الأربعاء، 2 يناير 2019

How To Protect Yourself From Mobile Malware: New Research Shows Increased Threats to Mobile Devices

Source CBNNews.com http://bit.ly/2LR237i

Five New Year's Resolutions To Raise Your Credit Score: Make 2019 The Year of Fiscal Responsibility

Source CBNNews.com http://bit.ly/2s3T7Cn

How to Start Using Instagram to Grow Your Small Business

Every business needs an active social media presence. This statement holds true whether you have a small, medium, or large company. In fact, it’s more important for smaller businesses than large ones.

Big brands like Apple and Nike are already household names. If they stop using social media right now, they’ll probably still generate sales.

But you can’t make a sale to people who don’t know who you are yet. Just like you can’t rely only on foot traffic to your brick-and-mortar store, if you operate online, you can’t rely solely on people navigating to your website.

That’s why you need Instagram as a marketing tool.

Honestly, if you’re not currently using Instagram, you’re behind: 71% of businesses are already using Instagram as a marketing channel. But it’s not too late to get started. That’s the inspiration for this guide.

According to Instagram’s user data, 80% of accounts follow a business. It’s obvious that people are willing to follow and engage with brands on Instagram. The key for you as a small business marketer is to figure out how to take advantage of this opportunity to drive growth for your company. This article explains some beginner strategies to stimulate business growth on Instagram and teach you ways to convert your followers into customers. If you’ve created an Instagram profile, but it isn’t active or effective, you can benefit from this information too.

Promote your profile with your existing customers

When you start your account, it’ll come with zero followers. It can be a little discouraging to start from zero, but you don’t have to start from scratch. Rather than trying to get random followers who don’t know who you are and don’t know anything about your brand, turn to your existing customers.

Start with your email subscribers. Check out how MeUndies signs off its marketing emails.

The CTA here is to follow MeUndies on Instagram.

Your email list isn’t the only place to recruit current customers to Instagram. You can promote your profile on your other marketing channels as well:

- YouTube videos

- website

- blog posts

- other social media profiles

- purchase receipts

- in-store signs

Take a look at how Shady Rays uses its website to get more followers on Instagram.

The social media feed showcases their most recent Instagram uploads. If you click on any of the photos here, it will bring you to that image on Instagram. There’s also a direct link and a CTA to follow Shady Rays on Instagram.

Showcase your products

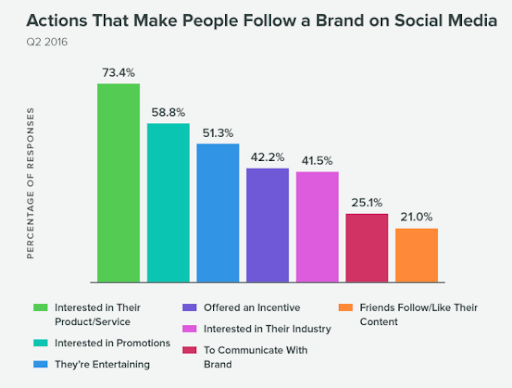

Now that you’ve got followers, let’s take a look a the reason they’re following your profile. Coupons? Sales? Let’s look at the top reasons why people follow brands on social media.

The number one reason people follow brands is because they’re interested in that brand’s products and services. That reason ranks higher than promotions and incentives. So while it’s not a bad idea to give people an incentive to follow your profile with an exclusive discount or another offer like that, research shows that more people follow a brand out of interest alone.

That means it’s definitely OK to show them your products.In fact, 65% of the top performing posts on Instagram featured a product. (This is a great chance for you to generate sales for a new product release.)

But, you don’t want to oversell on Instagram: 58% of users think it’s annoying when brands post too many promotions. So, showcase your products, but do so sparingly.

Take advantage of shoppable posts

It’s one thing to show products to your consumers. But Instagram gives businesses the opportunity to sell products directly through their platform. Shoppable posts take our last strategy one step further.

60% of people use Instagram to find new products and 75% of those take action after viewing a post. Those actions can lead to conversions, especially if you use shoppable posts.

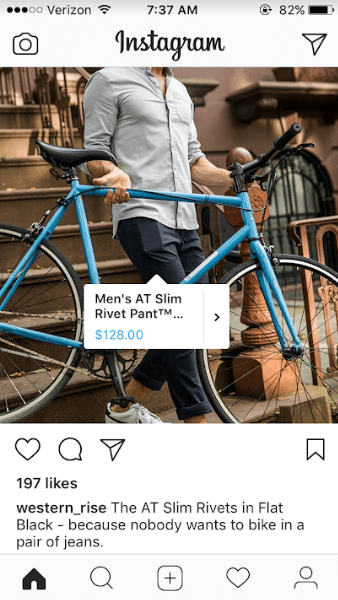

Here’s an example from Western Rise of a shoppable post.

It’s just a regular photo. But the promoted product is tagged. The tag includes the name of the product and the price. When a user clicks on the link, they are directed to a product page where they can buy that product.

This is far more efficient than what businesses had to do before this feature: In the past, brands would have to post about a product and then say things like, “find this on our website,” or “link in bio.” Way too many steps. Plus, if you had to use the one link in your bio, you couldn’t promote more than one item at the same time. Shoppable posts have way less friction and increase your chances of driving conversions.

You can also run shoppable stories. It’s the same approach: simply tag products in your story instead of your profile.

If you haven’t used this tactic before and need some help setting them shoppable posts, refer to our complete guide on how to increase ecommerce sales with shoppable posts on Instagram.

