The most successful marketers have one thing in common.

They find a way to gain an edge over their competitors.

Marketers who can analyze the trends and prepare for the future have the best chances of setting their companies up for success.

You don’t want to be the last one to jump on the bandwagon.

As we head into 2018, I’ve taken the time to identify the top marketing trends for the year.

I want to share my insights with you so that you can apply these concepts to your business and start the new year on the right track.

Properly applying these trends to your marketing strategy will improve customer engagement.

You’ll also be able to acquire more customers this year.

Let’s dive right in. These are the top 9 marketing trends for 2018.

1. Live video streaming

Social media platforms paved the way for the live video trend.

Instead of using social media for posting pictures and videos, you now have the ability to stream live content.

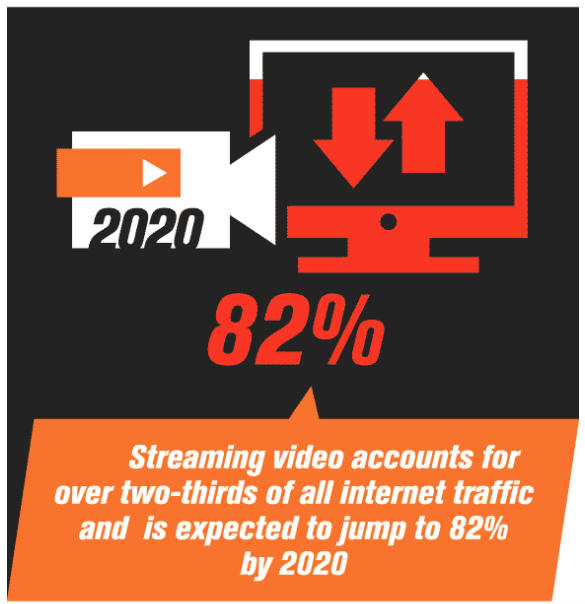

Take a look at how marketing experts are expecting live video to rise over the next two years:

If you weren’t using live video to interact with your customers in 2017, it needs to be a priority for you in 2018.

Studies suggest 80% of consumers prefer watching a live video from a brand as opposed to reading a blog.

And 67% of people are more likely to purchase a ticket to events like a concert after watching a live stream of a similar event.

Some of the most popular live video platforms include:

- Facebook live

- YouTube live

- Instagram live

- Twitter

- Periscope

I like it when businesses use live videos because it gives them a chance to interact with their audience directly.

You’ll be able to communicate and get feedback from customers in real time.

Plus, it’s not like your live video is gone forever once you stop streaming.

You can save those videos and repurpose that content in the future.

2. Artificial intelligence (AI)

Artificial intelligence will continue to rise in 2018.

If you’ve been to any marketing conferences or events in the last year or so, you’ve probably seen at least one session on AI.

AI tools are used to analyze consumer behavior.

Once the behavior is analyzed, these robots can make decisions according to how they are programmed.

AI robots can start to take over some basic human roles, which will allow your team to spend more time on assignments that require actual human insight.

An example of AI you may be familiar with is a chatbot.

These computer programs can have conversations with your customers.

I’m sure you’ve been on a website where a “customer service representative” popped up to start an instant message conversation with you.

That’s an example of a chatbot.

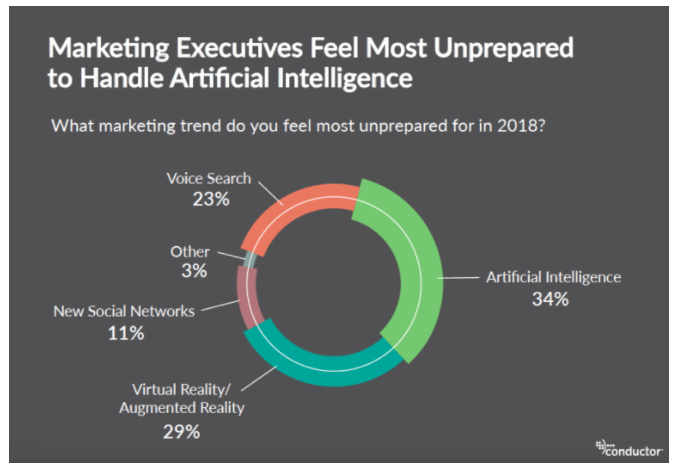

With artificial intelligence on the rise, marketing executives feel unprepared for this trend.

Now is the perfect time for you to educate yourself on the use of AI to improve different areas of your business.

It will give you an edge over your competitors who aren’t prepared.

