On the surface, blogs appear to be fountains of free-flowing information.

You read lots of rich and valuable research.

You collect plenty of juicy data.

You discover how to do a valuable task.

And, sure, some blogs are happy with lots of traffic and satisfied visitors.

But most content marketers know that blogs have the potential to drive insane conversion numbers.

Yes, conversions—as in people taking a desired action on your website. Maybe you want more email signups, more downloads, more free trials, or more purchases.

But here’s where things get dicey. Even though blogs are supposed to drive conversions, they usually don’t.

Why not?

It comes down to this. There is a disconnect between a blog’s conversion potential and its practical ability to achieve those conversions.

If your blog isn’t converting well, don’t beat yourself up. You’re about to discover some incredibly powerful ways to amp up the conversion power of your blog.

If you can improve the conversion power of your blog, it will transform into an unending revenue stream.

Once you learn how to remove the barriers, there’s no telling how high your conversion rate will soar.

Are blogs supposed to drive conversions?

First, let’s make sure we set the stage for the techniques that’ll follow.

What’s the purpose of a blog?

In a word, it’s this: revenue.

I hate to be so cold and businessy about it, but it’s true. Everything in business comes back to revenue.

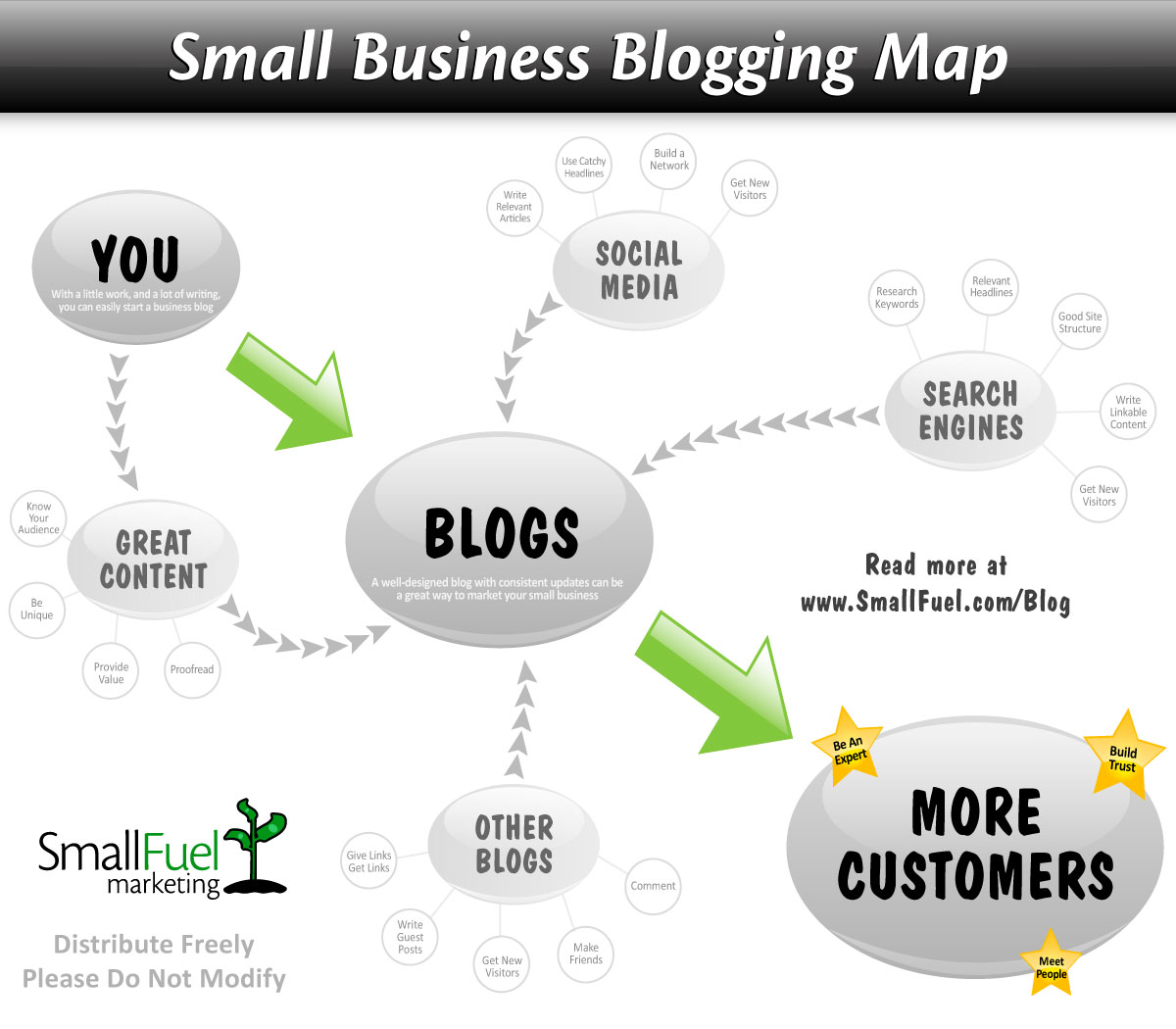

Let’s say you’re a small business. Ultimately, you want more revenue, right?

More customers will produce more revenue. And a great blog will help you get those customers.

This infographic from SmallFuel Marketing makes the point:

Source

But do blogs drive conversions?

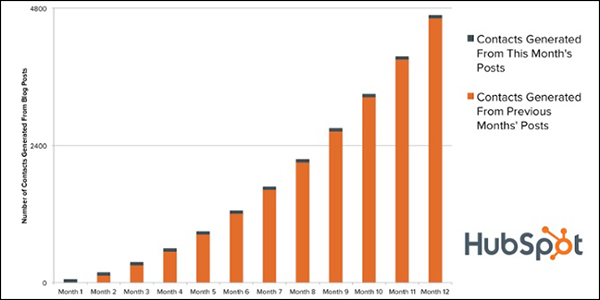

Hubspot’s research demonstrates that yes, indeed, they do. Hubspot’s analysis of a business’s blogging efforts showed that content published in the past 12 months gained an increasing number of contacts as time went on:

Source

Get this. The more you blog, the more customers you’ll gain.

