الأربعاء، 17 أكتوبر 2018

Need Cash for College? Apply for a $2,500 Comcast Scholarship by Dec. 7

The telecommunications conglomerate plans to award over 800 scholarships worth $2,500 each to students in need. That’s more than $2 million.

Who is Eligible for the Comcast Leaders and Achievers Scholarship?

The scholarship program is open to high school seniors who plan to enroll full time at an accredited two- or four-year college in the U.S. in the 2019-20 school year.

To be eligible, applicants must live in one of these cities: Boston, Chicago, Dallas-Fort Worth, El Paso, Los Angeles, Philadelphia, Phoenix, San Antonio, San Diego, New York, Washington, McAllen, Texas, and Orlando, Florida; .

You must provide a zip code to establish eligibility.

Students must have a 3.0 minimum GPA, need financial assistance and show a commitment to community service, good character and leadership.

Application Requirements of the Comcast Scholarship

Students must upload current official or unofficial transcripts and have their parents fill out the financial section using their most recent income tax return.

All applicants must complete two short essay questions. They are:

- What is your most impactful community service experience? Explain why in 2,000 characters or less (about 400 words, including spaces).

- Describe a time when you were able to use your leadership skills. (Keep it to 1,000 characters or less (about 200 words including spaces).

You’ll also be asked to list all volunteer activities, community service, work experience, honors and awards over the past four years.

To begin the application process, you’ll need to create an account, verify your email address and then complete each required section before submitting.

The deadline to apply is Dec. 7, 2018 at 5 p.m. EST. Winners will be notified in March 2019.

Check the FAQ if you have any questions.

The Founder’s Award

The scholarship money doesn’t stop there. Of the 800-ish recipients, an undisclosed number will receive a Founder’s Award on top of the $2,500.

Past Founder’s Award recipients have received anywhere from $5,000 to $10,000.

If you’re strapped for college cash, have good grades and live in the eligible service areas, it can’t hurt to apply for this scholarship because an hour of your time might net you $10,000 toward college.

Like The Penny Hoarder Life on Facebook to discover other scholarship opportunities.

And if you’re looking for even more scholarships to apply for, be sure to check out our list of 100 scholarships that will help you pay for college.

Stephanie Bolling is a staff writer at The Penny Hoarder. She’s never had Comcast.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2ymiC5r

Snag a UPS Seasonal Job at a Nationwide On-Site Hiring Event on Oct. 19

That’s the term the company is using to describe its hiring bonanza prior to the Black Friday and Cyber Monday holiday shopping sprees.

The shipping company says it will hire 40,000 full- and part-time workers at 170 job fairs nationwide on Oct. 19.

We previously reported that UPS was hiring 100,000 seasonal workers this year, so it looks like the brown jacket brigade is attempting to recruit a large share of its seasonal workforce in one day.

The hiring events are split into east and west regions, and applicants have the chance to receive employment offers on the spot.

The seasonal positions are primarily package handlers and drivers. Over the last three years, 35% of seasonal package handlers were hired on for permanent positions, the company notes.

Can’t make it to the hiring event? You can apply online at UPSjobs.com.

The company touts that permanent jobs — including part-time — come with health care and retirement benefits, as well as tuition assistance in some locations.

Tiffany Wendeln Connors is a staff writer at The Penny Hoarder. She covers benefits, invisible jobs and work-from-home opportunities. Read her bio here or catch her on Twitter @TiffanyWendeln.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2pXL2OB

How to Generate Sales by Triggering an Emotional Response from Your Customers

Emotions drive our lives.

Whether you recognize it or not, you feel a wide range of emotions on a daily basis. You might even be feeling some emotions right now as you’re reading this.

The word emotion is defined by an instinctive state of mind as a reflection of mood, circumstances, relationships, knowledge, or reasoning.

Sometimes emotions can cause erratic behavior, depending on the circumstances.

Other times, emotions can make people do great things. If someone is feeling inspired, they may create something that changes their life and the lives of people around them for the better.

As a marketer, you need to find ways to put yourself into the minds of the consumer.

You should be doing things like developing a customer persona to improve your conversion rates.

Once you can understand how people think, you can use that information to your advantage.

Marketers that know how to leverage the emotions of consumers will have greater success over extended periods of time.

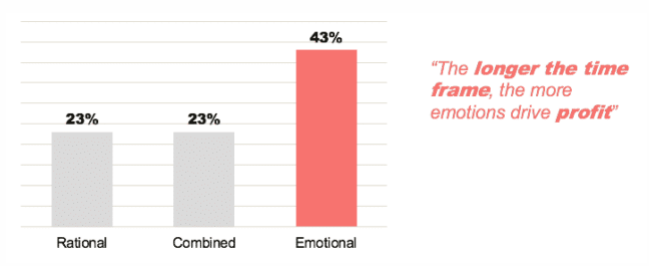

In fact, 43% of emotional advertisements had positive effects on businesses for three or more years.

Ads that trigger above average emotions create a 23% increase in sales volume.

That’s right. If you can stimulate an emotional response from your customers with an advertisement, it will increase your sales volume today and potentially for years down the road.

But where do you start? Which emotions work best?

Depending on who you ask, humans have anywhere between 6, 27, or upward of 100 emotions.

Honestly, the number doesn’t really matter. As long as your strategies can trigger a response that impacts the way the consumer feels, you’re getting the job done.

I’ll show you some of the best ways to generate sales by guiding consumer emotions.

Build trust

Would you give money to someone who you don’t trust?

I doubt it.

So you can assume that consumers won’t give money to brands that appear to be untrustworthy. That’s why you need to take steps to build and establish trust with your customers.

