الاثنين، 22 أبريل 2019

Medicare, Social Security Face Shaky Fiscal Futures

Source CBNNews.com http://bit.ly/2UzaIOe

How Student Loans Work | Understanding the Basics

College is far from cheap these days, and that’s true even when you go to an in-state school.

The College Board says that, on a national level, students paid an average of $10,230 for tuition and fees for four-year, in-state schools, and that doesn’t even include room and board.

If you include housing and meals in your planning, expect to fork over an average of $21,370 per year for public, in-state education.

With these figures in mind, it’s no wonder many students need to take out loans for college. It’s not feasible for most people to pay in cash — especially since college kids can’t always work while they go to school.

What is a Student Loan?

A student loan is a type of debt students take on in order to finance college tuition, fees, and living expenses while they finish college.

Just like any other type of loan, student loans charge interest on your balance that you’ll have to repay. However, with loans that are subsidized, the government takes care of the interest on your loans while you’re in school. With unsubsidized loans, interest starts accruing as soon as you take out the loan.

Some student loans — including Direct Subsidized Loans and Direct Unsubsidized Loans— grant you a grace period.

A grace period is an amount of time after you graduate or leave school before you must begin repaying your loans. Not all student loans come with a grace period, meaning some require you to make payments while you’re still in school.

Types of Student Loans

Federal Student Loans

In almost every situation, students should take advantage of any Federal student loans they qualify for first. Not only do Federal loans come with low fixed interest rates, but they also carry special benefits.

Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduate students come with a fixed rate of 5.05% as of early 2019, while Direct Unsubsidized Loans come with a slightly higher APR of 6.6%. Direct PLUS loans come with an APR of 7.6%.

If you have trouble making payments on your Federal student loans, you may be able to qualify for deferment or forbearance.

Both programs that let you suspend your payments for a limited time. You can also consolidate your Federal loans with a Direct Consolidation Loan and/or extend your repayment timeline.

Another benefit of Federal student loans is the fact that they can help you qualify for income-driven repayment plans that let you pay a percentage of your discretionary income for 20-25 years before having your loans forgiven.

Federal student loans also come with the potential of having your student loans forgiven. If you work for a nonprofit or the government, you could qualify for Public Service Forgiveness, a major advantage of this funding source.

Private Student Loans

While Federal student loans are preferable in most cases, there are times when it makes sense to apply for a private student loan. Private student loans are offered by independent lenders who can set their own terms and rates, and they are often very competitive.

Keep in mind that it’s possible to find student loans with a private lender with rates as low as 3.25% APR.

That’s part of the reason many borrowers wind up refinancing their Federal student loans with a private lender. When the goal is paying off loans as quickly as possible, scoring a lower interest rate can help the process along.

Of course, some borrowers apply for private loans outright and not during a refinance. Private student loans can be a good option when you’ve borrowed up to Federal loan limits but still need money to finish your degree.

How Much Can You Borrow?

When it comes to borrowing money for college, your goal should be borrowing as little as you can. Remember you’ll have to pay back every dollar you borrow plus interest and fees.

Even borrowing a few extra thousand dollars per year can make your payments considerably higher, so you should strive to only borrow what you need.

With that being said, Federal student loans do come with limits that dictate how much you can borrow while you earn your degree.

For example, first-year undergraduate students that are dependent on parents can only borrow up to $5,500, and only $3,500 can be in subsidized loans.

Second-year dependent undergraduate students can borrow up to $6,500, and third-year dependent undergrads and beyond can borrow up to $7,500.

Borrowing limits for independent students and graduate students are significantly higher. For example, graduate or professional students can only borrow up to $20,500 per year in unsubsidized loans.

How Do You Apply for Student Loans?

Federal Student Loans

If you plan to apply for Federal student loans, the first thing you need to do is fill out a Free Application for Federal Student Aid — or FAFSA form. The FAFSA form can help you determine whether you qualify for any Federal aid, and if so, how much.

If you plan to apply for private student loans, you should really do your research to see which lender might work best for your needs. Fortunately, this is easy to do online and from the comfort of your own home.

Private Student Loans

College Ave Student Loans offers fixed and variable rate student loans with low rates and flexible repayment terms.

They also let you repay your new loan over 5 to 15 years, which gives you the opportunity to pay more or less each month depending on when you want your loans paid off.

College Ave also offers the most loan options and terms to choose from when compared to competitors like Sallie Mae and CommonBond. You can use the College Ave Student Loans calculator to find out ways to compare loan options and find ways to save.

The prequalification tool allows you to see what rates you may qualify for (without a hard check on your credit score). Either way, applying for private student loans is easy since you can complete the entire application process online.

What Happens If You Don’t Repay Your Loan?

One of the biggest downsides of student loans is the fact it is nearly impossible to discharge them in bankruptcy. This is true of both Federal and private student loans too, so there’s really no way around it.

If you stop paying on your loans, they will go into eventual default and continue accruing interest and fees.

You may also be responsible for repaying collections charges and court fees.

Loans go into default at different rates once they become late — 360 days on federal student loans and it can vary for private student loans.

The government may also be able to seize a percentage of your wages if you stop repaying your Federal student loans.

The Bottom Line

Borrowing money for college may be essential, but you should still have a plan in place before you take out loans for school.

Make sure you borrow as little as possible and have a plan to pay it back, or else you could live to regret it for decades to come.

Also make sure you take out the right type of student loan for the right reason. Both Federal and private student loans have their own set of pros and cons, but it’s up to you to do the research and decide.

The post How Student Loans Work | Understanding the Basics appeared first on Good Financial Cents®.

Source Good Financial Cents® http://bit.ly/2Ds1fmm

This Company Will Give You $100 for Opening a Free Account

Sure, many banks offer sign-up bonuses throughout the year, but they often require you to jump through hoops with minimum requirements that feel impossible to hit.

Oh, and if you don’t meet another set of requirements? You’ll get slapped with a monthly maintenance fee. Honestly, at that point? Forget the cash bonus.

Instead of getting wrapped up into that mess, we found an account that makes snagging a $100 bonus super easy.

Here’s how you can be $100 richer this summer just for opening an Aspiration Spend and Save account.

How to Get a $100 Bonus When You Open This Account

We love this account because of the perks, including up to 2.00% annual percentage yield (APY) on your savings, 0.5% cash back on purchases with your debit card and reimbursement for ATM fees.

Plus, Aspiration works on a pay-what-is-fair model. You choose to set a monthly tip up to $20 or as low as $0, and you can change it anytime, so you don’t have to worry about those sneaky fees.

Follow these simple steps to add a $100 bonus to your new account:

- Open your Aspiration Spend & Save Account by April 30, 2019.

- Set up and receive a direct deposit from your paycheck or government benefits by June 28, 2019.

- You’re good to go! Keep your eyes peeled for that $100, which will appear in your account by July 15, 2019.

Now, happy spending — or saving! Luckily, it’s easy to do both with your new account.

Offer Terms and Conditions:

Offer is only valid for new Aspiration customers. Account must be created directly though this link. Customer must complete the following activities: (1) Between 12:01 a.m. Pacific Time 4/22/2019 and 11:59 p.m. Pacific Time 4/30/2019, open and fund an Aspiration Spend & Save Account with a deposit of $10 or more, and (2) by 11:59 Pacific Time on 6/28/2019, set up and make an electronic direct deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. Allow up to July 15, 2019 for the offer credit to post to your Aspiration Spend & Save Account. Aspiration Spend & Save Account must be open and in good standing, in the sole determination of Aspiration, through the date of the credit. All applicable account terms, fees and charges are subject to change. This offer may be revoked, modified or withdrawn at any time without notice.

Carson Kohler (carson@thepennyhoarder.com) is a staff writer at The Penny Hoarder. She’s been happily banking with Aspiration for more than two years now.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2Xxf0HN

Push Strategies for Getting More Visitors

A push strategy usually involves interrupting the content that is being consumed.

You aren’t the tweet they want to read, but instead, you’re the tweet ad that they read on their stream. You aren’t the YouTube video they want to watch, but you are the pre-roll ad that they watch to get to the content they were after in the first place.

