Launching an online store and trying to decide among the best ecommerce website builders, but don’t know which one’s right for you? They all seem to promise the same things: gorgeous templates, robust analytics, effortless inventory management, wonderful customer support.

I’ve got you covered. I took a look at all of the options to find the best website builder for creating an online store.

In my research, I paid attention to the following criteria:

- Functionality — The major difference between an ecommerce site builder and a “normal” website builder is you’re going to be running your business off this platform. It needs to accept payments instantly and securely. It needs to have a useful dashboard to monitor traffic, sales, and inventory. It needs to keep have a cart the makes buying easy, and a system for calculating shipping.

- Ease of use — There should be an easy way to add and remove products, an easy way to see your analytics, and an intuitive sales dashboard that can serve as your home base.

- Design — The templates should look good out of the box and be easy to customize without expert (read: $$) help; and the designs should be pretty hard to mess it up or make worse.

- Customer support — When things get tricky, you don’t want to feel like you’re going it alone.

- Marketing — The pages should be SEO optimized, and the template should work work with your social channels and easily to connect paid ad channels.

- Add ons — Since almost no system will have everything for everyone out of the box, I made sure the website builder had a way to accommodate additional needs.

- Pricing — Sure, I get that an all-in-one solution like an ecommerce website builder will be more expensive than a DIY option, but we don’t want to pay through the nose, and we want what we get to be worth it. This includes the terms for payment processing. This is the last bullet on the list for a reason though: saving a penny here isn’t worth losing out on a dollar later on.

Which online store builder should I use?

The short answer: You should probably go with Shopify, especially if you plan to do more than $5,000/month in sales. It’s the industry leader for a reason. It has the level of in-depth analytics, inventory management, POS, shipping options, and every other ecommerce feature that you need (and that you really need at the $5,000+ level. If you’re not thinking that big, it’s time to get started.

New digitally-native and niche brands are the future of retail. — “Small Is The New Big,” Forbes

If you’re running more of a professional portfolio with some sales or subscription offerings, then hen you should check out Squarespace. Price wise, they’re basically the same. Squarespace wins for design; Shopify wins for ecommerce features.

The other online store builder worth recommending is Wix, which has a pretty cool AI-builder that’ll turn your social media into a website with a coordinating color palette and pre-populated photos. If you run a bookings-based business, or a music business, then there are features in the Wix stores that are definitely worth checking out. It’s also one of the cheapest options, though if you’re picking your ecommerce platform by price alone, we need to have a side conversation about how you need to get your head in the game. There are some flaws I discuss further down in the in-depth reviews you should take into account — and see if they’re dealbreakers for you during your free-trial period.

Side note: No matter which website builder you pick, you should use the free-trial period as a test run. What features are missing and can you live without them? What’s it like to actually run your business from that platform?

I also reviewed WooCommerce which is an open-source, subscription-free way to sell things through your WordPress store. If you’re running a content site, I wholeheartedly recommend building your site with WordPress; it just wins in the content management space. Simple as that.

Finally, Weebly, which was recently acquired by payments processor Square, is fine, but not impressive. The standards set by Shopify, Squarespace and the other contenders are just too high for Weebly to hit them. I’ll keep an eye out though.

The top 5 ecommerce website builders compared

Shopify

- Best ecommerce platform for most businesses

- Drag-and-drop store builder

- 70 themes: 10 free + 60 paid

- Competitive pricing

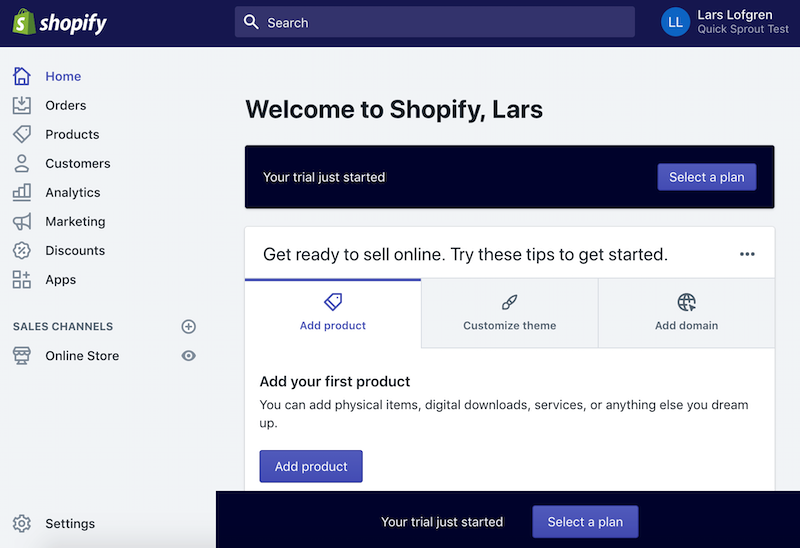

Shopify is my favorite ecommerce software — and the one I recommend to just about everyone. It’s the leader in the industry and rightfully so. The most important ecommerce features are ready to go without any customization, and Shopify makes it easy to customize anything else with its super robust app store. If you run into any issues, there’s 24/7 support.

The worst thing about Shopify is the price point — and it’s generally competitive. The subscription, which starts at $29/month is right in line with what you’d pay with any hosted option, and so are the payment processing fees, which start at 2.9% + 30¢ credit card rates and only get better from there. I just don’t like the 2% additional fee for non-Shopify payment processors. I get that Shopify wants you to stay in the Shopify ecosystem, but offering multiple payment options is better for customers and one of our 8 quick wins for ecommerce sites.

Pros

- Robust app store

- Clean, modern themes

- Intuitive product pages

- Easy-to-use drag-and-drop store builder

- Competitive payment processing rates

- Safety and security

- Speed

- Can create landing pages

- Optimized for SEO

- 24/7 Support

Cons

- Additional fee for payments from non-Shopify payment processors, like PayPal for example

- Blog feature is minimal — it’s technically there, but it’s not enough to run a content site on

- Majority of the apps in the Shopify app store aren’t free, so you could also increase your monthly spend there

- Liquid set up, not PHP

- Lock-in feature — it can be challenging to move your store away from Shopify. It’ll export as a CSV file, but it’ll be time-consuming to rebuild where you go next

Shopify pricing

It’s competitive, but like I said charges an kind of annoying fee for external payment processors. All in all, I think the price is worth it.