Tag a purposeful location

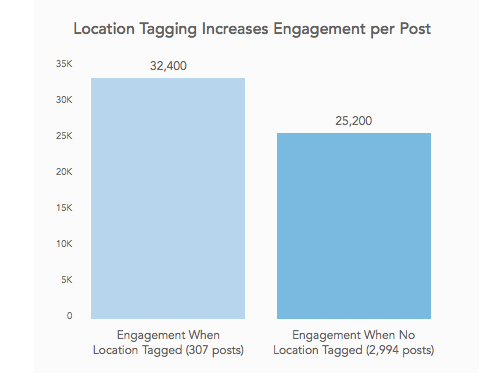

Next up, location tags. If you haven’t been using location tags, you aren’t maximizing your potential engagement. Just look at the effect that a simple location tag can have on your metrics.

Posts with location tags have more engagement.

There are a few reasons for this. First, tagging the location can make your post more visible on the popular page for people in that area. Second, people who are viewing that specific location on Instagram have a better chance of seeing your post.

The great part about location tagging is that you don’t actually need to be in that area you’re tagging to tag it. Let’s say you run a Boston-based company that sells bathing suits. You’re probably not going to be selling bathing suits to many locals in that area during the winter months. And you’re probably not going to increase your engagement all that much by tagging a bathing suit picture in Harvard Square. Instead, you can upload photos of your products on Instagram and tag warmer locations, like Miami or San Diego. This will lead to higher engagement rates, which will increase your social following, brand awareness, and chances that people will buy your products.

Add photos with faces

Let’s continue talking about engagement. Photos of products alone don’t perform as well as photos with faces. In fact, photos with faces generate 38% more likes than posts without a face. Furthermore, posts with faces get 32% more comments. The more people engage with your posts, the greater your chance of driving conversions that will ultimately help your small business grow.

Here’s another example of a shoppable post from PX Clothing that includes a face in the photo.

This is more effective than posting the duffle bag by itself without a face in the photo.

Partner with social influencers

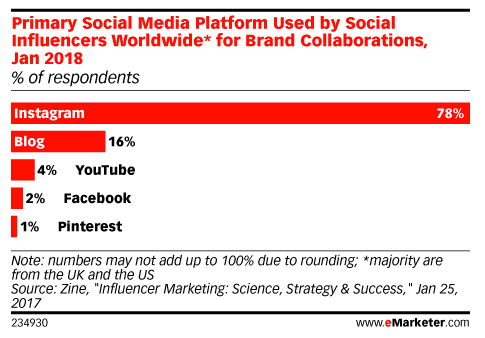

When it comes to influencer marketing, Instagram leads the way for brand collaborations with social influencers.

Your competitors might already be using this strategy. Now is your chance to jump on board to keep up with them. If you’ve never done this before and you don’t know where to get started, you can use our guide on the top platforms for effectively managing social influencers.

You’ll want to find influencers that have a strong following within a specific niche that speaks to your target audience. For example, let’s say you’re targeting women in New York City between the ages of 24 and 35. That doesn’t necessarily mean that you should be looking for influencers who fit that profile. Instead, you’ll want to find an influencer who has lots of followers that fit your target market. These resources will help you get connected with influencers in the right industry that will reach your target audience.

Run ads to generate leads and sales

Depending on your marketing budget, Instagram ads can be a suitable strategy for you to consider. If you’ve run Facebook ads in the past, you’re already familiar with how this works — Facebook owns Instagram and the two platforms use the same ad manager. You can choose your target audience, location, and budget.

The great part about advertising on Instagram is that you can have ads run in multiple formats.

- photo ads

- video ads

- carousel ads

- collection ads

- story ads

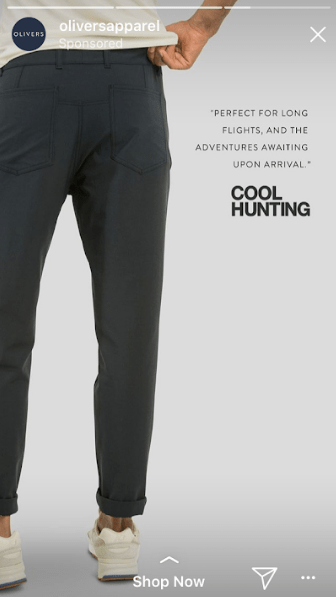

If you run story ads on Instagram, you’ll want to leverage the “swipe up” feature. Here’s an example from Olivers Apparel of what that looks like:

The “shop now” CTA at the bottom of this sponsored story takes users directly to a landing page where they can purchase the pants being advertised. This can definitely help increase conversion rates because it eliminates additional steps in the purchase process.

Encourage UGC

Another way to grow your business on Instagram is with user-generated content.

82% of consumers say that user-generated content is valuable to them during the purchase process. 48% of people say they discover new brands and products as a result of UGC. When customers get exposed to UGC, brand engagement increases by 28%.

One of the best ways to accomplish this is with contests.

This is one of our favorite strategies for several reasons. First, it helps you get more followers. For one of your followers to enter a contest, they’ll need to upload a photo to their own profile and tag your brand. In doing this, it increases the exposure to all of their followers, who may not currently know your brand or follow your profile. This added exposure will entice more people to follow you on Instagram. That’s because UGC is memorable and trusted.

People who see a user-generated photo on Instagram have a 4.5% greater chance of converting. If they interact with the post, such as liking it or commenting on it, they are 9.6% more likely to convert.

Engage your followers

It’s important for you to connect with your Instagram following. Now that you’ve found so many new ways to get followers, likes, and comments. You don’t want to lose those relationships.

Reply to their comments. Answer direct messages. If you don’t do this, you’re not providing the appropriate customer service needed to drive business growth. On the other hand, using Instagram to improve your customer service will definitely help your business grow.

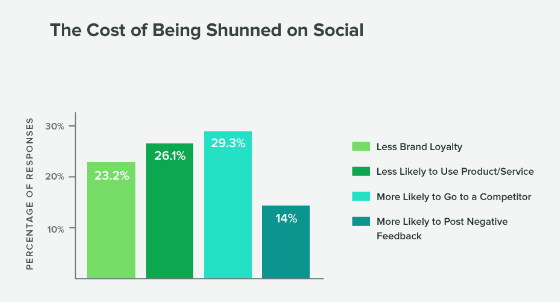

Here’s what will happen if you ignore customers on social media.

