I see people make this mistake all the time.

They come up with a slogan and assume it’s an effective value proposition.

Yes, slogans are a great way to build your personal brand.

It’s a great way to help consumers remember who you are.

But slogans are not value propositions.

What’s a value proposition?

It’s a unique message to the consumer that conveys the main reason why they should buy from your brand.

Your value needs to be relevant to the customer. Explain why your brand, product, or service can offer a solution to a problem.

Be specific when you’re talking about these benefits.

Differentiate yourself from the field.

Why should your target customers buy from you instead of your competitors?

Overall, this message needs to attract customers by creating value.

Keep these five types of value in mind while you’re coming up with a unique proposition:

- Functionality – Focus on convenience. What problems are you solving? Why is your company better than the competition?

- Emotions – Put emphasis on the most attractive part of the product or service. How can you get customers emotionally attached to your brand?

- Economics – Mention any financial advantages. Is your product less expensive than alternatives? Will it save your customer time or money in the long-term?

- Symbolism – Figure out what your company represents. Will your customer feel environmentally responsible after shopping? Or will your product elevate their social status?

- End value – Stress the importance of customer satisfaction. Be clear and concise. What are you guaranteeing?

If you’re looking to improve your current value proposition or build one from scratch, I can help.

I’ll tell you everything you need to know about creating a highly effective value proposition.

Focus on your target market

Your value proposition should not appeal to everyone and anyone.

Define your target audience.

You won’t be able to please everyone, so don’t try to.

Trying to reach a wider audience with your value proposition could potentially backfire.

It could end up turning people away.

Here’s an example from Dollar Shave Club:

Look at the wording and terminology they are using in this value proposition.

I pointed out a couple of key points.

It’s clear they are trying to appeal to a younger audience.

Older generations may not understand the “level 9 yogi” analogy of their flexible cancellation plan.

The same people may not respond well to something as informal and direct as “C’mon. Do it.”

But Dollar Shave Club clearly defined their target market.

Changing their value proposition to something more basic could turn off their existing customer base.

Why?

People could see a generic pitch as boring or not as cool.

This company handles their value proposition really well in terms of focusing on a specific audience.

The small things make a big difference

What added value can you provide?

It may sound like something small, but it could make or break the customer’s decision to buy something from you or a competitor.

If you offer added value, show it off.

Here are some examples:

- Free installation

- Free shipping

- Next day delivery

- Cancel subscription at any time

- Money back guarantee

- Fully customizable

Don’t wait until the checkout page to tell customers about these benefits.

If you don’t put it on your homepage, they may never even get to your conversion page.

Look at how Bed Bath & Beyond accomplishes this on their website:

The website visitors instantly see two pieces of added value:

- free shipping

- free truck delivery

Now they know they can get their order shipped free even if they are buying furniture.

It can entice them to add something big, like a couch or a table, to their shopping carts.

According to Marketing Land, free shipping is the top incentive for consumers who shop online.

This is an essential piece of information to anyone in the ecommerce industry.

Why?

Because it’s something that adds value to the customer.

How to present your value proposition

There’s no perfect way to display your proposition.

It’s not like there’s a blueprint that has specific requirements.

With that said, there are certain components you should consider when coming up with this display on your website.

Start with a headline.

Keep it short, and try to grab the customer’s attention.

Next, create a subheader.

It will be slightly longer than your headline, adding a little bit more information.

The subheader should be specific.

You’ll also want to come up with a few sentences that describe your brand, product, or services in greater detail.

It’s always helpful to include some bullet points that outline some of your top benefits or key features.

Images work well too.

Visuals help make the customer understand exactly what you’re offering or how the product works.

Let’s take a look at the value proposition from Square:

I love this homepage because it encompasses everything we just discussed.

The header instantly grabs the attention of prospective customers.

What exactly does the company do?

The sub header explains that you can “accept credit cards anywhere,” and the brief description goes into greater detail about how it works.

Square also included bullet points with their top features:

- free magstripe reader

- take chip cards

- countertop POS system

What does the product look like?

The image shows exactly what they’re offering.

Showing scale implies more added value as well. It’s so small that it can fit into your pocket.

If you’re struggling to come up with a layout for your company’s value proposition on a website, you can treat Square’s site as a template.

Just swap out their benefits and description for your own.

But what if you don’t know your top benefits?

If that’s the case, it sounds like you have a marketing problem or a possible issue with your company’s identification.

It’s fixable if you’re willing to put in some research.

Think back to what we outlined earlier.

Start with your target audience.

Conduct a study.

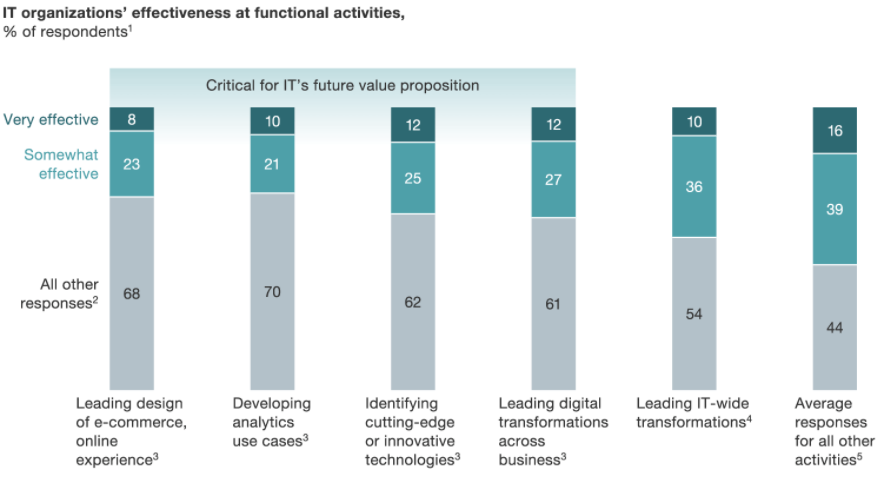

Here’s an example of some critical consumer research in the IT industry in relation to the value proposition.

