Arguably, the biggest Google algorithm shakeup of 2017 occurred on March 8.

Of all things, it was called…Fred.

The sheer randomness of the name and the massive drop in traffic that many sites experienced have left a lot of marketers scratching their heads.

What happened, who was affected and why?

More importantly, what steps do you need to take if your traffic took a plunge?

In this post, I’m going to cover all the details of the update, explain how to recover from its negative consequences, and talk about what you need to do to avoid future penalties.

Why was it called Fred?

Let’s start from the top.

The first thing you’re probably wondering about is how this update got its name.

We’re used to cute, cuddly animal names such as Panda, Penguin and Hummingbird, so Fred seems a little bizarre.

Well, here’s a screenshot of some Twitter dialogue between Barry Schwartz of Search Engine Land and Google Webmaster Trends Analyst, Gary Illyes:

As you can see, Illyes jokingly dubbed this update “Fred,” and it stuck.

So, there you go.

What happened?

This is definitely one of the more humorous names for an update, but not everyone is laughing.

Many sites took a major hit.

Some even saw their traffic decline by as much as 90%! That’s crazy!

Here’s the deal.

Google is secretive as usual, but according to research from multiple experts, the Fred update primarily targeted websites guilty of three types of offenses:

- excessive ads/affiliate links

- generic content offering little to no value

- low-quality backlinks

Here are a couple of quotes from experts that shed a bit more light on things.

Barry Schwartz:

About 95 percent of the sites that got hit were ones with content that looks to be written for ranking purposes and then has ads and/or affiliate links sprinkled through the article…they seem to have content on a vast array of topics that are not adding all that much value above what other sites in the industry have already written.

Sreelal G. Pillai of TechWyse:

Affected sites also have low-quality backlinks in common – meaning that the sites that link back to them all have low domain authority.

That’s the gist of it.

And I can’t say I’m surprised.

We already know Google’s mission is to provide its users with high-quality content.

If it’s clear a website is attempting to use manipulative techniques, create thin content and/or load it up with excessive ads/affiliate links, I can see why it would be penalized.

When it comes to generalist content—content written on numerous topics with little, if any, value—Google has been combating it for years.

Rehashing content and trying to cover a wide range of subjects, without any specialization, isn’t going to do you any favors with Google.

The same goes for low-quality backlinks.

I’ve written in-depth about the importance of a strong link profile, where your site receives inbound links from credible, authoritative and relevant websites.

2017 research found that “high-quality backlinks account for 30% of your overall page score in Google.”

It’s not a surprise the Fred update went down the way it did.

It’s basically Google’s way of maintaining its quality standards.

I was affected. What should I do?

There are two specific actions I suggest you take right away.

The first is to assess your website in terms of ads and/or affiliate links.

If you were affected, there’s a good chance you’ve gone overboard on advertising.

Don’t get me wrong. It’s totally fine to incorporate ads on your site and sprinkle in a few affiliate links here and there.

Some top brands do it.

But it’s pretty obvious when it’s excessive.

Here’s an example of Mashable using ads the right way:

Notice there’s just a single ad in the bottom left-hand corner.

It’s noticeable but doesn’t dominate the content in an obnoxious way, blending in with the rest of the page.

In other words, it doesn’t interfere with the user experience.

Here’s another example from Gadget Review:

Again, the ad is plainly visible, but it doesn’t dominate the rest of the content.

As for affiliate links, you may want to delete those that are:

- not necessary (e.g., not bringing any money),

- detracting from your content or

- likely to be deemed as spammy in any way.

The second thing you’ll want to do is check your link profile.

You can use several different tools for this.

One of my favorites is SEMrush.

The only issue is that the free, basic version is a little limited for analyzing backlinks.

However, the paid version offers all the data you could possibly need.