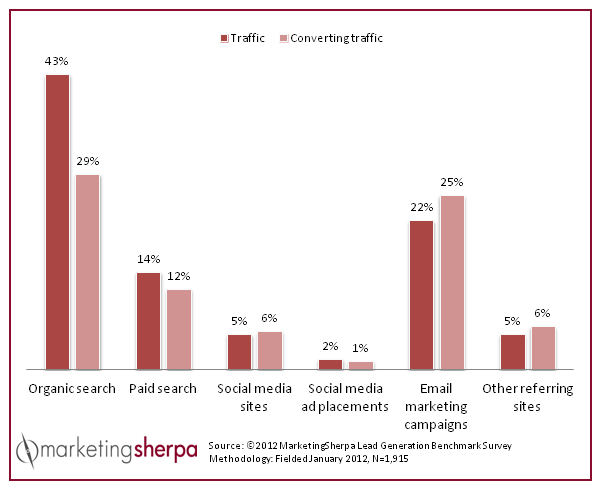

You may be thinking: But what about PPC, social media, and email marketing? What about all those other sexy techniques for driving conversions?

Fair question! Aren’t those effective methods?

Sure, paid search and social media are effective. But when you compare their conversion potential to that of organic search, there’s no contest.

Source

What’s my point?

It’s simple. Your blog can be a conversion machine.

But no, it doesn’t happen if you simply create good content. Good content is a given—something we should assume is already happening.

What you need beyond good content is the means and methods of persuading users to convert when they access your content.

Basically, it’s how you create that content and what you do with that content that makes all the difference.

So, what should you do to rev up the conversion engine that is your blog?

Instead of giving you granular tactics, I want to show you some of the deep methods that produce conversion power from the very source.

Create long-form content

Have you ever wondered why I occasionally write a 10,000-word blog post or a 50,000-word guide?

Is it because I get carried away? Have too much time to burn? Am getting paid based on word count?

No, no, and no.

I write articles like these for several reasons. Here are three of them:

- My readers love them.

- Search engines love them.

- People convert on them.

Content marketing, as I understand and practice it, is all about value.

I am intent on providing the best darn value, free of charge.

I tend to think a really long article will give you helpful information and hopefully have a positive impact on your business.

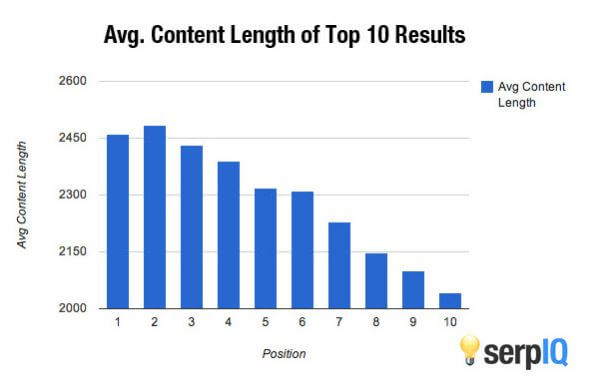

Second, we’ve seen the massive impact long-form articles have on SEO.

Let me show you.

Top results on Google correlate with content longer than 2,000 words. In other words, the highest ranked pages on Google also have the most content!

Plus, there’s the social sharing aspect to keep in mind. The longer your content, the more social shares you earn.

Finally, there’s the bit about conversions, which is where I want to settle for just a moment.

- When you have higher search results, you get more search traffic.

- When you get more search traffic, you gain more conversions.

Let’s say your blog’s conversion rate is around 2% at the moment.

If 1,000 people visit your ordinary blog article (1,000 words), two of them will sign up for a free trial.

A long-form article, however, gets more traffic than the average blog article. Using the share metrics as a benchmark, we can safely assume that a long-form article (3000+ words) gets 100% more traffic than a shorter article (0-1,000 words).

Now, you have 2,000 people visiting your content—twice as many! And you have twice as many conversions too!

This introduces a logical question: How long is long-form content?

I hate to be “that guy,” but the answer is: as long as it needs to be.

You were looking for a word count, right?

Okay, I’ll give it to you, but you have to listen to my little lesson first.

I—and Google and the rest of the world tend to agree with me—am more interested in the quality of your content than the actual length of said content.

If you spin out 5,000 words of crap, you’ll destroy your conversions, not improve them.

As cliche as it sounds, quality is more important than quantity.

If you’re looking for a word count, I suggest 2,500 words or more are sufficient for outranking your competitors, turning on the traffic floodgates, and boosting your blog conversions.

The Lesson: Crank out long-form content on your blog, and you will double your conversions.

Create content around long-tail keywords

What kind of content drives the most conversions?

There’s no question about it: using long-tail keywords brings in the highest blog conversion rates.

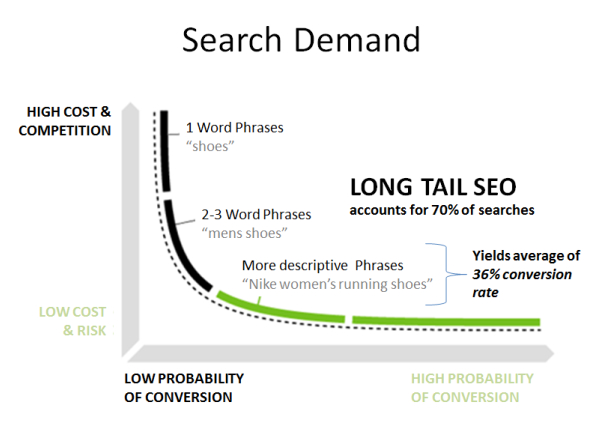

What are long-tail keywords?

A long-tail keyword is a search query—the words that people type or speak to find stuff on the web.

Long-tail queries are…well, long. They generally have more than three words.

For example, “shoes” is a short keyword (called a head term). But “Nike women’s running shoes” is long.

Source

The important thing to realize about long-tail and short-tail keywords is this: Your blog is more likely to rank for long-tail queries.

Plus, long-tail queries are focused in terms of user intent. The search volume may not be astronomical, but at least you’re gaining search volume from the right users.

Best of all, the conversion rates on long-tail queries are sky high.

