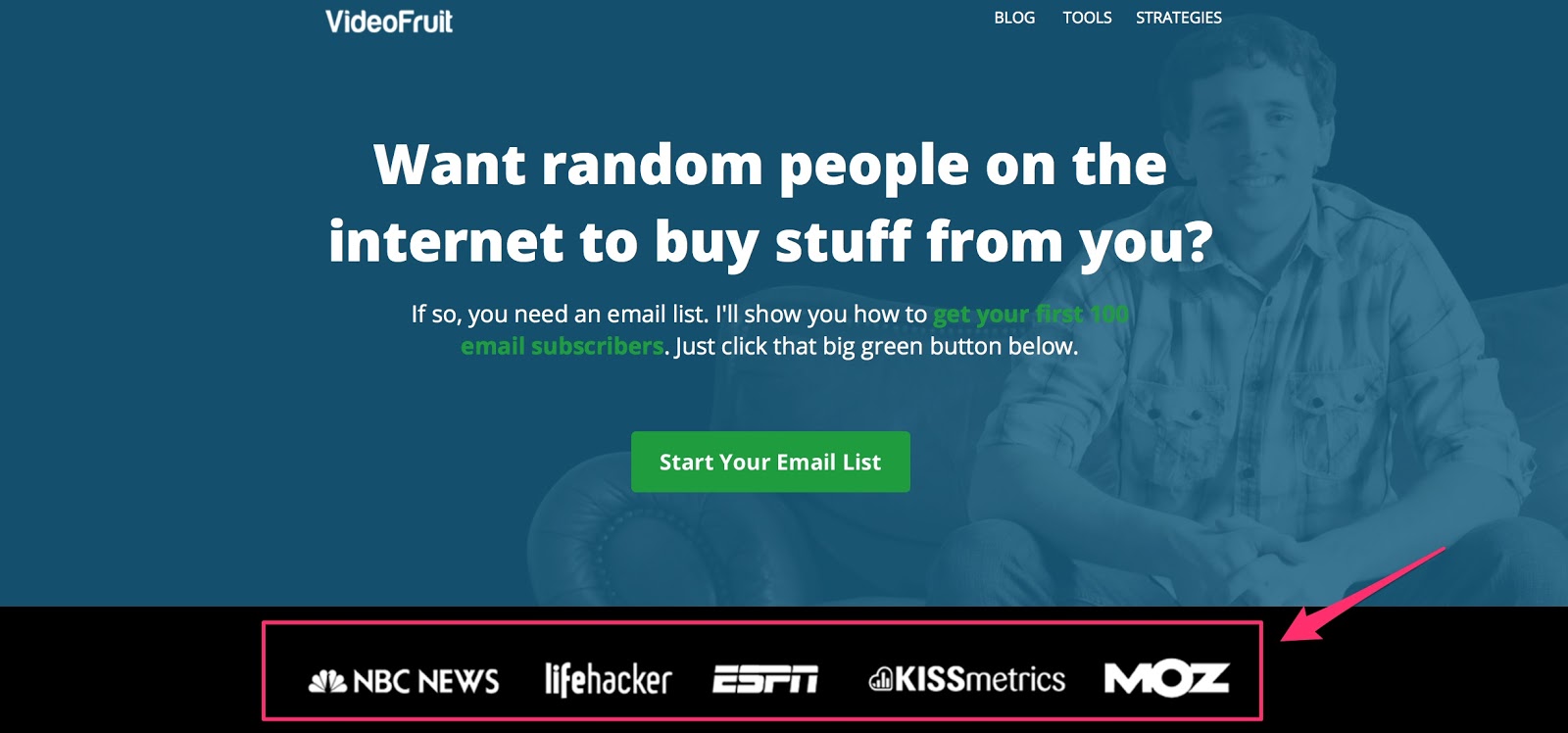

5. Media mentions

Have you ever seen logos of different publications splattered across some websites?

I’m sure you have. It’s commonly used.

Here’s an example:

It doesn’t have to be a formal media establishment like NBC News. It can be a popular website in your niche.