Pull is analogous to Hansel and Gretel. The sweets lure the children into the house on their own accord. Push is analogous to the Three Little Pigs. The wolf just huffs and puffs and breaks into their homes. You can pull them into your world, or you can push yourself into their world. That’s the main difference between pull and push tactics for getting visitors.

Understanding Lifetime Value of a Customers

The lifetime value of a customer (LTV) is basically the amount of money that you are going to make from a customer throughout their life. If you built an e-commerce app and you profit an average of $100 per customer, per year, and they typically buy for 5 consecutive years before they get bored with your inventory and stop shopping with you, then your LTV is $500.

This is important because another primary difference between pull and push tactics is that push tactics usually cost money. Going back to our example above, if a customer is worth $500 on average then it would be foolish to spend $501 to move someone through your funnel. You would ultimately lose $1 each time you retained a user. Keep this simple idea in mind with all of the tactics covered in this section.

1. Purchase Ads

It may not seem like growth hacking at first glance, but ads are definitely a place to hack the distribution of your product. Sure, if you just purchase ads without a strategy, void of creativity, doing nothing to gain an edge, and ignore the process of multivariate testing, then you will be like everyone else (and it probably wouldn’t be considered growth hacking). But that’s not what we’re going to do. Here are some things you must keep in mind as you approach this push tactic:

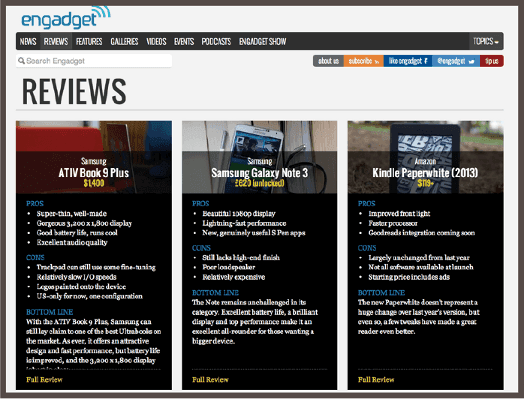

Understand Your Ad Platform Options

There are many different ways to purchase ads. Most people assume that there is just Facebook, Google, and Twitter, but there are so many more. You can also purchase ads on LinkedIn, which would make a lot of sense if you’re selling to corporate customers. There are niche ad networks such as Carbon (carbonads.net) or The Deck (decknetwork.net), both of which will allow you to target specific verticals. There is BuySellAds (buysellads.com) which allows you to purchase website banner ads, tweets, newsletter sponsorships, RSS includes, and even spots on mobile apps. There is a relatively new ad network that just focuses solely on email sponsorships called LaunchBit (launchbit.com). There is even a solution called Trada (trada.com) that will crowdsource the purchasing of your paid advertising and only take a cut if they exceed your goals. If you want to focus exclusively on mobile users then you can advertise using Tapjoy (tapjoy.com).

Here is a screenshot of Carbon, a niche ad platform.

Here is a screenshot of BuySellAds, one of the generic ad platforms.

This doesn’t even include the platforms that focus on retargeting. Retargeting gives you the ability to track users to your site and show your ads only to those people as they browse around the internet. Now, even your ads can be pre-qualified. If this sounds magical it’s because it is magical. In this space alone you have a number of platforms like AdRoll, Perfect Audience, and Retargeter.

Here is a screenshot of AdRoll, which was named the #1 advertising company by Inc. Magazine.

There has been an explosion of ad networks over the last few years. Some would argue we have too many ways to purchase ads. This can be a good thing if you are willing to investigate the options to find the ones that meet your needs.

Learn the Technical Details of Your Chosen Platform

Once you’ve found an ad platform that meets your specific needs then it will be imperative that you learn the technical details of their offering. The difference between making money or losing money could easily be the difference between knowing the technicalities or not. The most complicated and advanced platform is probably Google AdWords, and it could easily take months to truly master their product, but most of the other options can be learned in a weekend with a high degree of proficiency.

Buying Ads is a Business Model Competition

It’s always hard to know how much you should spend for a single click, or for a set of impressions, but the answer is actually a factor of your business model. If you are targeting the same audience as another company, but your business model is more efficient and your LTV is higher, then you can afford to pay more for the traffic without going upside down. The best thing you can do to win customers using ads is to have a great business model. It’s almost an unfair advantage because no amount of tips or tricks can overcome this one stronghold. If you can pay twice as much to acquire a customer then you have a very defensible strategy.

Consider the Various Personas of Your Customer

Your customers can probably be reached using various platforms. For instance, they are more than likely on Facebook and LinkedIn. You must then decide which persona they are utilizing when they want a product like yours. When someone is on Facebook they are thinking about friends and family. They are looking at photos of other people’s experiences. When people are on LinkedIn they are thinking about climbing the corporate ladder and how networking with others can help them reach their goals. If your product is for project management in agile environments then I wouldn’t choose Facebook, even though technically you could reach your demographic there. Yes, they would see your ad, but their mindset would be incorrect because you are introducing yourself to them in the wrong place. Always think about the persona your customers exhibit while using your particular product before choosing an ad platform.

Circumvent the Ad Networks When Possible

This tactic may not scale easily, but it is still well worth mentioning. You could go to BuySellAds (or other places) and buy banner ads on a particular blog that your audience reads. However, if you cut out the middleman (BuySellAds) and go directly to the owner of the blog then you can get cheaper rates for two reasons. First, BuySellAds is making a cut of every transaction, so if you go direct that is money that you can recoup without the blog owner losing anything. Second, you are able to negotiate. Very rarely is the lowest price and the advertised price the same thing. You can ask for a lower rate and often close a deal relatively simply.

If You Are Paying Per click Then Qualify Every Click

There are two ways to buy ads. First you can purchase them on a CPM basis, which means you pay for set number of impressions and it doesn’t matter how many clicks they get. Second, you can pay per click and this means that it doesn’t matter how many times your ad appears, you only pay when your ad is clicked. If you are paying per click then you don’t want people to click your ad unless they are seriously interested, because it costs you money every time they do. Luckily, there are things you can do to qualify clicks using the ad itself. Consider putting the price of your product in the copy so that people don’t click unless they are interested in spending money. Also, don’t use emotion to pull them in unless that same emotion will cause them to buy from you. Don’t put a picture of cute cat on your ad, just to get cat lovers to click on it, if your product doesn’t have something to do with cats.

Test Variations of Your Ad

One of the most fundamental lessons of ads is that you have no idea what your audience will respond to. You have to test multiple versions of the copy, multiple versions of the imagery, and then multiple combinations of the copy and imagery together. The numbers will tell you the truth about which ads you should be running, but your intuition or gut is probably not accurate.

2. Promo Swap

One of the easiest, and free, ways to drive traffic to your site is through cross promotions with other companies. If you find a company who is already serving your target demographic, and you wouldn’t be considered a threat to them, then there are plenty of ways that you could coordinate to promote each other. Here are some ideas to help you brainstorm possibilities:

- Swap Tweets: Each company sends out a tweet to their followers about the other company.

- Swap Facebook Posts: Each company writes a post on their Facebook page about the other company.

- Dedicated Email Swap: Each company send out an entire email about the other company.

- Sponsored Email Swap: Each company puts a “sponsored by” link in their existing newsletter, linking to the other company.

- Ad Space Swap: Each company allows the other company to place a banner ad on their website or blog.

- Pre-roll Video Swap: Each company gives away video ad space to the other company.

- Giveaway Swap: Each company promotes a giveaway from the other company on their blog.

-

3. Affiliates

Another way to push people toward your site is by hiring affiliates. This is an arrangement where you pay someone every time they reach a certain goal for you, like getting a visitor to your site, or activating a member. An affiliate might use many of the tactics in this book, but you are paying them to do it instead of worrying about it yourself. Here are a few things to know if you are going to use this tactic:

Think Carefully About the Incentives

If you give an affiliate $100 for every new signup, but there is no clause that says the new signup has to stick around for a certain number of months, then you could find yourself in a situation with misaligned incentives. The affiliate would be rewarded for getting you low quality customers that cancel quickly because it doesn’t affect their profit either way. Create a system where the affiliate only benefits if you benefit.

