No matter what type of business you have, you need to be using high quality images as a promotional tool.

You can distribute these pictures across all your marketing channels.

Share them on social media profiles such as Facebook, Instagram, and Twitter.

Add photos to your website to make it look more professional.

You can even send images to subscribers on your email marketing lists to make your messages more visually appealing.

Incorporate photos into your blog posts to break up the content and make it easier for people to read.

I like to use visuals in my blogs to illustrate what I’m talking about.

High quality images can add credibility to your website.

While there’s nothing wrong with using images you find online, nothing speaks to the customer like original photographs.

Taking your own photos means they are unique. Someone won’t be able to say,

“Oh, I’ve seen this picture somewhere else before.”

Ultimately, putting the perfect picture in the right place can help you generate more traffic and leads, which was identified as the top challenge for marketers in 2017.

Here’s the problem, however. Professional photographers are not cheap.

Your company has enough expenses to worry about, so you shouldn’t be paying for a service you can do yourself.

The other problem I see is original images often look terrible.

That’s no good either. You don’t want any low quality images to be associated with your brand.

It looks unprofessional and will result in a negative perception by your current and prospective customers.

If you fall into one of the above categories, I can help.

I’ll show you the right tools to take and edit photos without spending much or needing to hire a pro.

Get the right equipment

You don’t need to spend thousands of dollars on camera equipment.

But you shouldn’t be taking pictures on one of those cheap disposable cameras either.

Find a middle ground.

A sufficient camera might just be in your pocket right now.

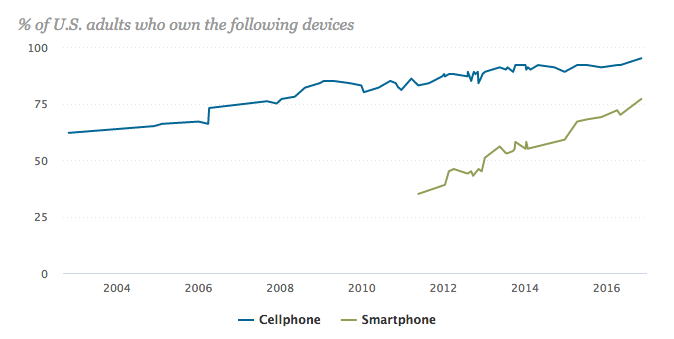

Currently, 77% of adults in the United States own a smartphone.

As a business owner or marketing expert, you probably have a smartphone.

The cameras on the majority devices are fairly decent.

If you’re in the market for a new phone, it makes sense to get one with a great camera.

There are tons of online review websites, such as Tom’s Guide, that give you detailed information about various devices depending on what you’re looking for.

Here are some of the best devices in 2017 for different categories reviewed by their experts:

- Best overall smartphone camera – iPhone X

- Best features on a camera – Galaxy Note 8

- Best camera for landscape photos – LG G6

- Best camera for selfies and low-light images – Samsung Galaxy S8

- Smartest phone camera – Pixel 2 XL

- Best smartphone camera for videos – LG V30

These are good places to start looking.

But do some research on your own before making your purchase.

You may even own one of these devices already.

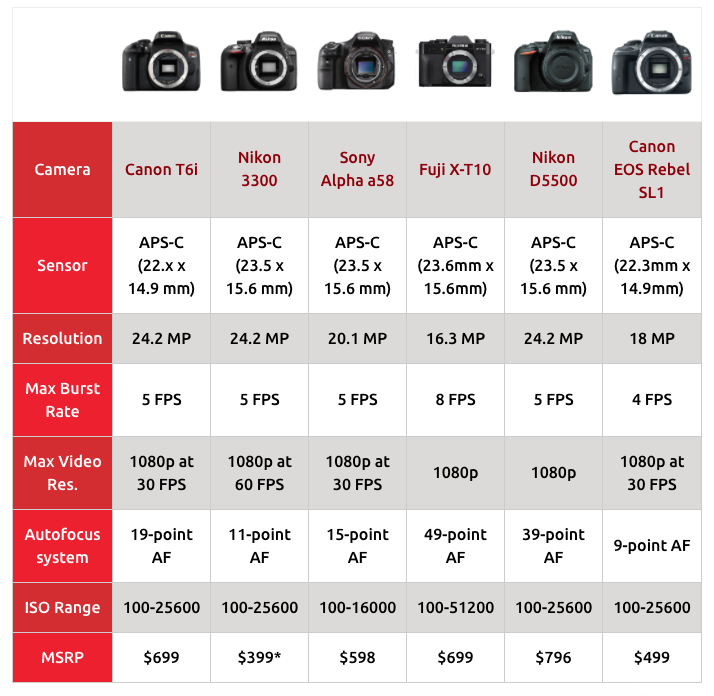

If you’d rather use a camera than a cell phone to take pictures, that’s fine too.

Here’s a comparison of some cameras ideal for beginner photographers:

As you can see, the prices range from about $400 to $800, which is reasonable.

