الاثنين، 26 فبراير 2018

NJDOT says I-80 needs safety fence; mayor disagrees

Source Business - poconorecord.com http://ift.tt/2EZ9ULw

Here’s How That Hockey Jersey Can Score You Free Eats at Chipotle

Well, maybe not everyone. But if you weren’t excited before, this news might have you practicing dekes and dangles to the nearest Chipotle.

I’ll wait while you Google those words…

Chipotle is giving out free food!

How to Score BOGO Burritos and More

Wear your favorite hockey team’s jersey to any participating Chipotle on Friday, March 2, 2018 from 10:45 a.m. to 10:00 p.m. and score — see what I did there? — buy one, get one free burrito, bowls, salads or tacos.

Chipotle is an official sponsor of USA Hockey and Hockey Weekend Across America, which has celebrated and promoted hockey since 2008.

And after carb loading on those burritos, you can take a child near you to try hockey for free!

March 3 is Try Hockey For Free Day. Hundreds of rinks will give kids ages 4 to 9 a chance to try out hockey for free. Coaches will be in attendance to show them the ropes and there will be limited equipment to borrow. See if there is a participating rink near you.

Jen Smith is a junior writer at The Penny Hoarder. She gives money saving and debt payoff tips on Instagram at @savingwithspunk.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2GMyRdV

How To File Your Taxes For Free

Source CBNNews.com http://ift.tt/2GJT6ZG

Love to Plan? This Company Is Hiring Work-From-Home Travel Consultants

From booking flights to finding affordable hotels, the abundance of choices available can make the process extremely overwhelming. Throw in a cancelled flight or miscommunication about a rental car, and it becomes downright stressful.

This is where a travel consultant comes in.

If you’ve got stellar customer service skills and enjoy planning and problem solving, then we’ve got a job for you.

Frosch, a travel-management company focused on leisure and corporate travel, is looking for full-time after-hours travel consultants.

This is a virtual position, and you would work from home during evenings, weekends, and holidays.

And if this doesn’t sound like your type of gig, no worries. You can check out our Jobs page on Facebook, where we’re always posting new work-from-home job opportunities.

Work-From-Home Travel Consultant Jobs at Frosch

Pay: Not specified

Responsibilities include:

- Managing clients’ travel reservations, such as coordinating airlines, hotels, and car rentals

- Processing cancellations and alterations and informing clients of these developments

- Resolving travelers’ problems in a timely manner

Applicants for this position must have:

- At least three years of recent experience using the Sabre Global Distribution System

- At least one year of experience using Apollo

- Extensive knowledge of both international and domestic routing

- Thorough understanding of airfare contracts

Benefits include:

- Medical, dental, and vision insurance

- IATA and LifeMart benefits

- Gym reimbursement

- Continued training opportunities

Apply here for the after-hours travel consultant job at Frosch.

Kaitlyn Blount is a junior staff writer at The Penny Hoarder

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2CoaHrR

McDonald’s Loves the Szechuan Sauce Drama. Here’s How You Can Avoid it

So much so that when restaurants ran out in 2017, it led to riots. Yes, seriously. McDonalds even released a series of podcasts about the whole incident. It’s good entertainment if you have a few minutes of downtime.

After what I can only imagine has been months of sadness and frustration, as these rabid fans of the sauce have had to go without since Oct. 8, 2017, McDonald’s is bringing it back. When?

Today. Monday, February 26.

While Ronald, Grimace and the gang promise not to run out this time — they will release 20 million packets of Szechuan Sauce this year — it’s best to be prepared. Why wait with bated breath for McDonald’s to release it each year when you can just make your own (possibly better) version at home?

How to Make Your Own Mulan Szechuan Sauce

For a few months, Reddit users have been upvoting a fan’s tribute recipe for McDonald’s Szechuan Sauce, which he developed somewhere between the fast-food giant’s sauce promotion for “Mulan” and its recent resurgence.

