Scroll through your Facebook feed, and you can’t help but see video ads. Quite a few of them actually.

You may have even seen my video ads, which I’m using to promote my businesses.

I’m doing this, of course, because Facebook Video is huge right now.

One of the more recent studies found that there are “8 billion daily views for Facebook Video in November 2015—a 100% growth from 6 months prior to the study.”

And here’s another interesting stat.

Videos’ organic reach on Facebook is 135% greater than that of photos.

This means one thing. There is an insane number of opportunities out there.

Including Facebook Video ads in your marketing repertoire can yield big results.

But like with any form of paid advertisement, you’ll naturally want to lower your costs and maximize your ROI.

That’s a given.

I’ve done plenty of experimentation with Facebook Video ads and have come up with a recipe that gets me the most bang for my buck.

More specifically, I’ve come up with a way that will lower your CPM (cost per thousand) by as much as 81%.

Here are five clever Facebook Video ad hacks you need to know and implement right away.

1. Only feature videos that you know get engagement

Although this is an incredibly simple hack, it’s one many marketers overlook.

Often, they’re so thirsty to get their video content up and running on Facebook, they never take the time to perform some basic split-testing beforehand.

Here’s what I recommend.

Create a few different videos or variations of a single video (at least three), and do some basic split-testing to see which one is getting the best response.

However, place them on channels that won’t cost you a dime.

For instance, you might:

- feature videos organically on Facebook

- place them on your website or blog

- place them on other social media channels

Then, take a look at some key metrics such as:

- play rate

- average length of viewing

- engagement levels

- number of leads each video generated

- number of conversions each video produced

Here’s a graph that illustrates the various methods of measuring video success:

You get the idea.

Before you put your hard-earned money into Facebook Video ads, test the waters and see which video(s) your target audience responds most favorably to.

That way, you can approach Facebook Video ads with confidence.

That, right there, should lower your CPM considerably.

2. Keep them short and sweet

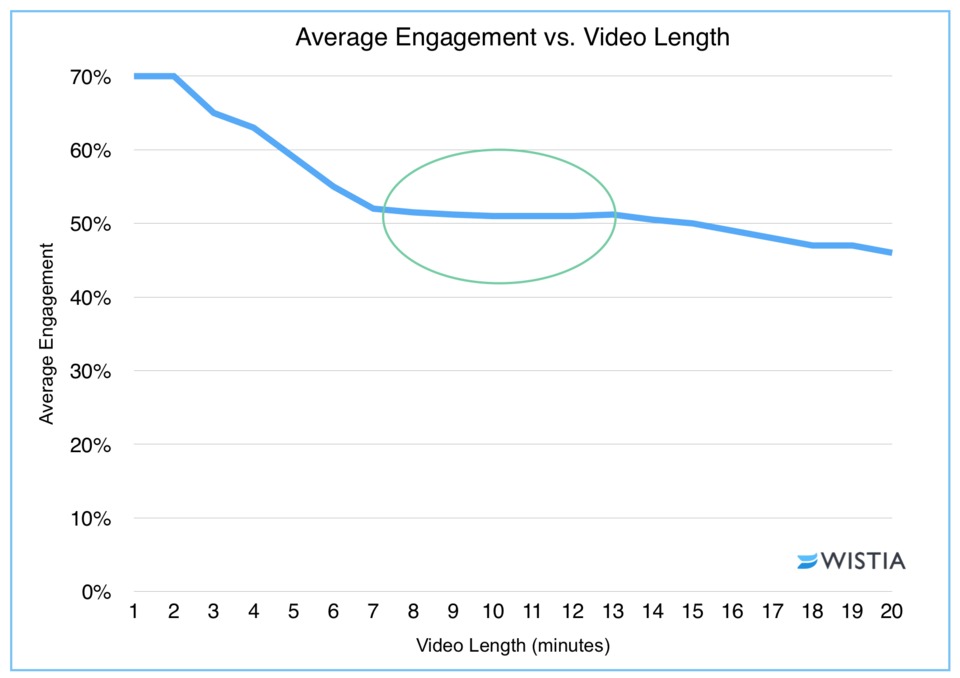

Wistia performed some fairly extensive research on the length of videos and engagement levels.

In fact, they examined 564,710 videos and more than 1.3 billion plays for their research.

Here’s what they found:

As you can see, there’s a steady level of engagement for up to 2 minutes:

But after the 2-minute mark, engagement drops off considerably until it hits 6 minutes.

At that point, engagement stabilizes once more until it reaches 12 minutes.

So, here’s the deal.

I wouldn’t recommend exceeding 2 minutes with your Facebook Video ads.

You probably won’t do yourself or your marketing budget any favors if you exceed this time limit.

Or as Wistia puts it,

Two minutes is the sweet spot.

But they also make another interesting point:

Engagement is steady up to two minutes, meaning that a 90-second video will hold a viewer’s attention as much as a 30-second video. This is surprising and actionable information for video marketers.

If you’re making short videos, you don’t need to stress about the difference of a few seconds. Just keep it under two minutes.

I find this to be great advice. You don’t need to sweat, getting your video length to an exact number of seconds.

Just keep it under 2 minutes, and it should maximize your engagement and lower your CPM.