If you’ve ever been featured there (guest post, interview, etc.), you can place the logo on your website as a form of proof.

This is almost always displayed on the Home page.

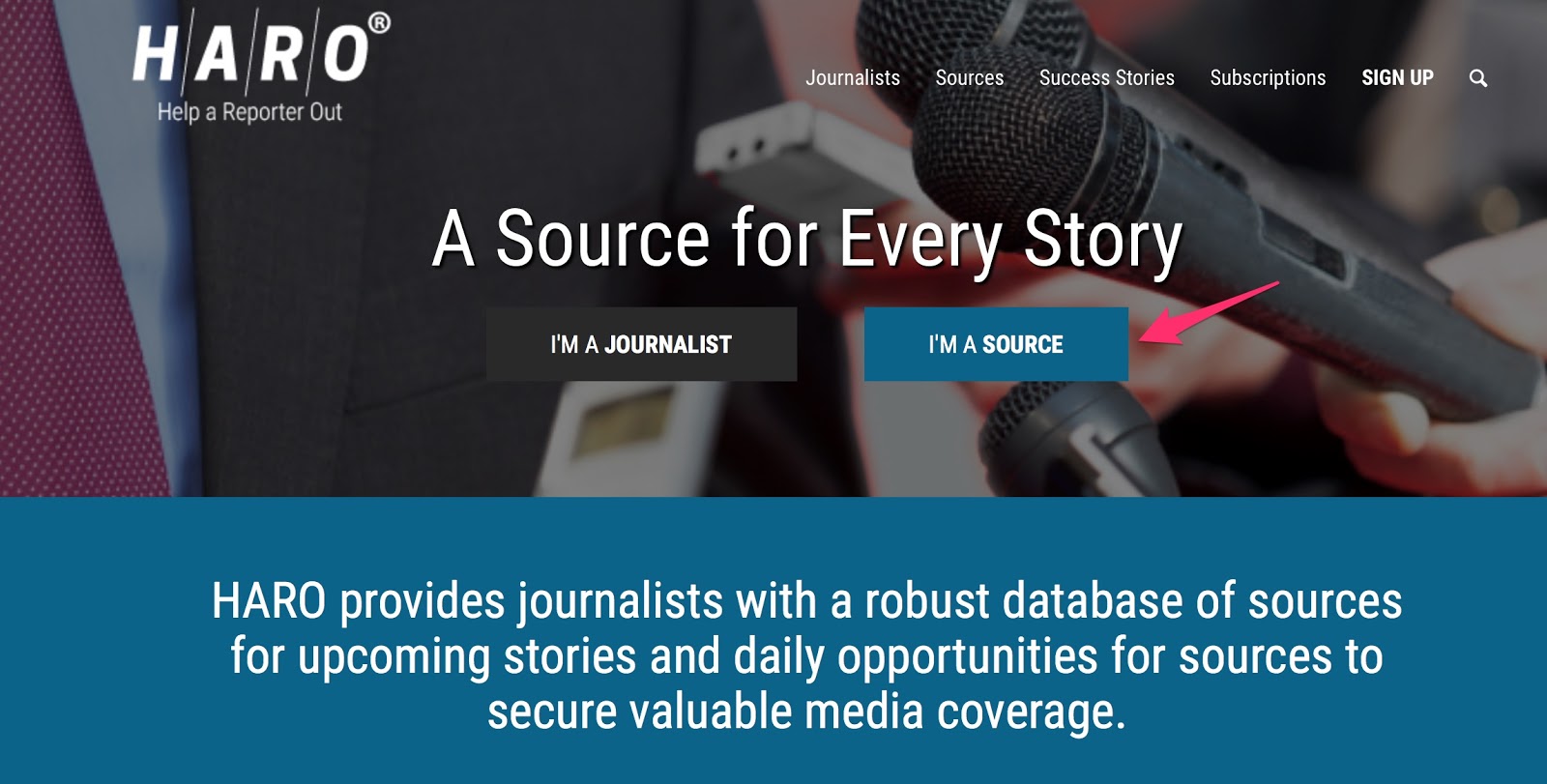

Here’s a pro tip for landing media mentions.