Here’s what it takes, according to user Xeropoint:

6 cloves garlic

4 tablespoons balsamic vinegar

Soy sauce (to taste)

2 tablespoons plum sake (optional)

3 ½ tablespoons Sriracha

2 tablespoons brown sugar

Red pepper flakes (to taste)

How much does that all cost?

Garlic cloves: $1.50

Balsamic vinegar: $2.68

Soy sauce: $1.44

Sriracha: $2.12

Brown sugar: $1.36

Red pepper flakes: $1.40

Plum sake (optional): $7.99

Total cost: $10.50 to $18.49

OK, so it’s not a money saver if you’re starting from scratch. But what would you rather do? Go to McDonald’s with your family, spend about as much to only get a few packets of sauce and be done with it? Or make this tribute sauce at home, where you can enjoy it again and again?

No, seriously, don’t make me solve your time versus money questions. I can’t take the pressure. It’s your sauce, people. Get it however you can get it.

Lisa Rowan is a senior writer and producer at The Penny Hoarder.

Tyler Omoth is a senior writer at The Penny Hoarder who loves soaking up the sun and finding creative ways to help others. Catch him on Twitter at @Tyomoth.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://ift.tt/2wK6GHP

How to Write a Business Plan for Your Startup

Anyone can have a great idea. But turning an idea into a viable business is a different ballgame.

You may think you’re ready to launch a startup company. That’s great news, and you should be excited about it.

Take it from me: as someone who has founded several startup companies, I know what it takes to be successful in this space.

Before you start seeking legal advice, renting office space, or forming an LLC, you need to put your thoughts on paper. This will help you stay organized and focused.

You’ll also be able to share this plan with others to help you get valuable feedback. I don’t recommend starting a company without consulting people first.

A typical business plan consists of the following elements:

- executive summary

- company description

- market research

- description of products and/or services

- management and operational structure

- marketing and sales strategy

- financials

Thoroughly writing out your plan accomplishes several things.

First, it gives you a much better understanding of your business. You may think you know what you’re talking about, but putting it on paper will truly make you an expert.

Writing a formal plan increases your chances of success by 16%.

Having a business plan also gives you a better chance of raising capital for your startup company. No banks or investors will give you a dollar if you don’t have a solid business plan.

Plus, companies with business plans also see higher growth rates than those without a plan.

If you have an idea for a startup company but not sure how to get started with a business plan, I’ll help you out.

I’ll show you how to write different elements of your business plan and provide some helpful tips along the way. Here’s what you need to know to get started.

Make sure your company has a clear objective

When writing a company description, make sure it’s not ambiguous.

“We’re going to sell stuff”

isn’t going to cut it.

Instead, identify who you are and when you plan on going into business. State what kinds of products or services you’ll be offering and in what industry.

Where will this business operate? Be clear whether you’ll have a physical store, operate online, or both. Is your company local, regional, national, or international?

Your company description can also incorporate your mission statement.

This is an opportunity for you to gain a better understanding of your startup. The company summary forces you to set clear objectives. The type of company you have and how you will operate should be obvious to anyone who reads it.

Include the reasons for going into business. For example, let’s say you’re opening a restaurant. A reason for opening could be that you identified that no other restaurants in the area serve the cuisine you specialize in.

You can briefly discuss the vision and future of your startup company, but you don’t need to go into too much detail. You’ll cover that in greater depth as you write the rest of your business plan.

Keep in mind, this description is a summary, so there’s no reason for you to write a ton. This section should be pretty concise and no more than three or four paragraphs.

