الاثنين، 2 يوليو 2018

Shimmers Are The New Credit Card Skimmers: How to Spot Them and Fight Identity Thieves

Source CBNNews.com https://ift.tt/2z51kwq

If You’re Not Grilling These 12 Foods, You’re Doing Summer Totally Wrong

Last summer, I made an avocado pie that was the talk of a party. Every single person asked me for the recipe, and now I’m expected to bring it to all gatherings.

Whether you’re a foodie or just getting tired of boring old hot dogs, we’ve assembled a list with some expert help of unexpected nibbles you can totally grill that will give your guests something to talk about.

Warning: Side effects may include never wanting to cook on the stove again.

12 Weird Foods You Never Thought to Grill Until Now

Here are 12 weird foods you’ve probably never thought to grill before that will change your cookouts to a new level this summer.

1. Pineapple

This tropical treat doesn’t need any dressing up before grilling, but that doesn’t mean you shouldn’t explore all the mouthwatering options. Sprinkle it with brown sugar and cinnamon, or brush it with olive oil, honey or teriyaki sauce.

You can cut the pineapple into big chunks or use canned rings; both come packed with flavor. Toss them on a burger or salad, roast them on a skewer, or serve them as a summertime side dish.

2. Watermelon

Go spicy, sweet or sour with cayenne pepper, honey or lime zest. Or you can keep it simple and sprinkle a bit of salt and pepper on your wedges.

Toss wedges with feta and mint, or dress them with a balsamic glaze or cilantro. Just make sure you get a seedless watermelon to work with.

Beware: Your guests will expect it every year.

3. Greens

Take your greens game to the next level by grilling them. Think heads of lettuce, bok choy, Swiss chard, romaine, kale and collard greens.

“Greens are a huge surprise the first time you try them,” said Mark Bittman, author of “How to Grill Everything.”

Keep the greens and core attached rather than breaking them apart individually, and cut bigger heads in half. Baste and add seasonings of your taste. This gives the outer layers a nice, caramelized char that cuts through the cruciferous bitterness, while keeping the inner leaves crisp.

Make them into an open-faced salad, or add them to another dish. Whatever you do, don’t take your eyes off them while cooking, as they go from delicious to depressingly wilted in a matter of seconds.

4. Cakes/Donuts

Why not? Donuts have served as the buffer for burgers, breakfast sandwiches and even ice cream. Toast them on the grill. You can add berries, give them a brulee take or add a French toast twist.

The same concept applies to pound or short cake. Brush premade pieces with butter and top with ice cream, whipped cream, berries or the glaze of your heart’s desire. Bittman has explored on-the-grill cakes and breads, which he said can either be cooked in advance or while you eat the main dish.

5. Beef Tongue

Bittman suggests this offal cut. Like other organ meats and entrails, it’s usually a bargain and helps prevent food waste. He described it as “shockingly good cooked slowly on the grill.”

It can be seasoned with onion, garlic and olive oil, or cooked with a chimichurri sauce. It’ll definitely give your guests something to talk about for months to come.

6. Artichokes

Artichokes were meant to be grilled. Steam them before grilling, and then season the fleshy leaves with salt, pepper, lemon or garlic. There’s nothing like the smoky taste their bite-sized leaves soak up. Serve them with hollandaise or an aioli. In the end, you’re rewarded with the heart of it all.

7. Avocados

Avocado: the fruit that keeps on giving. Turn the grilled pods into handheld bowls, and stuff them with tomatoes, salsa, quinoa or shrimp. Or skip the bowls, and drizzle them with a cream sauce, lime, Sriracha sauce or cheese.

Add grilled avocado to nachos, tacos or a sandwich. Pair them with grilled watermelon for a mouth explosion of yummy. Or simply elevate that avocado toast game and have your life forever changed.

8. Peaches

Just thinking of the warm peaches with dollops of ice cream on top has me salivating. Slice these summertime treats, and grill them for five minutes on each side.

Season with brown sugar, cinnamon and/or butter, or confuse your taste buds and add pepper, basil or prosciutto to the mix. You can’t go wrong with this seasonal favorite.

9. Eggplant

No need to drench and bake eggplants with cheese and sauce. Peel and slice up this purple bad boy in either direction, and give it a new crispy life on the grill. Keep it simple and season it with butter, salt, pepper and garlic. Or take it up a notch and add Cajun seasoning, top with bruschetta or turn it into a Parmesan boat.

Fun fact: Eggplant is one of Bittman’s favorite vegetables to grill, whole or sliced.

10. Bananas

This breakfast and pre-workout staple evolves into a must-have dessert on the grill. Turn a whole one into a banana boat filled with marshmallows, chocolate and nuts, and then wrap it in foil and grill. Or slice it lengthwise with the peel on and grill it.

Serve it with maple syrup, toffee, honey and cinnamon or transform it into bananas Foster. Warmth so good, it tastes like home.

11. Oysters/Clams

Get a few dozen oysters, scrub ’em down and heat them up until they open. Pry the rest of the way, and drizzle them with lemon butter or hot sauce. Or shuck them and roast them open, face up. Top with a cream or barbecue sauce, basil, cheese or garlic.

You can do the same with clams. Cook them your preferred way over the grill. Toss them with garlic, tomatoes and white wine or a lemon-cayenne mixture. Careful, they’re hot — and cook in no time at all.

12. Grapefruit

No longer bound by juice or as a breakfast side, grapefruit can become dessert when paired with the grill. Cut it in half and sprinkle the inside with cinnamon, sugar and a little butter, or drizzle with honey. Caramelize it on the grill. Serve it with mint leaves, coconut, nuts or creme fraiche.

4 Grilling Tips to Remember

Always make sure your grill grate is clean and free of remnants before cooking new items. This avoids cross-contamination (and hot dog-flavored bananas).

Keep a close eye on the heat and the food you’re cooking. Nothing is worse than investing time and money into a dish that burns in 30 seconds.

Watch for food thieves. They’re lurking and will swipe bites left and right until there’s none left for you. Store a backup plate for you to enjoy later.

Have no waste. Grill everything. Believe Bittman when he says, “I can’t think of a vegetable that can’t be grilled.”

Stephanie Bolling is a staff writer at The Penny Hoarder. She’s never had chestnuts roasting on an open fire.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2u351Nw

The Cheapest Time to Book a Flight May Be Further in Advance Than You Think

CheapAir.com analyzed 917 million airfares for its annual airfare study and found that travelers typically get the best deals on domestic flights if they book about 70 days (10 weeks) before their departure date.

That’s a significant jump from last year’s recommended 54 days in advance.

If you’re not that precise when it come to travel planning, CheapAir says the prime window to book flights is between three weeks and four months before an upcoming trip. Prices will fluctuate (fares for a given trip tend to change an average of 62 times within an 11-month time span), but fares purchased during this time window should stay within 5% of the lowest price.

Sure, you could test your luck at finding a last-minute low fare. But CheapAir found travelers who book seven to 13 days before a trip pay an average of $85 more than those who book within the prime booking window. Get your ticket less than a week out and you risk paying an average of $208 more than travelers who booked three weeks to four months ahead of time.

Buying a plane ticket too far in advance can also result in a financial penalty. Those who bought tickets 122 to 168 days in advance paid $20 more and those who purchased airfare 169 to 319 days in advance paid $50 more.

CheapAir found the best time to book varies by season. You’ll want to book 69 days in advance to get the best prices for a trip in the fall but only 62 days in advance for a winter getaway.

Those planning summer trips should get their flights 47 days days in advance. (There’s still time for a late August vacation!) Spring breakers need the most advance planning as the best prices for spring flights pop up 90 days ahead of time.

If you’re wondering when’s the best day of the week to buy your airfare, CheapAir’s study says it doesn’t really matter. What matters is what day of the week you plan to leave or return. Travelers save an average of $76 by flying on a Wednesday (the cheapest day of the week) instead of on a Sunday (the most expensive day).

And if you book on CheapAir.com, the company will reimburse travelers with travel credits up to $100 if they find the price of their flight drops before their trip.

