الثلاثاء، 10 سبتمبر 2019

GameStop lays off 14% of workers, closing up to 200 stores

Source Business - poconorecord.com https://ift.tt/2HYXVBm

Tannersville Dunkin' passes inspection

Source Business - poconorecord.com https://ift.tt/31c6lN3

Annuity Rider #7: Impaired Risk Rider

Probably the biggest benefit that comes from having an annuity is the fact that it can pay you an income for the rest of your life. Even if you live so long that you completely exhaust the funds in the plan, the insurance company will continue paying you each year.

But what happens if you are unlikely to live for 20 or 30 years? What if you only expect to live for 10 years, or maybe even five? This can be a possibility if you have a health condition that is likely to shorten your life. And for that reason, the insurance industry offers the impaired risk rider to go along with your annuity.

What is an Impaired Risk Rider and How Does it Work?

Annuities are typically set up to provide an income in retirement. At age 65, the most common retirement age, the average person can expect to live for another 20 to 30 years. That means that they will need an income that will last that long, and that won’t run dry at any time.

But not everyone can expect to live for several decades once they retire. If you have some sort of impaired health condition, it can shorten your lifespan. So what happens, if instead of living for another 20 years or more, you’re only expected to live for another 10 years?

As is normally the case with annuities, the unused funds in the plan will resort to the insurance company. This is actually a trade-off to counterbalance the possibility that you will outlive the value of your annuity. And if you don’t expect to live for at least 20 years, an annuity can be a losing proposition.

But that’s what the purpose of the impaired risk rider specifically addresses.

That means that you will actually receive higher payments than a person of the same age who has no health impairing conditions. Alternatively, the rider may entitle you to the same income payments that a healthy person would receive, but you would pay less for the annuity.

The rider results in a shorter income payout term for the annuity, which enables either the higher payments or the lower premium.

If you decide to add the impaired risk rider, your annuity will be medically underwritten (this is usually not required on most types of annuities). The insurance company will do a medical evaluation to determine the impact of your particular health condition(s) on your expected longevity. They will use this evaluation to determine your rated age (see next section for how this works).

The rated age will be something less than normal longevity for your age. The insurance company will then base the income payout period on that age. Since it will be shorter than would be the case for a completely healthy person, the insurance company will be in a position to either lower the premium or increase the annual income payment.

An impaired risk rider is typically added to an immediate annuity, which as the name implies, is an annuity that begins making income payments as soon as the annuity premium has been paid.

What is Impaired Risk?

An impaired risk is any health condition or related factor that is likely to reduce your longevity. Since there is an abundance of data available, the effect of common health conditions can be estimated with a high degree of accuracy.

This can include health impairments such as heart disease, cancer, stroke, alcoholism, leukemia, cirrhosis of the liver, high blood pressure, leukemia, and many other health conditions.

But apart from health conditions that you may have, the insurance company will also evaluate other risk factors in determining the degree of impaired risk. Those conditions can include:

- Certain lifestyle behaviors, such as tobacco use, alcohol consumption, and drug use

- Genetic factors, including a family history of major diseases

- A history of reckless driving, including an excessive number of accidents, citations and moving violations

- Participation in dangerous hobbies, such as skydiving, deep-sea fishing, mountain climbing and any other activity that carries an increased risk of premature death

- Dangerous occupations, such as police and firemen, construction work and roofing

- A history of traveling to foreign countries deemed to be dangerous

Annuity Rider Rated Age

Your chronological age is your actual age based on your birth certificate. But your rated age is something like your biological age – that is, it’s your age based on actual physical condition. It actually varies in most people, since even small impairments or advantages can either increase or decrease your life expectancy.

But if you have a recognized and chronic health condition, the insurance industry is able to assess, based on actuarial records, your rated age. So for example, if you are 65 years old, and you have a serious heart condition, the insurance company might assign you a rated age of 75.

If you will be expected to live to be 85 if you are completely healthy, the company would determine – based on your health condition – that you are likely to live for only another 10 years.

The Benefits of an Impaired Risk Rider

As I wrote earlier, the primary benefit of an impaired risk rider is that it can result in either a higher income payment than a healthy person would receive or a lower premium paid in order to purchase the same income payment as a healthy person.

Recognizing that a person with impaired health will not live as long as a healthy person, and will, therefore, be getting income payments for less time, the insurance company is able to accelerate those payments, resulting in a higher annual income. The greater the risk posed by your health condition, the higher the annual income payments are likely to be.

The biggest benefit of an impaired risk rider is one that can’t be known at the time you take your annuity. That’s the possibility that you will live longer than the insurance company expects, and will, therefore, collect more in income payments than you paid for the premium to buy the annuity in the first place.

This is actually not an infrequent situation. Many people to live longer than their life expectancy, despite having impaired health. Part of the reason is improvements in medical treatments. A new medication or surgical method can add years to the life of a person even if they have a serious health problem.

