الجمعة، 7 سبتمبر 2018

ESU holds economic summit

Source Business - poconorecord.com https://ift.tt/2wWOXyi

How to Improve Your Click Through Rates with Emojis

Whether you love them or hate them, emojis have become part of our lives and our digital culture.

The first emoji was created nearly 20 years ago in Japan. But today, the use of these tiny, animated faces and characters has drastically evolved.

They have become so popular that July 17th has been officially named World Emoji Day.

It’s a fitting date. Apple users may recognize July 17th from the calendar emoji.

Origins and history aside, the fact remains that emojis have become a dominating mobile trend. As marketers, we need to understand this trend and apply it in our businesses.

People have full conversations using emojis.

Some emojis are even used as a type of slang. Depending on the country you’re in, some emojis are used to imply things other than what the creators intended.

For example, some innocent pieces of food are commonly used to represent parts of the human anatomy.

There is even a middle finger emoji.

Even if you’re not using emojis for business, I’m willing to bet that you and your friends send them to each other when you’re texting. Or maybe you use one in the occasional social media caption.

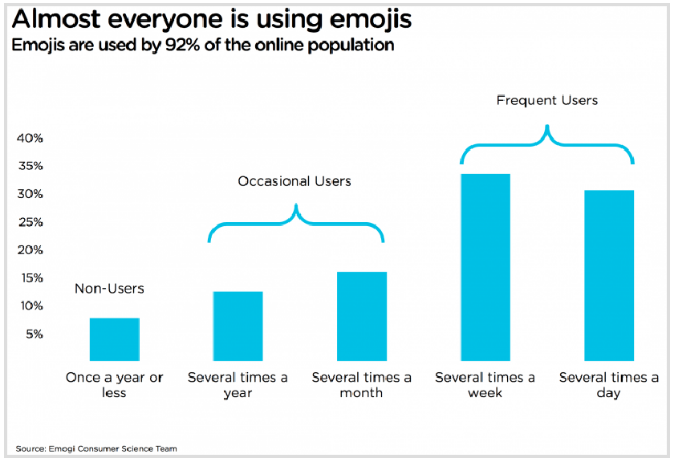

The odds are in my favor. That’s because 92% of the online population uses emojis.

Furthermore, it’s worth noting that women use emojis more than men.

In fact, 70% of women are frequent users, while just 50% of men fall into that category.

With all of this in mind, now it’s time for you to start using emojis to improve your business and not just your texting.

I’ll explain how you can implement an emoji strategy that helps you improve your click-through rates and ultimately drive conversions. Here’s what you need to know.

Make your email subject lines stand out

You need to learn how to increase your open rates with different subject lines. If people don’t open your messages, your campaigns won’t be successful.

One of the best ways to use emojis to increase clicks is by adding them to your email subject lines.

I know how much time and effort you put into your content. Don’t slack off when it comes to crafting a subject line.

Research shows that 56% of brands saw an increase in their open rates when they added an emoji to their subject lines.

They experienced higher click-through rates as well. Recipients were more engaged with the content.

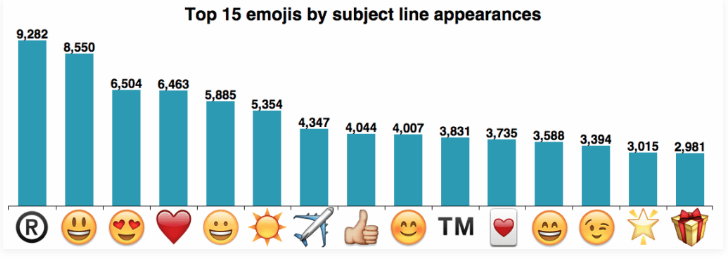

These are the most frequently used emojis for email subject lines:

That doesn’t mean they were the most successful.

You’ll have to see which ones work best for you depending on your brand, industry, and purpose of the message.

For example, using the gift emoji or airplane emoji in a subject line would be irrelevant if you’re a restaurant informing your subscribers of your new dinner menu.

Adding emojis to your subject line is a winning strategy because it helps you stand out from the crowd.

Your subscribers get their inboxes flooded with promotional content on a daily basis. Anything you can do to be different will help your cause.

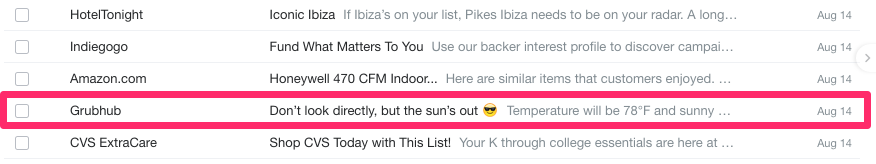

Look at how Grubhub used an emoji in this subject line:

It stands out from the others because it’s the only one with an emoji.

Plus, it’s relevant to the subject line. They used the smiling face with sunglasses for a subject line that’s related to the sun being out.

Add an emoji to your ad headlines

If you’re using sponsored ads to market your business, you should definitely consider adding an emoji to your headlines.

I know it may sound simple, but you’d be surprised at the results you’ll see.

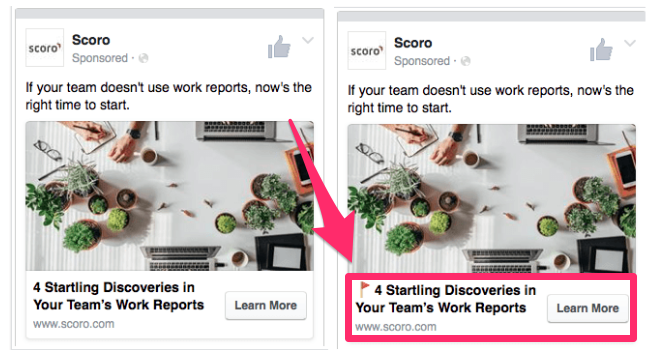

Take a look at this example of a promoted Facebook advertisement from Scoro:

At first glance, the two ads are seemingly identical. But the ad on the right has a simple red flag emoji added to the headline.

Nothing major, right?

Well, Scoro A/B tested these two headlines, and the results were astonishing. The headline with the emoji had 241% more clicks than the one without an emoji.

It’s worth finding out whether your company can have the same success.

Start running A/B tests on your upcoming ad headlines.

Use them in your push notifications

If you have a mobile app for your business, you have an advantage over all of your competitors who don’t.

Having the app is a great start, but you need to make sure you’re getting the most out of the tools at your disposal. You need to learn how to target your mobile customers with push notifications.

These messages get sent directly to the devices of your app users. It’s a great way to contact them with various promotions.

But just like with your email subject lines, the campaigns are useless if nobody clicks on them.

Studies suggest that adding emojis to push notifications can increase open rates by 85%.

The open rates are 135% higher on Android devices than on iOS devices.