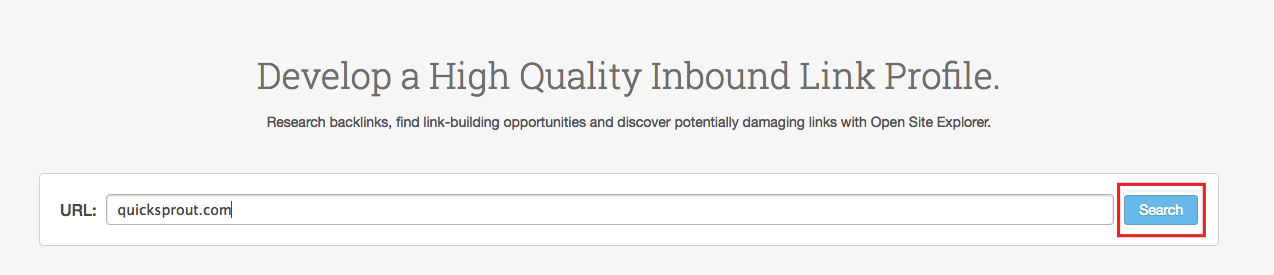

There’s also Moz’s Open Site Explorer.

It will provide you with some pretty solid information so you can see who’s linking to your site and tell if there are any problems.

Here’s what you do.

First type in your URL:

Click on “Search:”

Look for the “Inbound Links” section.

Click on “all pages” under “Link Source:”

Then click on “only external:”

This ensures you’re only seeing inbound links from external sites as opposed to internal links coming from within your site.

Here are some of the results I got:

These all look good.

Social Media Examiner, Backlinko, The Content Marketing Institute and Buffer are all high-quality sites relevant to Quick Sprout.

But if I see anything questionable (e.g., low-quality and/or irrelevant sites), I would want to investigate further.

Let’s say you’ve spotted less-than-ideal links.

What do you do?

Disavowing problem links

If you find you’ve got links from questionable sites, your best bet is to disavow them.

This is somewhat of an involved process if you’ve never done it before, so I can’t adequately cover it here.

However, this post from NeilPatel.com will fill you in on the details and explain how to use Google’s disavow tool correctly.

Your goal is to get rid of any problem links by disavowing them.

In turn, this should improve your link profile and should help you recover.

What you need to know moving forward

So we’ve established that any backlash from the Fred update is most likely due to one or more of the following:

- excessive ads/affiliate links

- generic content that offers little to no value

- low-quality backlinks pointing to your site

You’ll definitely want to avoid these transgressions moving forward.

Cutting back on ads and affiliate links is pretty easy. You just have to make some minor adjustments to your existing content.

And, of course, be conscious of how many affiliate links you include in your future content.

I would suggest including a maximum of three affiliate links per post.

However, you may want to go even lower just to be safe.

When it comes to generic content, that’s not always an easy fix.

The only remedy is to put in the time and energy to produce epic content.