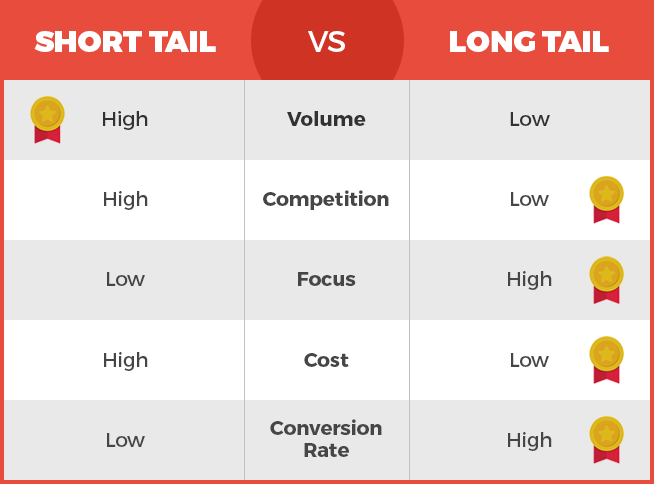

Take a look at this benefit list of the long-tail keyword. Pay special attention to that last point:

Source

What is a “high” conversion rate? Since “high” is a relative term, let’s do some comparison.

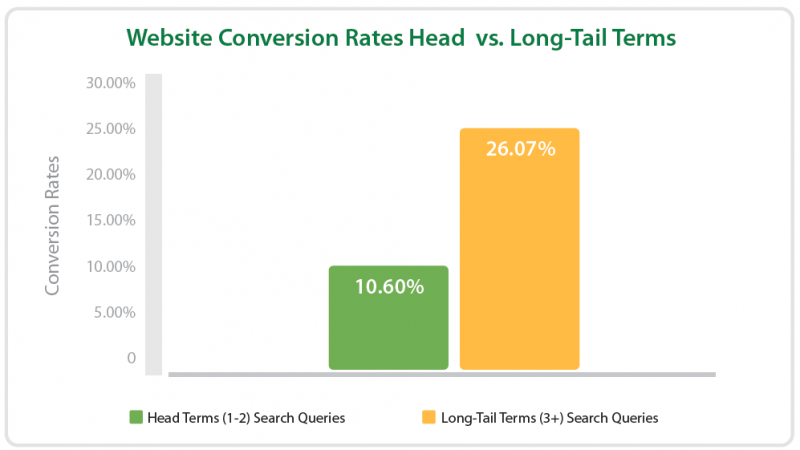

Notice the difference in conversion rates between head terms and long-tail queries. Which is higher?

Source

Long-tail queries converted at 26%, a whopping 160% increase over the 10%-converting head terms!

It’s one thing to know that long-tail terms have higher conversion rates. That’s nice. But the real question is: What do you do about it?

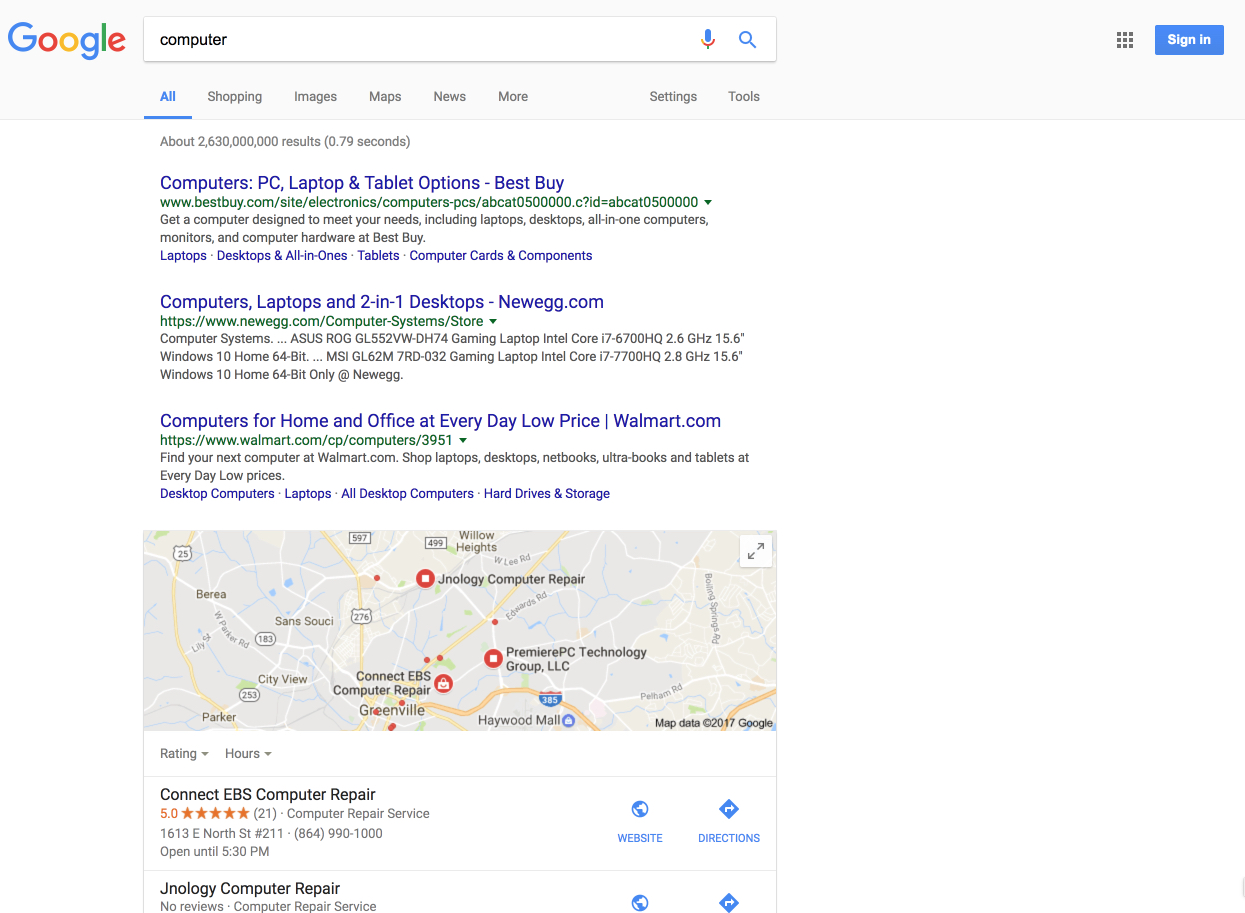

It doesn’t take an SEO whiz to know that your blog probably won’t rank for short head terms like “computer.”

When I query “computer” in my browser, here’s what I come up with:

The bulk of the above-the-fold results are major retailers. Below that are local results.

Sorry, but none of that stuff is long-form content!

I use “computer” as an example because of my personal experience.

I once had a client tell me, “We provide professional web hosting services. We’d like our website to rank for the term computer.”

“Hmm. I don’t think that would be the best approach,” I cautiously countered.