That’s an enormous difference.

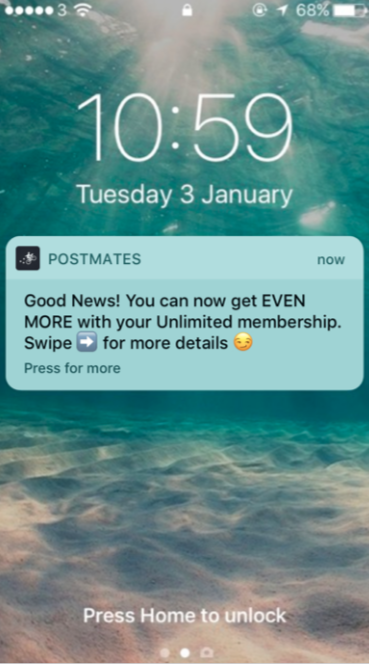

Here’s an example of how Postmates used this strategy with one of its push notifications:

It’s a simple and effective way to promote its membership.

Since push notifications have a limited character count, it’s important to grab the attention of your app users with just a sentence or two at most.

The arrow emoji reflects the swiping motion. And the side smirking face implies there is some type of secret or information worth reading.

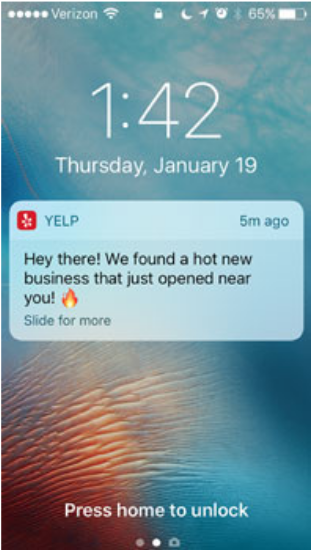

Here’s another example, from Yelp:

Again, it’s very simple. It’s using a flame emoji to enhance the phrase “hot new business.”

It’s not rocket science.

You don’t need to create your entire push notification strategy around emojis.

Just write what you were planning to say in the first place. Then add an emoji or two that fit the description, and you’re all set.

Program your chatbots to use emojis

How are you communicating with your customers?

You can provide better customer service by implementing live chat. Now your customers can reach you when it’s convenient for them, without having to make a phone call or send an email.

But it’s not always easy to have a customer service representative available to respond to these messages 24 hours a day, 365 days a year.

That’s where chatbots come into play. You can set up a chatbox to automatically appear in the corner when someone lands on your website.

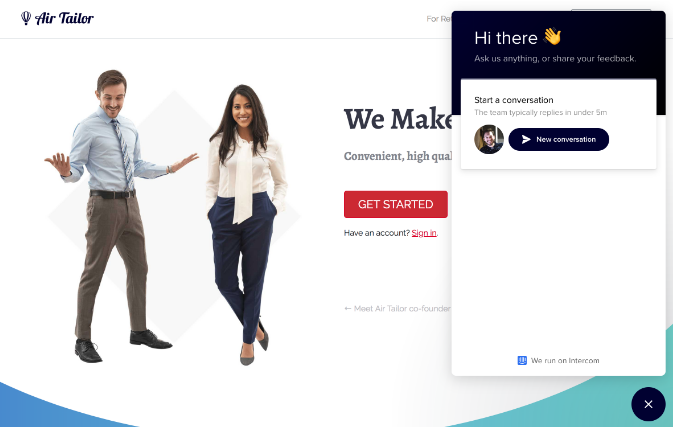

Take a look at how Air Tailor uses this strategy on its homepage:

For a business that promotes affordable clothing alterations, effective customer communication is definitely important.

Everyone has unique requests and needs when it comes to getting their clothes tailored. So getting welcomed by a chatbot is a great feature.

According to a recent study from Wise Merchant, adding emojis to the chatbot feature has helped Air Tailor grow by 100% each year.

This strategy worked for them, and it can work for your business as well.

An emoji from a chatbot adds a human element to the conversation, even though the communication is with a robot.

Include emojis in your meta titles

While you may not think of it, people are using emojis in search queries.

Adding an emoji to your meta titles can help improve your SEO strategy. The increase in clicks will drive more traffic to your website.

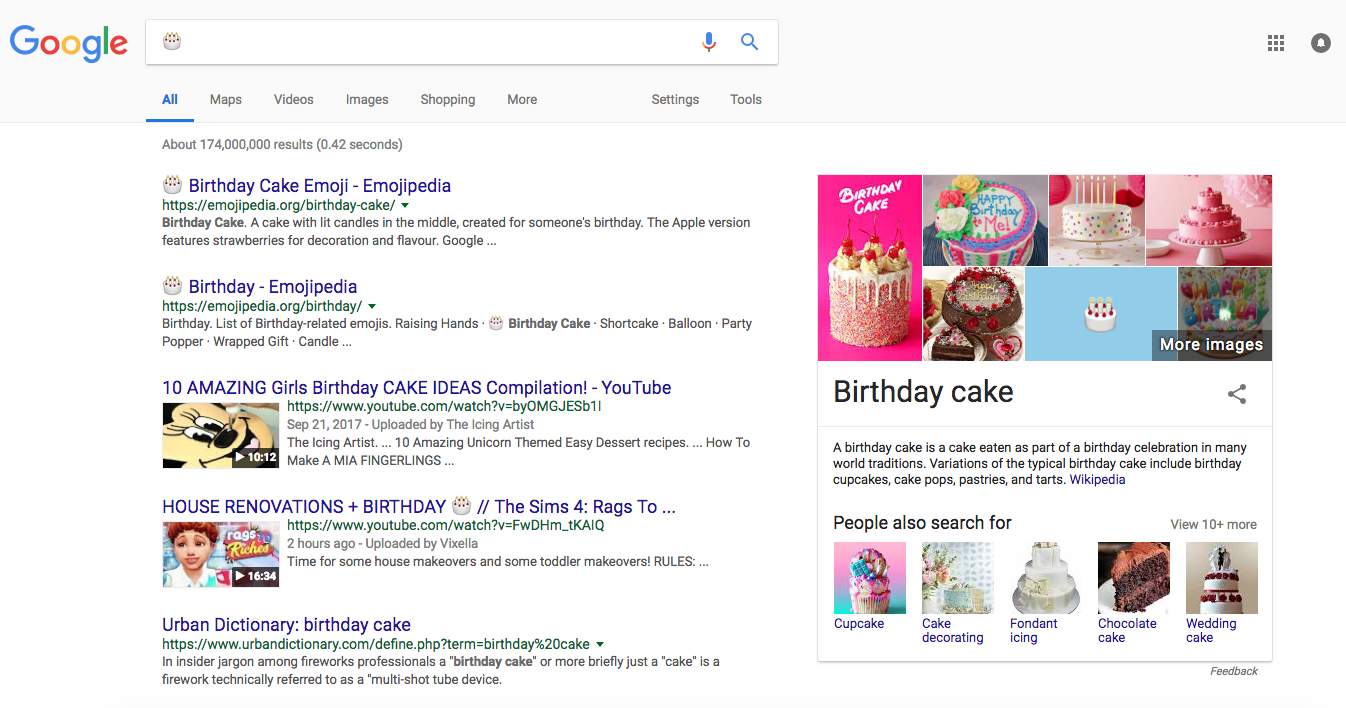

Here’s an example of what happens when you add the birthday cake emoji to your Google search:

Look at the top two results on the page. They both have a birthday cake emoji in the meta title.

