الجمعة، 7 ديسمبر 2018

Pocono airport receives grant

Source Business - poconorecord.com https://ift.tt/2rq9JUo

How to Drive Retail Sales with Beacon Technology

With online shopping growing in popularity, retailers need to come up with new ways to keep their customers engaged to drive sales.

Retail stores are no longer just competing with other neighboring shops. Consumers can shop for virtually anything from the comfort of their own homes or even on the go from ecommerce shops.

If your retail business can’t adapt to new technology and the latest trends, you’ll struggle for survival in the coming years.

Beacon technology is definitely something your business should consider using. While the term may sound futuristic and complex, it’s actually quite simple.

You’ll be using beacons to track your customers, similarly to GPS. Although beacons and GPS are often confused and associated with each other, they’re not the same.

GPS technology needs three major components to work:

- satellites

- ground stations

- receivers

Receivers, such as a cell phone or a car, send signals to satellites that calculate the distance between each one. As a result, these calculations can pinpoint exactly where the receiver is located.

Beacons are far less complex.

These devices are small and not very expensive. They run on battery power.

Instead of broadcasting their locations to multiple satellites, beacons simply share their locations with devices capable of receiving their identities.

It’s easy to install beacons throughout your retail store locations. Implementing this technology in your retail shops will help you increase sales by personalizing the customer experience.

If you have never used beacon technology before, this is the perfect guide for you. I’ll show you how to leverage this technology to drive retail sales.

You’ll even learn how beacons can help generate revenue for ecommerce businesses without physical locations.

Encourage customers to download your mobile app

The first thing you need to do is get people to download your mobile application.

If your retail store doesn’t have an app, you’ll have to put your beacon technology strategy on hold until the app is built. Your app is a great way to increase sales by encouraging mobile spending.

I’ve spoken to many business owners who are hesitant to launch apps for their retail stores. They don’t think it’s necessary because their clientele would rather shop in person than online.

Sure, some people would rather see, touch, feel, and try on items in person as opposed to online, but the reality is they are still using mobile devices during the process.

In fact, 80% of people have used their mobile devices inside of physical stores to improve their shopping experiences.

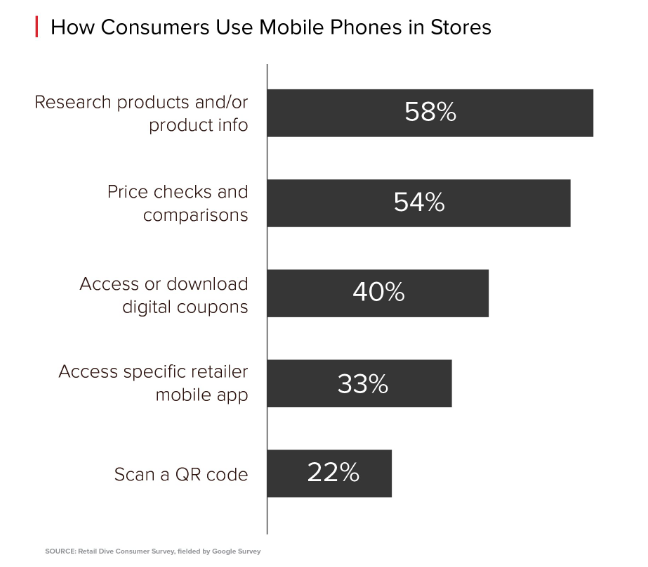

This is how consumers are using their devices:

You need to make sure your mobile app has all of these functions.

If you think your app needs improvement, you should read my guide on the top successful features of a mobile commerce app.

People won’t want to download your app unless it improves their shopping experience. But if your app does all of the things on the list above, it will be easier for you to get more downloads.

But you can’t just assume your customers will download the app simply because it’s available.

You need to promote it on all your distribution channels.

Share a link to the app store on your website. Talk about it on social media. Include a download link in your email campaigns.

Give your customers an incentive to download it, such as a coupon or discount off their next purchases.

Once the app is installed on their mobile devices, you’ll be able to use beacons to drive sales.

Monitor customer movement in your stores

If you have beacons set up throughout your retail store, you can track the way users shop.

