Google can be really frustrating sometimes.

If you’ve been in SEO for anytime at all, you know exactly what I’m talking about!

Google’s success and global search market dominance have largely hinged upon its ability to perpetually evolve and provide the best user experience possible.

As a result, SEO is in a constant state of flux.

It’s literally always changing!

But one thing that hasn’t changed is the fact that quality links are the foundation of nearly every successful SEO campaign.

Although many people have been predicting the demise of links as a primary ranking signal for years, link-building is still very much alive and quite well.

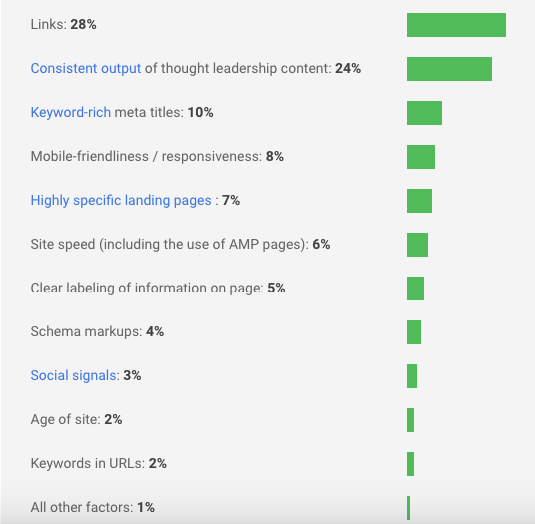

According to First Page Sage, links are still the number one ranking signal in Google’s algorithm in 2017.

As they point out,

inbound links have been the primary currency Google uses to determine its level of trust for a website since the search engine established itself in 1998.

It worked for them then, and it still works for them now.

So, yeah… Link-building is kind of a big deal, regardless of what the naysayers may think.

And this means one thing.

You need to have your link-building on lock.

Unfortunately, many link-building campaigns are full of holes due to misconceptions and misunderstandings as to what Google is really looking for.

It can be especially brutal for noobs, who are just getting their feet wet.

Here are some of the most common link-building mistakes SEO marketers make and how to resolve them.

Botching anchor text

The great anchor text debate has raged on for a few years now.

Okay, maybe that sounds overly epic, but employing anchor text is one of the most misunderstood aspects of link-building.

Back in the day, you could often outrank the competition by simply being obnoxious and going crazy with exact match anchor text (the keyword phrase you’re trying to rank for.)

But Google quickly discovered that way too many people were gaming the system and launched a counterattack with Penguin in 2012.

They tweaked their algorithm, and the sites that went overboard on exact match anchor text were penalized.

Of course, SEO marketers didn’t want to incur the wrath of Matt Cutts and his minions, so they did the only sensible thing.

They went the opposite direction.

Many people ceased to use exact match anchor text altogether.

And I can totally see why.

To be honest, I’m still a little sketched about using exact match anchors.

But here’s the thing. Doing anchor text the right way can be encapsulated in one word: natural.

If it’s natural, you’re good to go.

What exactly do I mean by natural?

You want to make sure you’re diversifying your anchor text and not going overboard with any particular format.

The different types of anchor text

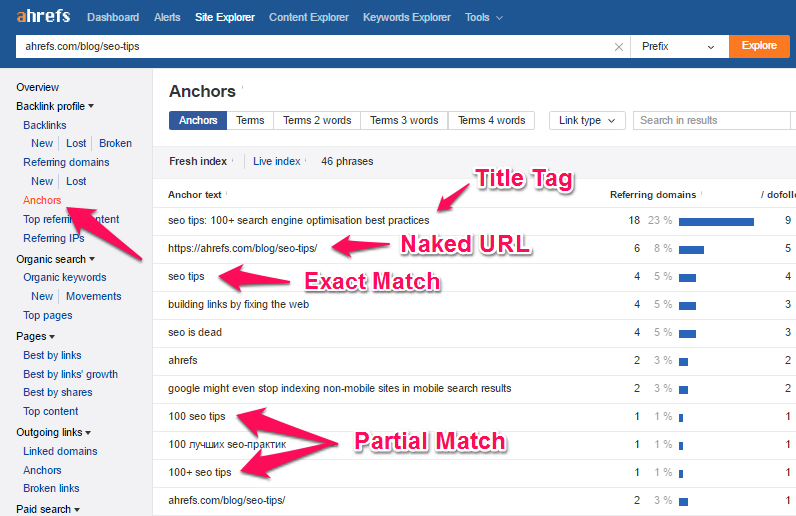

When you break it down, there are six main types of anchor text:

- Exact match – Like I already explained

- Partial match – This contains the keyword phrase you’re trying to rank for but isn’t exact

- Branded – The name of your brand

- Naked URLs – This is the URL exactly how it appears in your browser

- Generic (also known as junk anchors) – Some examples would be “check this out” or “click here”

- LSI – This is latent semantic indexing, which is variations of your keyword.

