الجمعة، 21 يونيو 2019

Global Recession: Is the Perfect Storm Coming?

Source CBNNews.com http://bit.ly/2Xun0wT

Rocket Dollar Review

If you’re looking for a self-directed IRA or solo 401(k) plan that will allow you to invest in alternative assets, you need to investigate Rocket Dollar.

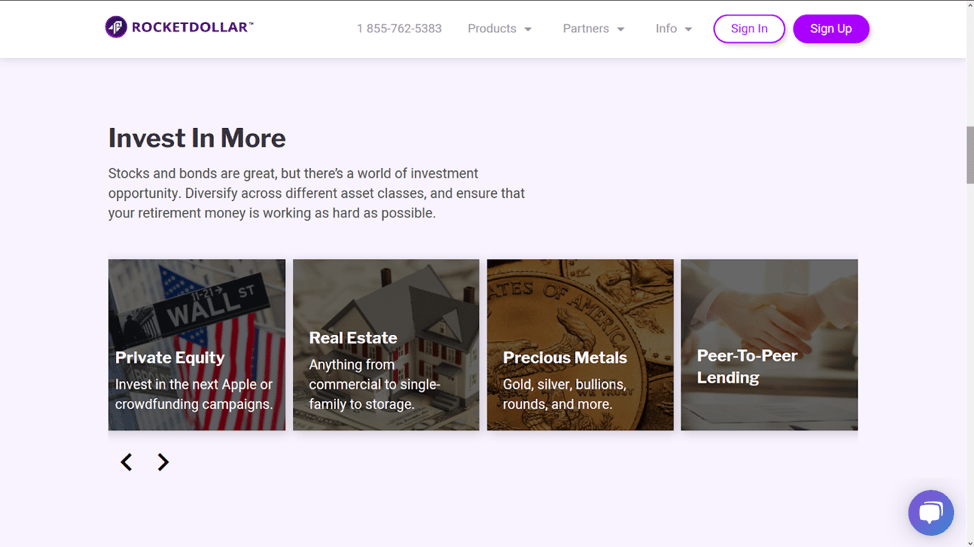

The platform has been established specifically for investors who want to hold non-traditional assets, like precious metals, cryptocurrencies, real estate, and peer-to-peer loan investments.

Even if you’re happy with your current employer-sponsored plan, you may want to add a Rocket Dollar account to add some alternative investments to your retirement plan portfolio mix.

About Rocket Dollar

Founded in 2018, and based in Austin, Texas, Rocket Dollar is an investment platform designed to enable people to take greater control of their retirement savings.

Founded in 2018, and based in Austin, Texas, Rocket Dollar is an investment platform designed to enable people to take greater control of their retirement savings.

Using the service, account holders can invest in any asset class permitted by the IRS.

That includes unconventional assets such as:

- Precious Metals

- Private Equity

- Peer-to-Peer Lending

- Real Estate

- Cryptocurrency

These are all assets you would not expect to see in a typical retirement plan, particularly an employer-sponsored one. It’s also it an advantage over most other investment platforms, that specifically exclude these types of investments.

Rocket Dollar is available for self-directed IRAs and Solo 401(k) accounts. The platform offers “checkbook control” of your retirement account. It enables you to make an investment by writing a check, sending a wire or using a debit card.

How Rocket Dollar Works

Rocket Dollar starts by guiding you through the process of opening a Solo 401(k) or a self-directed IRA. Each account comes with its own bank account, and you can invest in virtually any asset that isn’t prohibited by the IRS.

You can keep track of your investments using the Rocket Dollar investment tracker. You can easily track all investments in your account on an ongoing basis.

To get checkbook control over your account, you’ll set it up as part of an LLC. Rocket Dollar will provide you with necessary articles of incorporation, an operating agreement, and employee identification number (EIN) so you can open a business bank account.

The LLC is owned by your IRA, so you can invest through it.

With a Solo 401(k), you’ll open a trust account. Once again, Rocket Dollar will provide you with plan documents and an EIN document, which will enable you to open a trust account at a bank.

If you also open a Roth account, you will need a second account. You can also create an LLC within your Solo 401(k) if you want to hold real estate in your plan.

Once you have opened a bank account, either through an LLC or a trust, you can then purchase investments of your choice through the account. The bank account is owned by the LLC or trust, which are owned by your retirement plan.

Of course, you can also use your plan to invest in more traditional asset classes, like stocks, bonds, mutual funds, exchange-traded funds, and options. This can be done by holding traditional brokerage accounts within your Rocket Dollar IRA LLC or Trust.

Rocket Dollar Features and Benefits

- Minimum Initial Investment: N/A.

- Available Accounts: Solo 401(k) and traditional, Roth, and rollover IRA accounts.

- Permitted Investments: Single or multifamily rental properties, precious metals, cryptocurrency, undeveloped land, mineral rights, LLCs, LPs, and C-Corps; joint ventures, real estate, and business loans, and even racehorses. You can also invest in more traditional assets, like stocks, bonds, funds, certificates of deposit, and options.

- Mobile App: Not available.

- Customer Service: Live phone support is available 9:00 am to 5:00 pm, Central Time, Monday through Friday. You can also open an electronic ticket or leave a voicemail 24 hours a day.

- Account Custodian: Funds held with Rocket Dollar are held with their preferred banking partner, IRA Resources Trust (IRAR).

- Account Protection: Cash balances are covered by FDIC insurance through IRA Resources Trust. But due to the nature of the alternative investments held in your plan, they are not covered by SIPC. However, if your plan includes a brokerage account to hold conventional assets, SIPC coverage should be available through that account.

- Account Security: Rocket Dollar is a SOC2 certified company, which means they’ve undergone rigorous audits to ensure security standards are always up-to-date and at the highest levels. Originally developed by the American Institute of Certified Public Accountants, it’s defined as criteria for managing customer data, based on security, availability, processing integrity, confidentiality, and privacy.