- $29/mo for Basic Shopify — 2.9% + 30¢ credit card rates + 2% for non-Shopify payment processors

- $79/mo for Shopify — 2.6% + 30¢ + 1% for non-Shopify payment processors

- $299/mo for Advanced Shopify — 2.4% + 30¢ + 0.5% for non-Shopify payment processors

The difference between these packages:

- Increase in number of staff accounts: 2, 5, 15

- Unlock gift cards, reporting, and advanced reporting

- Unlock third-party shipping calculations

- Better rates on shipping and payment processing as you increase in the plans

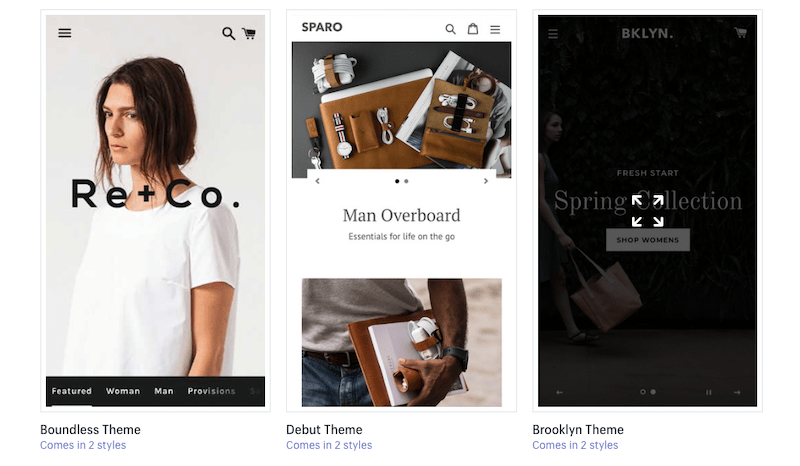

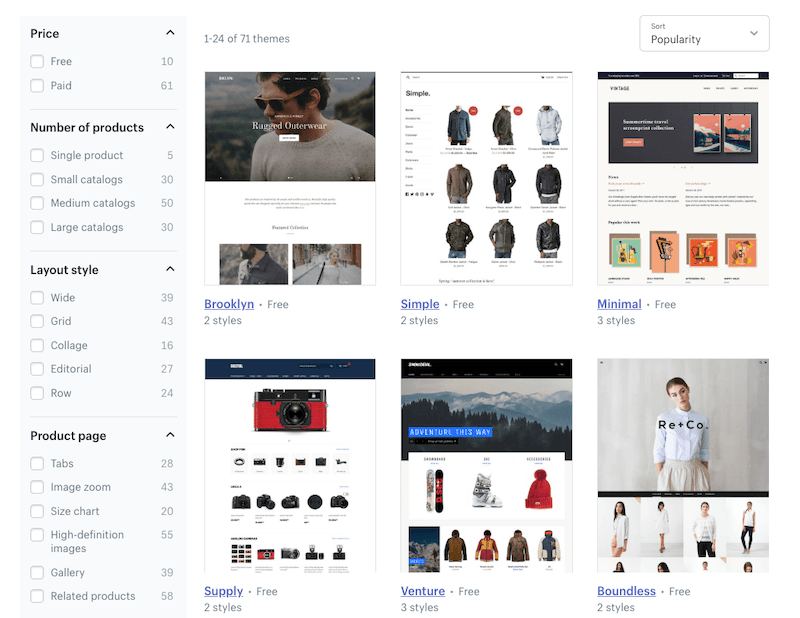

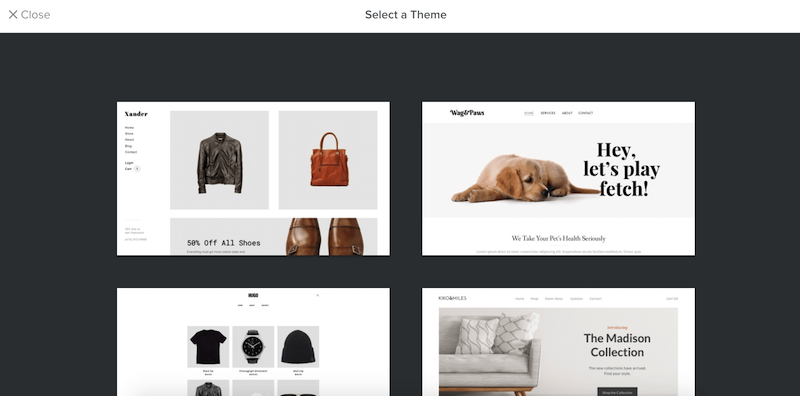

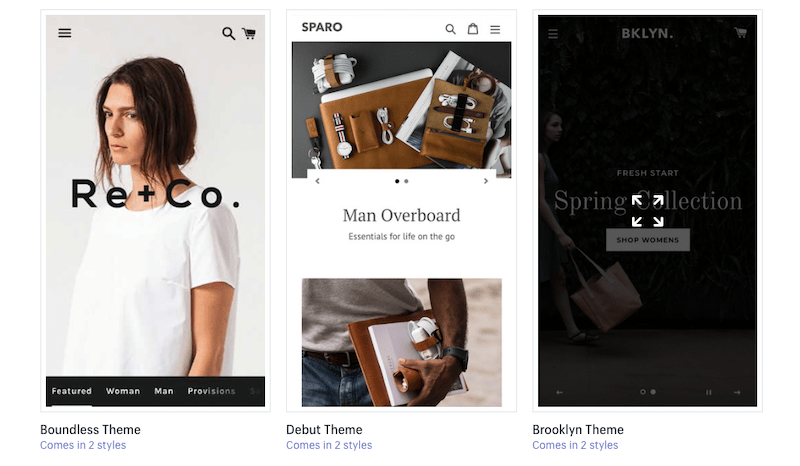

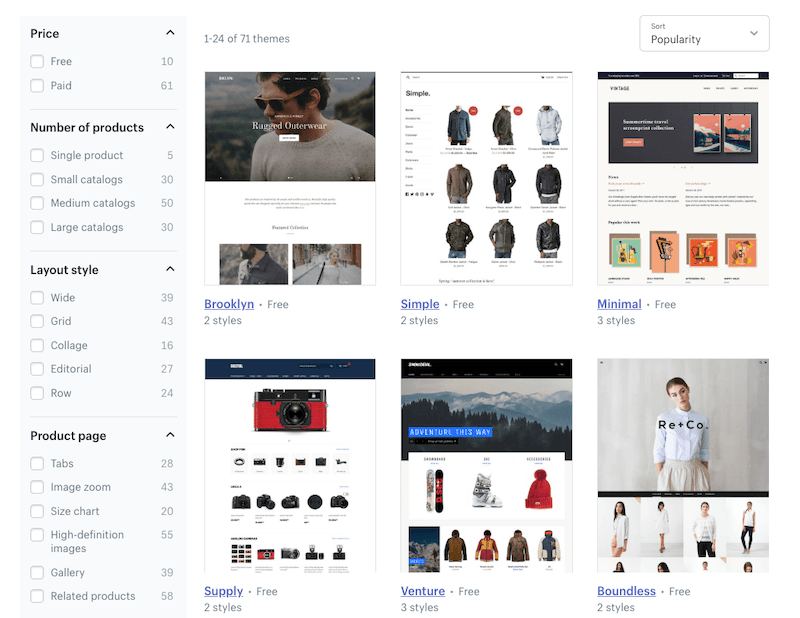

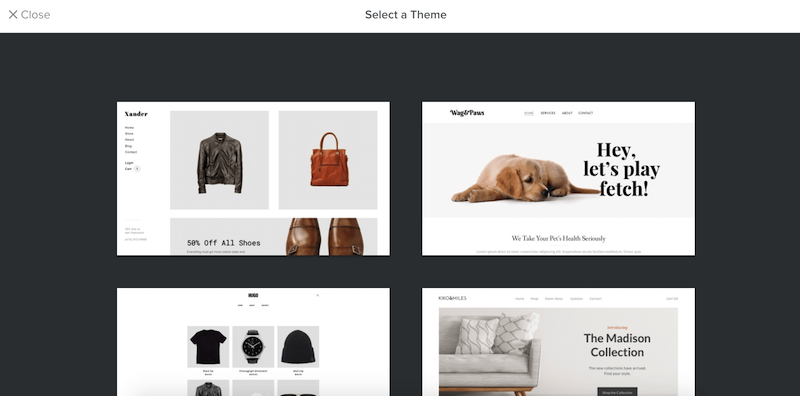

Shopify themes

When choosing a theme, I suggest skipping filtering by price point. None of the themes on Shopify are going to break the bank — the most expensive themes are $180. If a theme has what you want, that’s the theme for you. Go to the all themes and ask yourself a few questions.

The first question is the most important:

- How many products are you selling? Just one? A few? A lot? If you are selling one item your site will be very different than another online store that’s selling hundreds. In fact, set this filter and see if that’s enough to bring the templates down to a reasonable number.

If the number is still large, then you can filter even further:

- Do you need a size chart?

- What social media do you want integrated? Instagram? Twitter? Pop-up email form?

- Would you like a “related products” feature?

- Do you need video capabilities?

- What layout and menu option will be easiest for your user to navigate?

- What’s your store’s style? What’s your business like? Which theme reflects your business and creates the feeling or idea in your customer that you’re looking for? If you don’t have a clue where to start with this question, I recommend filtering by Industry. You’ll get a sense of the types of designs Shopify considers in line with most businesses like yours.

- How are you going to tell your brand story? Is it in video? Writing? Photos? Are you running a crowdfunding campaign and the goal tracker is part of that story?