But if you absolutely have to make a longer video, make it between 6 and 12 minutes because this is the “sweet spot number two.”

Anything longer than 12 minutes is just foolish.

3. Advertise “without advertising”

Here’s the thing about Facebook. Most people aren’t in the buying mindset when they log in to their accounts.

Most people are simply checking in to see what’s going on with their social circles and what their friends and family are up to.

Their mindset isn’t usually,

I’m desperately looking to make a purchase.

They may be thinking that when they log in to Amazon—but not Facebook.

Or as Aaron Zakowski eloquently puts it,

They’re buying intent is low.

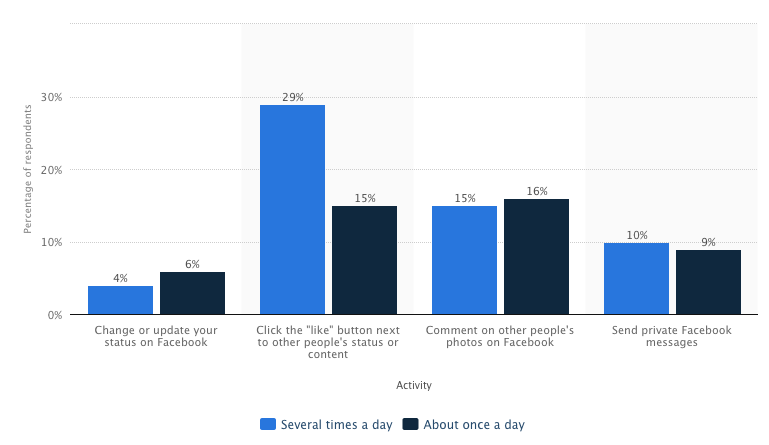

This graph shows how people spend their time on Facebook:

And guess what? None of these activities involve buying.

I think it’s really important to keep this in mind when approaching your video ad content.

The last thing you want to do is clobber users over the head with ads that have the subtlety of a slap in the face.

What you want to do is to promote your product/service/brand without making it seem like an advertisement.

You need to be cool about it. You need to be stealth.

How exactly can you deliver your message without being overly salesy or pushy?

Here are some suggestions:

- infuse humor into your ad

- use storytelling

- surprise them/catch them off guard

- teach them something

- offer insightful information

In other words, ditch the pitch.

People hate being pitched to, and it’s only going to inflate your CPM.

Instead, try to be entertaining and strive to make a genuine connection.

4. Add captions

There’s another phenomenon about Facebook videos that I’ve noticed.

It’s that many of us don’t watch videos with sound.

I know I find myself doing this quite a bit. And there are several reasons for this.

For instance, a person might be at work and “sneaking into” their account when they should be tending to more pressing matters.

Or a person might be accessing their Facebook account via mobile device in a public location where it’s simply not appropriate to have the sound blaring.

This means that a decent chunk of the people viewing videos are doing so without any sound.

If your video ads lack captions, this can obviously be a problem because it’ll be difficult for the viewer to decipher what you’re trying to promote.

One study of Facebook video ads even found that

41% of videos are basically meaningless without sound.

In turn, many people will simply gloss over your video ad and scroll down to the next interesting thing in their feeds.

If you haven’t been using captions thus far, I suggest including them right away.

This is almost guaranteed to improve engagement and, in turn, lower your CPM.

In fact, internal testing from Facebook found that

captioned video ads increase video time by an average of 12%.

5. Add music for those who do listen

I know it may sound a little contradictory to suggest adding music, considering my last point was about a great number of people viewing video ads without sound.

But there will be a portion of users who will view your ads with the sound on.

You’ll want to do everything within your power to increase their focus.

One of the most effective ways to go about this is to include music.

I’m sure you’ve heard about how helpful music is for aiding students in studying:

But you don’t want to include just any type of music.

You also don’t want the music to get in the way and drown out what someone is trying to say in the video.

It should simply accompany the video and enhance it.

But which type of music is ideal?

There have been several studies done to determine which kinds of music aid in focus and concentration.

By and large, classical music is the way to go.

According to a particular study, “researchers found that listening to classical music had the greatest effect on improving visual attention.”

This doesn’t necessarily mean that you have to use classical music. It just means that classical is one of the best “go-to’s” for capturing viewers’ attention.

Here’s my suggestion.

Play some type of background music throughout the duration of most of your ads.

If classical music happens to fit your message, brand, theme, etc., that’s great—stick with that.

But if not, go with something you feel would be suitable for optimizing your video ad.

I would recommend experimenting with a few different options until you find the one that meshes with your content the best.

Conclusion

The way I see it, Facebook Video ads are a fairly cost-effective form of paid advertising.

I get the fact that most people aren’t exactly “dialed in” to make a purchase when using their Facebook accounts.

But I have experienced first hand the results that video ads can get when they’re used effectively.

And, of course, you don’t want to just throw something at the wall to see what sticks with this, or any other, form of paid advertising.

It’s all about getting a solid ROI and lowering your CPM.

These hacks are great little loopholes for doing just that and will lower your CPM by as much as 81%.

Do you have any other Facebook Video Ad hacks that have helped you reduce your costs?

Source Quick Sprout http://ift.tt/2lrbzig