الاثنين، 10 ديسمبر 2018

More Americans buy groceries at dollar stores than Whole Foods, report says

Source Business - poconorecord.com https://ift.tt/2A1O6Pd

Where Should You Keep An Emergency Account?

Like it or not, emergency accounts are kind of boring.

And they need to be.

The main purpose of an emergency account is to sit around and wait for an emergency.

That certainly limits your options as to where to hold the money.

Because you may need the money on very short notice, the safety of principal needs to be the primary concern.

But that doesn’t mean you can’t try to earn some income on your emergency account in the meantime.

6 Best Places to Put Your Emergency Account:

You don’t want to take risks in doing it, but you should attempt to earn at least a little bit of income while you’re keeping your money safe.

Here are six emergency account options to consider…

1. Your Local Bank

Your local bank is always a solid option.

Unfortunately, most don’t pay much in the way of interest. And it usually doesn’t matter whether that’s interest-bearing checking, savings, money markets, or certificates of deposit (CDs).

Because they have a network of local branches, they don’t need to pay high-interest rates to attract customers.

For example, according to the Federal Deposit Insurance Corporation’s Weekly National Rates and Rate Caps, average rates on bank savings vehicles look something like this:

- Savings, 0.09%

- Interest Checking, 0.06%

- Money Markets, 0.16%

- 3-month CDs, 0.19%

- 6-month CDs, 0.31%

Those interest rates are downright microscopic. But the one advantage to local banks is that they can provide immediate physical access to your money in the event of an emergency.

And even though the interest they pay amounts to little more than dust, it’s better than nothing.

2. Online Bank Accounts

If you want to keep your money absolutely safe but earn higher interest than you can at a local bank, seriously consider online bank accounts.

In today’s world of electronic money, you can often get access to your funds from an online account just as quickly as you can from a local bank branch.

In fact, most provide various options for you to get your money, including transferring it into a checking account at a local bank.

But the interest they pay on your savings are a welcome relief from the fractional rates being paid at local banks.

For example:

- Ally Bank currently pays 2.00% APY on all balance tiers on its Online Savings account.

- CIT Bank currently pays 1.85% APY on its Online Money Market account.

- Barclays Bank is currently offering 2.55% APY on it’ 12-month CDs.

Online banks may not have local branches, but they’re the next closest thing in terms of liquidity. And when you consider that the interest rates they pay on savings instruments run between 10 and 20 times higher than what local banks are paying, it’s well worth keeping most of your emergency account with at least one of them.

You can open an account with Ally, CIT, or Barclays today.

3. US Treasury Bills

US Treasury Bills are short-term debts issued by the US government. And because they are issued by the US government, they are considered the safest of all investments, backed by the full faith, credit, and taxing power of the US government.

They can be purchased in denominations of as little as $100 through do US Treasury’s portal,

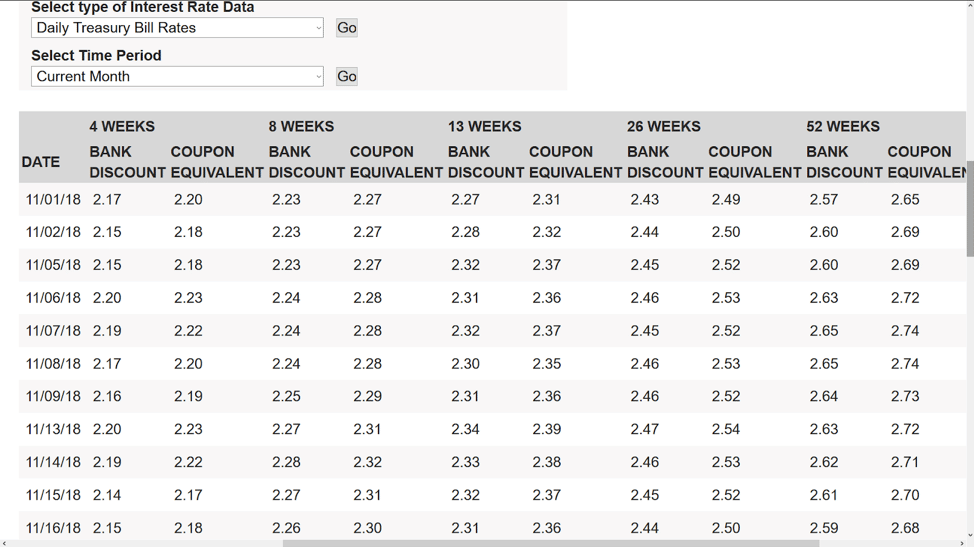

Treasury Direct, and with terms of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks. You can both purchase and redeem them through Treasury Direct.

Current yields on these securities are all in excess of 2% APY, with specific rates as of November 16, 2018, as follows:

4. Laddered Certificates of Deposit

CDs generally pay higher rates of interest than what you will get on savings accounts or money markets.

But the best rates go to the CDs that have longer terms. Typically, the better paying rates start with 12-month CDs.

That creates a bit of a problem if you’re looking to build an emergency fund. After all, emergencies don’t wait 12 months for your CD to mature. You’ll need an ability to access funds before a CD matures.

Now you can usually liquidate a CD early.

But if you do, you’ll be subject to an early withdrawal penalty. That can cost you several month’s worth of interest.

An alternative might be to have some money in a savings account or money market account, with most of your money in 12 months CDs earning higher interest.

But an even better strategy will be to create a “CD ladder”. The laddering part has to do with staggering the maturities.

For example, under Online Bank Accounts we noted that Barclays Bank offers a 12-month CD paying 2.55% APY.

You can divide up your emergency account into 12 equal parts and invest the funds in 12 different 12-month CDs.

If you have $12,000 in your emergency account, instead of investing it all in a single CD, you can instead invest $1,000 in one CD each month.

You’ll get the benefit of the 2.55% APY, but each month you’ll have one CD maturing, while investing in a new one.

Because one CD is maturing each month, you would have at least $1,000 available for that month, and for every month.

That’s how you can use a CD ladder to earn higher interest on your money, but also add a measure of liquidity for emergency purposes.

5. Betterment

If you want to add even higher returns to your emergency account, and you’re willing to take on some risk to do it, you can consider putting at least some of your money into a robo-advisor.