Rocket Dollar Self-Directed IRAs and Self-Directed Solo 401(k) Accounts

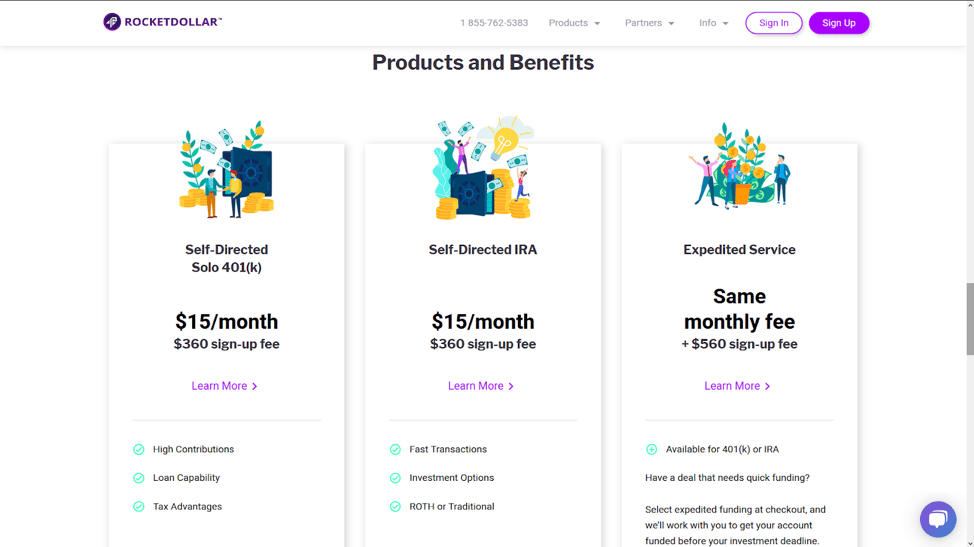

Rocket Dollar offers two basic plans, the self-directed IRA, and the self-directed Solo 401(k) plan.

Self-Directed IRA

The self-directed IRA can be either traditional or Roth. The advantage of a self-directed IRA held with Rocket Dollar is that your investment choices are almost unlimited.

You can hold virtually all the investments that are not available in traditional investment brokerage accounts or robo-advisors.

This means you can add actual real estate, rather than a real estate investment trust, within your account. As noted earlier, you’ll set up an LLC that will be owned by your IRA, and you can make alternative investments through that LLC.

Using the same format, you can also invest in hard money lending, venture capital, and startups and private companies.

Self-Directed Solo 401k

The Solo 401(k) plan works similar to the self-directed IRA, except you set up a trust owned by the plan, rather than an LLC. Your alternative investments are held through the trust. Also, you must be self-employed to set up a Solo 401(k).

A Solo 401(k) plan has the major advantage over an IRA of much larger contributions. For example, you can contribute up to $19,000 per year, or $25,000 if you’re 50 or older, for 2019.

But you can also make an employer contribution of up to 25% of your compensation on top of your employee portion. The total of the employee and employer contributions can be as high as $56,000, or $62,000 if you’re 50 or older.

The Solo 401(k) plan not only allows you to accumulate a large retirement plan quickly, but it will also provide a very large tax deduction. In addition, a Solo 401(k) plan also allows you to borrow money against the plan. You can borrow 50% of the value of the plan, up to $50,000.

Rocket Dollar Pricing and Fees

Rocket Dollar works on a flat monthly fee of $15. That will be beneficial for larger investors. For example, if your account has $100,000, $15 per month will be $180 per year. That works out to be 0.18% on an annual basis, which is lower than the typical 0.25% to 0.50% fee charged by Robo-advisors.

On a percentage basis, the fee will be high on smaller accounts. For example, with an account balance of $10,000, $180 per year will be a fee of 1.8%.

Rocket Dollar also charges a one-time sign-up fee of $360. This raises the $560 under the Expedited Service, which will enable you to participate in a deal that needs funding quickly.

There are no transaction fees with a Rocket Dollar account since all investments will be purchased directly using your LLC or trust bank account.

All fees can be paid with a debit card linked to your retirement account, or by a credit card if you prefer to preserve your retirement assets.

(Source URL: http://bit.ly/2Y7498c)

Rocket Dollar Pros and Cons

Pros:

- The flat fee of $15 per month will be especially attractive to larger investors since they’ll pay a lower percentage fee than they will on most investment platforms.

- Rocket Dollar allows you to invest in more asset classes than other platforms, including precious metals, cryptocurrencies, and peer-to-peer lending.

- Rocket Dollar also specializes in self-directed Solo 401(k) plans. These allow you to make much larger contributions, giving you a larger tax deduction, as well as the ability to take loans against the plan.

- A self-directed IRA or Solo 401(k) plan with Rocket Dollar can be the perfect addition to your retirement portfolio mix, to hold alternative investments with more traditional ones.

Cons:

- There is a $360 sign-up fee.

- The monthly fee – especially in combination with the sign-up fee – will be expensive for smaller investors when compared to other investment platforms.

- Customer service is limited to regular business hours only.

- No mobile app is offered with the service.

Should You Sign Up with Rocket Dollar

Rocket Dollar is a highly specialized retirement plan investment service, and not suitable for all investors. It will work best for those who understand alternative investments and have the risk tolerance to include them in their retirement savings.

It’s also an excellent option for anyone who already has a substantial retirement plan, concentrated in more traditional investments, like stocks, bonds, and funds. A Rocket Dollar account will provide you with an option to add alternative investments to your overall retirement plan mix.

It will work especially well for those with larger account balances – especially over $100,000 – since the fee structure will effectively be lower than most robo-advisors.

But since the investments held in Rocket Dollar are true alternatives, this isn’t a good choice for anyone who isn’t familiar with this type of investing. It’s higher risk than traditional investments and requires specialized knowledge. Another important factor is that Rocket Dollar doesn’t manage your investments for you. You’ll be completely responsible for all investment management.

As well, the fee structure of $15 per month will be excessive on smaller accounts, particularly those below $20,000 or $30,000.

But if you have a larger account, an appetite for greater risk, and at least some knowledge of investment alternatives, Rocket Dollar is the perfect retirement platform for you.

If you’d like more information, or you’d like to sign up for the service, visit the Rocket Dollar website.

The post Rocket Dollar Review appeared first on Good Financial Cents®.