It is entirely possible that you can even live a full life despite the health condition. And if you do, you stand to gain much more from your annuity than what you paid into it.

The insurance companies are actually well aware of this situation. This is the reason why relatively few insurance companies offer an impaired risk rider. Given that lifespans, in general, have been increasing, and that medical technology and treatments have been steadily improving, it is entirely possible that someone with a serious health condition can live much longer than expected.

The Cost of an Impaired Risk Rider

Adding an impaired risk rider to your annuity can cost between 0.50% and 1.50% of your annuity value on an annual basis. So if the cost of your rider is expected to be 1.00%, and your annuity will provide an annual return of 6.00%, you will actually receive a return of 5.00%, net of the cost of the impaired risk rider.

Why You Might Want to Add an Impaired Risk Rider to Your Annuity

If you have an annuity or you plan to buy one, and you have a major health impairment, then an impaired risk rider will certainly be worth considering. Since the annuity will pay you an income for life, the rider will offer you a higher annual income payment based on your expected shorter life expectancy.

That will not only help you to recover the cost of the annuity more quickly, but it can also provide extra income to help with medical bills and certain treatment options, like home care.

Be sure to do a cost/benefit analysis with your insurance agent, to determine if an impaired risk rider will be helpful in your situation.

The post Annuity Rider #7: Impaired Risk Rider appeared first on Good Financial Cents®.

Source Good Financial Cents® https://ift.tt/31exaAy

What is Affiliate Marketing?

If you’re looking for a way to ramp up your income, starting a blog can be a smart move. Sure, you can get a part-time job instead, but where’s the fun in that? And who wants another J-O-B anyway?

While most regular jobs require you to report to a physical building each day, you can run a blog from your own home. Better yet, a blog is something you own. You can put in as much (or as little) effort as you like, but all the spoils of your hard work go directly into your pockets.

When I started my blog years ago, I didn’t make a dime for almost a year! But over time, my income grew to $1,000 per month…then to $2,000 per month….and to $4,000 per month and so on.

And now that I’ve earned more than $1 million dollars blogging, I can honestly say that blogging for profit is the real deal.

What is Affiliate Marketing and How Does it Work?

Affiliate marketing comes in so many forms it’s hard to keep track. Not only can you sell the products of others, but you can market other people’s courses and services, too.

You can even sign up for affiliate marketing programs for products you use yourself.

Picture yourself as a salesperson who only sells stuff they love. Just by writing about new products or services, you can educate your readers on what they could benefit from. And when they make a purchase, you make money.

That’s pretty simple, right? Once you’re ready to get started, here are the basic steps you’ll take for your first affiliate sale:

Step 1: Start a blog or website.

To make money with affiliate marketing, you need to have a website of your own. It can be a blog or a review website of any kind, but it needs to be yours. And if you think there are too many blogs out in the world, think again. Remember there are billions of people in the world, and you only need a few thousand to check out your website each day to earn a real income. (Learn how to start a blog in four easy steps!)

Step 2: Build an email list and readership.

It’s hard to make money with affiliate marketing when hardly anyone is reading your blog. Before you can ramp things up, you need to build up your following and social media presence. I also suggest starting a simple email list right away. MailChimp lets you manage your first 2,000 email subscribers for free.

Step 3: Sign up for affiliate programs.

Before you can start raking in cash with your blog, you need to partner with various companies and their affiliate programs. While some products and services have their own programs you need to apply for, big affiliate websites like Commission Junction, Impact Radius, and Flex Offers can connect you with a ton of affiliate programs in one fell swoop. If you can’t get approved for all the affiliate programs you hope to join right away, keep trying! Your chances for approval will only increase as your traffic grows.

Step 4: Start promoting products.

Once you’re approved for affiliate programs, you’ll have a set of affiliate links to use on your own website. You can start promoting products right away, using your affiliate links to guide readers toward the purchase of a product or service.

Step 5: A follower clicks through your link and decides to buy something.

Eventually, a reader will decide to click through your link and purchase a product or service. This is where your profit comes into play.

Step 6: You earn a commission.

Affiliate programs pay out various percentages or flat-rate commissions based on the product or service. Where some affiliate programs offer a percentage of each sale (i.e. 40 percent of $100 sale = $40 per sale), others offer a flat payout for each signup. Some payouts are worth hundreds of dollars while others cough up pennies per sale. But remember, it all adds up!

Step 7: Let the money pile up.

While earning a commission may get you crazy-excited, it takes a while to get money in your hands. Most affiliate programs delay payment for at least 30 – 45 days. After their first affiliate cycle rolls up, you’ll start receiving a steady stream of income.

4 Ways to Make a Sale

If signing up for affiliate programs and adding a link or two made people rich, everyone would be a millionaire!

