الجمعة، 19 يناير 2018

Monroe County road work week of Jan. 22

Source Business - poconorecord.com http://ift.tt/2DkciMc

Bushkill 209 Diner to reopen under new owners

Source Business - poconorecord.com http://ift.tt/2DSxYjI

The New York Times Is Looking for the Next Generation of Writers

The old Gray Lady wants to get hip with you crazy kids.

At least, that’s what it sounds like in this New York Times post seeking five college students or recent grads to become correspondents. The company’s only qualifications are that you’re young and a good writer; no other experience is required.

The Edit, its newsletter for the younger set, will feature one correspondent’s essay each week, covering a topic supposedly of interest to your peers. The paper promises to pay for multiple contributions, although it didn’t say how much.

To apply, send an email with a brief description about yourself, along with 500 words about one of the four topics listed. One of the writing prompts is sharing your pet peeve about the way people write about your generation; I wouldn’t recommend using any Times articles as examples.

Writing not your thing? No worries, check out other gigs on our Facebook Jobs page, where we post new opportunities all the time.

Apply to Be a Correspondent at The New York Times

Responsibilities include:

- Write about issues of interest to students and people who’ve just started their careers. You’ll be expected to contribute multiple articles throughout the year.

Applicants for this position must have:

- Strong writing skills, although neither a journalism degree nor media experience is required.

- Knowledge about what the kids are talking about these days.

Apply here for a correspondent gig at The New York Times.

Tiffany Wendeln Connors is a staff writer at The Penny Hoarder. Her first paid writing gig was for The New York Times, when as a college student, she was asked to report on television coverage for the 1998 election. She got paid $50. Got a great job opportunity you’d like to share? Email her at tiffanyc@thepennyhoarder.com.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2DjmB3a

This is Why It’s OK to Ask for Cash Wedding Gifts (Plus How to Do It)

Last summer, one of the writers here at The Penny Hoarder HQ built a shed.

Why, you ask?

Well, to store all the extra stuff — stuff that had no other place to go — that he and his wife received from well-meaning friends and family who attended their wedding.

Now don’t get me wrong: I’m sure they were thrilled to have a third toaster and a set of crystal goblets (I’m only making a few assumptions here). But even so, wouldn’t they have been better served with a cash payout equal to the cost of all those duplicate wedding gifts?

A few months later, in October, my sister got engaged.

Since then, most of our family conversations have been wedding related. At one point, I brought up the new(ish) trend of a “honeymoon fund,” where the couple asks friends and family to contribute to their honeymoon budget, in lieu of gifts.

While not opposed to the honeymoon fund per se, she was absolutely taken aback when I took it one step further and suggested they ask people to just give them money with no particular allocation in mind.

An hour-long debate over the social and ethical implications of asking for money (with any goal in mind) at your wedding ensued — and we never really came to a resolution.

Money in Lieu of Traditional Wedding Gifts

To be clear, I’m pro asking for money instead of gifts at your wedding.

And it’s not a totally absurd concept, according to the 2018 Wedding Trends forecast published by The Knot this week.

More and more couples are asking for financial gifts to cover a down payment on a home, the cost of an adoption, a honeymoon or even just to put away as a nest egg or rainy day fund.

No Longer a Taboo Subject

There was a time when giving a cash gift (or worse, asking for one) was considered bad etiquette — but that was also the time when money was considered a taboo subject in polite society.

These days, we’re relaxing when it comes to discussing finances. In fact, 79% of millennials say they’re comfortable discussing finances with a friend (as opposed to the not insignificant 51% of baby boomers who said the same).

But why? Because we’re all starting to realize exactly how important it is to be able to talk about money. If you can’t talk about it, you’re going to have a hard time doing things like asking for a raise or helping friends (or asking for help yourself) when needed.

The Argument for Cash Gifts

The long and short of it is this: We’re more comfortable talking about money than ever, and the trend is only going to continue as we work to instill financial awareness in future generations.

So why is it such a strange concept to some that two people who are at a critical (and not inexpensive) juncture in their lives ask for a little financial boost?

Listen, no one’s asking for any crazy sum of money.

In fact, a cash gift at a wedding really shouldn’t be any larger than the amount a guest was willing to plunk down for a blender or a nice set of bed sheets. If it’s all the same coming out of your budget, why not give the couple the chance to decide exactly how that money would best be spent?

And just imagine all the things a couple could do with that money! They could pay off student loans, take a vacation, adopt a dog, remodel their kitchen or even start planning for parenthood.

And if your gut reaction is, “Yeah, but I could do all of those things with that money, too!” then by all means, go ahead and put the cost of a set of IKEA dishes into your savings account.

Then, take the same amount (or whatever amount you were going to spend on the couple’s wedding present, anyway) and hand it to them in an envelope instead of in the form of a third Brita pitcher. (They both already have one, I promise.)

And that’s the thing: Most adults already have a fully stocked kitchen. They don’t need a set of pricy Turkish dish towels, but they might really appreciate a little help affording a new dishwasher. They wouldn’t have room to store another crystal vase, but they would be so grateful to receive enough money to paint the horrific, sunshine-yellow dining room in their starter home.

And if you have the funds, why not go in with the rest of the new couple’s friends and family to help them on their way to being a little more financially stable?

Wedding Registry Ideas: How to Tactfully Ask For (and Give) Cash

There are a lot of different options when it comes to asking for money in lieu of traditional wedding gifts.

A honeymoon fund was one of the first versions of cash gifts that rolled out onto the wedding scene. Guests can either give a general amount or sponsor individual activities, like zip-lining or swimming with dolphins.

Some people simply ask for their guests to contribute to a “newlywed fund,” a general cash registry people can access and pay into online.

If you’re not feeling all that bold, consider giving specific line items your friends and family can “sponsor.” A portion of a new washer/dryer combo, “cabinets in the new kitchen” or the foundation of an emergency savings account are all options your friends and family would feel confident contributing to.

If you still think you’ll encounter pushback from a few more traditional wedding guests, The Knot has a wedding registry platform that allows you to set up a newlywed fund alongside a more conventional registry. That way, you give guests who may not be comfortable giving a cash gift a graceful out.

If you have a fully stocked home and feel pretty confident in your financial situation, you might even consider encouraging your guests to contribute to a cause or charity you’re passionate about.

What’s important is how you present the idea to your guests. You don’t want to be rude, and certainly don’t want to tell them what they have to do. Anna Post, the great-great granddaughter of Emily Post (yes, that Emily Post) even offered up some tips on how to graciously ask for cash contributions.

If you’re a soon-to-be wedding guest, and you’ve been asked to gift cash instead of a toaster, don’t freak out.

The couple isn’t looking for a whopper of a check to land in their mailbox, and you’re not obligated to give them any more than you would have spent on a traditional wedding gift.