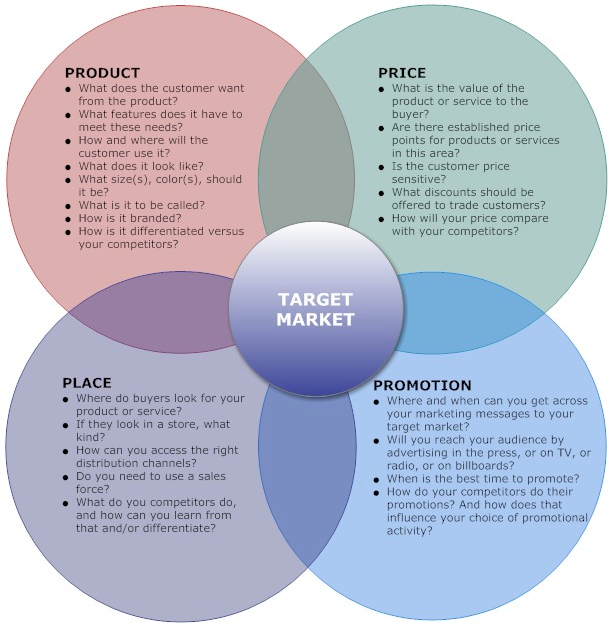

Identify your target market

Your business isn’t for everyone. Although you may think everyone will love your idea, that’s not a viable business strategy.

One of the first steps to launching a successful business is clearly identifying the target market of your startup.

But to find out whom you’ll target, you need to conduct market research.

This is arguably the most important part of launching a startup company. If there’s no market for your business, the company will fail. It’s as simple as that.

All too often I see entrepreneurs rush into a decision because they fall in love with an idea. Due to this tunnel vision, they don’t take the necessary steps to conduct the proper research.

Sadly, those businesses don’t last.

But if you take the time to write a business plan, you may discover there’s not a viable market for your startup before it’s too late. It’s much better to learn this information in these preliminary stages than after you’ve dumped a ton of money into your venture.

To figure out your target market, start with broad assumptions and slowly narrow it down. Typically, the best way to segment your audience is using these four categories:

- geographic

- demographic

- psychographic

- behavioral

Start with things like:

- age

- gender

- income level

- ethnicity

- location

As I said earlier, start broadly. For example, you may start by saying your target market lives in North America, and then narrow it down to the United States.

But as you continue going through your market research, you can get even more specific. You can target customers living in New England, for example.

By the time you’re finished, the target market could look something like this:

- males

- ages 26 to 40

- living in the Boston area

- with an annual income of $55,000-$70,000

- who are into recycling

This profile encompasses all four demographic segments I mentioned earlier. Plus, it’s very specific.

Your business plan should talk about the research you conducted to identify this market. Talk about the data you collected from surveys and interviews.

You’ll use this target market in other sections of the business plan as well when you discuss future projections and your marketing strategy. We’ll cover both of those topics shortly.

Analyze your competition

In addition to researching your target market, you need to conduct a competitive analysis as well. You’ll use this information to create your brand differentiation strategy.

When you’re writing a business plan, your startup doesn’t exist yet. Nobody knows about you. Don’t expect to be successful if you’re planning to launch a competitor’s carbon copy.

Customers won’t have a reason to switch to your brand if it’s the same as the company they already know and trust.

How will you separate yourself from the crowd?

Your differentiation strategy could involve your price and quality. If your prices are significantly lower, that can be your niche in the industry. If you have superior quality, there is a market for that as well.

Competitive analysis should be conducted simultaneously with identifying your target audience. Both of these fall under the market research category of your business plan.

Once you figure out who your competitors are, it will be easier to determine how your company will be different from them. But this information will be based on your target market.

For example, let’s say you’re in the clothing industry. Your competitors will depend on your target market. If you’re planning to sell jeans for $50, you won’t be competing with designer brands selling jeans for $750.

Or you can base your price differentiation on what you learned about your target market. From there, you’ll be able to identify your competitors.

As you can see, the two go hand in hand.

Budget accordingly

You need to have all your numbers in order when you’re writing a business plan, especially if you’re planning on securing investment funding.