The top two ranked pages of search results control roughly 50% of all clicks.

Adding an emoji to your meta titles and even meta descriptions can increase your chances of getting ranked higher.

Add emojis within the text of your marketing emails

Earlier I discussed how you can use emojis in email subject lines to increase your open rates. But that’s only half of the battle.

Now you need the email recipients to consume the content, click, and convert.

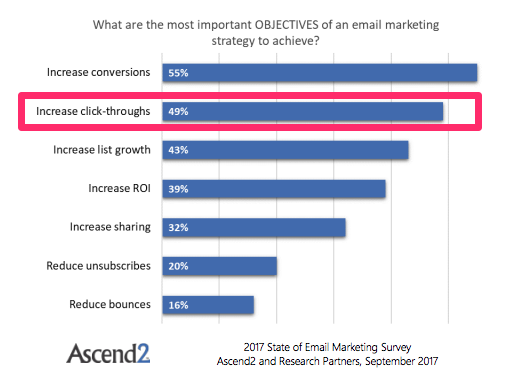

Increasing click-through rates is a top email marketing objective according to a survey of business owners and marketers.

That’s because there is a direct correlation between clicks and conversions.

Getting more clicks can ultimately help your business make more money. Depending on the goal of your campaigns, these clicks can directly drive sales.

A recent study reported that some businesses enjoyed a 93% increase in click-through rates after adding emojis to their email content.

Use emojis in the subject line to generate opens. Then continue using them within the body of the message to increase click-throughs.

Enhance your Instagram captions

You can’t have an effective emoji strategy without changing the way you do things on social media.

Adding an emoji to your Instagram captions is a great way to increase engagement with your followers.

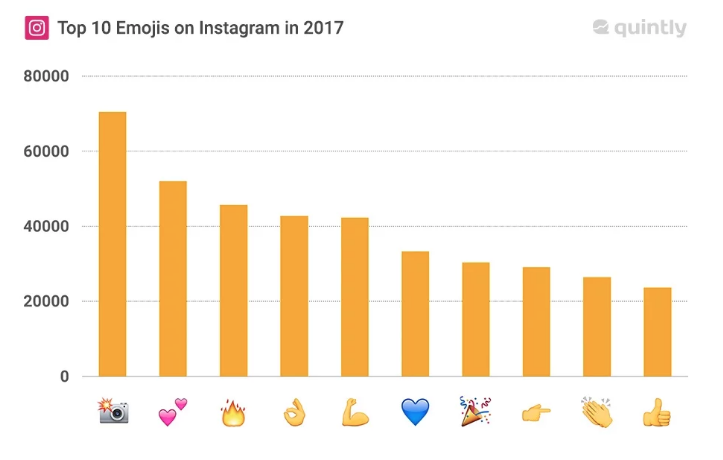

Here’s a look at the top ten most used emojis on Instagram last year:

Furthermore, posts with emojis increase interactions by 47.7%, which means users are more engaged with the posts.

It’s no surprise that the camera emoji was at the top of the list. I see this one used all the time.

People commonly use the camera emoji to give credit to another user who took the photo.

If your brand is encouraging user-generated content and sharing photos submitted by your followers, you can use this emoji instead of typing “photo credit.”

Gain an advantage over your competition

If you start using emojis in your marketing strategy, it will help you stand out among your competitors.

While emojis are popular for personal use, businesses are still adapting to this trend. It’s not a strategy that’s being implemented by everyone just yet.

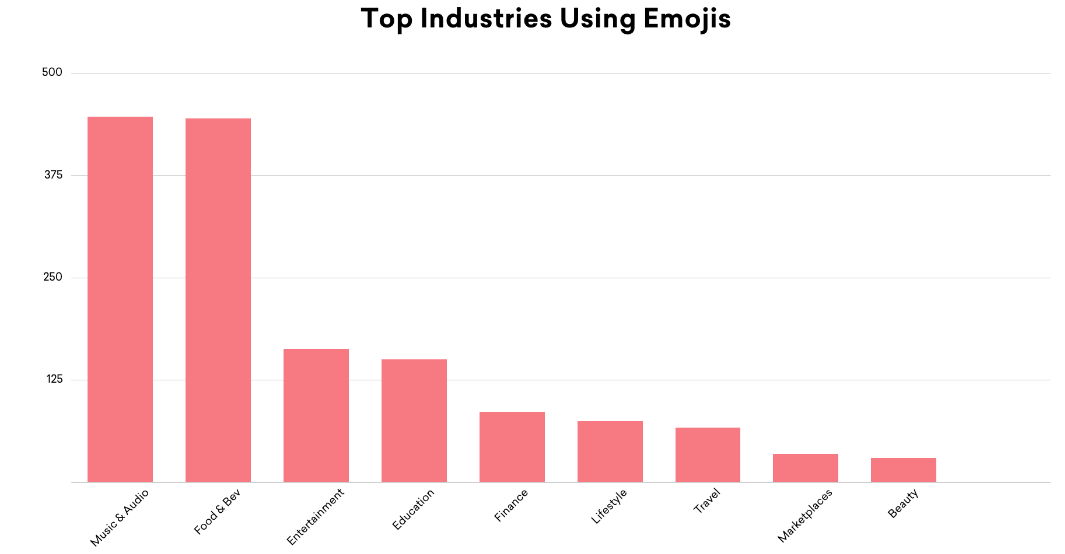

These are the top industries using emojis:

As I said earlier, emojis bring a human element to your marketing strategy.

Consumers don’t feel comfortable interacting with giant corporations. If you take yourself too seriously, you won’t appeal to your customers.

You can use emojis while still remaining professional.

When consumers see emojis in your marketing campaigns, they will feel as though they’re getting a message from one of their friends.

Jump on the emoji bandwagon before your competitors have a chance to catch up with these trends.

Get creative on Twitter

While Twitter may not be your primary marketing channel, you should still have an active account and post content on a regular basis.

Emojis are a great way to drive engagement on your posts and generate clicks. This is especially true if you’re sharing a video.