If you just can’t handle the thought of not giving them a physical gift topped with a flouncy bow, consider gifting them something thoughtful and personalized (and maybe even DIYd!). That way, you’re not just giving them another cookie jar, and you might even have some money left over to contribute to their nest egg savings fund.

Grace Schweizer is a junior writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2rlcFVb

How Belly Bandit Is Helping Women Pay for the Maternity Products They Need

Having a baby can be expensive — and that’s just considering all the items the baby will need. But expecting mamas have needs, too!

The cost of maternity clothes, nursing bras, prenatal vitamins and loads of ginger tea to fight through all the nausea can certainly add up.

To help more women afford the pregnancy-related items they need, Belly Bandit, a company that focuses on maternity and post-pregnancy products, has made several of its products eligible to be claimed on health insurance plans, including flexible spending account and health spending account programs that offer reimbursements for items paid for out of pocket.

“We wanted to make our pregnancy support and postpartum recovery products available to all women who need them — that was the motivation behind the insurance coverage,” said Belly Bandit co-founder Lori Caden.

She said the company went through a lengthy process of consulting with numerous doctors and specialists in the maternity field to establish the medical necessity of the products in order to obtain the proper diagnostic codes for insurance coverage.

“Our products address various issues, from back pain to diastasis recti,” Caden said.

Belly Bandit announced the health insurance initiative in September 2017.

Products that are eligible for insurance coverage include various wraps and bands made to support a woman’s body during pregnancy and aid in postpartum recovery. Supportive underwear for women who’ve had a C-section and compression socks may also be covered.

Dr. Cynthia Robbins, a OB-GYN who has worked with the company, said she prescribes the pregnancy wraps for support, to relieve back and pelvic pain, and to stabilize the postpartum body so early exercise can begin.

“I am very glad insurance companies are reimbursing these items as durable medical goods,” she said. “So many more women will be able to be helped now.”

Women must check with their insurance plans to see if Belly Bandit products are covered and submit insurance claims to their individual providers.

While Belly Bandit does have an insurance submission form on its website along with suggested steps to follow to submit a claim, it does not work directly with insurance companies, nor does it issue the reimbursement payments.

Nicole Dow is a staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2DjL48s

Finally, a Job for Those of Us Who Just Want to Cuddle With Cats All Day

You know how they say, “Do what you love and you’ll never work a day in your life”?

Well, there’s a job opportunity that recently came up, and it’s the sort of job “they” were talking about when “they” first uttered that phrase.

Right now, a veterinary clinic and cattery in Dublin is looking for a professional cat cuddler to, ya know, cuddle cats and stuff.

And I mean, if that’s not exactly the type of job they were referring to, then I really don’t know how to help you.

How to Get Paid to Cuddle With Cats

Just Cats Veterinary Clinic and Cattery focuses on providing low-stress, cat-friendly veterinary care by creating a welcoming, cozy and secure environment for, well, cats.

Part of that initiative includes having a professional cat cuddler on staff to pet the cats, cuddle the cats, play with the cats and generally make the cats feel both important and at ease.

The ideal candidate, the job listing says, will have gentle hands capable of petting and stroking cats for long periods of time, a soft-spoken voice and strong cat-whispering capabilities to calm the nerves of cats who have figured out that they are, in fact, in a vet’s office.

The ability to understand different types of purrs and cat communication cues will give you a “distinct added advantage” in landing the job.

(That makes sense; bilingual candidates are usually highly sought after.)

Other important traits that would make you successful in this role include loving cats, being a crazy cat person, having “cattitude,” feeding strays because you just love cats so darn much, getting warm and fuzzy feelings from petting cats, counting cats before you go to sleep (whether they’re your own personal herd or imaginary ones makes no real difference) and just generally being really enthusiastic about cats.

This position is based in Dublin, Ireland, but as far as premier locales for petting cats go, Dublin is high on the list. (FYI, locales at the bottom of the “great places to pet cats” list include: bathtubs, laser testing factories, dog parks, busy intersections, circuses — those are probably lions — and anywhere within 50 feet of a “beware of cat” sign.)

The only real drawback here is that the clinic freely and openly admits to discriminating against dogs. But no workplace is perfect, amiright?

If, despite the cattery’s unfair treatment of dogs, you’re genuinely interested in becoming a professional cat snuggler, visit the original job listing here to learn more about the role and how to apply.

Grace Schweizer is a junior writer at The Penny Hoarder. She spends 90% of her time at home snuggling one particularly needy cat.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2DTb4bC

6 Ways Government Shutdowns Hurt You (Even if You’re Not a Federal Worker)

Congress has until midnight Jan. 19 to pass a spending bill and avoid a government shutdown. The House voted to avert a shutdown late Thursday night, and it’s now up to the Senate to pass the measure with at least 60 votes before the midnight deadline. If the measure passes, it will keep the federal government running until mid-February.

The possibility of a government shutdown happens seemingly every year — sometimes twice — as Democrats and Republicans struggle for power in Congress and pull spending legislation their way.

And the idea of the government shutting down can sound scary if you don’t know what such a move entails.

Even if you’re not a government employee, the screeching halt of federal operations can affect you.

Here’s what you need to know about how shutdowns work — and how your life could be affected by one in the future.

What Happens During a Government Shutdown?

When a spending bill expires before Congress passes a new bill authorizing spending, the federal government shuts down most operations.

With spending stuck in limbo while all parties come to an agreement, the federal government runs out of money, forcing the closure.

During a government shutdown, essential services carry on. These include national security, law enforcement, emergency medical services, air traffic control and more.

But services considered non-essential stop, which can still affect your everyday life.

6 Things That Could Be Tough During a Government Shutdown

Each government shutdown is different, but here are some things that could become more difficult or impossible if federal operations go on hold.

1. Planning a Trip to a National Park or Monument

You can’t go to a national park or monument during a shutdown — they’ll be closed. This includes national zoos and museums too. According to Vox, the 2013 government shutdown cost $500 million in lost tourism income due to national park closures.

2. Getting a Passport

During the last shutdown, the State Department continued passport and visa operations because those functions are funded by fees, not government spending.

We reached out to the National Passport Information Center back in April 2017 when the possibility of a shutdown loomed. The representative we spoke to said it’s unclear how a present-day shutdown would affect services, adding that multiple factors go into determining whether you’ll still be able to obtain a passport during a shutdown.

3. Using Free School Lunch Programs

Free school lunch programs will continue during a government shutdown — as long as it doesn’t last too long. If a shutdown goes on for an extended period, school districts might run out of funds to provide the free meals, which some districts worried would occur during the 2013 shutdown.

4. Signing Up for New Social Security Benefits

Social Security benefits will continue to reach existing enrollees, but new applications for benefits may have to wait until after the shutdown to be processed.