Unfortunately, it takes a little more legwork to create an affiliate strategy that helps you earn a sizable income.

Here are the best ways to provide your readers with the value they need while also promoting your own affiliate interests:

#1: Write product reviews.

In-depth product reviews are a great way to introduce your readers to a new product or service while offering your own take on how the product works.

A product review can be created to market nearly anything. Maybe you love an awesome blender you purchased on Amazon.com. By writing an in-depth review of that blender and including your own pictures and funny stories, you could convince your reader that they need it, too. Pop in a few Amazon affiliate links and the money is sure to follow.

On the flip side, you can also review a service.

This TD Ameritrade Review is the perfect example:

Since I use TD Ameritrade myself, it was easy to type up an in-depth analysis of the company and how it works. And yes, I earn quite a few commissions with this review – even though I only update it around once per year.

#2: Sprinkle affiliate links throughout your copy.

While adding random affiliate links won’t always help you earn sales, it never hurts to try. And there are plenty of instances where adding helpful links to a post with a specific angle or purpose can help you earn money.

In this piece written on 107 ways to make money fast, for example, I include affiliate links to a ton of companies that can help people earn cash on their own. Once readers skim the post, they can learn how to make money by taking online surveys, earn $250+ by opening a new Chase bank account or drive for Uber.

Heres a good example of adding in affiliate links naturally:

The post works so well because it’s helpful, but also because it includes so many affiliates!

#3: Write a guide (or a ton of guides).

Guides provide readers with valuable information they can use to compare products and services. By writing a comprehensive guide on just about anything, you can share your knowledge while also promoting a handful of products.

Here’s a good example:

I wrote this guide on the Best Place to Open a Roth IRA because

a) Roth IRAs are awesome for people who want to build a stash of tax-free money for retirement, and

b) not all online brokerage firms are created equal.

By creating the guide, I could highlight the companies I trust the most while pointing out some of the pros and cons. On the flip side, readers are gaining valuable information that can help them choose the best account for their retirement savings. In a lot of ways, a smartly-written (and helpful) guide is a win-win for everyone.

#4: Promote something everyone uses.

While it’s smart to create affiliate strategies for products or services you use and believe in, you can rack up more earnings but adding some generic strategies to the mix. Everyone uses Amazon.com, for example. And tons of people shop at stores like Walmart, Target, and Macy’s. By signing up for those larger, more generic affiliate programs, you can earn extra money promoting services nearly everyone uses.

6 Awesome Strategies for Affiliate Marketing Success

If you’ve started a blog, you’re already halfway there. But before you dive headfirst into affiliate marketing, there are some very small (and very important!) details you should know.

To get the most out of your affiliate strategy, follow these instructions:

#1: Join affiliate networks as often as you can.

While seeking out individual affiliate programs can help you earn money, it’s a lot of work! Fortunately, affiliate networks can give you access to a bunch of affiliate programs in one place.

Consider affiliate networks like ShareASale and Commission Junction, both of which can save you time and stress. Once you join, you can browse all the available affiliate options to see which ones are right for you.

#2: Don’t forget to add a disclosure!

If you plan to promote products on your website, you need a disclosure. A disclosure explains that you receive compensation when people sign up for products or services through your links. A separate disclosure to protect you from legal issues should also be included on your website. If you’re unsure of what to include in your disclosure, speak with a lawyer or ask other bloggers in your niche about the disclosure they’re using.

Also, remember that affiliate programs have different rules for how you can use their links. Some don’t allow you to link to their programs via email, for example. Make sure you know each program’s rules before you dive in. To make money with affiliate marketing, you have to make sure you’re compliant!

#3: Be honest, and only promote programs you believe in.

While you might be tempted to promote everything under the sun, this is rarely a good idea. Trust me when I say the best affiliate marketing strategy is an honest one.

When people trust your words, they are a lot more likely to use your links. By promoting products and services you actually use and believe in, you will gain your reader’s trust and make money. Speaking the truth may not be the fastest money-making strategy, but it is the best one.

#4: Check out your competitors!

Unsure which affiliates to promote? The best thing you can do is check out your competitors. Whether your blog is about pet care, money, or travel, there are plenty of other websites in your niche. By seeing what they are promoting, you can get affiliate ideas for your own blog.

#5: Focus some of your efforts on SEO.

While writing reviews or guides is a great way to share your opinions on products and services, they won’t help you earn money in nobody reads them. One of the most important things you can do is learn about SEO or search engine optimization. By learning more about SEO, you can help your reviews and guides make it to the first page when people search for a term.