People expect brands to respond within four hours after they reach out on social media. The average response time is ten hours. 35% of consumers say that social media is their top choice for customer care, yet 89% of social media messages are ignored by brands.

Don’t let this happen to you. If you’re having trouble managing all of your Instagram messages with other social media comments, our favorite time-saving social media marketing tools can help.

Conclusion

As a small business owner, you need to establish an active presence on Instagram to grow your company. If you’re starting from scratch or don’t have many followers right now, turn to your existing customers to build a following on your profile.

Use Instagram to showcase your products. Drive sales directly with shoppable posts.

Find ways to increase your engagement, such as tagging your location, uploading photos with faces, and leveraging relationships with social influencers.

You can also run ads to generate brand awareness, increase your followers, and drive sales.

Create campaigns that encourage user-generated content, which will increase your reach in a trusted and memorable way.

Don’t ignore customers when they reach out to your brand with comments and direct messages.

How are you using Instagram to drive growth for your small business?

Source Quick Sprout http://bit.ly/2ApYPmu

Are Model Year-End Car Sales Really a Good Deal?

If you’ve turned on a TV during the last few months of the year, you’ve probably seen ads from your local car dealerships touting the huge savings you can get with their model year-end sales.

But because we’ve been trained to be cautious of too-good-to-be-true sales, and of car dealerships in general, we have to ask ourselves: Are model year-end sales really the best time to buy a new car?

For most, the answer is actually yes. Model year-end sales are when you can find the best deals on new cars. This is when dealers are starting to get in more of the next model year’s vehicles, and they have a pressing need to get rid of their current model-year leftovers.

This year, for instance, dealers are pushing out the last of their 2018 models as 2019 models continue to show up on their lots.

According to Edmunds, December has, on average, the highest discounts off manufacturers’ suggested resale prices (MSRPs): 6.1% off, in fact. When you’re talking about a $30,000 investment, a 6% discount saves you $1,800. New Year’s Eve is a particularly good day to purchase; TrueCar estimates you can save up to 8.3% if you buy on Dec. 31.

And it’s not just the discounts off MSRPs that model year-end sales include. Dealers will typically offer other incentives like lower annual percentage rates (APRs).

Why Year-End Car Deals Are So Good

Why can you get such a good deal on a new car, truck or SUV at the end of the year? It all comes down to sales goals. A dealership will have a sales goal that it needs to reach by close of business on Dec. 31, and as that terrifying date approaches, salespeople must scramble to incentivize buyers. The sales staff also have their own annual goals that affect their commissions, bonuses and raises.

Autotrader also suggests that, in much of the United States, cold weather keeps people from heading to the dealership around this time. That makes salespeople even more desperate to make the sale when shoppers do stumble onto the showroom floor.

The Downside to Model Year-End Sales

Everything good comes at a price — including low prices. Though you might be getting the very best deal on a new vehicle when you take advantage of a model year-end sale, you are exposing yourself to a few negatives.

For starters, your choices will be limited. Dealers are trying to clear out their lots, so the pickings may be slim when you arrive. That means you might not be able to get the exterior color, specific trim level or towing package that you were hoping for. To get the lower price, you might have to compromise on a few of your wants.

When you buy an outgoing model, you also pass up the latest technology. Maybe the 2018 model at a discounted price, for example, doesn’t come with blind spot monitoring or Apple CarPlay, but the new 2019 model offers those as standard features.

The biggest drawback to a model year-end sale, however, is the depreciation factor. When you go to sell that 2018 vehicle years later, it will be worth less than the 2019 model you could have purchased on the same date. It won’t matter that you bought it so late in the model year and that it has the same amount of miles on it as the 2019 models; the mere fact that it is one model year older will reduce its value.

Other Opportune Times to Buy a New Car

End-of-year sales, which can start as early as October, aren’t the only good time to purchase a new vehicle. They certainly offer the best deals, but you can find good deals on vehicles throughout the year.

If you aren’t going to buy in the year-end months of October, November (think Black Friday sales) or December, U.S. News & World Report says a good month to purchase is May. Why? Dealerships typically offer tremendous savings on Memorial Day weekend and also offer great deals throughout the month as shoppers begin to receive their tax rebates.

U.S. News & World Report also lists Monday as the best day of the week to purchase a new vehicle, simply because sales staff are less busy and can spend more time negotiating with you. And if you can pick a Monday at the end of the month, all the better. That’s because, according to Edmunds, salespeople are trying to hit their monthly sales goals, just as they are trying to hit yearly sales goals in December.

And the absolute worst time to buy a new car? January through April, says Edmunds. But if you find yourself in a need of a new set of wheels in the heart of February, don’t sweat. Check out these car-buying tips, and be ready to negotiate like a pro. And don’t forget to get the most money out of your trade-in: Here’s how.

Timothy Moore is a market research editor and freelance writer covering topics on personal finance, careers, education, pet care and automotive. He has worked in the field since 2012 and has been featured on sites like The Penny Hoarder, Debt.com, The Ladders, Glassdoor and The News Wheel.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder http://bit.ly/2EZwlmR

Eight Simple Things You Can Do Right Now to Put Yourself on a Better Financial Trajectory

The median American household income is about $60,000. Almost eight in 10 American households are living paycheck to paycheck, struggling to just get by. The majority of American workers believe they will always be in debt. The majority of Americans save less than $100 each month. It’s a bleak picture out there, folks.

The thing is, most households could make just a few tweaks to their lifestyle and simply stick with those tweaks and they’ll put themselves on a completely different trajectory. There are many, many little tweaks out there that people can make to their financial lives that they’ll barely notice, but in the background those tweaks will gradually contribute to a better and better financial situation over time.

Here are eight of them.

Increase your 401(k) contributions at work (or start one).