Go to a site called HARO.

It’s a platform that connects reporters with sources. If you have expertise in an area, you can easily become a source.

On the website, click on “I’m a source.”

Here’s how it works.

And that’s it!

You have a means of connecting with reporters and getting those much-coveted media mentions.

6. Trust seals and certifications

Trust icons help customers feel safe about working with you.

Certifications have the same effect.

Sure, we no longer live in a world where credentials matter as much as results.

But many people still rely on these signals so they can feel reassured in their decisions.

Certifications that demonstrate your expertise can give potential clients a push in the right direction.

This works best for service pages.

Just look at the number of badges Kristi Hines has on her freelance website:

I bet if someone is looking into her services, it may be enough to get them over the edge.

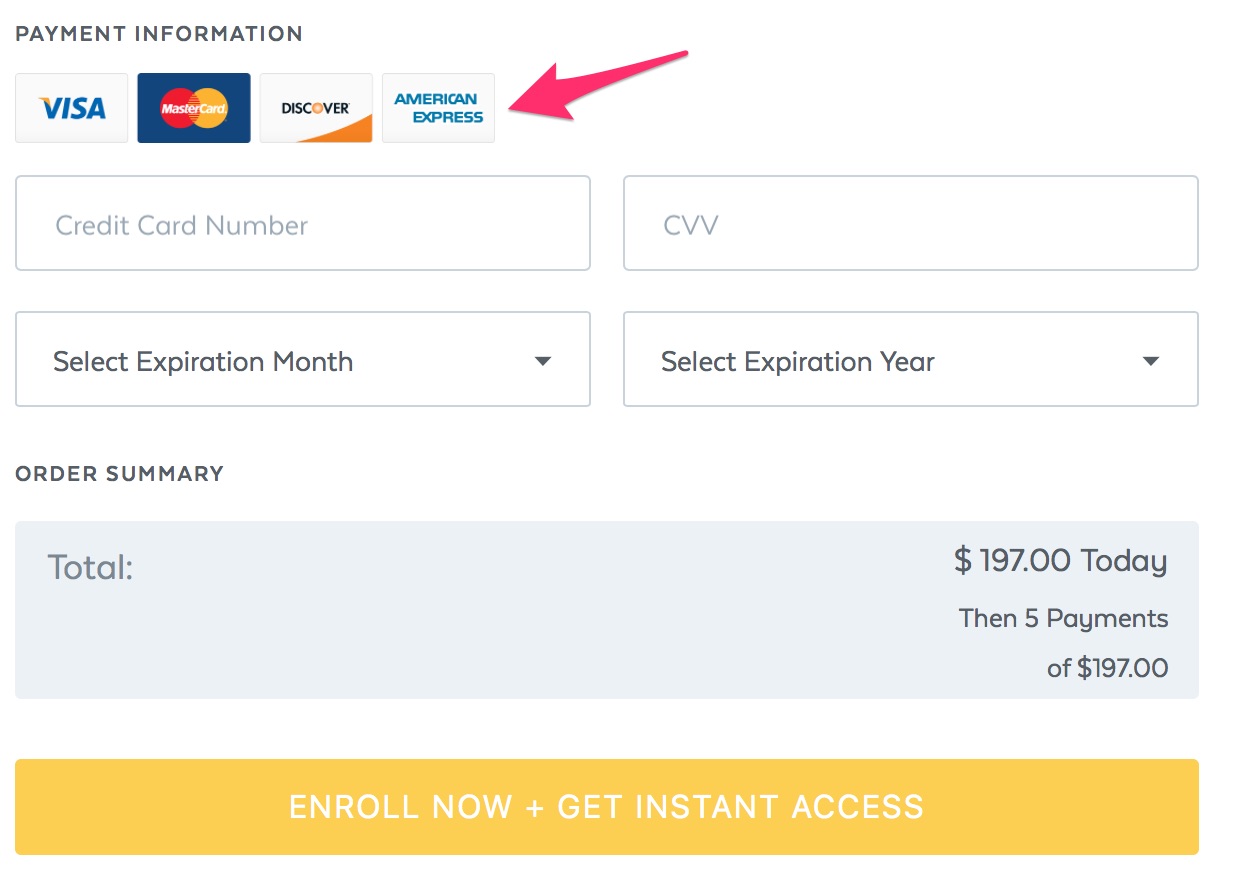

Now, let’s talk about trust seals.

