الجمعة، 26 يوليو 2019

'USA Is Set to Zoom!' Trump Team Touts Economy, Blames Fed Hikes for Q2 Slowdown

Source CBNNews.com https://ift.tt/2LLoHjV

The Basics of Asset Protection Planning – The Rules You Need To Know

While working with clients for almost two decades one of the most pressing concerns shared among all of them was protecting the nest egg they had accumulated. Any news headline or market correction would evoke fear about losing their portfolio. It didn’t take long to realize that utilizing asset protection strategies was a must for my clients emotional well-being.

The following is a guest post from Blake Harris. He is the Managing Attorney at Mile High Estate Planning where his primary focus is making sure his clients are protected on all fronts. When he offered to share some of his asset protection strategies on the blog I was excited to share his expertise. Here’s his thoughts on making sure your protected….

#####

For those who have assets, making sure they are safe is a top priority. There are various threats to your continued ownership of your property, including lawsuits, creditors and even divorce.

In today’s litigious society, many different people can try to take what you have worked hard for from you. The good news is you are not entirely defenseless in this area. There are laws you can use to your advantage in order to protect what you have, and it is entirely legal.

In order to do so, you will need an asset protection attorney who has an understanding of the relevant areas of the law.

What Is Asset Protection?

Asset protection is the term that can describe the variety of different financial structures and arrangements you can take in order to keep your assets safe from creditor, judgements and other occurrences such as divorce. There is not one set definition of an action you would take when it comes to asset protection as it could encompass any one of a number of steps. Defined loosely, these are steps to keep your assets in your hands in practically nearly all circumstances. This can be financial planning or a number of any legal steps that can be taken.

Who Can Help?

Generally, it will be an estate planning attorney that will have the knowledge necessary to assist with this process. There are any one of a number of different disciplines of law that may be involved in asset protection, including trusts and estates, family law, personal injury and corporate law. Most individuals do not have knowledge of one of these topics of law, let alone having sufficient expertise in all of them. This is not really something the average person can do on their own.

Instead, they will likely need the help of attorney to execute these plans. If anything is done wrong, it could nullify the entire asset protection effort. Then, you will not discover you are unprotected until it is too late. Hiring an attorney can minimize many of these risks and give you the peace of mind to know your asset protection plan will be effective.

What Happens?

There are several different outcomes with asset protection plans. One outcome is to move your assets beyond the reach of anyone who may be trying to take them from you. This will mean that, while you may be sued, your assets cannot be reached. Losing a lawsuit and losing your assets are not necessarily the same thing. When someone successfully sues you, they will obtain a judgment against you.

However, they will need to find your assets suitable to satisfy the judgement. If assets are protected or are moved out of your control, anyone who holds the judgments will not be able to attach the assets. They will only be able to go after what they are able to, and the asset protection plan will place much of what you have out of the purview of a judgment.

Alternatively, other forms of asset protection will give you the assets necessary to pay a judgment or creditor in the event they come after your assets.

When Do You Need It Most?

The simple answer to this question is now before it is too late. If your asset protection plan is not in place when trouble hits, you will have difficulty safeguarding your property. There are laws that prevent something called a fraudulent conveyance. This occurs when someone tries to transfer money to another party in order to avoid a debt or a judgment. The key here is there has to be a debt or a judgment that one must be trying to circumvent.

This means any plan must be in place before the debt or incurred or the judgment is entered because anything executed after that may be considered null and void by a court. While you may not go to jail for this, a court will look for an equitable solution in order to keep you from shifting assets around to get out from under an obligation. The appropriate time to worry about this is before there is anything to worry about. If the asset protection plan is already in place, then it will be operative and provide the safety you need.

While most people would benefit from some type of asset protection, not everyone will ultimately need it. By definition, you will need to have assets you are trying to safeguard, so you will need to have a net worth. People who would be ideal beneficiaries of this course of action would be those who may ultimately face frequent lawsuits or the threat of a financially crippling lawsuit.

For example, while doctors may have malpractice insurance, it does not always remove all elements of personal risk to them. Doctors live with the possibility they may have to surrender assets if there is a judgment against them. While they do need to maintain control over some of their assets, it may behoove them to “take money off the table” by executing an asset protection plan. In addition, spouses who enter into a marriage with significant assets of their own may also gain from an asset protection plan because prenuptial agreements may not always be foolproof.

Another important use of an asset protection trust is for someone who may eventually need nursing home care. Nursing homes will look to your assets first, and if you do not have them, then Medicaid would cover the costs of skilled nursing care. Thus, it is imperative to move assets into a trust so that the cost of a nursing home does not eat up all of the assets that you plan on leaving to your loved ones.

What Are Different Types of Asset Protection?

Many of these plans involve trust agreements where you will surrender some beneficial control over an asset in exchange for protecting it from creditors. In other words, you would establish any one of a number of different trusts and move assets into the trust. It is the surrender of control of the asset to someone else which legally separates the asset from you such that there is a distinct identity for the asset.

When you give up the right to exert various forms of control over the asset and give someone else the ultimate power over it, you and the asset are disassociated in the eyes of the law even if you maintain an ownership interest in it.

Other types of asset protection involve the corporate or legal form of the asset or entity. For example, you can set up a Limited Liability Corporation which protects your other assets. While this does not protect you from all types of liability, it means that, if there is a liability-creating event, all the creditor or judgment holder can go after are the LLC assets, including its bank accounts and any property that it has. When this is your business form, your personal assets are largely safe.

Another type of asset protection is to place assets in a tenancy by entirety if you have a spouse. This means that if there is a judgment, the property of the other spouse cannot be reached. Any asset is joint property. However, this means that in the event of a divorce, you may lose some of the property.