Don’t Roll Your Own Affiliate Solution

There are a number of products that will allow you to easily get up and running on the technical side of creating an affiliate system, and on the acquisition side of finding affiliates to promote your product. There are products like Commission Junction that will connect you with affiliates, and products like Omnistar that actually track affiliate payouts.

Vet Every New Affiliate Early On

When someone becomes an affiliate for you then they are representing your business to some extent. The tactics they use, the language they employ, and their general style, is a reflection on you. They may not be an employee, but they will be the front of your brand for the people they reach. Choose your affiliates very carefully.

4. Direct Sales

I’m going to be honest, this is a hard one to categorize as a growth hacking tactic, but it is a way to get traffic at the top of the funnel so I would be remiss to completely ignore it. Direct sales teams do not work for every kind of product, but in some cases it is a worthwhile tactic. AppStack, a startup that creates mobile websites in conjunction with mobile ads for local businesses, was able to grow revenues to over 50k a month in a relatively short amount of time, and their primary strategy was direct telephone sales. I use them as an example because it’s hard to imagine a startup using this method, but some of them do, and it actually can work.

Key Takeaways

- A push tactic usually involves interrupting the content that is being consumed.

- Push tactics usually cost money.

- Since money is involved with push tactics you must understand the lifetime value of your customers (LTV), so that you don’t spend more money on a customer then you’ll make from them.

- We covered 4 push tactics: purchase ads, promo swap, affiliates, and direct sales.

Source Quick Sprout http://bit.ly/2GAoufR

Get the Word Out With Public Relations

You’ve launched an amazing product or service. Now what? Now, you need to get the word out.

But you’re on a budget and can’t afford the $10K a month to hire a fancy agency and put out press releases. That’s fine. You’re better off executing you’re on strategy or hiring a really awesome consultant.

When done well, good PR can be much more effective and less expensive than advertising. For cost-conscious businesses, ROI is crucial. Every penny spent on marketing should generate revenue. PR is no different. Here are the steps you should take to form a successful strategy for your business:

1. Let go of the agency allure

The sad truth about PR is that existing process are broken. They’re outdated, costly, and inefficient.

- Many agencies are still buying very expensive ‘media lists’ and blasting our press releases and pitches to hundreds of journalists at a time.

- It’s hard for the PR industry to track and measure the value of what they do.

- Press release blasts entirely miss the mark on target audiences.

To succeed with PR, you need to focus less on the appeal of an agency and focus more heavily to focus on results. Prioritize what you want to achieve, not outdated ‘best practices.’ If you want to get in front of journalists, for instance, you are likely better off forming 1:1 relationships than bombarding them with irrelevant pitches.

2. Know When to Use a Press Release

A press release is worthwhile if your announcement is over-the-top catchy and newsworthy. But here’s the thing — most press releases read like giant sales pitches. If you think that journalists and publishers are going to be attracted to lukewarm content, guess again. They’re not. They don’t care. Their email inboxes fill up with 100s of spam messages again.

We hate to say it but marketers — get your head out of the clouds. The world does not revolve around your business, and journalists could care less about what you have to say.

If your goal is to get targeted placements for your brand, you will be better off cultivating a unique and thoughtful pitch in your area of specialty. A press release won’t cut it. Position your organization as a valuable, reliable, and trustworthy source of information instead.

3. Focus on Building Relationships and Making Connections

The problem with PR is ‘spray and prey’ or ‘broadcast’ mentality. If you shout at journalists with a megaphone, they’re not going to listen.

Above all, journalists care about compelling stories. They want to hear about your founders’ emotional journeys. They want to know what problem your company is solving and what motivates your team to wake up and come to work in the mornings.

Treat journalists like trusted business partners, not eyeballs. Develop a conversation. Let them ask questions.

Strategic Planning Wins the Race

Every so often, you’ll come across startups that generate insane amounts of traction on almost zero budget. You might think that it’s the outcome of luck — most likely, that isn’t the case. The more likely scenario is careful, strategic planning. WIth online media, Hollywood success stories are few and far between. Behind the scenes, marketers are hard at work — building key relationships with key stakeholders.

Karen X Cheng founded Dance in a Year, a platform that helps users learn anything in a year.

Karen learned to dance in a year and videotaped her entire journey. The outcome was an amazing video that went viral on YouTube. In just a few short months, her video has amassed millions of views. She makes the experience of learning to dance look seamlessly easy. She makes the process of making a viral video look pretty darn easy too.

That’s how you know that she put some real muscle behind the process.

- First, she posted her video to Facebook and Twitter, as well as social news sites like Reddit and Hacker News. She asked her friends to share the it and tweeted it to established bloggers. She also reached to bloggers who had previously written about viral dance video. Of the channels she pursued, Reddit was the top performer. The video gained attention and made its way to the top of the GetMotivated subreddit page. After day 1, she received 80K views.

- Day 2 was discovery day. The bloggers who had seen her video previously began telling her story on sites like Mashable, Jezebel, and the Huffington Post. These blogs were significant traffic drivers to Karen’s video. This coverage amplified her web traffic numbers to 800K views.

- The video’s popularity pushed Karen to the YouTube homepage. That chain of events helped take Karen to 1.8 million pageviews on the third day.

Karen also leveraged her video to connect with potential sponsors and stakeholders in her project. These included companies like Lululemon and American Apparel – two organizations that she was happy to support. Some of these companies supported Karen and shared her video on their social networks too.

She also released her video on Tuesday, guessing that on Monday, people are most likely to be catching up on emails from the weekend.

Use Public Relations Tools

The problem with PR is that the supply/demand ratio is completely imbalanced. PR seekers are constantly spamming writers, journalists, and bloggers for attention.

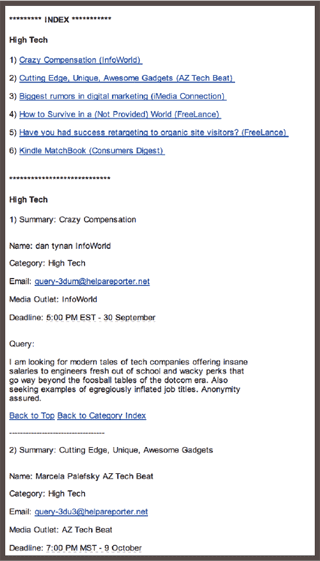

A service called Help a Reporter Out (HARO) can help to alleviate some of this crunch. Using this service, journalists can find sources to interview for upcoming stories. People seeking PR can monitor journalist queries and join the conversation where they’re qualified to contribute.

You can sign up for a simple e-mail digest that looks like this:

Here is what it’s like using HARO as a journalist:

For some queries, they’ll receive 50+ responses and most of the pitches I get are totally irrelevant. They make the journalist jump through hoops to get the information they need.

The thing to know about journalists is that they’re incredibly strapped for time and working under short deadlines.

From a journalist’s perspective, here are some tips for making your HARO query stand out:

- Answer the question specified in your pitch. Don’t assume the journalist can hop on a call. Tell they the story you want told upfront — offer to schedule a phone conversation as a follow-up. Send ready-to-quote material instead.

-

Don’t send a generic pitch. Send a unique, compelling story. Share something that stands out from a typical PR blast.

- Stop bombarding the writer. Journalists work on a deadline but do not necessarily know when their work will be published. Don’t bombard journalists with follow-up questions. Don’t harass them on LinkedIn, and don’t aggressively talk them via multiple email addresses. If you don’t hear a response, move on to the next story. Don’t be offended. HARO writers receive a ton of emails, and it’s impossible to respond to each and every one.

- Write a really compelling email headline. Instead of just replying to the query, take the time to craft a unique headline that summarizes your story’s value proposition. Remember that there is a human being on the other end of the computer screen. Make it really, really easy to deliver your message, and the reporter will be more likely to open your email message.