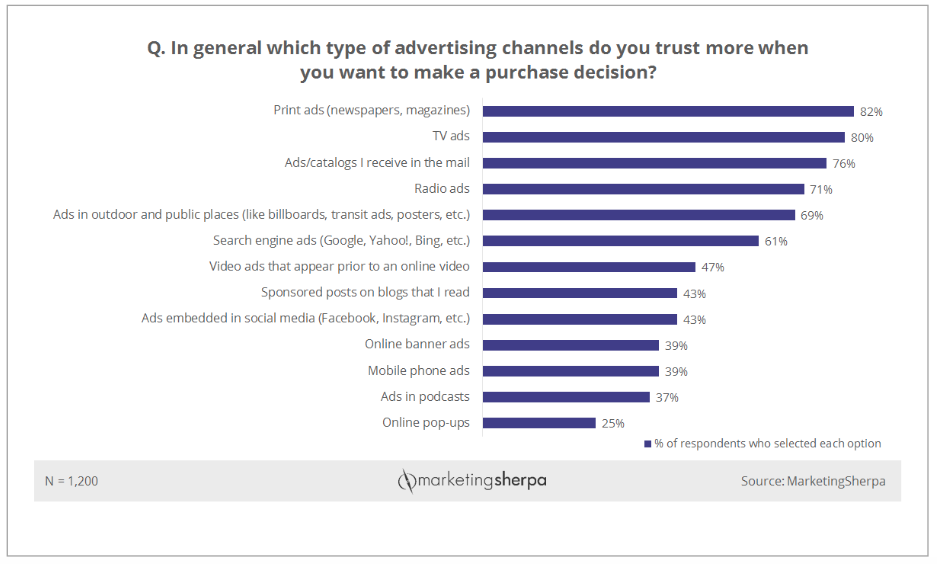

Take a look at the most trustworthy advertising channels based on a recent survey of consumers.

As you can see, none of the top five responses are forms of digital content.

Online advertising just isn’t as trustworthy as the other types of advertising channels.

People have the perception that they’re going to get scammed online. They are afraid of getting their identities stolen or credit cards compromised.

However, if they know that they’re dealing with a trustworthy brand, they’ll feel much safer.

For example, would you hesitate to enter your personal information and credit card number to make a purchase from Apple? Probably not.

That’s because they’re a well-known, established, and credible brand.

But if you’re browsing online and get a popup advertisement from a company that you’ve never heard of, are going to buy something without asking any questions? I hope not.

If your business doesn’t have a reputation established yet, you need to take the right steps to add credibility to your website.

Showcase customer testimonials. Encourage your customers to review your products.

Display your contact information. Make it easy for people to reach you with any questions, comments, or concerns.

Secure the checkout process. Get rid of ads for other brands on your site. Promote your hassle-free return policy.

If you do things like that, people will trust your business. Once they trust you, they’ll be more willing to buy.

Create FOMO

Fear is a powerful emotion.

I’m not saying that you need to scare your customers, although that can be an effective strategy as well.

For example, let’s say your company sells home alarm systems. You could run a video ad showing the results of a robbery.

The camera can show a missing TV that was ripped off the wall, furniture displaced and flipped over, a broken window, bedroom drawers pulled out of the dresser. Maybe the ad even shows a child’s bedroom.

As a result of this type of ad, people without an alarm system might be afraid that this could happen to them. So they buy an alarm from your company.

However, this type of tactic isn’t reasonable for every business.

Let’s say you sell clothing. It wouldn’t make sense to run an ad about trying to scare people into buying a t-shirt.

So instead, you can create FOMO or the fear of missing out.

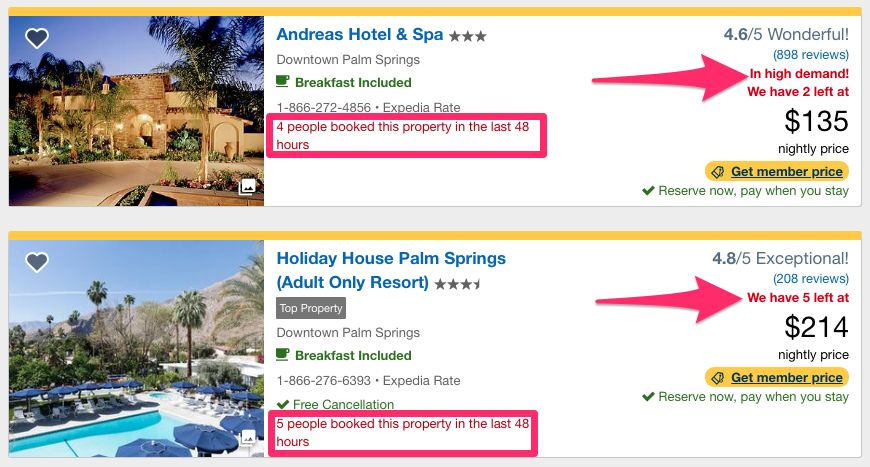

Here’s an example of how Expedia uses this strategy to sell hotel reservations through their platform.

They use this method all over this page.

For the first hotel, they have a message stating that four other people booked a room at this hotel in the past 48 hours.

Then there is a separate alert saying that the hotel is in high demand. There are only two rooms left at $135 per night.

As a result, the consumer will be afraid that if they don’t book the room now, the rate will go up, or the hotel will potentially sell out of rooms.

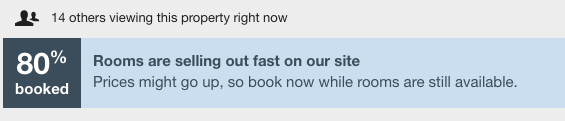

Expedia doesn’t stop there. When you click on a property to get more details, they continue applying the FOMO strategy.

So they’ve already told you that there are only two rooms left.

But now you find out that there are 14 other people viewing this property right now.

This makes the consumer think that they need to act even faster to secure the advertised rate.

You can apply this same tactic to your ecommerce website. Put up an alert that tells people there are a limited number of a certain product remaining.

I’m not advocating that you should lie to your customers, but realistically, nobody will know if you actually have plenty left in stock. So do what you want with that information.

Identify the desires of your customers

Desire can stimulate emotions as well.

Just like you and I, your customers have wants and needs. If you identify what they desire, you can use that to reach them through your marketing campaigns.

Let me show you what I mean.

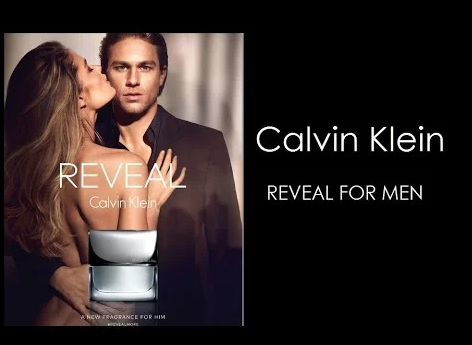

Here’s an example of a simple advertisement from Calvin Klein.