Further, while many think of complicated asset structures when they think about protection plans, this can be as simple as buying the right type of insurance. There are specialized policies that can protect assets in the event of a lawsuit. These policies will kick in when the amount of the judgment exceeds existing insurance limits. While insurance can help protect you, it is by no means foolproof and you may not be able to get a policy big enough to remove all risk.

What Are Different Type of Trusts You May Need?

Asset protection trusts can be either domestic or offshore. Which form you ultimately choose depends a lot on the state where you live and whether it permits certain offshore trusts. For example, there is something called a bridge trust that takes effect on the occurrence of a certain specified event. You can remain the trustee in full control of your assets until this event happens. When the event does occur, the trust is automatically set up and the foreign trustee takes control of your assets while you maintain ownership. Then, at some point, the trust can dissolve and you can regain control of your assets. There are various types of offshore LLCs that can act as asset protection entities.

Not every state legally recognizes a bridge trust. In fact, only a handful of them allow this under their laws. However, there are other forms of foreign offshore trusts that can protect your assets which are legal in all states. The countries where these trusts are domiciled have taken steps to make their jurisdictions as defendant-friendly as possible. There may still be attempts by courts to force you to repatriate your assets, but they will be better protected than if they are in the U.S.

Of course, you can always elect to use a domestic trust in order to protect your assets. These are easier to establish and they have certain tax advantages that foreign trusts lack. These will typically cost less to set up than a foreign trust since it will cover less geographic distance and there are fewer parties to work with when establishing the trust. One feature you must be aware of is some of these trusts must be irrevocable in order to provide the desired asset protection. In other words, once you move the assets into the trust, it is permanent and they cannot be moved out. Make sure your attorney checks the laws of the state you are in because they are not always permitted.

What Is the Extent It Covers?

To be clear, asset protection plans are subject to tax laws. Even if the assets are placed in a trust, you would still be responsible for whatever your tax liability is. While these trusts may protect your assets, they cannot be designed to defeat the IRS.

In addition, some judges may compel you to repatriate assets held overseas under court order. Some courts could impose a jail sentence for failure to comply with that court order. This depends on the particular judge and the type of arrangement you have.

How to Pick an Attorney

It is important to know the extent of the lawyer’s expertise before you retain them as your counsel. Look to see the areas of law with which they are familiar and make sure they have the ability to work across disciplines.

At the same time, you do not necessarily want a generalist who practices different areas of the law. It is better to choose someone who has a dedicated expertise in estate planning and asset protection because one mistake can permanently alter your financial picture.

The Bottom Line

Of course, this guide would be incomplete without a discussion of some of the drawbacks of an asset protection plan so you can make an informed decision about what to do with your property. One of the main considerations is trusts cost money to set up and maintain and then require tax returns over the life of the trust. In addition, as mentioned above, trusts can have a certain degree of permanence that is inescapable.

Finally, when placing assets in a trust, you will lose some element of control over the asset, lest a court “pierces the veil” and finds you are essentially the same as your trust.

Of course, you should compare the costs of setting up the trust to what you may stand to lose if creditors or judgement holders have the ability to help themselves to your assets.

The post The Basics of Asset Protection Planning – The Rules You Need To Know appeared first on Good Financial Cents®.

Source Good Financial Cents® https://ift.tt/2Ys636P

When Is It a Bad Choice to “Go Cheap”?

One of the challenges of trying to minimize one’s spending is knowing which situations where you aim for minimum spending result in unexpected negative consequences as a result of cutting too much spending.

I’ll give an example of something that’s a clear misstep: an old friend of yours is coming in from out of town and wants to spend some time with you. Rather than going out to eat together somewhere in town, you invite the friend over for a meal you prepare yourself, but the meal consists of barely-seasoned beans and rice. Your friend feels like you’re being cheap, the meal and conversation don’t go well, and that friendship gradually withers away.

Obviously, that’s a bad choice. You don’t want to be an absolute cheapskate to an old friend, and very few people would do a thing like this outside of an extremely difficult financial position.

The problem is that going “cheap” is a gray area where it’s not always clear whether you’re making a sensible choice in terms of bang for the buck or whether you’re cutting too hard in a way that will have negative consequences later.

For example, imagine you work at home and you’ve purchased a chair that you’ll sit in every day for work. If you buy the cheapest chair possible, you’ll save money up front, but it’s likely that the chair won’t last long and that it will be fairly uncomfortable during the time you use it, plus it may cause unnecessary lower back problems due to poor lumbar support or other issues due to bad ergonomics.

The challenge, of course, is that it’s often not perfectly clear in advance whether or not you’re going too cheap or whether you’re getting a good bargain for your dollar. There’s often trial and error involved.

A couple of years ago, I made a list of several specific items that you should avoid going cheap with, but that list really doesn’t help with evaluating new situations. Here are some principles that are worth following that will help you figure out when you shouldn’t go cheap.

Research the items you buy and aim for good value rather than the cheapest sticker price. For really inexpensive items, like household supplies, this usually isn’t much of an issue because the cheapest item is often identical to the more expensive versions except in different store brand packaging. However, as you start looking at somewhat more expensive items, the quality gap between the cheapest item and the best “bang for the buck” item is enormous – often the difference between “barely functional” and “does a great job” – while the price difference really isn’t very much.

The best thing you can do for most purchases beyond grocery store staples and household supplies is to do a little research on them. Hit your local library on occasion and check out issues of Consumer Reports to find out what they have to say about almost any purchase you can think of, and look for what they recommend as a “best buy.” Their “best buy” recommendations almost always perform fantastically well while having a pretty low price.