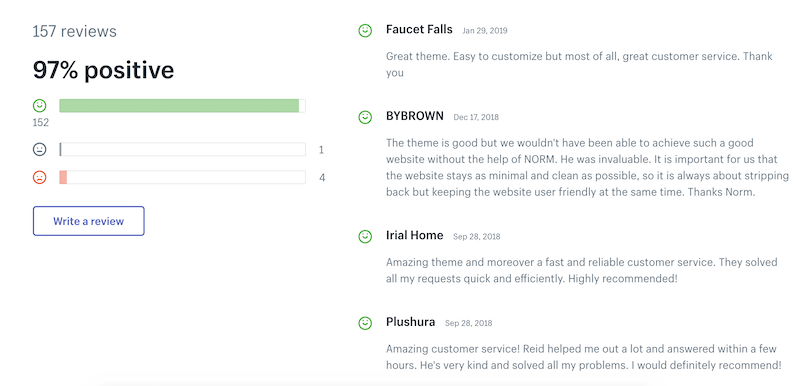

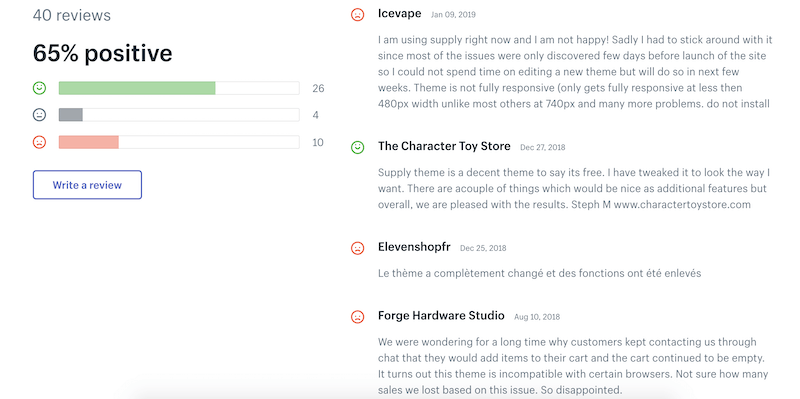

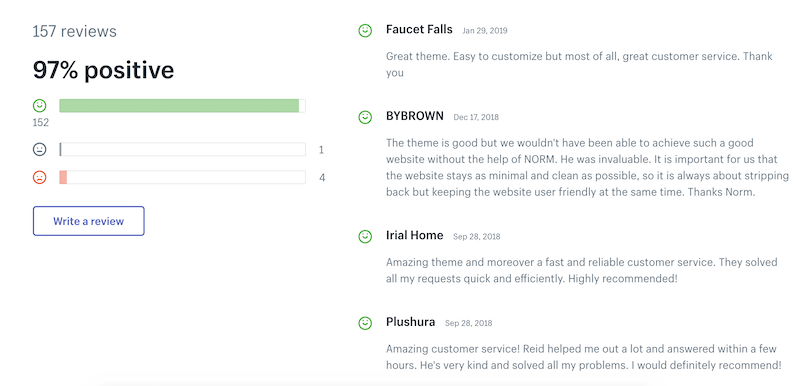

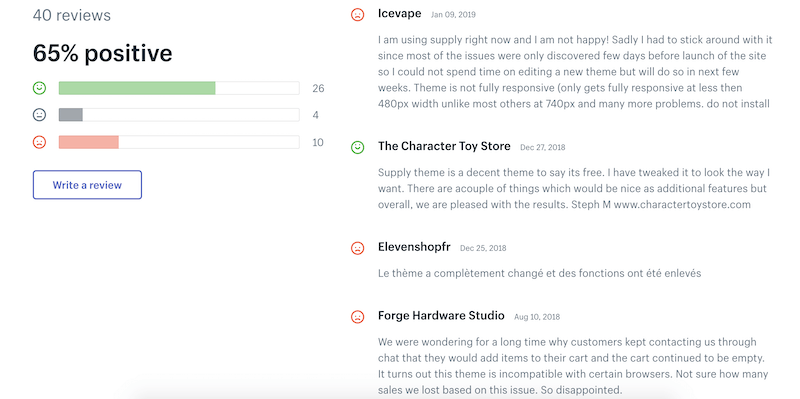

Find one you think you like? Check the theme reviews.

If other people have this theme and are frustrated, that’s a little peek into the future for you too.

Back away from themes with frustrated customers who haven’t had good luck with customer service.

Take a look at the demo sites both mobile and desktop versions. Then take a look at the actual stores using the theme. Are these in line with what you want to make?

If everything checks out, choose your theme. Don’t worry — you don’t have to buy it now. You’ll pay for it later, after you have a chance to test it out. Do check out the different versions of the theme — these will control the overall look and feel of your site, and you’ll want to decide which one you like best at this point. It can be hard to tell which one is best when you have only template content to look at.