What do men desire? Women.

Look, I get it. It’s 2018. I’m not here to get into a debate about sexual preferences or anything else like that.

I’m just trying to show you how Calvin Klein’s marketing team positioned this advertisement in a way to stimulate desire.

The ad implies that if you use this cologne, beautiful women without clothes will be attracted to you.

Obviously, that’s outrageous. But subconsciously, people will see this ad and get an emotional reaction from it.

Let me give you another example so you can look at this concept from a completely different perspective.

We’ll say that your company sells running shoes.

What do competitive runners desire? Winning.

So you can run an ad that shows someone winning a race while wearing your shoes.

Focus on what your customers want. Then tailor your marketing strategy accordingly around that idea to stimulate their desires.

Trigger envy

Envy and jealousy are not necessarily considered positive emotions.

However, as a marketer, you can still use these ideas to your advantage. I’m sure you’ve seen ads like this before.

There are commercials on TV all of the time about products like fertilizer that will help you grow a lawn that’s greener than your neighbor’s.

Those ads are trying to trigger the envious emotion that people feel. You walk by your neighbor’s house and see that their grass looks better than yours. Time to do something about it.

So when you see an ad like that, it speaks to you.

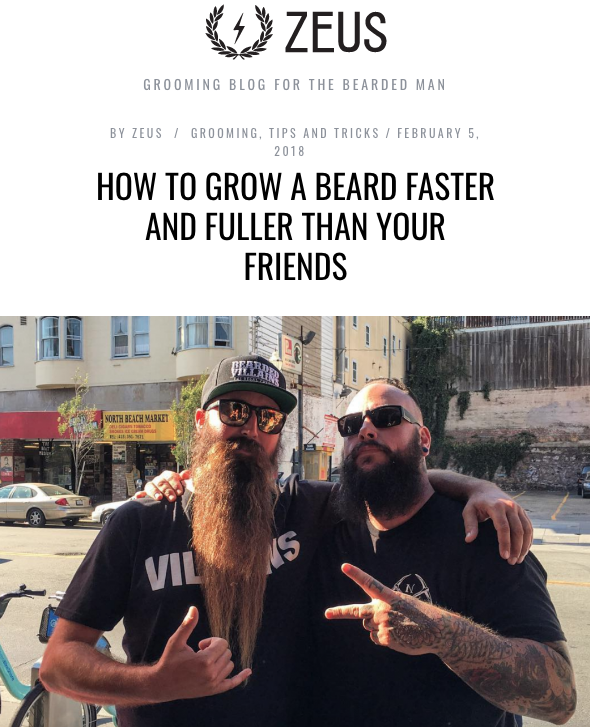

Here’s an example of this strategy used by Zeus Beard.

Zeus Beard sells a variety of beard grooming products and accessories.

This blog post explains how people can grow a beard that’s thicker and fuller than their friend’s beard.

So anyone who is envious of their friends or other bearded people will be inclined to read this content.

After that, they’ll be eager to buy products from this company.

It sounds silly, but it’s human nature to want to be better than people. Whether you want to admit it or not, I’m sure you’re envious sometimes too.

Don’t be ashamed. You’re not alone.

Fortunately, your customers get envious too. So trigger that emotion to get them to make a purchase from your brand.

Create content that’s creative and humorous

You need to run ads that will get the attention of your current and prospective customers.

So be creative and try to get some laughs out of people.

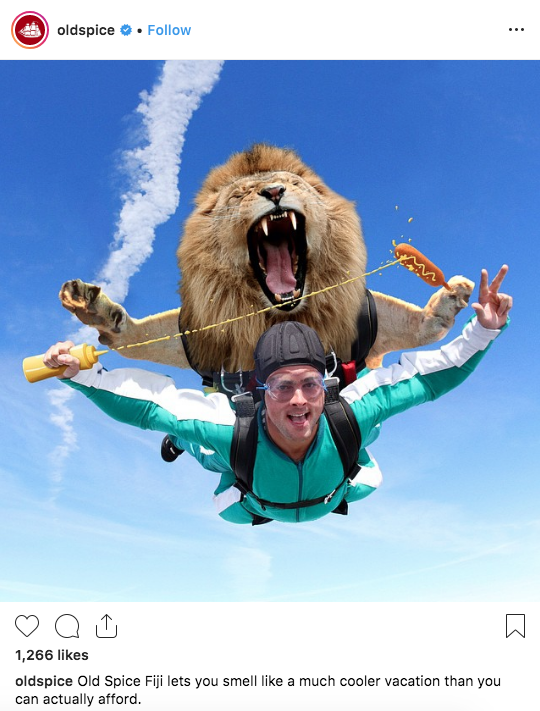

Here’s an example from the Old Spice Instagram page.

What exactly is happening in this picture?

It looks like this guy is skydiving with a lion on his back while putting mustard on corn dog that the lion is holding.

Is that going to make people buy deodorant? Not necessarily.

But it certainly grabs their attention. It may even make people laugh.

As a result, it will show them the human side of your brand, and even establish trust with them. This is something that we discussed earlier.

Laughter will improve the mood of the people viewing your ad.

If someone is happy, they’ll be more likely to buy whatever it is that you’re selling. So have some fun and get creative with your next marketing campaign.

Go for shock factor

Is a lion going skydiving shocking? Yes, but that’s not exactly what I’m talking about.

Shock your audience with reality.

Depending on your approach, this strategy can be used to stimulate fear, which we previously discussed.

One of the best ways to shock people is by showing them an alarming statistic to back up whatever you’re selling.

Here’s an example from the Action on Smoking and Health Organization.

This company is trying to get people to stop smoking.

So they ran this ad to inform people how tobacco products can cause diseases that lead to death. The idea here is that it’s more common than people think.

Someone may not realize the harm that they’re doing to their bodies by consuming certain products.