Don’t go cheap on friends and family, especially when the expense is irregular and you want to maintain a positive relationship. Your immediate family should be a part of the conversation about your frugal choices, particularly your partner. Your close friends and family members that you see frequently likely understand your spending choices and accept them. The real issue is the people you care about but don’t see regularly, as those are situations where there aren’t as many symbols of care as there are with immediate family and close friends and nearby relatives.

In those situations, the best thing you can do is put a lot of focus on regular positive contact with the people you care about a lot but don’t see often so that they know that you care, and then don’t go ultra-cheap when you do see them. This does not mean putting out an expensive spread for every meal, but rather putting out a good, flavorful meal that might cost a little more than you expect. This doesn’t mean going to the most expensive restaurant around, but it doesn’t mean shoehorning such a choice into the cheapest place around – rather, find a place that’s really really good without being overly pricy. If they’re staying in your home, use normal toiletries – don’t use watered-down hand soap, for example. Going super-cheap is not a symbol of caring.

What about gift-giving occasions? A thoughtful gift – one where you really thought about what the recipient cares about and enjoys – matters more than an expensive gift. I’d far rather have a $5 gift that actually lines up with what I care about (like, say, a pack of pocket notebooks or a bottle of interesting seasoning or something like that) than a $20 gift given with little thought, and most adults would fall into this camp.

Don’t go cheap on items you’re going to use literally every day or absolutely rely on. What are the things you use literally every day? Those things need to do their job well and should, at the very least, follow “best buy” recommendations rather than buying the absolute lowest priced version.

What kinds of things am I talking about? Shoes. Your mattress. Toilet paper and other basic toiletries. Undergarments. If those things are causing you discomfort, then it’s going to have a sustained negative impact on your life and the relatively small amount you’re saving is not worth it. Your shoes should not hurt your feet. Your mattress should be comfortable enough that you fall asleep with ease and not hurt your back. Your toiletries should not feel uncomfortable to use or have bad side effects. Your undergarments should not be uncomfortable or scratchy, either. Things you use every day should not be causing an ongoing negative issue for you or else you’re facing a serious quality of life challenge.

If you use your car every day or at least rely on it to get you to work, don’t skimp on it, either. I don’t mean that you should go out and buy a brand new car every year. Rather, I mean that you should stick to the maintenance schedule on your car and be proactive with repairs. The money you “save” by not getting maintenance done on your car or letting a “check engine” light stay on for a long time will usually end up costing you far more in the long run.

You should also be willing to spend for home maintenance. Things like replacing furnace filters might feel like something you can skimp on, but you end up paying for it with more energy use.

Don’t go cheap on hygiene. Yes, basic hygiene products are a constant expense, but things like toothpaste, toothbrushes, dental floss, deodorant, bath soap, hand soap, laundry soap, dishwashing soap, shampoo, and conditioner shouldn’t be skipped because they cost money. Their cost is pretty small in the big scheme of things and daily bathing and twice-daily brushing and flossing and deodorant use allows you to make a positive impression on the people around you, which benefits your social life, your professional life, and your romantic life. Even if you legitimately do not care about that for some reason, good hygiene also keeps health issues at bay. Things like the common cold and influenza and stomach illnesses are kept at bay with regular hand washing, bathing, and oral hygiene.

For most people, hygiene is an extreme common sense thing, but for a surprising number of others, it’s not. Don’t skip out on it to save money or to save time. You’ll regret it over the long run.

In general, if you follow these principles, you’ll avoid most of the issues that people fall into when it comes to being overly cheap. There’s a fine line between being frugal and cutting back so much that it becomes uncomfortable for you and offensive to others; these strategies will keep you on the better side of the line.

Good luck.

The post When Is It a Bad Choice to “Go Cheap”? appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2Mg3QVp

Dear Penny: I Can Get a 401(k) Loan and Pay Myself Interest. Should I?

Dear P.,

Mathematically, I can’t tell you whether you’d come out ahead if you took out a 401(k) loan. That depends on so many factors, like the interest rate you’re currently paying on the debt you’d use the loan for and how the market performs.

Generally speaking though, borrowing from your future is a bad deal — even when you’re paying interest to yourself.

First, a quick 411 on 401(k) loans: Not all employers let you borrow from your 401(k), but if your plan allows loans, the IRS says you can borrow up to 50% of your vested balance or $50,000 — whichever is less.

The loans are tax-free and usually repaid through automatic payroll deductions. The interest you pay goes back into your retirement fund, so the appeal is obvious. Of course you’d rather pay interest to yourself instead of a bank.

But as you acknowledge, you’re missing out on potential gains, which could be significant thanks to compound returns. That effect will be even greater if you reduce or eliminate your contributions while you pay back your loan, as many 401(k) borrowers do, or if your employer doesn’t allow you to make contributions while you have an outstanding loan.

The real danger, though, comes if things don’t go as planned.

If you leave your job for any reason, you’ll have to pay back the outstanding loan balance in full when you file that year’s tax return. So if you got fired or quit your job at any point in 2019, you’d need to repay your 401(k) loan balance by April 15, 2020, or Oct. 15, 2020, if you filed an extension.

But what if you can’t afford to repay it? Then the IRS will treat it as an early withdrawal, which means you’ll pay income tax, plus a 10% penalty if you’re under age 59 1/2. So suppose your outstanding loan balance was $10,000 and it’s taxed in the 22% bracket. With taxes and the penalty, that $10,000 loan would cost you $13,200.