- Set-up Google Alerts. Make sure that you have Google Alerts set-up for the keywords you’re monitoring about your brand. Especially with HARO, you may not know when a writer will feature your story. Don’t bombard the writer with questions. Run Google Alerts to help you keep your eyes peeled.

Use Tools To Save Time

Save yourself the time and hassle of combing through spreadsheets and sending hundreds of emails. Use tools that have been developed to solve your exact pain point — scale with limited resources.

One example resource is BuzzStream — a CRM (customer relationship management) platform that helps PR professionals build relationships, monitor conversations, and maintain historical records of conversations with PR and media platforms.

Features include:

- Automated tools for researching link-building prospects

- Resources for identifying campaign opportunities

- Team-based tools for building and managing relationships with influencers

- The ability to prioritize a human, relationship-based touch

BuzzStream lets you automate mundane tasks like saving information about key contacts and partners. Teams can also collaborate on initiatives and delegate outreach tasks.

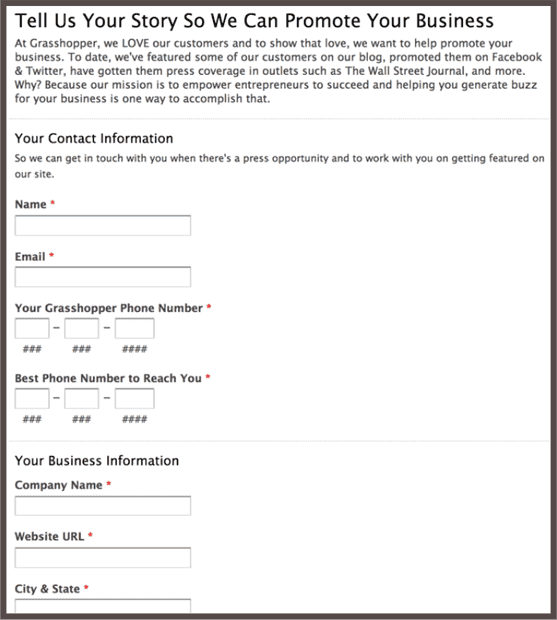

Collaborate With Other Business to Boost Your PR

Content marketing means that brands are becoming publishers and building their own audience bases. Companies, like you, are looking to connect with key audiences through PR and distribution.

Team up with fellow-business blogs who are looking to reach the same audiences as your organization. There are two ways to get going — guest post on industry blogs, or invite others to create content for your blog.

Grasshopper, a virtual phone system for entrepreneurs, uses its blog as a platform for giving props to their best customers. The company has a “submit your story” program and will write about their customers who have something awesome to share. For Grasshopper, PR is an invaluable way to say “thanks” to their trusted business partners.

Give Samples of Your Product or Service

One way to get press coverage is to give away trials or samples of your product or service. Reach out to prominent journalists and bloggers, and ask if they would be open to doing a product review. Give them a free trial or sample to try.

Always Say Thank You

When a journalist, blogger, or fellow business writes about you or your company — reach out and say thank you. Offer yourself as a resource for future stories. Position your organization as a company that wants to return the favor and help.

PR is, first and foremost, about building relationships. To the best extent that you can, maintain a personal touch. Take journalists out to dinner as a ‘thank you’ (not a bribe) for writing about you.

Show that you are grateful, and you’ll stand apart from the crowd of people who aren’t. Add value to your industry — don’t extract it. Pay it forward whenever you can. Connection karma, and you never know when something small will materialize into something much, much bigger.

Key Takeaways

- PR is an inefficient and frustrating rat race. Cut through the noise by zeroing in on the results you want to achieve.

- Treat PR like business development. Build key relationships with journalists.

- Put yourself in the shoes of a journalist. Craft meaningful, compelling pitches. Don’t ‘spray and pray’ a salesy advertising message.

- Personalize pitches to the journalists’ needs and interest.

- Develop a powerful brand story to share.

- Give more than you get. Say thanks. Offer to add as much value as you possibly can.

Source Quick Sprout http://bit.ly/2IzHptw

How to Tell Your Brand’s Story

Human-to-human connections are the heart and soul of business. At the end of the day, you’re dealing with people — your company is solving problems, alleviating pain points, and providing delightful customer experiences. Revenue is something that happens as a byproduct of a sound business model and a positive customer experience.

Storytelling is a powerful technique for building relationships. It’s an age-old concept that brings people together and keeps them engaged. It doesn’t matter where in the world you’re based or how much funding your startup has.

Good stories give big voices to small ventures. That’s why it’s mission-critical that companies take the time up front to fully develop their approaches to storytelling.

Storytelling and marketing go hand-in-hand. Just think about it. Whether you’re producing infographics, writing copy for a Facebook ad, or writing a free online guide (like this one), you need to capture your audience’s attention.

On a daily basis, consumers (yourself included) face advertising overload. Marketers are constantly competing for their prospects’ and customers’ attention. More likely than not, your brand will be buried under spammy advertising messages.

How can you make your brand stand out? Storytelling.

Chapter 3 is an all-inclusive guide that explains why your brand should prioritize storytelling and how your organization should get started. This is not fluffy stuff, either. Storytelling is a powerful and actionable marketing technique. Convinced? Let’s get to it.

What is Brand Storytelling?

Brand storytelling is:

- The reason why your company came to be

- What motivates your team to wake up and come to work everyday

- How your product came to be

- What types of customers find value in working with your brand and why

- A transparent view into the people behind the company

- A relationship-building tool

- More subtle than you realize

- A concept that underscores your entire web presence

- Something that your entire team, at organizational levels, embraces

- A look into who you are as a company

- Direct

Brand storytelling is NOT:

- A long-winded, 5-paragraph essay about your company

- A blog post

- Something isolated

- A fragmented view into your company

- Something reserved for the marketing team only

- A PR stunt

- A viral video

- A tool to manipulate customers and prospects

- Boring

- Artsy

Contrary to popular belief, brand storytelling is not about your company. It’s about your customers and the value that they get when engaging with your product or service. The most powerful brand stories are the ones that prioritize customers as the stars. Think of your company as a supporting character.

Oftentimes, marketers get hung up on this concept. They’re stressed about communicating the perfect message and confused about where this initiative should be housed within your business.

Should you hire a consultant? Should you loop in your company’s EVP of corporate communications? And what if you’re an engineer? Does that mean you’re doomed?

Don’t overthink this process. Storytelling is something that we do naturally. More often than not, we don’t even realize that we’re doing it.

The problem is, online content is difficult to write. Stories become lost in translation. The human interest behind our brands will fall through the cracks.

And you feel stuck — at a loss for words to describe what you do and why you matter to your customers.

So why not let your customers tell your story for you?

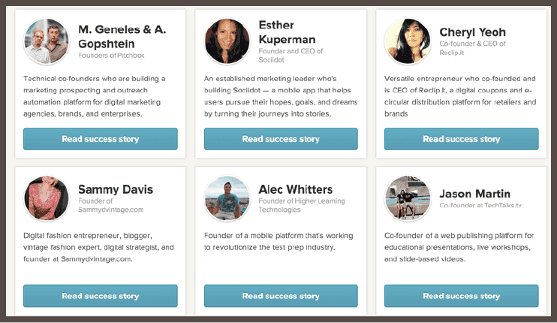

That’s what Clarity did. The company provides a marketplace for advice seekers and experts to connect and share business advice. The company recently launched a series of stories from actual customers. If you’re wondering how Clarity can help grow your business, take a lesson from the leaders who actually use it.

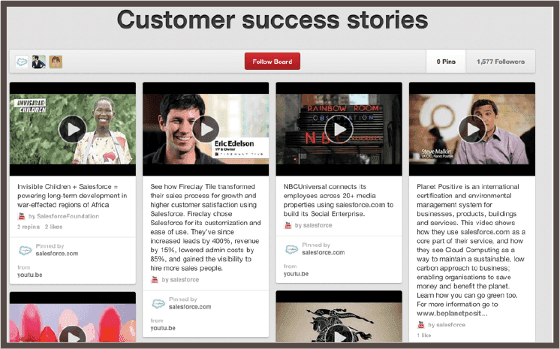

It’s not just startups that make use of this powerful approach. Enterprise CRM Salesforce hosts customer success videos on its Pinterest page.