The most popular, and perhaps the best robo-adviser overall, is Betterment.

For a low annual fee of just 0.25%, Betterment will provide you with a fully managed investment portfolio, that will be diversified across stocks and bonds.

Stocks are the more risky asset allocation, so if you plan to use a Betterment account as an emergency account, you should favor a higher bond position.

That will make it easier for you to liquidate funds at more predictable valuations than you can with stocks.

But maybe the best use of a Betterment account is to put the bulk of your emergency account into it, to earn higher returns on your money. But you should also hold a portion in more liquid assets, such as those listed above.

You would then be able to tap your liquid savings for immediate emergencies, and access funds from Betterment only when either a larger amount of money is needed, or the emergency lasts longer than expected, such as in the case of a job loss.

Either way, you probably won’t want to put all of your emergency account into Betterment. There is the risk of loss in the event of a general stock market decline.

The best way to protect against that risk is to make sure you always have at least some funds sitting in a completely liquid account, using the Betterment account as a secondary emergency account.

Start earning with Betterment today >>

6. Roth IRA

This one’s a bit controversial as an emergency account, but it can actually make perfect sense.

If you put money into a traditional IRA – or virtually any other retirement account – and you need to withdraw funds before you turn 59 ½, you’ll have to pay ordinary income tax on the amount withdrawn, plus a 10% early withdrawal penalty.

But the Roth IRA is the exception to that rule.

Under what is known as IRS Roth IRA Ordering Rules, you can withdraw your contributions to a Roth IRA at anytime, free of both ordinary income tax and the 10% early withdrawal penalty.

That’s because under the ordering rules, the first funds withdrawn from a Roth IRA are considered to be your contributions. And since contributions to a Roth IRA are not tax deductible, they are not taxable on withdrawal.

Apart from the fact that you can take tax-free early withdrawals from a Roth IRA, using one as an emergency account has several advantages:

- They can be used to earn higher rates of return, such as by holding the Roth IRA with Betterment.

- Investment earnings on a Roth IRA are tax-deferred, so they’ll build up more quickly than in a taxable account.

- Since a Roth IRA is first and foremost a retirement account, any funds not withdrawn for an emergency will continue to help you save for retirement.

Once your Roth IRA account gets big enough, you may be able to keep a small portion in liquid assets, like bonds, to use as an emergency account.

But the rest of the account, the majority, can be invested for growth as part of your retirement strategy.

Where You Should Put YOUR Emergency Fund?

As you can see, there are more options as to where to put an emergency account than just the local bank. Best of all, you don’t have to pick just one type of account.

You can use several, effectively turning your emergency savings into something of a diversified portfolio.

For example, you can hold a small amount, say enough to cover 30 days of living expenses, in a high yield savings account or money market.

You can put a larger amount into higher yielding (but safe) investments, like CDs and Treasury Bills.

Then you can put the largest amount into a growth account, like Betterment and/or a Roth IRA, to earn even higher returns for the long-term.

That will enable you to have the liquid funds you need for an emergency account, while earning a lot better than 0.09% in a local bank savings account.

The post Where Should You Keep An Emergency Account? appeared first on Good Financial Cents.

Source Good Financial Cents https://ift.tt/2UzPFMD

Questions About Energy Drinks, Balance Transfers, I-Bonds, and More!

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Squeezing Generation X

2. Replacing energy drinks

3. Balance transfer catch

4. Help breaking down a goal

5. I-bonds for emergency fund?

6. Sharing financial specifics with kids

7. Warm blanket recommendations

8. Paper planner usage

9. Old personal finance books

10. Used small kitchen appliance safety

11. 401(k) paperwork and identity theft

12. Should we have kids?

When I was younger, the idea of paying for a service to do an ordinary household task for you seemed silly. Why would I ever pay for someone to wash my laundry or do the dishes? I can do those things myself for free.

As I’ve gotten older, I have begun to realize that an hour or two of free time without undone things hanging over my head has a lot of value. How much value? How much would I pay to have an hour of additional free time to do something I cared about deeply? $5? $10? $20?

I know that I’d rather have an hour of free time at this point than most things I could buy for $10.

It’s become an interesting question. The reason this has come up is that we had an offer in the mail to do laundry by the square foot in our town. They give you a box of a certain size upon your request and you fill it with laundry with a lid that you have to be able to lock into place, so they assume you’ll jam it full. They wash it and fold it and return it to you and you pay by the cubic foot based on the initial container size. A friend did this and was really happy with the results.

I’ve been doing a lot of “back of the envelope” math to determine if it’s worth it, which involves me estimating how much actual time doing laundry and folding it takes me. The sorting, the washing, the drying, and the folding per load – how much time does it add up to, and how much is that time worth? Then how does that compare to a cost per cubic foot?

That’s what’s been on my mind lately. Here’s what’s been on the mind of some readers lately.

Q1: Squeezing Generation X

Here is a good blog article subject for you: “How Gen X is getting squeezed”:

1. Baby boomers are holding for dear life to the good paying jobs.

2. Squeezed between the 2008 recession and having kids and affording a home all at the same time.

3. Social Security is being exsanguinate by the politicians all these years and they do not show much interest in restoring it.

4. This kind of relates to #1 but 70% of the jobs created since 2008 are fairly low paying with no benefits.

5. Studies and statistics have proven age discrimination in the job market starts around age 35 though much worse for women.

I am just in a melancholy state the last few years. Just venting I guess. Been following Suze Orman and Dave Ramsey’s advice for the last 10 years and made a LOT of progress, just still not enough to [walk away from] my job. I am 46, no kids. I considered quitting and going on Medicaid just long enough to get my toe fixed surgically (if I got it fixed now I would pay 12K out of pocket), then find a part time job that would get me by monthly but without the ability to save anymore, but pay less enough to be on the subsidized Obamacare plan. To tell you the truth I am really burned out in the same job for 26 years and would just like a break as I have really worked hard, a lot of OT, and a lot of stress and physical toll on my body. Through extreme discipline and hard work I paid cash for my house last year but the yearly taxes, utilities, and insurance run about $6K. I eat very frugally like you do. Started shopping at Aldi.