The risks are real. A 2015 study by the National Bureau of Economic Research found that 86% of 401(k) borrowers who leave their company defaulted on their loan. (Caveat: When the research was performed, 401(k) borrowers only had 60 days to repay their loans if they left their jobs. The Tax Cuts and Jobs Act of 2017 extended the time frame.)

Also, consider that a 401(k) is an asset that’s protected from creditors, so you should be extra cautious about using it to pay off debt or put toward a property that could be seized if you fell on tough times.

There may be some circumstances when raiding your 401(k) is your least bad option — if you have a serious illness or are about to lose your home. If that were the case, I’d be inclined to at least consider a 401(k) loan.

But it doesn’t sound like that’s the case here. If you’re looking to pay down debt and have decent credit, a debt consolidation loan is a better option. Sure, you’ll fork over interest to a lender, but it’s much less risky than a 401(k) loan. Or if you want money for a down payment, finding a down payment assistance program or good old-fashioned saving are better options for the long haul.

It’s frustrating to watch your retirement balance rise and fall in a volatile market. But remember that these ebbs and flows are usually relatively minor. Saving for retirement is a long-haul game, and short-term fluctuations aren’t a big deal in the larger picture.

The purpose of your 401(k) is to fund your retirement. Until then, the best advice is: Do. Not. Touch.

Robin Hartill is a senior editor at The Penny Hoarder and the voice behind Dear Penny.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2Y7lW2Z

9 Popular Ecommerce Products to Sell Online in 2019

The ecommerce industry is booming.

People are buying products online more than ever before. Nearly anything you can imagine can be purchased on the Internet and delivered to your doorstep. It’s a great time to be a consumer.

But as an entrepreneur, you can leverage this craze by creating your own ecommerce shop.

You can take advantage of this opportunity and start an online store from virtually anywhere with Internet access. While technology has made it easier than ever for consumers to buy, it’s also easier than ever before to start an online business.

Sure, there are a handful of things that you need to figure out. You’ll have to create a website, choose an ecommerce platform, pick a web hosting service, and learn how to market your brand online.

But before you get ahead of yourself and start all of that, you need to figure out what you’re going to sell.

Lately, I’ve been talking to so many entrepreneurs who want to sell online, but they just don’t know what to offer. That’s what inspired me to write this guide.

Using in-depth research and trend analysis, I’ve come up with a list of nine popular products that you can sell online in 2019. Use this guide as an inspiration for your ecommerce shop.

1. Groceries

When most people think about selling products online, they automatically think of new gadgets or products that are designed for everyday use around the house. Or they try to think of something innovative that will solve a common problem.

However, it seems like people rarely think to sell food.

Consumers are buying everything else online, so why not groceries? It’s something that everyone uses on a daily basis.

