Are you familiar with backlinks?

If you’re not or if you’re just getting used to the concept, you need to make this common term part of your everyday vocabulary.

By definition, a backlink is an incoming hyperlink from one website to another.

Anytime a website mentions your name, brand, or company with a link to your site, that’s a backlink.

Sure, these may happen by accident.

Maybe a company was doing some research, stumbled upon a statistic on your page, and wanted to give you credit for it.

That happens.

But you can’t rely on that as the sole way to build high quality backlinks.

Do you need to put an emphasis on backlinks?

Absolutely.

Here’s why.

First of all, getting mentioned and linked to from other websites is a great way to increase traffic to your page.

A reader who has never heard of you may be more inclined to click on a link recommended by someone they read faithfully.

But there’s more to it than that.

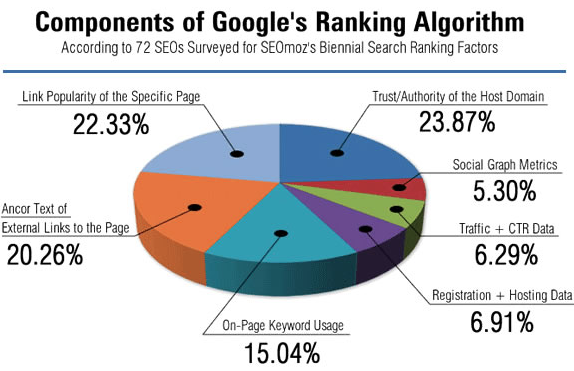

Backlinks affect your search ranking in Google’s algorithm:

Getting your page ranked high on Google needs to be a top priority.

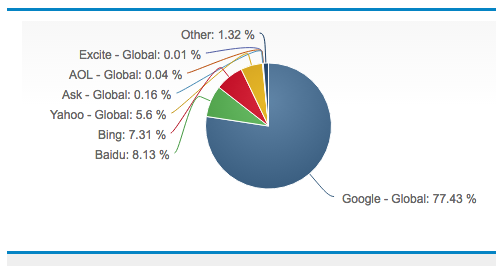

According to Net Market Share, over 97% of searches from mobile devices and tablets are made through Google.

Google is responsible for over 75% of the total global search traffic from desktop devices as well.

Take a look at the graph above.

Nearly 24% of that algorithm has to do with the trust and authority of the host domain.

Over 20% of the algorithm involves external links to your page.

Essentially, backlinks can help with about 44% of the factors influencing your search engine ranking.

That doesn’t even include traffic, click-through rates, and page popularity.

I’ll show you how you can build 10 backlinks consistently each week.

1. Take advantage of broken links

Broken links can harm your website’s ranking.

The key is to find broken links on other sites and get your page linked to as a replacement.

This is also a great way to network, make some friends, and establish beneficial business relationships.

Here’s how you do it.

Find some websites similar to yours within the same industry.

For example, if I owned a restaurant, I’d look for blogs about food or pages that critique and suggest places to eat.

Next, use a service like Dead Link Checker.

Most people use such tools to check for dead links on their own websites.

You can do that as well.

But we’ll take this one step further.

Search for dead links on the websites you found relating to your industry.

Next, contact the person running the website, informing them about these broken links.

You’re doing this person a favor because, like I said before, dead links will hurt a website’s search engine ranking.

Now, you can suggest replacing these dead links with links to pages on your website.

This isn’t a foolproof method.

The webmaster doesn’t have to take your suggestions.

They can simply thank you for the heads-up and replace the link with somebody else’s.

But it doesn’t hurt to try.

Think of it like this.

What were your site’s chances of getting randomly chosen as a replacement for broken links?

Probably slim to none.

At least now, you’re in the running.

Give it a shot.

2. Write guest posts

Guest posts may sound unappealing to some people.

You may think it’s not worth your time to create content for other websites.

Big mistake.

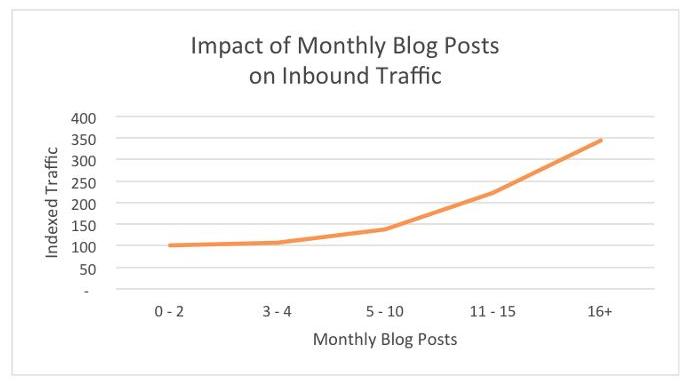

Sure, the number of monthly blog posts published on your site has a positive impact on your site’s inbound traffic.