– Laura

What you’re describing is the reality of what I (and others) call the “sandwich generation,” which I’ve written about before. The “sandwich generation” is people in the exact situation you described – they’re the people who often have children and younger competition in the job market while their parents are aging and often still taking up jobs, too. This happens at a time where there are a lot of life expenses hitting home – saving for retirement, buying a home, and so on. Sarah and I are definitely in this group, with three kids at home and parents who are either still working or pretty freshly retired.

It’s a challenge and the responsibility of it can be overwhelming, especially when it can feel kind of endless and a bit hopeless.

For me, the best approach has always been to ask myself how I can best play the hand I’m dealt. I can’t change societal things or major political things. However, I can control my own behavior and I can control my own thoughts. I can choose to think of the best way out of my situation. I can choose to see the positives in my life.

Some days, it’s easier than others. Some days, it’s really hard. I just focus on what I need to do today and keep moving along. It’s all you can do, really.

Q2: Replacing energy drinks

Trying to cut back on spending but I have a bad energy drink addiction. I drink Nos. When I stop for even a day I feel like crap and have a pounding headache. Cheap alternative?

– Alex

I assume you’re buying them in bulk at a warehouse club or something. If not, that’s the first step – don’t buy them one at a time.

My suggestion is to slowly dial back the energy drink you normally consume. If you drink, say, three a day, each time you’d drink one, drink only 3/4 of that drink for a while.

One good way to approach this is to get some resealable bottles and pour the energy drink into the bottles so that rather than grabbing a 16 ounce can (or whatever), you instead grab a 12 ounce bottle. 3 cans can fill 4 bottles, so drinking a 12 ounce bottle you filled yourself instead of a can is a way to dial it down.

Over time, slowly dial down the amount in each bottle. If you find you’re getting headaches, roll it back up a little bit and then keep going down slowly. Try to break the reliance on energy drinks. That way, you won’t have the expense in your life at all.

Q3: Balance transfer catch

What’s the catch of a balance transfer to a new credit card? I am considering moving my Amazon card balance to a new card because they have a 0% APR balance transfer for 18 months. Feels like there should be a catch in watching a 29.9% APR become a 0% APR.

– Alice

There are a few catches, but they’re minor.

Many credit card balance transfers add a small additional amount to the transferred balance, somewhere around 3%. So, if you’re transferring $1,000, it may appear on the new card as $1,030.

As you note, the balance transfer APR expires after a while, meaning that if you haven’t paid off the transferred balance at that time, it switches to a higher APR.

Also, the credit card companies consider the money “lost” by offering a balance transfer to be a small marketing cost to convince you to switch to their card. They generally believe that you’ll end up using your new card and they’ll make money on interest on that new card.

So, let’s say you’re transferring $3,000 to that new card. It’ll appear on that new card as $3,090, meaning they made $90 already (assuming you do eventually pay it off). You’ll have 18 months to pay it off and if you don’t then they’ll start charging interest on that $3,090. Plus, they’ve earned a new customer on one of their cards. Sure, you get to avoid paying interest for 18 months, so you both “win” out of the deal. (The best approach with a balance transfer is to stop using credit cards and just pay the balance off in full before the 18 months is up.)

Q4: Help breaking down a goal

Loved your recent post about breaking down goals. It seems to work well for some goals but not for others though. I want to pay off debt this coming year but that doesn’t break down into daily goals or behaviors very well.

– Amanda

Oh, but it does, my friend!

Start by asking yourself this: what can I do today to pay off my debts early? Focus on just that question.

Well, you can avoid unnecessary spending. If you’re going to spend on a “want,” plan ahead for it and just say no to any situations where you would spend on wants without having planned ahead. Get into a process of reminding yourself of this intent each morning and then a time or two throughout the day. I find that smartphone reminders really help with this, and I encourage you to look at this earlier post about establishing a good habit in your life, which is a process that works well for me.

You can take on a frugal task, like making meals in advance or making a big pot of soup that you can eat for leftovers for a while or putting caulk on your windows where there’s a draft or installing a weatherstrip or installing more efficient light bulbs or go to the library or something like that. This is something you can consciously add to your to do list each day (or at least fairly regularly).

It’s these little things that, done with extreme consistency, add up to much more. They add up to new patterns of living and those naturally lead to the goal that you want to achieve (and much more). The whole point is to get your life out of the rut it’s in and into a new rut that goes in a new direction.

Q5: I-bonds for emergency fund?

What do you think about using i-bonds instead of a savings account for an emergency fund?

– David

So, let’s start by talking about what an i-bond is. An i-bond is a shorthand term for a Series I savings bond issued by the U.S. government. A Series I savings bond works much like other savings bonds in that you buy it, it earns a fairly small interest rate that’s added to the balance of the bond regularly (in this case, every six months), and stops earning interest after 30 years. You can’t cash them in during the first year of ownership. Between year one and year five, you can cash them in, but you lose the last three months of interest. After that, you get all the earned interest.

The nice part about an i-bond is that the interest rate earned is tied to inflation. The interest rate matches the CPI-U, which is a statistic that estimates overall inflation for urban consumers, plus a small additional fixed rate. As I write this, the current overall rate is 2.83%, of which the small fixed rate is 0.50% and the rest comes from the inflation matching.

So, should you use these bonds for an emergency fund? If you’re in a situation where you can match your emergency fund with an annual purchase of these bonds, then you can switch to them after a year.

Let’s say, for example, that you had an emergency fund that equaled three months of living expenses – let’s call that amount $10,000. If you spent that entire amount on i-bonds, you wouldn’t be able to cash them out for a year, so during that year, you’d have no emergency fund. Bad idea.

So, what you’d want to be able to do is buy $10,000 in i-bonds without touching your emergency fund in your savings account, wait a year, then cash out your emergency fund and invest it elsewhere. If you have to tap your i-bond “emergency fund,” then you should save that much in cash in the following months, then buy that much in i-bonds after that, then wait a year, then you can invest that cash as needed.