“Well…okay. What about server…or maybe web server?” they replied.

I had a different perspective, so I proposed an alternative solution. I said, “Let’s focus on more specific keywords that could provide a more direct source of traffic and revenue.”

- First, I did some keyword research to come up with a list of long-tail terms.

- Second, I developed an article idea around each of the keywords.

That two-step process, although simple, was all it took.

What were the results?

One of the keywords I picked was “dedicated server capacity for e-commerce site.”

Yeah, it’s a mouthful. But a 2,690-word article on “How to Know if You Need a Dedicated Server for Your E-commerce Site” produced thousands of more conversions than a more general article would have.

To begin producing your own conversion-crushing long-tail keyword articles, follow this process:

- Develop a list of terms that people in your niche are searching for. Make sure these terms are 4 words or longer. This article will give you a great process for doing so.

- Create a blog article for each term. The article title should contain most, if not all, of the words in the selected long-tail phrase.

- In the body of the article, be sure to include the selected keyword phrase as well as other relevant terms.

- In keeping with the previous point about long-form content, write an article that exceeds 2,500 words.

The Lesson: Develop your blog’s content to target long-tail keywords.

Deliver content that is aligned with user intent

One of the most direct ways to gain more conversions is to create content that satisfies user intent.

What is “user intent?”

User intent is what someone wants when they type something into Google.

For example, if I want to fly to Delhi next week, I would type in: “tickets from Atlanta to Delhi.”

My intent as a user is to purchase an airline ticket from Atlanta to Delhi, India.

In response to my query, Google would show me some airlines with flight times and rates.

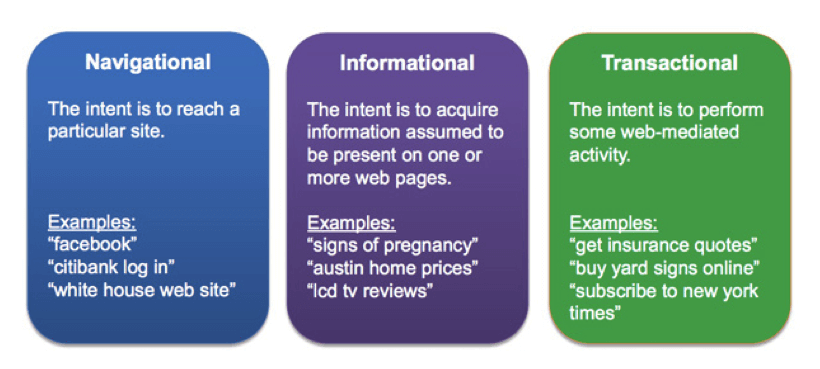

There are three main types of user intent, often called “query types.”

- Navigational: The user is trying to get to a specific website. For example, “quick sprout blog.”

- Informational: The user is trying to learn information. For example, “how do I increase my blog’s conversion rate.”

- Transactional: The user is trying to purchase or make a transaction on something. For example, “Coupons for Huggies diapers.”

Google is pretty good at determining the type of query you’re using and the best results to provide.

When I searched for airline tickets, Google provided a quick and accessible way to make a purchase based on my transactional query.

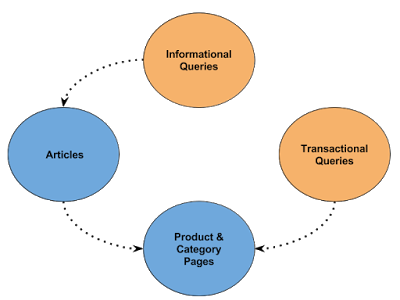

When you’re creating long-form blog articles, you are most likely targeting informational queries. These informational queries often bring up blog articles. (Transactional queries, by contrast, usually bring up product pages.)

But we still need to understand the following: What does user intent have to do with conversions?

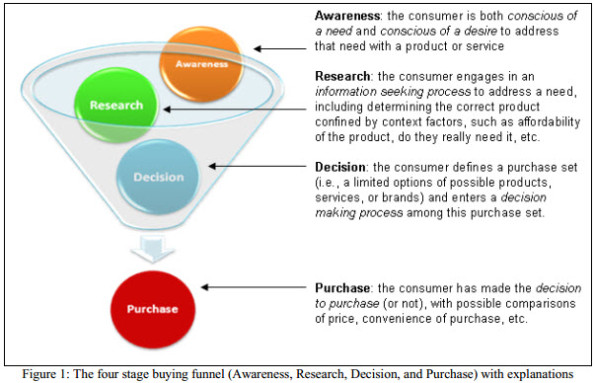

The answer lies within the buying funnel.

The buying funnel is a model that marketers use to demonstrate how users get around to purchasing something.

The iterations of the buying funnel are many. But the basic idea is this:

- The prospect becomes aware of the product.

- The prospect begins to consider, research, or compare different products.

- The prospect makes their decision and buys the product.

Congrats! The prospect has become a customer.

This is what the funnel looks like:

You, as a marketer or website owner, are targeting an individual within the second phase of the funnel—research and comparison.

Notice that the research phase is part of the user’s buying funnel. The information they find based on their query and intent can lead to a purchase.

Your content gives the user what they want.

They want detailed information? They want to hear a solution? They want a helpful discussion?

Enter your content, which satisfies their intent.

Such content can eventually lead to a purchase.

That’s why I recommend you deliver content aligned with user intent.

A simpler way to say it is this: Figure out what the customer wants, and give it to them.

Remember, at this point the person typing in a query is not a paying customer. They are an individual looking for information.

If they trust your website and content, they will move closer to becoming a customer—to converting on your content.

Keep in mind you should not expect to gain conversions simply on account of content that satisfies user intent. As I’ll explain below, you should also make it easy for users to convert.

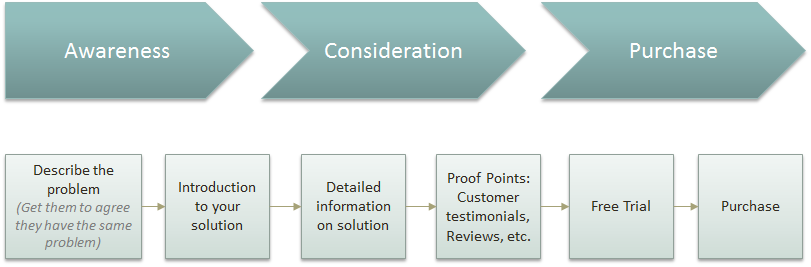

Let me give you an example of how this process works in real life.