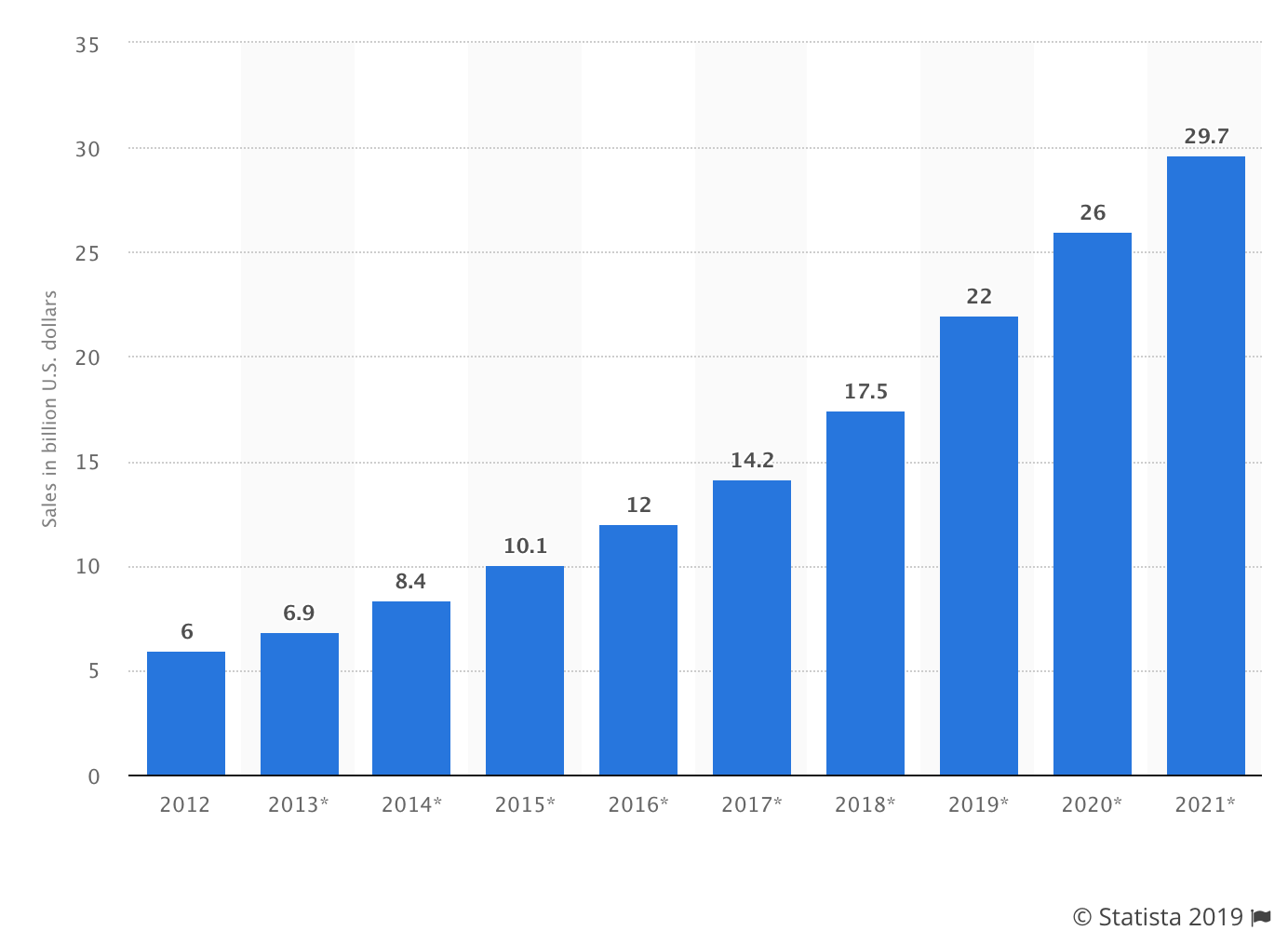

Take a look at the current and projected growth of online grocery sales in the United States alone.

By 2021, experts predict that this will become a $30 billion industry.

Furthermore, the online food and beverage industry is growing at 18% year-over-year

While the majority of grocery shopping still takes place in physical store locations, the ecommerce grocery movement is the way of the future. So this is a great chance for you to jump on board before the market gets too saturated.

There are seemingly endless opportunities here. You could sell anything from snacks, to produce, to prepared and pre-packaged meals.

Ultimately, there is plenty of money to be made in this space if you’re able to carve out the right niche. Just make sure you educate yourself about the legal aspects of selling food online, as the regulations are different from selling other products.

2. Electric scooters

If you live near any major American city, you’ve probably seen the rise of electric scooter usage over the last couple of years.

Depending on the area, this trend has seemingly taken over the streets and sidewalk.

Companies like Bird, Lime, and Razor are pioneering the scooter ridesharing industry. Even bigger names like Uber and Lyft have entered the e-scooter space.

The idea behind ridesharing scooters is great.

Essentially, riders just use a mobile app to locate and start a scooter. Then they ride to a destination and park it anywhere. They are charged based on usage and everything is handled through the mobile app.

With this trend growing in popularity, it seems like more and more people want to own electric scooters, as opposed to just using the rideshare options.

In 2018, there were roughly 44 million electric scooters and electric bicycles sold worldwide. That number is expected to reach 50 million in 2020.

This is a great opportunity for you to seize. That’s because high-end products can be sold at a higher price point.

Research shows that the average cost of an electric scooter is roughly $300. But some high-end models can retail for more than double that amount.

3. Virtual reality headsets

Virtual reality and augmented reality are increasing in popularity.

If you read my blog on a regular basis, you know that augmented reality already made my list of the top mobile trends that are dominating 2019. I also wrote about how augmented reality is impacting the future of SEO.

But now I want to take a moment to talk about the business opportunity for the virtual reality market. First, let me clarify the differences between AR and VR.

AR uses overlays on computer-generated screens to put digital figures into real-world images. For example, AR can be used on a smartphone to play games like Pokemon Go.

As the name implies, VR puts users into a virtual world, using more specialized and sophisticated equipment, like a VR headset.

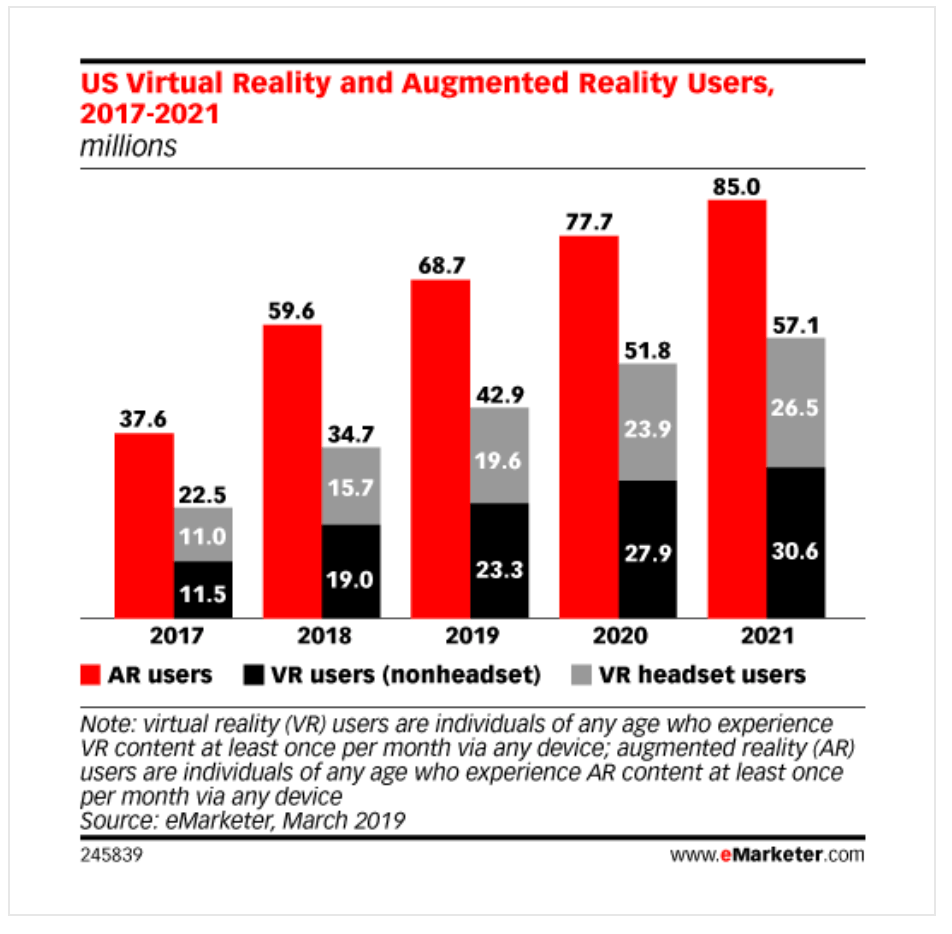

Take a look at the growth of VR and AR users in the United States.