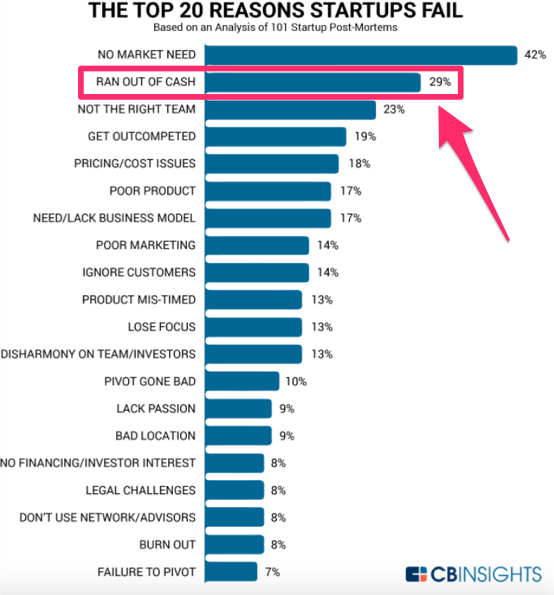

Figure out exactly how much money you need to start the business and stay operational; otherwise, you’ll run out of money.

Running out of cash is one of the most common reasons why startup companies fail. Taking the time to sort your budget out before you launch will minimize that risk.

Consider everything. Start with the basics like:

- equipment costs

- property (buying or leasing)

- legal fees

- payroll

- insurance

- inventory

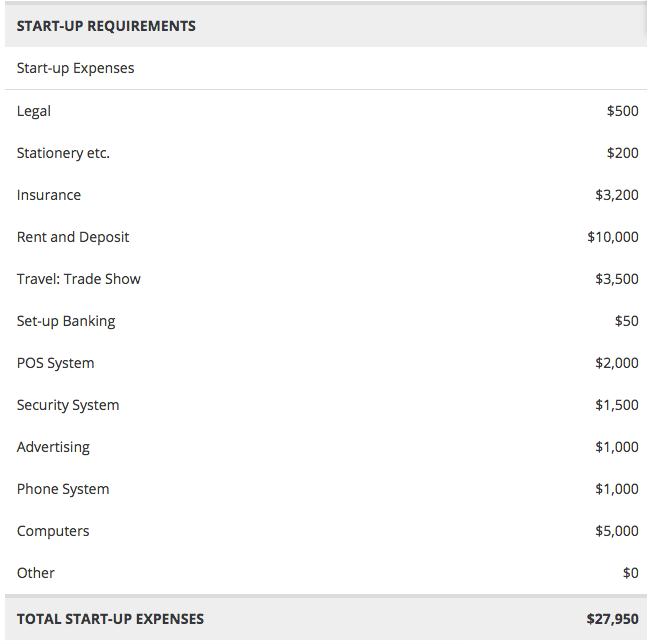

Here’s an example of what this will look like in your business plan:

These numbers need to be accurate. When in doubt, estimate higher. Things don’t always go according to plan.

In the example above, although the total startup expenses are less than $28k, it may not be a bad idea to raise $40k or even $50k. That way, you’d have some extra cash in the bank in case something comes up.

You don’t want poor budgeting to be the reason for your startup’s failure.

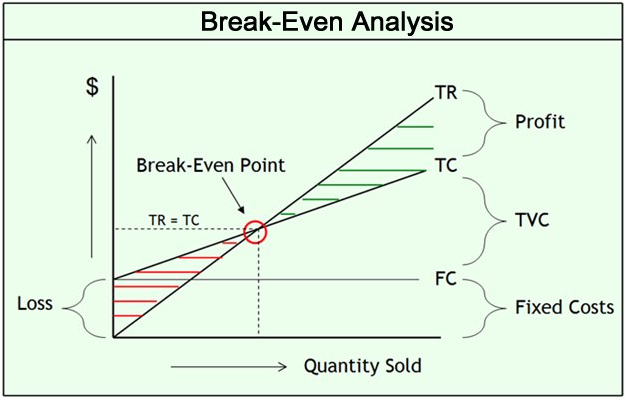

Identify your goals and financial projections

Let’s continue talking about your financials. Obviously, you won’t have any income statements, balance sheets, cash flow reports, or other accounting documents if you’re not fully operational.