Nicole Dow is a staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2KDWKXm

How to Save in Your 20s, 30s, 40s and 50s if You Want to Retire Someday

Sure, it’s easy for someone who doesn’t know me to say I should have double my salary saved, but they don’t know my salary, what I’m spending, or what I want to be spending in retirement.

And frankly, neither do I.

Retirement isn’t one of those set-it-and-forget-it things. Saving for retirement isn’t hard, but you can’t do all the steps at once — which is great, because that would be pretty overwhelming.

Ways to Save for Retirement: 3 Common Retirement Accounts

First off, let’s not get bogged down by the terminology and acronyms associated with retirement.

There are three foundational definitions you’ll want to know to understand your retirement accounts. Everything else is supplementary.

- 401(k): This is a retirement plan offered by an employer. The name “401(k)” actually refers to the section of the tax code that allows your contributions to be deducted from your paycheck before taxes are taken out.

- IRA: This stands for Individual Retirement Account. The most common types are traditional and Roth, and both have great tax benefits. There is a limit to how much you can contribute every year.

- Taxable account: This is a regular ol’ investment account without the tax benefits of the 401(k) and IRA. What it lacks in tax benefits, it makes up for in flexibility. You can open one with any company and withdraw from it at any age for any purpose with no penalties.

If an Employer Does Not Offer a Retirement Plan, What Might Be Another Way to Save For Retirement?

If your employer doesn’t offer a 401(k), bring up the possibility of adding one. If cost is an issue, companies like SaveDay offer 401(k) plans at no cost to employers and low fees for employees.

If you’re self-employed or you don’t have a 401(k) through your employer, you’re not off the hook. There are several types of retirement accounts you can open, depending on your needs.

How to Calculate What You Need to Save

You don’t need to be stressed about not having double your salary saved but how much should you have?

Ask yourself questions like:

- Where do you want to retire?

- Do you want to pay off your house?

- How frequently or far do you want to travel?

All these things and more will impact what you need to have saved for retirement.

Know that your plans will change, and inflation will make the things you want to do 3% to 4% more expensive every year on average. But it’s important to monitor your plan to ensure you’re on track.

How to Save for Retirement at Every Age

You don’t have to have your entire life planned to start saving for retirement.

You actually don’t have to have anything planned or know much at all about the subject. But there is a rule you can use to monitor your savings and to gauge your progress as you figure out where you’re going.

It’s called the 4% rule. The rule states that if you can live off 4% of your current retirement savings in a one-year span, your savings will likely last for at least 30 years. So if at any time you multiply your investment savings by 0.04 and you can live off that amount for the first year of retirement, you’ve arrived!

The 4% rule isn’t set in stone; it doesn’t mean you’ll be living off that savings forever, but it’s considered a safe withdrawal rate by most professionals and is a good way to monitor your progress.

How to Save for Retirement in Your 20s

The most important thing to do in your 20s is to just start.

The math doesn’t lie; you can plug $100,000 into a retirement calculator invested over different time spans, and the longest span of time will always produce the highest earnings. Starting with a zero balance and using 6% as an interest rate:

- $417 a month for 20 years will grow to $184,000.

- $278 a month for 30 years will grow to $263,000.

- $208 a month for 40 years will grow to $386,000.

Compound interest is bae.

Even if it’s in small amounts, you should start saving for retirement in your 20s. Make it easy on yourself by automating your savings. If your employer offers a 401(k) match, sign up to deduct from your paycheck at least as much as the company matches.

If you don’t have a 401(k), open a Roth IRA online through a mutual fund company like Vanguard, Fidelity or Schwab and enroll in automatic contributions. Roth IRAs are amazing, but they do have income limits. It’s best to start one when you have a lower income.

And who has a lower income than someone in their 20s, amiright?

Also, the government will literally pay you to invest when your income is low. If you’re below a certain income, the Saver’s Credit allows you to claim between 10% and 50% of your IRA or 401(k) contributions, up to $2,000 per individual.

How to Save for Retirement in Your 30s

Now that you have a few years of investing under your belt, it’s time to start optimizing your retirement savings.

Your next smartest move is paying off your debt. All the interest and fees you’re paying eat away at the amount you’re able to put toward retirement. And now that you’ve probably settled in a career and are getting raises, it’s time to double down and eliminate that debt.

If you didn’t open one in your 20s, open a traditional or Roth IRA and start maxing it out. As of 2018, the annual maximum you can contribute if you’re under age 50 is $5,500.

Because IRAs have a low limit and you never get those years back, start maxing out your IRA as soon as possible. The type of IRA you contribute to is up to you.

A traditional IRA lowers your taxable income, so if you’re within $5,500 of the next-lowest tax bracket, you can use a traditional IRA to slide in there. If you’re content with your tax bracket, you might like a Roth IRA, which won’t lower your tax bracket but grows tax-free.

A final thing to consider in your 30s is contributing to a health savings account, or HSA.

If you’re on a high-deductible health plan, you can contribute to an HSA. Contributions are deducted from your paycheck before taxes are taken out, and account balances above $2,000 can be invested just like they would be in a retirement account.

Your HSA can be used for any qualified medical expense at any time, and once you turn 65, funds can be withdrawn for any expense without penalty.

How to Save for Retirement in Your 40s

If you’re in your 40s, there’s a good chance you have kids, a house and a stable position in your company. You might start thinking about getting a new car, upgrading the kitchen or maybe getting that boat you’ve been eyeing for the past 10 years.

Now is not the time to start giving in to lifestyle inflation. You’re at a critical time when your investment returns are ideally going to start outpacing your contributions every month, and it’s time to capitalize on that!

It’s also time to figure out what you want to spend in retirement. Now that you have perspective on life, retirement and investing, you can plan a more reasonable retirement budget and figure out how long it’ll realistically take you to get there.

If your plan includes increasing your savings rate, start working toward maxing out your 401(k). As of 2018, the maximum annual contribution you can make is $18,500. If you don’t have a 401(k), open a taxable account and contribute there. You can usually do it at the same place you have your IRA.

How to Save for Retirement in Your 50s

At age 50, you can take advantage of catch-up contributions to your 401(k) and IRA — even though you won’t need to, because you’ve been on track for decades.

As of 2018, you can put an additional $1,000 per year in your IRA and $6,000 per year in your 401(k) once you reach 50.

| Under 50t | 50 and oldern | |

|---|---|---|

| IRA | $5,500t | $6,500n |

| 401(k)t | $18,500t | $24,500n |

Finally, it’s time to get a financial adviser. Most people who try to start with getting a financial adviser get frustrated when they pick the wrong one, because they didn’t know what they wanted in the first place.It’s also time to start thinking about Social Security. The longer you wait to collect, the more you’ll get each month. Look back at the 4% rule, and plan when you want to start collecting.

Now that you have a significant amount invested and an idea of what you want to do with it, it’s time to find an adviser with expertise in how to do that. They can help you optimize the final years of your contributions, protect what you already have and make a withdrawal plan that’s more accurate than the 4% rule.

This article contains general information and explains options you may have, but it is not intended to be investment advice or a personal recommendation. We can't personalize articles for our readers, so your situation may vary from the one discussed here. Please seek a licensed professional for tax advice, legal advice, financial planning advice or investment advice.

Jen Smith is a staff writer at The Penny Hoarder. She gives money-saving and debt payoff tips on Instagram at @savingwithspunk.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2Ko1UdX

16 Tips for Naming Your Startup

So you’ve got a great idea for a new business.

You took the time to write a business plan for your startup. After long and grueling months of conducting market research, coming up with prototypes, and analyzing your competition, you’re finally ready to turn this plan into a profitable business.

You even came up with a plan to raise the funds to get your company off the ground.

But before you can proceed any further, you need to name your startup company.

You may have had an idea or two. But how do you know if that name will work?

Naming your startup may seem minor, but it’s actually one of the most important and undervalued aspects of your business. This name will be attached to your brand image for years to come. You need to get it right from the beginning.

Otherwise, you’ll face some challenges if you try to change your name down the road. That’s a headache you won’t want to deal with.