5. Buying a Home

If you were planning to use a federal loan, like a Federal Housing Administration-insured loan or a Veterans Affairs loan, to purchase a house, the agencies will still process it — depending on a few factors.

During the 2013 government shutdown, the FHA released an FAQ stating it would still process single-family loans, though it warned that it could take extra time because of a reduced staff. Delays could occur for other reasons, like if you need to obtain documents from the IRS.

Are you a veteran? Thankfully, it’s unlikely that a shutdown would affect your VA loans.

6. Getting Your Tax Refund

And, perhaps, the worst of all, depending on the time of year and your specific situation: If you’re waiting for a tax refund from the IRS and the government shuts down, you may have to wait until it reopens to get your money.

Hopefully a shutdown isn’t in the near future — but if it is, now you know what to expect.

Kelly Smith is a junior writer and engagement specialist at The Penny Hoarder. Catch her on Twitter at @keywordkelly.

Senior writer and producer Lisa Rowan also contributed to this post.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2qk9I1D

Here’s the Last Day You Can Sign Up for Equifax’s Free Credit Monitoring

When credit reporting bureau Equifax announced in early September 2017 that a security breach may have compromised as many as 143 million Americans’ personal information, chaos ensued.

The process to determine whether you’d been affected was time-consuming and frustrating for many. But if you endlessly delayed checking in with Equifax — or maybe even forgot about the breach — there’s still time to take action.

Equifax’s free enrollment period for its TrustedID service expires Jan. 31. You don’t need to be a victim of the Equifax breach of 2017 to be eligible — all you need is a Social Security number to sign up here for one free year of the service.

The TrustedID monitoring service watches all three credit reporting agencies for suspicious activity and allows you to lock and unlock your Equifax file for free for one year. A credit lock typically costs $20 or more per month, and you must order one from each credit bureau individually.

The service also offers Social Security number monitoring and identity theft insurance.

Lisa Rowan is a senior writer and producer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2FV0yBt

How to Scale Your Lead Generation Through Blogging

I’m a big advocate of blogging.

It doesn’t matter what business you have or what industry you’re in, blogging can be used as a lead generation tool.

How often do you get unique visitors to your website?

Unless you have an ecommerce store, there’s no reason for a prospective customer to visit your website more than once or twice.

There’s only so many times someone needs to read your “About Us” page or look up your contact information.

But if your website has a blog, it gives people a reason to keep coming back.

Even if these visitors aren’t necessarily buying anything yet, there are certain ways you can turn a blog reader into a customer.

First of all, if you’re not blogging, you need to start ASAP.

Next, you can focus on driving traffic to your new blog.

I consulted some businesses that didn’t have a blog because they say it takes too much time.

Depending on the length, the average blog post should only take you a few hours to write.

Trust me, I know from experience this time adds up based on the number of posts you’re writing per week.

But it needs to be part of your marketing strategy.

And it’s not expensive. The only cost is your time.

You can even ask your staff members with excellent writing skills to write a few posts per week.

If you want to start pumping out lots of content, you may want to consider adding an in-house writer to your payroll.

Regardless of how you plan to delegate these tasks, blogging needs to be a top priority if you want to generate new leads without spending much money.

Here’s what you need to do to write blog posts that convert.

Offer exclusive content

Why should someone read your blogs instead of those of your competitors?

There are so many blogs out there in every industry.

With a market that’s oversaturated with content, your posts need to differ from those of the competition.

Studies tell us 55% of readers spend only 15 seconds reading an article.

But if you offer exclusive content, it will give them a reason to spend more time reading, which increases your chances of getting them to convert.

Here’s a great example from the Conversion XL blog:

This post stands out because of the exclusive feel of the headline.

Where else can you find 11 experts voicing their opinions and reviewing software tools in one place?

When people search for this subject on Google, they will be more likely to click on this than other results.

But what if you don’t have access to a dozen experts in a particular industry?

No problem.

You’re the expert.

Use your own expertise to offer exclusive advice to your readers.

Master the art of storytelling, and tell a personal anecdote that generated results for your company.

The more often you can do this, the more it will add credibility to your brand.

Once you’re known as an expert in a particular field from your blogs, it will be much easier for you to get leads.

Add more subscribers to your email list

Are you looking for new ways to get more email subscribers?

Well, your blog is a great way to accomplish this.

Here’s how you can turn a reader into a customer.

Let’s say someone stumbles on one of your blog posts.

They skim through it and like the content, but now what?

That won’t necessarily make them buy something, sign up for a subscription, or pay for some other service you’re offering.

However, they may be interested in reading more of posts in the future.

Rather than hoping they come back on their own, you can encourage this visitor to join your email list to get content delivered straight to their inbox.

Jeff Bullas does this with his blog:

Jeff promotes his mailing list on the sidebar of his blog homepage and each individual blog post as well.

You can do this too.

Once you have their email address, you can do much more than just send them new blog posts.

If you have an ecommerce store, try sending some coupons to entice a sale.

Once you have the leads, proceed with all your winning email marketing campaigns.

But first, you have to get these people hooked with your initial blog post.

Promote your blog on other marketing channels

I consult with companies that struggle to manage their social media accounts all the time.

They recognize the importance of posting on a regular basis, but they’re not quite sure what to write.

Well, your blog gives you a great excuse to stay active on social media every day.

When your fans and followers see your brand on their timeline, it helps create awareness.

Even if they aren’t customers yet, the constant awareness can eventually help drive a sale.

For example, let’s say your company sells niche products such as camping equipment.

The consumer may not need what you’re selling the first time they see your business online.

But maybe six months down the line, they decide to plan a camping trip.

If you’ve been flooding their social media timeline over the last several months, your company will be fresh in their minds when it’s time for them to buy a tent or sleeping bag.

I use this strategy as well. Take a look at my Twitter account:

I’m constantly promoting blog posts there.

This is also a great way to get new readers interested in your blog.

After they see a catchy headline on your Facebook or Twitter page, they will be more likely to join your email list, which we just discussed.

Use the comments section to facilitate a discussion

You’re making a big mistake if you don’t allow comments on your blog posts.

After someone reads your content, give them the opportunity to contribute to the conversation.

They may have some further insight to share, a personal story to tell, or a question to ask you.

It’s possible they disagree with some of your viewpoints and opinions on a topic as well.

That’s okay.

One of the best ways to encourage comments is by ending your blog posts with a question.

Make sure the question is related to the topic.

This will help reassure the reader you actually want to hear from them.

Respond to all the comments.

Here are some of the comments from a recent blog post I wrote about creating an actionable drip campaign:

A couple of readers had questions that were related to their own websites.

It’s a great way for you to keep the reader engaged.

You can also offer a solution to these questions by suggesting certain products or services your company offers.

Readers may also have a discussion among themselves in the comments section.