As you can clearly see from the graph, both VR and AR users are growing each year.

There are more AR users, simple because augmented reality is easier to use and doesn’t require special equipment.

With that said, the number of virtual reality headset users is still continuing to grow and carve out a good-sized market share in this niche.

In 2017, there were roughly 11 million VR headset users in the US. That number has already doubled and will reach 26.5 million users by 2021.

There are lots of potential consumers to target with this product. According to a virtual reality headset review by The Verge, VR headsets have quite the price range. Inexpensive headsets can be bought for less than $100, while higher-end models retail for upwards of $800.

4. Smart speakers

As long as we’re on the technology subject, I figured this would be a good time to talk about smart speakers. This is another trend that’s growing in popularity.

Today, in 2019, there are more than 74 million smart speaker owners in the United States.

However, this only makes up 26% of US Internet users, meaning that there is still plenty of room for growth in this space.

China has that most smart speaker owners in the world, with 85 million. But this makes up just 10% of the country’s total Internet users. Again, this proves a high global demand for the product, with tons of room for growth in the category.

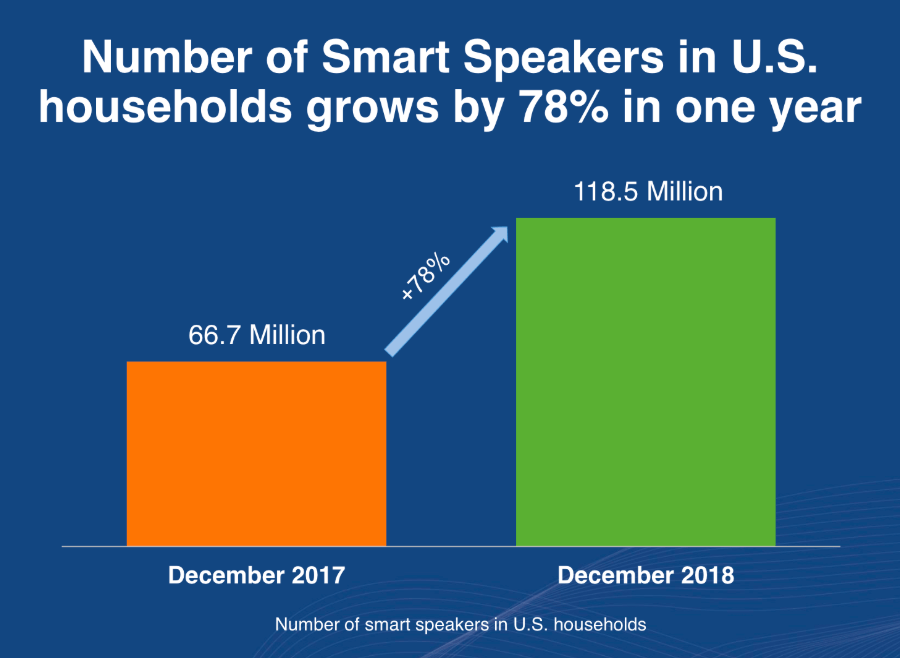

Speaking of growth, look at the number of households in America that have a smart speaker.

There was a 78% growth rate between 2017 and 2018.

Here’s a crazier statistic. More than half of smart speaker owners have two or more devices.

This means that current smart speaker owners are still potential customers for you. This product is a great opportunity to sell online via your ecommerce shop.

5. Vapor products

E-cigarettes and electronic vaporizers, better known as “vapes” are growing in popularity.

There are several different components to vapor products. There is the device itself, which operates by heating a liquid solution. Then there are the flavored liquids, usually containing nicotine. Plus there are other accessories as well, and these products come in all different shapes and sizes.

Just to be clear, I’m not here to talk about the health risks of vaping or anything like that. Nor am I encouraging the use of e-cigarettes or nicotine products.

But like every other product on this list, I’m simply identifying market trends and sharing the information with you. These trends are telling me that it’s a hot category.

By 2023, the global vapor market is expected to reach $43 billion. That’s a 15% compound annual growth rate for five years. The figures are impressive, to stay the least.

There is definitely a market for this product, and plenty of money to be made by selling vapor products online. Just make sure you comply with all of the legal regulations associated with selling vapes and accessories through an ecommerce shop.

6. Jewelry

Jewelry is another product category with seemingly endless opportunities for online sales.

You can target men, women, children, and teenagers with high-end diamonds, low-end rings, and everything in between. There are so many options for products and targets in this industry.