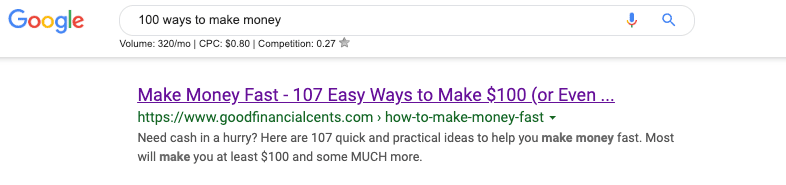

Look at this awesomeness below:

If someone searches for “100 ways to make money,” they’ll find my monster money-making post on the first page of Google.

That’s because this post is doing awesome with a ton of search terms people use all the time.

#6: Don’t give up too early.

Here’s the painful truth about blogging: It’s hard work! If it were simple to set up a page and earn a boatload of cash, everyone and their mom would be rich.

Earning money on the web doesn’t happen overnight; it takes time. It takes months of trial and error to find a few strategies that work well – and work for the long haul.

If your goal is making money, you should commit to blogging for a full year without worrying too much about the income side of the equation. If you give it a year, you will start earning some side income that can grow over time.

Is Affiliate Marketing Best For Your Blog?

With a blog and a solid affiliate marketing strategy, anyone can earn money online. But that doesn’t mean it’s easy; just like any other entrepreneurial venture, starting a blog is hard.

If you stick with it long enough, however, you can earn money with affiliate marketing and other strategies.

Blogging takes guts, and it definitely takes time. But it all starts with that very first step. When will you take yours?

The post What is Affiliate Marketing? appeared first on Good Financial Cents®.

Source Good Financial Cents® https://ift.tt/32AI6IR

How to Invest in Yourself without Significant Financial Risk

Let’s start off by clarifying exactly what I mean by “investing in yourself,” because it is a term that has somewhat nebulous meaning that can vary a little from place to place.

For the purposes of this article, investing in yourself means applying resources you have to improving personal traits and skills and improving your resume. You are taking things you have – money, time, energy, and so on – and using them to make yourself better, with “make yourself better” usually meaning some measurable or discernible improvement in a particular trait that’s important to you and/or your career.

Here’s the catch: improving yourself is great, but it is not a direct recipe for career success and greater income. Almost always, investing in yourself merely increases the likelihood of career success or of the success you want in other areas, but it does not guarantee it.

In truth, the ideal goal of investing in yourself should be to improve your own traits and nothing more. Those better traits will improve your chances of the kinds of outcomes you desire. However, most people won’t go through that effort without either a very strong personal desire to improve themselves or else what they perceive as a near-guarantee of better pay.

Because of that, avenues of investing in yourself that require a significant up-front payment are inherently risky. Usually, such investments are done with the expectation that they’ll return much more over the long run, but, as I note above, that’s not a guarantee. There are many risky ways to invest in yourself. Such investments might end up with an improvement in a particular trait or skill, but the large financial investment is far from being recouped. This includes things like going back to school for a new degree when you already have one, buying expensive equipment without a very clear and immediate purpose for that particular piece of equipment, and buying luxury items to impress people and inflate your own confidence.

In short, investing in yourself with a large financial expenditure is very risky. Sometimes those things pay off. Often, they don’t and you’re left with debt (and sometimes other non-financial costs, too).

A much better approach is to find ways to invest in yourself that don’t have significant up-front financial investment and instead involve regular investment of other resources you have in your life, such as time, energy, focus, relationships, and so on.

Committing time and energy on a very regular basis to invest in yourself can feel like a challenge, but what it actually means is simply trimming out the least important time use in your life to make space for it. Thus, the first step in investing in yourself is to figure out the least worthwhile use of your time in a given day or week and cutting that time out of your life. Any time you spend aimlessly visiting websites or browsing television channels can be significantly cut, for example. Time spent on hobbies and leisure that aren’t bringing you refreshment and renewal can also be significantly cut. Commuting time can often be used for self-improvement, too – take the bus and use that time to improve yourself in some fashion.

Here are nine ways to invest in yourself that don’t require a huge financial investment, yet offer the strong possibility of professional and personal success.

Developing a Lifetime Independent Learning Habit

One of the most effective ways to invest in yourself is to get into the habit of spending time each and every day learning something new. Learning things directly applicable to your career path is obviously going to increase the likelihood of being able to translate that knowledge into improved income, but simply widening your knowledge base and understanding of the world often pays dividends in unexpected ways.

The key is to make this into a regular, sustained practice; learning is most effective when it is part of your everyday life. Not only does this maximize the amount of things you’re learning, but it also means that you’re practicing the art of learning. The ability to self-learn is in itself a skill, one that is actually quite useful in many of today’s jobs, and so simply developing that skill regardless of what you’re actually learning has value.

This is something that’s been a part of my life since … forever, really. I am constantly attempting to learn new things, read challenging books, take on complex intellectual tasks, and so on. This is part of a normal day for me, serving to keep my mind sharp, add to my knowledge base and understanding of the world, and maintain my ability to quickly learn things when I need to.