Source Good Financial Cents® http://bit.ly/31I9x3X

Some Simple Advice for Estate Sales and Auctions

One of my favorite things to do on a lazy Saturday is check out an estate sale or estate auction. These types of sales occur when someone passes away, the family removes personal effects and neatens up a house, and then it’s partially opened so that people can go in and buy or bid on the items.

Estate sales exist in a wide variety of formats. Sometimes, they’re like yard sales, where everything has a sticker price and there’s a little room for negotiation. Sometimes, it’s an auction with an auctioneer. Sometimes, it’s a silent auction where you drop bids in a box for each item you want and then you’re contacted if you’re the winner.

In the past, I’ve come home from estate auctions and sales with all kinds of strange items. A decent portion of my home brewing equipment came from an estate sale, as did a bunch of my oldest tabletop RPG books. I bought some very solid gardening equipment at an estate sale, most of which is still in use around our property. I’ve also flipped a few items I’ve bought from estate sales, including some vintage records and magazines that no one seemed interested in that I got for pennies.

In any case, the purpose of an estate sale of any kind from the perspective of the buyer is to seek out bargains, and there are a few strategies that work well regardless of the style of the sale. Here are some things I always do whenever I take the time to check one out.

Set a budget before you go and bring the means to easily pay for the items you win. This way, you can be sure that you’re not exceeding what you can afford in the heat of the moment. My strategy is to simply take cash to an estate auction. I’m not usually looking to buy extremely expensive items, so a reasonable amount of cash is usually more than enough for the few items that I might bid on. Plus, cash in hand means that I can handle the transaction easily.

If I happen to not spend the amount I budgeted for the estate sale, I just deposit it right back into my bank account the next time I’m near the bank or an ATM.

Show up as early as possible to examine the items and get first choice. Be there at the first moment people are allowed to view the items, if not earlier. If you get there earlier, get in line.

If it’s a sale, the first people in the door get first pick of the items on sale. If you’re late, the items are often picked over, with some of the best items already sold.

If it’s an auction, getting there early gives you more time to examine the items before bidding begins. This means you have a little more time to do some research on your phone and settle on a bid.

Figure out which things you might have an interest in personally and which items you feel very confident you can flip, and ignore everything else. If it’s not something you personally want to own and it’s not something you are completely confident you can quickly flip for a profit, just ignore it. Pretend it doesn’t exist.

You might see an amazing price on a riding lawnmower, but if you don’t need a riding lawnmower and you don’t think you can quickly flip it for more, skip it.

The key for buying stuff for yourself is to make sure you really have a use for the item or whether it’s just “more stuff.” The key for buying stuff to flip is a strong confidence that you can sell it off quickly and earn a nice profit for doing so.

If it’s an auction, set a “target number” for each item that represents your maximum bid, write it down, and stick with it. Whenever I’m checking out items before an estate auction, I write down any items I’m interested in along with what my maximum bid will be for that item.

The thing is, I’m not going to pay a lot for an item at an estate sale where all sales are final. If I’m buying something for my own use, I recognize that the item is used and that it would be utterly silly to buy it for any more than I could find it elsewhere used. If I’m buying something to flip, it needs to be really easy to flip and secure a significant profit margin for my efforts, so I’m going to set a low target number here, too.

Make that target number uneven. This seems like a strange tactic, but it often works. Many people set their target number at a very even amount, like $50 or something. I’ll often settle on a target number that’s uneven, like $53 or $46. That way, I often beat the people who make very even bids by just a little bit.

This tactic is most effective at silent auctions, where people quite often submit round number bids. I pretty consistently make $11 and $21 bids during silent auctions because that extra $1 is often the difference maker, netting me the item for only $1 more than someone else’s bid.

Don’t be intimidated by crowds. Sometimes, estate sales will have just a few people. Sometimes, there will be tons of people. Don’t sweat it either way.

The most important thing to do is to not alter your “target number” for items just because there are a lot of people there. Don’t spend more just because you think there might be more competition for the item you’re interested in. If you hit your ceiling, stop. There will always be another opportunity to get that item.

Another factor worth noting is that, quite often, the crowds aren’t even looking for the items you’re looking for. I went to an estate auction once where there were several people bidding like mad on old signs, but when other items came up, you could hear a pin drop. I walked away with multiple bargains from that auction because I didn’t inflate my target prices due to crowds.

Do not get caught up in the heat of the moment! Stick to your plan! It can be tempting during an auction to get caught up in the moment and try to win rather than sticking to your game plan. Don’t let that happen.

Here’s the truth: if you’re still bidding after exceeding your starting price, you’ve already lost. You’re paying more than you intended for an item you can likely find elsewhere, or else you’re eating directly into your profit margin from the flip and reducing the value of your time invested in flipping that item. Don’t do it. Only regret lies down that path.

Don’t buy anything that you can’t thoroughly clean before taking it into your house. If I buy something from an estate sale, I want to be able to thoroughly clean it before taking it home, especially if it’s any sort of cloth item. Clothes, linens, curtains, and other cloth items can often harbor bugs and other unwanted elements, so if I’m unable to easily wash the item before taking it home, I don’t bid.

The last thing you want is to get bedbugs or other items in your home because of an estate sale “bargain.” Just don’t bring items home that could potentially be harboring such things.

Ask about items in other locations, such as sheds, barns, or outbuildings. Sometimes, estate sales are split up with items in multiple locations around the property. Usually, most of the items can be found in the house, but there are often many items for sale in sheds, barns, cellars, outbuildings, and other places.

It never hurts to ask the person running the sale whether there are items to be found elsewhere on the property. Are there items in the barn? The shed? The worst case situation is that they say, “Nope, everything for sale is right here.” On the other hand, it’s quite possible that you’ll be directed to a treasure trove of items that other buyers have completely missed.

Estate sales are a great way to find an occasional amazing bargain on something you can flip or something you actually need. The items are typically much more varied than a usual garage sale. Plus, if nothing else, it’s an interesting way to spend a lazy Saturday.

Good luck.

The post Some Simple Advice for Estate Sales and Auctions appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2XlZAd6

Dear Penny: How Long Will a Bankruptcy Stand in the Way of Buying a Home?

