How well do you know your competition?

Depending on your industry or location, the market may be saturated with businesses providing the same services or offering the same products as your company does.

Not everyone will survive.

Sooner or later, one or two companies will separate themselves from the crowd.

If you want to be an expert in your niche, you’ll need to learn effective competitor analysis skills.

Otherwise, you could put yourself at risk of falling behind those businesses that adopt these strategies first.

As a marketing expert who founded several startup companies, I’m well aware of how competitive certain spaces can be.

It’s not easy to operate a business, especially when you’re worried about the guy down the street taking customers away from you.

Whether you’re a small-town business or a global ecommerce store, you need to analyze your competition.

If you’ve never done this before, I’ll show you how to get started.

My techniques will help you improve your business and increase profits fast.

Identify your competitors

Knowing your competitors may sound obvious to you, but you’d be surprised how many people I meet can’t name their competitors.

Those of you who fall into this category have to identify your top competitors before you do anything else.

Even if you know who your competition is, it won’t hurt to start here. You may be find new information.

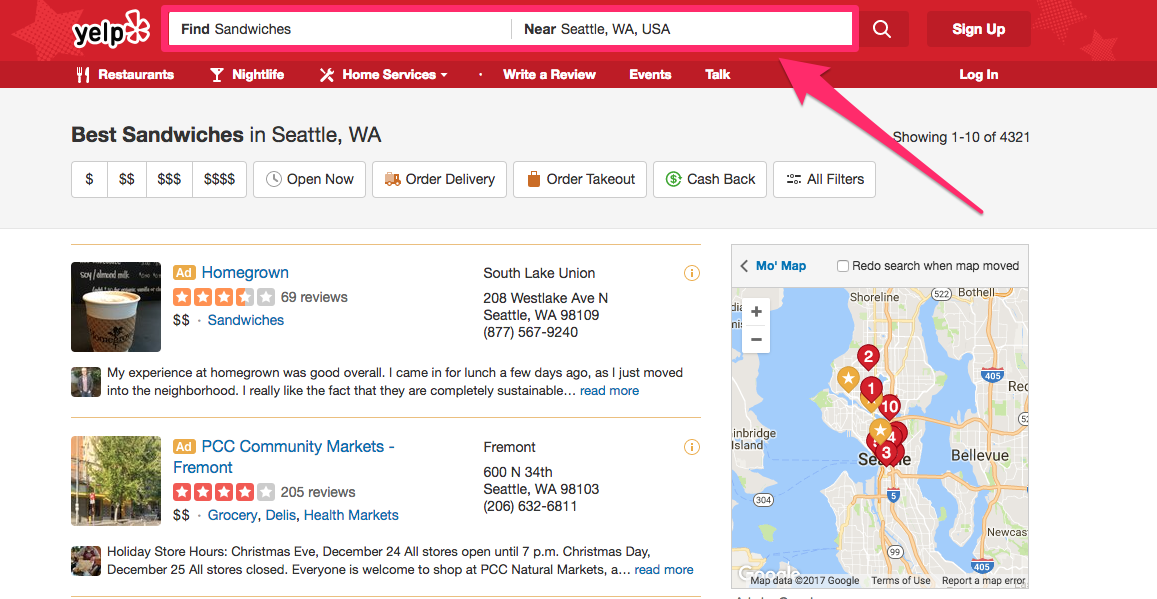

Let’s say you’re a local business selling sandwiches in Seattle.

Run a search on Yelp:

Simple.

The top results will be advertisements, but that doesn’t mean those aren’t your competitors.

Don’t disregard them completely just yet.

Here’s something else to keep in mind.

You’re looking only for your direct competition.

If your sandwich shop also sells cookies or pies, you’re not looking for bakeries or specialty dessert shops.

You’re also not competing with every bar in your neighborhood that has a sandwich on the menu.

Make sense?

So filter your search to get more accurate results:

If you click on the “all filters” tab, you can narrow the results.

For this example, I’d recommend picking a price range similar to yours and a place in the same neighborhood.

If your most expensive menu item is $12, you don’t care about the gourmet restaurant 8 miles away selling $45 sirloin steak sandwiches on their dinner menu.

Now that you’ve got a more accurate list, write down your top competitors.

In a busy city, like Seattle, you may find upward of 30 sandwich shops in your neighborhood alone.

That’s way too many.

Look for businesses with the most reviews and the highest ratings.

Narrow that list down to 5 or 10 at most.

Yelp isn’t your only resource.

Depending on your business, you can also reference Google Local or Angie’s List.

However, these platforms may not be helpful if you’re trying to identify competitors in a digital marketplace.

If your operations are run completely through a blog, website, or ecommerce store, you’ll need to use other tools to identify your competitors.

Try using a service like SimilarWeb:

They offer lots of competitor analysis tools, including competitor identification.

All you need to do is put in the name of your website, and they’ll generate a list of your competitors.