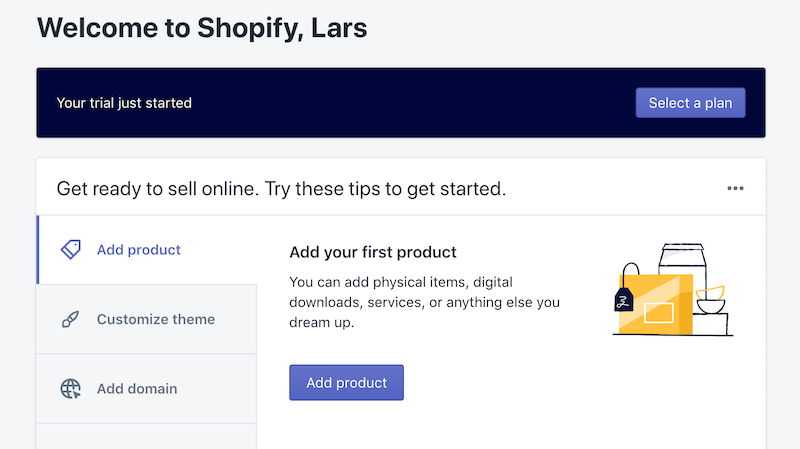

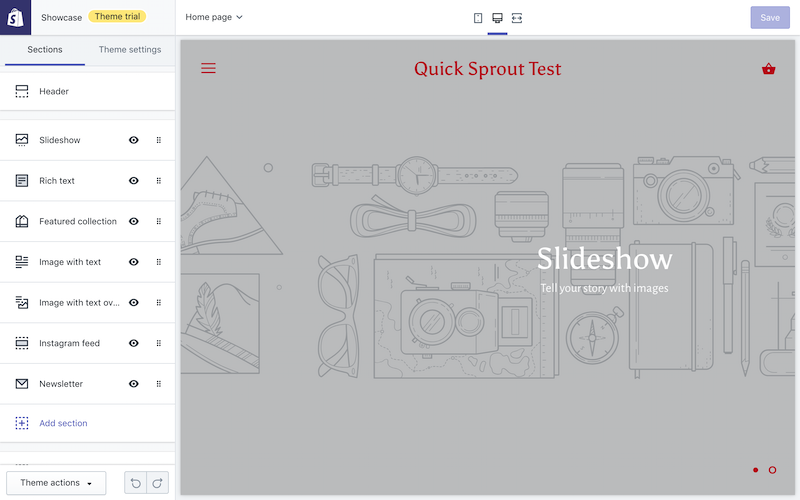

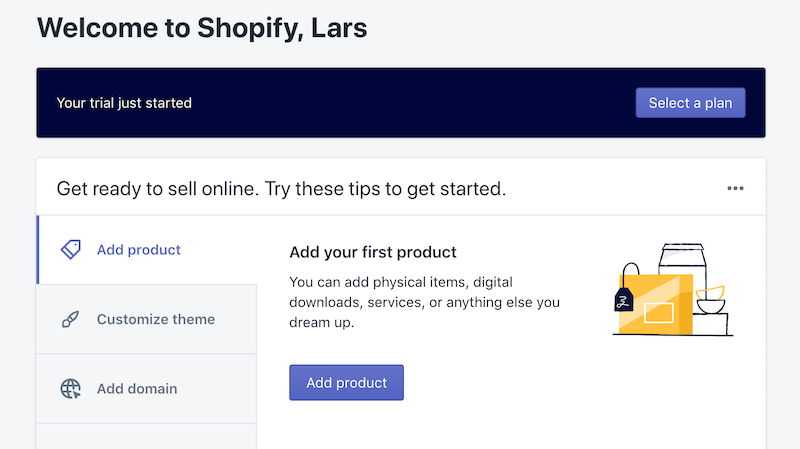

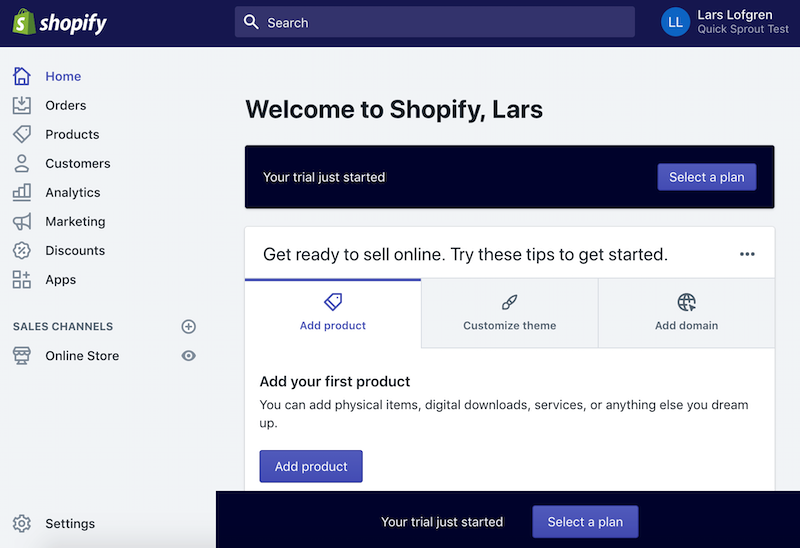

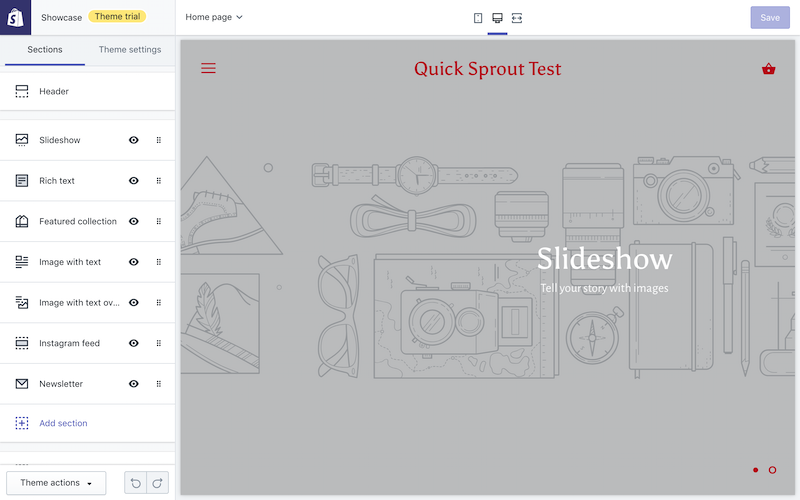

I went through this process with a hypothetical business that sells one, and found a theme I like for this business. I chose the Showcase theme because I like the full-page photography. I picked the theme, answered a few questions from Shopify and then got to my dashboard.

From here, I can add merchandise, or I can customize my theme. I’ll do a little bit of both, of course.

Key changes to make:

- Change the font — this ensures your store will look different than other stores, even stores with the same theme

- Layout, content blocks — you’ll drag and drop these in the menu on the left side and the preview will update to the right

- Attach your social media feeds

- Customize the cart experience

Shopify app store

If there’s anything your theme doesn’t have, like customer reviews, there’s the Shopify app store. Basically the apps are little snippets of code that will add a feature to your Shopify store. It’s like having a dev build something for you, but because Shopify is a huge ecosystem, you don’t have to pay them the real price of custom building you something. They’re going to sell this same code to thousands of other stores. I love this about Shopify. According to the Shopify app store, more than 80% of stores use apps — and I’ll bet if you filtered that number by the number of live, active stores that are really making sales, then the percentage would be really really close to 100%.