However, you can still make projections. You can base these projections on the total population of the target market in your area and what percentage of that market you think you can penetrate.

If you have an expansion strategy in mind, this would also be outlined in your financial projections.

These projections should cover the first three to five years of your startup. Make sure they are reasonable. Don’t just say you’ll make $10 million in your first year. In fact, your company may not be even profitable for the first couple of years.

That’s OK.

As long as you’re being honest with yourself and potential investors, your financial plan will cover your break-even analysis.

While it’s reasonable to expect your sales revenue to increase each year, you still need to take all factors into consideration.

For example, if you’re planning to expand to a new location in year four, your financial projections need to be adjusted accordingly.

You may not be profitable until your third year of operation, but if you’re opening a new facility in year four, that year may have a net loss as well. Again, this is completely fine as long as you’re planning and budgeting accordingly.

Another example of a goal could be launching an ecommerce store in addition to your brick-and-mortar locations. Just don’t try to bite off more than you can chew. Keep everything within reason.

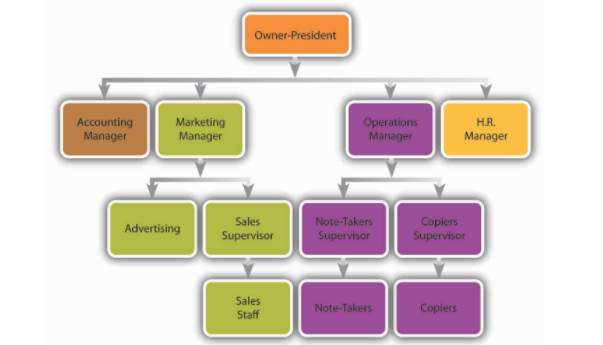

Clearly define the power structure

Your business plan should also cover the organizational structure of your startup. If it’s a small company with just you and maybe one or two business partners, this should be easy.

But depending on how you’re planning to scale the company, it’s best to get this sorted out sooner rather than later. Here’s an example of what your organizational chart may look like:

It’s really important to have this hierarchy in place before you get started. That way, there’s no debate over who reports to which position. It’s clear who is in charge of specific people and departments.

Don’t get too complex with this.

If you put too many layers of managers, directors, and supervisors between the top of the chart and the bottom of the chart, things can get confusing.

You don’t want any instructions or assignments to get lost in translation between levels. You also don’t want anyone to be confused about who is in charge.

This is an opportunity for you to outline how your company will operate in terms of board members and investors. Who has the final say in decisions?

While I understand you may need to give up some equity in your startup to get off the ground, I recommend keeping the power in your hands.

Discuss your marketing plan

Your marketing plan relies on everything else I’ve talked about so far.

How will you acquire customers based on the market research of your target audience and competitive analysis?

This strategy needs to be aligned with your budget and financial projections as well.

I could sit here and talk about different marketing strategies all day. But there’s no right or wrong way to approach this for your startup company.

My recommendation would be to stay as cost-effective as possible. Be versatile and well-balanced too.

Acquiring customers is expensive. You don’t want to dump your entire marketing budget into one strategy. If it doesn’t work, you’ve got nothing to fall back on.

Take these categories into consideration when you’re coming up with a marketing plan:

Before you try anything too crazy, get the basics sorted out first:

- launch a website

- stay active on social media platforms

- start building an email subscriber list

- focus on customer retention

- come up with customer loyalty programs.

Don’t ease into this one step at a time. Come out fast. Even before your company officially launches, you can start building your website and social media profiles.