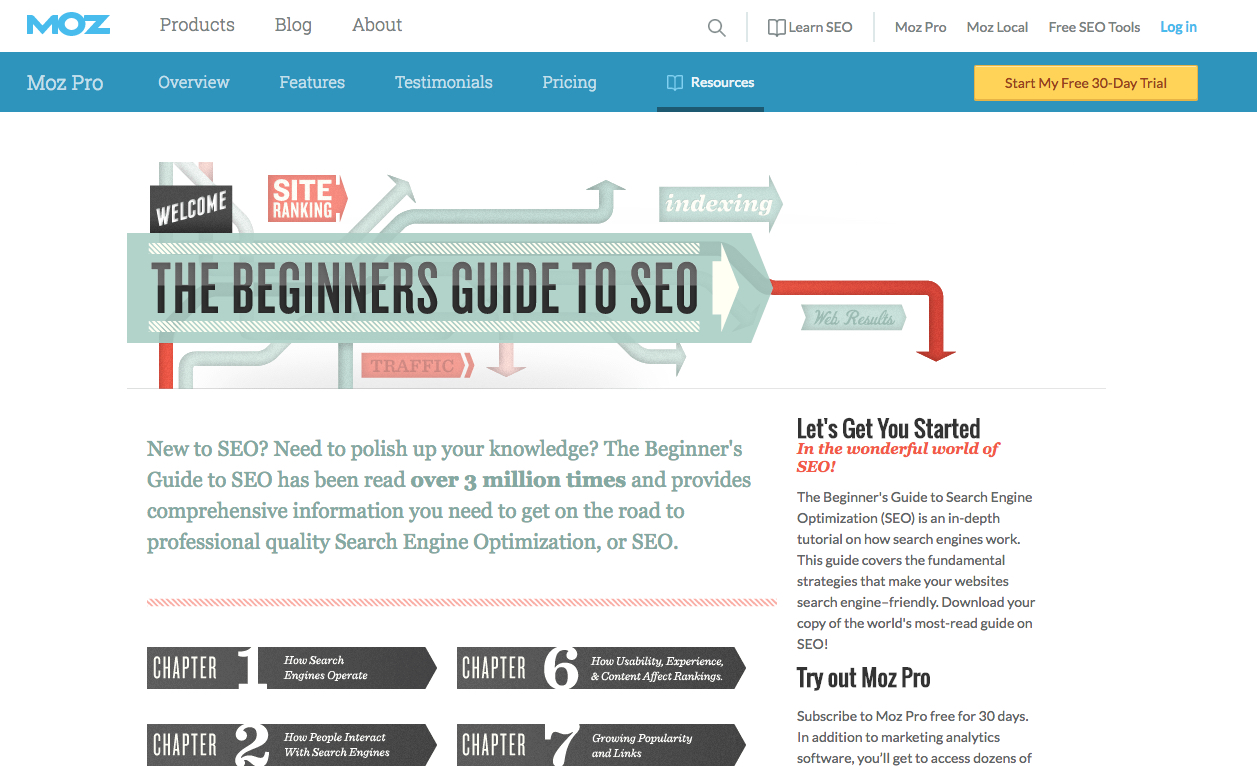

Let’s pretend you want to understand SEO. You type in “how to do SEO.” That’s an informational query.

You are not a customer, but you are in the awareness/research phase of a typical purchase.

This is what you might see in the search results:

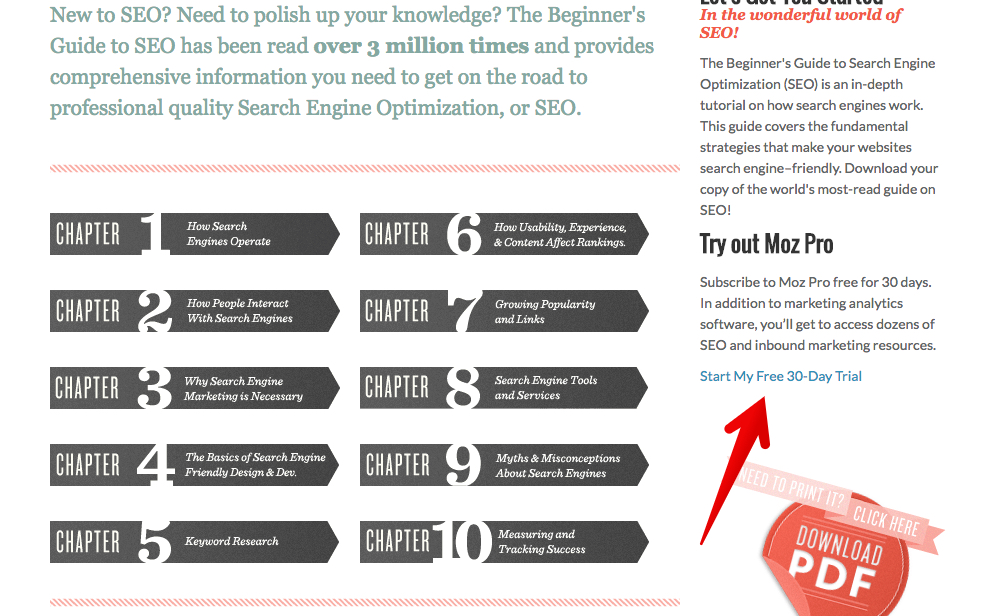

The first result from Moz looks hopeful, so you click on it.

You see a comprehensive guide that “covers the fundamental strategies that make your websites search-engine-friendly.”

This is what you’re looking for! Your intent has been satisfied by this comprehensive long-form content.

This feeling of satisfaction is important because it has now prepared you to convert on a call to action.

Let’s take a look at what that might mean.

First, you might be likely to click the yellow button, “Start My Free 30-Day Trial.”

Perhaps, you see this call to action in the sidebar as you’re reading the content.

Or you may want to subscribe to Moz’s Top 10.

Moz creates content that satisfies a user’s intent. Then, they provide an easy way for users to convert on that content.

How do you figure out user intent on your website?

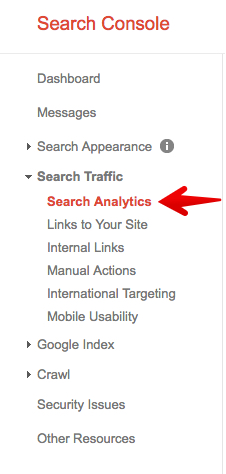

One of the most straightforward methods is to use Google Search Console.