You can do this over time, of course. Let’s say you bought one $250 i-bond a month out of pocket. After a year, you’d have $3,000 in i-bonds, at which point you could start buying them out of your cash emergency fund each month instead of out of pocket. Then, over the next few years, just convert all of that emergency fund into i-bonds. This would ensure that you always had at least $10,000 in easily available money for your emergencies. You just need to be careful in replenishment – if you cash in a $250 i-bond, for example, you should put $250 in savings when you can, then buy a $250 i-bond when you can, then take back that $250 in savings after a year because you’ve fully “replenished” your emergency fund with an i-bond you can easily sell.

This is a lot more complicated than just using a savings account, but i-bonds offer a far higher and very stable return than a savings account. The problem is that you can’t cash them in during that first year, which is a big part of why I can’t strictly recommend moving straight to an all i-bond emergency fund. Instead, you need to transition to them.

Q6: Sharing financial specifics with kids

I have two children, ages 16 and 12. My 16 year old is taking a consumer education course at school and is really digging it. She has started asking questions about our family finances for her own curiosity. I am undecided as to how much detail to share with her. Thoughts?

– Jerry

I think it really depends on the teenager and your assessment of their character and maturity.

There are some teenagers (if they were my children) that I would feel completely fine sharing virtually everything with. There are others that I would not. It really comes down to their individual personality traits and character, which is something that I can’t possibly judge for you.

Has your daughter shown herself to be highly trustworthy? Does your daughter have a good “filter,” meaning she has a good sense to not speak about things she knows? Does your daughter exhibit greedy behavior and a sense of entitlement to your assets and wealth? Some kids have these traits and some do not. Kids that do have these traits are ones I’d be more open to sharing such information with.

For me, if my oldest were a few years older and asking such questions, I’d probably trust him with it. His younger siblings are still too far out to assess their maturity at this point, but I think they’re both on reasonably good paths.

Q7: Warm blanket recommendations

Do you have any suggestions for warm blankets. We have started turning the house temperature down at night but we’ve learned our bed coverings don’t keep us warm at night and we’re actually cold in the night.

– Jeff

Buying a single expensive warm blanket is fine, but it’s actually cheaper to just buy a few inexpensive blankets and cover in layers, just like you should do with your clothes when you go outside.

I’m going to stay far warmer in a bed with four or five cheap blankets on it than in a bed with one expensive “warm” blanket on it, and that one blanket is going to be more expensive than the four or five cheap ones.

This is exactly how Sarah and I cover our bed in the winter. We have a bedsheet, a few layers of inexpensive blankets, and our top bedspread. It gets nice and toasty in there, and if it’s too much, we can just ditch one of the thin blankets and that helps. With a single thick blanket, you can’t just ditch a little of it.

Q8: Paper planner usage vs. digital

Loved your article on 2019 goal setting. Was hoping you could explain more how you use paper planners versus digital tools.

– Ambie

In general, I use paper planning when I’m really thinking through what I want to be doing next. When I’ve decided that and written it down, then I transfer specific tasks to a digital to-do list tool that just tells me what I need to do next throughout the day. A lot of the “things I need to do everyday” are already in the to-do list tool and recur every day (or on every regular schedule I need) – if I decide I don’t need to do one of those things today, I just check it off.

I use a printed Momentum planner because it strongly matches how I plan things. I spend a bit of time each evening (or early morning) planning out what I’m going to be doing in the day to come, and I also do a weekly review each Sunday morning to review what the last week was like and set some plans for the week to come. Once every month, that weekly review becomes a bit bigger as I review the past month, reflect on any 30 day challenges I did, and come up with a few more. I also do big quarterly reviews and an annual review (usually early in December, from which that article came). That’s exactly how a Momentum planner works, too, on the same schedule of weekly, monthly, and quarterly reviews, so it just really clicks with me.

So, here’s what I actually do each morning (sometimes, I do part of this the night before if I do it before I’m completely dead and ready for bed). I’ll sit down and check over both my print planner and my to-do list program (I use Omnifocus, but lots of them are very good) and see what I left undone from the day (and feel good about all the stuff I actually did do). For each of those things left undone, I decide if I really want to do them or not and, if I do and I just didn’t get to it, I transfer it to the next day. I then look ahead at the next day and consider whether there’s anything I need to do in the next 24 hours that isn’t already written down. I usually brainstorm a little, but when I actually write something down in the Momentum planner, I intend to do it. Then, when I feel good about the coming day, I transfer everything new into my to-do list program. During the day, I mostly just operate from the to-do list program, checking things off as the day goes along.

That bit of reflection in the morning (or the evening before) is mostly intended to help me distinguish between things that are “urgent but not important” and things that are “important but not urgent.” I want to not bother with the things that are “urgent but not important” and I want to make absolutely sure I’m giving time to the things that are “important but not urgent.” I find that I usually don’t end up writing down the things that are “urgent but not important” and if I do, I immediately recognize it and cross it off.

If I just toss stuff into my to-do list program without thinking about it (which I used to do), a lot of “urgent but not important” stuff will get in there and I’ll feel overwhelmed with things to do and have a sense that a lot of it isn’t getting me anywhere. Using a paper planner and thinking about it more helps take care of that problem.

Q9: Old personal finance books

We were cleaning out my grandpa’s attic and among some old books I found a couple of personal finance books, The Seven Laws of Money and Financial Security. Are these books worth reading still? Or is it all outdated?

– Amy

For starters, I’m guessing that you’re referring to The Seven Laws of Money by Michael Phillips, first published in 1974, and Financial Security by Max McKitrick, also first published in 1974. I bet the books were vintage from the 1970s as those were among the “big” personal finance books in the 1970s.

So, here’s the scoop with old personal finance books. The principles generally remain true, but the specific tactics are really dated. The good personal finance books focus on principles and then give examples of those principles using tactics, and those books are still worthwhile as they show how the good principles are timeless. The bad personal finance books aren’t based on any real principles and just throw a bunch of tactics at you.

How can you tell the difference? Read the first chapter of a personal finance book and ask yourself how much of what was said would have worked thirty years ago and would also work today. If it’s a good timeless book, most of it will work in both timeframes. We’re talking about principles like spending less than you earn, investing the difference in a meaningful fashion, controlling your lifestyle inflation, and so on. Almost all of personal finance that actually works for a lifetime rests on those principles – the only thing that changes is the specific tactics you use to do those things.