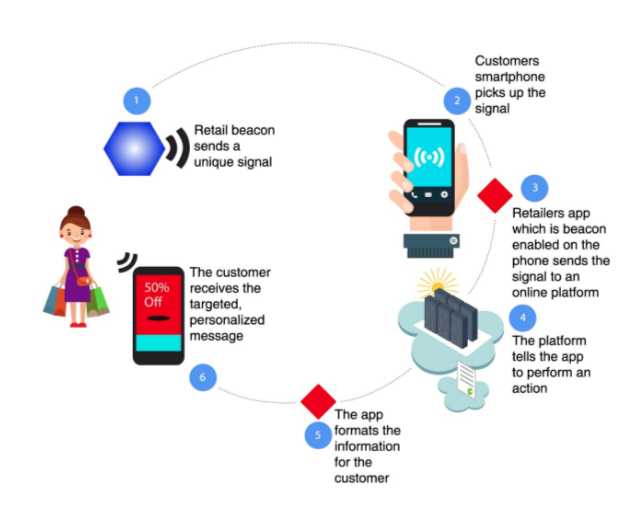

It’s simple. When a customer who has your app walks past a beacon, the beacon transmits a signal.

Here’s a visual representation of the way this works:

As you can see, the example above ends with the customer receiving a targeted, personalized message.

But you need to make sure there are specific parameters set up before a message gets sent. Here’s what I mean.

Let’s say your retail store sells clothing.

A male customer who has your mobile app on his smartphone comes in to buy a new pair of jeans. But in order to get to the men’s jeans section, he needs to walk past the baby clothes and footwear.

If you have beacons installed in those locations of the store that automatically trigger a message about those departments, it’s ineffective. In fact, this strategy will probably backfire.

We know that 52% of app users find push notifications annoying and distracting.

Further, 46% of people will disable push notifications if they receive more than two from the same app in one week. And 32% of users will stop using an app altogether if they get six or more notifications a week.

Make sure your message is relevant and timely, which I’ll discuss in greater detail shortly.

You can send the user a message if they are spending long periods of time near a certain beacon.

For instance, if that shopper in the above example is spending 15 minutes in the men’s jeans section, it’s a safe assumption they’re shopping for that product.

Improve in-store navigation

If you have a small boutique retail shop, your customers may not need much help getting around your store. The layout is probably pretty self-explanatory.

But that’s not the case for all retail locations.

Sometimes, it feels you can get lost inside these big shops. Customers spend more time trying to find their way around than they do shopping.

What’s your current system for helping customers navigate through the store?

Maybe you have a store map at the entrance or signs above each aisle.

But that doesn’t help someone who is in aisle 14 and the product they’re looking for is in aisle 26. They aren’t going to walk back to the entrance to read the map, and they certainly can’t read the signs that far away.

Traditionally, this is how retail shops operate. But now, with the help of technology, you can create a map function in the mobile app.

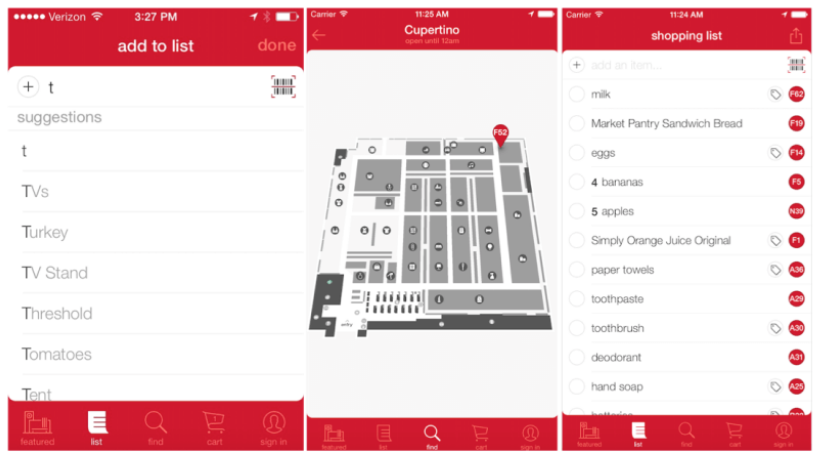

Take a look at how Target puts a creative twist on this simple feature:

Its customers can use this tool to create a shopping list before they arrive at the retail location.