I see that happen on my posts all the time as well.

It’s encouraging, and it shows that people are genuinely interested in the topics you’re writing about.

Be consistent

How often do you add a new blog post to your website?

When you first started off, you may have been trying to put out articles every day.

But as the weeks pass, I’ve seen some websites get discouraged if they aren’t seeing immediate results.

Generating leads through blogs takes time.

You won’t see a drastic increase in your traffic or bottom line overnight.

Slowly but surely, you’ll notice a difference—as long as you stay consistent.

Here’s an example.

Let’s say you post a new blog every day for a month.

You start to get some faithful readers.

But all of a sudden, you change your pattern and only post once a week.

Well, your regular audience is going to be disappointed if they visit your website and don’t see any fresh content.

When it comes to blogging, more is always better.

A recent study suggests that bloggers saw stronger results the more frequently they posted:

Just make sure your quality doesn’t suffer.

You still need to write good content, or nobody is going to read it.

Publishing 20 articles per day doesn’t mean anything if all the posts are garbage.

Do what you can, but don’t overextend yourself.

If you’re just starting off, I think it’s reasonable to aim for one blog post per day.

See how that works for you and then go from there.

Write guest posts

You’re making a mistake if you’re turning down guest posting opportunities.

Look, I realize on the surface it may not sound very appealing.

I was skeptical about this too before I started guest posting.

It’s hard enough to put out content on your own website, why should you write for someone else for free?

Guest posting gives your brand great exposure.

Your content will be exposed to a new audience that may have never heard of you or your company.

You’ll also have plenty of chances to pitch your content and services throughout your post.

Websites will typically let you include a biography about you and your brand either before or after the article.

Take a look at this guest posting example from Crazy Egg:

Daniel Threlfall is one of the co-founders of Launch Your Copy.

Contributing to Crazy Egg gave his company exposure and drove more traffic to his website.

Hyperlinks can drive traffic to your highest converting pages

I’ll continue with my last point.

Throughout the content of your blog, you have the chance to add hyperlinks.

If you’re writing a guest post, you can have several links to your website in each article.

You can apply this same strategy to the posts on your site as well.

As you can see from reading my posts, including this one, I do this all the time.

I use hyperlinks to cite all my sources, but I also use internal hyperlinks to drive traffic to other blog posts and landing pages.

Internal linking is also great for your Google search ranking.

Getting ranked higher on Google can help you generate more leads.

Let other bloggers contribute to your website

In addition to writing guest posts for other websites, you can also let other writers contribute to your blog.

Guest posts on your own site can give you a bit of a break.

You can still publish an article a day without having to do as much writing.

When someone else writes a guest post for your blog, they may promote it to their own readers and share the post on their platforms.

This will give a wider audience a reason to check out your blog.

They may initially come just to read their favorite writer’s post, but there’s a good possibility they will read your content as well.

Look at how HubSpot encourages people to contribute to its website:

You can employ a similar strategy on your blog.

Plus, this could help you develop a relationship with other writers.

Maybe they will return the favor and let you write guest posts on their websites.

Just make sure their posts get approved before publishing.

You don’t want a guest writer to say anything that’s not aligned with your brand.

Even if you don’t write it, you are still associated with all the content on your website.

Encourage readers to share your content

If you’re a good writer, people will want to share your posts with their friends.

You want to make this as easy as possible for them.

All your posts should include social sharing icons.

Here’s what it looks like on my blog:

Again, this exposes your brand to a new audience.

Getting your readers to promote your content for free is a huge win for your company.

People are much more likely to share a recent, relevant, and informative blog post than just a random link to your website.

It’s a great way to get new leads.

Conclusion

Every website needs a blog.

It’s one of my favorite ways to generate leads.

Offer exclusive content in your posts to get readers hooked and keep them engaged.

Try to use your blog as a platform to get more subscribers to your email list.

New blog posts give you a great excuse to post on your social media accounts and other marketing channels.

Stay engaged with your readers by continuing the discussion in the comments section.

You should try to write guest posts for other websites and allow other writers to contribute to your site as well.

Just make sure you’re consistent with the frequency of your posts.

Use hyperlinks to drive traffic to your highest converting landing pages and improve your Google search ranking.

Provide social sharing options on your blog to encourage readers to share your content with their friends.

These tips will help you write better blogs and generate more leads for your website.

How many blog posts does your website publish per week?

Source Quick Sprout http://ift.tt/2EUZ2hj

9 Creative Ways to Pay Rent When You Don’t Have Anymore Plasma to Sell

Rent’s due.

Cue anxious scrambling.

You riffle through old birthday cards; maybe there’s a stray $10 bill in one?

You offer to pet-sit any and every critter in your neighborhood (even the squirrels). You see what you can do for $5 on Craigslist. You stare into your closet and wonder what your local consignment store will give you for that pilly sweater. You contemplate calling Mom or Dad… anything but that.

You even Google “sell plasma.” You know, just to see what that’s all about.

It’s a sad reality; many of us struggle to make rent.

Creative Ways to Make Your Rent Payment on Time

For a quick fix, we’ve got a few ways to make extra money this month — so your landlord doesn’t come a-knockin’.

1. Find Unclaimed Money

Rather than shuffling through your neighborhood’s streets and looking for a tumbleweed of unclaimed money (we wish, right?), find your unclaimed money.

Did you know state treasuries throughout the U.S. have more than $43 billion in unclaimed funds? Just sitting around! And you’re here trying to pay the darn rent.

In 2017, one South Carolina man hit the jackpot. He got a phone call from his state treasurer letting him know he was entitled to $763,000 in unclaimed money. That’s, like, 63 years of rent.

We advise you to be careful of calls like this; chances are, it’s a scam. But you can take matters into your own hands and see if you have any unclaimed money floating around.

Start by checking with the National Association of Unclaimed Property Administrators. Click your state on the map, and it’ll redirect you to your state’s appropriate search site. You can also check with Missing Money.

If you’re not as lucky as that South Carolina man, keep reading.

2. Sign up for a Flexible Side Gig

Need a fun, flexible way to earn money while also meeting lots of new people?

Try driving with Lyft.

Demand for ridesharing has been growing like crazy, and it shows no signs of slowing down. To be eligible, you’ll need to be at least 21 years old with a year of driving experience, pass a background check and own a car made in 2007 or later.

We talked to Paul Pruce, who’s been driving full-time with Lyft for over a year. He earns $750 a week as a driver.

Best of all, he does it on his own time. You can work days, nights or weekends — it’s up to you!

Because it’s simple to switch between apps, many Lyft drivers also sign up as a driver partner with Uber.

As a driver partner with Uber, you are an independent contractor. You create your own schedule and work as much or as little as you want.