Here are some strategies for pulling this off.

Set aside time each day for self-directed learning. I set aside an hour each day (at least) for challenging reading, with the intent of adding to my knowledge base and encouraging deep thinking. As of late, it’s typically during the first hour after my children get home from school, when they’re often doing homework or studying themselves. I “study” alongside them.

Learn about things that engage you. If you’re forcing yourself to learn about topics that you have no interest in, this will be an awful practice. Instead, focus on areas where you have motivation to learn, whether it’s internal motivation because you’re curious, a motivation to directly help your career or some other aspect of your life, or, ideally, both. Don’t just learn about something you don’t care about for the sake of self-learning. Choose things that matter to you.

Choose methods of learning that click for you. Some people learn best from reading (like me). Others learn from listening or watching or, when applicable, doing. Figure out what works for you. Try reading challenging things. Try listening to challenging audiobooks. Try watching Youtube videos. Try really challenging projects related to whatever you’re learning about. Figure out which styles work best for you.

Take some form of handwritten notes. Along the way, try to write down some of the things you’re learning in your own words and in your own handwriting. This might feel awkward, particularly if you’re not used to it, but there are tons of studies that demonstrate that doing this vastly increases both understanding of ideas and retention of those ideas. The goal of lifetime learning is to understand and retain ideas and information, so find a practice that works for you.

Strongly challenge yourself – but don’t overwhelm yourself. You’re not learning if the material is just repeating what you already know. You’re also not learning if you’re completely lost. The magic point is in the middle – it’s new ideas and new material that build on what you know, but aren’t so far out there that you have no idea what’s going on. You should be able to follow the general thread, mixed with occasionally stopping to look up words or concepts elsewhere. My general rule is that if I’ve read a page and felt confused more than twice such that I had to stop and look up something in another work, I need to find a simpler text.

Keep track of your progress. I find it really useful to track my own learning progress by keeping a list of all of the books I’ve read, along with the notes for them. I maintain a “master list” of notes, along with digital copies of the notes for each book, on my computer, and I love looking through that list of challenging books and sometimes reading through the notes of individual books, particularly when I’ve read something new on a similar topic. It reminds me of how much I’ve learned and grown on my own.

A highly recommended book on adult self-learning is The Art of Learning by Josh Waitzkin, which deftly mixes a great primer on lifetime learning with some fascinating autobiographical elements. (Have you ever seen the film Searching for Bobby Fischer? Waitzkin is the main character in that movie.)

Developing an Independent Exercise Habit

Much like a lifetime learning program is helpful for expanding your knowledge base, your ability to learn quickly, and your mental sharpness, a routine of daily exercise keeps your body in shape to be able to handle challenging situations, ward off aging, and keep yourself healthy for as long as possible. It can also help you look better and definitely feel better and more energetic.

To be clear, when I say “exercise,” I’m referring to any activity that involves physical exertion to the point of significantly elevating your breathing and causing you to sweat for at least some sustained period. Over time, regular exertion like this leads to more energy and better capacity for such activity, and that is strongly tied to better health outcomes.

Again, the key is to make this into a regular, sustained practice; exercise is most effective when it is part of your everyday life. Exercise shouldn’t be a rare thing – it should be a healthy, normal thing that you do pretty much every day.

How do you do that? Here are some tips that work well.

Set aside time each day for some form of exercise. It doesn’t even have to be that much time – ten minutes can be enough. Just set aside some time each day for the purpose of breathing hard and sweating, for exerting yourself, and make that time non-negotiable. This is what you’re doing during that time, no questions asked.

Do something you enjoy doing that makes you sweat and gets you breathing harder. The exact activity that makes you sweat and breathe hard depends a lot on your fitness level, and the activity you enjoy depends a lot on your own tastes. Thankfully, there’s an almost infinite list of things you can do that will make you sweat and breathe hard. I recommend trying a variety of things to find out what clicks for you, things that you actually enjoy doing. For example, after a lot of trial and error, I discovered that things I like include brisk walks (preferably in wooded areas), hiking, and taekwondo, along with specific exercises intended to make me better at taekwondo, like basic calisthenics and yoga.

When you figure out things you like, take the time to learn best practices for doing them safely with minimal chance for injury. You can dabble in things to figure out what’s enjoyable to you, but once you figure that out and start committing your exercise time to a particular activity, figure out how to do it well and with minimal risk for injury. This often involves things like stretching and warmups, better postures, and smarter techniques.

Keep track of your progress. As with the learning described above, I find it incredibly powering to find a way of measuring what I’ve achieved with my exercise and recording it in some fashion so I can look back and see how far I’ve come. I keep a list of significant trails I’ve hiked and I also keep track of personal bests in terms of various exercises as well as daily routines.