Dear S.,

There’s a common myth that it’s impossible to rebuild your credit while your credit reports are still scarred by a bankruptcy — and you’ve proven it wrong.

You’ve re-established credit. You’ve managed it responsibly. Now, you have a pretty darn good score to show for it, even with a bankruptcy in your file.

But there seems to be a different misconception implied in your question: that it’s impossible to buy a home while a bankruptcy is still on your credit report. This, too, is a myth.

I think you have two questions here: How long will a bankruptcy stay on your credit report? And will a bankruptcy hold you back from buying a home?

Let’s start with how bankruptcy affects your credit. A bankruptcy is one of the ugliest battle wounds you can have on your credit report, but you didn’t need me to tell you that.

And the effects are long-lasting. A Chapter 7 bankruptcy — the kind where many of your assets are liquidated and you emerge with no debt obligations — stays on your credit report for 10 years after you file. A Chapter 13 bankruptcy, in which you repay a portion of your debts, will fall off your reports after seven years.

The effect of bankruptcy on your credit score is most acute in the year or two after you file. But as you build a positive credit history, it matters less and less. The fact that your score is at 742 suggests your credit has already recovered significantly.

But will that be enough to overcome a bankruptcy when you try to buy a home? You don’t say whether you’ve actually been denied for a mortgage or if you’re waiting for the bankruptcy to drop off your report before applying.

To qualify for a conventional loan (the kind that isn’t insured by the government) after filing Chapter 7 bankruptcy, you’ll typically have to wait four years after the bankruptcy is discharged. For nonconventional loans (the ones that are backed by the government, such as FHA or USDA loans), the requirement is usually two or three years.

You’re long past the required waiting periods, but keep in mind that these are just minimums. Every lender has different requirements.

If you do forge ahead now, be prepared to document your finances and how you’ve managed credit since filing bankruptcy in painstaking detail. Making a large down payment could help you get approved, but you should still be prepared for higher interest rates.

If there were extenuating circumstances that factored into the bankruptcy, like a job loss or illness, providing a letter of explanation with supporting documents could help you get approved.

But even if you can’t get a mortgage on the terms you want, remember: Ten years is a long time, but you’re so close to the end. In another two years or so, your bankruptcy should automatically be deleted from your file.

When you do reach the 10-year mark, you can verify that the bankruptcy has been removed by obtaining a free copy of your credit report from each of the three bureaus at AnnualCreditReport.com. If it still appears, you can request that they remove it stat.

Bankruptcy may seem like a scar on your credit report, but it isn’t permanent. Because time heals both old wounds — and derogatory credit marks.

Robin Hartill is a senior editor at The Penny Hoarder and the voice behind Dear Penny. Send your questions about rebuilding credit to AskPenny@thepennyhoarder.com.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2RtKEV2

Bluehost Web Hosting Review (2019)

If you’re on the hunt for a new web hosting service, Bluehost is definitely a top option to consider. This platform powers more than 2 million sites across the globe.

All web hosting services are not created equally.

I see so many new webmasters make the mistake of just going with the cheapest web host or the web hosting site that appears first in their Google search results.

For something as important as web hosting, you can’t rush this decision. It’s crucial that you take the time to weigh your options in order to find the best web hosting plan for your needs.

That’s what inspired me to write this guide. Since so many of you will likely come across Bluehost during your search, I wanted to give you as much information about this web hosting service as possible.

I’ll explain all of their hosting plans, pricing, and discuss the best parts about using Bluehost. I’ll even tell you about a couple of cons associated with Bluehost, just to make sure you have all the facts before you sign up.

Bluehost Web Hosting Plans

Not every website has the same web hosting needs. Bluehost knows this and has three different types of web hosting options for you to choose from.

- Shared

- VPS (virtual private server)

- Dedicated server

Choosing which kind of web hosting plan to go with will vary based on how much you want to pay, your expected site traffic, and the type of website you have. If these terms are foreign to you, I recommend reading my guide on everything you need to know about web hosting. This will give you a more detailed description of the differences between these hosting options.

Shared hosting

If you have a new website and you’re on a tight budget, shared hosting might be your best option. Bluehost offers four different pricing plans for its shared hosting services.

- Basic — $3.95 per month

- Plus — $5.95 per month

- Choice Plus — $5.95 per month

- Pro — $13.95 per month

I know what some of you are thinking. If Plus and Choice Plus are priced the same, wouldn’t you automatically go with Choice Plus?

All Bluehost plans go up in price once you renew. The advertised prices above are just the introductory rates. It’s worth noting that Plus renews at $10.99 per month, while Choice Plus renews at $14.99 per month.

Bluehost has managed shared hosting platforms, meaning you won’t have to worry about managing servers or anything like that.

VPS hosting

VPS hosting from Bluehost is the middle-tier option of the three plans. There are three pricing options for a Bluehost virtual private server.

- Standard — $19.99 per month

- Enhanced — $29.99 per month

- Ultimate — $59.99 per month

The biggest differences in these plans are the cores, SSD storage, RAM, bandwidth, and IP addresses.

With the Standard plan, you’ll get 1 core, 30 GB of SSD storage, 2 GB of RAM, 1 TB of bandwidth, and 1 IP address. Cores, SSD storage, and RAM double at each tier for the Enhanced and Ultimate packages.

Using Bluehost for a VPS gives you dedicated server resources. You’ll be able to use your RAM, CPU, and disk space, no matter what other users on the same server are doing. VPS hosting also has increased security, since you won’t be sharing an operating system with any other Bluehost users.

Dedicated hosting

Picking a dedicated server plan from Bluehost means you’ll be taking advantage of their top of the line services. These plans are made for those of you who are tech-savvy and want complete control over your server.

- Standard — $79.99 per month

- Enhanced — $99.99 per month

- Premium — $119.99 per month

As you can see, top-tier plans come at higher price points. With VPS hosting, you’re maxed out at 120 GB of SSD storage, 8 GB of RAM, 3 TB of bandwidth, and 2 IP addresses. But dedicated servers from Bluehost go all the way up to 1 TB of storage, 16 GB of RAM, 15 TB of bandwidth, and 5 IP addresses.