If you want to give it a try here are a few of the things to keep in mind: You must be at least 21 years old, have at least one year of licensed driving experience in the U.S. (three years if you are under 23 years old), have a valid US driver’s license and pass a background check.

Also, your car must be a four-door, seat at least four passengers (excluding the driver), be registered in-state and be covered by in-state insurance.

Here’s a link to sign up to use the Uber app.

3. Find a Work-From-Home Gig

If you’re not in the mood to leave your sweet abode (we get it; you’re paying a lot for that space), start looking for a work-from-home job.

You can find anything and everything out there — virtual assistant gigs, data-entry clerk positions, or even proofreading and transcribing jobs.

One we want to mention is an online tutoring website called VIPKID. It offers a flexible way to make money on the side.

With VIPKID, you’ll become an English tutor for children in China between ages 4 and 12. Base pay ranges from $14 to $22 an hour, and teachers get paid between the 10th and 15th of each month.

Learn more about the work-from-home gig on the VIPKID website.

4. Declutter Your Space

Living that #Minimalist lifestyle is all the rage right now, so why not use this mentality to your advantage when you need a couple of extra bucks?

Start taking a good hard look at your belongings. What do you actually need?

Technology: Begin with your overcrowded entertainment center, likely full of outdated music and movies. Consider selling these items to Decluttr. It’ll buy your old CDs, DVDs, Blu-rays, video games and even cell phones and tablets. Shipping is free, and Decluttr pays you within 24 hours of retrieval.

Books: Bookshelf collecting dust? We love books as much as the next person, but see if your treasures are worth anything by simply searching their ISBNs at Bookscouter. The platform searches dozens of buyback sites to see where you could get the most money.

Clothes: If you have clothes you haven’t worn in the last year, why do you hang onto them? Try selling them to folks in your area through an online marketplace like letgo. It takes about five minute to list an item.

Gift cards: While you’re digging out those stiff winter coats, check the pockets. You might come across a gift card or two in there. If you do, sell it for rent money through a gift-card exchange site like Raise.

5. List Your Expensive Space on Airbnb

Have a spare room? Might as well use Airbnb to make some money by renting it out.

If you’re a good host with a desirable space, you could add hundreds — even thousands — of dollars to your savings account with Airbnb.

And there’s no reason you can’t be creative. We even found a guy who earns $1,380 a month renting out a backyard tent on Airbnb.

Taking a few simple steps can make the difference between a great experience and a less-than-satisfactory one.

Here are a few tips:

- Make your space available during high-demand times in your area. Think: concerts, conventions and sporting events.

- Be a good host, and make sure your place is stocked with the toiletries you’d expect at a hotel — toilet paper, soap and towels.

- Be personable. A lot of travelers turn to Airbnb for the personal touch they won’t find at commercial properties.

Here’s the link to sign up as an Airbnb host.

(Hosting laws vary from city to city. Please understand the rules and regulations applicable to your city and listing.)

6. Try Mystery Shopping (and Eat Pizza)

Mystery shopping, the act of posing as a regular customer but secretly reviewing services and products, is one way our CEO Kyle Taylor got by when he struggled to make rent. He was able to bank between $400 and $500 a month as a mystery shopper.

Some of the most popular types of mystery shops are for pizza companies. So you can actually get paid to eat pizza. Both Papa John’s Pizza and Pizza Hut regularly conduct mystery shops.

As part of the assignment, you’re required to time delivery service and review the quality of pizza. It’s pretty easy to do, and you can do it several times a year.

If you’re interested in giving it a try, here’s a list of mystery-shopping companies.

7. Get Ahead of It: Set up an Emergency Fund

Nothing is more motivating than a nice dose of panic, right?

While you’re fretting, put your nervous energy to good use and start an emergency fund to help prevent this rent panic from happening again.

Tons of apps make this process painless nowadays, including Digit. It saves only money you can afford to spare.

Simply link it to your checking account, and the app’s algorithms will determine small (and safe!) amounts of money to withdraw into a separate FDIC-insured savings account.

Using the set-it-and-forget-it strategy, one of our editors was able to save more than $4,300 in just over two years. He was able to use the funds when he needed — like when he picked up and moved from Tampa to New York City, where rent is, well, expensive.

Digit is free for the first 100 days, then $2.99 per month thereafter — less than Netflix.

8. Ask for Help

If you feel as though you’ve exhausted all your options, call a local resource line for help.

Start with 2-1-1, a confidential service offered through United Way that’ll help you find the resources you need to find affordable housing, make rent or pay utilities.

To use the service, head to 211.org and enter your location. It’ll show you services in your community and give you a number to call.

You can also look into applying for a grant. Take, for example, Modest Needs grants.

This nonprofit organization supports low-income workers, mainly through its Self-Sufficiency Grants. These are designed for workers just above the poverty line, who are ineligible for most conventional methods of social assistance but are still at risk for the types of financial disasters that result in homelessness.

If you’re working and in need, reach out and see if Modest Needs can help you.

9. Avoid the Endless Loop of Bank Fees

Calling it close with rent is a scary feeling. You might feel as though you’re playing chicken with your bank account, dodging various fees: late fees, overdraft fees, minimum-balance fees… you name it.

Rather than cowering in fear, you can switch to a bank account that won’t punish you for close calls.

We like the Aspiration Summit Checking account for that reason. It has no monthly fees and no minimum deposits, and it even reimburses you any ATM fees you might pay. Account holders also earn up to 1% in annual interest, which is a nice little form of passive income that might come in handy down the road.

(And maybe next month, finally start a budget?)

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2DQ1y9s

Building a Smart Job Loss Plan

Imagine that tomorrow – or your next day at work – you go into your workplace only to find a pink slip waiting for you. You’re done. Your employer heard some horrible rumor about you, or maybe your organization is downsizing, or maybe you made a big mistake recently and it’s caught up to you. Whatever it is, your job is no longer yours. You have 15 minutes to clean out your desk and half an hour at HR to sign some papers and then you’re out on the street.

What now? What do you do?

For many Americans, this scenario is a total nightmare. Remember that 78% of Americans live a paycheck-to-paycheck lifestyle – they’re running into major financial trouble if they miss just a single paycheck (here’s the scoop on that frightening statistic). The idea of a sudden job loss can feel almost overwhelming, and it’s often those big overwhelming things that we push to the side and try not to think about.

As with most big fears in life, however, an unexpected job loss can be made much more tolerable by having a plan in place for what to do if and when it happens, and then taking action on some of those steps now rather than later, because actions on those steps will often help you now.

Here are six things you can do right now to prepare yourself for the possibility of a job loss and make the impact far less painful. These steps lead directly to actions you can and should take as soon as you find yourself without work.

Step 1: Keep your resume updated all the time.

Your resume should always be ready to hand to someone, regardless of how you feel about your job security, because you never know when an opportunity will pop up, just as you never know when you might lose your current job. A resume is a tool that you need for both positive and negative unexpected events.