If you want some resources for getting started, I highly recommend Fitness 101: The Absolute Beginner’s Guide to Exercise by Dulce Zamora, which is available for free.

Eating a Healthy Diet

The purpose of eating a well-balanced and healthy diet is to improve energy and improve long-term health outcomes, both of which are very highly linked with an appropriate diet. To be clear, I’m not talking about “going on a diet” with the goal of losing weight, but simply about recognizing that the food you consume is fuel for how you feel, the energy you have, and your long term health.

I’m not going to get into the science of healthy eating, because for starters there is no perfect diet for everyone, but I largely subscribe to these ten principles that almost all food and dietary studies tend to agree on. The key principles:

+ avoid added sugar

+ make sure you have omega-3s in your diet (you can get these by eating nuts, fattier fruits and vegetables like avocados and coconut, fish, and omega-3 eggs)

+ avoid artificial trans fats and, by extension, anything with hydrogenated or partially hydrogenated vegetable oils

+ eat plenty of vegetables and some fruits; you don’t have to be vegetarian, but make them a major part of your diet

+ avoid refined carbohydrates like white flour and white bread and white pasta; eat the whole grain versions instead

+ choose unprocessed foods; stick to the produce and meat section and not convenience foods or fast food

If you stick to those guidelines most of the time, you’re doing a pretty good job of eating a healthy diet, much better than the average American, and you probably feel it with better health and more energy.

Here are some specific things you can do to move in this direction.

Think of almost all food and drink you consume as being fuel for living above all else. There’s nothing wrong with eating for pleasure on occasion, but make it a splurge that you anticipate rather than a routine. Instead, start thinking of the food you eat and the beverages you drink as healthy fuel for the things you want to do in life.

Learn how to prepare foods yourself so you’re not relying on processed foods from restaurants. The more you cook at home, the more control you have over what exactly goes into your mouth, plus the better you’ll get at it. The best starting guide I know of is How to Cook Everything by Mark Bittman; here are the eleven cookbooks I actually keep and reference frequently in my own home.

Replace white bread and white pasta with whole grain bread and pasta. This is an easy substitution that will really help with your health. If you make your own dough for bread items at home, switch to using whole wheat flour. For some, this will be a significant switch in terms of flavor, but it’s a really good step in terms of health.

Eat a wide variety of things. The more variety in your diet, the more likely it is that you’re going to cover all of the micronutrients and macronutrients you need. If you find yourself getting into a rut and eating the same things over and over, intentionally switch things up.

Stop eating or drinking things that have “sugar” or “high fructose corn syrup” as ingredients. If you see that on the label (or know it would be on the label), just eliminate it from your diet. This might cause some cravings for a while, but it will really help.

If you just do those things and then continue eating as you normally would otherwise, you’ll see positive changes after a while in terms of how you feel and your energy level, and they will definitely help your long term health outcomes.

The next four sections will seem similar, but there are enough distinctions between them that I felt they needed to be addressed separately.

Developing New Practical Skills (and Honing Old Ones)

By “practical skills,” I mean things what you would use in everyday life outside the bounds of your career. Think of things like basic carpentry, cooking at home, basic plumbing, and so on. These are skills that keep you from calling a repairperson. These are skills that can often be utilized to help out a friend. Occasionally, they might have application within your career path, but mostly they just make you a more well rounded and self-sufficient person.

I could provide a long list of such skills, but it’s better to just identify some basic strategies for honing them.

Do things for yourself rather than paying others to do them for you. The more you do things for yourself, the easier the task becomes for you and the more likely you’ll try gradually more challenging tasks in that area and begin to share those skills with friends and neighbors. Rather than paying others to prepare food for you, prepare it for yourself. Rather than calling the plumber when you have toilet problems, try to fix it yourself. Rather than calling a handyman to fix a doorbell, try fixing it yourself. You might not succeed, but I guarantee you’ll learn some things and you’ll also recognize that it’s approachable.

Use Youtube. This, in my opinion, is the “killer application” of Youtube: videos that teach skills. You can sit your phone down to free up your hands, start up a video on a particular task, and use that video to show you step by step how to do that task. Along the way, you’ll build a number of little skills that add up to the ability to handle a particular task on your own, and many of those little skills will transfer to other similar tasks (like how to make dough or how to properly use a screwdriver).

Stick to basic but well made tools. You don’t need twelve knives and eleven pots and pans to cook in the kitchen – almost everything you’ll make can be done with three knives (a paring knife, a chef’s knife, and a bread knife – and even the bread knife is debatable) a small pot, a larger pot, and a skillet. You don’t need infinite tools – one good claw hammer, a large and small Phillips screwdriver, a medium regular screwdriver, and an adjustable wrench will do an awful lot of little tasks. If you do find you need specific things for specific tasks, see if you can borrow one first; only buy it if you actually see yourself needing it frequently.