Brand storytelling is more than what you write on your webpage to your customers. It’s more than your blog posts and about pages. It’s how you communicate your messaging. It’s your values. Your brand’s stories are values are infused in every piece of copy, customer service answer,

Okay, so you’re convinced. But what what the heck does it all mean? Storytelling still feels tough. Web copy and advertising messaging are still challenging to write. Here’s what you need to do.

Forget About Marketing

This may sound counterintuitive, but it’s the key to successful marketing. Stop thinking like a marketer. Stop trying to sell your product, and instead, focus on developing human interest. Answer the question of why people should care about what your company has to say.

That means being persuasive and appealing to emotion.

Whatever you do, don’t be boring. Do not let the words on your page hide the personalities behind your organization.

Share more than what you sell. Share your strengths, weaknesses, and how you arrived at where you are today. One way to do this is by participating in the storytelling ecosystem. Just as you’re looking for customer testimonials and case studies, make sure to pay it forward by offering to do case studies for other companies.

Be Conversational

Authenticity is crucial to copywriting. If you’re overly formal or on guard, you’ll lose trust with your audience. And that’s because consumers can sense disingenuous messaging from miles away. From awkward stock photos with fake customers to false promises, empty messaging can only hurt your brand.

Be real instead. Be human.

Pretend that you’re talking to a new friend over drinks or coffee — not giving an academic presentation in 1862. If you talk down your customers and prospects (or show any indication of lack of respect), they’re going to stop listening immediately.

Don’t dwell over whether or not you’re using perfect grammar. You can always hire a copywriter for that. Stop worrying about the occasional misplaced commas. Focus on developing your messaging instead.

Conversational writing also means keeping it short. Write what you want to say. Get it all on paper. Then cut it. And cut it again. Stop trapping yourself into the mentality that you need a minimum word count to convey information effectively.

Write what you feel like writing — with the exception that you can’t let your stories get too long and unwieldy. Too much writing on a blog post or webpage will make your readers feel distracted or lost. Say what you need to say in as few words as possible. There’s no need to try to sound smart. If you build a great product, your customers and prospects will perceive your company as incredibly smart.

Craft Your Message Architecture

Brand storytelling is more subtle than what your company is saying. As we mentioned earlier, the ‘how’ matters just as much. Take a lesson from Pinterest’s lead content strategist, Tiffani Jones Brown. She and her five-person team are responsible for the voice, tone, user interface copy, grammar conventions, and pinner education on the site.

That’s right. It takes five people to get Pinterest’s public-facing messaging just right. This fact may seem surprising, given that some companies have zero resources devoted to getting their messaging just right.

Your company’s message architecture is far from coincidental. It takes careful strategic planning to position your strategic planning.

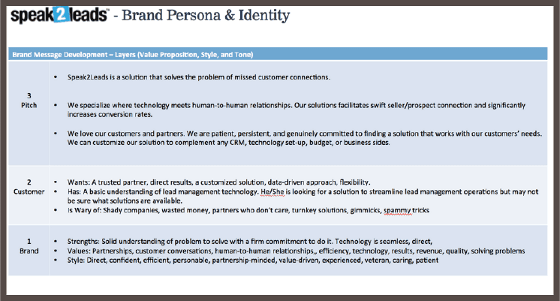

Don’t expect good stories to appear out of thin air. You need to focus on getting your messaging just right. You need to craft your company’s message architecture to underscore all of your brand communications. Yes, this is a real thing. And it looks a little something like this:

This table represents the steps that Speak2Leads has taken, conceptually, to connect with the company’s core audience — sales team leaders and small business owners who are looking to increase the speed of connecting to new leads. The concept is simple — when you wait too long to connect with an interested prospect, your company risks losing his or her business.

But here’s the problem. When sales teams are too aggressive, they risk driving customers away. That’s why Speak2Leads has positioned its company and product as one that boosts human-to-human connections. Selling is not about annoying your customers and prospects. It’s about being the first to respond and building a superior connection.

Before articulating your company’s brand persona, you need a thorough outline of your message architecture.

So what does that mean?

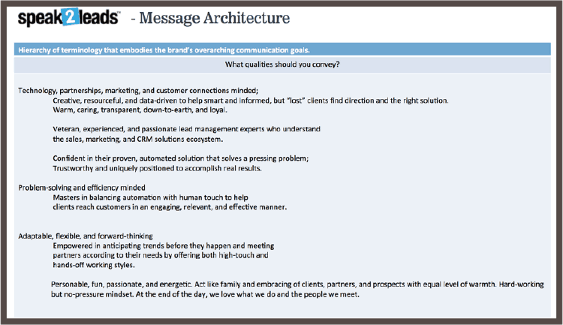

A message architecture, according to Bloomstein, is a way to transform vague goals into substantive concepts with context and priority. Your company’s message architecture will look a little something like this:

Speak2Leads incorporates these values in all of the company’s written material from help center documentation to email marketing initiatives and blog posts. The goal is to keep communication standard across its entire team and to maintain that consistency as the organization begins to scale. That’s why the company defined its message architecture as early on as possible.

The company’s story as a technology, partnerships, and customer-service minded organization comes through in absolutely everything on the website. Even though the company’s blog and help center, for instance, are managed by two different people — a customer service lead and marketing consultant, the same brand story will always shine through. Speak2Leads is a company that prioritizes human interest and is committed to solving a real problem in sales.

The company’s blog:

The company’s customer-facing knowledge center:

So how do you get started in choosing the keywords to place in your message architecture?

Brand strategists leverage a technique called a card sorting exercise.

- Create a list of keywords relevant to your brand. These could be keywords that you customers have said about your company as well as descriptions chosen by your own employees.

- Transcribe these keywords onto note cards.

- As a group, sort through the note cards to determine which words are most applicable to your band. Separate these words from the rest.

- Go through what’s left and rank the keywords in order of priority to your brand. Which are most relevant and which aren’t?

Assemble these words into sentences that describe your brand. - Piece together your message architecture.

Is possible, try to get your customers involved in this process. One way is to interview them for customer case studies. What words and expressions are they using to describe your brand? The more interviews and service reviews you conduct, the more patterns you’ll start to see.

Let your customers determine your brand messaging. Let them define the voice behind your company.

Unify Your On-site and Off-site Presence

Your company’s story, message architecture, and brand identity should follow your team members everywhere from on-site blog posts to PR opportunities in major media channels. You need to keep your company’s identity as unified and consistent as possible. As we mentioned earlier, the image you share with the world should be a genuine, authentic, and transparent view into your organization.

Choose Your Words Wisely

What you say is just as important as how you say it. Make sure you’re using the tone, voice, and communication style that your audiences value most.

How do you know what this should be and what words you should choose?

Jump back to chapter 1, where we walk through the art meets science of knowing your audience.

If you’re speaking to an audience of millennials, for instance, they tend to embrace a casual, conversational tone and style — more so than an audience of baby boomers would.

Again, unless you were a college English major (like Ritika was), the concepts of voice, tone, and style are really vague. How the heck do you put it all on paper?

What you need is a styleguide to provide instructions for all of your on-site and off-site brand communications. Get started by completing the following template:

- Website goal: Jot some notes about what your website visitors should hope to accomplish when visiting your website.

- Audience: Who do you expect to be engaging with these specific website sections?

- Core concepts to be reinforced: What do you want your audiences to feel after visiting this section of your website or piece of writing?

- Tone: What emotions should come across after somebody reads this story or section of your website?

- Perspective: Do you want your writers to communicate in the first, second, or third person? Who is telling the story?

- Voice: Should the language be conversational, formal, or somewhere in between?

Your brand styleguide and message architecture can be custom-tailored to any form of multimedia, beyond writing. Whether you’re producing infographics, brand videos, e-books, or blog posts, your plans will ensure that your messaging is consistent across mediums. Writing is only one form of online communication. Make sure that you invest the time in energy in creating structure behind everything that you produce online.