(If you do not have GSC set up on your site, please refer to this guide from Google on how to get started.)

- Log in to your GSC account.

- Click “Search Traffic.”

- Click “Search Analytics.”

Search Analytics provides a variety of keyword data with configuration options not easily accessible in Google Analytics.

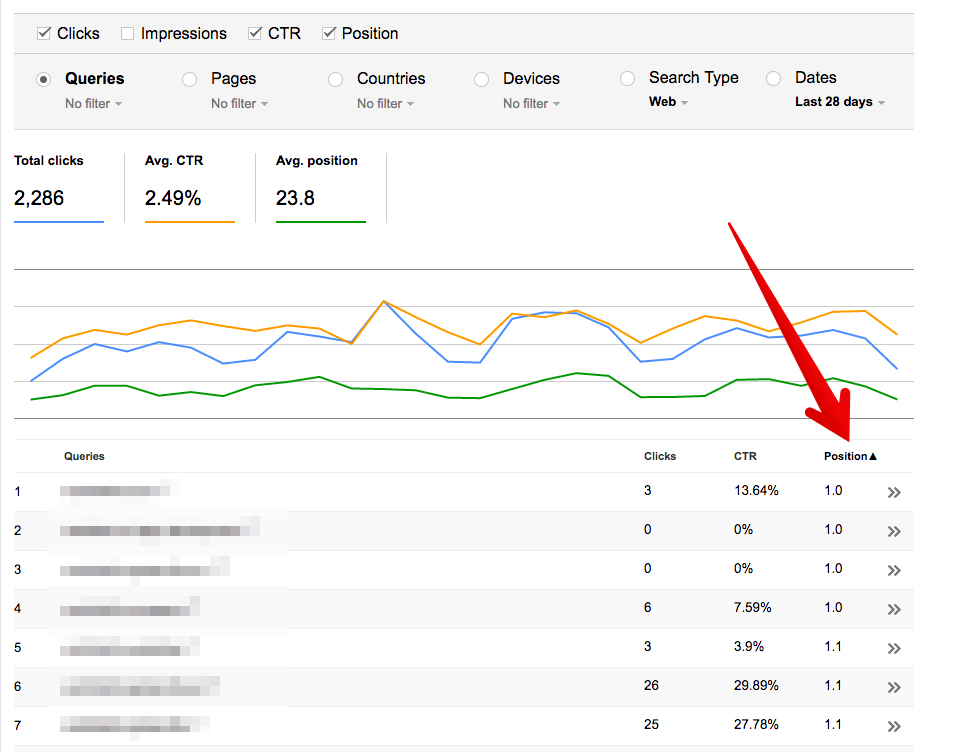

Turn on “Clicks,” “CTR,” and “Position” by clicking the checkboxes:

Next, sort the results by position so you can find out what queries you are ranking for. Click “Position” in the results table:

In the table, look for queries that have a CTR (click-through rate) of 30% or above.

This means that 30%+ of the users who typed in a given query clicked on your results when they appeared in Google. We can safely assume these users are interested in your content.

For this website, I notice that a high percentage of users are clicking on the result for “django benefits.”

The query is django benefits. This is an informational query.

To satisfy user intent, I should provide comprehensive information on that topic.

You can visit the SERP the query directs to by clicking the icon next to the query.

From there, you can navigate to the relevant page on your website.

This foundational technique is helpful. If you give users the kind of content they want (their intent), you will provide a way for them to convert.

But that brings us to a really important point: How do you get them to convert?

The remainder of this article will show you some super practical ways to score those conversions.

Content is king. Keywords are necessary. User intent is important.

But what about the actual conversions?

Create a low-barrier-to-entry conversion action

So far, we’re driving relevant traffic to your page.

Now that we have those readers, we want them to convert.

The definition of conversion is pretty simple:

“The point at which a recipient of a marketing message performs a desired action.”

When you ask for a conversion, you’re not asking your blog reader to pull out their credit card and give you their money. You’re simply asking them to take the next logical step.

Often, this is an easy, low-cost, and logical way to take the relationship to the next level.

Here are some common conversion actions. Notice that each of these takes a few seconds and clicks:

- Email subscription

- Free trial

- Download a resource

- Facebook like

- Twitter follow

- LinkedIn follow

- Pinterest follow

- Instagram follow

- Google Plus circle

- YouTube subscription

- Slideshare subscription

Let’s take a look at a few of these. Each of these are located on a long-form blog article.

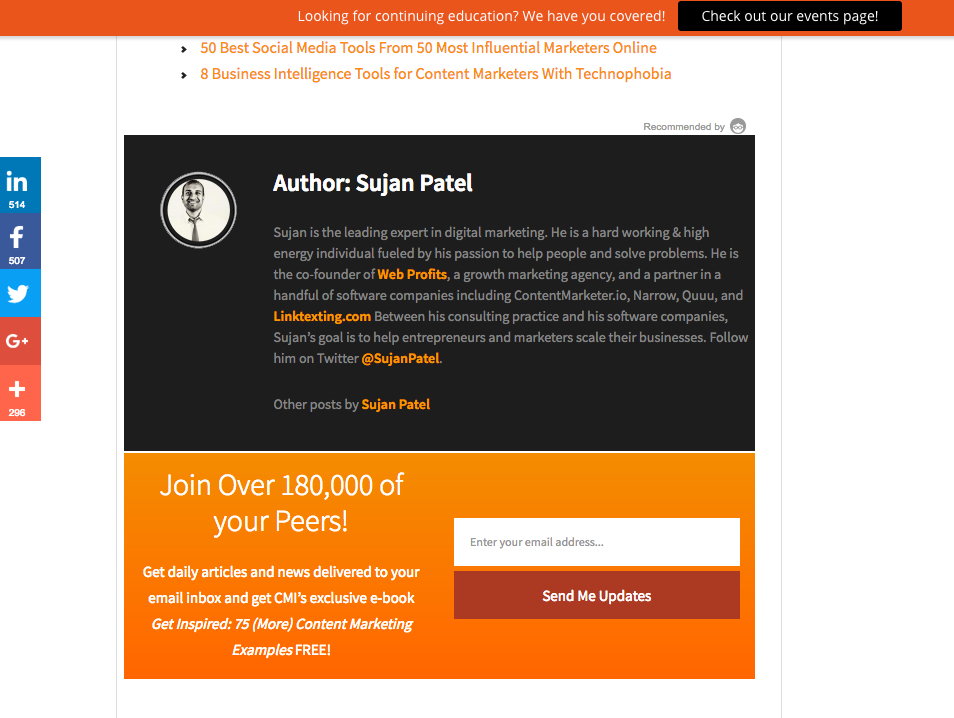

The Content Marketing Institute invites you to subscribe to their mailing list and to read their e-book. This is an example of conversion action that includes email subscription and downloading a resource:

Buffer invites you to get started with a free account. The header pictured below is persistent, meaning you’ll always see it as you scroll through the article:

The Optimizely blog invites you to get a copy of their customer stories:

The Marketing Sherpa blog uses a shadowbox popup to invite you to subscribe to their mailing list:

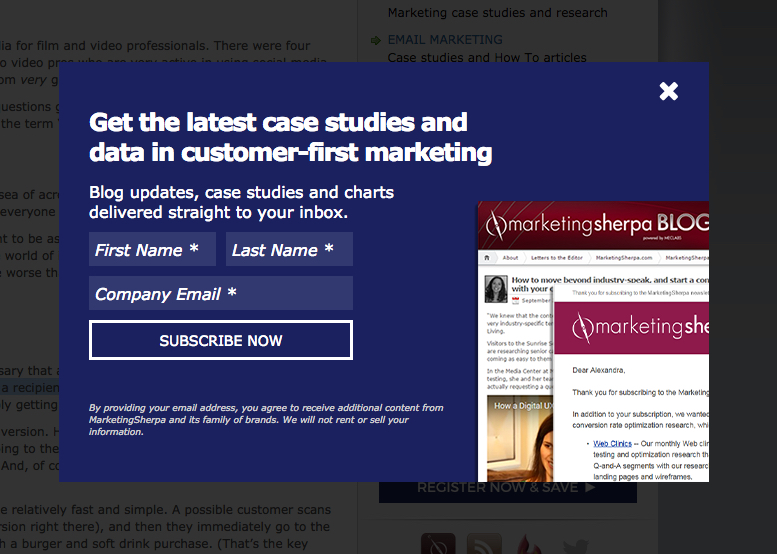

Qualaroo uses a “Start Free Trial” button in their header:

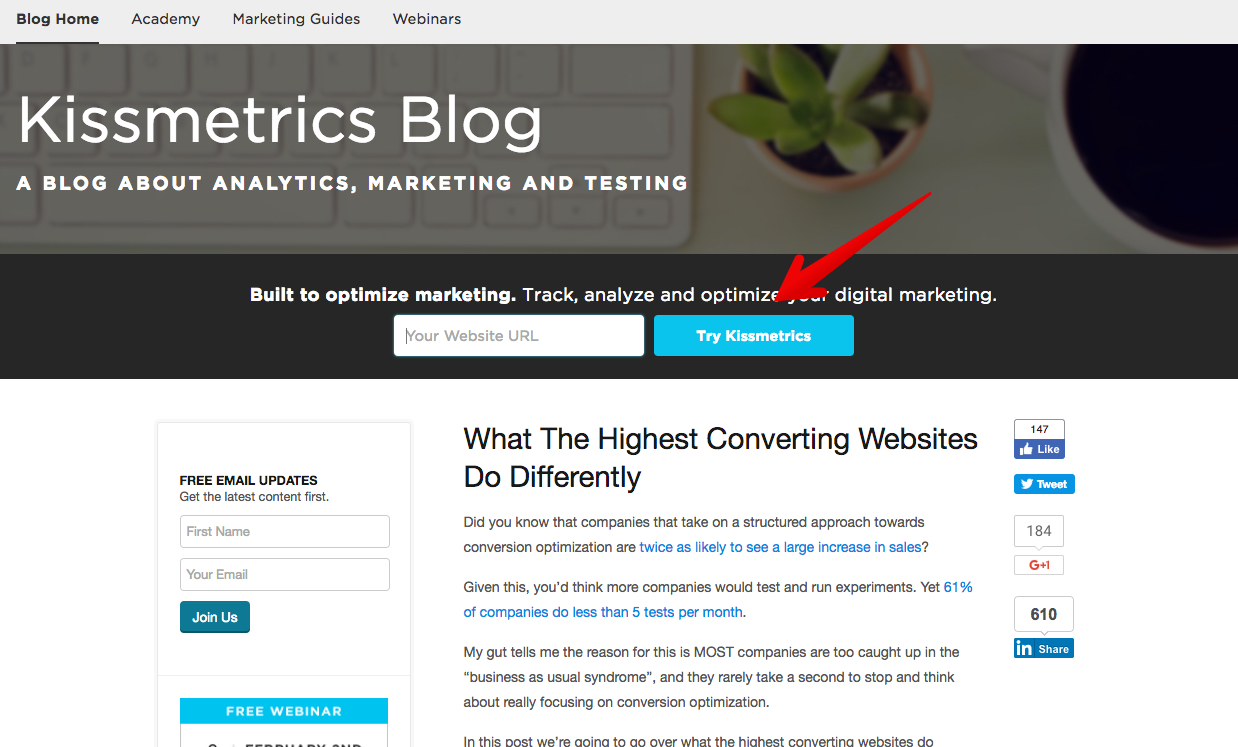

Kissmetrics asks you to try their SaaS:

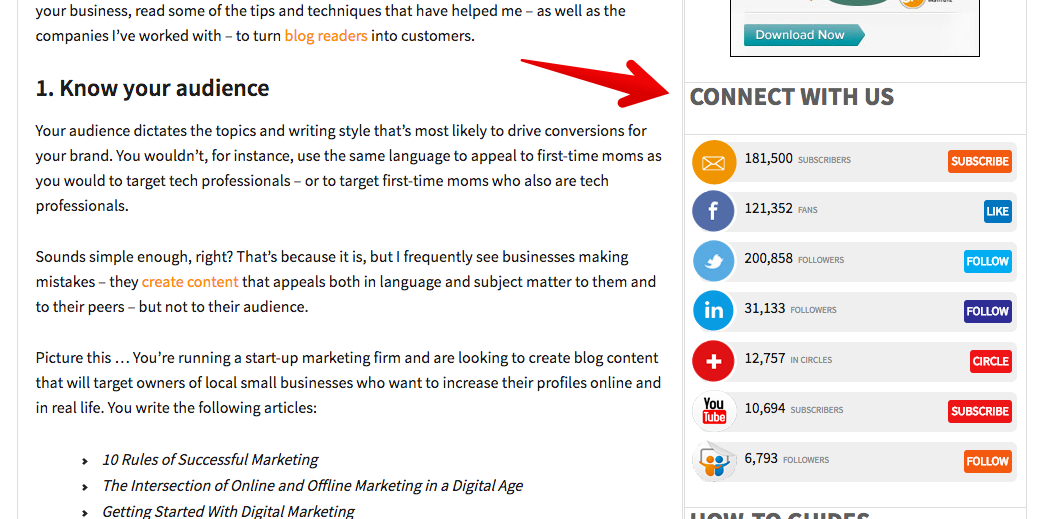

Invitations to social accounts are so common that it’s easy to overlook them.