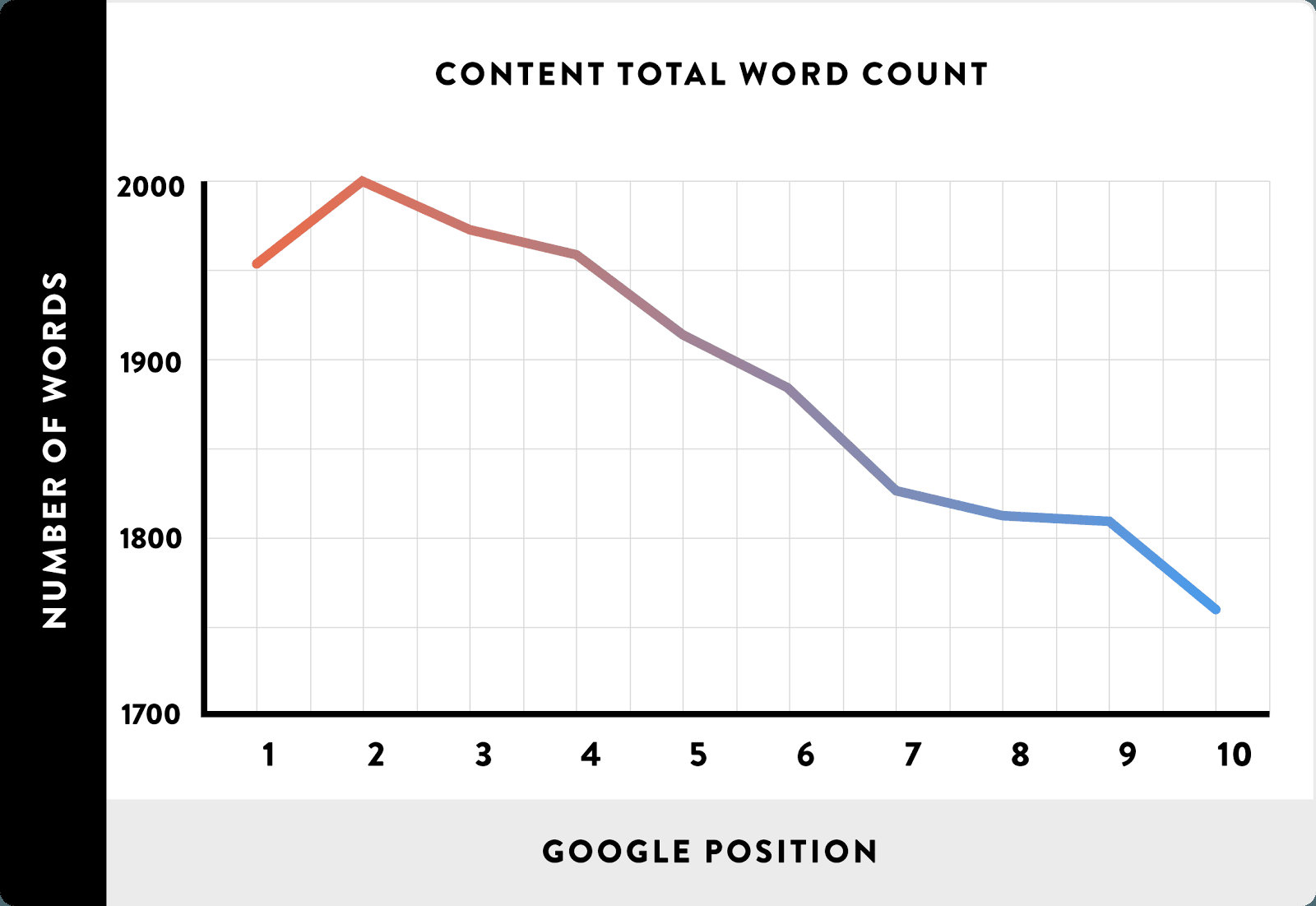

This usually entails long-form content because it tends to be more in-depth than your run of the mill 500-word post.

And, of course, there’s an undeniable correlation between a higher word count and higher rankings:

This is not to say that simply writing longer content is a magic bullet, but it certainly doesn’t hurt.

I also recommend sticking to the subject matter you genuinely know and are passionate about.

You may need to “niche down” to ensure you’re not creating generalist content people can find anywhere.

But as long as it offers real value, has an original angle and isn’t piggybacking off a million other articles, you should be in pretty good shape.

As for low-quality backlinks, the best thing you can do is get in the habit of routinely checking your website’s link profile.

This will alert you to any unsavory sites linking to you.

And once you learn how to disavow links, you can quickly remedy the problem and maintain a rock-solid link profile.

Conclusion

Google is on an endless quest to improve the quality of its SERPs.

And that’s fine with me.

I like to know that, when I’m doing research or shopping for a product, the sites I land on are the cream of the crop.

I don’t want spammy, generic, low value content that’s only going to waste my time and prolong my search.

The Fred update is just another example of how Google is constantly fine-tuning its algorithm and supplying its users with great content.

That’s how it maintains its position at the top of the ladder.

If your site was adversely affected, it’s probably a sign you’re not abiding by Google’s Webmaster Guidelines and changes need to be made.

By following the steps I mentioned above, you should be able to get things back on track and work your way back up the SERPs.

It may take a little time, but you’ll get there.

Just make sure you’re following best practices from this point on to prevent additional penalties down the line.

Did you experience any setbacks from the Fred update?

Source Quick Sprout http://ift.tt/2u3ToIU