When they arrive, the map will indicate where to find the items they need. This makes it easy for them to navigate around the store without getting lost.

Beacons placed throughout the store will show where the item is in relationship to the signal being transmitted from the phone.

Send timely discounts

As I said earlier, you want to make sure that any messages you send to your customers are timely and relevant.

For the most part, you can’t go wrong with sending a discount. Everyone wants to get a deal.

Think about the shopping experience from the perspective of your customers. As they browse around the store, they get a notification on their device.

Which type of message do you think would entice them to make a purchase?

“We sell winter coats and jackets!”

or

“20% off all winter coats and jackets!”

This is a rhetorical question. Obviously, the discount is more enticing.

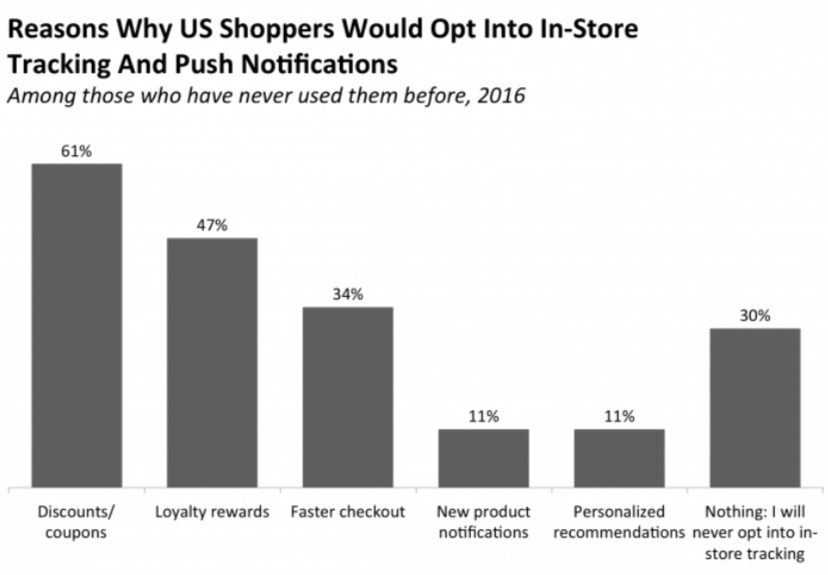

Furthermore, discounts and coupons are the number one reason why shoppers would agree to in-store tracking and push notifications.

Stick to what you know your customers want. Don’t try to make things more complicated than they need to be.

If you send them a push notification or message that’s for something other than a discount, it’ll annoy them. Then you run the risk of that customer disabling their location settings or turning off push notifications for your app.

Target nearby customers

Customers don’t need to be in your retail store to benefit from your beacon technology campaigns.

You can use beacons to target customers who are in the area.

If you place beacons around stores, you can send a message to customers giving them a reason to come in and shop.

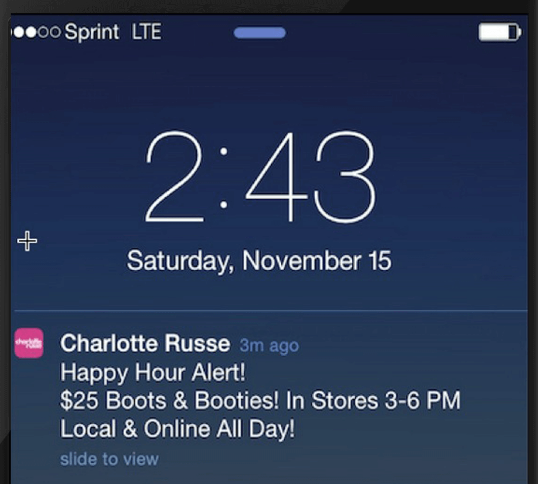

Take a look at this example from Charlotte Russe:

A customer who passes a beacon near the store could be sent this type of push notification.