These are especially crucial for order forms.

Here are some examples of trust seals:

- SSL certificates

- privacy badges or statements

- money back guarantee

- credit card logos

These are the most common ones.

No order form or sales page should come without at least a few trust icons.

This is where money is exchanged. Your customers need to know their information is safe.

Sometimes all it takes is to have credit card iconography, like this:

ConversionXL tested a few popular trust seals to see how they fared with customers.

PayPal was the most trusted, and Visa-Mastercard was the most familiar brand.

7. Expert opinions

I get asked this question all the time:

“How can I display social proof on my website if I’m new to business and have no clients?”

That’s an excellent question.

I recognize many people may not have access to all these proof elements.

Endorsements, case studies, and testimonials are not always easy to acquire.

The simple solution?

Expert opinions.

Here’s how this works.

Let’s say you’re starting a blog on consumer psychology.

You haven’t worked in this space before, and you have no credentials.

While you work towards getting the necessary proof elements, you can feature quotes from experts in the consumer psychology field.

It tells people your topic is valid and there’s a track record of success in the industry.

It doesn’t have to be a personal testimony, and this expert doesn’t have to be connected to you.

As long as you credit them as the source of your quote, you’re good to go.

8. Popular posts and products

This is another way to have proof elements on your website when you don’t have many choices.

I assure you, it works.

You can display popular posts in your sidebar as I do:

You can also place them in your footer, like Blogging Wizard does:

Again, be mindful of negative social proof.

If your numbers are low, turn off the count feature in your popular post widget.

If you run an ecommerce store, you can display popular products, a.k.a. best sellers.

It has the same effect:

9. Reviews and ratings

This one is a no-brainer.

I bet you’ve never purchased a product on Amazon or any other online store without reading multiple reviews.

If it doesn’t have at least a four-star rating, you’d be even more skeptical and cautious.

The perfect placement for reviews and ratings?

On product pages.

This is more applicable to ecommerce stores.

Some people find it useful to incentivize customers to provide reviews. They give a freebie or credit toward another purchase.

While that’s a solid strategy, I prefer a more organic way of generating positive reviews.

I’m a big fan of customer advocacy.

This is where you deliver such a spectacular customer experience that your customers are compelled to sing you praises.

They’ll recommend you to their friends, use their social media assets to promote your business, and be your most loyal customers.

The best part?

They do it for free (no incentives or payment required).

Mobilize customer advocates, and you’ll have an organic system for generating the kind of reviews that will inspire others.

10. Client or customer list

A creative way to display social proof is to feature a client list.

It helps if your clients are recognizable names in your industry. This is even more impactful than a verbal endorsement from an influencer.

Here’s an example from Sleeknote:

Service-based businesses can do this as well:

Smart, right?

Conclusion

The premise of social proof is simple.

When you call on other people to tell your prospects how awesome you are, the message hits home more powerfully.

And when you do decide to toot your own horn, at least you’ve got the testimony of dozens of people to back you up.

Social proof isn’t something that’s just useful. It is critical.

Your customers want to see these proof elements because they want to feel confident investing in you.

You have no shortage of options.

I’ve given you ten of the most impactful ones and the best placements for them on your website.

Both service- and product-based businesses can use these elements. So can new and veteran entrepreneurs alike.

Put these proof elements to work. Engagement on your content will go through the roof, and conversion rates will improve.

What kind of social proof works best for you?

Source Quick Sprout http://ift.tt/2evc65E