If you’re in the IT field, you should focus your proposition on:

- ecommerce

- landing design

- online experiences

- analytics

- innovation

- digital transformation

That’s just one example.

It’s up to you to conduct research based on your company and industry.

Reach out to your customers directly and ask what they’re looking for.

Create online surveys. Conduct customer interviews.

This will help you accomplish a couple of things at the same time:

- build a better relationship with your existing customers;

- use the information to create a value proposition that attracts new customers.

Essentially, you’re killing two birds with one stone.

Test your value proposition

Now that you’ve developed a value proposition, it’s time to make sure you have it optimized to maximize conversions.

A/B testing is one of the best ways to do this.

Make sure you test only one thing at a time.

If you change too much, you won’t know which aspect of the test increased or decreased conversions.

Here’s an example from California Closets:

At first glance, these website versions appear identical.

The only thing changed was the heading.

Split-testing your website to find out which part of the value proposition is more effective will increase your conversion rates.

After you test the header, test something else.

In the example above, they could test the background image next.

They could also add more bullet points or put the bullets on another part of the screen.

The options are endless.

Another way to test your value proposition is through pay per click (PPC) advertising campaigns.

For the most part, we’ve been discussing your value proposition in relation to your website.

But that’s not the only place where you’re trying to acquire customers and get conversions.

It makes sense to have an effective value proposition on other platforms as well.

Consider using Facebook’s PPC services.

It just depends on how much you’re willing to spend.

The placement of your advertisement will impact the price.

Back in 2012, Facebook acquired Instagram for $1 billion dollars.

If you want to run a PPC campaign on Instagram, you have to go through Facebook.

This will be one of the most expensive ways to test your value proposition through PPC advertising.

However, if you have the funds, you could get the most accurate results with this method.

But don’t feel obligated to use Instagram.

Facebook offers other, more affordable, placement options.

If you’d like to avoid Facebook and social platforms altogether, you’ve got other options.

Consider running your PPC testing through Google AdWords.

You can test your value proposition at a local level or internationally.

Google lets you set this up by:

Less than half of small businesses are currently investing in PPC advertising.

Even if your business is small, you can still take advantage of this strategy.

It will give you an edge over your competitors.

Focus on customer emotion

The emotional value was something we briefly discussed earlier.

I want to elaborate on this because I think it’s important.

Triggering an emotion in your value proposition can elicit a certain response from your customers.

In your case, obviously, you want this response to be a sale or conversion.

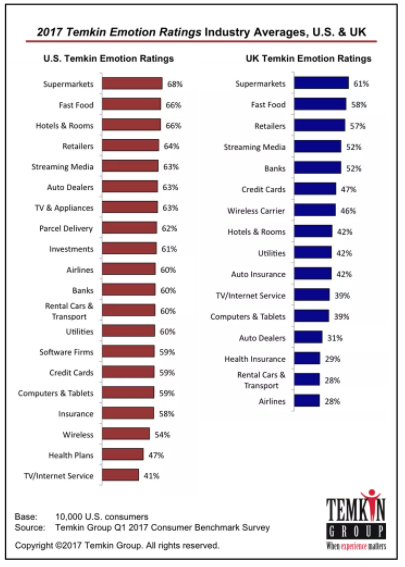

Take a look at how different industries are rated based on emotional responses:

How can you elicit certain feelings from your customers?

Think about the goals and mission of your company.

Your value proposition should portray what your business represents.

Here’s an example from Mercedes-Benz:

Look at the phrases they are using in the top left corner:

- benchmark of luxury

- peak of intelligence

- eloquent expression

- leading edge luxury

It’s clear what kind of emotions they are trying to elicit.

They used the word luxury twice, so they’re targeting people who want to have a very specific experience.

Symbolism.

This car portrays a certain level of social status.

That’s how they have effectively branded their company.

Let’s take a look at another example that’s on the opposite end of this spectrum.

We’ll discuss a company involved with charitable organizations.

Have you heard of Project 7?

They sell gum and mints.

A portion of their sales goes to nonprofit businesses, suppliers, and distributors who help people in need.

The money goes to 7 different missions:

- Save the earth

- House the homeless

- Feed the hungry

- Quench the thirsty

- Heal the sick

- Teach them well

- Hope for peace

Businesses that give back to the community both locally and internationally should be proud of what they’re accomplishing.

Share that information with your customers in your value proposition.

It can trigger an emotional response leading to a sale.

Conclusion

If your company has a catchy slogan, that’s great.

But your slogan is not the same thing as a value proposition.

Your value proposition should talk about the functionality of your brand, products, or services.

What differentiates your company from the competition?

Your value proposition won’t appeal to everyone.

Don’t worry—it doesn’t have to.

Focus on your target market.

Mention any added value as well.

Even if it’s something small like free shipping, free installation, or a money back guarantee, it could be the deciding factor that drives a sale.

Learn how to present your value proposition:

- header

- subheader

- description

- bullet points

- images

After you build an initial value proposition, test it.

I recommend using A/B testing and PPC advertising to find the best option for your layout.

What does your company stand for? Use this to generate an emotional response from your customers.

If you follow these tips, you can create a highly effective value proposition.

What added value does your business offer to differentiate itself from the competition?

Source Quick Sprout http://ift.tt/2mAec7n