Developing New Transferable Skills (and Honing Old Ones)

By “transferable skills,” I mean skills you will use within your career path but would also apply if you changed to a different career path. Examples of this include time management, information management, presentation skills, public speaking skills, communication skills, and networking skills. Many careers use some or all of these skills, and if you have such skills sharpened, you’re already ahead of the pack in a lot of different career paths. Not only that, they can help you in your personal life as well.

Again, I could provide a long list of such skills, but it’s better to just identify some basic strategies for honing them.

Get in the habit of keeping a calendar and an ongoing to-do list and refer to them frequently throughout the day. There are a lot of people that will read this and go “Duh, obviously,” but the number of people who don’t do this is almost shocking. They rely on their short term memory to remember dates and tasks and only refer to calendars or lists infrequently, if at all. Find a calendar and a to-do list system that works well for you and start using it. If you have a smartphone, I recommend Google Calendar and Todoist for starters; if you use paper, just get a simple planner with a calendar and a lot of blank pages you can use for a to-do list. Start recording every single date and appointment you can think of, as well as reminders in advance for things like buying gifts. If you have a task to do, write it down, and frequently go through your list of tasks to do. The goal is to get all of that stuff out of your head and into a permanent place where it can’t be forgotten or misplaced.

Take time when communicating in written form to others. Rather than just dashing off a message or response, ask yourself what you’re really trying to convey to the recipient. What will make the message you’re about to send actually useful or valuable? When you make your messages more useful and genuinely valuable, you become more useful and valuable.

Don’t shy away from any and all opportunities to present and to communicate with people in your field. If such opportunities ever come up, take them. Give presentations. Go to meetings and participate. Don’t hide during social hours or networking events. You don’t have to become best pals with everyone, but if you spend that time avoiding people, not only will you have zero chance of connecting with people, you won’t build the skills needed to make it go well.

Developing New Technical Skills (and Honing Old Ones)

By “technical skills,” I mean skills that are ones that define your career path and are the unique things you do that people are willing to pay for. What are the core elements of your job that relatively few people can do? Those are your technical skills.

The list of technical skills is essentially infinite, but here are some good practices for keeping yours sharp and developing new ones.

Stay up to date in your field. This means doing things like reading trade publications, reading websites focused on your field, and attending meetings and presentations related to your field as a constant habit and practice. If topics come up that you’re unfamiliar with, make a point to learn about them on your own. Your current field of expertise should never “pass you by.”

Take on projects that are a little beyond your skill level. The best projects are the ones where you feel like it’s possible to get from where you’re at now to the finish line, but you’re not 100% sure of each step for getting there. Those projects force you to hone and expand your core technical skill set, and the more things you do that fall into this category of stretching yourself, the better.

Use continuing education resources. If your workplace offers resources or funds for continuing education and certification, gulp up every bit that you can. If your workplace supports it, you should be aiming to earn all kinds of certifications and higher degrees. Getting such things for free or at a steep discount is a direct boon to your skill set and to your career.

Applying Deliberate Practice to Your Moneymaking Skills

One aspect of investing in yourself that often isn’t considered is the value in honing and sharpening some of the key skills you use to make money. Here’s another way of thinking about it: what basic things are you asked to do at work frequently? What kinds of tasks do you do over and over again?

Whatever those things are, there’s great value in applying deliberate practice to them. You take those specific tasks and really dig into them, trying to hone your ability to do those tasks with excellence and efficiency.

Here are some ways to apply that idea.

Take a task that you do all the time at work and do it very slowly and deliberately, looking at each little piece. For example, if you send dozens of emails a day, slow down on a few of them and move through them step by step, asking yourself what you’re doing, what you’re trying to communicate, how the recipient will use it, and how the recipient will feel about it. What can you do in that process to make the result you want be as good as possible? Then, how can you do that better version as efficiently as possible? Do that for every task you do repetitively: who will be the person benefiting from the result of this task? What will they get out of the work you produce? What can you do to improve what they get out of it (meaning how can you make the end result more useful for them)? Then, how can you change what you’re doing to get that best result more efficiently?

Do some of your regular tasks very slowly and with intense focus to try to produce maximum results. If part of your job is to stock shelves, do that very slowly and methodically some of the time so that the ending shelf display is as neat and attractive to customers as possible. What little things can you do to make that happen? That’s what you should have learned from the previous step, when you broke down this repeated task. Do those things carefully and deliberately.

Gradually improve your efficiency at the task. Over time, aim to do that “better” version of your task at a faster pace. How can you do this task really well – which you figured out already – but do it really efficiently? Intentionally try to do the high quality version of a task (once you’ve figured it out) as fast as you can, over and over again, moving through those steps as efficiently as possible.

Then, start the cycle over again, re-evaluating that same task or moving on to another one.