Pairing an emoji in a tweet containing a video generates six times higher interest and emotional connection among your followers.

Even if you’re not sharing a video, you can still get creative with emojis to improve your tweets. Look at this example from Domino’s Pizza:

Sure, it may be a bit corny, but it’s definitely creative.

Just look at the engagement on this post. It has more retweets than favorites, which means it’s being exposed to a wide audience.

As a result, the page will be seen by more users, even if they don’t follow the brand.

This increase in exposure will translate to more traffic to the company’s profile and website and ultimately yield more clicks.

Conclusion

It doesn’t look like the emoji trend is going away in the foreseeable future. You need to recognize this and start promoting your content accordingly.

Add emojis to your email subject lines to increase your open rates. Then continue using them within the body of your emails to generate click-throughs.

A/B test emojis in your ad headlines. Use emojis to enhance your push notifications.

Add a human element to your live chat feature by programming your chatbots to use emojis.

Use emojis in your meta titles to improve your SEO ranking. This will help give you an advantage over your competition.

Emojis will increase your engagement metrics on Instagram and Twitter as well.

You don’t need to apply all of these strategies right away. Pick a few and see how they work out for your brand.

Which emojis are you using to increase click-through rates for your marketing campaigns?

Source Quick Sprout https://ift.tt/2NrGoFL

Lessons from the Average American’s Food Expenses

Let’s start off with a fact that’s “mildly interesting” on the surface, but takes on a whole different set of meanings when you dig in a little bit.

The average American household spends $7,203 a year on food, of which $4,049 is spent on food at home and $3,154 is spent on food away from home.

Let’s break that down a little bit into numbers that are more practical for how you and I live our lives.

Each month, the average American household spends $600 on food, of which $337 is spent on food at home and $263 is spent on food away from home.

Each week, the average American household spends $139 on food, of which $78 is spent on food at home and $61 is spent on food away from home.

Each day, the average American household spends $19.73 on food, of which $11.09 is spent on food at home and $8.64 is spent on food away from home.

Before we go on, let’s break this down into individual people. The average American household is 2.58 people, thus the average American person spends $2,792 per year on food, or $233 per month, or $54 per week, or $7.64 per day on food.

What does $7.64 per day look like?

It means that virtually any day that you eat out is an above average food spending day. If I eat a full meal at almost any restaurant, I’m going to be spending more than $7.64. There are a few restaurants that can slip a meal in under that price, but it’s either something super unhealthy and of questionable origin or it’s something quite small.

The reality is that eating out is a budget buster, moving you quickly above the American average food expenditure. If you treat eating out as a consistent “everyday” or “multiple times a week” phenomenon, it is extremely likely that your food spending is significantly higher than the average American’s.

In fact, the same is probably true if you eat convenient prepackaged foods. If you eat a prepackaged meal, it’s probably eating up a lot of that $7.64 that the average American spends on food each day.

That has consequences. If you look at the full annual budget for the average American, the extra money you’re spending on food has to come from some other budgetary element. Where is it coming from? Clothing? Housing? Retirement savings? Health care? Entertainment? For a lot of Americans, it comes from credit cards, to be quite honest. None of those options are particularly wise when it comes to financial success.

Your excess food spending comes from somewhere. What other part of your budget is it consuming?

For me, the solution to this problem was to ensure that my baseline meals were as inexpensive as possible. Unless there is a reason to do otherwise, I strive to eat cheap meals, which are meals made at home out of inexpensive staple foods or things on sale at the store.

What do I mean by “inexpensive staple foods”? I’m referring to what I call the six frugal food staples: rice, beans, dry pasta, eggs, fresh produce (on sale), and oatmeal. Those staples, mixed with things to flavor them (spices, sauces, sweeteners, and so on), can form the backbone of a healthy, nutritious, and varied diet. That’s because those six staples can be remixed in infinite ways. They form the backbone of a lot of different meals and cuisines from around the world.

The best part, of course, is that those six staples are really cheap. A meal utilizing rice, beans, oatmeal, on-sale fresh produce, dry pasta, or eggs is a meal that’s probably going to come in under $1. I can make a lot of meals for less than $1 per person using those ingredients as a baseline. Thus, those ingredients are often the backbone of many of our meals.

For example, for breakfast, the cost of a pound of cooked oatmeal is about $0.25. I can whip up a couple of pounds of cooked oatmeal ($0.50 or so) and add some fresh fruits on sale (another $0.50) and maybe a bit of sweetener (another quarter) and then feed my family of five breakfast for a cost per person of about a quarter. That’s a “default breakfast” for us, leaving us with $7.39 to spend on the rest of the day’s food.

Alternately, I might scramble a dozen eggs (total cost: around $2) and lightly season it (total cost: around a quarter) for breakfast for the five of us, giving each person roughly two and a half eggs worth of scrambled eggs. Per person, the cost of that is around $0.50, leaving us with $7.14 apiece for the rest of the day.

Lunchtime might include a rice and bean bowl or some pasta with sauce that was purchased on sale or something left over from a previous meal, making for a dirt cheap lunch.

This leaves us with $6 or so per person for the cost of dinner, and if I can come in way below that, we’ve spent substantially below the national average for food for a day. If I can do that most of the time, then we can eat out occasionally and still stay well within a completely reasonable food budget.

It starts with cooking at home, not relying on convenience foods, and using inexpensive nutritious staples as the backbone of your meals.

There’s another key lesson hidden in these numbers: Averages don’t paint the full story.

So, the data says that the average American spends $7.64 in food on a given day. Let’s take a group of 50 Americans. On average, those 50 people should spend a total of $382 on their food, right?

Let’s say one of the group of 50 eats out at a restaurant and drops $50 on his meal and eats $5 in food over the rest of the day. Another person eats out at a restaurant for $20 and eats another $5 in food over the rest of the day.

Those two people together spent $80 on their food. That means that the remaining 48 people in the group spent a total of $302 on their food for the day ($382 minus the $80 spent by the two big spenders). Those remaining 48 people only spend $6.29 for the day on their food.

The reality is that numbers like the $7.64 a day “average” are really skewed by the big spenders that are spending many multiples of that amount on food in a day. These are people going to expensive restaurants or eating all of their meals at moderately priced restaurants or consuming super-expensive ingredients at home. They’re out there and they’re busting the average.

What’s actually more interesting is the median person’s data.

Imagine if you take those 100 people and line them up in order of how much they spent on food for the day. The person right in the middle of the line is the “median” person – the same number of people spent more than him or her as people who spent less than him or her.

Compare that to “average,” where everyone in the line adds up how much they spent on food for the day and then divides that by the number of people in line.

The truth is that this “median” person almost assuredly spent less than $7.64 on their food (which was the “average” amount). How do I know this? The simple fact that lots of people spend many multiples of that amount on food each and every day, as witnessed by the existence of expensive restaurants and the presence of expensive foods in grocery stores.