However, after seeing a shocking ad like this, they may reconsider their actions. As a result, they could reach out to the organization and seek whatever services they’re offering to help them quit a bad habit.

With that said, shock doesn’t always have to be associated with fear.

You can shock people with news that’s exciting and encouraging as well.

Inspire your customers

Sometimes you just need to give people a little bit of motivation to accomplish something.

By triggering emotions that inspire consumers, you can entice them to make a purchase.

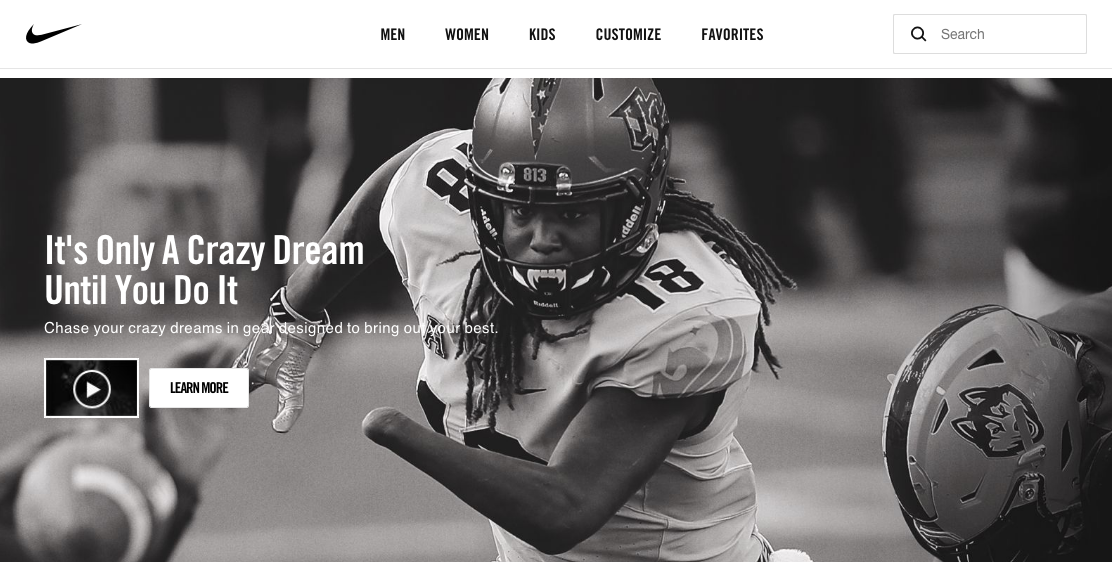

Here’s a great example from the Nike website.

Just do it.

We all know this as the Nike slogan. But what does it really mean?

This powerful image on their website shows exactly what their slogan looks like in real life.

Football is a difficult sport for anyone to play. So for someone with only one good arm, it may seem like just a crazy dream.

Nike explains that it’s only a crazy dream until you do it, and they have proof to back it up.

Are they displaying this content to tell people across the globe that they can play football with one arm? No.

They’re doing this to inspire people.

No matter what you think is holding you back, you can accomplish it.

Do you think you’re too overweight to go to the gym? Are you too old to run a marathon?

Whatever it is that you need to overcome, a promotion like this can inspire you to accomplish your goals. Once people feel inspired, they’ll need to buy the right products to help them reach their potential.

Build anticipation

Anticipation can drive you crazy.

We’ve all been there. Waiting by the phone for a certain call. Sitting in front of the TV anticipating a new episode of your favorite show to start.

Waiting to hear back the results of a test.

Once anticipation gets built, you can get your customers to buy something.

Here’s an example from the Apple website.

Apple is notorious for their keynote events.

During these events, they announce the launch of new products and software. In the past, some of these announcements have been groundbreaking to the industry.

So by promoting the event with not much information besides the date, location, and time, it builds anticipation.

If they told people exactly what they were going to announce at the event, it would defeat the purpose.

This is a great example of how to build hype for a new product launch.

Once they announce the new products, they still aren’t available right away. However, Apple gives their customers the opportunity to pre-order items.

First, they build hype by promoting the event. Next, they continue to build anticipation by announcing a new product without launching it.

By the time the product hits the shelves, people are lined up around the corner ready to hand their money over.

Entice kindness

Despite what you might think, people are actually kind.

I know some of you who live in certain places may not agree with that, but just bear with me for a minute here.

If people believe in a certain cause or want to help other people, their kind nature will be brought out.

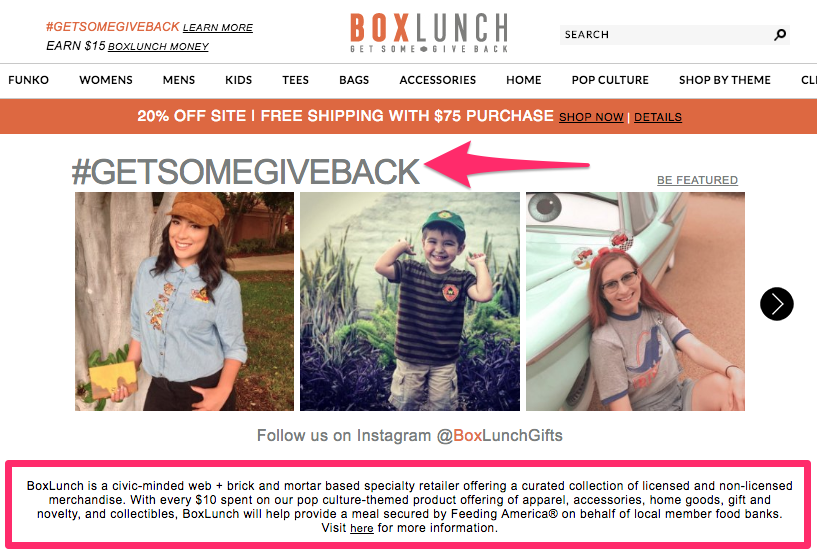

Take a look at how Box Lunch incorporates this strategy with their overall brand mission.

For everyone $10 spent, this company helps provides meals to people in need.

It’s a great pitch to consumers.

Buy from this brand, and you’ll help feed the hungry.