These plans will probably exceed the needs and uses for what most of you are looking for. But with that said, as your website grows and your traffic scales, you might want to consider a dedicated server in the future.

Benefits of Bluehost for web hosting

Now that you have a better understanding of the plans offered by Bluehost, it’s time for us to discuss what makes Bluehost a great choice for web hosting.

Low pricing options

If you have a brand new website, you don’t need to be spending thousands of dollars per year on web hosting. With Bluehost, you won’t have too.

As you’ve already seen, the introductory rates for Bluehost shared web hosting starts at just $3.95 per month. Being able to host your site for less than $50 is a great deal.

All Bluehost shared hosting plans come with a free SSL certificate and free marketing credits. When you factor in the storage and bandwidth you’re getting, that’s a fairly decent value for the price.

Overall, this is one of the lowest prices you’ll see for a legitimate web host.

Great security

Even though Bluehost has some inexpensive pricing options compared to other web hosts on the market today, it doesn’t mean that they’re inferior when it comes to crucial security features.

I’ve already mentioned that an SSL certificate comes standard, regardless of which plan you choose.

Furthermore, their plans have a feature to hide the personal information that you used when signing up for a private domain. Lots of times hackers will target this information from website owners.

Bluehost has features to prevent malware attacks, as well as tools used for automatic daily backups. You’ll also get a security tool that offers spam protection for the email address associated with your website.

Again, this is all a great value considering how much these plans go for.

Top loading speeds

Page loading speed is something that always needs to be taken into consideration when you’re shopping around for the best website host.

If your site takes too long to load, it’s going to kill your engagement metrics. People will abandon your site, and you won’t be able to drive conversions. It’s as simple as that.

So let’s take a look the response time for a Bluehost test website.

The average response time for Bluehost so far in 2019 is 352 ms. To put that into perspective, refer to my SiteGround web hosting review. SiteGround’s average response time over the same period of time was 662 ms, which is still fast.

Bluehost nearly cuts that time in half.

Easy to use

You don’t need to be a tech expert to host your website with Bluehost. Nearly anyone, regardless of their experience level, can find a beginner hosting plan from this platform.

That’s definitely not the case with all web hosting providers on the market today. There are plenty of web hosts out there that are specifically designed for advanced webmasters.

Whether you’re using WordPress or taking advantage of the Bluehost website builder, everything will be pretty straightforward and easy to follow.

Excellent support

Even though Bluehost is easy to figure out, you may still find yourself in a situation where you need some help or guidance.

In most cases, you should able to find an answer through their knowledge base page. This is essentially a support center that has how-to guides, tutorials, and articles with instructions for troubleshooting and FAQ. Simply search what you’re looking for, and there will likely be a resource to help you out.

Furthermore, Bluehost has 24/7 phone support, which is great for those of you who like to be talked through problems.

If you’re like me, you’ll probably just take advantage of their live chat agents. It’s a fast and easy way to get an answer without having to leave their website.

High uptimes

You can’t give a web hosting review without referring to uptime rates. Take a look at where Bluehost stacks up compared to other web hosting providers in this recent study.

Bluehost ranked second on the list with a 99.991% average uptime for the year. That percentage is identical to MidPhase, which ranked first on the list.

Furthermore, you can see that Bluehost only had seven total outages on the year, which was the lowest for all hosts in the top five, including the top-ranking provider on the list.

It really doesn’t get much better than that. So if you host your website with Bluehost, you can rest assured knowing that your site isn’t going to have much downtime throughout the year.

Money-back guarantee

Like most web hosting services, you won’t get a free trial to try them out. But with that said, Bluehost does offer a 30-day money-back promise.

So if you’re on the fence about using Bluehost, it’s comforting to know that you’ll get refunded if you’re not ultimately satisfied in the first month.

But with that said, it’s worth noting that the refund only applies to web hosting costs. So if you use Bluehost for a domain name or other add-ons, those purchases are final.

WordPress hosting

If you’re using WordPress, Bluehost is definitely a top option for you to consider. That’s because this web host is just one of the three “official” recommended choices from the WordPress website.

DreamHost and SiteGround are the other two recommended web hosting services on this WordPress resource.

With that said, you can still use nearly any other web hosting service on the market to create your WordPress website. But it’s definitely a positive sign that Bluehost is recognized as a WordPress partner.

Other considerations

While Bluehost has its fair share of positive characteristics, it’s still not perfect. I wouldn’t be doing my job if I didn’t mention some of the shortcomings of this web host.

High renewal rates

I briefly mentioned this before when we were discussing the different plans and pricing options. Like many other web hosting services, Bluehost jacks up the prices once you renew your subscription.

Depending on your plan, the monthly rate will change as follows:

- $3.95 to $7.99

- $5.95 to $10.99

- $5.95 to $14.99

- $13.95 to $23.99

- $19.99 to $29.99

- $29.99 to $59.99

- $59.99 to $119.99

- $79.99 to $119.99

- $99.99 to $159.99

- $119.99 to $209.99

As you can see from this list, in some instances the price more than doubles. So it’s in your best interest to commit to a longer term plan if you want to get the best rate for the longest amount of time.

Bluehost offers plans for 12, 24, or 36 months. So if you know that you’re ready to commit to this web host, I’d recommend going with a three-year contract when you first sign up. It will save you money down the road.

Costly site migrations

It seems like the majority of web hosting services out there will migrate your current website to their service at no cost. This is a major selling point for new customers.

However, Bluehost does not offer free website migrations.

For $149.99 they’ll migrate up to five websites and 20 email accounts. This gets handled by experts at Bluehost, so you won’t have to do any heavy lifting.

But with that said, you do have to pay for it, which can be a turn-off for those of you with an existing site.

Conclusion

Simply put, I definitely recommend Bluehost as a web hosting provider. There’s a reason why it’s one of the most popular services on the market today.

Bluehost has exceptionally fast loading times as well as one of the highest uptime rates we’ve seen in the last year.

They offer different hosting types, plans, and options to meet the needs of any website. I’m sure you’ll be able to find a plan from Bluehost that is suitable for your web hosting needs.