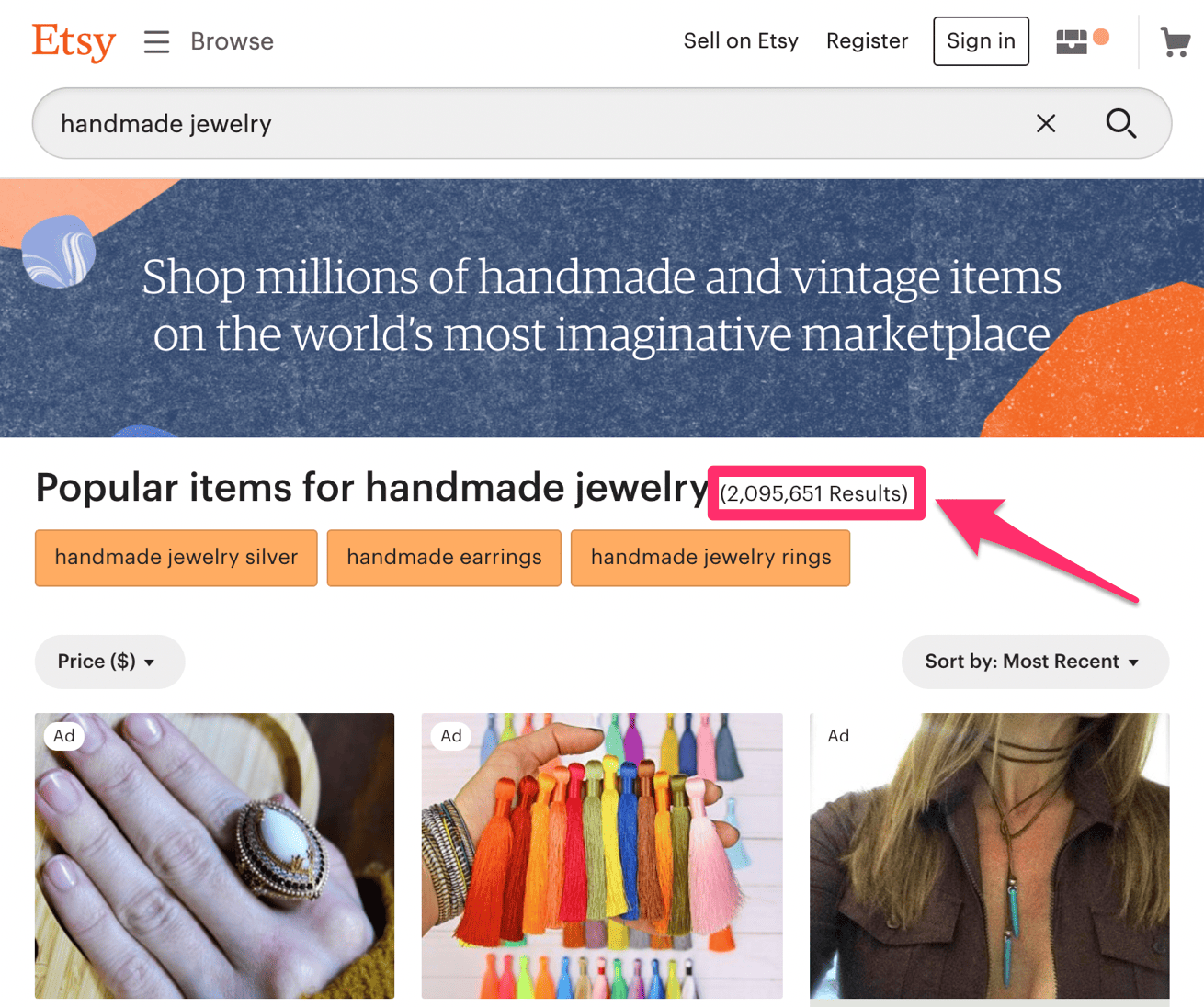

Plus, you can even make jewelry by hand. More than 2 million handmade jewelry products are sold on Etsy.

Studies show that the global online jewelry market is expected to grow at a CAGR of nearly 16% between now and 2022.

According to Shopify, ecommerce only represents 4-5% of all jewelry sales worldwide. However, that number is expected to be 10-15% by 2020.

What does this mean? Jewelry sales, like most products, are starting to trend in the ecommerce direction. There is so much room for growth in the coming years with this product category.

7. Digital courses and learning material

You don’t always need to sell tangible products on your ecommerce shop. You can also sell digital goods like ebooks or online learning courses.

This is another booming industry.

According to Forbes, the e-learning industry is going to reach $325 billion by 2025.

There are so many potential customers here as well. In fact, 77% of corporations in the US use online learning tools. E-learning increases retention rates by up 60%.

So if you’re good at something, take advantage of it. Teach others how to do whatever it is that you know best.

Product content like blogs, ebooks, and videos. Then sell those digital goods online.

The best part about this is the low overhead. Your only costs will be running your website, processing transactions, and your time. Everything else is just straight profit.