With this in mind, I wanted to show you how you can simplify this process. These are the top 16 tips to keep in mind when you’re naming your startup.

Use this guide as a reference before you finalize your name.

1. Keep it short

The name of your business should roll off the tongue.

People shouldn’t have to take a breath midway through saying your name out loud. Just think about some of the brands that dominate worldwide.

Nike. Apple. Walmart.

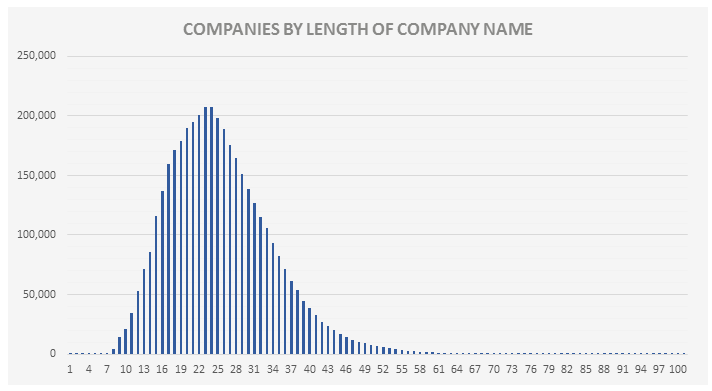

I found a really interesting study conducted by a UK insurance broker. They discovered that the average length of a company name in their region had 22 characters.

More than half of these businesses fell within the 17 to 24 character mark.

While these are obviously longer than names such as Apple or Nike, they still fall within the lower end of the spectrum, as you can see from the graph.

Your business shouldn’t sound like a sentence. Sure, in some instances, two words might be appropriate. I’m talking about names such as Waffle House or even Quick Sprout. Ha! But both of these names are still short and roll off the tongue.

Most importantly, keeping your name short will make it easier for consumers to remember it, which will help you tremendously with your marketing campaigns.

2. Make sure it’s easy to spell

Put yourself into the minds of consumers.

Let’s says they hear your brand name somewhere. Whether it’s on TV, the radio, or in a conversation. Next, they search for it online, but can’t find you because they don’t know the spelling – it’s too complicated.

Stick with names that are spelled exactly how they sound.

Even if they see your oddly spelled brand name written somewhere, they may not remember how to spell it when they look for it.

Don’t do anything weird, like using the number 8 to replace the “ate” sound or use the letter “Z” in a place where you should have an “S.”

3. Don’t restrict growth

Right now, your startup may be focusing on something specific, whether it’s a product, location, or target market.

But that doesn’t mean you should name your business something extremely specific.

For example, let’s say you’re creating a fashion brand selling men’s jeans. Naming your company “Jeans for Men” is a bad idea.

What happens when you want to start making shirts, shorts, hats, or women’s clothing? The new directions no longer fits with your name.

Or let’s say you name the startup based on the location of your first physical store. You may be thinking something along the lines of “Tuxedo Shop of Seattle.” But when you want to open a new location in Chicago or San Diego, you’ll be faced with a challenge.

Instead, name it after something like a street if you want to have some connection to your local area. Just make sure it’s easy to spell.

4. Check the domain name

So you think you’re ready to settle on a name.

Next, use an online tool, such as GoDaddy to see if the domain is available:

I see businesses make this mistake often. A company settles on a name, but someone already has the .com domain. So instead of trying to purchase it, they decide to use another extension, such as .net, .biz, or .org, instead.

I don’t recommend that. Consumers have grown accustomed to associating .com domains with credible and established businesses.

But that also doesn’t mean you should make your domain different from the name of your startup just to secure a .com domain.

My suggestion is this. If your domain name is taken and you can’t buy it, try to come up with a different name for your business.

5. Be original

You want your brand to be unique. Your name needs to be memorable and stand out from the crowd.

Do your best to avoid common names. “John’s Plumbing.”

How many plumbers out there do you think have that name? I’m willing to bet there is more than just a handful.

You want your name to stand on its own, without any confusion or association with other companies.

6. Say it out loud

Your name may look good on paper. But what happens when it’s spoken?

Earlier I said names should be easy to spell, but they should also be easy to pronounce.

Make sure that when you say it out loud, it doesn’t get confused with other words. You don’t want it to sound like something that could be inappropriate.

I won’t give you any examples in this instance. I’ll let you use your imagination.

7. Ask for feedback

You don’t have to struggle alone naming your company.

Sure, you can come up with some ideas and ultimately have the final say. But if you’ve got a team or partners, make it a group discussion.

Write down your ideas. Narrow the list down to five or ten names.

Then reach out to your family and friends. See what they think. If one name by far stands out from the crowd based on that feedback, you should consider it more than the others.

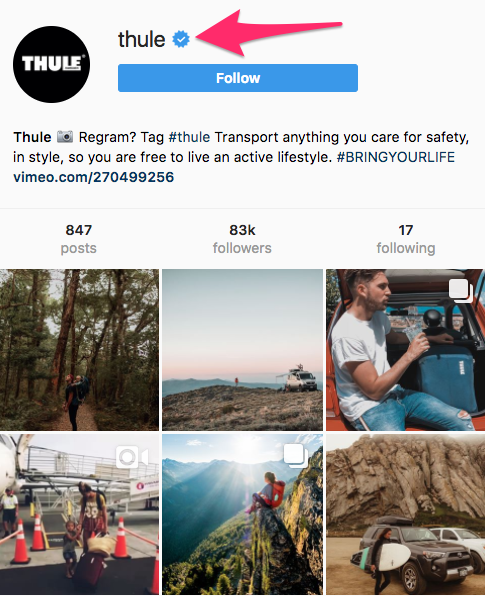

8. Research social media profiles

This is similar to your domain name search.

You want your branding to be consistent across all your marketing channels. See if certain social media handles are taken.

Here’s an example from Thule. Let’s look at its Facebook page first:

And now let’s check out its Instagram profile:

As you can see, the company uses @thule everywhere.

It may sound simple, but you want to make sure all of this is squared away before you name your startup.

Having different social media handles on each platform will confuse your customers. It’ll complicate your efforts to build brand awareness for your new company.

If your name is available on all social media platforms except for one, reach out to the user and see whether you can purchase it from them, or consider coming up with a new name.

9. Make it catchy

Your brand name needs to resonate with consumers. It shouldn’t be forgettable.

Even though you’re in the early stages of your business, you should always be looking toward the future and thinking about potential marketing campaigns.

How will this brand name fit with your campaigns? Will it be easy for you to come up with a company slogan that flows well with the name?

You can’t pre-determine whether something will be catchy or not, and there aren’t any tools that can help you with this. But you can still figure it out based on your gut feeling and feedback of others.

10. Search the Secretary of State records

Once you come up with a name, you’ll need to register your new business.

You’ll probably form an LLC or corporation. In the US, check the Secretary of State records to make sure the name isn’t too close to a business that’s been previously registered.

If the name is too similar, the state may disallow you from registering that name.

Find a lawyer to help you register your new business. They can potentially help you with this research as well.

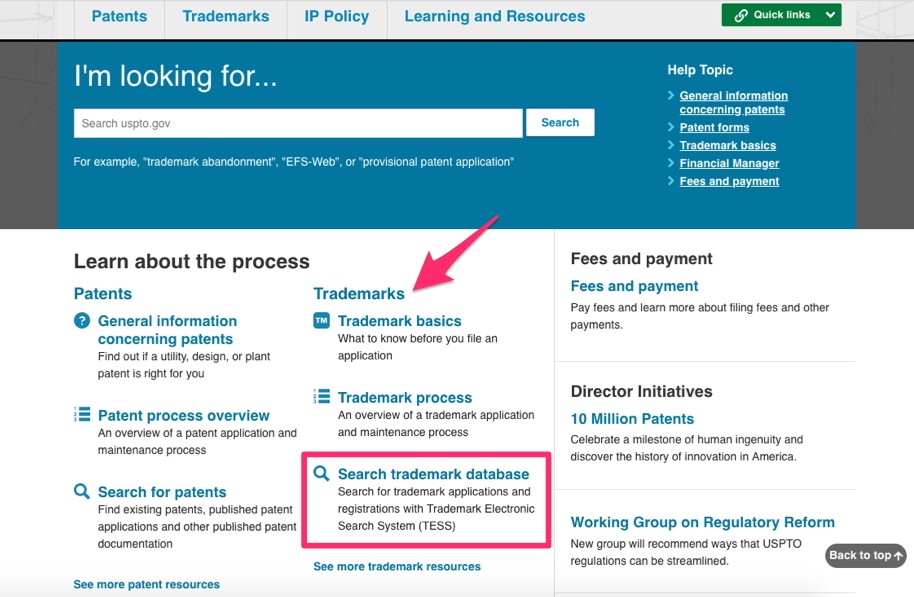

11. Do trademark research

You don’t want someone else to be able to steal your name.