Take a moment to look at the time this message was sent.

It’s reflects my previous point about timely discounts.

The in-store promotion is being run 3:00 PM – 6:00 PM. The push notification was sent at 2:40 PM to someone in the area.

You can use this strategy to run flash sales and other promotions as well.

It makes much more sense to send an in-store promotion to someone in the area than to every single app user. If people aren’t in the area, the promotion won’t be relevant to them.

Improve customer profiles

Everything I’ve talked about so far involves timing concurrent with shopper’s behavior. But you can leverage beacon technology for future actions as well.

Collect data on the ways customers shop in your store. Then use that information to improve their profiles.

Right now, you are probably using data such as online browsing behavior and purchase history to send personalized recommendations to your customers.

For example, if a customer browses for headphones online but doesn’t purchase them, you may send them a follow-up email the next day with a discount on headphones.

You can do the same using beacon technology.

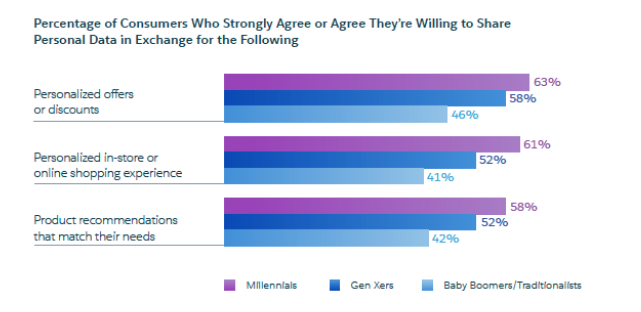

Consumers are willing to share personal data if it improves their shopping experience:

As you can see from the data, younger generations are more comfortable with this type of technology than older generations.

That said, it’s more likely that a Millennial will install your retail app on their phone than a Baby Boomer, so you should be in the clear here.

Besides, in order for you to proceed with beacons, you’ll need to request location permission from users as they install your app on their devices. Otherwise, you’d be in violation of their privacy rights.

Customers who spend longer periods of time in certain sections of your retail store are obviously interested in those products.

Include that information in their customer profiles.

The next time they launch the app or shop online while signed into their profiles, recommend those types of products on their homepages.

Use beacons for your ecommerce shop

The majority of the discussed ideas in this post are relevant to physical retail stores.

Yes, there were some examples of how retail shopping behavior can improve online shopping experiences as well.

But beacon technology can also be used for ecommerce shops without physical stores. You just need to get a bit more creative.

For starters, you still need to encourage your customers to download your app for this strategy to work effectively.

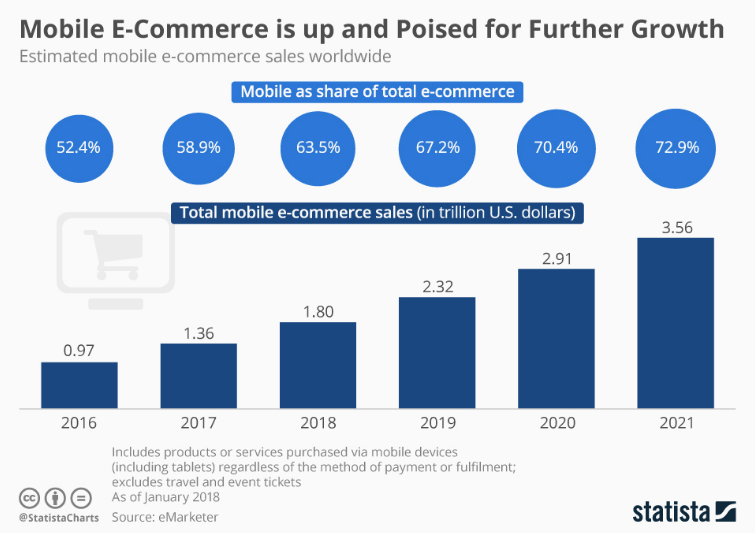

Focus on it no matter what. Just look at the way mobile commerce is trending upward:

Then you can put beacons in locations related to what you’re selling. Here’s what I mean.