If this still seems a little vague, here are examples provided by Ahrefs:

Speaking of Ahrefs… They performed some extensive research on anchor text fairly recently (mid-2016) to determine its impact on SEO.

There’s a ton of data, which can be a little confusing if you’re not an SEO nerd.

Allow me to give you the key takeaways.

First of all, anchor text continues to play an integral role in link-building, and SEO in general, and is unlikely to change any time soon.

Second, it’s completely true that you need to be careful when using keyword-rich anchor text.

Going overboard can definitely get you penalized.

However, this doesn’t mean you should never use keyword-rich anchor text.

It’s actually okay—as long as you don’t go crazy with it.

Ahrefs suggests “using exact match at around 2 percent and phrase match at around 30 percent.”

And that sounds about right to me.

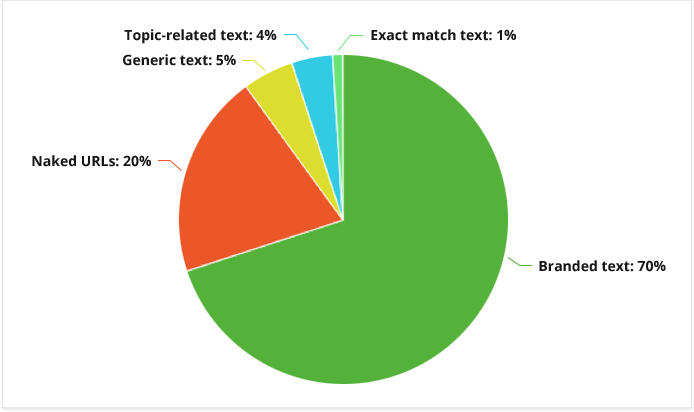

The bottom line with anchor text is that it needs to be natural.

To achieve that natural effect, you want to use a variety of different formats.

This graph from Search Engine Journal offers their version of ideal anchor text diversity:

It’s usually all right to throw in some keyword-rich anchor text, but you need to be smart about it.

If you follow this formula, you should be good to go, and you can construct hyperlinks—both internal and external—the right way.

For more insight, check out the article from Ahrefs I referenced above.

In my opinion, it’s one of the best currently out there on anchor text.

The myth of never linking to directories

Ah…directories.

Most SEO marketers cringe at the mere mention of them.

And I totally get it.

I remember back in the mid-2000s, directories were popping up everywhere, and they were a cheap way to get links.

Most had little to no credibility and looked incredibly spammy. And quite frankly, many were.

So, of course, when you ask your average SEO marketer whether or not you should ever get links from directories, most would adamantly say “no!”

But I disagree (sort of).

Now, let me preface this by saying you shouldn’t get links from highly-questionable, spammy, irrelevant directories that have absolutely nothing to do with your niche/industry.

That’s a recipe for disaster.

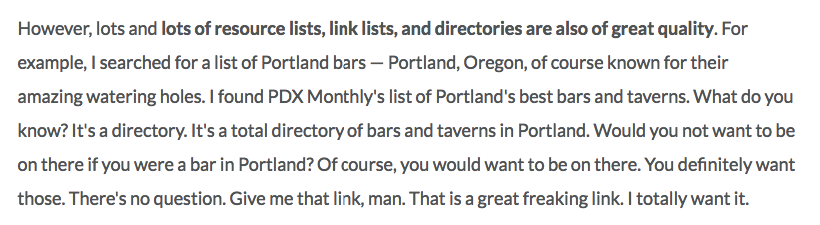

However, Rand Fishkin of Moz made a really great point in one of his Whiteboard Friday sessions.

He basically said that there’s an ongoing myth that you should never get links from directories.

