All businesses can benefit from more sales.

Whether your company is thriving or struggling to get by, a sales surge can help you get more cash in the bank.

If your current marketing strategies aren’t working or growing stale, I’ve got a solution for you.

Produce more video content.

Regardless of your industry, videos can do wonders for your company.

Don’t believe me?

Well, more than half of marketing experts across the globe say that videos yield the highest ROI compared to other types of content.

Furthermore, 43% of consumers want marketers to produce more video content.

You need to give the people what they want.

I’ve seen too many businesses avoid video marketing tactics because they don’t know where to start.

They are afraid of doing something wrong. I’ve even heard some business owners say they don’t use video content because they don’t have the right equipment.

You don’t need any fancy or expensive video equipment.

All of the tactics I’m going to show you can be accomplished with a smartphone or basic camera.

That’s it.

Here’s something else to consider.

Think about the other marketing tactics you’re currently using.

Can more than one person view them at the same time?

I doubt it.

But look at how video content gets consumed in groups:

It’s unlikely two or more people will sit side by side and read your email newsletter together.

However, if you send a video, it’s more likely people will watch it together.

Plus, look at all the device options people use to consume video content.

Videos can help you:

- increase your website traffic

- enhance interactions with your customers

- grow your email list

- get more followers on social media

- expose your brand to a wider audience

- promote new products or services

All these benefits lead to more sales.

This is how you do it.

1. Create a YouTube channel

If you’re not currently using any videos to promote your company, creating a YouTube channel is the first step.

Here’s why.

Once you add videos to YouTube, it’s easy to share them on other platforms.

Whether you’re embedding the video into your website or just sending a link, the YouTube platform makes it simple to accomplish this.

As you’ll see shortly, you’re going to distribute your videos across lots of different platforms.

Uploading all your content to YouTube first will help save you time because you won’t need to make the same video more than once.

Let’s look at an example so you can see what I’m talking about.

Here’s a video I included in a blog post;

Guess where it came from?

I took it directly from my YouTube channel.

Making the video again would have been a waste of time.

That’s why this should be the first place where you start.

Don’t be intimidated.

You won’t have hundreds of videos overnight.

Just focus on one at a time.

It took me years to get over 25,000 subscribers on my YouTube channel.

But now, I have videos with over 22,000 views.

Plus, users, in addition to viewing YouTube content on other platforms, will view it directly on that site as well.

YouTube is only second to Facebook when it comes to the number of active monthly users.

All the content on their platform is strictly videos, and it is still extremely successful.

That alone should show you how powerful video content is in terms of what users want to consume.

2. Post videos on social media

Even if you’re not currently using videos, I’ll assume you have active social media profiles.

Use them to their full potential.

You should be posting on social media every day.

This will keep your brand fresh in the minds of your followers.

The reason why so many companies don’t always post on social media is because they don’t know what to share.

Well, if you’re adding new videos to your YouTube channel, social media is the perfect platform to share your new content.

Most social media platforms have their own software to create and publish video content, but we’ll get to that shortly.

For now, just try to focus on getting all your YouTube videos onto your Facebook and Twitter profiles.

That’s a great place to start.

Take a look at how videos have been trending on Facebook for the last two years:

We saw a 6% jump in video posts by businesses from 2016 to 2017.

I expect that number to continue rising each year for the foreseeable future.

3. Add more videos to your website

What’s the first thing people see when they visit your website?

Too many words on the page can be confusing and unappealing.

You shouldn’t have lots of long paragraphs explaining how your company operates.

Nobody wants to read that.

Instead, simplify the design and color schemes.

Replace all of it with a video message.

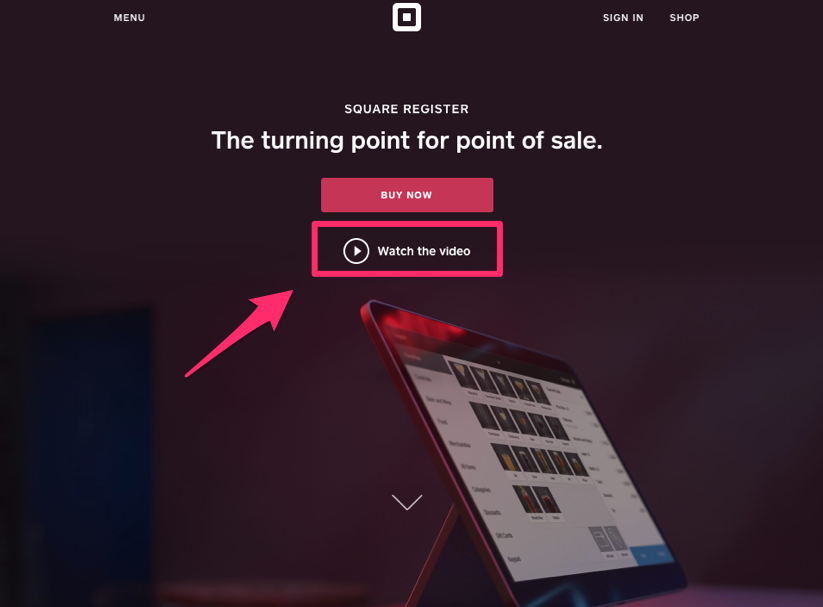

Square uses this tactic to explain how their products work:

Do you see how little text they included on this page?