If you sell surfboards, kayaks, paddleboards, etc., you can put beacons by a beach. When a customer with your app goes to the beach, they’ll get a notification about those types of products.

If your ecommerce shop sells sports jerseys and other fan apparel, you can put beacons outside of various sports stadiums.

For example, if a customer walks by Fenway Park in Boston, they’ll get a notification about discounted Red Sox jerseys and hats.

This would make more sense than sending them a notification about a team that plays in Los Angeles.

The promotions are still timely and relevant, improving the user experience. This type of message would definitely entice the app user to buy from your ecommerce shop.

Conclusion

Retailers need to adapt to new technology trends if they want to survive today and in the future.

Beacon technology is a great place for your retail store to start.

First, you need to make sure as many customers as possible download your mobile app.

Then, you can place beacons throughout your store to monitor their shopping behavior.

Use this information to send them timely, relevant, and personalized messages that will improve their shopping experience and drive sales. Beacons can be used to target customers in the vicinity of your shop by enticing them to come in and buy something.

Once you collect data about customer in-store shopping behavior, you’ll be able to improve their customer profiles.

Ecommerce shops without physical stores can benefit from this technology as well. You just need to think outside the box to find places for your beacons.

If you follow the tips I’ve outlined above, your retail stores and ecommerce shops will generate more sales with the help of beacon technology.

How is your retail business using beacons to improve the customer experience?

Source Quick Sprout https://ift.tt/2RBrEmy

Keeping Down with the Joneses

Sarah and I live in an area where most of the homes near ours are similar to our own and most of the families near us have a similar level of income and external signs of spending.

This isn’t a particularly bad thing, but it’s not a particularly good thing, either.

On the one hand, if there’s no one nearby that’s clearly much more affluent than us, there’s not much of a desire to “keep up with the Joneses.” Aside from people doing regular things like vehicle upgrades (most people here tend to buy modest late model used cars and drive them until they’re getting pretty old) and modest yard landscaping, there’s not a lot to “keep up with.”

At the same time, however, there’s no one nearby that’s clearly less affluent than us, so there’s no motivation to “keep down with the Joneses.” As I said, we live in an area where everyone seems to have very similar external levels of spending, so you don’t see people living in really small homes (ours is of moderate size) or driving older cars.

This concept of “keeping down with the Joneses” is an interesting one, so let’s dig into it a little bit.

As is widely known, we tend to try to match our lifestyles to the people we associate with the most, and the area in which we live – particularly the area within a block or two of us – provides a constant example along those lines. People tend to live a lifestyle roughly equal to the lifestyle lived by others that live near them, in other words. You don’t typically see a ramshackle house next to a really nice house. You don’t typically see an old rusty car parked regularly next to a house with brand new cars. While there might occasionally be an outlier here, it’s not an extreme outlier.

The idea of “keeping up with the Joneses” comes from someone who perceives that their level of affluence is lower than those that live around them. They see the neighbor having a nicer home and driving a nicer car and having nicer clothes and going on amazing trips and so on and they want that lifestyle. Often, they feel as though they should have that lifestyle because they live close to the proverbial Joneses, so they spend beyond their means to try to keep up.

On the other hand, the idea of “keeping down with the Joneses” comes from someone who perceives that their level of affluence is higher than those that live around them. In this case, the person is nudged by the people around them to lower their level of affluence. There’s less social pressure to buy a new car or to have perfect yard landscaping or to dress everyone in really nice clothes and so on.

In other words, if you live in an area where you’re on the low end of affluence, there’s a subtle pressure to “keep up with the Joneses” which can encourage more spending on unnecessary things, whereas if you live in an area where you’re on the high end of affluence, there’s no pressure to keep up and, if anything, there’s a nudge to “keep down with the Joneses” and keep your spending on unnecessary things in check.

Here’s the cold, hard truth: I’d far rather be in a situation where I was nudged to “keep down with the Joneses” than “keep up with the Joneses.” I’d rather live near people who were at or, even better, just a bit below my own level of affluence so that the subtle hints I get from my environment about spending nudged me to spend less, not more.