Source Quick Sprout http://bit.ly/2IXsW8w

You Could Win Free Electric For Life By Cutting off Your AC for a Few Hours

Listen, we know it’s hot in California this summer, so this might sound silly… but would you be willing to turn your air conditioning off for an hour tonight?

Just one hour. Power down that AC, and flip on the fans.

Why? Because you’ll be one step closer to potentially getting your electric bills paid for life.

Yup — if you sign up for OhmConnect, a California energy-saving program, and power down for one hour tonight, you might never have to pay an electric bill again.

How to Get Your Electric Bill Paid for the Rest of Your Life

Honestly, there are a lot of sweepstakes out there, and we gloss over many of them because, well, what are the chances you’ll actually win?

But OhmConnect’s MEGA Summer 2019 contest is different. Even if you don’t win its grand prize (your electric bills paid for life!), you’re still winning.

OhmConnect will pay you to reduce your energy usage for a few hours each week. San Diego resident John Hastie made more than $400 in one month through the platform.

Here’s how it works:

Once you sign up for your free OhmConnect account, you’ll connect your online Pacific Gas & Electric Company, San Diego Gas & Electric or Southern California Edison account.

Then OhmConnect will email or text you about upcoming #OhmHours. These occur a couple of times each week, and you’ll get rewarded when you cut back on your energy consumption. Hold off on laundry and dishes, turn the AC off and unplug that coffeemaker — just for an hour.

Now here’s where the contest comes in.

This summer, between June 1 and Sept. 30, you’ll get notified of MEGA #OhmHours, which include specific energy-saving goals for you. Hit these goals and automatically get entered to win weekly prizes.

Once you collect three entries (or successfully participate in three MEGA #OhmHours), you’ll be entered to win the grand prize: free electric for life.

When OhmConnect ran this contest last year, it gave away $2.5 million in cash and prizes.

It’s super easy to sign up and enter, and we like it because, even if you don’t win that grand prize, you’ll still get paid to save electricity during #OhmHours.

The free electric for life is just an additional perk.

Honestly, can you even imagine a world where you didn’t have to pay an electric bill?!

The average monthly electric bill in California was $101.49 in 2017, according to the U.S. Energy Information Administration. If you win, you could save more than $1,200 in savings a year.

Oh, the places you could vacation with that money…

Carson Kohler (carson@thepennyhoarder.com) is a staff writer at The Penny Hoarder. When she lived in Florida, her summers were very, very expensive.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2L4gshX

Lessons learned from the Woodford funds debacle

If you hadn’t heard of Neil Woodford before, chances are the media storm of the last couple of weeks will mean you have definitely done so by now.

Earlier this month his eponymous Woodford Investment Management sent shockwaves through the fund management sector when it announced the suspension of the £3.7bn (€4.2bn) fund following an increased level of redemptions. This has left investors unable to access their money for a 28-day period, or maybe even longer.

It would be easy to point the finger at former high-flying fund manager Neil Woodford. He allowed a personality cult to develop around him, especially after he went solo in 2014. And he lost his Midas touch, increasingly investing in things he had little or no experience with.

His reputation as a star fund manager is damaged and is unlikely to recover. The short-term nature and coverage of active investment doesn’t take any prisoners, but it also means that for those who can generate some good returns can quickly get back into favour. Although it will take something extraordinary for Woodford on this occasion.

But this is a salutary tale for all of us, not just Mr Woodford. The whole affair is an object lesson in the risks of non-advised investing. Here are some hard lessons learned.

Only buy what you understand

This is the guiding principle of the Warren Buffett school of investment. Buy blue-chips and brand names you know.

Anything else, avoid.

Ironically, it was this very approach which made Mr Woodford’s fame and fortune in the first place. He eschewed fashionable technology stocks at the height of the dot-com boom, sticking with out-of-favour FTSE-100, dividend-rich blue chips (the stock of a large, well-established and financially sound company that has operated for many years) instead. He was proved right.

But at some point, Mr Woodford himself began dabbling in start-ups that are not listed on any recognised stock exchange.

The risks of this are now obvious for all to see. People failed to pay attention to what was actually happening until it became too late.

So, always make sure you know what it is you are buying. If ever there is anything you don’t understand, be sure to ask the questions and get the answers. And remember, everything reverts to the mean – a star fund manager’s luck or success will eventually run out. You can’t beat the combined wisdom of all market participants consistently over time.

Or, as Mr Woodford and his followers are finding out, the market can stay irrational longer than you can stay solvent.

Know the difference between best-buy tables and actual advice

This could perhaps be the biggest takeaway from these events. Mr Woodford was a firm favourite of fund ‘best buy’ lists, chief among which are those of the various investment platforms. In particular, Hargreaves Lansdown, one of the most influential financial intermediaries, have received major criticism since the fund’s suspension for this reason.

To give Hargreaves Lansdown credit, they have always taken a long-term view with Mr Woodford, promoting him for his ability to deliver over time. But even a broken watch is right twice a day. Increasing level of redemptions showed investors’ patience with Mr Woodford was wearing thin.

The bigger question here is the responsibility on these ‘best buy’ lists. People take these as the basis for making their own investment decisions without any protection or recourse when they go wrong.

With this level of influence, it is clear that intervention of these lists is needed. It needs to be made much clearer that investors using these platforms are really on their own. Hopefully this is where the FCA is looking.

The reality for Hargreaves Lansdown customers in Mr Woodford is that, despite it appearing in its Wealth 50 and launched with a huge fanfare, there is nowhere to go if they believe they have been mis sold.

Understanding the term ‘liquidity’

Liquidity refers to how easy, or difficult, it is to buy/sell certain assets. Shares in companies listed on the stock market are bought and sold every day – these are call ‘liquid’. Start-ups or privately-owned companies with fewer shares traded and not listed in regular exchanges are referred to as ‘illiquid’.

Mr Woodford’s fund suspension has reopened debate over a fundamental flaw with so-called open-ended funds that invest in illiquid assets. These funds offer investors the ability to buy and sell on a daily basis — but their fund managers cannot do the same with the assets they hold, such as property or early-stage companies.