But this just isn’t the case.

There are plenty of high quality directories that can be very beneficial to your link-building campaign.

Here’s a screenshot of an example he provides about a monthly list of bars in Portland, Oregon:

The point here is that you should definitely take a link like this.

It’s legit and going to help your SEO.

Once again, I’m not condoning getting spammy links from low-quality directories.

But in many cases, the right directories can be quite beneficial.

Just use your best judgment.

Having a “quantity over quality” mindset

If you look at it on paper, it might seem more sensible to get a high volume of so-so links rather than only a handful of high-quality links.

I get it. It’s much easier to grab the low hanging fruit and take the path of least resistance.

But like with many areas of online marketing, you’re much better off opting for quality over quantity.

Just like it makes more sense to create one in-depth, longform, high-quality blog post than three or four mediocre, generic 500-worders, a single high-quality link can be much more valuable than dozens of low-quality links.

Think of it like this.

High-quality links do much more than just improve your link profile and provide you with SEO juice.

They can enhance your brand equity and bring in quality referral traffic as well.

If you’ve had a quantity over quality mindset up until now, it’s time to change it.

Forgetting about social signals

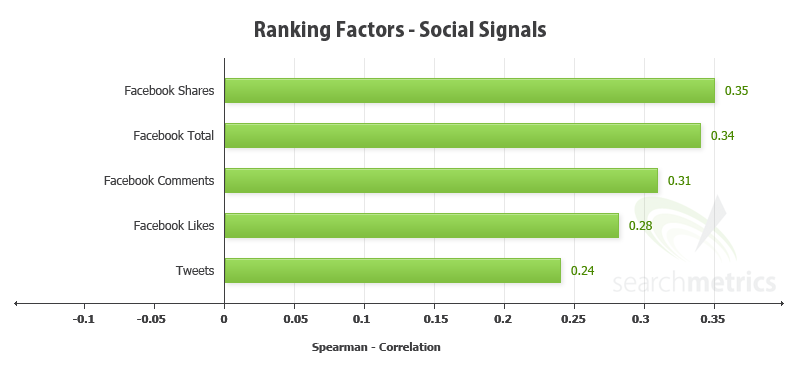

One of the other great SEO debates is just how big of a factor social signals are.

Some people seem to think social signals are a significant ranking factor, while others believe they’re just a waste of time.

I’m in the camp that believes they’re a substantial ranking factor. At least nowadays.

While I’m not saying they’re super high on the totem pole, you definitely don’t want to overlook social signals in your link-building.

In fact, Backlinko includes social signals in a recent list of Google’s 200 ranking factors.

More specifically, they mention the following social signals as having a considerable impact:

- Number of tweets

- Authority of Twitter user accounts

- Number of Facebook likes

- Facebook shares

- Authority of Facebook user accounts

- Pinterest pins

- Votes on social sharing sites

- Number of Google+1s

- Authority of Google+ user accounts

- Social signal relevancy

You get the idea.

A few years back, Moz broke down the potency of some of the more powerful social signals:

I know it’s a little outdated (2012), but I think this data is still fairly relevant today.

The bottom line here is that you should do everything within your power to maximize your social signals.

This starts with creating epic content that outperforms that of your competitors (see the skyscraper technique).

You should install social media buttons if you haven’t done so already.

This is super easy to do if you’re a WordPress user. Just install a plugin.

Also be sure to ask your audience to share your content.

Sometimes that’s all it takes!

And don’t forget that social signals do much more than just boost your SEO.

They can also have a considerable impact on your brand’s reputation and whether or not readers will stick around and read your content.

Just think about it.

Which brand would you take more seriously?

One with an article with a high volume of social shares like this…

Or an article with only a handful of shares?

I rest my case.

Conclusion

Like it or not, link-building is essentially the lifeblood of SEO.

And I really don’t see that changing anytime soon.

Until Google radically changes its algorithm, links are likely to remain one of the top ranking factors.

But like with many other areas of SEO, what constitutes proper link-building can be a little confusing.

There’s plenty of room for misunderstanding even for the most adept of SEO marketers.

By acknowledging any mistakes you’re making, you can tighten your link-building and make your overall campaign run like a well-oiled machine.

Can you think of any other common link-building mistakes SEO marketers make?

Source Quick Sprout http://ift.tt/2pkfNz2