Key Takeways

- Human-to-human connections are the heart of marketing. Brand storytelling is a technique that can reinforce these bonds.

- Stories can give your brand a powerful voice, regardless of whether you’re running an enterprise organization, small business, or startup.

- Storytelling is medium-agnostic. Tell your story through blog posts, customer help centers, about pages, videos, or infographics.

- You need to formalize your brand story to build connections both on and off your site, especially if your company is actively building a PR strategy.

- Storytelling is more than what you say explicitly. It’s how you communicate your message and how you connect with your target audiences.

- Storytelling concepts are vague, abstract, and tough to plan. Rely on card sorting exercises, message architecture maps, and brand styleguides to articulate your strategy and scale it across teams.

- Brand stories are cross-functional commitments that should guide your entire organization. Your sales team, engineers, product managers, executives, and entry-level professionals should all have a hand in articulating your brand’s messaging.

- Who defines your brand? Your customers. Study and truly understand what they’re saying about you. Identify patterns, and hold these concepts as close to your heart as possible.

Source Quick Sprout http://bit.ly/2XEYZzP

Drive Sales With Affiliate Marketing

Connections are the heart of online marketing. Affiliate programs take that concept to the next level.

Let’s say that you’re running a company that specializes in shoes. Your customer base knows that you’re a shoe expert but also values your input on other high quality products — like handbags. Maybe your customers have asked you about handbags, and you find yourself recommending the same options over and over again. As a shoe vendor, you’re acting as a marketer for the handbag company.

Wouldn’t it be great if you could finalize the deal?

With affiliate marketing, you can.

Company A directs Customer to Company B where the transaction occurs.

Company A then earns a commission from the transaction on Company B.

Affiliate Marketing Quick Facts

The earliest days of affiliate marketing stem back to the 1990s, around the time that Amazon launched its Associates Program (which still exists).

Affiliate marketing as grown quickly since its inception. One report points out that the worldwide affiliate marketing industry is worth $6.5 billion across sectors including retail, personal finance, gaming, gambling, travel, telecom, education, publishing, and forms of lead generation.

Affiliate programs are both consumer-based and business-to-business oriented.

Most affiliate programs follow a revenue sharing or pay per sale model. A small proportion follow cost-per-action. CPC and CPM payment methods are much more rare. Typically, commissions are fixed up-front, as part of a standard program.

Participants in the affiliate marketing ecosystem are typically known as “publishers” or “advertisers/merchants.” An advertiser/merchant is the provider of the offer. A publisher promotes the offer. A publisher can also be an advertiser — they are not mutually exclusive roles.

Here is an example of affiliate offers on a mom blog. Here, Amazon is the advertiser/merchant, and 3boysandadog.com is the publisher:

Some advertisers offer programs in tiers. Once publishers reach certain thresholds, they can begin to earn higher commission rates.

Affiliate programs are appealing to advertisers because there is no loss involved. It’s entirely based on “pay per performance.” In other words, advertisers pay for incremental sales, only.

What businesses cannot do is rely on its affiliate program to replace its sales stream. Advertisers need to actively build their own sales and marketing arms. Publishers are typically third parties and are independent entities.

Advertisers have limited ability to control publishers. If they don’t sell? Tough. Publishers might be open to hearing an advertiser’s suggestions, but ultimately, the two entities are independent from one another.

The Most Popular Affiliate Programs

Merchants can host their own affiliate programs or distribute offers through one or more established networks. An affiliate network is, essentially, a matchmaking service between merchants and publishers. Affiliate networks monetize by taking a portion of the commission.

The most popular programs are:

- Amazon Associates: Bloggers, large content sites, or large networks can choose products to market directly to their customers.

- Commission Junction: This affiliate network works primarily with large consumer brands to distribute their offers.Publishers who wish to join the network can choose from pay-per-call, lead generation, and even international solutions.

- ShareASale: This affiliate network features opportunities for B2B.

Does Affiliate Marketing Work for B2B?

ffiliate marketing can be a challenge for the B2B landscape, but success is entirely possible. For a publisher to succeed in driving sales, web traffic is key — typically, a publisher will need to generate significant traffic to generate any significant return.

If you’re a high-traffic publisher, it can be worthwhile to feature B2B offers, and revenue potential tends to be much higher, even though there are fewer sales (there are higher dollar-value transactions).

B2B advertisers may find success in working with publishers who run B2B blogs. Conversely, merchants may find success in promoting complementary products and services that are of interest to its customer base.

Check out some of Heidi Cohen’s offers, for instance. She runs a blog about marketing, so she’s promoting offers that her audience would care about — links to free guide and whitepaper downloads as well as the opportunity to sign up for a conference.

If you run a B2B blog, and you want to promote affiliate deals (but you don’t want to sell), check out RevResponse. This affiliate network will pay you to promote free resources to your readers. You’ll be paid between $1.50 and $20 per download. The value to the advertiser is that they will be able to connect with your audience. If you run a content marketing program, you can use this platform to reach audiences outside of your existing visitors.

Is Affiliate Marketing Right for You as an Advertiser?

The first step is not to go out and research potential affiliate networks.

To answer this question, you need to think about the following questions:

- What products or services would you advertise on an affiliate network?

- Who would be potential publishers?

- What would you expect the yield from these services + publishers to be?

These questions will help you forecast your revenue potential. Is the market big enough for you to pursue? If not, you should invest your limited time and resources into higher yield marketing opportunities.

An important step is to get out and talk to prospective publishers and business partners. Do they participate in affiliate programs already? What has the yield been in terms of performance? What are the typical revshares that ad networks are taking? What are typical conversion rates? What would be the incentive for publishers and business partners to promote your products and services?

Real data and partner insights can help you better understand the role of affiliate marketing in helping you meet your market demand.

After completing the exercises above, you will have determined whether affiliate marketing is right for you. Once you’ve come to an answer of “yes,” you need to make the following decision:

Should you join an existing affiliate network or create your own?

The answer to that question will stem from a simple cost/benefit analysis.

- Is there an existing affiliate network that aligns with your company’s products and services?

- What is this affiliate marketing company’s track record? Do you feel confident in the company’s ability to deliver results?

- How much time would it realistically take for you to build an affiliate network from scratch? Do you have someone on your team to oversee this initiative by forming relationships with publishers, handling disputes, troubleshooting technical problems, and making sure that payments are sent on time? Do the anticipated returns justify the invested time?

If an affiliate network doesn’t exist for what you need and you think that the ROI is worth it, you should definitely go and launch your own. But keep in mind that you’ll need to devote resources to get this up, running, and profitable.

Is Affiliate Marketing Right for You as a Publisher?

If your organization is looking to promote affiliate deals, you need to ask yourself these key questions:

- Is this a viable revenue opportunity?

- Does promoting affiliate offers align with user experience goals?

If the benefits outweigh the costs, the first step is to run a small test on a (random and representative) cross-section of your web traffic. Do your users convert? Are affiliate deals complementing or creating a distraction from your core business lines?

If you see a tangible return on your affiliate deals, you can gradually scale up your test by increasing the percent of your web traffic that sees it.

You have a range of options for hosting affiliate deals on your website. You might want to run these on the sidebar of your blog (like Heidi Cohen) or at the bottom of a piece of content (if you’re a mom blogger like 3 Boys and a Dog. If you’re running a B2B organization, you could have a portion of your site devoted to partner offers).Test different placements of your affiliate offers rather than confining them to one area of your website.

Be Generous

Treat your affiliates are your most valuable partners, and they’ll jump to do business with you.

Around 2007, entrepreneur Mike Geary from The Truth about Abs joined Clickbank’s affiliate program. He noticed that most merchants in the network were paying between 35% and 50% to their affiliates. Because he was selling a digital product, he had leeway to be more flexible with payouts — he didn’t have much overhead.

This sounds crazy and over-the-top generous. It was. But here’s what happened.