I’ve read some older personal finance books that were still great and I’ve read some that were useless garbage. I can’t speak to either of those books, but you can probably tell within a few pages using that litmus test.

Q10: Used small kitchen appliance safety

How do you know that a used small kitchen appliance is safe when you buy it at Goodwill?

– Tom

How do you know that a new small kitchen appliance is safe when you buy it at Target? You find out by plugging it in and using it a few times while you’re nearby before fully trusting it.

That’s the same exact thing you do when you buy a toaster or a slow cooker from a secondhand store. You plug it in and use it a few times while you’re close by so you can unplug it quickly if there’s a problem.

Plug it in at the store if they’ll let you. If they don’t, take it home and plug it in and use it while you’re around. If there’s a problem, you’ll know it quickly.

Remember, most things you find in a secondhand store are there because they simply weren’t used by the original owner. Maybe the original owner passed away, or maybe they moved, or maybe they just cleaned out their closet. That rarely means that the item doesn’t work. In fact, the items that don’t work have often been filtered away and returned to the manufacturer or retailer rather than winding up at a secondhand store.

Q11: 401(k) paperwork and identity theft

I went in to sign up for 401(k) at work and the person there had a bunch of 401(k) papers just sitting out on their desk. At a glance I could see names and Social Security numbers. I do not want my information handled in this way so I didn’t sign up. I am not sure what to do.

– Jenny

If I were in your shoes, I would collect the paperwork regarding the plan and ask to take it home to read it, then contact the organization directly using the information on that paperwork. The papers may actually give you a URL for online signup; if not, contact them directly and ask about it.

I agree with you that this is really questionable office protocol regarding personal information of employees. Stuff like Social Security numbers should not just be sitting out on someone’s desk. It should be properly filed and locked away at the very least.

If you can’t sign up for a 401(k) online, I’d suggest giving an anonymous tip to that person’s supervisor, because that’s just a very bad protocol for the company’s HR person to be following. You may want to consider doing it anyway.

Q12: Should we have kids?

I am 26 years old. My wife is 24. I have a very stable job with the state. My wife is finishing up school as a dental hygienist and looks to have a job lined up in January. We are talking about when the right time to have kids is and whether we even want to have them. How did you and Sarah decide when to have kids and whether to have them?

– John

Sarah and I knew that we wanted to have kids when we were fairly young – close to your age – and that we wanted to have all of our kids in a bundle as quickly as we could and then stop there. That’s because we wanted to have multiple kids but have them close enough in age that they could be peers to each other rather than having a big age gap. My wife is close in age to her sisters, while I’m almost a generation apart from my older brothers, and we wanted a situation closer to my wife’s family than my own. This is a discussion we had and we had settled on even before marriage, and it was fairly obvious to both of us when to start trying to have our first child.

I will say that having kids will drastically change your life, particularly the first one, and it’s even harder if you don’t have extended family nearby to help with some things. Sarah and I live a few hours away from much of our extended family, so we’ve been unable to have aunts or uncles or grandparents help with anything at any point other than a “visit to the grandparents” a couple of times a year. It’s hard to overstate how much your life will change when you have a kid, because your freedom to do basically whatever you want in the evening will largely go away or will become very heavily dependent on babysitting. For the first year of the child’s life, a good night of sleep basically won’t happen, though that gets better. You’ll also find yourself constantly worried about things that were never on your mind before that.

Is it worth it? I think so, but not everyone feels that way. Sarah and I feel like we’re contributing three great citizens to the world. Our aim has been from day one to raise them to be good independent people who make the world better than they left it and I think we’re doing that, at least thus far. There have been a lot of wonderful moments along the way. At the same time, it has been a lot of work and worry, though, more than I ever expected.

The best thing you can do with your spouse is just talk it through in detail. Do you really want to have kids? I genuinely believe that the desire to have kids is a biological signal that isn’t really a rational choice for many people (though not all). They just deeply want children in a way that can’t be described, and if that sounds accurate for both of you, then you should have kids. I would suggest doing it early enough so that you’re in great health throughout their childhood and early adulthood, but late enough that they’re coming into a family that has some financial stability. It sounds like you’re building that stability now, so I’d just use the next few years to eliminate any debts you might have and maybe consider buying a home and then go for it, if it feels right in your gut.

Got any questions? The best way to ask is to follow me on Facebook and ask questions directly there. I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours.

The post Questions About Energy Drinks, Balance Transfers, I-Bonds, and More! appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2LarJLq

10 Marketing Trends That Will Dominate 2019

As we close out 2018 and enter a new year, it’s time to look toward the future.

Many of you might be making some new year’s resolutions such as diet changes, workout routines, and quitting bad habits.

But outside of your personal goals, you also need to keep an eye on your business operations. More specifically, you must focus on your marketing department.

Marketing continues to change over time. Each year we’re seeing new trends.

What worked for your company in 2010 may not work in 2019.

Don’t get me wrong. I’m not saying you need to completely abandon or change your strategy that worked in 2018. But you need to at least recognize the newest trends.

It will be up to you to make any necessary adjustments based on what’s trending.

Here’s the thing. Other marketers are already jumping on board with new trends and technology.

To gain an advantage over your competitors, you want to prepare yourself to adapt to these trends before they have the chance.

I’ve narrowed down the top ten marketing trends you need to look out for in 2019.

1. Chatbots

Chatbots and live chat isn’t new technology by any stretch. However, we’re definitely seeing a shift in the way these are being used from a marketing perspective.

Have you seen chatbots recently when visiting websites?

According to stats, 1.4 billion people interact with chatbots each year.

And 80% of companies say they’re already using or plan to use chatbots by 2020.

I’m expecting to see a huge increase in chatbots being used for marketing purposes in 2019 in order to reach that number by 2020.

You should consider using this technology in your business if you’re not already doing so. That’s because implementing live chat provides better customer service.

It’s much easier for customers to communicate with chatbots online than to send an email or call a representative.

Using chatbots has many potential benefits:

You can have a chatbot window automatically pop up once a visitor lands on your website.

This will make it much easier for them to reach your customer service team.

Chatbots also help drive conversions.