In other words, if I were buying a home, I’d rather have one of the nicer homes in a less expensive neighborhood (that still met my criteria) than a low end home in an expensive neighborhood. I’d say that I live currently in an average home in my area, so I’m not really nudged either way. If I lived in an area where I was on the low end of the relative level of spending, I’d probably want to move to a new area so that I wasn’t constantly nudged to spend more and more and more.

How can you apply this idea of “keeping down with the Joneses” without moving to a new home, though?

The easiest thing you can do is cultivate and strengthen friendships with people who don’t spend extravagantly. Ideally, you’ll want to have friendships with people whose spending and possessions don’t make you feel as though you’re not spending enough. If they make you feel anything at all, they should make you feel as though you’re spending too much on possessions and experiences.

It’s simple: surround yourself with people who really enjoy and appreciate free and low cost experiences and don’t have a drive to accumulate expensive possessions. Look in your social circle for those people and accentuate those relationships. Seek out new connections with people who feel similarly.

A good place to start is in your own neighborhood. Walk around and look at the homes of people who aren’t trying to one-up each other with expensive purchases. Look for the more modest homes where people appear to be doing interesting things and get to know those people. I’ve made several friendships within a few blocks of my home by doing that very thing – if I see someone doing something interesting at their house, I’ll stop by and say hello and get to know that person. I’ve actually knocked on people’s doors before because I saw an interesting project in progress in their driveway, just to ask about it, and each time it’s been the beginning of a friendship (or at least a healthy acquaintanceship).

Another thing to do is spend your social time and your free time in situations that aren’t centered around spending and don’t require an expensive purchase. Go to a friend’s house, or invite a friend over. Don’t engage in “retail therapy.” Find free things to do when you’re out and about. Don’t go to expensive events with any regularity. Don’t join an expensive club with a high membership fee (unless there’s a professional reason to do so).

Along those lines, avoid media that’s crowded with advertisements or lauds affluent lifestyles. Both of these things essentially create a virtual sense of “keeping up with the Joneses” that you don’t need in your life.

Instead, read meaningful books and, when checking out media sources, choose those that don’t prop up an affluent lifestyle and instead laud a frugal one. Again, you want your focus to be filled with subtle cues encouraging a practice of “keeping down with the Joneses,” not up with them. Choose media that focuses on the meaningful lives of people who practice frugality rather than consumption. Find media that matches what you value and make that your center (though it’s always good to explore other perspectives sometimes).

Finally – and this is fairly obvious – don’t overlook the value of moving. I know, I know, I said things that didn’t involve moving, but if you’re in a situation where you’re really stretching your financial picture just to keep up with the people in your neighborhood and to keep up an expensive property, it might be worth your while to simply move to a less affluent neighborhood or to an apartment. There are definitely cost of living reasons to do so – it’s far less expensive to cover the mortgage, utilities, and taxes on a more modest property in a more modest area with a lower cost of living – but in a more modest area, there’s far less compulsion to “keep up with the Joneses.” Rather, if you’re in one of the nicer houses in the neighborhood, there’s even a slight compulsion to “keep down with the Joneses,” which is a far healthier state for your pocketbook.

Good luck!

The post Keeping Down with the Joneses appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2QfMYS5

I’m Second-Guessing the Way We’ve Been Saving for Stepdaughter’s College

Dear Frank,

We laugh about saving for college when kids are very small. They’re little bundles of joy who simply need to be fed and clothed. Why fret about what’s going to happen 18 years from now? And then, all of a sudden, they’re not small anymore. They grow like very opinionated weeds and have their own senses of humor and points of view. And body hair.

I can imagine you’re not the only parent quietly panicking at this as you glance over your stepdaughter’s shoulder trying to decipher how they’re teaching math these days. This very far-off life event is not actually that far off.

The good news is that you’re saving. The bad news is that your money probably isn’t working hard enough for you while it waits for your stepdaughter to make some big decisions about her future.

A 529 savings plan is a solid option because it’s a tax-free investment account. But the penalty is steep for those non-educational withdrawals: a 10% penalty on top of income tax. However, it’s important to note that those funds can be used for almost any educational endeavor, and you can change the beneficiary on the account in the event she doesn’t need all the money.