If your company supports charitable organizations, don’t be afraid to share that with your customers. Use that to help stimulate an emotional response.

This will help you generate more sales.

Promote joy and happiness

Lots of times people associate certain emotional responses with negative feelings.

Someone may do something stupid if they’re mad or angry. But on the flip side, people who are happy and joyful can have an emotional response as well.

Nobody who is in a bad mood buys coffee for a stranger.

But someone who is having a great day might pay it forward to the car behind them when they’re going through a restaurant drive-thru.

If someone is feeling down or depressed, they probably won’t be as open to spending money.

However, if you can find a way to bring joy to the lives of your customers, they’ll be more likely to buy what you’re selling.

Here’s an example from Tropicfeel.

This startup company sells sneakers for both men and women.

They posted this image on Instagram to show two people having a great time while wearing Tropicfeel sneakers.

Just look at their faces. As a consumer, you almost can’t help but smile while looking at how happy these people are.

Sure, they’re models working for this company.

But that doesn’t change the fact that this picture can make you happy.

This relates back to one of our previous talking points about identifying desires. People have the desire to be happy.

If you’re able to explain through your ads how your brand can make this possible, it will increase your chances of getting people to convert.

Conclusion

Certain actions and behaviors happen as the result of an emotional response.

Marketers need to recognize this concept, and learn how to leverage consumer emotions into sales.

Build trust with your customers. Identify their desires.

Stimulate fear, envy, shock, creativity, and humor.

Be inspiring. Build anticipation. Entice kindness. Find ways to make your customers feel joyful and happy.

If you can stimulate these emotions properly, consumers will respond by making purchases.

How is your company driving sales by leveraging the emotions of your customers?

Source Quick Sprout https://ift.tt/2J3nIHM

Different People, Different Goals

Simple Dollar reader Jennifer pointed me toward this discussion thread on LinkedIn, in which a big group of people are complaining about the idea of financial independence.

The discussion starts off with this:

Anyone else disagree with the constant “retire early” mindset? This dominates the retirement media newsfeed. No, I don’t want to clip coupons to retire at 35 so that I can worry about my $500 monthly budget while living in a van. I want to have a long career facing steep challenges, impossible odds, business turnarounds, success, failure, and the inbetweens. I’m invested in my career and I don’t see it as a quick meal ticket.

And here are a few key responses:

I don’t get this absurd fascination with “retire early” either. If you are passionate about what you do, then why would you consider retiring early? If you’re not passionate, then maybe you need a career change. Bailing out in 30s-40s really hurts you because you are just getting into prime earning years, which hurts your potential savings and your social security contributions. Not to mention that early 30s is when most people start families and how can you support a family if you take the early retirement approach? Unless you get in early on an IPO and can walk away at 35 a multi millionaire, which is extremely rare, why would you subject yourself to a life of penny pinching and coupon clipping?

and

What if everyone retired early? Who is going to turn the lights on, pick up the trash, run the factories? I’d argue that early retirement (without finding another job of some sort) is selfish. You need to trust that the people next to you are carrying their weight. “Drink from the well, replenish the well.”

and

When you have the chance to do more why in any way you want to settle for less. You’ve been living in the same cocoon the whole life and now when you have the chance to explore and actually do something really good for your future, why do you want to settle for less. The kind of thrill, knowledge and wisdom one can get is amazing. And this gonna lead to nothing but unhealthy and obese people because when you have nothing to do with your life you just sit and eat.

What I see in each of these messages is someone who has different life goals than I do. Their life goals seem very oriented toward their careers, particularly in terms of rising to some level on their career path. In the third message, there’s even a hint that society should expect everyone to follow this path.

Here’s the issue, though: not everyone has the same goals in life.

Many of the people in that discussion view a lifelong career path as a goal they hold extremely dear to their hearts, but a lifelong career path isn’t really a goal that I have for myself.

For a while, I tried to follow a career path in a research field and it led either right to a management situation, which I wasn’t interested in, or into doing very repetitive maintenance work, which I also wasn’t interested in. I realized this and switched careers.

For a while after that, I tried to be an “online entrepreneur” and a bit of a “financial guru,” but I found I didn’t like that, either. Again, I was moving straight toward managing people and away from creative work that I enjoyed doing and conversations with people I could help.

I looked ahead at my future and I saw that if I followed a “career path,” I was going to end up places I was unhappy with. I love my work, but I work to live, not live to work. I have many other goals in life that don’t involve my career at all.

I want to be a good, involved father for my children. That role will change as they grow up, but I want to be a valuable father figure and mentor for as long as they need me.

I want to be a great husband for Sarah. I want to have her close every day of my life and enjoy as many life experiences as I can with her by my side.

I want to learn how to do countless things. Learning new things has been something that has made me feel deeply alive for many, many years.

I can make an extremely long list of other things I want to do, from hiking the Appalachian Trail to doing charitable work, from writing a novel to going to meditation retreats, from playing in a bluegrass band to spending more than a week camping and hiking in every national park, from launching and organizing a local tabletop gaming convention to running for the state Senate.

Those are all things that I would like to achieve in the future years of my life, probably in the next 20 years or so.

At the same time, I don’t want to spend those years of my life bolted to a smartphone and focused on workplace politics and making products no one really wants while convincing them that they do. In short, I want to reach a point where money is not a consideration at all in terms of how I spend my time. Given that most of the things I want to do with my time aren’t incredibly expensive things, saving as much money as I can at an earlier time in my career where my focus is on parenting and many of the other options aren’t on the table mostly due to parenting enables me to no longer have to work for money later on when I don’t have the same commitments to parenting.

In short, when our youngest child walks out the door, I want to be financially prepared to no longer have to work and to start doing all of those other things I want to do with my life without a need to continue to work for money.

That’s really the end of the story when it comes to my reasons for seeking financial independence. The idea that I’m aiming “to clip coupons to retire at 35 so that I can worry about my $500 monthly budget while living in a van” is ludicrous. Someone who advocates coupon clipping as a frontline strategy for retiring early has a warped picture of what early retirement is, as is someone who visualizes a $500 monthly budget – I’m aiming for an annual budget similar to what Sarah and I would spend alone if we didn’t have kids so that our fundamental lifestyle doesn’t change.