Live chat makes it three times more likely that your customers will complete the purchase process. Furthermore, live chats generate a 20% increase in conversions and a 305% increase in ROI.

Marketers have recognized these advantages and acted accordingly.

I’m expecting to see more websites with chatbots in 2019. You should consider using this marketing strategy as well.

2. Interactive video content

Video marketing has been trending upward for years now.

We’re seeing an increase in videos on social media, websites, and blogs. People are even running successful video blogs.

But in 2019, we’ll start seeing additional changes in the way video is consumed. I’m talking about interactive videos.

The Washington Post uploaded this 360-degree video to its YouTube page:

As the video plays, users have a chance to view the entire area by clicking the navigation button in the top left corner of the screen.

You can start using interactive videos for all other purposes I mentioned earlier:

- website

- social media

- blog

The idea behind interactive videos is to increase engagement:

They perform better than regular videos. There is a greater chance that people will finish watching a 360-degree video and you’ll get a higher return on your investment.

In fact, 98% of people in the United States believe that 360-degree videos are more exciting than traditional video formats.

And 90% of people say content is better when it can be viewed with a 360-degree view. It should be no surprise that 360 videos have a click-through rate eight times greater than that of traditional videos.

Furthermore, 70% of marketers say interactive videos have had a positive impact on their businesses.

Audiences are 65% more likely to interact with a 360-degree video.

Given these numbers, we’ll see more of this content in the coming years, starting in 2019.

3. IGTV

Have you heard of IGTV?

It’s a standalone app owned and operated by Instagram.

This concept launched in June 2018 and was specifically made for mobile devices.

This app is similar to YouTube. One of the major differences is that all of the videos are vertical since they are made for phones.

Video content plays as soon as you open the app, similarly to the way a video would be playing if you turned on a TV in your house.

Instagram has seemingly taken over social media.

Everything the team touches turns to gold.

Its active users have been trending upward since its inception in 2010:

I don’t see any signs of this slowing down.

Even if it can get only a fraction of those 1+ billion users to download and use IGTV, the new app will be a big hit in 2019.

Marketers will need to adjust their strategies accordingly.

They’ll need to have a presence on IGTV in addition to Instagram.

This will force marketing teams to produce more video content specifically for this app.

You’ve got to follow the consumer. If your target audience and current customers are using IGTV, you need to do the same.

Since the platform is so new, you can get ahead of the game right now by familiarizing yourself with the app and producing more content for it.

4. Enhanced personalized recommendations

Artificial intelligence algorithms are making it possible to offer more personalized content than ever before.

Your company can increase sales by personalizing the customer experience.

I’m sure you’ve seen this in your own life. For example, when watching Netflix, you get recommended movies and TV shows based on what you’ve watched so far.

Businesses use this on their websites as well.

Again, this isn’t necessarily new. I’m sure some of you might even be using this strategy on your sites.

But in 2019, the technology will make these recommendations better and more accurate than ever before.

Consumers are willing to share personal data if they can benefit from a more personalized experience.

As you can see from the graph above, younger generations are much more accepting of this technology than older ones.

That said, everyone needs to jump on board now.

This marketing strategy will be the way of the future.

5. Facebook and Instagram ads

Paid social media ads aren’t new, but the trends are definitely changing.

More businesses are focusing on Facebook and Instagram ads than on other social media platforms.

As you can see, Instagram and Facebook are the only two social sites that more businesses are planning to use paid ads for than not.

And ads on other social sites such as Twitter, Pinterest, and Snapchat are slowly becoming obsolete.

In fact, 31% of brands on Instagram are currently using ads.

That number is up from 24% in 2017, 12% in 2016, and just 4% in 2015. The volume of ads on this platform has grown nearly eight times in just four years.

It doesn’t surprise me that Facebook and Instagram are the two platforms trending upward for paid advertisements.

Since Facebook owns Instagram, businesses manage ads on both of these social sites in the same place. The format makes it much easier for businesses to create ads that target the right audience, based on its needs.

You even have the option to use lifetime value to create a Facebook audience that actually converts.

Those same benefits aren’t offered when you advertise on other social sites.

The types of ads that can be run between Facebook and Instagram are also versatile. Businesses can experiment with these formats to see what gives them the best results.

What does this mean for you?

If you’re currently using other social media platforms to advertise, you may want to consider switching to those trending.

If you are not running any paid ads, you should at least try them, or your competition might steal your customers on social media.

6. Beacon technology

Beacon technology is similar to GPS, but it’s not quite as complex.

Businesses are leveraging beacon technology to target customers, especially in retail stores. Here’s how it works.

First, companies need to encourage their customers to download their mobile apps.

Once the app is installed on a user’s device, it will track their location. When an app user walks by a beacon in a store, the company knows exactly where the customer is within that store.

It’ll be able to tell when the person is shopping for a specific product. Then, the brand can send the user a promotion via a push notification that’s related to what they’re looking at.

![]()

It’s a great way to improve the profitability of your small business mobile app.

Ecommerce businesses can use this technology too, even without a physical store.

If you have an ecommerce platform, you can place beacons in public areas relevant to what your company offers. Then you can send targeted push notifications when app users are in the vicinity of those beacons.

The reason why this technology will increase in popularity in 2019 is because mobile app popularity is growing as well.

And 42% of small businesses already have mobile apps.

An additional 30% of companies plan to build an app in the future. Further, 55% of businesses owned by Millennials have mobile apps.

Younger generations have recognized the importance of this technology. That’s why they are adapting sooner.

Your company needs to jump on board as well. You won’t be able to leverage beacon technology without a mobile app.

7. Voice search

Between smartphones and products such as Amazon Echo or Google Home, voice search is booming.

Voice recognition software isn’t new. You’ve been able to use the speech to text function of your phone for years now, but you’ve probably experienced its imprecision.

Technology has evolved. Google Home has 95% word level accuracy.

Voice search will have a direct impact on ecommerce sales.

Experts predict that by 2020, 50% of searches will be voice searches.

Last year, 13% of households in America owned a smart speaker. This number is expected to reach 55% by 2022.

As of January 2018, voice search was conducted 1 billion times a month. I predict that number to be higher in 2019.

8. Predictive analysis

Predictive analysis is somewhat related to personalized recommendations.