Do a search on USPTO.gov to see whether you can trademark it.

This website will provide you with the resources and information you need to know about existing trademarks and the application process for your own trademark.

12. Make it relevant

Earlier, I talked about picking a name that doesn’t restrict your growth.

But that doesn’t mean you should pick something random or obscure.

Let’s say your startup company focuses on Internet security. Don’t name it “Bunny Ears LLC.”

Is the example a bit extreme? Probably. But you get the point.

13. Keep your logo in mind

Your brand name will be tied to all your marketing efforts. Keep your logo design in mind as well.

Different color schemes can impact sales. That’s because visuals are processed faster than words. Consumers will remember a name if the logo is memorable.

Think about McDonald’s. The “M” golden arches are iconic.

How will your brand name translate to your logo and will it be recognizable? Ask yourself that when coming up with a name.

14. Take advantage of brainstorming tools

If you’re stuck on a name, you can use technology to help.

Use a tool such as NameMesh to come up with a unique domain name. Or use Namium to choose a name based on specific themes.

But one of my favorite tools is from Shopify:

This business name generator helps you come up with ideas while checking for domain availability at the same time.

15. Don’t drive yourself crazy

Picking a name is important. But don’t let it consume your life.

It shouldn’t turn into a six-month project. If you take time to work things out, you’ll be just fine.

Will the name be perfect? Maybe not. But what is?

Don’t keep second-guessing yourself. Go with it if:

- all the pieces line up

- the domain is available

- nobody has the social media handles

- the feedback is good

- you’re able to trademark it.

16. Make sure you’re happy with it

The name of your startup will be something you hear, say, write, and think about all the time.

If you don’t like the name, don’t use it. This startup is your baby. You wouldn’t name your baby something you don’t like, right?

The same concept applies here. Otherwise, you’ll regret it, and that could impact your behavior and the way you run the business moving forward.

Conclusion

What’s in the name? More than you think.

The name of your startup company will be your new identity. Don’t approach this task haphazardly.

Whether you’re struggling to come up with a name or you have a name in mind but unsure how to proceed, use this guide to help you finalize the decision.

It’s better to take the time and be sure of it now as opposed to trying to change your name in the future.

What’s the name of your new startup company?

Source Quick Sprout https://ift.tt/2IKc9Ue

How to Budget if Spreadsheets Make You Want to Gouge Your Eyeballs Out

Which one you are depends on the day — and how long it’s been since your last paycheck.

The result: a pitiful savings account balance, scrimping to pay the minimum on your credit card, and feeling like you’re still living paycheck to paycheck even though your income has come a long way since your first job out of college.

You know there is a way to solve this problem. You know that if you just create a budget — and by some miracle, stick to it — you could finally get the financial freedom everyone else seems to have already figured out.

You also know budgeting is a buzzkill.

But if you give it a genuine shot, I promise I will, too. We’re in this together.

How to Budget in 4 Easy Steps

Creating a budget doesn’t have to be a grueling process. If you take some time to prepare and learn how to budget in a way that makes the most sense for your lifestyle, you can start on the road toward controlling your finances in no time.

We laid out exactly what you need to do in four pretty easy steps.

Step 1: Know How Much You Make and Spend

Before you can make a budget that works, you need to know your numbers. Log in to your bank account online, and grab your last couple statements. While you’re at it, grab your credit card statements, too.

First, write down how much you bring in each month.

Your biweekly paycheck. Any extra money that comes in from your side hustles. Child support payments. Recurring bonuses or stipends. Financial aid payments. Include it all.

Up next, the painful part: It’s time to log your expenses.

Start with the recurring stuff: Your rent or mortgage, car note and car insurance, health insurance, phone bill, internet and utilities. Don’t forget the fun stuff, like your Netflix and Spotify Premium accounts.

From here, you’ll want to start adding up your discretionary expenses. How much are you spending on shopping, eating out and drinks with friends?

To get a full picture, you can put these things in categories. For example, movies, concerts and museum visits can all go under entertainment. Your gym membership, yoga membership and the drop-in rate on that one CrossFit class can all go under fitness.

Look at a few months of statements for this part, too. That will give you a more accurate picture of your finances.

Step 2: Set Your Financial Goals

If you’re going to succeed at this budgeting game, you need have an idea of what you’re hoping to accomplish.

It can be a simple short-term goal like learning to budget so you can save for a vacation with your college besties. Or a long-term one, like learning to budget so your kid can go to college without student loan debt.

Set a goal, and make it good — it could be the only thing that stops you from buying yet another pair of shoes this weekend.

I take it a step further and mix my financial goals with my personal ones.

For example, I tend to overspend on restaurant meals. But budgeting less for eating out means I cook more healthy meals at home, so I save while staying on track to accomplish my weight loss goals, too. Then, I can use the money I save to build up my emergency fund as I pay down debt a bit faster.

Step 3: Find Your Favorite Budgeting Method

Once you have a complete picture of your finances, it’s time to pick the budgeting method that works best for you. The one you choose will depend on how much time and energy you have to devote to it. If you feel comfortable with an Excel file, you can do that.

But we’ve got a few super simple ideas you can try if charts make your eyes glaze over.

Bare-Bones Budget

You don’t have to spend several hours a month working on a budget. The easiest way to budget is to grab a pen and paper and simply write down how much you make and how much you need to spend and save.

That’s it. You’re done.

I’d suggest keeping that sheet of paper somewhere visible to remind you to rein in your spending.

Zero-Based Budget

The zero-based budget takes the bare-bones budget one step further. The goal here is to get to zero at the end of each month. It helps you account for each dollar on the way.

Write down how much you make, and divide it to cover all your bills, savings and discretionary spending until you hit $0 at the end of the month.

Although this plan encourages you to get down to nothing, the idea isn’t to spend without regard; it’s to make sure every dollar goes exactly where you intend for it to go every month.

50/20/30 Budget

This takes all the guesswork out of deciding which expenses should stay in your budget and which ones need to go.

With the 50/20/30 plan, 50% of your money goes to essential expenses like housing, utilities and your car payment. From there, 20% will go to financial goals like savings and investments. The final 30% is yours to spend on the fun stuff like restaurants, movies and drinks with friends.

Once you’ve picked your favorite budgeting method, don’t be afraid to bend it a little to fit your financial situation.

Step 4: Find the Best Budgeting Books, Apps and Software for You

While budgeting by hand works great, your smartphone can streamline it.

My favorite free app is Mint, which is available on iPhone and Android devices. You can connect your bank account and credit cards, and set a dollar amount for how much you plan to spend in each category.

Mint will then automatically analyze your spending and notify you when you get close to your budget or overspend. It’s pretty easy to use and can save you lots of time. The only downside is that the “You’ve exceeded your budget” emails can sometimes feel a little judgmental.

If Mint isn’t for you, there are a few other books and software apps you can try that come highly recommended by my Penny Hoarding co-workers:

You Need a Budget: This started out as an app and then became a book, too. It hinges on four rules:

- Give every dollar a job.

- Embrace your true expenses, not your ideal ones.

- Roll with the punches, and adjust your budget as you spend.

- “Age your money,” and start to break the habits that leave you living paycheck to paycheck.