If your workplace offers a 401(k) or 403(b) or TSP plan or something similar, sign up for it and start contributing a small sliver of your paycheck. (How much? Start with just a couple percent of your check; if your employer offers matching, try to contribute enough to get every dime of that.) Don’t sweat the investment option – if your plan offers a target retirement fund, just choose that one.

If you already have such a plan in operation, just bump up your contributions by 1%. Go from 2% to 3% or from 3% to 4%.

- Read more: A Complete Beginner’s Guide to 401(k) Plans

Cut the cable cord.

“But how will I pay for those additional 401(k) contributions?” One simple way to cover it is to finally cut the cable cord. Look at alternative streaming options for your entertainment needs like Netflix and Sling. We cut cable several months ago and our family legitimately didn’t even notice; we saved about $80 a month due to the move and we replicated virtually every program we watch with a mix of Netflix ($10/month), over the air coverage with a digital antenna (free), Sling ($25/month), and occasional HBO Now binging.

As I was writing this, I asked my family if there were any programs that they actually miss and couldn’t watch right now that they would watch if we still had cable; one child named one program and another child showed them immediately where it could be found, and no one else could come up with anything. Talk about low hanging fruit to save $80 a month.

Start an automatically-funded emergency fund at another bank.

This one’s simple. Just open up an online savings account at another bank (Ally is a good choice and is pretty universally recommended by The Simple Dollar) and set up an automatic contribution to that account from your main checking account. Have it move over $10 a week – you probably won’t even notice that. At the end of the year, you’ll have $522 (or so) in that account, which is more than enough to handle a real-life emergency like a car breakdown or something of that nature. Put aside $15 a week and you’ll be around $783. Put aside $20 a week and you’ll have $1,044 or so.

Forget about that transfer. Just let the new account keep slowly filling up a drip and a drop at a time from your main checking account. Then, when emergency strikes, you can just sign into your new online savings account and transfer the money back to your checking and suddenly you don’t have to go into credit card debt to deal with the emergency. Rather than having a hefty new balance on your card, the financial emergency is just handled.

Negotiate a better cell phone deal.

“But how will I get the money for that emergency fund?” A simple way to come up with enough money each month to fill up that emergency fund is to shop around for a better cell phone deal. See whether or not other providers in your area are offering a good deal. Check the big ones like Verizon and Sprint, but don’t overlook other smaller providers like Ting and Cricket.

Figure out a plan that gives you what you need, and don’t forget to look at the new customer offerings for your current cell plan. Then start by calling up your current company and say you’re looking at jumping ship to this other offer because you simply can’t afford the current plan and see what you can get. Many cell phone companies will match – or come close to matching – that other offer to retain you as a customer. Boom – instant savings. (Note that this doesn’t work really well if you’re in the middle of a contract.)

A strong suggestion here: Be courteous and calm and pleasant when talking to customer service representatives. They have thankless jobs and often catch verbal abuse from other callers. Try to make their day as pleasant as you can and you might just find that they’re more willing to help you than you might expect. A customer service rep won’t go the extra mile for a raging customer, but they might just do so for a nice, pleasant one.

Start a Roth IRA and automatically fund it.

What do you do if you don’t have a 401(k) plan at work? Or what do you do if you’ve heard your plan at work is pretty bad? The solution is to start your own Roth IRA, which is essentially a “do it yourself” retirement account offered by most investment firms. I have one myself, through Vanguard.

Getting one set up is easy. Just go to your financial institution of choice and sign up for one – it’s much like signing up for a checking account. You’ll have a plethora of investment options available – a good default choice is the “target retirement fund” that best matches your expected year of retirement.

When it comes to funding this account, the money will come straight out of your checking via an automatic transfer, so choose a small amount on a regular basis that you’re sure you can handle.

- Read more: The Best Roth IRAs

Shop around for better car insurance, homeowners insurance, and renters insurance.

“But how will I come up with the cash for that Roth IRA?” One way to get that cash is to shop around for better deals on the insurance policies you carry, from car insurance to home insurance. Companies like Geico and Progressive tend to offer great prices for new customers, particularly if they switch companies, so it’s worth your time to shop around.

Visit a few insurance websites and gather a few quotes for the policies you want and see if any of them are a better deal than what you’re currently paying. If you find a good deal from a reputable insurer, jump ship – or at least call your current insurer and give them a chance to match the rate you found.

Pay off a credit card quickly by setting up an automatic payment plan through your bank’s bill pay.

Many banks offer online banking and bill pay services, which means that you can set up many of your bills to be paid automatically. One great feature of this is that you can set up a recurring extra credit card payment that automatically throws money toward taming your unruly credit card balance each month while you continue to cover the minimum balance.

It’s quite simple. Just set up an automatic monthly payment in your bank’s online bill pay service that pays a certain amount to your credit card each month on a date when you’re sure your checking account will be flush with cash. Over time, those extra payments will slowly eat away at your credit card balance, which means lower balances and lower finance charges and eventually freedom from that debt.

Set your thermostat a few degrees lower (in winter) or higher (in summer) than you’re used to, and wear sweatshirts (in winter) or open the window (in summer).

“But how will I come up with the cash for that regular credit card payment?” One great way to do that is to simply adjust your thermostat a bit more aggressively. During the winter months, slide that thermostat down a few extra degrees and wear socks and a sweatshirt around the house. During the summer, slide it up a few degrees and open the windows on the shady side of the house.

Such a simple change will make a profound difference in your monthly energy bill, as your heating and cooling systems will run far less than before.

There’s a simple principle hidden behind all of these simple steps: You can pay for debt repayments and retirement savings and other such goals by being frugal if earning more money isn’t an option for you.

You need money to build an emergency fund or invest for the future or pay off debt, and there are basically two places to get it: earn more money or spend less money.