Reducing Stress

A reasonable level of stress is actually beneficial, as it causes you to focus better on the task at hand. Where stress becomes a problem is when it becomes a distraction, adversely affecting your health and causing you to be unable to focus well because of the stress in your life. Furthermore, continuous heavy stress has serious long term health consequences.

Simply reducing the level of stress in your daily life is a powerful form of investing in yourself, improving your ability to focus and handle unexpected events, making daily life more pleasant, and improving long term health outcomes. Here are a few steps for doing this.

Set aside time for adequate sleep. Inadequate sleep can make the impact of stress in your life that much stronger while also leaving you feeling tired and unfocused throughout the day. Simply get in the habit of going to sleep early enough such that you can get a full night of sleep before you absolutely need to wake up in the morning. For example, if you need to be up by 7 AM, start going to bed by 10:30 PM so you can be asleep by 11 PM, ensuring a good seven to eight hours of sleep per night.

Set aside time for true leisure. There should be periods in your life where you are able to engage in things you do solely for personal enjoyment. Such periods of leisure are deeply refreshing and renewing, yet many people simply don’t put aside time for them, viewing themselves as “too busy” even as they spend multiple hours a day aimlessly browsing their phone or flipping through channels or what’s new on Netflix. Put aside a big block of time each week for uninterrupted leisure, doing whatever it is you deeply enjoy, and during that time, turn off your phone and kill other distractions that would take you out of the moment. If you’re struggling to find the time, spend a little less time doing things like watching television and instead fill that time with tasks that would keep you away from your leisure block.

Adopt a daily reflective practice. Just spend a moment or two each day directly focusing on the positive things in your life. Think of five things you’re grateful for in your life and hold each one individually in your mind for twenty or thirty seconds, thinking about how great that element really is. Think of family members or good friends or moments where you felt really good or the taste of a really good cup of coffee or whatever it is that makes you feel glad to be alive. You’ll find that appreciating what you have in life makes stress melt away.

Developing and Maintaining Quality Relationships

Relationships with other people provide social opportunities, companionship, opportunities for help when you need it, and often unexpected additional opportunities as well. Professional relationships can open career doors, while personal relationships can open up life opportunities you never saw coming.

The thing is, cultivating new relationships as an adult, especially outside of work, can be difficult, and maintaining older relationships is something that can easily fall through the cracks. Here are a few good strategies for making it easier to cultivate new relationships and maintain old ones.

Touch base with an old friend or family member or professional acquaintance each day. This doesn’t mean broadcasting your latest life events to them, but sending them a text asking them what’s up in their life. Make this a daily habit to reach out to someone in your life, personally or professionally, and then have a conversation with them. You can do this via text, via a private social media message, or even by sending them a handwritten card. I actually try to do this with two or three people each day.

Intentionally put yourself in social situations with like-minded people with the goal of meeting people and building relationships. I regularly go to social events that revolve around people with which I have at least something in common with – meaning that we have a shared interest or are in the same field – and I make it my goal to have five meaningful conversations while there with three of them leading to worthwhile follow-up, meaning I have an actual reason to text them or send them an email or a message on a social media platform later that could turn into actual dialogue. This sometimes means forcing myself to be social at those events, and it also means seeking out events like this, which is a challenge for an introverted person like me, but it’s the only efficient way I know of to actually meet and begin to build friendships and professional relationships with people as an adult outside of simple “drinking buddies.”

Give of yourself freely, especially when it’s multiplicative (but don’t be used). You can invest in relationships by giving of your resources freely to others – time, energy, information, focus – particularly when the value is multiplicative, meaning that what you give has far more value to them than to me. This is particularly true for information, but is often true for things like lending a hand when they’re moving or doing a home improvement project. However, this should be part of an emerging or long lasting relationship that reciprocates with at least some frequency; if you help someone a bunch, then ask them for something a few times and they don’t offer help, then it’s okay to dial down that relationship in favor of others. It is great to give and it is powerful for building relationships and for earning help when you’ll need it later, but giving should never be wholly one-directional over a sufficient period of time. You might view this as “investing in others,” but what you’re earning for yourself is relationships in which others hold you in esteem, which is incredibly valuable to have both professionally and personally.

Final Thoughts

Investing in yourself doesn’t have to involve a big outlay of money. Rather, some of the most effective ways to invest in yourself involve using time and focus and energy, and those investments often produce far more than what you invest in them, often producing valuable things like professional advancements or meaningful relationships or a better state of mind and body.

Put aside time and energy each day for investing in yourself, using any or all of the strategies described above. They’ll all provide elements of a better life for you, and they will usually produce dividends far beyond what you put into them.

Good luck!

The post How to Invest in Yourself without Significant Financial Risk appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2N5CmDm

Why was I charged £99 for £10 of petrol?

Source Moneywise - 29 years of helping you with your finances https://ift.tt/32xeHiH