3. Micro influencers

I’m sure you’re familiar with brand ambassadors and social influencers.

These are people on social media who have relationships with companies and get paid to promote products on their personal profiles.

It’s a legitimate marketing strategy.

When it comes to social influencing, to be considered a celebrity, one has to have over 1 million followers.

People with 500k–1 million followers and 100k–500k followers fall into the macro influencer and middle influencer categories, respectively.

Micro influencers have between 1k–100k followers on social media.

Brands are reaching out to these micro influencers because it’s easier for people to relate to them.

Let’s be honest.

Not many people can connect with celebrities. Plus, it’s obvious when they’re promoting something on their profiles.

You may even have doubts that those celebrities use the products they’re pitching.

But it’s much easier for the average person to relate to a micro influencer.

Why?

Well, for the most part, these people aren’t actually famous. They have normal jobs and live regular lives. But they happen to be popular on social media.

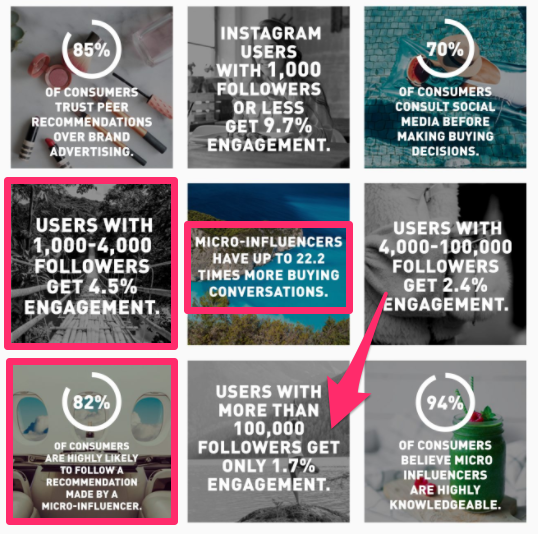

Take a look at how micro influencers are perceived by consumers:

In this case, less is more.

Notice the difference in user engagement between influencers with 1k to 4k followers and influencers with over 100k followers.

Consider finding some micro influencers to represent your company on social media.

Another benefit of this strategy is the cost.

If you want to partner with a celebrity like Beyoncé, it’ll cost you $1 million per post.

That’s absolutely outrageous.

But a micro influencer will likely cost you only $250 – $500 per post.

Plus, you can also send them some free stuff to keep them happy.

4. Content marketing

If you’ve had any marketing success over the past few years, I’m sure you’ve used content marketing strategies.

Well, 2018 isn’t the year to take your foot off the gas pedal just yet.

Content marketing is still trending upward.

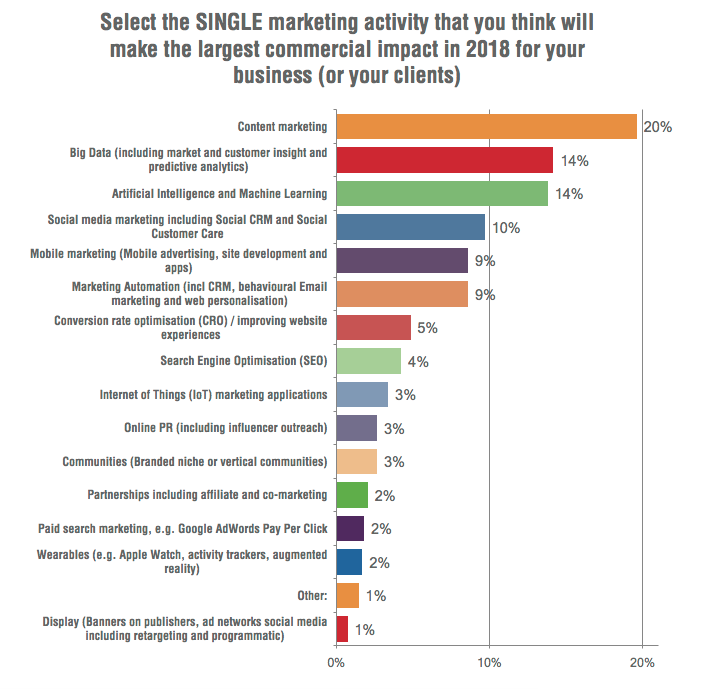

Compared to other factors, content marketing will have the biggest impact on companies in 2018, according to business executives:

Rather than coming up with new content marketing strategies, refine your existing ones.

Make sure your content is relevant and has a clearly defined audience.

Content marketing is great because it’s typically not expensive.