There is the argument that a crackdown is needed on open-ended funds investing in illiquid assets. However, it does allow customers to invest in a diversity of fund options so perhaps it is instead a case of just adjusting the frequency of dealing in these assets.

Importance of diversification of funds

The whole point of investing in a fund in the first place is to diversify risk, rather than put all your eggs in one basket. However, some funds are more diversified than others.

A broad-based portfolio that invests in different asset classes, industries and markets across the world reduces risk compared to buying a specialist fund or individual stocks and shares.

While it will be worrying and frustrating for investors who cannot access their money in Woodford’s funds, hopefully other investments have performed better.

Keep fees low

Finally, keep costs to a minimum. Spread your risk. Buy and hold for the long term. Unless you are confident and well-read on the world of investments, don’t try to beat the market. Buy low-cost tracker funds.

Above all, ignore the cult of the star fund manager and their just-as-highly-paid promoters.

Do this, and your overall investment returns might thank you for it.

Anthony Morrow is chief executive and co-founder at OpenMoney

Section

Investing FundsFree Tag

funds investing savingsImage

Workflow

Source Moneywise http://bit.ly/2XueXQF

Our son has learning difficulties. How do we protect him in our will?

Question

Both my husband and I are in our 60s. We would like an outline of the steps we need to take to ensure our son, who lives with us and has mild learning difficulties, is protected financially when we are no longer around.

We haven’t made a will yet. Do we get financial advice first before making a will? Would it be a good idea to set up some form of trust for him and how do we do this? Our son is partially dependent on us, he works part-time and does not receive any benefits. Would a trust cause problems for him if he had to claim benefits in the future?

From

Making a will is a sensible step for anyone, irrespective of their circumstances because it makes sure that your wishes regarding who should benefit from your estate are fulfilled rather than relying on the law to decide.

In your circumstances, it is definitely worth getting advice on making a will to make sure your son’s needs are met.

When doing this, it is important to take into account your future need to be able to access your savings as well as your desire to look after your son. If you feel your son wouldn’t be capable of handling his financial affairs, a trust may be appropriate. You should discuss whether to incorporate this into your will so that it only takes effect after your death, or to set it up now potentially reducing any inheritance tax payable after your death.

For most people, an inheritance could affect their ability to claim means-tested benefits, but non-means-tested benefits are not affected. There is a special kind of trust for people with disabilities that protects the capital from means testing, known as a disabled person’s trust.

Even though your son may not be claiming benefits currently, I would recommend getting professional advice to find out whether he would be eligible for such a trust, because this could make a big difference to the benefits and tax treatment of his inheritance.

Image

Section

Work & family Family lifeFree Tag

inheritanceAsk Experts Blurb Top

Source Moneywise http://bit.ly/2IuX108

“I’m upset with my favourite hotel over extra fee”

When a Moneywise reader booked to go to the Riu Arecas Hotel in Tenerife earlier this year, it was set to be an emotional trip.

VO of Leicester had spent several happy holidays there with her husband of 60 years, who sadly died last year.

It was to be her first holiday without him, so family members agreed to fly out to keep her company at different points during the three-week trip.

VO booked accommodation for two people and emailed the hotel with the names of the family members who would be joining her. The first week went well, but when her daughter tried to check in for the second week, she was told that she couldn’t stay in the hotel because the booking was in the name of the first guest for the entire three weeks.

VO’s daughter was only allowed to stay if VO paid another €648 (£577) for the booking, which was described by the hotel as a ‘walk-in fee’.

VO’s grandson told me: “We think this is unfair and the hotel is exploiting a vulnerable customer. All their guests at this time of year are elderly people.

“It’s not about the money – it’s more the principle. We’ve tried to complain, and it has offered points to use in the hotel in future, which is not helpful as she won’t be going there again.”

When I contacted the hotel, it responded: “We would like to point out that our guests are the most important to us.

“We strive every day to give them our best service. We can assure you that our hotel team always follows the established protocol, rules and company’s regulations.”

In other words, it didn’t seem to think its staff had done anything wrong. This sort of attitude from big companies really angers me. Yes, it had not broken any rules, but it hadn’t shown any customer care.

I told the firm: “I’m sure your hotel team followed established protocol, rules and regulations, but they showed no understanding and compassion for my reader’s grief and situation.

“At the very least, I would have thought you would have wanted to refund the needless extra charges.”

I then pointed out that I would warn Moneywise readers that the hotel chain appeared to be a company that puts profits before customer happiness, which is not a good look for a hospitality business.

That worked.

While the hotel still defended its staff’s actions, its stance then softened. On the basis that there was “a misinterpretation or misunderstanding” by VO, the company said that it would refund the €648 reservation fee charge as a gesture of goodwill.

I’m glad that the hotel finally saw sense and I hope that it tries to be more understanding with loyal customers in the future.

OUTCOME: Reader is refunded €648 fee

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2L6AEzI

Head to head: Buy and hold or short-term trades?

Managers put the case for their investment philosophy: in the red corner, patient investors James Anderson and Tom Slater of Scottish Mortgage trust – and in the blue corner, Merian’s flexible investment fan Ian Heslop

Scottish Mortgage

We operate within an impatient industry, which often seems as if it has forgotten its underlying purpose. As managers of Scottish Mortgage Investment Trust, our job is simply to take capital from those who wish to invest and funnel it towards the businesses that can best use it, in the search of profitable returns for all.

We look for strong, well-run and growing companies, public or private, based on the attractiveness of their fundamental operating economics and competitive advantages. We then try to hold such businesses at sufficient scale over time to make a difference for our own shareholders’ returns. They can be in any industry and from anywhere in the world, because the best opportunities vary in nature over time. This flexibility allows us to adapt to the structural changes occurring in the world and is inherent to our longevity.

James Anderson, fund manager at Scottish Mortgage

Patience is a virtue

Investment requires patience. Any business owner knows that entrepreneurial progress takes time and is rarely a smooth path. We therefore view it as critical to try to support businesses in their extraordinary endeavours and ambitions, especially when the daily news tumult or operational challenges try to blow us off course. Making judgements on managerial excellence or the potential for sustainable competitive advantage is only worthwhile over a suitably long-term time frame. Anything less is speculation.