Professional photographers may be charging you more than that for a day’s work.

Brush up on some basic photography skills

Now that you’ve got a proper camera to take pictures with, you need to master some simple photography concepts.

Learn how to use the various tools and picture modes on your device.

For example, let’s say you’re using an iPhone to take pictures.

You’ll notice an option called “HDR Mode.”

HDR stands for high dynamic range. Here’s how you turn it on:

When should you use it? For every picture?

The HDR mode works best for outdoor photographs and landscapes.

That’s because both of these usually have some bright as well as dark areas. Without the HDR mode, some details can get lost between the light and dark contrasts.

But it takes your camera longer to process HDR photos.

If you’re trying to take images in a rapid succession or photograph a moving object, you’ll want to keep the HDR mode off.

You also need to consider where you plan to take photos.

Conditions—whether inside, outdoors, in the sun, or in the dark—will dictate how you take them.

For example, it’s tough to capture an image if the sun is directly behind the subject.

Unless you have a professional camera, the picture will come out either super bright or too dark, depending on what you’re focusing on.

You also need to learn when it’s appropriate to use the flash on your camera.

The composition is important as well.

You need to understand how the subject should appear in your photo.

One of the most common photography concepts of composition is the rule of thirds:

Imagine your camera frame is broken up into nine sections of equal sizes.

Some cameras have these horizontal and vertical guides to help with your composition.

You want to position your subject where those lines meet.

The example above has the subject positioned in the left third of the screen.

But let’s say you’re taking a picture of a landscape instead of a person or object.

In this case, you’ll want to align the horizon with the upper or lower third of the frame as opposed to the left or the right, like in this example:

As you can see, this makes for a much more appealing picture.

Another basic photography tip is natural framing.

Let’s say you’re taking a picture of a building that has pillars or columns.

It makes more sense to position your subject between two pillars as opposed to in front of one.

Here’s an example of a bridge creating a natural frame:

If you see the opportunity to capture a natural frame when you’re taking pictures, use it.

In the above example, pretend that the top of the image was cut off. It wouldn’t look as natural. But including the entire frame makes it appear more professional.

Something else you need to consider when you’re taking pictures is what you’re focusing on.

If you are photographing a person or specific subject, it’s imperative they are in focus.

Sometimes it’s a cool effect to have part of your photo in focus but the background blurry.

Photographs that have symmetry and patterns are visually appealing and professional-looking as well.

Check out this photo of the Taj Mahal:

All the elements are symmetrical, and the building is still positioned in the top third of the picture, so it follows all the rules.

There are tons of other photography rules you can follow to make sure you’re taking great pictures, but following these is a good to place to start.

You can do some more research about photography basics or even take a class. Both of these options are considerably less expensive than hiring a professional.

Plus, it’s always beneficial to learn a new skill applicable to your business.

Use Canva

Once you’ve taken the pictures, you’ll need to edit them to minimize any imperfections, making them look as professional as possible.

Canva is an image editing tool. It’s one of the best options you’ll find online.

You can edit pictures directly on their website or download a mobile version of their software for your iPhone or iPad.

I like to use Canva because it’s super diverse.

You’re able to access many different features all in one place.

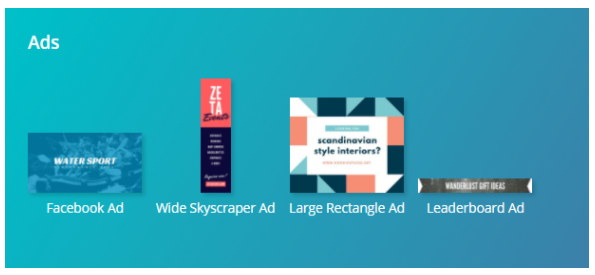

Canva has multiple templates for your images, depending on where you want to distribute them.

For example, do you promote your company with paid advertisements on social media or other mediums such as Google AdWords?

Canva ensures your image is sized appropriately depending on the type of advertisement you’re running.

If you attempt to do this on your own, the image could be distorted, blurry, or even illegible. So it’s best to use professional editing software for this.

One of the best parts of Canva is it’s free.

You may encounter a couple of features that cost a few bucks to access, but you can do all your basic edits without having to pay for anything.

For those of you who want access to everything on the Canva platform, I’d recommend upgrading to their Canva for Work package.

It’s only $12.95 per month, and you can save over 20% if you pay for the full year upfront.

You can try it free for 30 days to see if it’s worth it.

Again, this is way more cost effective than hiring a professional photographer to edit your pictures.