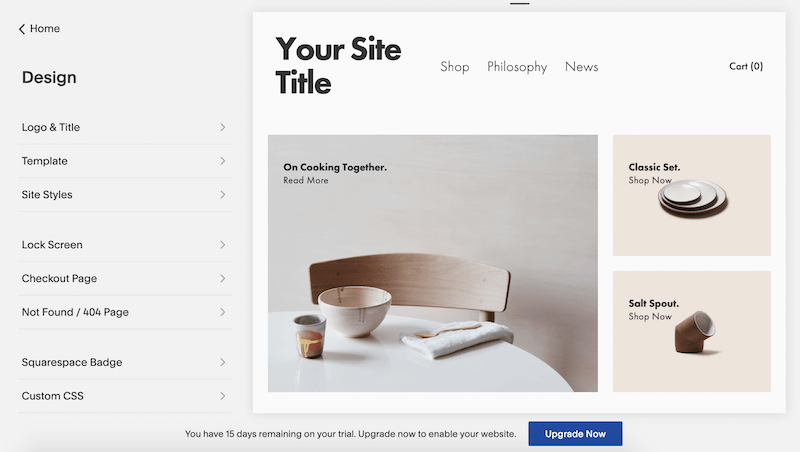

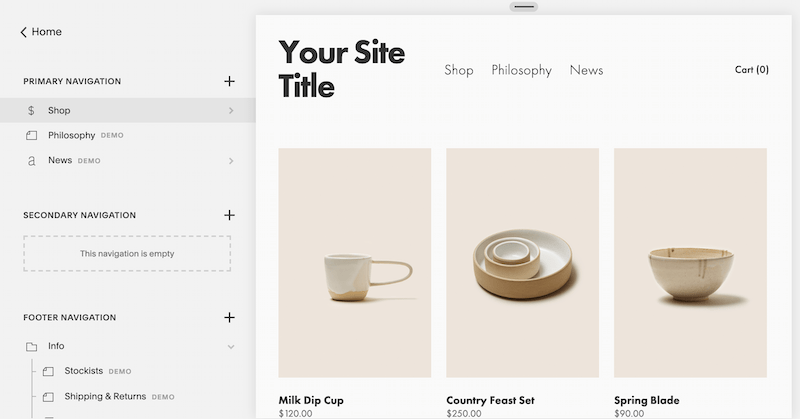

Squarespace

- Stunning templates

- Professional look

- Ideal for portfolio sites

- Has a learning curve

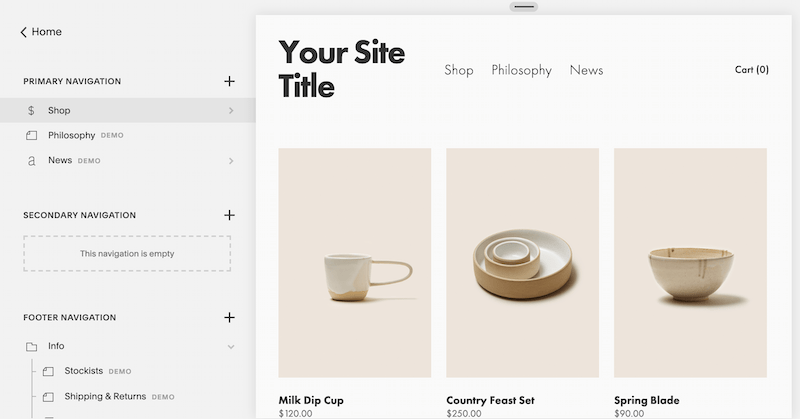

Squarespace has a reputation for beautifully designed templates. That reputation applies to its ecommerce store themes as well. They’re handsome, I must admit it. There are a few things you should know going in: I recommend Squarespace more for professional portfolio sites than true ecommerce stores. It’s just set up for those kinds of stores better.

It’s not a bad idea to run your online store with Squarespace; Shopify is just easier when it comes to managing inventory and customizing every little nuance of your store. The Squarespace builder is a module-based builder. It’s not drag-and-drop — but you can get the hang of it pretty easy. Don’t get frustrated by the “demo” content or “sample” pages. You’ll have to copy the page before you can customize it, a silly step but not one to deter you from getting your work done.

Pros

- Gorgeous templates

- Incredible looking result

- 24/7 support

- 15-day free trial

Cons

- Tabbed interface that’s not super intuitive

- Design requires high-quality photography (which you should get)

- Only integrates with Stripe, PayPal, and Apple Pay

- No app marketplace

Squarespace pricing

- Basic online store: $26/month billed annually

- Advanced online store: $40/month billed annually

What’s the difference between these plans?

The Advanced plan includes flexible coupons, subscriptions, abandoned cart auto recovery, gift cards, and advanced shipping. Unless you want one of these features, you’ll be good with the Basic online store. There are also two other plans that aren’t aimed at ecommerce stores — Personal website for $12/month billed annually, and Business website for $18/month billed annually. With the Personal plan you can’t sell anything. With the Business plan you can, but you’ll pay a 3% transaction fee. If you’re doing more than $275 in sales each month, there’s no question between the two plans — you’d be paying in fees the difference in the price without unlocking any of the online store features like inventory, tax, coupons, and shipping labels.

You can also upgrade or downgrade your plan at any time. Unless you know you want one of the Advanced features, I’d start with the Basic online store and go from there.

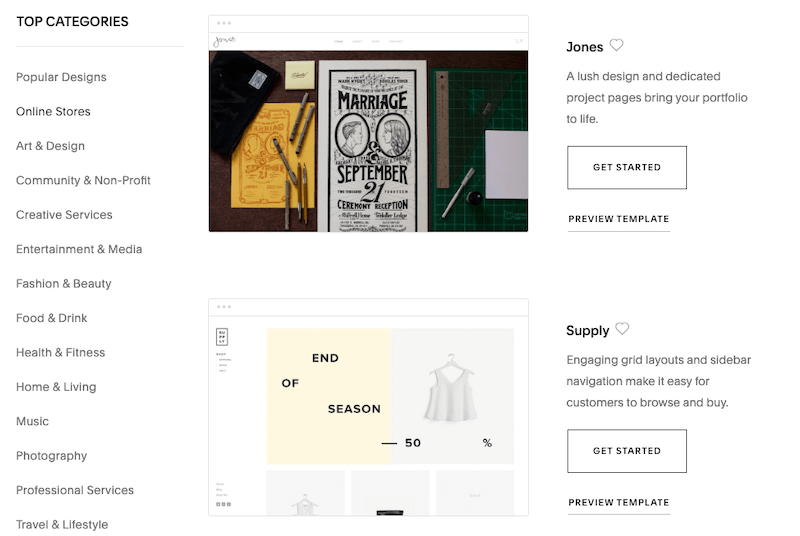

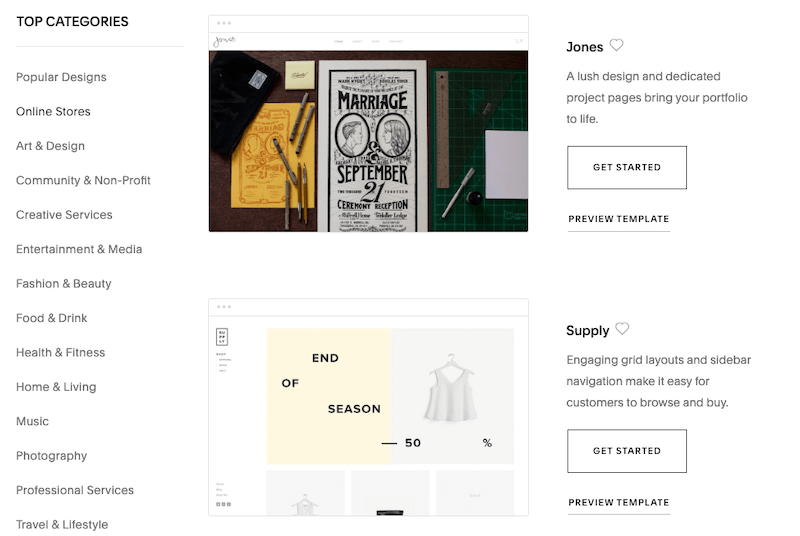

Squarespace templates

All of them are beautiful. Let’s start there. To find one that fits your store, I’d start by sorting into Online Stores. You’ll see your options are narrowed to 11 templates. Then ask yourself:

- How many products do I want featured on the homepage?