You’ll also see more sales and an increase in customer loyalty when you properly execute these strategies.

Don’t think you need to focus all your energy on new trends, like artificial intelligence in 2018.

Continue your content marketing efforts.

5. Generation Z

It seems over the past several years, companies have been focusing on Millennials.

There’s nothing wrong with that.

It’s important to target consumers while they are young so you can try to retain them for as long as possible.

Every generation has different buying habits.

Millennials have helped shape the marketing trends over the last decade or so.

But now it’s time to put some more emphasis on younger generations as well.

Generation Z, also known as the iGeneration, Post-Millenials, or the Homeland Generation are people who were born in the late 1990s to mid-2000s.

The oldest people in this generation are entering their early 20s.

As they get ready to graduate from college, they’ll enter the workforce, which means their consumption habits will change.

A steady job means they will have more buying power.

Companies need to do more research on this generation and find out how to target them.

It doesn’t matter what industry your company is in.

Start to shift your focus toward Generation Z in 2018.

I’m not saying you should abandon your approach with Millennials or Generation X, but just recognize there is a fresh market for you to target.

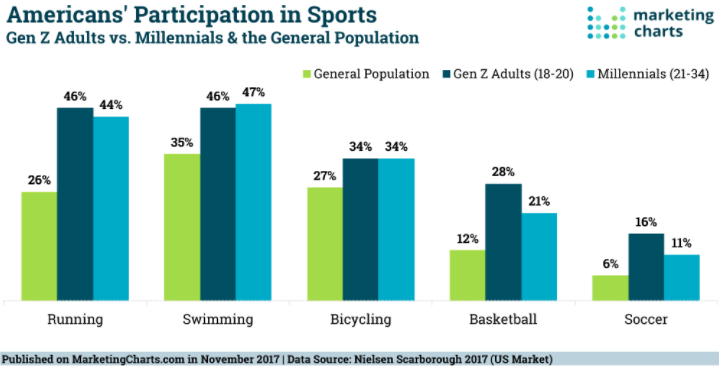

Find out how they spend their free time. For example, look at how active Generation Z is in sports compared to the general population:

Even if your company doesn’t make sporting equipment, you can still use this data for your marketing strategy.

You can focus your Generation Z marketing campaigns around physical activity or athleticism.

That’s just one example.

Do your research, and find out what Generation Z wants and how they consume information.

That’s the key to acquiring these consumers.

6. Consumer personalization

You need to give your customers a personalized shopping experience.

That’s one of the best ways to increase engagement and sales.

It’s what your customers want.

In fact, 75% of consumers prefer retailers that use personalization to improve their shopping experience.

Encourage people to create a customer profile on your website or mobile application.

That way, you can monitor their habits and give them special offers based on their browsing pattern or previous purchases.

This is absolutely essential for companies who have an ecommerce website.

Personalization tactics make it easier for you to upsell and cross-sell to your customers.

Ultimately, this means you’ll make more money without spending much.

It’s cheaper to target your current customers than it is to acquire new ones.

You can also send personalized email messages to your subscribers.

Email personalization can improve your conversion rates by 10% and increase click-through rates by 14%.

If you personalize the subject line of an email, there is a 26% greater chance of the recipient opening it than if you don’t.

Numbers like this are too good to ignore.

Those of you who weren’t using personalization in 2017 need to start doing so in 2018.

7. Privacy protection is more important than ever

People are worried about their privacy.

Marketers need to start using privacy protection as a selling point.

Let your customers know how you are protecting their information.

Over 143 million Americans were affected by the Equifax breach in 2017.

That’s scary.

It’s especially scary since the company is a consumer credit reporting agency.

If your information isn’t safe with them, where is it safe?

This event has consumers on high alert moving into 2018.

They may be hesitant to do things like entering their credit card information online fearing they could become victims of credit card fraud.

How can you make consumers feel safe?

There are certain things you can do to add credibility to your website.

- display all your security badges

- provide up to date contact information

- add customer reviews and testimonials

- make it easy to navigate

- have fast-loading pages

- make sure your checkout process is secure

All of this will make customers feel safe when they’re shopping.

If your company appears sketchy or untrustworthy online, it’ll be difficult for you to get lots of sales.