Another option is a custodial account. As long as the account earns less than around $2,100 per year, the earnings are taxed at the child’s rate instead of the parents’.

This type of account can negatively affect how much need-based financial aid she’s eligible for when she applies to school. But the benefit of a custodial account as a college savings plan is that she gets control of the money when she’s 18. That can sound scary right now with a new teenager in the house, but it means that if she chooses not to go to college, she can still use that money toward her future financial security.

Every method of saving for college — from 529s to savings bonds to stuffing cash under the mattress — will have drawbacks. At this point, what’s essential is that the money you’ve already saved gets into an investment account of some sort. When the time rolls around — oh, and it’s about to roll around — you want that money to stretch as far as it possibly can.

Have a tricky money question? Write to Dear Penny at https://www.thepennyhoarder.com/dear-penny

Lisa Rowan is a personal finance expert and senior writer at The Penny Hoarder, and the voice behind Dear Penny. For more practical money tips, visit www.thepennyhoarder.com.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2BXGPBb

Attractive bond rates may be just one of the reasons to consider a credit union

Rock-bottom interest rates mean savers have seen their returns dwindle in recent years.

Savers looking for an alternative might want to consider a credit union, which sometimes offer better rates.

What is a credit union?

A credit union is a non-profit making co-operative controlled by its members who pool their money together and lend to one another. Once dubbed the ‘poor man’s bank’, their popularity is growing with the number of members hitting two million for the first time this year, according to the Bank of England.

There are more than 380 credit unions in the UK. They operate on the principle of helping people and often have savings rates better than those offered by high street banks.

Like banks, credit unions accept deposits, provide loans and mortgages as well as a host of other financial services. However, unlike banks, credit unions don’t have to pay shareholders, so the cash can be used to reward members.

They are authorised and regulated by the Financial Conduct Authority, and up to £85,000 of your money is covered by the Financial Services Compensation Scheme.

Alternative to major lenders

Credit unions provide a useful alternative for people who have trouble getting credit from major lenders. While some unions offer a fixed rate on savings many still pay a yearly dividend, which is how profits are shared with members.

Andrew Hagger, a personal finance expert at Moneycomms, says: “Unfortunately, many people probably aren’t aware they have one in their local area. They are all individual providers offering different products, so as a consumer you have to do a bit of digging around.”

As an example, My Community Bank is currently offering very attractive rates. Its one- and two-year fixed-rate bonds both pay 2.20% AER, while its three-year fixed-rate bond pays 2.25% AER. The minimum you need to open an account, which needs to be opened online, is £1,000 and the maximum you can save is £50,000.

There are other restrictions. As it is a fixed-term bond, you can’t withdraw the funds early. You must also have a job in what the Office for National Statistics designates a ‘minor’ occupation. This includes nurses, teachers and engineers. A full list is on the My Community Bank website.

“Many people probably don’t realise they have a credit union in their area”

Not just for savings

Credit unions are also seen as a cheaper alternative to payday lenders and sometimes offer better rates than high street lenders.

However, some credit unions may require you to have been with them a certain amount of time before they will lend to you. Be cautious, though, as rates can start from as low as 6% but can go as high as 43%.

My Community Bank, for example, offers loans from £1,500 to £15,000 over one to five years at an APR of between 5.9% and 42.6%, depending on your circumstances.

Meanwhile, credit union retailCURe, which launched last year, offer interest rates ranging from 7.4% APR to 26.8% APR on loans from £250 to £10,000.

You can find out more about local credit unions at Findyourcreditunion.co.uk or you can contact the Association of British Credit Unions (Abcul.org).

Note: Rates are correct as of 20 November 2018.

FEATURED PRODUCT

retailCURe Easy Access Savings Account

RetailCURe’s savings account pays 1% AER as well as the annual dividend. You can access your account online or with the mobile app and deposit up to a maximum of £15,000. In order to qualify for the account, you have to work in retail. You can withdraw money whenever you want by transferring electronically to a nominated account.

Section

Free Tag

Source Moneywise https://ift.tt/2QjUuuY