But the AI and machine learning algorithms used for predictive analysis can be used for many other things.

Here’s a look at how businesses are already using this technology:

As you can see, 23% of businesses are using predictive analysis, while 90% of businesses believe it’s important to use this technology.

Since business owners recognize its importance, but less than a quarter of them are actually using the technology, it’s only a matter of time before they jump on board.

As you can see from the graph, only 26% of businesses surveyed have no plans to use predictive analytics in the near future. Everyone else is either currently using it or has plans to use it for marketing.

Predictive analysis will help you segment your customers better.

This technology can help improve your automation efforts and reduce churn.

One of the best ways to use predictive analysis is to prequalify your leads. Algorithms and software can help you come up with a better lead scoring system.

By prioritizing your leads and identifying top prospective customers, you’ll be able to generate more conversions.

9. Mobile payments

Does your business currently accept mobile payments?

If not, you need to plan on it soon. This will be a growing trend in 2019.

Just look at these numbers:

One portion of mobile payments allows customers to pay for goods and services directly from a mobile app.

Businesses such as Starbucks have an app that allows customers to buy coffee in their storefronts by paying with their mobile phones in advance.

Another portion of mobile pay comes from alternative payment methods.

Roughly 440 million users across the world used contactless pay options in 2018, such as Apple Pay, Google Pay, and Samsung Pay.

That number is expected to increase to 760 million by 2020.

To go from 440 million users to 760 million users, 2019 will have to be a huge year for mobile payments.

Your business should adapt and be prepared to accept these types of payments.

Consumers are getting used to it. If you don’t have their preferred payment option, they may take their business elsewhere.

10. AI and machine learning adaptation

Many trends on my list use AI and machine learning.

This technology has been around for quite some time, but it continues to improve and evolve each year.

There are many different uses for AI in the future:

Lots of these functions can be applied to your marketing strategy.

You need to learn the marketing skills you need to survive in the age of AI.

Furthermore, AI is the fastest growing marketing technology:

It has the highest year-over-year growth compared to all other technologies on the list.

Your company can no longer afford to ignore adapting to the new technologies, such as AI and machine learning.

If you do, you won’t be able to keep up with your competitors.

Conclusion

2019 is going to be a big year for marketers.

New technology and ease of accessibility have made marketing more competitive than ever before. That’s why you need to recognize the newest trends.

If you’re not sure what to expect in 2019 from a marketing perspective, you can use this guide as a reference.

This isn’t a list of bold predictions or trends that I pulled out of thin air.

Everything I listed above is backed by data that’s trending upward. It’s a safe bet to follow these trends if you want to be successful.

What marketing trends is your brand planning to follow in 2019?

Source Quick Sprout https://ift.tt/2zQ6sSW

Are You Credit Invisible? Here are 4 Ways to Get a Credit Score

Are you one of the 45 million consumers in the United States whose credit is “invisible†or unscoreable, according to the Consumer Financial Protection Bureau (CFPB)?

If you are credit invisible, it means that you have no credit record. When lenders or potential landlords go to the credit bureaus to pull your credit history, they simply won’t find anything.

Or, you may be unscoreable, meaning that the bureaus will find some credit data, but not enough to create a reliable credit score. You can also be unscoreable if the data on your credit record is “stale†— that is, not recent enough.

The Big Problem With Being ‘Credit Invisible’

Credit invisibility is not the same thing as poor credit — which results from having a history of late payments, maxed-out cards or accounts in collections — but it has many of the same negative effects.

Both of these lead to the same problem: Lenders will not extend credit to you. With no credit, it’s just as difficult to access low-interest credit options, because lenders can’t make an educated guess about how likely you are to pay back your debt. Rather than chance it, they’re more likely to refuse you credit. (Not fair, but that’s the way it often goes.)

A November 2017 report examining “credit deserts†found that credit invisible consumers “tend to utilize alternative financial service providers or ASFPs (such as payday lenders, pawn shops, check cashing and rent to own) at higher than average rates.â€

Without access to much-needed credit-building opportunities, these kinds of providers may seem like your only option. But the truth is, they are likely to leave you in even worse financial shape. The better option is to focus on becoming credit visible. Fortunately, it’s easier to remedy credit invisibility than it is to rebuild poor credit.

How to Become ‘Credit Visible’

There are some smart and relatively easy steps that you can take to become credit visible and build up a strong credit score over time.

1. Become an Authorized User on an Account

When you become an authorized user on a family member or friend’s credit card, you will typically get a card tied to their account with your name on it.

Keep in mind, you don’t actually have to use the card to get the benefits of being an authorized user — and it might create problems if you’re not careful. Always discuss any purchases you plan to make with the account owner. If you think you’ll be tempted to make unnecessary purchases, just let your friend or family member hold onto that card for you. Then, remain an authorized user until you’re approved for an account of your own.

2. Find a Co-signer

Another way to “piggyback†your way to strong credit is to get a co-signer. Just keep in mind: Asking someone to be your co-signer is a big deal, because they’ll be legally responsible for your payments too. That could spell big trouble if you don’t always make payments as agreed and on time.

3. Get a Secured Credit Card or Credit Builder Loan

One way to become credit visible on your own is to open a secured credit card. You’ll need to put down a deposit, typically a few hundred dollars, as collateral toward the card’s limit. As you make regular payments and maintain healthy credit usage, you’ll see your score start to grow.

A second option is a credit builder loan. The bank will deposit a small sum of money into a secured account for you. You’ll make regular payments until you’ve paid the “loan†back. Then the money is yours again, often plus any interest you’ve earned. This shows lenders that you can maintain a regular schedule of payments.

4. Report Your Responsible Rent Payments

Another way to become credit visible is to get credit for paying your rent. You might think you’re already getting credit for this, but most landlords aren’t reporting that data. In fact, only 0.3% of consumers have a rental tradeline reported in their credit file, according to FICO.

But it’s easy to start getting data about your responsible rent payments reported to all three credit bureaus. RentTrack, for example, allows you to report rent without getting your landlord to sign up or verify each payment. Be sure to pick a service that reports to all three credit bureaus, since you want to make sure those on-time payments show up, no matter which report lenders pull.