Your resume should be intentionally geared toward getting the job that you would like to have if your current job vanished. Would you be aiming for the same type of position? Something a little higher on the career track? Something decidedly different? Whatever that target is, design your resume to sell yourself for that job.

Make sure that your resume is loaded with things you’ve actually achieved and skills you can clearly demonstrate that all indicate competency and qualification for that job that you want. Remember that general skills, like leadership and organization, are generally always welcome. If you load it down with irrelevant things, you’re making it harder to get that job.

How do you get those things? You should be aiming to do as many resume-worthy things in your current job as possible. Make a conscious effort to work on things that you’d want to list on your resume, and try to get involved with tasks that make for good material for your resume.

The document itself should be continuously updated, too. Keep it somewhere where you can grab it in a pinch. Keeping it updated on sites like LinkedIn is a good way to keep yourself open for opportunities.

Step 2: Keep your training and education current, preferably using current workplace resources.

The “training” and “education” sections of your resume should be as fresh as possible and directly applicable to the things that people are looking for right now as they search for professional candidates to fill positions.

If you don’t know what’s in demand right now, do the homework. Look at the exact job listings for positions you might want to fill and ask yourself if you have everything that they’re asking for in a reasonably current form. If not, then you have a checklist of things to work on.

Right now is the right time to start working on this, because there’s at least some likelihood that you can take advantage of workplace resources with your current employer to obtain that training and education. Does your workplace offer any resources or funds for additional training? Do they offer flexibility for increasing your education? Talk to human resources and know what’s available to you.

Keeping these parts of your resume fresh will go a long way toward not only opening up opportunities for you today, but ensuring that you’re ready to go should a job loss come your way tomorrow.

Step 3: Have a set of strong professional contacts in place; do favors and make sure those relationships are strong.

Who do you know in your field that would be able to quickly connect you to another position should your current one dissipate? Which people are working at companies that are actively hiring? Who do you know that’s a high performer in your field?

Cultivate those relationships. Have lots of conversations with those people. Go out to lunch with them. When you hear that they need a favor, step up to the plate, particularly if it’s a “multiplier favor” – the kind of favor that’s far more valuable to the recipient than to the giver (you should always give out multiplier favors in any and all situations) – and don’t expect anything in return immediately. These relationships become ones that you can tap when the chips are down. They’re also relationships that sometimes pop up in your life with great opportunities.

Build those contacts. Invest the time to keep them strong. This means sending emails and Facebook messages and tweets. This means going out to lunches and participating in professional groups. This means even going to conferences and conventions. Those are things you should always be doing to maintain professional relationships.

Step 4: Have a very healthy emergency fund.

Having enough cash sitting in the bank to sustain you for a month or two without a job is another key step in preparing yourself against a potential unexpected job loss. That money can sustain you for a few paychecks while you find new employment opportunities.

Not only that, a healthy emergency fund is able to assist you in other life emergencies, such as a car breakdown or a need for emergency travel. Those expenses can come out of nowhere and cause all kinds of personal crises.

Doesn’t a credit card work in this situation? A credit card works as long as your identity is secure and the bank is willing to extend credit to you. In an credit card fraud or identity theft situation, your credit card is useless; if a bank happens to be reassessing credit limits, your credit card can become useless. Don’t rely on it for genuine emergencies. Cash is king.

Getting this started is easy. All you have to do is set up an automatic transfer from your checking to your savings where a small amount of money is moved each week – say, $20 or $40 or whatever you’re comfortable with. Set it up and forget about it and you’ll have thousands set aside within a year or two.

Step 5: Know exactly what benefits you’re due if you were to lose your job and how to get those benefits.

What exactly is due to you should you lose your job for some reason? What benefits does your contract provide if your employment is terminated for various reasons? What benefits are available to you outside of your workplace in that situation?

You owe it to yourself to know what these benefits are and how to access them. It’s well worth the half an hour of research needed to find that information and store it someplace secure, such as in a note on your phone.

If you’re not sure where to start in terms of finding out that information, your human resources officer is the right person to ask. Simply ask the questions and, if asked for a reason, state that you’re simply reviewing your finances because you want to get all of your ducks in a row (which is the genuine truth).

If you do find that you are suddenly unemployed, having the phone numbers to call all ready on your phone makes the crisis a lot easier to deal with. It’s likely that you’ll be emotionally fraught at that point, and it’s also likely that human resources may suddenly be less cooperative with you than before. Ask the questions now. Get the information straight now.

Step 6: Have a list of people to contact immediately to start finding another job.

If you’ve lost your job, what do you do next? For many people, this is a panicky crisis and they’re likely to not make the wisest of moves in those first days after a job loss. That’s why it pays to give the matter some thought now when you are calm, cool, and collected.

Who exactly would you call first if you lost your job in order to start moving toward your next employment opportunity? If you’re not sure, give it some careful thought. Who are your first contacts? Who’s likely to return your call and actually provide genuine help?

Make a brief list of these people and their contact information. That way, if you do find yourself in this situation, you know who to contact quickly and efficiently. Again, this is a good “note” to have on your phone for just such a situation.

The key lesson here extends beyond mere job loss.

The key lesson is that thinking about life’s potential problems now and coming up with solutions in a rational and calm way, then taking steps to make those solutions easy to execute in a crisis, goes a long way toward making any and all crises in life much easier to handle.

The little steps you take now, handled with rational thought and just a little effort and a little money, can save you enormous headaches and a great deal of money down the road when an unfortunate event does occur. Preparing for a job loss is just one example of this powerful life strategy.

Good luck!

Related Articles:

- Six Simple Skills Anyone Can Learn to Improve Their Earnings Potential at Work

- Will You Have a Job in 10 Years? Five Visionaries Weigh In

- How and Why to Write a Career Plan

- Nine Skills Worth Learning for Any Career – and How to Learn Them

The post Building a Smart Job Loss Plan appeared first on The Simple Dollar.

Source The Simple Dollar http://ift.tt/2mVsP38

Here’s a Wine Snob’s Honest Opinion on Winc’s Wine Subscription

If you asked me to describe my version of heaven, “excellent wine” would be among the first words you’d hear.

Excellent wine delivered right to my doorstep at below-retail prices? I honestly couldn’t have dreamed up such opulence unaided. And yet, we live in a world where that level of extravagance isn’t just available; it’s in ready supply.

The future has arrived — and although we’re still waiting on our hover cars and jet packs, we do have wine-subscription boxes.

This is my kind of compromise.

Are Wine-Subscription Boxes Worth the Money?

Having a quality supply of vino available without having to navigate wine labels in the wild — and without even having to leave the house (i.e., put on pants) — certainly sounds like a pretty great deal, especially since many clubs offer wines with special subscriber discounts.

