Infographics are amazing!

Besides being one of the best ways to explain a complicated topic with ease, they make information come alive.

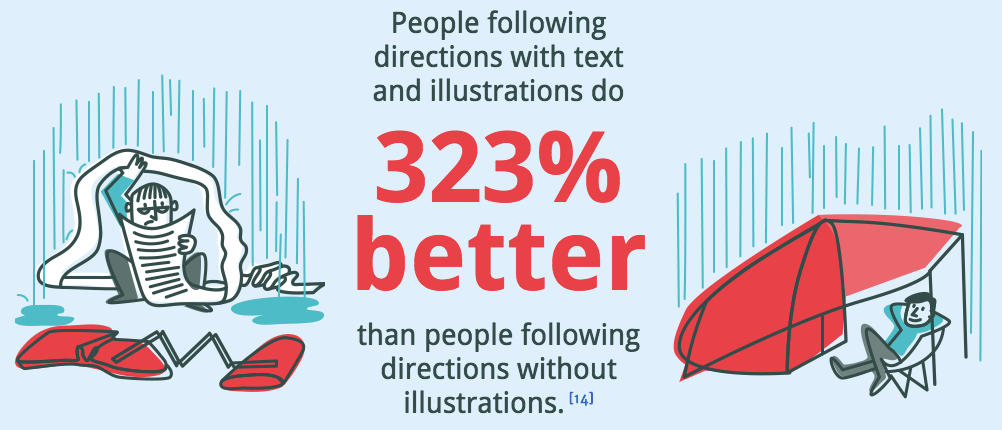

Research found,

people following directions with text and illustrations do 323 percent better than people following directions without illustrations.

Maybe that’s why “infographics are ‘liked’ and shared on social media 3x more than any other type of content.”

And the concept of relaying information through visuals is nothing new.

If you think about it, cave paintings and hieroglyphics dating back to 30,000 BC accomplished the same thing.

They were far less sophisticated but demonstrate just how hard-wired we are when it comes to visual information.

So it’s easy to see why infographics have become so ingrained in content marketing.

They get results!

Unbounce even went so far as to say “infographics are the most powerful tool in your content marketing arsenal.”

And like with any piece of content you create, you’ll want it to be SEO friendly.

But here’s the thing.

Doing SEO for an infographic demands a slightly different approach than the one you would use for a conventional blog post.

In this post, I explain the most vital components of infographic SEO to ensure yours gets proper visibility in the SERPs.

The biggest hurdle

Let me start by saying infographics are technically just images.

They are typically saved in image formats such as JPEG, PNG, GIF, etc.

Of course, they’re much more robust and contain far more information than a regular image, but that’s how Google views them.

This is important to know because Google can’t “read” images like it can text-based content such as a blog post.

Fortunately, there are several other elements that you can optimize.

Start with keyword research

You won’t be able to take advantage of keywords in the actual body of an infographic, but there are a few areas where you can insert keywords.

That’s why you’ll still want to do some keyword research to identify a primary keyword phrase as well as a couple of secondary phrases to target.

Let’s say I was planning on creating an infographic about productivity hacks.

A quick search on the Google Keyword Planner shows me that “productivity hacks” is low competition, which is good.

The only issue is that it’s a short-tail keyword with only two words.

But I could still probably make it work, especially if I added “infographic” to the end of “productivity hacks.”

In terms of secondary keywords, there are a few possibilities.

The bottom line here is to perform keyword research like you would for any other type of content.

The only difference is how you go about inserting those keywords.

File name

Selecting the right file name is vital.

This is one of the main factors that Google will analyze to determine what your infographic content is about.

You need to get it right.

I shouldn’t even have to say this, but you’ll obviously want to stay away from anything generic like Image001.png.

This tells Google absolutely nothing and is going to be a strike against your infographic SEO.

A better choice would be something like productivity-hacks-infographic.png.

It’s short and sweet and lets Google know exactly what your content is about.

Just make sure you’re not doing any keyword stuffing, using the same phrase multiple times or anything else that’s spammy.

But you already know that.

Alt text

Equally important is your alt text.

This is the text alternative of an image that lets someone know what an image contains in the event that it doesn’t load properly.

Screen readers for the blind and visually impaired will read out this text and thus make your image accessible.