Earning more money is incredibly powerful, but it’s a long-term approach that often doesn’t pay off much in the short term. Spending less money, especially in ways that don’t affect your quality of life, is an approach that anyone can use without needing to earn more money. It’s always there. There isn’t a “better” option for everyone when comparing the options of earning more or spending less because it depends so much on your situation.

Good luck!

The post Eight Simple Things You Can Do Right Now to Put Yourself on a Better Financial Trajectory appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2GSVEJG

Three reasons why pensions are better than Jisas for your kids

If you are a parent, or grandparent, and are worried about how your children or grandchildren’s financial future will pan out, why not do something about it?

A person on the UK average salary of £27,000 now needs to build up a pension pot of over £300,000 to be able to maintain this level of income in retirement, new analysis has shown from Aegon UK.

But the size of the average pension pot in the UK remains around a sixth of the size of this recommendation, at just £49,9881, according to research published by Aegon in its Retirement Readiness Report 2017.

In a world where the onus of ensuring financial security in retirement has very much moved from the employer to the individual, it is never too early to start the process of saving for your children’s future.

Of course, there are a number of ways that you could look to do this, a popular route being a Junior ISA (JISA). However, we believe there are many reasons why a pension could be a better route.

Not only does a pension give the money more time to grow, putting your child one step ahead, but by involving them in retirement saving from such a young age they should be more engaged and have a better understanding when it comes to looking after their own financial and retirement planning.

This decision to start saving now could end up being one of the greatest financial gifts you ever give. Here are three reasons why:

- Tax relief: the first big advantage is the generous tax relief on the pension contributions your child will get even though they don’t earn an income.

Every child is eligible for a pension from the day they are born. It is taken out in the child’s name and anyone can contribute, including parents, grandparents and other relatives.

The Government will give 20% tax relief up to a maximum of £2,880 per year. So if you contribute £2,880, it’ll be topped up to £3,600.

- Benefit from investment growth: If you invested the £2,880 a year contribution for 18 years, assuming an average net growth rate of 5%, your child would have £68,181 in their pension (in today’s money and assuming an inflation rate of 2.5% per year).

What’s more, when left invested for 50 years (by which time your child will be 68), without them adding another penny to it when they were old enough to, and still assuming the annual net growth rate of 5% each year, the pension would be worth £227,478 again in today’s money.

- Limited access to their pension until they retire: A child pension is also appealing if you want to save for your child but you’re concerned about how they might use the money. Junior ISAs, a popular choice when saving for children, gives children access to their money at age 18, when it becomes a standard ISA.

By investing in a child’s pension, you can live safe in the knowledge that your child isn’t going to splash out on a fancy car or a round-the-world trip with their savings the moment they hit adulthood. They just might when they reach retirement!

One drawback is that it’s pretty much inevitable that pension rules will change between now and your child’s retirement. The age and way they will be able to access their pension could change, but the pension pot that’s built up should still be significant and one you should absolutely consider given the relatively low initial cost.

As with any financial matter it’s always better to seek advice before making a decision.

Jamie Smith is a partner at financial advice firm Foster Denovo.

1. Aegon UK Readiness Report, April 2017, pg. 6.

Section

Pensions Starting your pensionFree Tag

children pensionsImage

Workflow

Source Moneywise http://bit.ly/2F2jrnY

What does 2019 have in store for pensions? Tax relief changes, state pension rise and more

From moves to encourage more people to save for retirement to the challenge Brexit poses to those seeking an income from their investments, Moneywise speaks to a panel of experts to find out what 2019 has in store for pensions.

Workplace pension contributions to rise - again

From April 2019, the amount of money people pay into workplace pensions will rise as minimum contributions from employees are increased from 3% to 5% under auto-enrolment rules. Employers will also see their contributions go up from 2% to 3%.

This follows increases in April 2018 for employees from 1% to the current level of 3% and 1% to 2% for employers.

Although all eligible employees are automatically signed up to their workplace scheme, they are able to leave the scheme if they so wish. This means that there is always the concern that if employee contributions increase by too much, opt out rates will increase.

Tom Selby, senior analyst at AJ Bell says: “To put it into perspective, someone earning around £27,000 and paying in the auto-enrolment minimum will see their personal contribution rise from about £500 this year to more than £850 in 2019/20.

“While for most people this is still not enough to enjoy a comfortable retirement, we are now getting to the stage where some reluctant savers could start to feel the pinch. Rising average pay during 2018 should help ease the pain, but anyone missing out on a salary hike could well be tempted to prioritise spending today over saving for tomorrow.

He adds: “Anyone thinking of quitting their workplace pension needs to understand that they will be losing out on both tax relief and their employer contribution, which put together double the value of the money they put in. Put another way, opting out of your pension is a bit like taking a voluntary pay cut – so nobody should do it lightly!”

Mr Webb, however, is confident that the scheme will continue to achieve its object of increasing individuals’ private pension savings.

“With a fair wind this should go well,” he says. “New research from the DWP has shown that the April 2018 increase in contributions had virtually no impact on pension opt out rates. Pay packets will also be boosted in April 2019 by the increase in tax-free personal allowances which should also ease the pain of the contribution increase. Unless there is a lot of Brexit-related turmoil in April 2019, the contribution increase should pass off without event.”

More support for the self-employed?

The government and the industry at large have long been looking at ways to encourage self-employed people – who do not have the luxury of a workplace pension – to save for retirement.

According to the latest figures from ONS, just 37% of self- employed people aged between 40 and 60 have a pension, compared to 79% of employees.

At the end of 2018 the government announced a series of pilots and trials to raise awareness of pensions amongst the self-employed community.

Mr Long says: “If you are self-employed or have your own business you can expect to be prodded, cajoled and coerced into pensions in 2019, as the government tests a programme of nudges designed to boost the number of self-employed who are saving for retirement.