- What amazing photography do I have?

- Do I want to use video backgrounds?

- Does the quality of my images stand up to the quality of the Squarespace design?

- Do I have much to say in words? Do I want those words over the top of my images or beside them?

- What kind of menu do I want?

- Do I want anything specific: Grid layout? Scrolling features? On-hover effects?

I suggest you preview the theme and notice what it’s like to use the example layout. To be honest, your site is going to be at best like this one, so if there’s anything you don’t like, take note. It’ll likely annoy you even worse in your own store.

Once you find a layout you like, click Start with “Theme Name.” You’ll create an account at this point. Don’t worry, you don’t have to pay yet — you have a 15-day free trial to customize the store and make sure it’s what you want.

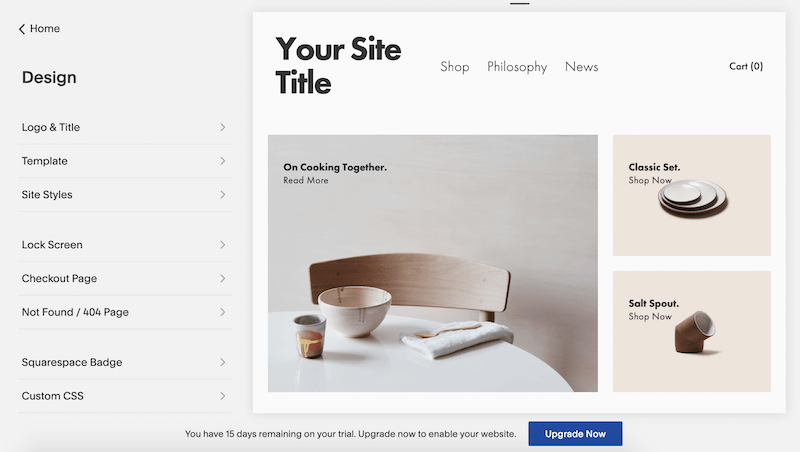

To make changes to the pages, you’ll need to make copies of the sample pages. The interface is minimal and soothing, but not very helpful. Just get in a meditative mindset and keep clicking to figure things out. There are a lot of tabbed sections, which I don’t love. But it’s not challenging.

I wouldn’t call the builder drag-and-drop — it’s more of a module based style to build and go. You’ll get use to it the more time you spend with the system. Though, I’ve gotta say, if you’re using Squarespace, I suggest you take your cues from the design that’s ready-made. It’s one of the things you’re paying for.

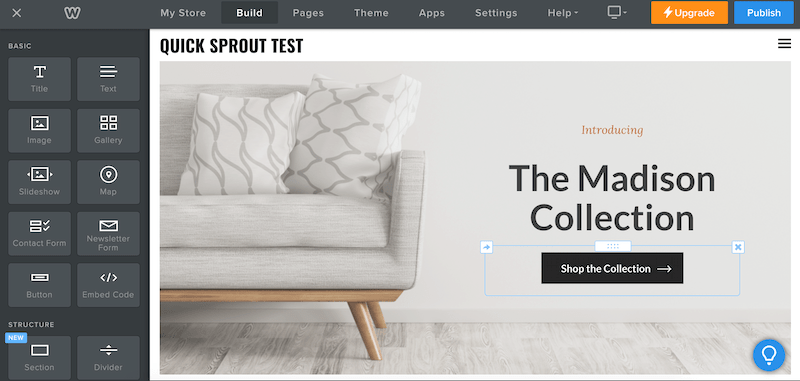

Wix

- 500 templates

- Drag-and-drop without limitations

- Quick-start with the help of an AI designer

- Unique templates for booking, music, events and restaurants

I really like the way Wix has used AI to automate the design decisions. It’s the exact opposite of the Weebly approach of making you pick a theme based on your first glance. If you already have some web presence — maybe in your Instagram or Facebook — Wix will take the work you’ve already done and create a website to match. You can also start from scratch. That’s one of the things I like most about Wix. It’s pretty much down to help you build your online store the way you want to: with help or without, from scratch or from a template, in the drag-and-drop builder or deep in the code.

Pros

- Cheapest website builder in this list

- Dozens of payment gateways including Square, Stripe, and 2Checkout

- VIP Priority Callback support option

Cons

- Limited reporting and analytics

- No way to automate or integrate tracking numbers

- Product pages don’t have a sort filter

The biggest drawbacks for Wix are its store features. Some very basic things you’ll want to do if you’re actually shipping products may become very irritating. I’m talking things like attaching tracking numbers to orders or downloading your reports.

If you’re making the choice on which ecommerce website builder to use simply on price, I implore you to stop using that as your methodology. There is a false logic at play. The $6 you’d save by choosing one website builder over the other will not be worth it when you’re wasting time trying to make the software do something it’s simply not built to do. Give the website builder you do select a thorough test run during your trial. This is the software you are using to run your business — don’t let a few bucks stand in the way of getting software that’ll really support you.

Wix pricing

- Business Basic for $20/month

- Business Unlimited for $25/month

- Business VIP for $30/month

What’s the difference between these plans?

- Storage: 20GB, 35GB, 50GB

- Video hours: 5 hours, 10 hours, unlimited

- VIP plan also gets VIP support with Priority Response

- There are also 4 non-ecommerce plans that won’t allow you to accept payments

If you’re interested in learning how to make a Wix website for your online store, I have a whole tutorial on it, so I won’t repeat myself here.