This won’t confuse anyone.

Instead, the viewer’s attention gets drawn to the video.

When you click the link, it plays a video from Square’s YouTube channel.

It’s much more effective than trying to explain how your products work in long and messy paragraphs.

4. Go live on Facebook

I love it when businesses use Facebook live as a promotional method.

It’s one of the best ways you can engage with your Facebook followers in real time.

But there’s science behind it.

You don’t want to just go live randomly for no rhyme or reason.

Instead, you should schedule your live streams to run at a set time every week.

That way, you can continue building a regular audience.

Think about your favorite TV shows.

They are on at the same day and time every week.

If they just came on sporadically, it’s unlikely you’d be able to catch every episode.

That’s the kind of following you’re trying to create here with your live video streams.

Just like your website, Facebook live is a great chance for you to promote your products or do a demonstration.

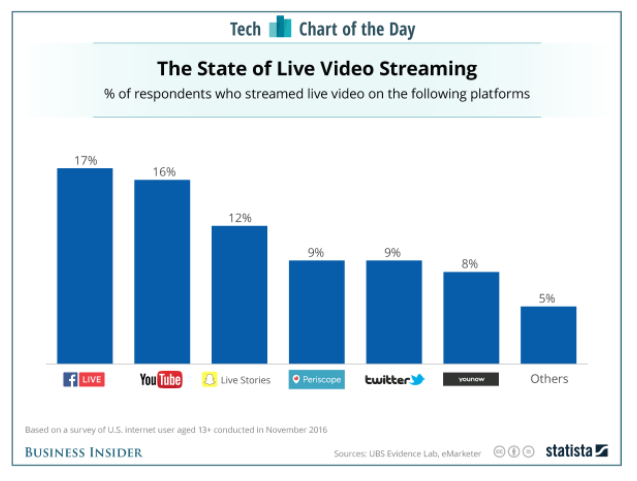

Facebook is the most popular live video streaming platform:

The user interaction is my favorite part of Facebook live.

Viewers have a chance to comment on your live stream.

It’s absolutely imperative that you respond to those comments.

This interaction will help you build a stronger bond with your customers.

The acknowledgement will show them how much you care.

Call them out by name while you’re live.

Thank them for watching.

Give the viewer a reason to tune in next week.

Go live for a long time.

Facebook allows you to have a stream that lasts for up to four hours.

You don’t need to use all four, but I’d say go for at least two or three.

The longer you’re live, the greater the chance you’ll have of getting more people to watch.

Long live videos mean you need to come prepared.

Don’t just wing it.

Have some notes or references for topics, products, and services you’re planning to discuss.

5. Use Instagram stories

You can post pictures and videos to your Instagram story.

For today’s topic, we’ll focus on the video portion of this.

Instagram stories expire after 24 hours.

Feel free to post several each day to keep your brand fresh in the minds of your followers.

These stories appear at the top of everyone’s homepage.

Anyone who follows you will see you have a story posted that day.

To view it, all they need to do is click on your photo, and the video will play through.

Popular stories will also show up on the search page for users who don’t follow you.

It’s a great way to increase brand exposure.

Instagram also has a live video feature that’s incorporated into their stories.

You don’t need to approach this the same way you do Facebook live videos.

Instead, use your live Instagram stream when you’re somewhere cool.

You can give your followers a tour around your production facility or introduce them to your staff.

This helps create an exclusive feeling for anyone watching.

Now they have access to something that would normally be kept behind closed doors.

Plus it’s so easy to do.

Just pull your phone out of your pocket and start recording.

But like on Facebook live videos, you’ll definitely want to respond to the live user comments.

6. Encourage customers to make their own videos

Not all your video content needs to be produced by you.

Try to get your customers involved.

You’ll accomplish a few things with this method.