He adds: “Of course, you don’t need to wait for this, tax relief on contributions make pensions one of the best ways to save for the long term and with pensions available from as little as £20 per month and with the ability to stop and start contributions whenever you want, flexibility shouldn’t be too much of a problem.”

Pensions Dashboard

2019 should also see the launch of the long-awaited pensions dashboard.

Steven Cameron, pensions director at Aegon says: “As we move through 2019, we’ll see the start of pension dashboards becoming available, allowing individuals to get information on all of their pensions including their state pension in one place, online. Initially, there may be some gaps but over time, these should be a huge help for people keeping track of multiple pensions, making it easier to work out if they’re on track for the retirement they hope for.”

Mr Long adds: “We’ll also see the arrival of simpler annual statements and the new single finance guidance body which aims to make it easier for people to take control of their own retirement.

“2019 looks set to be the easiest year yet to put yourself in the driving seat of your own retirement planning.”

State pension rise

The state pension will rise by around £4.25 a week or £220 a year from April.

The full state pension will be worth £168.60 per week, or £8,767.20 after rising from £164.35 a week - above the rate of inflation.

Cold calling ban

Pensions fraud has been rife since the introduction of pension freedoms in April 2015, with the Financial Conduct Authority reporting that in 2017, the average victim lost £91,000 of hard earned savings.

After lots of talk and very little action, it seems like that government’s cold-calling ban, which would prevent scammers in the UK making unrequested calls to savers, will finally see the light of day on January 9.

Mr Cameron says: “Helping to reduce the risk of people being scammed out of their pension savings can’t come soon enough. For that reason we’re anticipating laws to be passed early in the New Year to ban ‘cold calling’ in relation to pensions.”

Tax relief changes

The level of tax relief offered to pension savers has become an increasingly contentious point in recent years. George Osborne consulted widely on the matter during his tenure as Chancellor but while he took the decision not to act, it remains something of a political hot potato.

Mr Webb says: ‘2019 is likely to see the cost of pension tax relief come under renewed scrutiny. In Autumn 2018 the Chancellor said that the cost of tax relief was ‘eye-wateringly expensive’ and it is hard to think that annual limits on pension contributions will not be reduced in a Budget soon.

This would specifically involve reducing the level of tax relief offered to higher-earners, but Mr Cameron hopes the rules will also be changed for the lowest earners.

“We’re seeing an increasing number of people whose earnings are below the income tax threshold being automatically enrolled into pension schemes. Members of some workplace pensions which use the ‘net pay’ approach aren’t receiving the pensions tax relief they’re entitled to and we hope the government will look at changing the rules to make sure everyone gets their full entitlement,” he says.

Brexit, Brexit, Brexit

With the government still in gridlock on how to proceed with Brexit, it’s impossible at this stage to predict what impact it will have on pensions. Nonetheless, it’s not a subject that can be ignored either.

Steve Webb, director of policy at Royal London says: “By far the biggest issue for everyone’s pensions in 2019 will be how the economy responds to Brexit. Good pensions depend fundamentally on a strong economy. If the economy does well there are taxes to pay for state pensions, good wages to pay for employee contributions and good profits to fund employer pension contributions and provide returns to investors. But if the economy grinds to a halt, everything gets more difficult.”

Nathan Long, senior analyst at Hargreaves Lansdown says that investors must be prepared for a degree of stock market turbulence, particularly at the start of the year.

“If you’re invested in your pension but a long way from retirement you can shrug off any share price drops, knowing that a fall in your pension value allows your regular payments to buy in at low prices. If you have cash in the bank, a drop in the stock market may be a great opportunity to top up your pension.

“Those closer to retirement or using drawdown to provide an income have more to lose, as it may not be possible to recover from any falls over a short time horizon. A great way to de-risk ahead of any suspected turbulence is to buy an annuity. However, you don’t need to use all your pension pot in one go, buying smaller tranches of annuity allows you to de-risk your pension investments gradually over time.”

However, while it might be impossible to escape Brexit, Alistair McQueen, head of savings and retirement at Aviva, says savers shouldn’t let it take over their retirement planning.

“Whether you like your Brexit soft or hard boiled, I sometimes find it helpful to remember that there is a world beyond “the B word”. Whatever Brexit brings, our society will still be ageing; our customers will still need to save; and our industry will still have a responsibility to serve. Amidst all the heat, let’s not lose sight of those unchanging truths,” he says.

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2F3uz4J

Get Paid to Lose Weight and Be Healthy

Wouldn’t it be nice if you could get paid to lose weight? Sounds too good to be true, right? Well, guess what? There are plenty of opportunities out there designed to help you earn money while you lose weight! And it’s not just about getting paid to lose weight, either. Many of these work-at-home options can […]

The post Get Paid to Lose Weight and Be Healthy appeared first on The Work at Home Woman.

Source The Work at Home Woman http://bit.ly/2CbJYet

Fund briefing: how to invest in the mixed-assets sector

If you want to shield yourself from financial shocks, investing in mixed-asset funds could be the answer. Just make sure you find the right ones for you

Everyone knows that diversification can help investors sleep at night. Having exposure to a range of asset classes means you are less vulnerable to sudden shocks. Should equities take a tumble, for example, the hope is that bonds will be less affected.

However, building a portfolio that includes the optimal combination of asset classes can be a challenge. This is why UK investors have ploughed billions of pounds into mixed-asset funds and handed the responsibility to professional fund managers.

Multi-asset funds provide this diversification and are managed by experts who are responsible for monitoring underlying assets and making changes to improve performance, according to Patrick Connolly, a chartered financial planner with Chase de Vere.

“The ease of administration of having a whole portfolio in one fund benefits those wanting a ‘buy and hold’ solution,” he says. “They are also very useful for those with smaller amounts to invest as they can achieve a high level of diversification through just one fund.”

The four Investment Association sectors that offer multi-asset exposure could also benefit those lacking the confidence or inclination to make their own investment decisions, according to Adrian Lowcock, head of personal investing at Willis Owen.