What it comes down to is this: different people have different goals in life. Sarah and I have life goals that aren’t career-focused. Other people do have life goals that are mostly career-focused, and that’s okay. Some people find their calling and purpose in life through their career path, and others find their calling and purpose elsewhere. What matters is that you find your calling, not where you find it.

What about that other claim, the one that implies that people have an economic responsibility to work, earn, and spend? I do have a responsibility to my neighbor, but that responsibility doesn’t come in the form of buying things I don’t want in order to possibly help keep him employed in an extremely indirect way. My responsibility to my neighbor comes from conversations, from giving a helping hand every once in a while, from watching their property to make sure nothing goes awry. I have no moral responsibility to buy things I don’t want or need.

Beyond that, my money is still helping the economy even if I don’t spend it immediately simply because it is invested in something. Almost every financial investment a person can make puts that money to use somewhere in the economy. Using your money to buy things is not the only way to help the economy. Buying things is one way to help certain sectors of the economy, but investing is also a way to help other sectors of the economy.

In the end, don’t let people who have different goals than you chide you or make you feel bad for the goals you have. Your goals are yours and yours alone, not theirs. Similarly, there’s no reason to chide others for having goals different than your own.

What matters is that we have meaningful goals that inform our use of our time and our money in a positive way. That’s true whether you’re highly career oriented or if you’re highly oriented toward retiring early. What matters is that you have a vision of your future, that vision is a positive one, and you’re working toward it in a meaningful fashion.

Good luck!

The post Different People, Different Goals appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2ClxwM2

A guide to peer-to-peer lending

Income-seeking investors have been drawn to peer-to-peer lending on account of the attractive returns on offer. Here’s everything you need to know about this growing sector

The Bank of England may have nudged the base rate up to 0.75% – its highest level in almost a decade – but this rise hasn’t been passed on to most savers.

Three quarters of banks and building societies have failed to pass the rate rise on to customers, with the average easy-access savings account offering a pitiful interest rate of just 0.52%, according to MoneyFacts.

Almost a decade of low interest rates has caused many income-seekers to veer away from traditional savings accounts. With a number of peer-to-peer (P2P) platforms offering returns above 10%, savers have been abandoning their traditional cash savings accounts in favour of P2P.

P2P has gone from a quirky financial outsider to a billion-pound industry, winning approval from financial watchdog the Financial Conduct Authority (FCA) and the government. What is more, Innovative Finance Isas (IF Isas) allow savers to enjoy tax-free returns on their P2P investments.

So what exactly is P2P and how can you get in on the action?

Some P2P firms let you choose exactly which firms to lend cash to

P2P: the basics

The idea is pretty straightforward: you lend your money to individuals or businesses using a P2P platform as the middleman. Interest rates on loans are still considerably higher than the returns available on savings accounts. For example, the recent base rate rise was swiftly passed on to borrowers, so you can enjoy a better interest rate as a lender.

Because you are cutting the banks out of the deal, P2P is good for both borrowers and lenders. The person borrowing money gets a lower interest rate than they would from a traditional lender and the person lending the money is offered a higher interest rate than they would receive from a traditional savings account.

Some of the best-known P2P platforms are Funding Circle, LendingCrowd, Lending Works, RateSetter and Zopa. Expect returns of between 3% and 7% a year, depending on which account you choose.

P2P platforms operate in different ways: some require you to spread your money across numerous loans, while others allow you to choose exactly which firms to lend money to.

For example, Zopa offers two types of account: Zopa Core, which aims to return 4% a year, and the riskier Zopa Plus, which targets an annual return of 4.6%. After you select an account, Zopa will spread your money across a number of suitable loans. This means you will not have a say in the loans that are selected for your portfolio.

Alternatively, LendingCrowd allows you to choose which businesses to lend to, with interest rates ranging from 5.95% to 14.25% a year.

Depending on the length of the loan, it can prove difficult to access your money once you have invested in P2P. The best way to do this would be to sell your loan on to another investor. Some platforms allow you to do this via a ‘secondary market’, but there may be fees and charges involved.

Avoid the banks

The prospect of cutting out the banks attracted David Ivison, 55, a teacher from East Sussex, to P2P lending.

“Back in 2007 I required a loan, so approached my bank of 25 years and was given a loan offer with what I considered to be a very high interest rate. It seemed that loyal customers are just another group to be exploited, so dissatisfaction with the traditional financial institutions was a big factor in my interest in peer to peer,” he explains.

David has been investing with Funding Circle since 2012 and has gradually built up his P2P loan portfolio.

“With Funding Circle, I like the thought that I am lending (almost) directly to small businesses which need the money and want to bypass the banks. It gives me a feeling that I am really involved in helping them. Most are very small and have maybe been refused by a bank.

“Of course, I have to trust that Funding Circle can correctly assess the loan, but, so far, I am happy to say that it has my trust,” he explains.

Get tax-free returns

Back in April 2016, P2P got a boost when the IF Isa launched, allowing savers to generate returns on their P2P investments tax-free. Individuals can invest part or all of their £20,000 Isa allowance into an IF Isa during this tax year.

However, it has taken a while for the IF Isa to gain traction. This is because P2P platforms required FCA approval before they were able to launch these products, and this took a surprisingly long time – up to a year in some cases. In the end, some of the lesser-known names managed to get through the red tape first.

During the 2017/18 tax year, investors subscribed to 31,000 IF Isas, up from 5,000 the previous tax year. While this represents a significant increase, it pales in comparison to subscriptions of 7.8 million in Cash Isas and 2.8 million in Stocks and Shares Isas.

However, it is worth noting that individuals who subscribed to an IF Isa invested relatively large sums. The average IF Isa attracted £9,355 during the 2017/18 tax year, which compares to £5,114 for a Cash Isa and £10,124 for a Stocks and Shares Isa.

Today, close to 85 companies are authorised to offer IF Isas – including Zopa, RateSetter, Funding Circle and Lending Works – and the number of people opening accounts is expected to steadily increase.

The lure of attractive returns

The prospect of higher returns in comparison to traditional savings accounts attracted Hazel Johnson*, 60, a university professor from north London to P2P investing. She has invested with RateSetter for several years.