This is more hands-on than other apps. It’s also the only option that’s not free. After the 34-day trial, you’ll pay $6.99 per month for the service.

Every Dollar: If you’re a fan of the zero-based budget, this is the free app for you. It’s also perfect for the side hustlers whose income can fluctuate from month to month. As you manually track your spending with the app, use it to make sure every dollar you make is accounted for.

Prism: This isn’t technically a budgeting tool. But it’s still worth mentioning. This free app puts all your bills in one place so you always know exactly how much money you have and how much you owe. You can connect everything from rent and car insurance to student loan payments and your Tidal music streaming account, and you can pay your bills right from the app.

“The One Week Budget”: This book is an Amazon bestseller by Tiffany “The Budgetnista” Aliche. We’ve even got a copy in our library at The Penny Hoarder HQ. With a series of worksheets, it walks you through how to analyze your income, track your spending, and pay down debt fast so you can get back to saving for the life you want.

“The Total Money Makeover”: This book was written by financial guru Dave Ramsey. A few Penny Hoarders who have paid off heaps of debt swear by his teachings. His book is also an Amazon bestseller and could be the perfect place to start if you want to break some of those not-so-great money habits and start building a budget that works.

Desiree Stennett (@desi_stennett) is a senior writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2KA8A7T

Why Women Should Invest and How to Get Started

Lately, women hear a lot about gaps: how to combat the gender pay gap, how to avoid a resumé gap when you take time off to raise children, whether or not a thigh gap matters (it doesn’t).

One “gap” that isn’t discussed enough is the gender investing gap.

Women Are Less Likely to Invest Than Men, and That’s a Problem.

According to Ellevest, an investment platform created by women for women, “of all the assets controlled by women, 71% is in cash – aka not invested.” Statistically, women are less likely to invest, and even those who do invest tend to wait until they are older to start.

Most women don’t think they know enough about investing to properly grow their savings; therefore, they wait to start investing until they feel they’re more financially stable and believe they can risk the possibility of losing money. A common misconception around investing is that you have to be an expert in the industry to succeed when the reality is that there are so many tools and resources that make easy to start investing with as little as your pocket change.

Why Should Every Woman Invest?

According to a study by Merrill Lynch, 41% of women wish they invested more of their money. But why is it such a necessary part of personal finance?

Financial Equality

First and foremost, it’s important for women to be able to achieve a sense of financial equality and independence. In the face of issues like the gender pay gap and the pink tax, investing is one of the best ways for women to ensure that they have the potential to accumulate the same amount of wealth as men.

“It’s important for women to be able to walk away from situations that are hurting or not serving them – whether that’s a bad job or a bad relationship,” comments Ellevest’s Susan Thompson. “You should be able to have your own financial power to make decisions that enable you to care for yourself.”

Reaching Financial Goals

Whether you are looking to go back to school, save up an emergency fund, send your kids to college, save up for a large spend like a house or wedding, or just grow your overall wealth, investing is arguably the best way to reach those goals.

Saving for Retirement

Women earn approximately 83 cents to every dollar a man earns, on average. That means that even if we’re saving the same percentage of our income as men, we’re not going to save the same amount. In addition, women also tend to live longer. Basically, less money has to last longer when women simply save their money without an investing strategy.

Many employers do a match on a 401(k) or similar retirement savings plan. If you’re unsure about whether or not investing is really a good option for you, enroll in your employer’s program and watch as your savings grow.

Why Is a Savings Account Alone Not Enough?

Cash that sits in a checking account, safety deposit box, or under the mattress is actually depreciating in value year-over-year because of inflation. That means you’re essentially losing money when you aren’t actively growing your savings.

Check out the chart below, and you can see that a solid investments strategy can help you grow your savings exponentially over the course of 10, 20, and 30 years.

Men are five times more likely to name investing as their number one financial goal, meaning that more men are achieving those exponential returns throughout their lifetime than women. Investing allows women to earn more money than a savings account alone, even with small monthly deposits.

How to “Invest Like A Woman”

Despite the stereotypical belief that we aren’t good investors, women actually tend to possess quite a few qualities that give us an edge in the market.

Kiplinger’s article on the secrets of women investors puts it perfectly: “Studies show that men are more included to behave like baseball sluggers, who swing for the fences, even if it means running the risk of striking out for more often. Women, by contrast, are more like contact hitters, who are satisfied with a string of singles.”

Because women approach risk differently, we’re less likely to see large swings in our portfolio values, meaning a steadier growth over time.

Studies have also found that women are:

Less likely to trade investments, which translates into almost a 1% higher increase in investment earnings per year than men (who trade 45% more frequently than women).

Long-term planners, meaning we focus on our specific growth goals rather than chasing risky returns that may end up costing us.

More likely to ask for financial help. Just because 60% of men think they are experts at investing does not mean they know everything there is to know about the market. Women being more willing to seek out trusted financial advice from experts in the industry give us more opportunities to grow our wealth.

So, how do you leverage these qualities in your investments strategy?

Choose a Strategy That Works for You

Not all investing strategies are created equal, and unfortunately, most of the “gender-neutral” investing tools available to the public ultimately hinder the potential earnings for women.

Ellevest released a side-by-side comparison of a retirement scenario where a man and a woman both started saving at 30 years old, earning $85,000, and investing 10% of their salaries over the course of 37 years.

The study found that because of the gender pay gap and the natural progression of women’s careers (our salaries tend to peak at 40 while men’s salaries tend to peak at 55, and women are much more likely to take long career breaks), the woman would have about $320,000 less by the time she retires based on average market returns. That means she’ll have less money to live off of even though she’s likely to live years longer than the man.

Take these differences into consideration when you’re defining your goals, retirement plan, and investment strategies.

Figure Out Budget Allocation

Experts suggest a 50/30/20 philosophy when allocating your budget. You should strive to keep your “needs” at 50 percent of your income – food, rent/mortgage, clothes, utilities, etc. Then, 30% should be dedicated to self-care. Have some fun, get a manicure, go out to eat with friends. Lastly, 20% should be saved or invested.

Figuring out how much you should invest vs. set aside in a short-term savings account comes down to how much risk you’re willing to undertake. Year over year, the market has been steadily rising, but that doesn’t mean that a return is guaranteed. The golden rule is to never invest more than you’re willing to lose, especially if you’re going after aggressive or volatile markets.

Once you decide, Susan Thompson suggests setting up automatic withdrawals each month, even if it’s only $20 a month.

“In our mind, investing should be a ritual like any other that we undertake,” said Thompson. “Make a habit of putting money back towards your future, even if it’s a small amount.”

Know the Basics

Even though you don’t have to be a stock market expert, knowing the basics can help you communicate your goals and understand what’s happening with your money.

Some of the different types of assets you can invest in:

Stocks. They represent a part ownership in a company or corporation, also known as business equity. Basically, when a company performs well, the stock tends to increase in value. Stocks tend to be more volatile investments, meaning they can give you a high return on your investment long-term but tend to have larger swings in value in the short-term.

Bonds. Also known as fixed-income investments, bonds are one of the most popular assets for conservative portfolios. While they tend to be more stable than stocks or other volatile investments, they also have a lower return potential.

Money Market Accounts. When investing in these types of accounts, you’re allowing the bank to make low-risk investments into certificates of deposit (CDs) or government securities. The best money market accounts are low-return, yet stable investment assets.

Real Estate. Property has a tendency to rise in value over time, and there is a subset of investors who specialize in transforming real estate investments into high returns.

Cryptocurrencies. Bitcoin and blockchain technologies are continuing to grow in popularity. Experts expect for the current volatile market to become more stable in the coming years, which means

Conservative vs. Aggressive Investment Strategies

Investing and portfolio strategies are typically broken down into two main categories: aggressive and conservative. Aggressive strategies will put more money into stocks or other volatile markets such as cryptocurrencies. Conservative strategies will put more into bonds and money market accounts.

Aggressive investments typically get you a much higher return over time, but they’re also riskier. By contrast, conservative investments are more stable, but without the opportunity for the maximum return.