For another example of the difference between “median” and “average,” look at American incomes. In 2015, the median household income (meaning everyone stands in line and we look at the person in the middle) was $56,516, while the average household income (meaning we add up everyone’s incomes and divide by the number of households) was $79,263. How is that possible? It’s possible because some people earn far more than the average – many, many, many times more – in a given year, and that skews the average.

The truth is that the “median” person – that real person in the middle – almost assuredly spends less than $7.64 on food per day. My back-of-the-envelope math, which is extremely rough and based on some guesses, says that this person’s average food spending is somewhere between $5 and $6.

What’s the point? Aiming to spend something like $1.50 per meal and $1 on snacks for the day puts you pretty close to what the median American spends on food in a given day. You’re not a big spender and you’re not a small spender if you aim for that.

In fact, if your salary is somewhere in the middle of the pack, one way to get ahead is to put in the effort to keep your numbers below that. Aim for $1 meals as much as you can. Learn how to use the six frugal staples as much as you can (and a few other good bargains, like chicken and peanut butter). Cook at home as much as you can.

As Dave Ramsey says, “Live like no one else so you can live like no one else.” If you aim for average, you’re going to get average results.

Sometimes, the reality of how other Americans actually live can be a really helpful eye opener.

Good luck!

More by Trent Hamm:

- How I Shop: Specific Tricks for Your Next Trip to the Grocery Store

- 10 Smart Ways to Use Leftover Rice

- How to Reduce the Urge to Eat Out

- Surviving and Thriving on an Extremely Small Food Budget

The post Lessons from the Average American’s Food Expenses appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2wTzG0O

I’m 23 and Afraid Full-Time Work Will Kill My Dreams for My Chess Game

Dear J.,

Hold up. We need to break this down a little bit. You’ve got a lot of thoughts and ideas swirling in your head, and I wonder if your worries are starting to cloud your judgment. (We’ve all been there.)

Buying a camper and renting out your mom’s house sounds like more trouble than it’s worth. Beyond needing the cash upfront for the camper, you would have to administer to the needs of your frequent short-term tenants.

Could you take on a roommate or two to live with you inside the house instead? Your utility bills may rise from having additional people, but you’d be splitting the tab with your roommates. Plus, you may be able to share some additional expenses, like grocery staples or streaming video services.

Having roommates isn’t always easy — especially when you want to preserve your quiet time for studying. But it may provide a short-term solution to make taking care of your mother’s home more bearable.

Now, for your work schedule. The way I see it, you have two options.

The first is to use some of your savings to supplement your part-time income. Doing so will buy you time to study chess. Because you mentioned chess is your priority, and your love of recreational vehicles did not exactly come up, I’m going to guess that would be a better use of your savings than a camper.

The second is to take on more hours at your current job. I know this will be hard to consider, because you’re dedicated to your studies. But sometimes, having a challenging schedule pushes you to work smarter.

A colleague recently reminded me about Parkinson’s law: Basically, it says that work expands to fill the time you have to complete it. When I’m busy, I might be stressed for a short period, but I can get a lot done. When I don’t have a lot on my schedule, I find that even the smallest tasks can take hours.

What could you still accomplish with your chess studies if you worked five more hours each week at your job? What if you could take on 10 more hours of work? Could you still reach your chess goals and be able to earn that grant?

If there’s little availability at your current job, think about taking up a side gig that has a low barrier to entry. Maybe you could serve as a chess tutor and use the skill you already have to make extra cash.

Map out a few different options — not for the long term, but to get you through the next six months to a year. Where can you add hours at work or add on side gig earnings? How much could you cut back your chess studies and still develop your skills? This seesaw might need to dip to one side more heavily than the other for a while.

And those days when you feel pressed for time and you’re eating cereal for dinner (again) and you’re staying up late because you have to, remember that this is only temporary. This is only temporary.

The inbox is open. Submit a question or send your worries to dearpenny@thepennyhoarder.com, and I’ll see what I can do to help.

Disclaimer: Chosen questions and featured answers will appear in The Penny Hoarder's “Dear Penny” column. I won't be able to answer every single letter (I can only type so fast!). We reserve the right to edit and publish your questions. Don’t worry — your identity will remain anonymous. I don’t have a psychology, accounting, finance or legal degree, so my advice is for general informational purposes only. I do, however, promise to give you honest advice based on my own insights and real-life experiences.

Lisa Rowan is a senior writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2wR9DYY

Tight Budget Will Travel: How We Planned for Three Weeks Overseas

As my best friend Megan and I began to plan our trip to see Scotland and Ireland, we quickly realized we could see a lot more and stay a lot longer if we planned the trip ourselves.

Here’s how we did it.

Creating the Vacation Budget

Megan and I have long been motivated to travel. Together, she and I have explored the Pacific coast, our nation’s capital, the beaches of Mexico, the city of St. Louis and more. Separately, we’ve adventured all around North America.

To do so, Megan and I have given up a fair amount. While friends our age spent their money on frequent nights out, Megan and I stayed in for board game nights. While they bought new electronics and clothes, we made do with less. We recognized that if we wanted to travel as twentysomethings, we would need to be serious about sacrificing some nice-to-haves to save for absolutely-must-dos.

For me, that meant putting between 4% and 6% of my biweekly paycheck into a sub-savings account I had created specifically for vacation savings. If I earned unexpected income through a surprise freelance piece or a stuffed birthday card, I put that money into my savings as well.

For more than two years, Megan and I saved this way. We dipped into our vacation funds for trips to Cedar Point, Gatlinburg, New Orleans and more, but the bulk of those savings were waiting for our big European adventure.

Eventually, we had each set aside $4,000 for the trip of a lifetime.

Deciding to Plan a Trip All by Yourself

Originally, Megan and I had intended to do a paid tour of Ireland and Scotland. There are, admittedly, a lot of benefits to paid tours: You don’t have to plan anything on your own, you don’t have to worry about driving (and getting lost) and you have an expert who can give you all the information you could ever want about each amazing thing you see.

The downside? Tours of Scotland and Ireland are expensive. For the $4,000 we had saved, we could afford a 12-day guided tour – with enough money left over for flights, uncovered meals and souvenirs. For the same amount, we managed to explore all of Ireland, Northern Ireland and Scotland for 21 days.

Guided tours are also limited in their scope. They really only take you to the highlights, without the flexibility to see some of the lesser-known gems of the countries. We saw all the amazing stops the guided tours would have offered, but we also hiked up the mountainous coast of Ireland’s Slieve League, biked through the pastures of the Aran Islands and spent five nights truly experiencing the wilderness of the Scottish Highlands — all of which we would have missed with basic tour packages.