But considering you can get at-least-passable wines plenty cheap at Trader Joe’s or even out of a box, cheapskates like us might still think twice before clicking that oh-so-tempting “sign up” button.

With most memberships starting around $50 per month, and some climbing higher than $100, wine deliveries can add an appreciable expense to your budget, especially if you don’t typically drink as much wine as you’d get from the program.

And then there’s the quality of the service itself to consider. Are the wines really excellent? Are the “discounted” rates really a value? Is home delivery really that much more convenient?

In a brave and selfless bid to discover the answer to these questions, we tried one of the most popular wine clubs on the market.

You’re welcome.

Which is the Best Wine-Subscription Box?

As the resident Penny Hoarder wino wine connoisseur, I was tasked with the Herculean chore of choosing and evaluating one of the many available wine-subscription options. There were quite a few to pick from, ranging from Firstleaf’s monthly delivery of six-bottle cases to Vinebox’s pricy by-the-glass model.Even Martha Stewart is in on this wine-delivery game, gang. It’s real.

But all told, Winc seemed like the perfect starter option. It delivers a reasonable four bottles per month without a membership fee or commitment, and it even includes free shipping.And, I’ll be honest, there’s a pretty sweet $20-off deal available on your first box.

In fact, it’s less like a wine club and more like a discount wine shop. Once you sign up, you’re free to choose whichever bottles in its online store catch your eye.

Because the monthly delivery model promises winemakers some consistency, the bottles are available at lower prices than they would be at your local liquor — although they’re still not super cheap. Winc’s wines start at $13 per bottle, and some cost more than $40.

But if you, like most of us, don’t really know what you’re looking for, here’s the cool part.

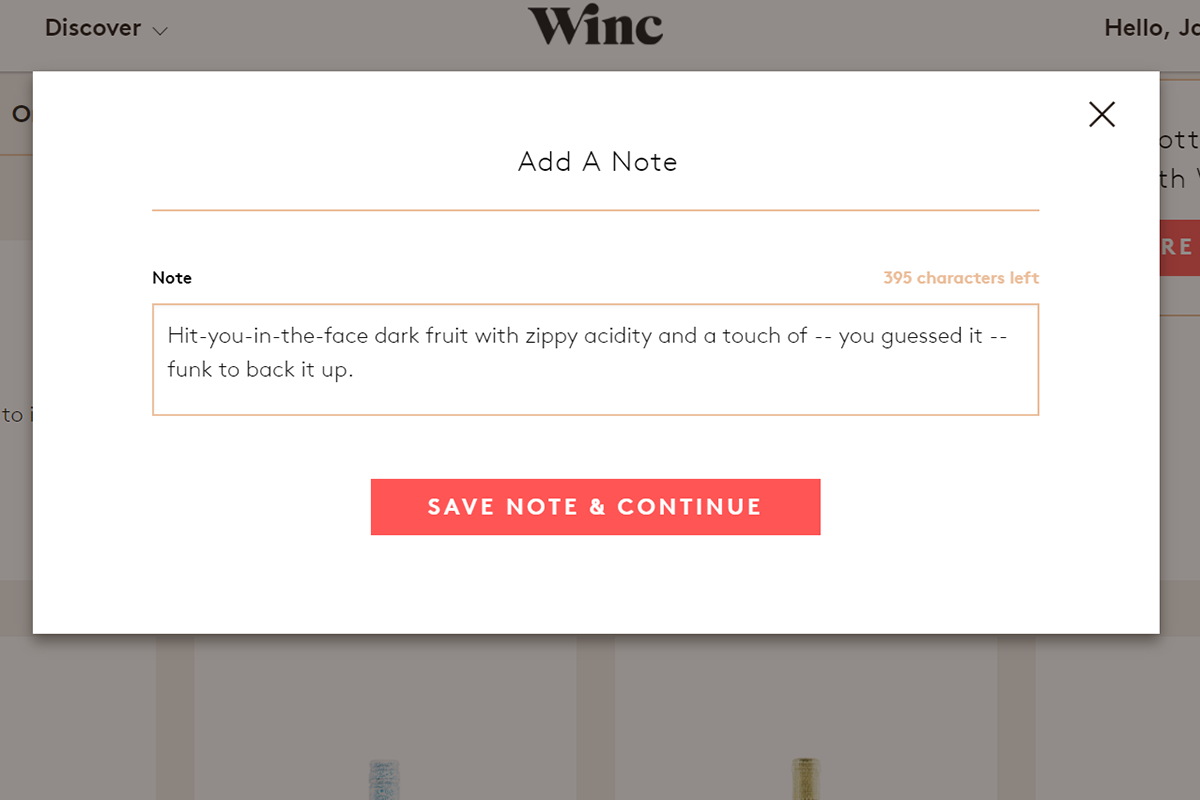

Each wine comes complete with plain-English descriptions, tasting notes and even suggested food pairings so you know exactly what you’re getting into well before you pop the cork.

Plus, Winc’s team of experts will recommend specific bottles each month based on your feedback, which you can leave for every wine you taste through a simple rating system. The taste-tailoring process starts with a quick-and-easy quiz when you sign up, which examines your palate through questions like how you take your coffee and whether or not you like citrus.

By default, you’ll be signed up for the “Winc Featured” membership, so you’ll receive an assortment of wines primarily from Winc’s $13 collection. That means you’ll pay at least $52 per month, and perhaps a few bucks more if one of your wines is an upgrade. There’s also the costlier “Winc Select” option if you’re open to premium-priced recommendations.

But you can always go in and customize your wine choices before they ship, so you’re in control of exactly how much it costs each month.

You can also skip a month or cancel entirely at any time, as long as you make the decision 48 hours before your upcoming shipment.

We Tried Winc. Here’s What We Thought

OK, enough about how it works — how was it?

I’ve got some wine know-how, so I hand-picked two of my bottles and let the system recommend the remaining pair. All told, I bought three $13 bottles and one amazing-sounding $19 splurge.

Satisfied with my choices, I clicked “submit,” paying a total of $33 after my first-box discount, which was hiked up to $25 from $20 as a holiday treat.

That comes out to $8.25 per bottle, which is way lower than I usually pay in a store if I’m expecting a high-quality product. As I’ve admitted before, I’m a little bit of a wine snob.

So far, so good.

My wine shipped the next day and was scheduled to be delivered within 48 hours. Winc does a great job keeping its customers updated along the way, quickly forwarding tracking information and providing optional text message notifications, but I still managed to miss the first delivery attempt. Someone does have to be home to show their ID and sign for the package — it is alcohol, after all.

When I finally got my hands on the box, I couldn’t wait to open it, but I did take a few moments to appreciate all the fun extras Winc included. The colorful welcome booklet features “The A-Z of Wine” — A is for acidity; S is for skin contact.