Your personal strategy can be a mix of both, and your strategy should ultimately be based on your financial goals, timeline, and risk tolerance.

If you’re looking at short-term financial goals such as saving up for a wedding or looking to pull together an emergency fund, a more conservative route will work best. This limits the risk of you losing money while still promising a good return.

However, if you’re looking to save for retirement over the course of 20 or 30 years, an aggressive strategy is going to get you the best return possible. While aggressive markets tend to fluctuate widely in the short term, the overall market trends upward an average of 10% each year. When you can afford to be patient in the market (something women are proven to be better at than men), an aggressive strategy can definitely pay off in your favor.

Also, remember that your investment strategy is not set in stone. As your financial goals change and as you get closer to when you plan on pulling money out of your investment accounts, it’s important to readjust your priorities and risk tolerance.

Choose the Right Investment Platform

If you don’t consider yourself an investment expert (and frankly, even if you do), getting professional help is a good idea. There are a lot of options out there for both the DIY-er and someone looking for one-on-one help. However, be careful about who you choose to trust with your money.

1. Choose a fiduciary.

A fiduciary is a company or organization that is legally bound to do the right thing by their clients. Not all brokers or investment firms classify as a fiduciary, so make sure to ask before officially signing with anyone. If you find a great firm that isn’t a fiduciary, just make sure that they put client security and well-being above personal gain.

2. Know their strategy.

Talk to any potential firms about their strategy for investments. Some firms craft personalized portfolios that you have a heavy hand in selecting. Others use a formula and automated system for choosing your investments. Every firm and platform is different, so make sure that the firm you choose uses a strategy that will work best for you.

For example, most robo-investment platforms use an investment algorithm that is based on a man’s salary projections and career lifetime, so they aren’t always the best choices for a personalized approach to fit a woman’s financial goals for the long-term.

3. Consider your budget.

Take a serious look at the minimum balance requirements and fees for each platform or firm you’re considering. If you have a tighter budget, it will be worth it to find a platform or firm structured like Ellevest, where you can choose an account

4. Trust your gut.

If you get an “off” feeling about a firm or platform that you’re considering, trust it. You are trusting a company with your financial future, and in order to do that, you have to trust that they are acting in your best interest. Take the time to find a platform or firm that serves you and your financial goals.

5. Look for firms that support women.

While women investors are on the rise, there is still a gap between the number of men and women are in the investments market. Make sure you’re choosing a firm that will support your financial goals and understand the unique challenges that women face in the industry. Also take a look at the companies that these firms and platforms invest in. Are any of them led by women? Do they support women? While it may not immediately affect the return you get, choosing a firm or platform with a pro-women mindset will help us gain financial equality in the long-run.

Resources: Where to Look for Help and Inspiration

Ellevest’s Susan Thompson’s first piece of advice for women looking to get started was to dig into some research.

“Women are very fortunate today because there is an abundance of really good quality content online,” said Thompson. “Go places where the content can just get you thinking about your options.”

Check out a few of these resources for a deeper look at why and how you should be investing your savings and how you can maximize your return:

- Ellevest’s “What The Elle” Newsletter. The Ellevest site as a whole is my favorite resource for women-specific investment research and advice. They have content about the gender pay gap, how to invest responsibly, how to negotiate for a raise, and every financial topic in between. Their co-founder and CEO Sallie Krawcheck has a monthly newsletter called “What The Elle” that gives insights into everyday investing and financial advice for women.

- Women Investing Network’s Podcast. Twice a week, this podcast talks with powerhouse authors, entrepreneurs, financial experts, and top-tier investors about insider tips and tricks to mastering your personal finances.

- The Everygirl. While this site isn’t purely focused on finance or investing, they have a great resource pool of advice from everyday women. They cover topics on how to bridge the gender pay gap, investing 101, investing apps, and more.

- Money Girl. This podcast covers the entire sphere of personal finance in short, 10-minute episodes that break down incredibly complex topics.

- Stock Market Simulator App. This app will let you try your hand at the U.S. stock market to invest in virtual funds without any real risk. While this isn’t recommended as a decision-making tool, you can get the hang of the stock market and learn more about the investments industry.

- Wall Street Journal. Sometimes this publication can seem like a daunting resource tool for the beginner, but it’s one of the best platforms for staying up-to-date on all things wall street. You’ll be able to take a look at investment trends, tips and tricks to maximize your return, and more.

If you’re looking for a way to automate your own investment strategy or want to start investing on a small-scale without using a broker or firm, an investment app might be the right platform for you. If you type in “investment apps” in the app store search tool, hundreds of options will pull up, but not all will help you grow your savings to hit a solid return.

Robinhood

Robinhood is a commission-free trading app. While it’s functionality is basic without many research or analytic tools, if you’re looking for a basic platform for trading stocks, this is a great option for you.

Fidelity

The College Investor lists Fidelity as their favorite app that allows users to invest for free. They offer no-minimum IRAs and a range of commission-free ETFs, making this the perfect app for those of you who are looking to manage your own investments on a budget.

E*Trade

One of the more well-known trading apps, E*Trade started as a desktop online broker. The app works similarly to their website, including offering an Investor Education Center.

Acorns

While it’s not really a trading app, you can invest your extra change or add a scheduled auto deposit to continually invest. You choose your strategy (aggressive, mildly aggressive, mildly conservative, or conservative), and the app takes care of the rest for you.

Whether you’re looking to save for retirement, bridge the gender pay gap, or just grow your wealth and financial security, investing is a great option. Do your research, trust your gut, and get started. When you see how much your savings can grow, you’ll wonder why you didn’t start sooner.

“Don’t be afraid,” advises Thompson. “Investing is less expensive and less intimidating than you think.”

The post Why Women Should Invest and How to Get Started appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2Kr7T1G

Questions About Camping, Potlucks, Allergies, Kindles, and More!

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Finding time for home cooking

2. The “perfect” potluck dish?

3. Free campsites?

4. Receipts and renters insurance

5. Sell house or rent it?

6. Advice for shut-ins?

7. Portable office?

8. Frugal allergy solution

9. Fridge in garage cost effective?

10. Cleaning out grandpa’s house

11. Breaking Kindle book buying addiction

12. Strong pay for difficult job?

As we sit at the midpoint of 2018, I can’t help but spend some time reflecting on the half year that’s past and the half year to come. In fact, I spend a good hour yesterday doing exactly that.

My conclusion? As is often the case, I’m doing really well on a couple of goals and initiatives, and doing not nearly as well on other ones. Most years, I set 3-5 goals – for 2018, I set 4, of which 2 are doing great and 2 are not.

So, the question becomes what I’m going to do with the rest of the year. Do I try to recover those two lagging goals? Do I accentuate the positive and make sure the two that are succeeding continue to do well?

I decided to stick with the latter. I decided to drop the goals that weren’t doing well and reconsider them at the end of the year, and instead focus on the two that are doing well and make sure that they carry through until the end of the year.

It’s much easier to focus hard on one or two things than to split your focus even more than it already is.

Q1: Finding time for home cooking

I enjoy your posts on making food at home and it obviously saves money but it seems impossible in terms of time. I’m at work from 7:30 AM to 5 PM every weekday and often later. My husband doesn’t get home until 6ish either. We have two kids in child care that I drop off and pick up on my commute. I get home at about 5:45 PM most days and I’m dead. Husband gets home between 6 and 6:15. About all I want to do is either order delivery or cook something from the freezer and delivery tastes a lot better.

– Angelina

There are a lot of things you can do.

For example, one thing you can do is start making stews or other simple things in a slow cooker a couple of nights a week. Stews are incredibly easy – you just dump a bunch of vegetables and cut up meat in there and just cook it on low all day while you’re at work. You can cook a pot roast or a whole chicken with vegetables in much the same way – just put everything in in the morning and cook it all day. If you get one with a timer or use an outlet timer, you can have it start at like 10 AM or so so that it doesn’t cook the vegetables into oblivion.