Investors in the UK have ploughed billions into mixed-asset funds

“Some of these funds are great starting points for investors as they offer diversification and an experienced manager implementing the fund,” he says. “They can act as a core portfolio from which investors can build satellite funds.”

The four sectors are IA multi-asset 0-35% shares, IA multi-asset 20-60% shares, IA multi-asset 40-85% shares, and a flexible sector. Which one will best suit your needs depends on your investment goals and attitude to risk.

“Each sector covers a broad range of different strategies and funds, from some that offer a simple shares and bonds split right through to ranges of multi-asset portfolios which are targeting specific levels or risks or outcomes for investors,” explains Mr Lowcock.

Quick guide: Is this approach right for me?

Consider investing in future trends if…

- You are looking for a one-stop shop investment

- You don’t want to make asset allocation calls

- You have smaller pots of money to invest

However, while they can help investors narrow down the universe, there is still the need to do some extra research. “Funds aren’t built with your individual needs in mind, so portfolios are unlikely to match an individual’s specific requirements,” he adds.

Their names dictate the level of equity exposure. For example, funds in IA multi-asset 0-35% shares have up to 35% of the fund invested in equities, with at least 45% in fixed income investments, such as corporate and government bonds, and/or cash.

IA multi-asset 20%-60% shares, meanwhile, have between 20% and 60% invested in company equities, while at least 30% must be in fixed income investments and/or cash investments. It follows that funds in IA multi-asset 40%-85% have between 40% and 85% in equities.

The IA flexible sector, meanwhile, has greater scope. The funds in this sector are expected to have a range of different investments, with no minimum or maximum requirement for investment in equities. The manager can have up to 100% if they feel this is correct.

These sectors are certainly popular. At the last count, there was around £50 billion in both IA multi-asset 30%-60% shares and IA multi-asset 40%-85% shares. IA flexible weighed in with £29.6 billion, while there was £9.2 billion in IA multi-asset 0%-35% shares.

The recent turmoil in global markets, particularly the economic and political uncertainty in Europe and the US, has increased their attraction. In fact, IA multi-asset 40-85% shares was the biggest selling sector in September, with £268.1 million of net retail sales.

There are never any guarantees and these sectors are no different

However, there are never guarantees in investment and these sectors are no different. One of their particular downsides is relying on one manager to get the asset allocation correct, points out Darius McDermott, managing director of Chelsea Financial Services.

“There are hundreds of funds in them all doing very different things,” he said. “You need to look carefully at what you are investing in and make sure you understand it. Some funds can be quite expensive, so you need to be getting value for money.”

He believes the starting point is deciding how much equity exposure you are comfortable with having because this will determine which of the four IA mixed-asset sectors are most suitable.

“You should then look at each individual fund to see what it is investing in, how dynamically the fund is managed, and the costs involved,” he adds.

He suggests M&G Episode Income and Premier Multi Asset Monthly Income are worth considering, as well as Jupiter’s Merlin range of funds.

“The Merlin funds, which have different investment objectives, are predominantly funds of funds, managed by a very experienced team,” he says.

He likes the team’s focus on buying ‘the right quantities of the right fund manager’ and the fact it invests in equity, bond, commodity and property funds, as well as Exchange Traded Funds (ETFs) and trusts.

One to watch: Investec Cautious Managed

The aim of the fund, which has been going for a quarter of a century, is to provide income and long-term capital growth.

It seeks to invest conservatively around the world in a diverse range of equities and bonds, as well as cash, other funds and derivatives as required.

The manager, Alastair Mundy (pictured), is an experienced hand, according to Patrick Connolly, a chartered financial planner at Chase de Vere.

He particularly likes the split between growth assets and those providing protection, such as the holdings in gold and silver. “He adopts a contrarian approach, by making long-term investments in cheap, out-of-favour companies,” Mr Connolly adds.

At present, the fund’s largest allocation is to UK equities (25.6%), followed by the 19.9% in North American equities and 19.8% in cash and short-dated government bonds.

Its top 10 equity holdings, which account for 20.9% of the fund, include Citigroup, Capita, Travis Perkins, Barclays, Grafton Group and Royal Bank of Scotland.

The other asset classes, each of which account for less than 10% of assets, include physical gold and silver, Norwegian Government bonds and Japanese equities.

As far as sector exposure is concerned, there is 25.1% in financials, 23.6% in industrials, 9.3% in consumer discretionary, 8.2% in information technology, and 6.2% in materials.

The other areas that are represented include utilities (4.2%), energy (3.5%), communication services (2.2%), real estate (1.5%), consumer staples (1.1%) and healthcare (0.9%).

Value of £100 invested in the fund over five years

| Year | 2014 | 2015 | 2016 | 2017 | 2018* |

|---|---|---|---|---|---|

| Fund percentage movement in year (%) | 0.38 | -2.16 | 19.1 | 3.58 | 0.38 |

| Value of £100 ** (£) | 108.79 | 106.44 | 126.77 | 131.31 | 126.07 |

* To 9 November 2018 **The £100 was invested on 1 January 2018.

| Manager | Alastair Mundy |

| Launch date | 7 June 1993 |

| Total fund size | £1.9 billion |

| Minimum initial investment | £1,000 lump sum |

| Monthly investment | £100 |

| Initial charge & Perf. fee | 0%/0% |

| Annual management fee | 1.5% a year |

| Contact details for retail investors | 020 7597 1800 |

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2F06nPU

Savings Accounts vs. CDs vs. Money Market Mutual Funds

If you’re saving money for a near-term goal — like buying a house, taking a trip, or building an emergency fund — the priority should be keeping the money safe. The last thing you want to do is invest it in something risky, only to find that the money isn’t there when you need.

But it’s also nice to earn at least a little return. After all, you’re working hard to save that money and it would be nice for your money to return the favor and work a little for you as well.