Planning a Three-Week Trip

Though we saved money by opting to plan the trip ourselves, Megan and I spent dozens of hours during evenings and weekends researching and designing the trip. Be ready to invest time in place of money.

Selecting What You Want to Do

Our process started by studying existing tours offered by major companies, to see what common stops they included. We used sites like TripAdvisor to discover can’t-miss attractions and locations. Friends and family who had previously visited the countries offered insights on their favorite memories. Using this, we were able to compile and prioritize everything we wanted to do over the course of three weeks.

We made to sure to balance the trip well with historic sites, museums, beaches and hikes. As you map out your extended vacation, make sure you don’t put too many castles or museums in a span of just a couple days or you might burn out. Likewise, too many hiking days in a row can be draining if you’re not in peak physical condition.

For food and drink, Megan and I researched TripAdvisor’s top-rated restaurants and pubs in each area we would be visiting and compiled a list with notes on the cuisine, price and atmosphere. That way, when we arrived in a small town, we knew our options, where they were located and how much we would likely spend at each. This made choosing a lunch place a fast and easy process, while still giving us the flexibility to eat something we were in the mood for.

Timing

The best advice I have when planning a trip of this size is to allow more time than you think you’ll need. Investigate the forums for every museum you intend to tour, every hike you plan to take, every castle you intend to explore — and see how long people say they spend there.

Our rule of thumb was to average the numbers we saw and add a little padding time (roughly 15 minutes for every hour). So if the average time spent at a location was two hours, we would plan 2 1/2 hours.

We also applied this to driving time. We used Google Maps to chart out all of our stops and lodging; we even noted the time in between each stop. We always rounded up to the nearest hour or so to account for parking and missed turns, which happened quite a bit.

This method worked for us. Megan and I had only one close call over three weeks: We were two minutes late to our Guinness Storehouse tour, but as it was self-guided, there was no harm done. Otherwise, our careful planning and time estimation ensured we never missed a thing.

Booking Flights, Lodging and Attractions

Megan and I followed the findings of CheapAir.com’s 2017 study when booking our trip. They found that the best deals on European flights were found 99 days out. Though we didn’t book exactly 99 days out, we acted right around the three-month mark and definitely got the best deal. Prices had been dropping steadily until then and started to climb back up shortly after we booked. (Note: The study been updated for 2018.)

We also thoroughly researched lodging for each city we intended to stay in. To save money, we spent most nights at hostels. You get what you pay for with hostels: There is a lack of privacy, showers are an awful affair (most require you to press a button every 10 seconds to keep the water going) and the beds are just a flimsy piece of foam with a limp excuse for a pillow.

However, hostels are significantly cheaper than hotels and bed-and-breakfasts. If you can sacrifice some personal luxuries in the name of seeing and doing more on your trip, book hostels. For our sanity, Megan and I sprinkled in a few nice bed-and-breakfasts, castle stays and unique sleeping cabins (e.g. Jedi huts at Skyewalker Hostel) to break up the hostel routine.

We kept our entire itinerary in a detailed Excel workbook with hour-by-hour guidance on what we’d be doing — driving, sleeping, eating and, most importantly, exploring. Since we knew when we expected to arrive at each attraction, we were able to pre-book tours and tickets online in advance. Most places offered notable discounts (multiple pounds/euros) for booking online, and several places (especially tours in big cities) had sold out by the day of our arrival, meaning we would have missed out had we not booked in advance.

Because we did not have a tour guide joining us at each stop, we thoroughly researched each destination ahead of time. I made Megan and myself detailed folders with history lessons and fun facts about each stop on our route, which added something extra to our trip (and gave us something to talk about over breakfast each morning).

When booking your flight, lodging and attractions — and when spending money during your time abroad — use a travel rewards credit card with no foreign transaction fees. By using our Capital One Venture card, we earned a couple free nights of lodging.

Packing for a Three-Week Trip

Perhaps more daunting than planning a three-week trip is packing for one. You want enough space to pack all the essentials, but you don’t want to overpack and have to carry multiple bags down Edinburgh’s cobblestone streets. Megan and I managed with one duffel bag each and a couple backpacks.

A few packing must-haves:

- Packing cubes

- A microfiber towel (if showering at a hostel)

- TSA-approved locks

- Extra phone chargers

- Weather-appropriate clothing and shoes (in Ireland and Scotland, this meant layers, rain jackets and waterproof shoes)

- Protein bars or protein-heavy snacks (so you can skip breakfast)

- A water bottle

If you will be gone for three weeks, plan to spend time at a laundromat or, if you’re lucky like Megan and me, stay with a friend who lives abroad and use their laundry machines. By washing your clothes instead of packing enough to last you 21 days, you will save a ton of space. And don’t be afraid to rewear clothes — a lot. Just bring long-lasting body spray or Febreeze, and voila! You can suddenly wear your same Dunder Mifflin T-shirt for the third time in a week.

My biggest mistake on the trip was overpacking. I packed more shoes than I needed, and despite three options for pajama shorts, I wore the same pair every night. I also packed three books and only finished one of them (I know: I need an e-reader).

Money-Saving Tips

Megan and I did not plan our trip perfectly. We made some money mistakes along the way, and at times we felt a little rushed. However, we also did a lot of things right. Here are the ways we saved money on our trip:

Download Offline Google Maps

Rental car companies will try to sell you cars with navigation systems for a steep daily rate. However, many reviewers online lamented that the maps were not always up-to-date. Instead, Megan and I downloaded the Google Maps for each of the countries we were visiting and then accessed them while in airplane mode. Though they lacked real-time traffic updates, the maps still gave us turn-by-turn directions, and the only times we got lost were because of human error, not map error.

Stay in Hostels

I’ve already mentioned this, but it bears repeating: Stay in hostels when you can. We spent about $20 to $30 a night each on hostel lodging, compared to the $50 to $75 we would have spent each on hotels or bed-and-breakfasts. Most hostels also offer free breakfasts and discounts on day tours or overnight tours out of the cities.

Request a Hybrid

Petrol is more expensive in Europe, and I have a lead foot. It was immensely helpful to our wallets to drive a hybrid in each location. How’d we swing that? We simply asked when making the reservation, and it came at no extra cost.

Get Full Coverage

If your credit card and personal auto insurance do not cover you abroad, get full coverage for your rental. The country roads of Scotland were rough, particularly in the Highlands. Our rental suffered multiple large dents that we were ultimately not responsible for since we opted for the full coverage.

Walk

When you visit major cities, it can be tempting to park near your destination in an expensive parking garage. But if you do your homework before visiting, you’ll likely find cheaper lots (or free spaces) that might require you to walk a little farther. Though our feet and knees were sore most nights, Megan and I saved a lot of money by walking farther — and I lost 20 pounds (in weight!) on the trip, despite stuffing my face with potatoes every meal.