They have a free sign-up option, but to maximize your research, I would recommend paying for an upgraded subscription.

If you don’t want to pay for a subscription, consider reaching out to your current customers.

Creating an effective customer survey can help you learn more about their habits.

Send a survey to your subscriber list asking them to identify other websites they shop at or blogs they read.

Who is their target audience?

Now that you’ve identified your top competitors, it’s time for you to see whom they are targeting.

You can’t assume their target market is the same as yours.

Don’t believe me?

Let’s continue with the local sandwiches example.

Here’s a chain sandwich shop called Cheba Hut:

Take a look at the names of the sandwiches on their menu.

Also, notice how they refer to their different sizes.

Based on your research, you may have identified this company as a top competitor.

They have the same hours as you; they’re close to you; and they sell sandwiches at the same price point.

But it’s clear this business is trying to appeal to a certain crowd.

It works.

Don’t get me wrong.

I’m not saying you need to adopt this strategy and look for a niche market to focus your marketing strategy on.

All I’m saying is you need to identify the target market of your top competitors.

After further analysis, you may determine you want to make some adjustments, but we’re not quite there yet.

Here are some things to consider when you’re identifying your competition’s target audience:

- Age

- Location

- Income

- Gender

- Marital status

Your results won’t be perfect, but try to come up with an accurate customer profile based on their advertising campaigns.

Your Google ranking is essential

How can you be better than your competitors?

You both have the same type of content on your website.

You’re targeting the same customers.

They even update their site, services, and products as frequently as you do.

Why are they ranked so much higher on a Google search than you are?

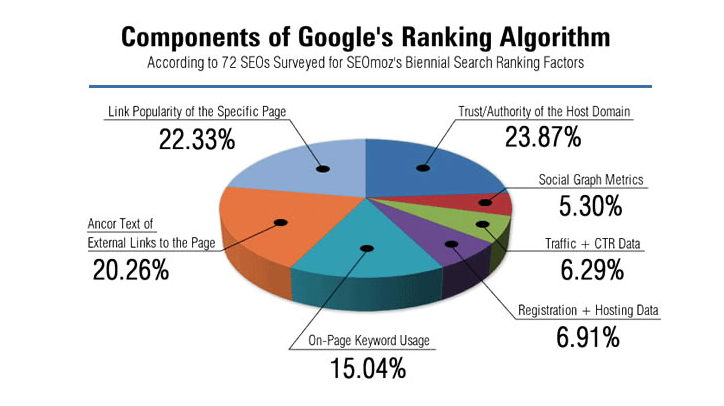

You need to understand the components of Google’s ranking algorithm:

Visit your competitors’ websites.

Evaluate their SEO.

Determine how they are using keywords to boost their search ranking.

Look for keywords and phrases in the following places on their sites:

- Title pages

- H1 headings

- H2 headings

- Internal links

- URL structure

- Content

Do you notice a pattern?

See what words are getting used the most in these places.

It may have an impact on their rankings.

Compare their content to the keywords on your site.

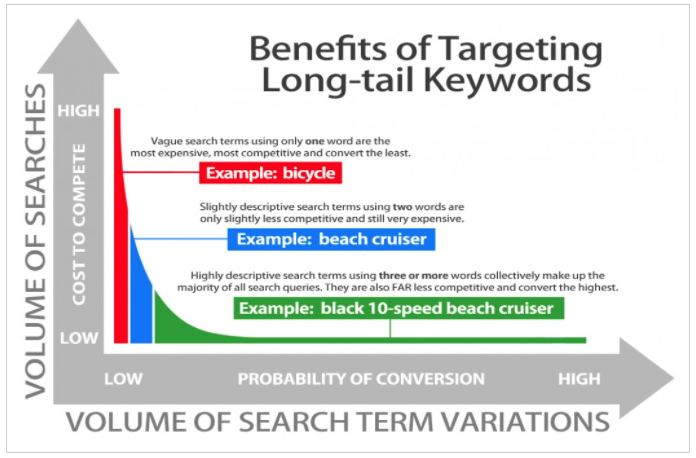

Are you using long-tail keywords?

You should be.

Incorporating a long-tail strategy into your content creation will improve your ranking because it’s more specific.

Ecommerce sites use this tactic all the time to get more hits.

If you’re selling a pillow, adding the word “pillow” all throughout your content isn’t as effective as using terms like “down pillow for side sleepers.”

Is your competition using this strategy?

If so, that’s probably why they’re outranking you in related search results.

Analyze competitor content

Take your analysis one step further.

Getting customers to your platform is only half the battle.

But what do these people see once they arrive?

Here are some other things to look for on your competitor’s page:

- Blogs

- Pictures

- Videos

- Case studies

- Buying guides

- FAQ pages

- Podcasts

- Guest posts

- CTA

Compare these to your own website.

They may have certain features you’ve omitted from your site.