8. LinkedIn will continue to lead the way for B2B marketers

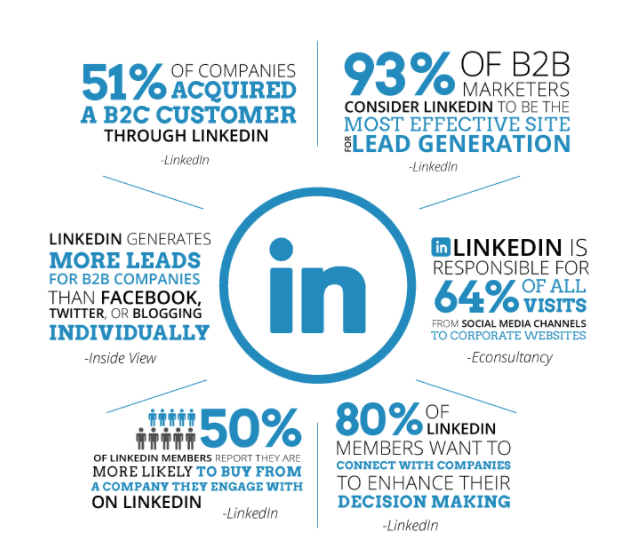

While B2C companies will have better luck using social media platforms and email marketing tactics to connect with their clients, B2B marketers have to focus on their LinkedIn presence.

Look at these numbers.

Over 90% of B2B marketers say LinkedIn is the most effective platform for lead generation.

If you’re in the market for new customers, LinkedIn should be the first place to look in 2018.

Connecting with a potential client on LinkedIn increases the chances of them buying from you by 50%.

I expect these trends to continue in 2018.

Beef up your LinkedIn presence if your company operates on a B2B revenue model.

9. Interactivity

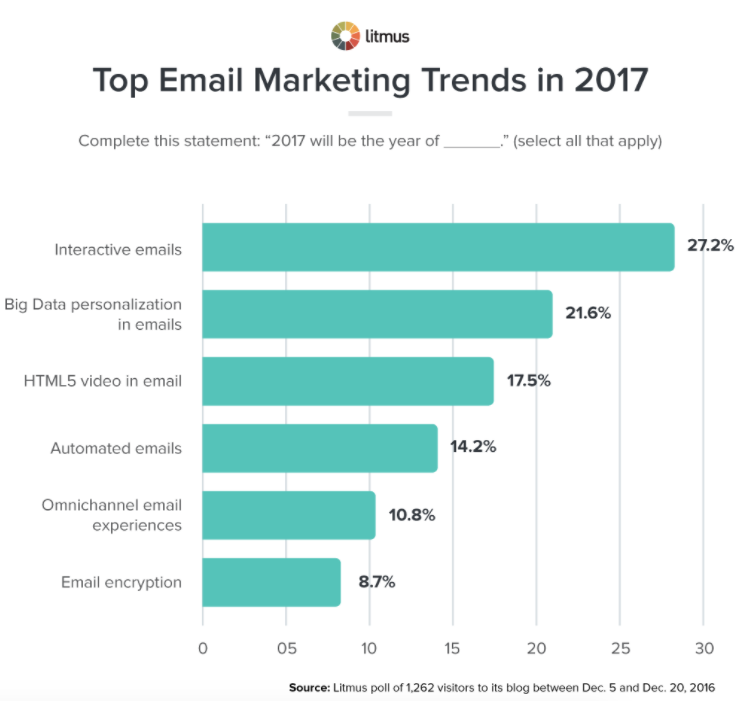

In 2018, your company needs to focus on interactivity, especially when it comes to email marketing.

Contrary to popular belief, email marketing is far from dead.

But you can’t just keep sending out the same boring emails over and over again and expect to get different results.

Interactive emails improve engagement with your subscribers.

In 2017, interactivity was a top email marketing trend.

But that wasn’t a fad.

This trend will continue through 2018 as well.

Here are some of the best ways to incorporate interactivity into your email marketing campaigns:

- use real-time marketing

- add surveys, polls, and reviews

- include videos

- add menus for easy navigation

- use GIFs instead of pictures

- add live shopping carts

If you saw success with interactivity tactics in 2017, continue to use them in the new year.

And if you haven’t tried them yet, it’s not too late to jump on board in 2018.

Conclusion

Staying up to date with the latest marketing trends is a recipe for success.

The best marketers look toward the future to predict consumer behavior.

If you can identify trends and make applicable changes to your marketing strategy, it will give you an edge over your competition.

After extensive research, I came to the conclusion the above trends will have a major impact on the success of your brand in 2018.

If you’re struggling to come up with new ideas, start with the topics I’ve outlined in this post.

What marketing trends has your business identified, analyzed, and implemented for 2018?

Source Quick Sprout http://ift.tt/2l6UlJS