People look at these numbers the wrong way.

Yes, you need to write lots of blog posts each month on your own website.

But that doesn’t mean you can’t contribute to other blogs.

It’s not a waste of time.

Guest blogging is an effective inbound marketing strategy.

And it won’t cost you anything.

The only price is the time it takes you to write.

Guest blogging will open lots of doors for you.

First, your name, company, and brand will get exposed to a new audience.

These readers may have never heard of you before.

Next, you’ll have a chance to create backlinks to your own website throughout the article.

If a reputable company offers you to write a guest post, say yes.

You can also actively search for sites in your industry looking for guest posters.

3. Mimic the methods used by your competitors

If your competition is having success with building backlinks, you can follow their example.

Subscribe to your competitors’ newsletters.

Follow them on social media.

Pay attention to their tactics.

It’s an effective way to analyze your competition.

You can take this a step further with their backlink strategy.

Use a service like Monitor Backlinks.

With this platform you can monitor:

- domains

- competition

- keywords

It’s structured similarly to Google Alerts, which I’m sure you’re familiar with.

The only difference is the primary focus of this service is backlinks.

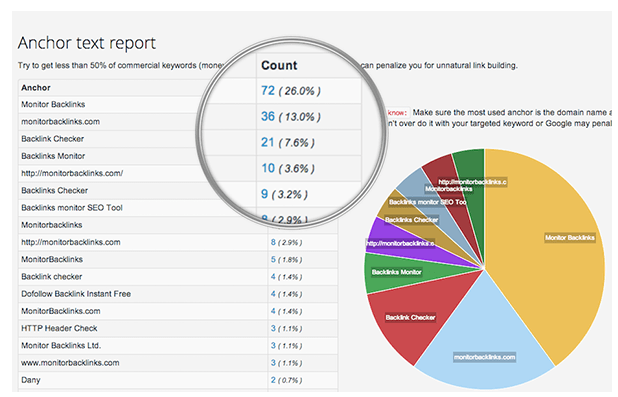

Here’s an example of what your reports will look like:

If you discover your competition has a home run strategy for building backlinks, follow their lead.

What websites are featuring your competition?

Reach out to them directly and ask if you can write a guest post.

Maybe send them a link to one of the infographics you created, and offer it as a source of information.

Monitoring the habits of your competitors is a great way to stay ahead of the curve.

4. Reach out to bloggers and journalists

Earlier, I talked about contacting webmasters to get backlinks through broken links on their websites.

You can apply this same concept to websites run by journalists and bloggers.

Even if they don’t have broken links, reach out to them. It can’t hurt.

If you don’t know how to reach the right person, here are some options.

First, try the “Contact Us” option directly on their website.

If that doesn’t work or an email address isn’t listed anywhere, try to search for the person by name on other platforms. Do they have a Linkedin account? Connect with the blogger there.

You can also send them a message on Facebook or another social media platform.

Introduce yourself. Tell the person why your pages would be a credible source to mention on their blog.

5. Actively promote your content

You won’t be able to generate any backlinks if people can’t find your information.

How are you promoting your content?

Content promotion needs to be at the top of your list of things to do every day.

Having a website isn’t enough.

You need different avenues to distribute your content across multiple channels.

Are you using videos as a marketing strategy?

You should be.

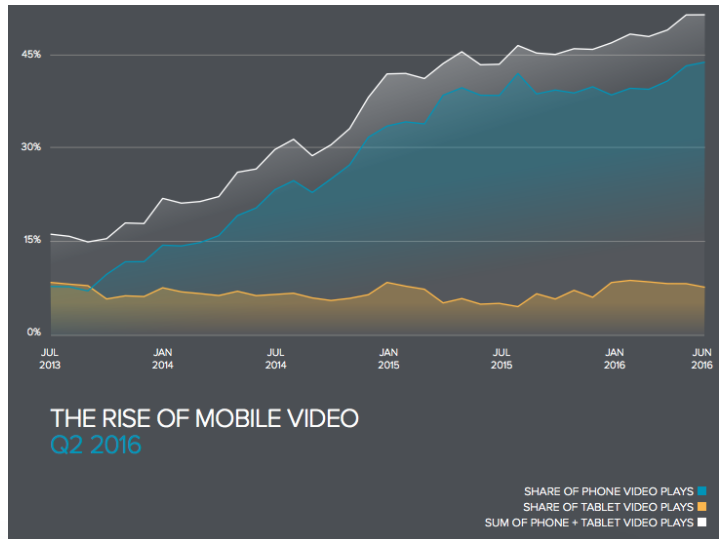

Videos are growing in popularity, especially on mobile devices.

