Customers are the lifeline and driving force of your business.

Without them, you wouldn’t exist.

That’s why you need to spend the time and use various resources to develop a better understanding of your customers’ thinking.

The idea is to put yourself in your customers’ shoes—their minds, really.

You want to figure out their perception of your company.

Creating an accurate customer persona can help you accomplish this.

It will help you learn about their habits, behaviors, and interests.

That way, you’ll be able to market to them accordingly.

Customer personas can help you get more money from your existing customers and even help you acquire new customers.

You’ll be able to keep your customers engaged.

Ultimately, this will improve conversion rates.

If you’ve never created a customer persona before, it can sound a little intimidating.

Don’t worry—it’s not as difficult as you might think.

I’ve created the ultimate guide for developing customer personas that can help you improve your conversion rates in a dramatic way.

Here’s what you need to know.

Customer personas are not the same as a target market

One of the first steps to starting a business involves identifying your target market.

This should be done before you officially launch to make sure people will be interested in your brand, products, or services.

But target markets are not the same thing as your customer personas although they will have some similarities.

Here’s an example of what it takes to identify your target audience:

This is a logical place to start, especially if you’re a new business.

Even if your company has been operating for quite some time, it doesn’t hurt to go back to the drawing board.

Re-evaluate your target market if you’re struggling with conversions.

You need to have a firm grasp of this topic before you can develop a customer persona.

Demographics are a key component of your target market.

I’m talking about factors like:

- geographic location

- age

- sex

- religion

- marital status

- income

All of these play a role in determining your company’s target audience.

But your customer persona is going to break that down even further.

While your target audience encompasses the elements that show what different groups of people have in common, the customer persona looks for differentiating factors.

What makes each person within a certain demographic unique?

Just because two people of the same gender and same age live in a specific city doesn’t mean they have similar interests.

One may be the perfect customer for your company, while the other would be a waste of time and money to focus your marketing efforts on.

Relate the customer persona to your brand

Ultimately, you want this marketing profile to be related to your company.

For example, if your company sells cars and you don’t have any information that relates to the customer’s driving needs, you’re approaching this the wrong way.

You have to ask yourself,

“Who wants and needs the product I’m selling?”

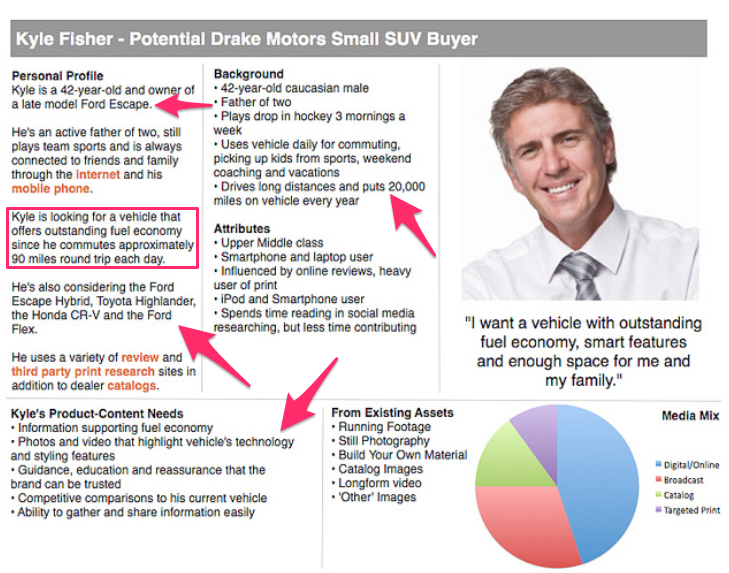

To illustrate my point, here’s a perfect example of someone who needs to buy an SUV:

There’s a ton of information on this marketing profile such as the customer’s name, age, and race.

You also learn he has two kids and enjoys playing hockey.

These factors impact his need for an SUV.

Since Kyle has children, he can’t buy a coupe. Plus, safety is important to a family man.

Since SUVs are larger, he might feel safer driving his kids in a full-size vehicle.

The fact that he plays hockey means he needs room in his car for big, heavy, and bulky equipment, so an SUV makes the most sense.

But now I want you to notice the specific information I emphasized in this customer persona.

These points are related directly to what Kyle is looking for when he’s shopping for a vehicle.

You want to make this information as specific as possible.

This is what differentiates one customer from another.

It shows the number of miles he drives to work each day, which is why fuel economy is important to him.

The profile also includes some recreational activities he uses his car for such as family vacations, coaching, and driving his kids to and from their sporting events.

Can you see how this persona can be drastically different from that of another 42-year-old male who lives in the same area but doesn’t use his car for any outdoor activities?

The key here is you always need to relate the persona back to what you’re selling. Otherwise, the information won’t be as helpful.

Start with the basics, and be specific

The first step to developing a persona should be the person’s name and age.

Refer to your target market for this.

Let’s say your brand appeals to men in their early 40s. If he’s 42 years old in 2017, that would mean he was born in 1975.

These are the top 15 baby names from that year in the United States:

Based on this information, we can refer to this customer persona as Michael.

Next, determine where he lives.

While geographic location such as state, city, or region from your target market is a good start, you want to break this down even further.

Does Michael own property or does he pay rent?