But soon, even clever reading material would not distract me. I was long overdue for a glass.

I cracked open my $19 bottle first: a 2016 red blend out of Santa Barbara County, California, dubbed the Funk Zone. The bottle had actually been one of Winc’s recommendations and was marked down from a retail price of $24.99.

Once I tasted it, the retail price didn’t surprise me. Composed of 90% syrah and 10% viognier (an aromatic white grape), this is a full-bodied red with the kind of hit-you-in-the-face dark fruit punch I adore. It’s got notes of blackberries and blueberries, dark chocolate, and just enough earthiness on the nose to live up to its name.

Later on, I poured myself a swallow of Winc’s other recommendation, Wonderful Wine Co.’s ambiguous California white blend. It’s an off-dry white without a specific appellation, and as a bone-dry red girl, I was skeptical — but this wine actually made me say “wow” aloud as soon as I took a sip.

Plus, just a few minutes after I cracked into the box, I got an email recommending some delicious-sounding recipes to pair with my wines, courtesy of Food52.

So, all told, I’d definitely say I was satisfied.

Is a Wine Membership Right for You?

Although my Winc experience was a good one, I’m not sure I’ll keep the membership indefinitely — although the fact that I can skip a month anytime means I don’t feel pressured to make a decision right away.

I love the easy rating system, and it’s fun to try new wines I wouldn’t otherwise have access to. At the same time, though, there are definitely months when I wouldn’t spend $50 or more on wine alone.

When deciding whether or not Winc, or any other wine subscription box, works for your budget, ask yourself a simple question: How much do I spend on wine right now?

If the answer is less than the cost of your would-be subscription, think carefully about whether the novelty and convenience is worth the extra money. You may end up with a backlog of bottles you can never seem to get to — or drinking more than you should.

But if alcohol is already a line item in your budget, and you want a fun and easy way to learn about new wines, a subscription box might just be right for you — and I’m happy to give Winc my recommendation.

Cheers!

Jamie Cattanach (@jamiecattanach) is a WSET-certified wine geek who’s written for VinePair, SELF, Ms. Magazine, Roads & Kingdoms, The Write Life, Barclaycard’s Travel Blog, Santander Bank’s Prosper and Thrive and other outlets.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2ETstAr

Here’s Exactly How This “Bad Saver” Put Away $4,300 Without Thinking About It

In the past two and a half years, Matt Wiley, a self-described “Bad Saver,” has managed to save $4,300.

“It feels weird saying ‘I saved,’ because I really didn’t do anything,” he says.

Despite being an editor at The Penny Hoarder, Wiley admits he’s never been good at putting money away.

“When I was a teenager and started working, I’d be able to save up a couple hundred bucks, and then I’d end up blowing it on something stupid, or something that came up that I actually really needed to pay for,” he says.

“I don’t have a good reason for why it has been difficult, other than I’ve never been good at forcing myself to put money aside to not touch.”

So how’d that $4,300 stack up? For fellow Bad Savers everywhere, we needed to know.

Digit Review: How This Bad Saver Stashed Away $4,300

In early 2015, Wiley heard about an automated savings platform called Digit from one of his wife’s friends, who was already using it.

Digit uses an algorithm to calculate how much money its users can afford to set aside each day, then puts the money into a digital savings account. The amount automatically adjusts based on your income and spending habits.

“I was intrigued by the idea of an algorithm pulling money out of my account in ways I wouldn’t notice,” Wiley says. “I was working my first job out of college and basically living paycheck to paycheck, so I definitely hadn’t been putting anything aside. It seemed worth a try.”

So he set out to form his own Digit review.

Wiley set up his account, and he remembers it being straightforward and simple. All he had to do was connect his checking account. Plus, it’s all safe — 128-bit security, what most banks use.

Then Digit started doing its thing, analyzing his income and spending habits and sneaking bits of money from his account every few days.

If Digit ever recognized he couldn’t afford to save one day, it wouldn’t touch his money. This is part of its no-overdraft guarantee, so he’d never be left under water.

“One day could be 75 cents; another, it could pull $30,” Wiley says. It just depended on how much he could afford.

At first, Wiley just wanted to see if he’d notice the money leaving his checking account and if it’d actually stack up in his Digit account.

Stack up it did. He signed up in May 2015, and by the end of that year, he’d already set aside $607.

In 2016, he tucked away another $1,884. In 2017, it was about the same — another $1,857.

Although you have the option to, Wiley never set a specific goal. He just wanted to have some sort of emergency fund for those inevitable, just-in-case life events.

And of course those happened — in the form of unexpected vet bills, wedding expenses, travel and, most recently, a move from Florida to New York City.

“If I’d never touched it, I’d have an extra $4,300 right now,” he says. “It sucks that I don’t, but Digit helped me have money for whatever life events came up.”

So yeah, Wiley the Bad Saver did withdraw money from his Digit account, which you can do whenever you need to. He’s fortunate he actually had that money to withdraw. Otherwise, he would have been forced to rack up credit card debt.

Here’s How to Save Automatically

If you’re curious like Wiley was, visit Digit’s sign-up page to get started.

Before you sign up, note the $2.99 per month service fee (though your first 100 days will be free). For Wiley, this fee — totaling less than $100 over the years — was worth the $4,300 he saved without thinking about it — or ever panicking about his bank balance.

“Way less than Netflix,” he says.

Plus, for every three months you’ve saved with Digit, you’ll earn a 1% cash-back bonus on the balance in your account. If you’re able to save enough (about $300 over three months), this can cover the monthly fee.

OK, now to sign up, enter basic information and verify your identity with a special code Digit texts you.

Select the bank you have your primary checking account with, then enter your log-in information. (Digit won’t store it.)

It’ll then take Digit a couple of days to analyze your cash-flow patterns.

In the meantime, set some specific goals. For example, start with a rainy-day fund. Then perhaps create a travel stash. You can even set up how much you need and by what date, and Digit will hustle to make it happen for you — without breaking your bank.

At any time, you can pause saving for up to 30 days. You can even switch out your checking accounts.

And you might have noticed you have some text messages from the service’s textbot waiting on your phone. You can access your Digit account from SMS messages, making it super easy to send commands (like Transfer and Withdraw) and to check your balance.

If for some reason you hate Digit, you can cancel any time, and your balance will be automatically transferred back into your checking account.

After three years with Digit, Wiley doesn’t see himself canceling anytime soon.

“I’m definitely a fan of passive saving,” he says. “For people like me [he’s talking about all the Bad Savers out there], not having to think about it is the best way to save.”

Carson Kohler (@CarsonKohler) is a junior writer at The Penny Hoarder. She’s a big proponent of sneaky savings. Otherwise, she’d be a Bad Saver, too.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2DfZne3