But when I say “walk,” I don’t just mean walk from the car park to your destination. I also mean you should make walking your actual activity. My favorite memories of my trip were the experiences I had outdoors: hiking to Steall Falls, exploring the Neist Point lighthouse, collecting shells on Derrynane Beach. All of those had two things in common: They required a lot of walking, and they were completely free.

Set a Daily Budget

After booking flights, lodging and attractions, Megan and I knew how much we had left of our $4,000 to spend on food, booze, souvenirs and gas. We simply divided that number over 21 days and determined how much we had for our daily allowance. Of course, we also remembered that for three weeks, we weren’t spending money at home on groceries, gas or entertainment, so we padded our wallets with a little extra.

Don’t Overpay for Drinks

A friend told us never to pay more than 5 euros for a pint of Guinness in Ireland. She wasn’t wrong. Prices for Guinness ran the gamut, but pints were most expensive in the most touristy places. If we ordered a Guinness that was significantly more than 5 euros, we knew: 1) we should find a less touristy place for an authentic experience; and 2) we were being ripped off.

Timothy Moore is an editor and freelance writer living in Germantown, Ohio, with his partner and their two dogs. He has traveled to lots of cool places, including Mexico, Scotland, Ireland and all over the US, but his favorite vacation is and will always be to Cedar Point in his home state.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2Nu5wvs

Property auctions: how to avoid hammer horrors

Buying at auction is an increasingly popular way to pick up a bargain.

Your home sale or purchase will go through much faster than via an agent and you can even buy your dream home or fixer-upper online. But watch out for the pitfalls – and remember, don’t bid unless you’ve done your homework and have your finances sorted.

Think property auctions and the BBC’s Homes Under the Hammer is likely to spring to mind. It’s fascinating to watch individual investors and developers buying fixer-uppers to revamp and resell or rent out.

But there is a change taking place, with many leading auctioneers reporting that more home buyers are making a bid for a place to call their own, tempted by the lower prices listed at property auctions and by how quickly they sell.

Read more: Buying a freehold home? Check the small print

How to find an auction

To find out about auctions in your area, check adverts in local and specialist property newspapers. Other good starting points are:

Essential Information Group (EIG) Offers a comprehensive database of property auctions. EIG is offering Moneywise readers a two-week free trial (see below).

IAM Sold Search for properties online throughout the UK. Iamsold.co.uk/auction

NAVA Propertymark The self-regulatory body for valuers and auctioneers, it has a useful ‘Find an Expert’ tool. Nava.org.uk/find-an-expert

Pattinson Holds live auctions in the North East and North West of England and online auctions in London, the Midlands, Scotland, Wales and Yorkshire. Pattinson.co.uk/auction

Rightmove When you search by area, there is a filter to show auction properties only. Rightmove.co.uk

SDL Auctions Search for online and live auctions nationwide, with properties added daily. SDLauctions.co.uk

One advantage for buyers is that you can bid for properties that you won’t necessarily find via an estate agent. For instance, it’s a good place to find a bargain property being sold by mortgage providers looking to offload a repossession or by executors wanting a quick sale.

“We get a lot of properties via executors who want to get a good price in a fixed timescale. They don’t want to be faffing around with estate agents for a long time,” explains Paul Mooney, director at Savills national auctions.

From a seller’s point of view, auctions are attractive because of the speed of the sale – and fees may work out cheaper than paying an estate agent commission.

According to figures from Rightmove for July 2018, it takes 57 days, on average, to get a property marketed on the property portal until it is sold subject to contract – plus you need to allow several weeks more to exchange and complete. In contrast, it takes around 21 days to get a property marketed before auction day and if sold, the completion date is usually 20 working days later.

Auction room bidding

I spoke to Gary Murphy, co-head of auction house Allsop’s residential department, just before he picked up his gavel at its London auction in July.

“Most people of a certain age have a home to sell if they are going to move, so that has always been a bit of a barrier to buying at auction. But for first-time buyers, second-home buyers and amateur buy-to-let investors who may be in rented accommodation, it’s great, because you know you can buy very quickly and efficiently,” Mr Murphy says.

But he stresses the legally binding aspect of a traditional (also known as an unconditional auction). “I always say at the start: ‘Unless you’ve seen the property, unless you have the money in place, don’t bid’ – but they don’t always listen.”

Windmill, Sutton, Norfolk

Guide price: £35k | Sold: £92k | Three bids | IAM Sold

Once the auction got under way, there was a flurry of activity, with bids often escalating by £5,000 at a time and properties selling for well above their reserve price (the minimum price a seller will accept). However, some were occasionally withdrawn because they didn’t reach their reserve price.

Bidding seems quite straightforward, so you needn’t worry about buying a £10 million house because you’ve scratched your head.

Mr Murphy explains: “We get a real mix of regular and novice bidders. Once someone is in the bidding, the first bid is quite obvious and then it could just be a blink… it’s almost subliminal after several bids back and forth.”

When the gavel comes down, the buyer will pay a deposit of 10% and complete the sale 20 working days later.

To give an idea of fees, at Allsop the buyer will pay a £1,000 buyer’s fee, while Allsop’s standard commission fee for sellers is 2% , with a minimum fee of £1,000 plus VAT. Then there is an entry fee for marketing and listing your property, which ranges from £450 to £2,000 plus VAT, depending on the size of the entry in the catalogue.

Surprisingly, remote bidding (by phone and online) only accounts for around 10% of bids at Allsop.

Read more: Could you win a home? The pros and cons of property raffles

Allsop auctioneer Gary Murphy takes the bids

Online auctions

While some bidders prefer the thrill of a live auction room, there is a growing trend towards online bidding. The main firms leading the online auction revolution are IAM Sold, Pattinson and SDL Auctions. These offer estate agents an online platform for auction sales.

When IAM Sold first introduced online auctions in 2011, around a fifth of its auctions took place this way. By last year, just under two-thirds (62%) were online.

You can bid for homes you won’t find via an estate agent

Jamie Cooke, managing director of IAM Sold, says: “Buyers can benefit from being able to bid from the comfort of their own home 24 hours a day, 365 days a year. Not only that, but it offers greater transparency – a property sold at an online auction will achieve its true market value with huge exposure to the market because the platform never closes.”

Jason Lee, national sales manager at SDL Auctions, adds that homeowners buying at auction are not necessarily cash buyers.

“It’s a huge misconception that you can’t buy at auction with any sort of funding – just over half of all of our sales now are to people with some sort of funding, whether it be mortgages, bridging loans or the Bank of Mum and Dad,” he says.

Whereas live auctions tend to list investment properties, online auctions are more varied.

“What we’re finding is that more people who know their property is highly desirable, and that they can sell it quickly, are going down this route. We’re selling anything from a one-bedroom, run-down apartment to properties well in the millions, where you can move straight in. It’s very similar to what many people use almost every day, and that’s eBay,” Mr Lee adds.