Research shows that rent reporting has a huge impact. A 2017 report by the New York City Comptroller’s Office showed that after adding rent as a credit file account, known as a tradeline, almost 30% of tenants with no credit file gained a score. Out of those who gained a score for the first time, the average score amounted to 700 points — not too shabby.

Even if you have been labeled as “credit invisible,†it doesn’t mean you’re a lost cause — it just means you need to show the credit bureaus what you’re capable of. Make the most out of these tips and strategies, and before you know it, you will be well on your way to a stronger financial future!

Megan Eales Monroe is the digital marketing manager at RentTrack, the first credit reporting agency to report rent payment data to all three bureaus. She loves inclusive credit, marketing, travel and her mystery breed rescue dog, Lewis.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2RLiKTy

Fed Meeting Preview: How to Take Advantage of Rising Interest Rates

The Federal Open Market Committee (FOMC) holds its last meeting of the year on December 18-19, and the general expectation is that it will raise interest rates by 0.25%.

If that happens, it will continue a steady rise over the past three years that has seen interest rates increase from near 0% to the expected new benchmark rate of 2.25% to 2.5%.

So, how would such an increase affect your personal financial situation? And what financial decisions might you want to make in 2019 based on a rise in interest rates?

Let’s dig in.

How the Federal Funds Rate Affects Your Everyday Finances

When the FOMC decides to raise interest rates, what it’s really doing is raising what’s called the federal funds rate. This is the interest rate at which banks make overnight loans to other banks, and it sets a baseline from which most other interest rates are determined.

“The federal funds rate is the single most important U.S. interest rate since it affects virtually all monetary and financial decisions,” says Jason Lazarow, the founder of Lazarow Wealth Management. “A majority of consumer based debts are derived from the federal funds rate, ranging from mortgage rates, auto loans, and the interest you pay on your credit cards. It also affects the interest rate you receive on savings accounts and CDs.”

In other words, an increase in the federal funds rate generally leads to an increase in interest rates everywhere else. That can be helpful, as it is with higher interest rates on your savings account. And it can be harmful, as it may lead to higher interest rates on debt.

One thing to pay attention to is the timing of such changes, as it isn’t always the same across the board.

“Banks are reluctant and slow to raise rates on what they pay to savers,” says Lazarow. “On the other hand, they are fast to raise rates on debt. That means anyone with credit card debt or an adjustable rate mortgage faces potentially paying thousands of dollars extra a year just in interest costs.”

To be clear, even interest rates on your variable rate debts likely wouldn’t change immediately. And a 0.25% increase isn’t big enough to cause too much harm, so there’s no need to panic.

Still, there are a few financial strategies worth considering as interest rates rise.

Three Ways to Capitalize on Rising Interest Rates

1. Find a better savings account.

Even though interest rates have steadily climbed over the past few years, many of the big banks are still paying just about nothing on their savings accounts. They’re benefiting from those higher rates without passing on those benefits to their customers.

Other banks have been much quicker to adapt. Online banks like are already paying around 2% and are more likely to increase their interest rates quicker than the big banks. Local credit unions can also be a good source of competitive interest rates.

Depending on how much money you have in savings, that difference could be a dig deal. A 2% increase in interest on $1,000 comes out to $20 per year, and on $10,000 it would lead to an extra $200 per year.

All of which is to say that switching to a bank that’s actually adapting to these increasing interest rates can make you some money.

2. Pay down debt.

Rising interest rates overall could lead to higher interest rates on some of your outstanding debts, in which case paying down those debts could provide an even bigger return on investment than it would have in the past.

“If your credit card is subject to a variable rate, then you’ll be paying higher interest costs and you should look to pay those off as a first priority,” says Dale Wong, president of Missio Investment Management.

Paying off a credit card that charges 18% interest is equivalent to earning a guaranteed 18% return on your investment, which is a better return than you can get just about anywhere else (with your 401(k) employer match being pretty much the lone exception). And if you can turn that debt into savings, the return is even higher.

Let’s say that you typically carry a $1,000 balance on that credit card, which costs you $180 per year in interest. Paying it off would save you that money, but paying it off AND putting the equivalent into a savings account earning 2% would also earn you an extra $20 in a year, for a total round-trip gain of $200.

All of which is to say that turning debt into savings is even more valuable when interest rates are on the rise. Making that a focus of 2019 will serve you well.

3. Consider refinancing your variable rate loans.

If you have an adjustable-rate mortgage or other type of variable rate loan, it’s worth understanding when your rate could adjust and how big that adjustment could be, and at least considering a refinance.

“Homeowners with adjustable-rate mortgages need to monitor when those loans will reset to the higher rates,” says Wong. “If you are in year two of a five-year ARM, then you have time to plan around switching to a fixed rate or seeing if rates ease some before your loan resets.”

There are costs to refinancing, so it’s not an automatic win. Just like buying a home, you typically need to stay in the house for several years in order for the upfront costs to be worth it.

But interest rates are still near all-time lows, even with the recent increases, so in the right situation locking in a fixed rate could save you a lot of money over the long term.

- Read more: How to Find the Best Refinance Rates

Don’t Overthink It

While there are certainly some ways to capitalize on rising interest rates and save yourself some money, it’s also important to remember that interest rates are just one of many factors that can influence your financial situation. There’s no need to overreact, no matter what happens with them.

“I don’t think everyday investors should pay too much attention to the FOMC meetings to do any type of market timing or planning in their day-to-day life,” says Tim Kenney, CFP®, founder of TK Pacific Wealth. “Whether they raise rates is not only something you can’t control, but it doesn’t have all that much of an immediate impact on your financial situation.”

At the end of the day, the financial decisions that are smart today will largely be the same financial decisions that are smart if interest rates rise. So while it’s helpful to understand how you could capitalize on an increase in rates, it’s always worth keeping these things in perspective.

Matt Becker, CFP® is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families.

More by Matt Becker:

- Are CDs and Savings Accounts Becoming Viable Investments Again?

- I’m a Financial Planner — Here’s How I Invest My Own Money

- Your Year-End Investment Checklist

The post Fed Meeting Preview: How to Take Advantage of Rising Interest Rates appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2C0vLmX