- You’ll get videos free, and it won’t take any of your time

- It’ll enhance the customer experience

- You’ll get more brand exposure if your customers share their videos

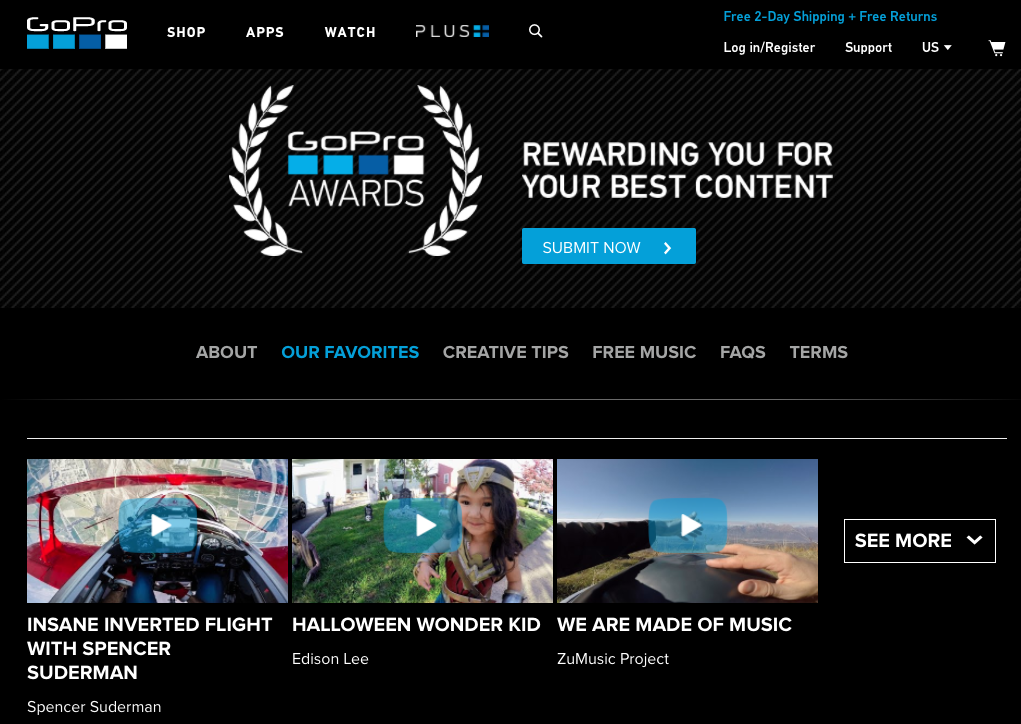

Look at how GoPro encourages their customers to create video content:

They post the best videos on their website and even give out awards to the creators of their favorite submissions.

Giving the customer recognition for their work is a great way to get people on board.

Plus, people are really creative.

You may find out their content is even better than yours.

Run a contest or some other promotion that gets your customers to break out their cameras and start filming.

7. Email videos to your subscribers

Remember earlier I said we could use the videos from your YouTube channel on multiple platforms?

Well, here’s another chance to share those videos with your customers.

Look to your email subscription list.

Those people may or not be following you on social media, so it’s not a guarantee they’ll see your live streams or other shared videos.

But you have direct access to their inboxes.

Use it.

Embed YouTube videos into your email marketing campaigns.

Given the statistics above, you can see that emails with video content:

- improve your CTR

- increase leads

- increase conversion rates

- minimize unsubscribes

So it’s a no-brainer to employ this strategy, especially since you don’t have to come up with brand new videos for each email.

Just use the existing ones from your YouTube channel.

8. Make sure all your videos are mobile friendly

One constant you need to maintain with all your videos is the compatibility with mobile devices.

That’s why I’ve been recommending you use platforms like YouTube, Facebook, and Instagram to share your content.

That way, the videos automatically get optimized.

Take a look at how videos are being consumed on mobile devices:

Mobile videos are trending upward.

Just make sure any videos included on your website and emails are on mobile friendly templates.

If your videos aren’t loading and can’t be viewed on phones or tablets, you’ll defeat the purpose of posting them in the first place.

Conclusion

Those of you looking for an easy and inexpensive way to get more sales for your business need to start creating more video content.

Create a YouTube channel, and add videos to it.

You’ll be able to share those same videos on other platforms like social media pages, your website, and even in email campaigns.

In addition to sharing pre-recorded videos, take advantage of live video streams.

Use Facebook and Instagram for this.

It’s a better way to engage with your viewers since you can respond to their comments in real time.

Another way to produce more video content is by getting other people to do it for you.

Come up with creative ways to get your customers to submit videos.

You can share those videos on your website as well.

No matter what kind of videos you’re making, just make sure they are optimized for mobile devices.

The increased brand exposure combined with an easy way for you to explain your products and services will ultimately boost your sales.

What platforms are you currently using to share your video content?

Source Quick Sprout http://ift.tt/2ity8nA