The good news is that there are a few different ways you can accomplish both goals. Savings accounts, CDs, and money market mutual funds all offer the opportunity to get a little return while also keeping your money safe.

But which one is the best choice for your needs? This article breaks down the pros and cons of each so that you can make a smart decision.

The Basics of Savings Accounts, CDs, and Money Market Mutual Funds

Before diving into a comparison of each of these savings options, let’s quickly get on the same page about what each one actually is.

Savings Account

Savings accounts are offered by banks and provide three main benefits:

- The promise that your account balance will never decrease.

- A small return in the form of the interest rate.

- FDIC insurance that guarantees your account will never lose value (up to certain limits).

While the interest rate can and will move up and down based on the federal funds rate, a savings account is still one of the safest and steadiest places to keep your money. And if you use an online bank, you can earn a pretty reasonable return.

Certificate of Deposit (CD)

CDs are also typically offered by banks, and while they share some similarities with savings accounts, they also have a few unique features:

- They offer a fixed interest rate for a set period of time.

- If you withdraw your money before that set period of time is up, there is typically a penalty.

- Because your money is less accessible than it would be within a savings account, CDs typically offer slightly higher interest rates.

- CDs issued by banks are also covered by FDIC insurance.

While those are the basic characteristics, different banks offer CDs with all sorts of unique features, so it’s always worth shopping around.

Money Market Mutual Funds

Money market mutual funds are offered by investment companies, not banks, and they operate much like stock and bond mutual funds in that they hold many different investments.

The key with money market mutual funds is that the investments they hold are generally all high-quality, short-term debt, which makes them function a lot like a savings account. The key features include:

- Returns that vary with market interest rates, but that are comparable with savings accounts and CDs.

- The potential for tax savings, depending on the type of money market mutual fund you choose.

- Because they are investments, there is the possibility that they can lose some value.

- While they are not covered by FDIC insurance, they are covered by SIPC insurance, and some investment companies purchase additional insurance coverage as well.

While money market mutual funds don’t pay an interest rate in the way that savings accounts and CDs do, you can look at the fund’s SEC yield for an estimate of what it might return.

Savings Accounts vs. CDs

The main reason to consider a CD over a savings account is the potential to earn a higher interest rate. For example, as of this writing, Ally Bank is currently paying 2% on their savings account and 2.75% on their 12-month CD.

There are two significant downsides that you have to accept in order to get that higher interest rate though.

The first is the fact that you’ll have to pay a penalty if you want to take money out of your CD before the set time period has passed. That penalty varies from product to product, but in many cases will come in the form of a forfeit of interest, which would mean that your actual return was less than your expected return.

The second is the fact that, in most cases, a CD’s interest rate is fixed while the interest rate on a savings account can change over time. In a rising interest rate environment, which many experts believe we are currently in, that could mean that you might earn more in a savings account over time, even if the interest rate is smaller right now.

Still, a CD can make a lot of sense if you’re relatively sure you won’t need the money for a certain amount of time, the potential penalty for early withdrawal is small, and the difference in interest rate is significant.

For example, let’s say that you have $20,000 set aside for a down payment on a home that you plan on buying when you move in a year. If you put that money into Ally’s 12-month CD instead of their savings account, you’re looking at earning an extra $150 with very little risk.

If, on the other hand, your timeline is less certain, you may be better off going with the savings account and avoiding the potential penalty.

One thing to watch out for when choosing a CD is that a longer term doesn’t always lead to a higher interest rate. Again looking at Ally Bank’s CD rates as an example, their 18-month CD is currently paying a little less than their 12-month CD. The benefit there is that you have that interest rate locked in for a longer period of time, which would be helpful if interest rates fall. But the downside is that if interest rates rise, you may miss out for an additional six months.

Savings Accounts vs. Money Market Mutual Funds

Money market mutual funds have two potential advantages over savings accounts.

First, you may be able to get a slightly better return. For example, the SEC yield on Vanguard’s Prime Money Market Fund is currently 2.37%, compared to the 2% interest rate on Ally’s savings account.

Second, you may be able to get a better after-tax return by choosing the right money market mutual fund. For example, if you use a money market mutual fund that invests exclusively in US Treasurys, your earnings will be exempt from state income taxes. If you use a money market fund that invests exclusively in municipal securities issued by your home state, your earnings will be exempt from both state and federal taxes.

Of course, there is some risk involved with these funds when compared to savings accounts.

The biggest risk is the lack of FDIC insurance, which means that your money is not protected against the loss of value. The SIPC insurance that covers these funds does protect you against bankruptcy, but it’s important to understand that your account balance can fall.

Another risk, especially if you’re trying to maximize your after-tax return, is that by concentrating too much on one type of investment (e.g. municipal securities issued by your home state), you’re losing some of the benefits of diversification and exposing yourself to greater risk of losing value.

And finally, while not exactly a risk, the fact that your money is held at a brokerage instead of your bank means that you may not be able to access it as quickly. Whereas you can typically withdraw at least some money from a savings account immediately, or transfer it to your checking account, it may take a day or two to get it from your brokerage account to your bank.

At the end of the day, though, money market mutual funds fare generally incredibly safe. And if you live in a high-tax state, the ability to get a little bump in after-tax return may be worth the investment.

Get What You Can Without Overthinking It

Savings accounts, CDs, and money market mutual funds can all be used to earn a little return while keeping your money safe. And while there may be ways to eke out a little extra return here and there, the reality is that the three options are more similar than they are different.

As long as you find an approach that’s safe, convenient, and earns you a competitive return, you’re doing just fine.

Matt Becker, CFP® is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families.

More by Matt Becker:

- Investing for Medium-Term Goals

- As Interest Rates Rise, Are Savings Accounts and CDs Becoming Viable Investments Again?

- From CDs to REITs: The Investment Riskometer

The post Savings Accounts vs. CDs vs. Money Market Mutual Funds appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2LK1KuQ