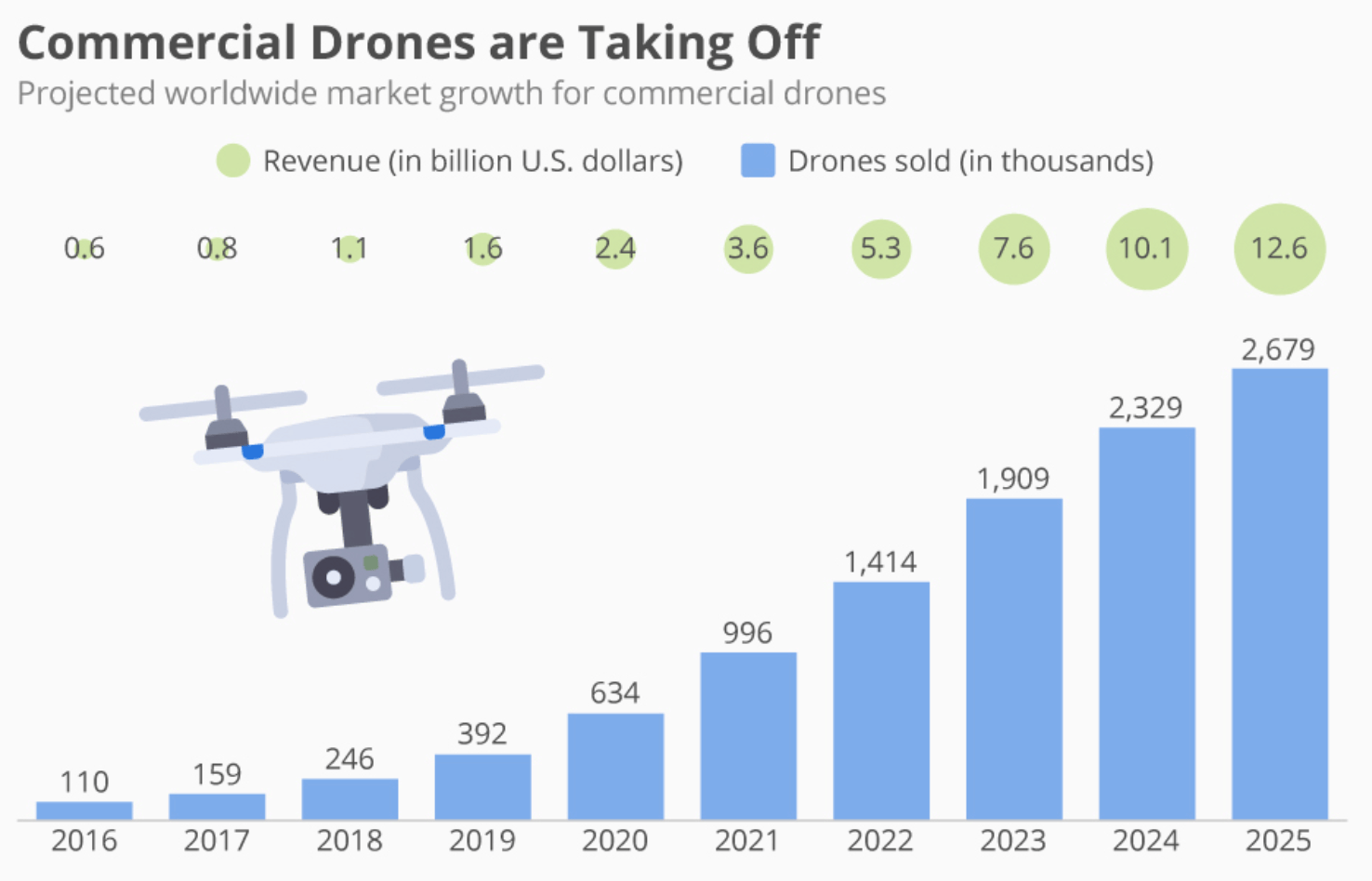

8. Drones

The drone market is segmented into two categories.

- Consumer

- Commercial

There’s actually a military category too, but that’s not really relevant for ecommerce purposes.

While you might be tempted to just target the average Joe who wants to flow a drone around his neighborhood, you might want to consider the commercial market as well. Check out the growth of commercial drones over the years.

Between now and 2025, the global commercial drone market is expected to grow by roughly 700%. Now is the time to jump on this trend to get your share of the action.

You can still go after consumers as well. The unit sales of personal drones dominate 94% of the market. However, this only represents 40% of the total revenue share, since commercial drones are typically priced higher.

9. Clothing and accessories

It may sound simple, obvious, or boring, but the online clothing industry is huge.

But in order to be successful here, you definitely need to go after a niche. Trying to sell to anyone and everyone will be too competitive to survive.

By 2023, revenue from online clothing, footwear, and accessories in the US is expected to surpass $145.7 billion. That’s up from $93 billion in 2017.

58% of Americans have purchased clothing online.

Again, this is another industry where you have tons of options. There are different types of people to target, and countless options of products to sell at varying price points. Ultimately, there’s lots of money to be made selling clothes online.

Conclusion

There has never been a better time to sell products online. Starting an ecommerce store is easy, and consumers are continuing to buy products on the Internet more and more each year.

But what should you sell online?

Use this list as a reference. Unlike other similar posts that you’ll find online, I took the time to actually research industries and trends. I didn’t just pull random products out of thin air.

That’s why this information is so valuable. If you can set up your ecommerce shop around these trends, it has a much greater chance of being successful.

Source Quick Sprout https://ift.tt/2yc03QL

Home-sitting rules – from both sides of the fence

Source Moneywise - 29 years of helping you with your finances https://ift.tt/2MfN3St

In which tax year will £6,000 gift count?

My parents each gave me £3,000 just before the end of the 2018/2019 tax year. They each gave me a cheque and I deposited them into my bank account around 2 April, which was still within the 2018/2019 tax year.

However, the cheques didn’t clear until after 6 April which was into the new tax year.

My parents are thinking about giving me another £3,000 each in this 2019/2020 tax year.

My question is whether or not the £6,000 I have already received is classed as having been gifted in the 2018/2019 tax year or the 2019/2020 tax year?

You are referring to the annual exemption. This exemption allows people to give away assets or cash up to a total of £3,000 in a tax year and this amount is then no longer considered to be part of their estate for inheritance tax purposes.

However, a gift given by cheque isn’t effective until the cheque has cleared. This makes the timing beyond the control of the donor if there is a delay in the recipient presenting it to the bank.

The reason for this position is that until such time as payment is cleared, the transaction can still be cancelled.

As a result, the gift that you received will be deemed to have been made in the 2019/20 tax year.

The good news is that your parents can carry forward any unused part of their annual exemption by one year.

So, assuming they didn’t make any other gifts in the 2018/19 tax year, they will be able to each give you £3,000 now.

Source Moneywise - 29 years of helping you with your finances https://ift.tt/2ZdacIP