At SDL Auctions, the seller pays a set fee of £199 plus VAT, while the buyer pays 3.5% of the purchase price plus VAT – so it’s very different from a traditional estate agent’s fee, where the seller will pay the agent and the buyer will have no fees to pay.

At Pattinson, the seller pays no fees, while the buyer pays an administration fee of £780 (including VAT).

Two-bedroom semi, Bury, Greater Manchester

Guide price: £132k | Sold: £149k | 16 bids | SDL Auctions

Meanwhile, IAM Sold’s fees for both live and online auctions range from 2.5% to 3.5% of the purchase price, depending on what the agent wants to charge, with a minimum fee of £5,000 plus VAT. It’s up to the seller whether they or the buyer will be liable for the fee. In most cases the seller will opt for the buyer to pay the fees, but sometimes they will pay them – for example, if it’s a property aimed at first-time buyers.

Moneywise trial offer of EIG auction website

Essential Information Group (EIG) is offering Moneywise readers a free two-week trial of its auction website.

EIG’s search facility enables you to find auction properties across the UK. The website includes pictures, guide prices, auction results, lot details, similar properties, location maps, legal documents and more. It is recognised as the industry standard for auction information and includes details on over 750,000 properties for you to browse and search.

Access to the website costs £175 a quarter, £275 for six months or £475 a year, plus VAT.

To take up the trial offer, you need to register by 30 September 2018 and either call 01737 226150 quoting ‘Moneywise trial offer’ or visit Moneywise.co.uk/eig-offer.

Buyers beware

Sensible buyers will get a lawyer to check the contract in the weeks before bidding, but some professionals will just look at the legal documents on auction day.

However, Natalie Bradley, head conveyancer at national law firm Stephensons, recommends buyers exercise extreme caution.

“We would not advise any client to buy at auction unless they have had a professional carry out a thorough check of the legal title. Once the deposit has been paid, this is the point of no return and the buyer is contractually obliged to complete the purchase. If they fail to do so, then they will lose their deposit and, potentially, be significantly out of pocket,” she says.

“Even where a professional carries out the legal check it is usually not as thorough as a conventional purchase, as the only information widely available is that which is contained within the auction pack. This could be missing key information that could help in informing the buyer’s decision whether to proceed with the sale. Equally, the auction pack may be missing information which could influence the decision of a lender.

“Drawing on my own experience, I have encountered issues with the purchase of a flat at auction on behalf of a client. The service charge account was massively in arrears and, under such circumstances, we would normally ask for an undertaking from the seller’s solicitors that they would pay all the arrears on completion. However, at auction, it is not possible to obtain such an undertaking before committing to exchange. The buyer would be liable for all arrears if the seller refused to pay.”

“Once the deposit has been paid, this is the point of no return”

Allsop’s team take phone bids at the live auction

Mortgaging your auction home

Unless you’re a cash buyer, one of the biggest hurdles is making sure your finances are in place before you bid.

David Hollingworth, associate director of communications at broker London & Country (L&C) Mortgages, explains: “The time from mortgage application to offer is a process that can take anything from two to four weeks, depending on the circumstances, so starting from a standing start could put severe pressure on timing. If the borrower ultimately finds the amount of borrowing difficult to secure, it could jeopardise meeting the deadline, which could risk losing the property and the deposit.”

You can ask a mortgage provider for a mortgage offer in principle – a shortened application form for the borrower to complete their personal details, income and expenditure, which enables the lender to credit check and score them, so that the lender can indicate they will, in theory, be happy to lend up to a certain amount. But a mortgage in principle can’t be transferred to other properties should your bid be unsuccessful.

Mr Hollingworth says: “An agreement in principle is not fully underwritten and is not a guaranteed offer. When a formal application is made, the lender will need to see evidence of income and ID, etc, as well as undertake a valuation of the property itself. If the breakdown of income is different to that originally indicated on the agreement in principle, it could alter the lending decision.

“In addition, if the property did not meet the requirements or the surveyor finds a problem, then a mortgage may be refused.”

Indeed, Nationwide, for example, urges applicants to have an independent structural survey and valuation and to be aware of the condition of the property before attending an auction. It says that a standard mortgage valuation isn’t detailed enough to identify all defects and is only for lending assessment purposes, “especially in auction properties, which are often unusual”.

Nationwide adds that you must have a mortgage offer before bidding, so there is no doubt over any conditions that will apply to the loan. Buyers will need to source the 10% deposit themselves.

Buyers pay 10% deposit and complete 28 days later

Two-bed detached house, Leicester

Guide price: £137k | Sold: £155.5k | 20 bids | SDLAuctions

Read more: Moneywise Mortgage Awards 2018

Bridging loans

If, for example, you are waiting for the sale of your home to go through, a short-term bridging loan could tide you over for a few months – but it will come at a premium and you’ll face exit fees if you want to pay back the loan early.

Mr Hollingworth explains: “Bridging finance will charge higher rates than standard mortgage lending, but may offer an alternative. Specialist bridging lenders may be able to turn things round quickly, and if the property needs substantial refurbishment they could help where traditional lenders could not. That will, therefore, come at a cost and it is designed as a short-term funding solution, but buyers will need to factor in those costs.”

To give an example of what you could pay for bridging finance, Market Financial Solutions has its own funds and panel of surveyors and lawyers, so it can act quickly. Its bridging loans have a loan to value (LTV) of 80%, with rates starting from 0.65%. Buyers can borrow between £200,000 and £10 million with a minimum term of three months and a maximum term of 18 months, with an arrangement fee of up to 2%.

Specialist lender Together, meanwhile, focuses on smaller bridging loans of between £30,000 and £250,000 for residential properties. Interest rates start from 0.49% for six months (1.24% from month seven), with an LTV of up to 75%, plus a 2% arrangement fee (minimum £800).

‘An online auction offers a good chance of selling a house like mine’

Joanna Francis (pictured, left) decided to sell her three-bedroom home in Burton upon Stather, north Lincolnshire, via auction because it is rather unusual. A throwback to the 1940s, it comes complete with Anderson bomb shelter in the back garden, a coal-fired cooking range, a ‘posher’ and dolly tub for washing clothes, and an outdoor toilet.

Joanna says: “The way my house is, the local market wouldn’t have been any good. I need a wider audience where I’d have more chance of a sale.”

The house is being sold with all its furniture and furnishings and Joanna would prefer it to go to someone who would keep it as it is.

The property was auctioned by Pattinson in late August, but there were no bids and it may be auctioned again later this year.

Section

Free Tag

Related stories

- Buying a freehold home? Check the small print

- Could you win a home? The pros and cons of property raffles

- Moneywise Mortgage Awards 2018

Source Moneywise https://ift.tt/2M6v7WP