More importantly, this gives you another opportunity to explain to Google what’s in your infographic.

Just follow best practices for your alt text and describe as succinctly as possible what your infographic is about.

In this case, I might want to use “Infographic explaining 15 productivity hacks.”

URL

Your URL is important for obvious reasons.

As I mentioned in a post from NeilPatel.com that referenced Google’s top 200 ranking factors from Backlinko, when it comes to the significance of URLs, here is what we know:

- URL length is listed as #46

- URL path is listed as #47

- Keyword in the URL is #51

- URL string is #52

I’m not going to cover the nuts and bolts of URL optimization here.

You can find that in the post I just mentioned.

But I will tell you that you want to aim for a short URL that contains three to five words and a max of 60 characters.

This advice comes directly from an interview with Matt Cutts, so you know it’s gold.

When it comes to keywords, be sure to include one or two of them in your URL.

Research from John Lincoln and Brian Dean found that this is the sweet spot and considered as part of URL keyword best practices (at least for the time being).

H1 tag

Although you can’t capitalize on the H1 tags (or H2s, H3s, etc.) in the body of your infographic, you can still place one above your infographic so Google can “read” it.

Here’s an example:

See how the same keyword phrase that’s in the actual infographic is used as an H1 tag at the top?

This is a simple yet effective way to give your infographic a bit more SEO juice.

While H1s may not be as big of a ranking factor today as they were a few years ago, they certainly don’t hurt.

And they can be especially helpful for infographics where you have a limited amount of text to work with.

Meta description

Ah, the good ol’ meta description.

Here are a few best practices to adhere to when creating one for your infographic.

- It should be between 135 and 160 characters in length.

- It should include your keyword phrase (once).

- It should accurately describe the content within your infographic.

- It should have a CTA at the end to encourage search engine users to click on your content.

Getting it just right should make your infographic go further with Google and help you rake in more organic traffic.

For more on creating a killer meta description, I recommend reading this post from Yoast.

Supporting text

I really like hacks, shortcuts, loopholes, etc.

Call them what you will, little tricks like these are what help you gain the edge on the competition.

And there’s one specific hack I would like to point out in regards to infographic SEO.

It’s simple. Add some supporting text at the beginning.

Here’s a great example of what I’m talking about:

Notice that it’s nothing fancy.

It’s just a few paragraphs that expound upon the infographic and offer a quick preview of what it’s about.

This is helpful for two reasons.

First, it provides a brief description for human visitors, which should hopefully pique their interest and make them want to check out the infographic.

Second (and more importantly), it supplies Google with additional text to crawl and decipher meaning from.

This helps your infographic get found and increases the likelihood that it’s indexed under the right keywords.

So it’s a win-win situation.

There’s no reason to go overboard and write 1,000 words of supporting text, but 100 words or so can be a great help.

An added plus is that you can throw in a couple of internal links to relevant pages on your website.

Don’t force it, but try to work in some internal links as well.

Load time

Back in 2010, Google announced that page speed was a ranking factor.

Content that loads quickly will get preference.

Not only that, a faster load time tends to translate into a lower bounce rate, more time spent on your site and so on.

The point I’m trying to make here is that you should be conscious of how long it takes your infographic to load.

Keep in mind that infographics are fairly bulky images, so this can definitely be a concern.

Generally speaking, PNGs, GIFs, JPEGs, BMPs and TIFFs load the fastest, so keep this in mind when choosing a file format.

You can also test the loading speed of your infographic with this free tool.

Just type in the URL.

Then click “Analyze.”

Google will analyze it and grade it.

If there are any issues, Google will provide you with specific advice for speeding it up.

Conclusion

Doing SEO for an infographic isn’t dramatically different from doing SEO for any other type of content.

It incorporates many of the same techniques and strategies.

The main thing you have to work around is the fact that an infographic is an image and therefore Google can’t “read” it like it can regular text-based content.

Fortunately, there are several ways to get around this and ensure your infographic is perfectly optimized for search engines as well as humans.

By covering all the bases, you’ll position it to climb the rankings and achieve maximum visibility in the SERPs.

Do you have any other recommendations for doing SEO for an infographic?

Source Quick Sprout http://ift.tt/2twXXv1