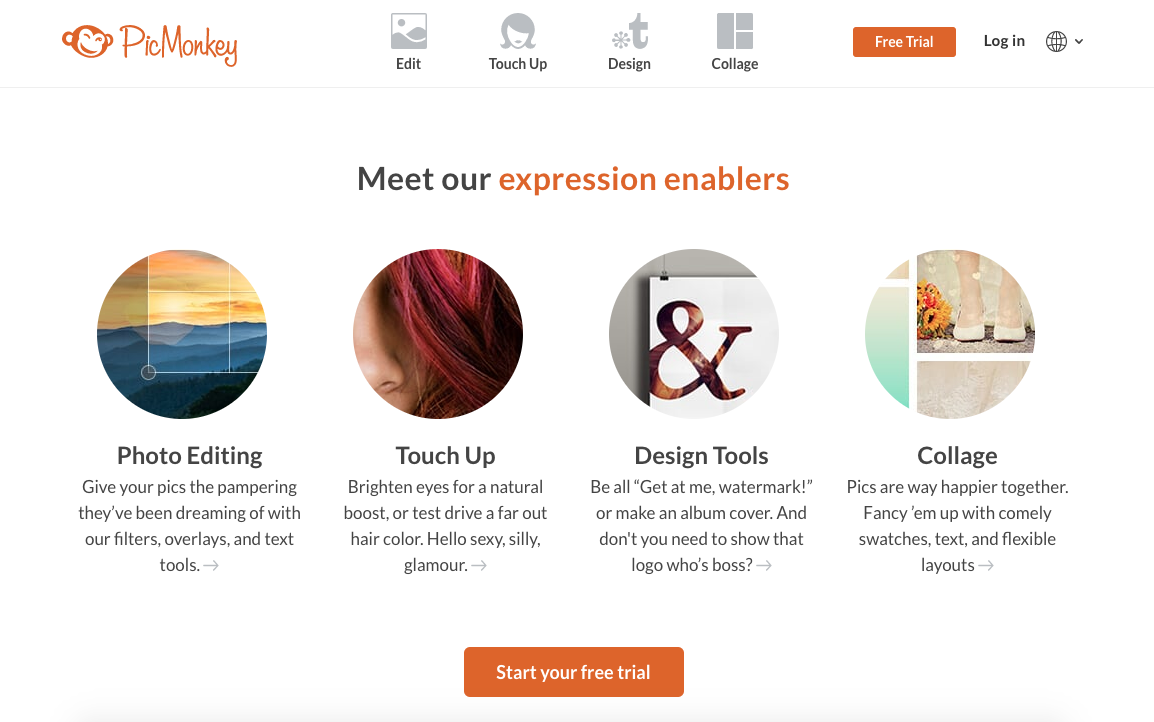

Try PicMonkey

PicMonkey is another one of my favorite editing tools.

It’s really easy to use, and uploading your photos is a breeze.

They also have a mobile app in the Apple App Store and Google Play Store, so it’s perfect for both Apple and Android users.

If you’re taking pictures on your smartphone, it’s easy to edit them directly from your device without having to upload them to a computer.

PicMonkey has great photography tutorials.

They cover some of the basic concepts I discussed earlier and teach you how to use different functions of their software.

But overall, I think it’s pretty easy to use.

These are the top features of PicMonkey:

- editing tools

- touch ups

- collages

- designs

It’s pretty much everything you could need to edit the photos you took on your own.

The collage tool is perfect for showcasing different products or features on your website.

You can create one simple image with a combination of the photos you took.

Here’s an example of a really cool collage on the Square website:

You can create something similar for your business with PicMonkey.

Create infographics with Piktochart

Sometimes you don’t need to take a photograph to have an original image on your website.

Build an infographic.

It’s a great way to increase engagement on your website or blog.

In fact, people are 30 times more likely to read an infographic as opposed to plain text.

Infographics can also increase traffic to your website by 12%.

Visual content gets liked and shared on social media three times more than other types of content.

The Piktochart website has all the tools you need to create customized infographics.

You can even use your own pictures as background images.

Find other ways to incorporate those original photos into your infographic so you’re not forced to use those cartoonish designs if that’s not your style.

They have a free membership for basic features.

You can also upgrade to a $15 per month or $29 per month plan with extra features.

But try the free version first to make sure you’re happy with it.

Conclusion

Unique photos can give your website, blog, emails, and social media pages the final touches that appeal to your customers.

You don’t need to hire a professional photographer to take and edit your photos.

That’s a waste of money.

You can do all of this on your own without spending much at all. It’s easy.

Just make sure you have the right equipment.

Get a smartphone that has a great camera. Or you can start off with an actual camera designed for amateur photographers.

Next, familiarize yourself with some basic concepts of photography.

Refer back to the points I outlined earlier as a guide for composition:

- rule of thirds

- natural frames

- symmetry

- focus

Once you’ve taken pictures, you can use editing tools on your computer, smartphone, or tablet to touch them up and make them look more professional.

Use tools such as Canva, PicMonkey, or Piktochart to get started.

Follow these tips, and you’ll be snapping and editing photos like a pro in no time.

What are some other tools you use to edit your photos like a professional?

Source Quick Sprout http://ift.tt/2Cj4vRu