Hundreds of affiliates noticed Geary’s payout and switched their traffic to point to his website. Out of more than 10,000 products being sold on Clickbank, Mike’s product shot up to being the top sold, which drove even more attention to his company.

According to Mike, his revenue is around $1M per month.

Case Study: CrazyForBargains.com

Here is a great case study from Practical Ecommerce and CrazyForBargains, a family-owned retailer of high-quality sleepwear. The company has been around for more than 10 years — Melissa Canepa Murphy launched their e-business in 2002.

In 2004, Murphy launched an affiliate marketing program on the ShareASale platform with the goal of developing a diversified revenue stream for her business. At the time, the majority of her web traffic was coming in through search engines. As of 2012, the company still relies on search engines, but they have developed additional (healthy) revenue streams.

Murphy has grown the affiliate channel to represent 11 percent of her overall revenue. She hopes that she will be able to grow that number to 20 percent. What she likes most about the affiliate channel is that it is performance based — instead of paying for ad placements and hoping that they work, she pays a 12 percent commission on actual sales generated. The program tracks sales based on a 365-day cookie, which means that affiliates earn commissions on repeat purchases that occur within one year of the initial referral.

At the beginning, Murphy created her own affiliate program in house. She found that this process was a major time sink — she had to take the time to constantly monitor her program and remember to pay affiliates regularly. She made the jump on an affiliate network, where she could immediately access tracking, reporting, and payment systems (as well as instant access to affiliates who were more-than-ready to help sell her products).

In 2009, she also hired an outsourced program manager to run the affiliate program — she pays him between $2,500 and $5,000 per month. The variance depends on whether or not there are performance incentives in place and whether or not there is a need for additional services like design and development.

Maintain a Personal Touch

Interpersonal relationships have been crucial to the success of Murphy’s program. She frequently consults with top affiliates directly to keep communication open. She’ll also adjust her product mix and merchandising to increase conversion rates to drive mutual profitability and long-term value. CrazyForBargains takes these key steps to stay active in the affiliate community:

- Participate in forums

- Purchase PPC advertising

- Attend marketing conferences

- Actively recruit new affiliates

Remember that there’s a person on the other side of the computer screen. Form lasting, business-to-business relationships. Hop on the phone. Meet your top affiliates over the phone. Strategize together.

Case Study: Groupon

Until 2009, Groupon was considered to be a significant failure. But at the end of 2010, their traffic exploded. There was even speculation that Google would buy Groupon for $5 billion dollars.

Groupon eventually went on to float the largest IPO from a web company since Google.

What sparked this growth? Two words: affiliate marketing.

One important part of Groupon’s strategy was to cut out middlemen — affiliate networks that took huge cuts from the revenues generated. Instead, Groupon focused on creating direct relationships with affiliates.

Groupon would then sync up with influential publishers. Keep in mind that thanks to social media, you don’t need to be a publisher to have a following — you can promote affiliate deals to your social media network.

Groupon knew that they needed to make life easy for affiliates, so they pre-made banner ads for partners to use. Each day, affiliates would automatically receive new deals — all tied to a single affiliate ID. This strategy fueled Groupon’s growth.

Groupon went out and built affiliate relationships from the ground up. Here’s what you should learn about building your own.

Lessons learned from Groupon:

- Reach out to bloggers: Approach individual bloggers who are aligned with your product and industry and ask if they would be interested in being an affiliate. Don’t just target big-name bloggers. Find influencers who support your brand and have a strong connection with your audience.

- Connect with social media influencers: Hunt down mid-to-small range social media enthusiasts who may be interested in joining your program.

- Partner with publishers: Ask key publishers and media outlets if they would be interested in reviewing your products and services. Keep in mind that most big sites won’t want to write about your affiliate program or deal. You’ll likely find better luck with smaller publishers.

How to Get Started with Affiliate Marketing

Here are the steps that you need to take to launch your own affiliate program:

1. Look at your current audience

The key to getting your affiliate program off the ground is to find the right affiliate for your company. Start by looking at your blog readers, email subscribers, and social media followers. Some of these folks are current, previous, or future customers.

2. Define how you will market your affiliate program

If you want a successful affiliate program, you will need to market it outside of your existing user base. Affiliates won’t just randomly find you.

- You need to actively recruit them by hunting down bloggers and website owners who could promote your product or service. Also look for publishers with email lists.

- Another option is to go through networks and have them recruit affiliates for you.

- There’s no reason why you can’t start your own affiliate network while participating in a third party’s. When you’re getting started, do a bit of both.

3. Focus on acquiring traffic

Traffic acquisition is critical to the success of your affiliate program. Help your affiliates drive more traffic, and most importantly diversify your traffic so that you’re not relying on a single affiliate for your business. Use paid traffic sources and build relationships with bloggers.

4. Announce the program

Take the time to make sure that your community knows about your affiliate program. Publicize your affiliate program on directories like OfferVault, PointClickTrack or 5 Star Affiliate Programs and relevant forums.

5. Measure results

If you want to grow something, you need to measure it. Use your analytics tools to figure out what is and isn’t working.

Key Takeaways on Affiliate Marketing

- Unlike most marketing channels, you only pay per transaction with affiliate marketing. In other words, you only spend money when you make money. This strategy is important for small businesses that have limited resources to spend on advertising.

- It’s easy for anyone to be an affiliate — even if you don’t have a website. You can rely on your social media channels, entirely.

- If you make things hard for your affiliates, no one will want to work with you. Make the process as seamless as possible.

- Treat your affiliates as trusted business partners and advisors. Work with them towards a common goal — to amplify sales for your product.

Source Quick Sprout http://bit.ly/2ZtMed8

Questions About Practical Gifts, Low Cost of Living Cities, Custmer Rewards, Debt Collection, and More!

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Car loan versus retirement savings?

2. Moving to cheaper city?

3. “Customer rewards” and work

4. Cheap pocket notebooks

5. Uses for food scraps

6. Debt collection question

7. Struggling with focus

8. Student loan forgiveness

9. Saving for retirement too slow

10. Thoughtful practical Mother’s Day gift

11. Standing desk and joint pain

12. Best recent books

One of the most interesting parts of being a parent of adolescent children is that you get to see flashes of both the young child they once were and flashes of the adult they are becoming, often in quick succession.

For us, this past weekend was full of these kinds of back to back moments.

I would see our children reveling in joy at an Easter egg hunt, then just a moment later be engaged in a sophisticated, calm, and mature conversation with a relative.

Our children sat quietly and peacefully during a full lengthy Easter morning church service, then quickly dove into boisterous play just a few moments after the service was complete.

My oldest child exhibited extreme patience and kindness and supervision with his toddler nephew for a very long time, and then got in trouble just fifteen minutes later for getting his nice clothes dirty after throwing dirt clods back and forth with his sister.

I heard deep theological questions followed by bodily humor.

It’s an interesting age that these children find themselves at, with one side of them still firmly in childhood and another side of them growing straight toward adulthood.

On with the questions.

Q1: Car loan versus retirement savings?

I have about $12K in savings to which I add $100 a week automatically. It’s an emergency fund but may be used for other things sometimes when it gets really fat. I have about $4K left on my car loan which is at 5.5% interest which I intend to drive until it fails. When it is paid off I intend to raise my 401(k) contribution rate at work. Should I dip into the $12K and pay it off early? 28, single, make $58K a year at a pretty stable job, no plans to marry or move any time soon.

– Barry

In your shoes, with that salary and that relative stability, I’d pay off the car and bump up the retirement contributions today.

If you pay off that car loan, that leaves you with about $8K in your emergency fund, which is going up $100 a week. It’s pretty clear that your monthly living expenses are $3K a month or less (you’re making $58K and are able to sock $400 a month into your emergency fund and are also contributing to retirement, so your expenses aren’t that high), which means that your emergency fund would cover at least two months of living expenses, almost definitely three months, and probably more than that.

As a single person, three months of living expenses in your emergency fund when you have a relatively stable job, a decent resume, and reasonably low expenses is a good situation to be in. You’re probably making the right choice amping up retirement savings now and getting that car paid off.

Q2: Moving to cheaper city?