In the Kissmetrics screenshot above, you can see a list of social icons on the right side.

The Content Marketing Institute uses an entire section on their sidebar to ask for social connection:

Each of these conversion actions is simple, easy, and painless.

That’s what you want to do. You want to make it easy for the reader to become a regular.

Here are some rules of thumb for effective low-barrier conversion actions:

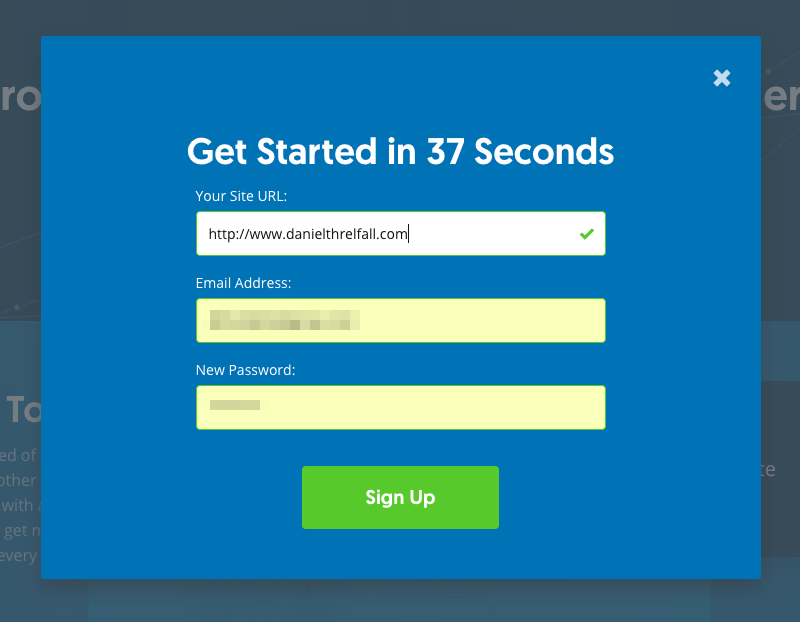

1. If you use a form, limit it to three fields

I suggest only one field (an email address) if possible, but this depends on the product you’re selling.

SumoMe asks for only a user’s email address:

For creating an account—a different purpose—they’ve included three fields on the form:

It’s still easy, fast, and effective.

2. Make it appealing and persuasive

Don’t lie, cheat, or steal when you’re asking for a conversion. Just be honest and ask for what you want.

The right kind of users want to convert. But sometimes, it takes a little persuasion and some good old-fashioned appeal.

Here’s an example.

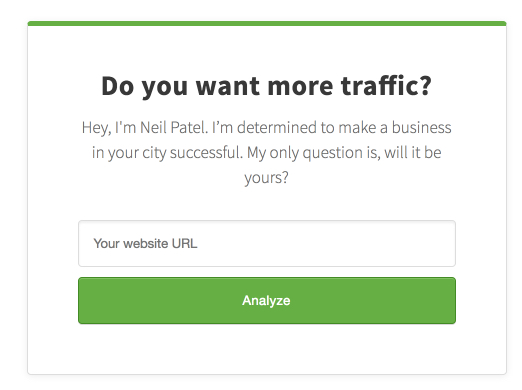

If you read my blog, you’ve probably seen this little box:

I’ve put that call-to-action box in my content because I want to persuade you to get your website analyzed.

You have a choice. I’m not twisting your arm.

But I am trying to persuade you.

And the reason I keep using that box is because it’s working!

3. Ask for what you want

You know the expression “ask and you shall receive.”

It’s true in online marketing.

Asking for the user to convert is a gift. They want to do it.

All you have to do is ask.

A business that uses free consults as part of its sales cycle should offer the user a free consultation. Here’s an example:

A company that provides heat mapping analytics should ask users to create a heatmap, like this:

A chiropractor can offer users a free exam and x-ray:

The conversion action you choose depends on what you’re trying to accomplish.

All you have to do is ask for it.

Give in-your-face levels of value

I don’t know what business you are running.

- Maybe you’re starting an e-commerce website.

- Maybe you’ve created a SaaS and want to sell it.

- Maybe you’re doing marketing for a startup.

- Maybe you’re running a side hustle.

- Maybe you’re blogging your heart out and hoping it will pay off.

But whoever you are and whatever you’re doing, this is my plea.

Give value. Metric tons of value. Dump trucks full of value. Warehouses of value.

You believe in the product you are selling. You believe the world needs it. You believe there are people whose lives you can improve.

Do you want them to see it?

Then give it to them straight. Go for in-your-face levels of value.

You should offer so much value that the user can’t help but accept it.

Your goal as a marketer isn’t to take. Your goal as a marketer is to give. You want to provide an enormous amount of value free of charge.

That’s what I mean by “in-your-face.” It’s all about the sheer amount of value you deliver.

The website ConversionXL is recognized for actionable, data-driven, highly-researched long-form content.

When you visit the blog, here’s what you see:

They are asking you to subscribe.

This is good. Because they are offering insane amounts of value!

And that is why I recommend in-your-face techniques. Value, value, value.

It’s one thing to praise the in-your-face marketing methods, and it’s quite another to actually implement them.

Conclusion

Getting more conversions sounds simple.

Put up a form field!

Add a button!

Use a popup!

Those are fine methods. I’ve used all of them.

But getting conversions requires a lot more than just techniques. It requires a strategy.

That strategy is built on long-form content, enhanced by long-tail keywords, and maximized by giving people value.

Using this method for getting conversions is virtually guaranteed to work!

What are some strategic methods you’ve used to increase conversions on your long-form content?

Source Quick Sprout http://ift.tt/2oZ63qK