“I had received an inheritance and put this aside in ‘protected accounts’ [Isas and savings accounts] funds that were needed for my children’s education and other essentials. So I only used P2P for funds that were at the very limit I could lose, but the aim was clearly to get a better return than was offered by typical lenders.

“I also read widely to get a sense of which P2P company seemed the most reliable and had self-regulated protections in place to deal with bad loans, so I went for a calculated risk.”

Hazel also took steps herself to keep the risk to a minimum.

“I put funds in the rolling fund [easy withdrawals] to keep control and when there was some publicity in the press about a bad commercial loan that RateSetter had made, I removed some funds.

“I am not so flush that I could take more than calculated risks. However, when it became clear that this bad loan had resulted in no loss to individual investors, I reinvested funds into RateSetter,” she says.

“I like helping small firms that maybe a bank has turned down”

Beware of the risks

When it comes to P2P, remember the first rule of investing: the prospect of higher returns may mean that you are taking on more risk. It is not the same as putting your money in a savings account at a bank.

Despite the fact that several comparison websites including GoCompare and LoveMoney list P2P alongside savings products on best-buy tables, your cash is at risk and you may get back less than you put in.

By lending your money out to individuals or businesses, you run the risk of a borrower defaulting on their repayments and leaving you out of pocket.

It’s also worth noting that P2P platforms are not covered by the Financial Services Compensation Scheme. This means that if the platform goes bust, you could lose your money.

Understandably, you may presume that opting for a P2P platform that offers the highest interest rates means you are taking on the most risk. However, this isn’t necessarily the case. Every platform assesses risk differently – so if a P2P lender offers a lower interest rate, it may not mean that you are taking on less risk.

The P2P market has been going strong for the past 10 years, which has been a period of relative stability for financial markets. The sector is yet to experience a downturn, in which a large number of borrowers default on their loans. A financial crash could also increase the amount of time it takes you to sell your loans on the secondary market if you want to get your money out.

“P2P has not yet been through a full normal market cycle, so we have not experienced the impact of high interest rates, high inflation and high default levels on the market,” says Danny Cox, chartered financial planner at investment platform Hargreaves Lansdown.

“The interest cost of a P2P loan is actually quite small. It is the repayment of the capital that is the problem. This means the business lending P2P market will be sorely tested when businesses start to flounder or fail in a recession, and on the personal lending side when unemployment rises,” he adds.

In the past, many P2P platforms tried to mitigate the risks associated with lending by having safeguard or provision funds in place. These acted as a safety net to cover losses in the event that one of your borrowers defaulted on their loan. However, it is not clear how these funds would cope in a financial crash, as they don’t hold enough money to cover the platform’s entire loan book.

What is more, several big P2P platforms don’t have provision funds at all. For example, Zopa started phasing its out last year, while Funding Circle doesn’t have one in place.

“We don’t believe the provision fund model is the best way to provide investors with stable returns. Instead, diversification and transparency are the best way for investors to manage risk effectively,” says Kendra Bruckner, a communications executive at Funding Circle.

It is essential to ensure diversification across your P2P portfolio.

Neil Faulkner, founder of 4thWay, a peer-to-peer lending ratings agency, notes that spreading your money across at least half a dozen P2P platforms and many hundreds of loans can “tremendously lower your risks”.

“Lenders should not allow themselves to believe they can accurately select a small number of loans to outperform,” he adds.

Moneywise verdict

P2P investing offers a lifeline to savers looking for a better return than those on offer from traditional savings accounts.

But be aware of the fact you are investing: this is higher risk than simply keeping your money in a savings account. Take steps to keep that risk down by diversifying your P2P portfolio, making sure only a fraction of your savings are in P2P and keeping some money in a traditional savings account for emergencies. Also, make sure you are comfortable with the fact your investments could go down in value.

Comparing P2P platforms can be complicated, so Moneywise recommends that beginners stick with a mainstream provider until they gain more experience in the sector. After some time, they may wish to invest via a specialist platform that provides control over where the loans are allocated.

Our top picks are highlighted above – Zopa, RateSetter, Lending Works and Funding Circle. They all scored highly at the Moneywise Customer Service Awards 2018, with Zopa named the Most Trusted P2P Provider and Lending Works taking the award for the Best P2P Platform for Investors, with Funding Circle, RateSetter and more property-focused Assetz Capital and Lendy also shortlisted.

Where to invest – the big players

Zopa

This is the longest-running P2P platform in the UK, having launched back in 2005. It has lent £3.5 billion since it began, with more than 60,000 lenders and more than 300,000 borrowers on its books.

Choose between Zopa Core, which aims to return 4% a year, and Zopa Plus which targets an annual return of 4.6% (after fees and bad debts). You have to invest at least £1,000 and Zopa will split your money into £10 chunks that are lent to different borrowers. There is a 1% charge if you want to access your money early.

Zopa also offers an IF Isa with the same Core or Plus options and projected returns of 4% or 4.6% respectively.

RateSetter

RateSetter has lent more than £2.7 billion since its launch in 2010 and has close to 68,000 lenders and 499,000 borrowers registered on its website.

You can choose between three different accounts, depending on how long you wish to tie your money up for. The first option is to open an account offering access to RateSetter’s ‘rolling market’, which allows you to access your money whenever you like free of charge. This account targeted an annual return of 3.1% at the time of writing.

The next option is RateSetter’s one-year account, which had a projected return of 4.3% at the time of writing, while the five-year account targeted 5.6% a year. With the latter two, you’ll pay 0.3% or 1.5% respectively for early access.

RateSetter has a provision fund, which totals £34.3 million and is used to provide a buffer against credit losses. If you use this platform, you will be offered a set rate at the time you invest that you should receive. So far, RateSetter’s customers have received the rate they signed up for.

There is also an IF Isa option with the same three accounts to choose from.

Funding Circle

Funding Circle is another big player with £3.8 billion lent. It has 39,000 businesses and 75,000 lenders on its books, including the government-backed British Business Bank which has provided more than £100 million for small business loans.