I currently live in the Boston area and make about $85K. It is surprisingly hard to make ends meet because everything is so expensive here compared to where I grew up (UP Michigan). The solution that so many suggest including yourself is to move to a lower cost of living city, but I don’t see how that helps when your salary drops, too. How am I better off making $60K in Des Moines even if the cost of living is way less?

– David

Well, if you do a side-by-side comparison of Des Moines and Boston, the cost of living is about 40% less, according to several different cost of living calculators that I checked (here’s one, for example). All costs are lower, but housing is somewhere around 60-65% lower, entertainment is about 30% lower, healthcare is around 25-30% lower. Even things like transportation and food costs are 10% to 15% lower. The calculator linked above estimates that making $85K in Boston equates to the same standard of living as making $50K in Des Moines.

Most of the time, the calculators aren’t even looking at taxes. If you make $50K in Des Moines, you’re in a much lower tax bracket than if you were making $85K in Boston, which means that your tax bill is much lower for an equivalent standard of living in Des Moines. So, yes, $60K will go much further in Des Moines than $85K will in Boston because things like housing and taxes are gulping up a much smaller portion of your salary.

I’m not arguing whether one city has certain perks that the other does not, but I will say that there are enormous differences in the cost of living in different metro areas in the United States and they will make up for drastic differences in salary. You simply need a lot more salary to have an equivalent standard of living (2 bedroom apartment, decent diet, a car) in Boston or San Francisco than in Des Moines.

Q3: “Customer rewards” and work

What do you think about the ethics of keeping customer rewards perks when you spend money for work? So at my work we have a weekly working lunch for our team paid for by the company. We used to take care of ordering the food on a rotating basis but then I discovered that I could order from some restaurants and scrape up lots of customer rewards points by ordering from some places usually adding up to a free meal or two. Is this ethical to keep them? If so, I think it’s a good strategy to try to volunteer to do this more often.

– Kelly

Is it ethical? It depends on your company policy. Most companies, unless they have an account of some kind with a retailer, don’t seem to care if the individual employee doing the ordering keeps the customer rewards benefits for themselves as a perk for doing the rather … dull job of ordering meals and such. This is particularly true when it’s done in the form of reimbursements. Most companies see this as fine because you are effectively extending a small amount of credit to your employer out of your own pocket, since you’re paying for the meal out of pocket and then requesting reimbursement later. You’re basically acting as a credit card for your company out of your own pocket.

To be sure, you should talk to someone in human resources. 99% of the time, it is really not worth the effort to the company to scoop up a small number of rewards points at a restaurant for something like this. They’re just not going to care. So, you’re almost always going to get an “it’s fine” response, but it’s worth stopping in and talking to someone just so you can say you did your due diligence.

So, what I’d do in your case is stop in to talk to HR about it. I’d address it in a general sense by asking about things in addition to the restaurant purchasing, like travel rewards if you’re going on a work related trip that you book yourself, which would fall under the same category. What you’re really wanting to know is whether the company has a general policy for these kinds of rewards if the employee handles things themselves and then asks for reimbursement. As I said, it’s extremely unlikely that your company will care. If they don’t care, then you probably can score some free meals for yourself by volunteering to take over all of the meal ordering (assuming your company is very reliable in reimbursing those meals).

Q4: Cheap pocket notebooks

What do you use for cheap pocket notebooks? I like Field Notes but they’re $10 for a three pack and I can go through a notebook a week and that adds up. Do you know of any cheaper options?

– Darren

First point of advice: don’t use spiral-bound pocket notebooks if you’re going to actually carry them in a pants pocket, unless you want to get stabbed by a loose metal end on a regular basis. I started off using cheap spiral-bound pocket notebooks and quickly moved away from them after about the second stabbing. I generally only use staple-bound pocket notebooks at this point.

My usual source for pocket notebooks is buying them in stores (online and off) when I see them on sale. There are a lot of brands of pocket notebooks, like Field Notes and Scout Books and Doane and so on, and they tend to pop up on sale frequently. If I can find them below the $1.25 per notebook threshold, I’ll buy a bunch of them; if I’m low, I’ll even stock up at the $1.50 or even $2 per notebook level.

I did try making my own, but I quickly discovered that the covers I used for my own notebooks did not stand up to pocket wear. You need some good material to stand up to a few weeks of normal pocket wear and finding good enough material wasn’t something I was easily able to do and I didn’t want to deal with a cover for them.

So, my advice is to just look for sales on pocket notebooks regularly. Watch Amazon, for starters; I also sometimes find sales on the notebooks at pen retailers like Goulet Pens and from Field Notes themselves.

Q5: Uses for food scraps

Recently heard a story about how Americans waste a pound of food per person each day so we’re trying to watch our food waste. I noticed that I do throw a lot of scraps away, things like coffee grounds and banana peels and apple cores. Is there anything useful that can be done with that stuff?

– Anna

The easy answer is to compost that stuff. Take any vegetable and fruit scraps and coffee grounds and save them in a bucket until they turn into rich brown or black matter, at which point it makes amazing fertilizer for your garden. However, this isn’t something a lot of people are willing to do or are interested in doing.

Vegetable scraps can be used to make really good vegetable stock, which can be used to make soups and many casseroles and other dishes quiet flavorful. Just save the scraps in a big Ziploc bag or other container in the freezer, and then when it’s full, put all of it in a big pot or slow cooker, add some peppercorns, cover the vegetables with water (and add a couple of extra inches) and let it simmer all day long. Strain it and save the liquid.

A lot of fruit scraps have at least some other use. For example, banana peels make for a surprisingly good meat tenderizer. When you go to roast, say, a chicken breast in a skillet, put a banana peel in first, then put the meat on top of that. It keeps the meat from drying out.

Q6: Debt collection question

I have been hounded by a debt collector for the last several months. I didn’t pay for several items bought on credit at a store when my old business was struggling and when it went out of business I didn’t do anything about it and now they’re hounding me. I can afford to pay off the debt now and I would actually like to clear my name but [I don’t want to deal with the debt collector]. Should I contact a lawyer?

– Daniel

The first thing I would do is contact the business that you originally owed money to and find out if they wrote off the debt. If they still have it on the books, work it out directly with them. If they don’t have it on the books, that means they wrote off the debt and sold the debt to a debt collector.

It’s worth noting the the longer you’ve had this debt, the more likely it is that it’s been written off and sold for pennies on the dollar to a debt collector. If you haven’t had it for too long, they may be using a collections agency, which is a business that the company you were originally indebted to pays to get back money that the business was owed. If you’re in a “collections agency” situation, then contacting the business will work out; if it’s already been sold, then you’re out of luck. Your best approach in that latter situation is to negotiate, because if the business bought your debt at a steep discount, they’re likely willing to negotiate with you and get the easy smaller win rather than fighting tooth and nail for the possibility of a bigger one.

If you had a properly-formed business – not just a sole proprietorship – then it may actually be the business that’s liable here and you should contact a lawyer.

Q7: Struggling with focus

I graduated last May and got a great job where I basically spend 5-6 hours a day writing code. There are minimal meetings and it’s not very stressful at all most of the time. The problem is that I’m having a very hard time focusing. My job only has really long term deadlines and deliverables so if there isn’t something due in the next 2-3 weeks I find it really hard to do anything. There have been three big projects that when it got down to the 3 week mark I just buckled down and worked 90-100 hour weeks and got it done, but during the gaps in between those sessions I can barely get anything done. How can I focus better when there aren’t any deadlines?

– Martin

If you have a good track record of producing the work when it’s needed, you might want to talk to your boss about having a more milestone-based approach to your job. Rather than having these huge projects that are due every six months, set up some milestones that are due every week or two and have a review of those milestones when they come up.

If you’ve done good work up to this point and you tell your boss honestly that this will work better for you and not kill you close to the project deadline, it’s likely that your boss will work with you to move to this kind of milestone-based system.

My current work is very milestone-based (an article a day, basically) and I am concerned that I, too, would be fairly distracted if it were not.

Q8: Student loan forgiveness