Online marketers are recognizing this trend and planning for it accordingly.

If you’re not using video to promote your content, you’ll fall behind the competition.

Build a successful YouTube channel.

YouTube videos are optimized for mobile devices, which is necessary based on the graph above.

They also have a mobile application, so it won’t be a problem for people to find your video content.

You can include these same videos on other platforms like:

- Facebook

- Twitter

- Your website

- Other people’s websites as guest posts

It’s an effective content promotion strategy.

Marking experts recognize the importance of videos and plan to use them more often moving forward:

The majority of businesses are planning to incorporate some form of video marketing as part of their content distribution channels in the next year.

You need to do the same thing.

Promoting your content will make it easier for people to find you.

Ultimately, you’ll end up getting more backlinks.

6. Build infographics on your website

People love images and visual data.

Use this knowledge to your advantage.

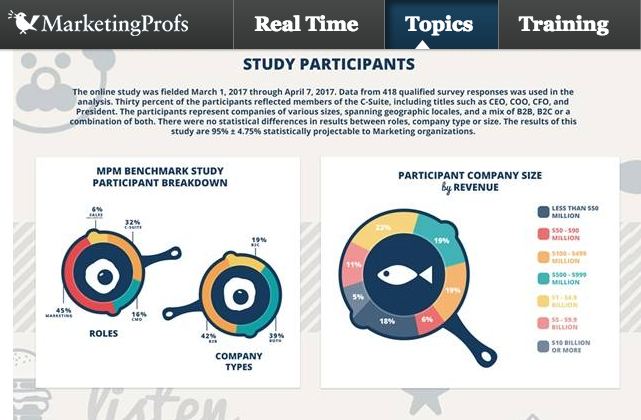

Here’s a great example from Marketing Profs:

Look at what they did.

They found a study and built a visual representation of the data.

What’s someone else more likely to use for a blog post?

Numbers? Or the infographic?

The infographic wins.

It’s easier for readers to find and interpret infographics, especially if they’re reading a long blog post.

Make infographics.

People will use them on their websites and backlink to your page as the data source.

It’s super effective.

If you’re a faithful reader of mine, you know I love to include infographics in my blog posts.

I always give credit to the source with a backlink.

Here are some tips to follow when building an infographic:

- Stay relevant. Use information related to your industry or areas of expertise.

- Use legible images. Nobody will use your graphic if it’s too hard to read or understand.

- Use accurate numbers. Make sure your data is coming from reliable and high quality sources. You don’t want to get a reputation for spreading inaccurate statistics.

- Use recent information. Data changes over time. Make sure you update your infographics. Instead of coming up with completely new graphics every year, update your old ones.

Building infographics will also increase your website traffic.

It’s a great way to generate backlinks as well.

7. Write reviews and comments

Here’s a great opportunity to backlink to your website.

Comment on related blog posts and articles in your industry.

Use your full name whenever you write comments.

This is a perfect opportunity to generate leads.

Here are some tips to keep in mind while you’re commenting on someone’s blog post.

- Talk to the author directly.

- Address them by their first name to start your comment.

- Take a stance on a specific topic in the article or ask a question.

- The post should be relatively short but more than just a few words.

- Always use a valid email address so people can contact you.

- Do not spam.

- Your whole post shouldn’t be about your business or website.

- Stick to the topic.

- Place a backlink to your page in a natural way within the comment.

- Don’t be afraid to comment on big blogs such as Forbes or Mashable.

Again, it’s a great way to gain exposure.

Conclusion

Now, you have a method for each day of the week to build backlinks to your website.

These seven tactics work.

And they don’t take much time or effort.

Building backlinks needs to be a regular part of your content marketing strategy.

Why?

Backlinks are a factor in Google’s ranking algorithm.

It’s the most popular search engine in the world.

If you’ve never actively tried to build backlinks, it’s easy to get started with the strategies I shared with you.

Start by contacting webmasters, bloggers, and journalists.

Use online tools to look for broken links. Try to get your page as the replacement link for these.

Even if you can’t find broken links, it doesn’t hurt to reach out to other websites, asking for a backlink.

Do not turn down guest posts. Search for websites in need of guest writers.

Build infographics. People will use your images as a source of information for their articles.

Actively promote your content. Use platforms such as YouTube to make videos as a promotional method.

See what your competitors are doing. If they have a great backlink building strategy, try their methods.

Comment on blogs and articles. It’s a great chance for you to gain some exposure and backlinks to your site.

Which strategies will you start using this week to build backlinks for your page?

Source Quick Sprout http://ift.tt/2ytL0UZ