The platform offers two accounts: Balanced, where your money is lent across the risk spectrum, and Conservative, which only lends to the two lowest-risk classes. Balanced has a projected return of 6% to 7% and Conservative aims for 5% to 5.5%.

You can no longer choose which companies you lend to with Funding Circle. The firm now uses an ‘auto-bid’ system, which means your money is spread across a large number of borrowers to minimise the risk of a bad debt making a significant dent in your returns. No more than 0.5% of your money will be lent to a single business.

Your money is lent over a six-month to five-year period. If you want to access it before the loan matures, you’ll need to trade it on the secondary market.

Funding Circle also offers an IF Isa with the same Balanced and Conservative options.

Lending Works

This P2P platform specialises in personal loans and works in a similar way to RateSetter – your account choice will be determined by how long you want to lend money for. You can either opt for a three-year option earning 4.5% a year or a five-year account at 6% a year.

If you want to access your money early, you’ll pay a 0.6% fee and will only be able to do so if other investors are available to take over your loans.

Lending Works also has a ‘shield’ to protect your money from missed loan repayments and defaults. This is made up of an insurance scheme and a reserve fund.

As with the other platforms, your money will be spread across numerous loans to protect you from one bad loan wiping out your capital. A nice thing with Lending Works is there is plenty of data on its website to show you how much is being lent, who is borrowing and how the Shield has protected lenders over the past five years.

Lending Works also offers an IF Isa with the same rates as its standard P2P offering.

Reduce your risk

Investing in P2P comes with more risk than keeping your money in a traditional savings account. But, as with all investments, there are sensible steps you can take to lower the risks.

- Spread your money between providers – Investing your money with several P2P platforms means that if one firm goes bust you won’t lose all your cash.

- Make sure you pick a varied portfolio of loans if you plan to choose them yourself – for example, don’t just invest in property loans.

- Only put some of your savings into P2P – make sure that you’re not investing money that you can’t afford to lose.

*Name changed for privacy.

Ruth Jackson is a freelance personal finance journalist who writes regularly for Moneywise,The Times and MoneyWeek

Section

Free Tag

Related stories

- Understanding the risks of peer-to-peer lending

- Zopa looks to re-open platform to new investors

- Peer-to-peer Isa fails to take off

Source Moneywise https://ift.tt/2yHSVf1

Credit FAQ: What’s the Difference Between a Charge-Off and a Collection?

The credit world is full of myths and misconceptions: Credit scores are used by employers. You only have one credit score. Closing credit card accounts can help your scores.

All of these are demonstrably false, yet they seem to have a life of their own in the blogosphere.

Another myth that has sprouted up recently has to do with charge-offs and collections. The myth is that they’re the same thing. This post will serve to dispel that myth. Although both charge-offs and collection accounts can potentially cause credit score damage, they’re not actually the same.

Charge-Off vs. Collection

When you fail to pay a debt for a long enough period of time, it will eventually go into default. Your lender may eventually give up on you paying the debt. And, as an accounting maneuver, they may move the debt from being a profitable asset to a business loss on their accounting ledgers.

That move is formally referred to as “writing off to profit and loss.” Informally, we call that a “charge-off.” Charge-offs are commonly reported to the credit bureaus.

Conversely, debts that have gone into default are also sometimes either sold or consigned to third-party debt collectors, or collection agencies. These accounts are known as “collections.” Collections are also commonly reported to the credit bureaus.

How Do Collections and Charge-Offs Impact Your Credit Score?

Both charge-offs and collections have the ability to damage your credit scores. The reason both of these issues can damage your credit scores is that both collections and charge-offs are predictive of elevated credit risk. As your risk goes up, your credit scores come down.

Although both charge-offs and collections are considered derogatory entries with the potential to harm your credit scores, there are other factors that will determine how much your credit scores are impacted, if they’re impacted at all. The first consideration is the recency of the incident.

Let’s assume your credit report is perfectly clean with the exception of one collection and one charge-off. In this case, you might be able to determine which entry is having the more damaging credit score impact by looking at which one occurred more recently. For example, if there’s a collection account on your credit report that is three years old, and a charge-off that is three months old, the newer charge-off is damaging your credit scores more.

Accounts that have been charged off by a lender will often be reported with a past-due balance to the credit bureaus. A past-due balance is another credit report entry considered by credit scoring models — and, as you can imagine, past-due balances are not good for your scores. A charged-off account that has a past-due balance is worse than a charged-off account that has been paid or settled.

Meanwhile, the balance associated with a collection account is not considered in FICO’s scoring models. I know that’s hard to believe, but the value of a collection in your score is the incident, not the balance. That’s why paying off a collection doesn’t actually result in a higher credit score.

And you could even get hit with a double-whammy, where a charged-off account leads to a collection, and both end up being reported to the credit bureaus. Here’s how: You have an account that goes into default and is eventually charged off by the bank. That is reported to the credit bureaus. Then, the bank outsources the debt to a third-party collection agency, who also reports it to the credit bureaus.

As long as the collection is the only entry that shows a balance, that’s perfectly legal and standard. But it’s yet another reason why it’s so much better to avoid charge-offs in the first place.

More by John Ulzheimer:

- Which Debts Should I Pay Off First to Raise My Credit Score?

- Four Ways You Could Be Harming Your Credit Score Without Realizing It

- This Is the Law That Protects You From Abusive Debt Collectors

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times over the past decade in media outlets including the Wall Street Journal, NBC Nightly News, The Los Angeles Times, CNBC, and countless others. With professional experience at both Equifax and FICO, Ulzheimer is the only credit expert who actually comes from the credit industry. He has been an expert witness in over 230 credit related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit.

The post Credit FAQ: What’s the Difference Between a Charge-Off and a Collection? appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2Oy100F

9 Helpful Blogging Tips For Beginners

It’s been almost ten years since I began my blogging journey and what an adventure it’s been. Like many entrepreneurs and bloggers, my path to entrepreneurship started out of personal frustration. When my daughter was born, I knew that I wanted to stay-at-home with her, but I also wanted to make some money. As I searched […]

The post 9 Helpful Blogging Tips For Beginners appeared first on The Work at Home Woman.

Source The Work at Home Woman https://ift.tt/2AfqSp2