Another thing you can do is make a casserole or something on Sunday evenings and just make 2 or 3 extra pans. Make lasagna, except make 4 pans at once and freeze the other three. Do this every Sunday you can and fill your freezer with those kinds of meals. You can easily freeze such meals in Gladware containers. Then, 1-3 nights a week, grab one of those frozen meals and move it to the fridge. Two days later, when it’s fully thawed in the fridge, throw it in the oven.

That takes care of most evenings and requires minimal effort in the evenings, not any more than you’re doing now. It just requires advance planning.

I find that the “I don’t have enough time!” issue is mostly the result of not planning ahead a little bit. If you know that you’re going to come home dead in the evenings and not want to cook at all, plan ahead so that you don’t have to cook.

(And there’s nothing wrong with takeout or delivery at least once in a while.)

Q2: The “perfect” potluck dish?

Summer is here, and we (my husband, me and two children) go to BBQs and evening get-togethers, and in the wintertime we go to dinner at a friend’s house probably once a month (we are very lucky to have such a network). Usually it’s asked that you bring a side, dessert or drink (or sometimes a main dish if it’s a big potluck). To save money, we try not to bring a six-pack or store-prepared sides and I try to make something instead. But I haven’t found the “perfect” potluck dish that is both inexpensive and gets eaten (easy to make would be a major plus as well). I was wondering if you had any creative ideas or portable food recipes that are low in cost yet still tasty?

– Amy

I don’t really have a “go to” because it depends on the crowd at the potluck. I like to bake, so often we’ll bring bread items, but that doesn’t really work for something that’s super quick (though it is easy).

We often bring things in a small slow cooker for such events. We’ll make it at home, then bring it in the slow cooker so it can easily sit out with the other foods and be eaten as desired. A few things we’ve done that seem to go over well are a small batch of chili (we usually do it very low liquid as people often put some on hot dogs) or spinach artichoke dip or buffalo chicken dip – any kind of dip will do as long as you bring along things upon which to put the dip (i.e., tortilla chips).

Another good option, if you have access to cheap strawberries, is to bring chocolate covered strawberries. You basically just pat the strawberries dry, dip them in heated chocolate, lay them flat on a baking tray, and stick then in the freezer for a while until the chocolate is hard. After that, just keep them in a big container in the fridge. I guarantee they’ll vanish.

When I was a kid, my parents would bring ham and cream cheese roll-ups. They were my favorite. Just take some deli ham, spread cream cheese on them, then roll them up and slice them. Some people put a quartered dill pickle in the middle of the slice.

Q3: Free campsites?

I found this website that lists free campsites (https://freecampsites.net/). Have you ever used a free campsite while camping? Seems like they would fill up super quick and you would run a risk of not getting a spot if you were traveling.

– Jeremiah

I have camped at free campsites in the past, but it is a bit of a risky proposition. You will sometimes show up and find them to be full or find them to be in utter disrepair. On one memorable occasion, I’ve found them full of sketchy people (apparently I came across a cult reunion or something). However, when they work, they work well.

You should expect that free campsites will probably not be highly maintained. You probably won’t find convenient fire rings or sometimes even clear spots for camping. There will sometimes be trash-related issues and the restrooms may be completely unavailable or poorly maintained. However, the cost is free – you just show up and pitch a tent – and that can make up for a lot, especially if you’re fairly self-sufficient.

The best success I’ve had in terms of quality free camping experiences have been in US National Forests and Grasslands – they call this “dispersed camping” and offer a nice guide. For the most part, if you’re outside of recreational areas, you’re allowed to camp anywhere you wish within National Forests and Grasslands. Most of the time, you’ll just park in one of the parking areas and carry your gear into the grasslands or the woods. You may have a park ranger check on you at some point, but you’ll usually be off by yourself. Be aware that the expectation is that you will leave no trace and the link above offers some guidance on that.

Q4: Receipts and renters insurance

Is a profound declaration with all the stolen goods in case of theft out of an apartment enough for the renters insurance in order to pay for the damage, or do you need receipts also to be able to accept the damagepayment?

– David

You don’t need the receipts as long as you’re honest about the list. Insurance adjusters are extremely adept and clever about figuring out what constitutes an honest list of possessions and whether someone’s making things up.

The best approach, however, is to do a regular photographic or video review of the contents of your apartment or house, capturing all of your significant possessions. It’s probably good to do this once a year or so and save the pictures on your phone or elsewhere. This makes it easy for you to assemble a list later on.

Naturally, receipts are pretty clear evidence that you owned an item. I would keep receipts for major purchases around anyway, because it never hurts to have them and they don’t take up a whole lot of room.

Q5: Sell house or rent it?

My husband and I have a 7 month old and would like to move out of the city to the burbs. We have great credit, owe a bit on our car and heating system. No credit card debt. We have two options: sell the current house and dump the money into a low mortgage amount and payment, or keep the current property as a rental. Take a HELOC, buy the new property. Rental has enough profit that out monthly mortgage cost from our 9-5 paycheck will stay the same. I see the rental as a way to have passive income and two mortgages paid off in 15 years, with the rental highly appreciating. I’m interested in your thoughts.

– Alison

Are you planning on managing this property yourself? That includes the process of finding someone to rent it, doing background checks on them, handling any and all renter issues that come up (repairs, renters who refuse to pay, evictions, etc.), and so on.

If you are, then you’ll probably make money doing this, but you’ll sink quite a bit of time into it – more than you probably expect. If you aren’t, then the management company will devour a lot of your profits in the form of a significant chunk of the rent plus the costs of significant repairs (depending on the arrangement).

I don’t think you should assume that renting out the property will guarantee you enough money to cover the mortgage. It has a good likelihood of producing enough money to mostly cover the mortgage most of the time if you put in your sweat equity, or cover some of the mortgage most of the time if you hire a management company to take care of the property.

Now, if that still sounds good to you, go for it. If not… I wouldn’t. I have seen firsthand how much work it can take to deal with even a single rental house and I have no interest in ever doing it.

Q6: Advice for shut-ins?

You must have some other readers in my position. I am essentially shut-in and relatively elderly (67.) I live alone except for my feline companion, and have calculated that I am by myself 97% of the time. I use a wheelchair and due to particular physical disability, can only use a Paratransit van for transportation. (Because of the hills in San Francisco, and the fact that the elevator in my building is out of service 5% of the time, I cannot count on being able to get out, although I do try to sit in the sun outside the building’s doorway when possible.) Therefore, many thrift ideas are out of the question for me. For example, I cannot go to a dollar store or to Costco, and have to rely on home delivery services.

Recently, my 17-yr-old cat passed away from cancer and I had to invest nearly $2K on the transition to a kitten, even with shelter adoption. (The house-calls vet is very expensive.) Note that I live in one of the most expensive cities in the country, San Francisco. I felt very badly about reducing my savings so much (in order to repay my credit cards within the coming two months, I have only half of my former savings left) but absolutely -especially since several of my disabilities are mental illnesses, having company is an imperative. I make everything I can from scratch – bread, broth, even ketchup! I don’t part with a dollar w/o careful consideration, but as I have implied, everything has to be delivered (generally, I use Amazon. I invest in Prime only one month out of every few yrs, and make the most of it with many deliveries quickly. The new kitten is an example of such a time for Prime use.) I occupy myself as a writer of self-help works for people with brain injuries like me and/or mental illnesses like me.

Do you have any ideas for me and those others who are shut in? I live on Section 8 housing and have Medicaid and Medicare. Food Stamps are not worthwhile since I can’t get to the stores. I do get Food Bank home delivery weekly. I am a client under scholarship of a wonderful social services agency that visits me monthly. Many thanks in advance.

– Connie

It really, really, really,/em> depends on the specifics of your situation, particularly what your disability enables you to do, and that’s why it’s hard to give “blanket advice” for all situations. The disabilities and specific conditions that shut-ins face vary widely, and those varieties of conditions drastically change what that person can take on.

What is your current financial situation? What debts do you have? What family support do you have? What community support do you have? What physical activity are you capable of taking on? Those answers vary greatly from shut-in to shut-in, and those answers drastically change what advice I can give.

Quite honestly, you’re probably in a far better position to assess strategies that can help shut-ins improve their financial situation.