WordPress with WooCommerce

- Complete control over your ecommerce site

- No subscription fees

- 1 theme, with variations and customizations

WooCommerce is a little bit different than the other ecommerce options we’ve looked at so far. It’s a self-hosted option, which is the more DIY version. A website builder like Shopify is like living in a hotel where everything is already included: there’s a coffee maker and coffee grinds, clean towels, and shampoo. If anything breaks you know you’ll have help. But it’s also more expensive and you have less control and ownership. You can’t take the towels from the hotel home with you, for example. With WooCommerce, you’ll build your own site on WordPress and use the free WooCommerce Storefront theme. It’s not a drag-and-drop website builder, but you can customize the look and feel.

Pros

- Free theme

- Works with WordPress blog

- Great for content-heavy sites

- Easy to customize with add-ons

Cons

- Not a drag-and-drop builder

- Not an all-in-one solution

WooCommerce pricing

- Free

- Common add-ons range from $10–$60 a year

With WooCommerce you can get started for free. You’ll need to buy a domain name and set up web hosting. We have a how-to guide on all those steps here in How to Start a Blog. When you get to Step 6, choose a theme, you’ll choose the WooCommerce Storefront theme. There are a few different “child themes” to choose from — these change the look of the theme the way a new coat of paint changes the look of a room. Some child themes are free; others are $39.

I recommend also checking out the WooCommerce extensions. Most sites will benefit from the customizer bundle. You may also need features like the pricing table, a contact section (yes, you definitely want this), and maybe a hamburger menu. Some extensions are free, others are paid. The price points are reasonable.

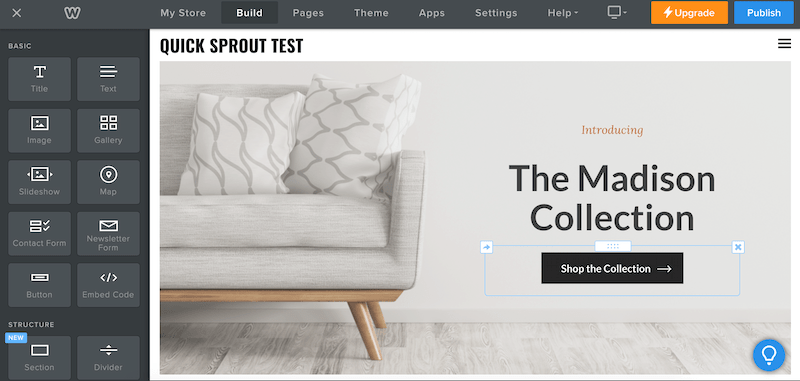

Weebly

- 35 ecommerce themes

- 348 apps

Weebly was bought by Square in 2018, and though Weebly is run as a separate business, it’s clear to me that Square is attempting to bolster it’s full-service suite of offerings for small businesses — with the cornerstone of that suite being in-person POS systems and payment processing. The drag-and-drop builder is intuitive, but the set-up and guidance isn’t all there for me. For the price point — $4/month less than Shopify — I don’t think it’s worth going with Weebly.

Pros

- Intuitive drag-and-drop builder

- Includes memberships, forums, support

Cons

- Not very useful in helping pick a theme

- No way to sort themes by feature

- Cluttered page system that’s not good for more than 10 pages

- You’ll need to manually copy blog posts if you migrate

If you’re launching an online store, you can skip right over the Starter and Pro plans — you’ll be pay a premium of 3% on every transaction and you’ll be limited in a lot of ways. You won’t be able to modify your cart, for example. For the price, I think you’ll get a better store from Shopify’s $29/month plan.

- Starter $8/month annually

- Pro $12/month billed annually

- Business $25/month billed annually

- Performance $38/month billed annually

What’s the difference between these plans?

- Weebly transaction fee: 3% on Starter and Pro, 0% on Business and Performance

- Number of products: 10, 25, unlimited, unlimited

- Features only available on Business and Performance: Shopping cart, digital goods, product reviews, coupons, inventory manager, shipping calculator, among others

Weebly themes

When you create a store, Weebly will ask what you’re selling and if it’s online or offline, or both. After just two questions, it’ll pop you into a store for you. This seems kind of curt, and it is. When you click customize your store, you’ll be able to choose a new theme. How will you decide? Weebly doesn’t make it easy — there’s a page of themes offered, but you can only sort them by the top-of-the-fold look and feel.

Weebly pricing

The first few options are pretty and white.

Take note of a few things:

- How large are the photos?

- Is there a border?

- Is there text on the photos?

- Is there a CTA?

- Where is the menu?

- How many products are featured in that first view?

Since there’s no filtering, your best hope is to choose one you think looks like your store should look.

It’s pretty intuitive to add products and personalize your store. Keep checking back with the preview and you should do fine.

In sum: How to choose the right ecommerce platform for your online store

For an online store, you can’t go wrong with Shopify. It’s the industry leader, easily one of the best ecommerce website builders, and it’s well worth the price point. I like it a lot — particularly how much you can customize it with the app store. It’s got the analytics you need to run a real ecommerce shop. I also like the designs from Squarespace. They really do make it possible for a total beginner to create a professional looking site.

The other contenders for all-in-one builders are Wix and Weebly. I found them to have limitations, so they’re not my top picks. I did like the Wix AI creator and the features it boasts for booking businesses and other speciality stores, like music or video creators. It’s worth checking out (there’s a free trial period) if one of those things intrigues you. I’ll keep tabs on Weebly. However, right now it doesn’t come close to competing with Shopify and Squarespace.

If you want to run a WordPress site, then look into WooCommerce. You’ll find it is very familiar and has all the things that are great about any WordPress site: nearly limitless customization, great content management, excellent SEO, all subscription-free and open source. Granted, you’ll probably end up spending some on customizations and will need to throw down for your domain name and your web host. But if you’re the type that’s curious about building a self-hosted site, you already knew all that.

Source Quick Sprout https://ift.tt/2HrCM35