If he’s a homeowner, is he in a condo complex or a single family home?

Does he rent an apartment or a house?

What are his monthly mortgage or rent payments?

Notice that we started with some broad facts but slowly came to more specific information.

That’s how you need to approach this.

From here, you can begin to come up with more information about Michael’s personality based on his living situation.

For example, you could say he owns his house because he’s raising a family and doesn’t plan on going anywhere.

Alternatively, you could write that Michael pays rent because he’s single and doesn’t want to commit to one area for long periods of time.

Just make sure you’re relating this persona back to your brand.

Let’s say your brand sells expensive furniture. You wouldn’t be marketing to a renter who moves to a new city every year or so.

You’d focus on the man who owns his home and plans to live there for the next 30 years.

Include information about their career and income

Assuming your customer has a full-time job, their career is an important part of who they are.

They’re spending at least 40 hours a week at this job, so it’s a huge part of their life.

Think about how much of your schedule revolves around your profession. I’m willing to bet it factors into many of your decisions.

Here’s another example that includes this information:

Look at how much detailed information about his career this customer persona has.

They even related his top objectives and biggest fears to his job.

All of this is important for creating an accurate marketing profile.

Furthermore, while a person’s job may impact their happiness, schedule, and mindset, it also is directly related to their spending habits.

That’s essential to your goal of improving your conversion rates.

The more money someone makes, the more money they spend.

Take a look at the differences in average annual spending for high- and low-income homes:

Higher income homes spend more money annually in every category on this list.

In some instances, the differences in the amounts are drastic.

When you’re developing a customer persona, make sure the hypothetical person you’re creating can afford your product.

Here’s an example.

Let’s say they make $45,000 per year after taxes.

They spend $14,000 annually on housing and $7,000 on transportation.

The essentials, such as their insurance and food, cost $12,000 in total.

This leaves them with an extra $1,000 per month of disposable income to spend on everything else.

Can they really afford the $450 pair of headphones your company is selling?

Probably not.

In this case, you’ll need to develop a customer persona with a higher paying job.

Find out how their interests and behaviors impact their consumption habits

This part is going to help you reach your customers when it comes to your marketing efforts, which we’ll discuss shortly.

For example, what do they use to determine the credibility of a company?

Refer back to the first customer persona we analyzed earlier: Kyle, the prospective SUV buyer.

He actively uses social media but doesn’t post anything.

Instead, he uses it as a research tool to read reviews.

You’ll also want to include information about their hobbies, likes, and dislikes.

What is this person good at?

Are there certain things they can’t do?

For example, depending on your industry, it might be valuable to know whether or not this person can cook or whether they tend to eat out.

If they eat out, you can also assume they don’t have as much of a disposable income since they are spending more money on food even if they have a higher salary.

How does this person buy their products?

Are they an impulse buyer? Or do they take time to research their options and compare different brands?

Use this information to improve your marketing content.

Apply your customer personas to your marketing strategies

Now that you’ve developed an accurate and detailed customer persona, it’s time for you to use it to improve your conversion rates.

Let’s say you are getting plenty of traffic to a particular landing page, but not many visitors follow through with your call-to-action.

You may want to re-evaluate the source of that landing page and the message that entices customers to convert based on the persona.

For example, your customer persona may be a 20-year-old female who goes to college in New York City and has a part-time job paying $20,000 per year.

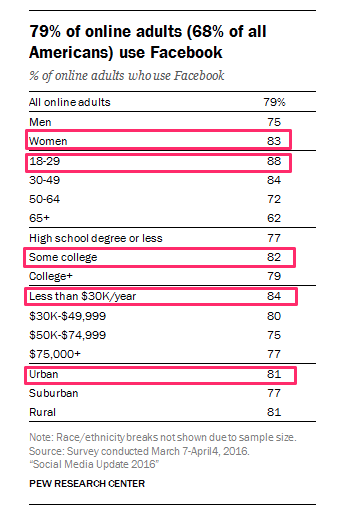

Based on this persona, it’s safe to say she has an active Facebook profile.

You should be trying to improve your marketing efforts so that she gets brought to your landing page through some kind of Facebook campaign.

Now let’s get to her buying behavior, which we just discussed.

If she’s an impulse buyer, you can use scarcity tactics to get her to make a purchase:

- Sale ends tomorrow

- Only three tickets left at this price

- Sign up before midnight and get 25% off your first purchase

Marketing campaigns like this can get her to buy something.

Conclusion

Customer personas are not the same as a target market—although you need to have a clear target audience to help you come up with an accurate persona.

The persona will include much more detail about your customer.

That’s because two people with similar demographics aren’t necessarily going to shop the same way. You want to focus your efforts on the ones who fit your persona.

Your customer persona needs to be relevant to your brand and whatever you’re selling.

Start with basic information like their name and age.

Then get more specific with their job, income, location, and living situation.

Find out how their interests, hobbies, lifestyle, and personal life impact their buying behavior.

Use this information to improve your current marketing campaigns.

Now you can target people based on specific factors to improve your conversion rates.

Don’t stop after your first customer persona.

Make as many as possible so you can come up with different ways to appeal to specific types of customers.

What information will you include in your customer personas to increase conversions on your website?

Source Quick Sprout http://ift.tt/2E1Ob4F