A long-term investment horizon is crucial, too, if you are to accrue the benefits of compounding returns. Once we find good companies, we anticipate holding them for many years. Our low average portfolio turnover of under 12% per year is the proof that we actually do this. Our longest investment, Swedish industrial company Atlas Copco, has been held continuously since the 1980s, and more than 60% of the current portfolio has been held for more than five years.

Scottish Mortgage shareholders need to share this patience; the trust is not suited to impatient investors looking for a quick turnaround or smooth path. The best rewards will only come to those who can endure. We try to maximise Scottish Mortgage’s own competitive advantages, using the investment company structure to invest in private and public businesses, but also by utilising Scottish Mortgage’s scale to keep the cost of accessing these investments as low as possible for our shareholders.

Academic work on the past 90 years of US stock returns shows that the best-performing 90 companies out of a total of around 26,000 accounted for more than half the excess return from equities over that period. A handful of exceptional companies had an outsized impact, consistent with their persistent dominance in the real world. These findings are consistent with our experience of investing globally.

Tom Slater, fund manager at Scottish Mortgage

Compounding growth

They highlight the fundamental attraction of actual investment in companies: the downside is limited to the capital invested. But when companies compound their growth over the long term it is possible to make many times your investment, skewing the balance of risk and reward in the patient investor’s favour. Our portfolio is therefore relatively concentrated, with around 80 holdings. We are unashamedly trying to uncover just that small number of companies and hold them.

The broad global index and its short-run gyrations therefore merit little attention from us. We have distinct feelings of apathy towards our industry’s constant angst over such volatility, which is often mistakenly conflated with ‘risk’. True investment risk is the permanent destruction of capital value where an industry background or a company’s execution/competitive advantage is not what we had imagined. We acknowledge the uncertainty in investing, accepting that not all will come to pass as we hope. We try to minimise the human reality that we will make mistakes. But we do try to ‘beat’ the market and its mood swings. That is a very different task.

We actively search for stock-specific ‘risk’ and then diversify this, through investing in a wide range of businesses. Scottish Mortgage may be best known for its investments in Amazon, Alibaba and Tesla, but there are plenty of other exciting businesses in the portfolio addressing specific and large markets such as the genomics revolution in healthcare (Illumina, Grail); the transformation of financial services (Ant International, TransferWise); digital media (Netflix, Spotify); food consumption and production (Meituan, Grubhub, and Indigo Agriculture); and transportation (NIO, Full Truck Alliance and Lyft).

What all our investments tend to have in common is the fact that they are the companies leading change in their industries, driving progress. Scottish Mortgage aims to help its shareholders share in the benefits of the success of their endeavours.

Merian Global Investors

I admit that for some private investors, buy and hold, or holding on to stocks for a long time, may be a fairly good strategy. It could reduce their trading costs because the number of transactions will be relatively small. It could also help them avoid some behavioural or psychological biases that can detract from return.

The bias of herding, for instance, is when investors thoughtlessly chase short-term market movements: it leads investors to panic and sell after market falls, and to become over-confident and buy at the top of rallies. Herding has recently been evident in markets, which over the past year have become more volatile and changeable than they were previously.

However, there are plenty of reasons for not adopting a buy-and-hold strategy, at least not when running a fund. Sometimes buy and hold is presented as if it were a moral virtue: we are told that a long-term investment horizon is good, and that short-termism is an evil.

This argument is based on a simple confusion between investment horizon and trading strategy – it is perfectly possible to combine a long-term investment horizon with a shorter-term trading strategy.

We all want to optimise our returns over the long term, but that does not necessarily mean we have to hold individual stocks for long periods. More important is to hold the right stocks during the right periods.

Let’s look at some reasons why holding stocks for a long time may not always be sensible and why adopting a flexible investment strategy can be beneficial. I shall draw on behavioural finance to explain investors’ cognitive and emotional errors.

Behavioural finance

Behavioural finance is a useful corrective to the ‘efficient market’ hypothesis of traditional economics, which portrays investors as sublimely rational wealth maximisers, and share prices as perfectly and instantaneously reflecting all information.

Recent financial theory has moved beyond the efficient market hypothesis, but you do not need to be a finance expert to see the problems with it, because it flies in the face of common sense. Is anyone you know completely rational all the time? Can they instantaneously process all information? In the real world, investors are driven not only by reason but also by emotion.

By studying how investors actually react, and the way in which real (rather than theoretical) markets behave, we can seek to exploit inefficiencies in market pricing.

One behavioural bias is known as conservatism (with a small ‘c’). Under this bias, beliefs are insufficiently revised even when new evidence is presented. What does the buy-and-hold investor do when new evidence emerges against their previous investment case?

A type of conservatism that I believe to be widespread in markets is rigidity of investment style. An example of an investment style is a value style, or buying relatively cheap stocks.

Value investing has outperformed over the past 100 years, attracting academic interest and leading some investors to strongly believe in it as a long-term strategy.

However, this is of scant comfort to those who have suffered from the value style’s significant underperformance during the past decade, when cheap stocks have become even cheaper.

Another behavioural bias is the endowment effect. People tend to value something they own more highly than something they do not.

Buy-and-hold investors are in danger of succumbing to this behavioural bias: it can lead them to hold underperforming stocks for too long and could fail to form a fair view of them.

Ian Heslop, head of global equities, Merian Global Investors

The merits of flexibility

Although stocks are rights to ownership in companies, they can be dominated by market, rather than company-specific, factors. In running funds, my team and I see ourselves as temporary holders of stocks, and we seek to use them to take advantage of changes we observe in the market environment.

We favour a dynamic process, which means responding to market changes by flexing our investment style. We use elements of a value style, for example, when we believe the market conditions are right for it. But we use elements of a growth style (buying shares in faster-growing companies) when we believe the market environment has moved on to favour that style instead. By being style-agnostic, and by flexing our style, we aim to earn better returns across different types of market than we could by buying and holding.

This feature first appeared in our sister magazine, Money Observer.

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2IvsWgP