I’m not saying you should automatically mimic the structure of their pages, but see what’s working for them.

For example, let’s say you discover your top three competitors have a blog. And all three outrank you on Google.

You should consider adding a blog to your site.

This data about the benefits of blogging speaks for itself.

Adding a blog to your website will help you:

- Generate more leads

- Increase conversions

- Get more inbound links

- Have more indexed pages

- Gain trust from consumers

And that will lead to increased profits.

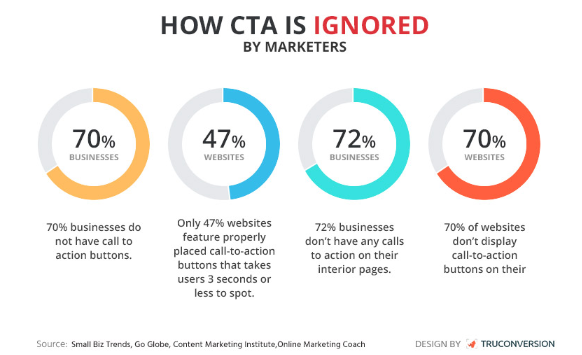

Something else to keep an eye on while you’re analyzing their website is their calls to action.

How is your competition adding subscribers, generating leads, or converting sales?

Look at their sales pitches.

See what benefits they are offering.

How do their top features compare to yours?

You may realize your product and service are significantly better than those of your competition.

But that doesn’t mean anything if you can’t relay that information to your customers.

Look at how marketers are failing to use CTAs:

Reviewing the CTA on your competition’s website could be an eye-opening experience for your marketing department.

Your competitors may excel in areas where you’re lacking.

That’s okay for now. But it needs to be fixed before you fall too far behind.

Look at their social media presence

All businesses should have a presence on social media platforms.

For now, I’m going to assume your company is active on at least some of the most popular platforms:

- Facebook

- Twitter

- YouTube

- Instagram

If not, you need to follow my social media guide.

For those of you who already have profiles set up, navigate to your competitors’ pages.

How active are they?

What are they posting?

Are their customers engaged with their posts, photos, videos, and comments?

Here’s an idea.

Start adding their followers.

These people are obviously interested in your industry if they are following your competitors.

Maybe they don’t know your company exists.

Don’t be selective. Add all of them.

The more people you add, the greater your chances of getting customers to follow you back will be.

Understand why consumers follow brands on social media:

Once they start following you, it’s essential you keep them engaged.

Keep in mind, some of these people may have already established a brand loyalty with your competition.

You really need to blow them away to convince them your brand is better.

See what kind of promotions your competitors are running on social media.

Try to run one that’s more appealing.

How do they incorporate videos into their social media marketing strategy?

Video content makes up more than 90% of Internet traffic.

You should be using live video to engage with your customers.

Even if that’s something your competition isn’t doing, it’s a great way to stay ahead of them.

Recognize areas needing improvement

Now that you’ve analyzed your competitors’ customers, websites, marketing strategies, and social platforms, it’s time to adjust your business.

Based on your research, what areas of your business need improvement?

Where do your competitors excel while you struggle?

There’s always room for improvement. Don’t be biased.

It’s okay to recognize your competitors are doing well.

Run a SWOT analysis:

Here are some questions to ask yourself.

Strengths

- What are you doing well?

- How have you separated yourself from the competition?

- What makes your company unique?

Weaknesses

- What do you need to improve to compete with your top competitors?

- What resources or tools do you need to achieve that?

- Do you need to change your location or conversion method?

Opportunities

- What is the current public perception of your company?

- How can you target new customers based on your competition’s strategy?

- Are there any new changes in the industry or market?

Threats

- Which competitors are directly impacting your revenue?

- What’s preventing you from improving your business?

- How are you leaving yourself vulnerable to losing customers?

These questions are just a starting point.

You can take this SWOT analysis much further to make the necessary changes and improvements.

Conclusion

If you want to increase profits, start by analyzing your competition.

Competitor analysis is an effective strategy for businesses in all industries, whether your company is large, small, or somewhere in the middle.

The first thing you need to do is identify your top competitors.

Narrow this list down to 5 or 10 at the most.

Only look for direct competitors—not just any business similar yours.

Once you’ve identified these companies, you need to focus on their customers.

What’s their target market?

How are they appealing to these customers?

Focus on your Google ranking:

Analyze your competition’s website to see what kind of SEO tactics they’re using.

Review their content, and compare it to your own.

What pages on their site generate the most user engagement?

Consider adding a blog to your website if you don’t have one already.

Check out the social media profiles of your top competitors.

Start adding their followers in an attempt to draw more customers to your business.

Use the SWOT analysis to recognize and implement any necessary changes.

Making these changes can help improve your business and increase profits.

Which online tools will you use to identify the top 5 direct competitors in your industry?

Source Quick Sprout http://ift.tt/2AJEFlk