Even given all of that, I have one big suggestion for every shut-in: make it your daily goal to improve your situation in some fashion, even if it’s just a tiny improvement. What can you do today that will make tomorrow (and the days after that) just a little bit better than today? No matter how difficult your situation is, there is always something you can do to improve tomorrow (and, ideally, subsequent days). Maybe it’s something as simple as getting a bit of exercise, or taking care of a task you’ve been dreading, or preparing for an upcoming event. Whatever it is, take on that task today instead of putting it off, and make sure that at least once a day, you do something to make tomorrow a little better than today.

Also, question every single thing you take for granted in your life. What is it that you actually need? What is it that actually provides genuine value to you? If you’re not sure, try going through days without various elements. Turn off the television for a day or for a week. Turn off the internet for a day or for a week. Don’t eat prepackaged food for a day or for a week. Don’t get delivery for a day or for a week. See how it goes. See if the things you just take for granted are really requirements in your life.

A final tip of advice is to make sure you’re getting every kind of assistance you’re eligible for. A great place to start with this search is benefits.gov. The search can be a little overwhelming at first, but invest the time to actually do this and you may find a surprising number of things that help.

This is one of those situations where I’d love to help, but the variables are so many that it’s impossible to give good advice that works for even a significant percentage of shut-ins.

Q7: Portable office?

You’ve mentioned before how you use your backpack as a portable office. Could you explain what you mean by that?

– Aaron

At all times, I keep all of the material that I need for work that I’m not actively using at home in my backpack. This usually includes a few personal finance and other books I’m reading that might relate to Simple Dollar articles, my laptop, my tablet, a few notebooks, headphones, power cables for those devices, a water bottle, and all of the other odds and ends I might need to work almost anywhere I might go.

The reason for this is that I can just grab that bag at any moment and go to the library or a coffee shop or some other environment and be completely ready to take notes, brainstorm, or write articles. I’ve worked in all kinds of environments – in the woods, at an interstate rest stop, in what seems like half the public libraries in Iowa, and so on.

My “portable office” is one of those trusted elements in my life. I know it’s always going to contain what I need for work, so when I want to work somewhere outside the house, I just need to grab that bag and I’m ready to go.

So, what are the specs? It’s a North Face Surge II backpack. It has an older (circa 2012-2013) MacBook Pro in there with a charging cable and a more recent iPad with a charging cable. I have a Nalgene water bottle in there. I have an external mouse in there – a cheap generic Amazon one for when I’m doing things on my laptop that go beyond what I want to be doing with a trackpad. I have a legal pad in there and a smaller notebook with some pens. I currently have four books in there – one is a dog-eared copy of Your Money or Your Life that’s been in there for years. I have a toothbrush and a small tube of toothpaste and some dental floss and a stick of deodorant in there. I have some aspirin in there. I have a few granola bars in there. I have a couple of mix-in packets for my water bottle in there. I have a small flashlight and a multi-tool in there. That pretty much covers it.

Q8: Frugal allergy solution

Do you have any frugal solutions for allergies? I get them in the spring and early summer really badly. I used to take prescription Claritin but can’t afford it any more. All I find online are weird homeopathy solutions that don’t work. Suggestions?

– Gina

The first thing I’d do is see whether or not your health insurance covers immunotherapy shots. If they do, head down to your doctor and see about getting the shots. This is a permanent (or close to it) solution to allergies.

Another solution is to try a store brand version of an over-the-counter allergy medication. For example, Zyrtec is just cetirizine hydrochloride, and these are cetirizine hydrochloride tablets for less than $20 for a year’s supply.

The only harmless natural solution I’d try is local honey, which usually has a ton of the local pollen in it and also is naturally soothing to the throat. Start drinking local honey in a cup of tea each morning and see if that helps.

Q9: Fridge in garage cost effective?

I enjoyed your recent article about buying a new fridge. My question is whether or not a refrigerator in the garage is cost effective, which you didn’t really address. If you have a free fridge, is it cost effective to put it in the garage for additional cold storage?

– Jasper

As I mentioned in that article, the energy cost of a 20 year old fridge is about $120 per year. Add on top of that the fact that such a fridge is already past its average expected lifetime and there’s a decent chance it will fail in the future.

That being said, if you are primarily using it to support bulk buying of refrigerated items and otherwise using it to store things that won’t spoil, there really is a good chance that such a fridge will be cost effective. All you need is for that refrigerator to save you about $2.50 a week in bulk buying, on average, for it to break even in terms of cost, and then beyond that it basically just provides a free (or even money saving) convenience.

Want to buy 20 pounds of peaches to make peach cider and you found a cheap bulk buy, but need to keep them cool for a while so that they don’t go bad as quickly? That’s the kind of thing that a garage fridge can help with. Want to keep a lot of bottled water and soda and beer cold for a party? That’s the kind of thing that a garage fridge can help with.

In other words, if you can think of lots of good use cases in your life, it’s probably worthwhile. If you can’t think of many uses, it’s probably not.

Q10: Cleaning out grandpa’s house

My grandpa died suddenly a few months ago. I am his only living relative (his only son was my dad, who died a few years ago) so I am his executor. He left everything to me which wasn’t much after all debts were paid but I do own his house free and clear. The problem is I don’t want to go in there and empty it out. I’ve tried three times and I can’t do it. I want to get rid of 99% of the stuff and save just a few possessions and then sell the house but every time I go in there I can’t deal. I considered hiring a service but I know I’d wind up losing things I’d regret if I did that. Suggestions?

– Marcus

Honestly, I’d talk to a few of your closest friends about it. Tell them flat-out what you’re going through and ask them for help in cleaning out that house.

Get them to do most of the work in going through the house while you focus entirely on evaluating things. Keep or not to keep? That way, this doesn’t turn into a lonely project for you.

A good friend will definitely step in and help with a task like this, so I’d definitely start with my innermost social circle.

Q11: Breaking Kindle book buying addiction

I am very good financially except for one thing. I buy waaaaaaay too many Kindle books. I am an avid reader and use the library but I still find myself often buying interesting books on my phone almost without thinking about it and then the credit card bill comes in and yikes. I don’t realize how many I’ve bought. Do you have a good solution for this?

– Tammy

From this, I’m getting that you would like to buy a few Kindle books a month, but you often fall into the trap of buying too many – or more than you planned for, anyway.

In that situation, I’d recommend getting a reloadable prepaid Visa card and using that as the primary form of payment on your Amazon account. Load it up each month with whatever your Kindle budget for the month is and buy away. Whether it’s $10 (and you’re the queen of the Kindle Daily Deal

The advantage here is that when the prepaid card empties out, Amazon will just decline the transaction and then you have to wait until you reload it. (In fact, you can actually automate that reloading – on the first of each month, transfer some amount onto that prepaid card for Kindle stuff!)

Or else stop using Kindle. That’s another option.

Q12: Strong pay for difficult job?

Your recent column from 6/23 on finding meaning and purpose in financial progress and Drew’s article on satisficing from 6/27 really struck a chord with me. I work for the government in a job I really enjoy most of the time, with good pay and mostly good work-life balance (when it’s good, it’s good; about 1-2 months/year it is horrid). My wife and I have a decent sense of what we’d like our future to look like, and a plan that should get us there.

However, the timeframe for arriving at that future seems so far away. I could probably get a job working for private companies with a salary that would make our planned future happen much sooner. Ideally, I’d do that for 2-3 years, and then return to my current job (a fairly common occurrence at my agency). During that time, we would keep our spending in check, so as to not get addicted to the higher pay, and I’d be focused on learning as many lessons for future governmental work as I can. However those 2-3 years would likely be bad, in terms of stress, life balance, and not feeling good about the work I’d be doing.

I’m kind of stuck between staying or going. Do you have any suggestions for how to approach this decision

– David

If you have a very strong likelihood of being able to fall back to your current position, then I’d go for it. You have a light at the end of the tunnel and as soon as the other opportunity gets to be overwhelming, you can bail. You’re not signing yourself up for something painful with no other options. You have options.