The last thing you want is for consumers to find out about your brand but then be unable to find your website or contact information. Or worse, get directed to a website that’s broken or unfinished.

Keep it short and professional

I’ve talked about many different components of your business plan. It may sound overwhelming, but don’t be alarmed.

This shouldn’t be a 100-page dissertation.

You definitely want it to be detailed and thorough, but don’t go overboard. There’s no exact number of pages it should be, but have at least one page per section.

It should also be written cleanly and professionally. Don’t use slang terminology.

Proofread it for grammatical and spelling errors.

Remember, you may need to use this to raise capital. People may be hesitant to give you money if you overlook the small stuff like proper grammar.

Conclusion

Launching a startup company is exciting. It’s easy to get so caught up in the moment that you rush into things.

If you want to set yourself up for success, you need to take a step back and plan things out.

Going through the process of writing a formal business plan will increase your chances of securing an investment and also improve your potential growth rate.

The market research you’ll need to conduct in order to write this plan will also help you determine whether this is a viable business venture to proceed with.

If you’ve never written a business plan, use this post as a guide for what you should include. Follow my tips for best practices.

Writing a business plan may seem like a tedious task right now, but I promise it will keep you organized and save you lots of headaches down the road.

Good luck!

What elements of a business plan have you started drafting for your startup company?

Source Quick Sprout http://ift.tt/2ETmznv

Should you join the open banking revolution?

Open banking aims to boost competition in the financial sector, making it easier for consumers to compare bank accounts and then switch to a better deal. Moneywise weighs up the pros and cons of this move towards sharing data.

The arrival of open banking in the UK opens a wealth of possibilities for people looking to better manage their finances, laying the ground for apps that tell you when you could get a better bank account elsewhere – and where to go for a better deal.

A Moneywise online poll in January 2018 (see below) found that while one in 10 readers welcome open banking because they think it will make comparing accounts easier and introduce more competition to the sector, the majority are sceptical.

Moneywise reader Chez says: “I have yet to be convinced that it is something I want or need.”

Others say they are worried about the financial security of sharing data with third parties.

Unleashing your data

Open banking launched on 13 January 2018. It means that customers of the UK’s biggest banking brands can share current account data with trusted third parties if you give them permission to do so.

The Competition and Markets Authority is behind this project and wants to stimulate competition in the banking sector by making it easier for customers to compare accounts across multiple providers.

Banks are now required to hold your financial data in a standardised format, which can be used by third parties, such as apps and websites.

At first, only the nine biggest current account providers in the UK: Allied Irish Bank, Bank of Ireland, Barclays, Danske Bank, HSBC, Lloyds Banking Group, Nationwide, RBS and Santander have been required to open their data for customers.

However, five of these brands – Bank of Ireland, Barclays, HSBC, RBS and Santander – have missed the deadline for some customers and won’t be fully integrated until September 2018. There was no financial penalty imposed on the banks who were late. They were simply given extra time to comply with the rules.

Initially only your current account data can be shared with third parties. However, the rules will be extended to cover all credit cards, e-money (services such as PayPal) and savings accounts that are accessible online by the end of 2019.

By then, the rules will also cover all current accounts that are accessible online, regardless of provider. So a building society offering current accounts with no online functionality would not have to comply, but smaller banks who offer online accounts will.

This is part of the second European- wide Payment Services Directive, which aims to create a regulated ecosystem for payments and account information.

Brexit shouldn’t make a difference because this is a directive (and thus is implemented by our national regulator), rather than the rules being imposed directly by the EU itself.

Looking to the future

It will take time for third party companies to understand what customers are looking to get from their data and what can be achieved with the data they have access to.

Open Banking – the organisation set up to promote the scheme – says that firms will initially offer basic services, such as an app that lets users view transactions across all their accounts, so you can better manage your spending. This could be expanded so that customers can transfer their current account overdraft to another provider, depending on which bank is offering the best rate.

However, there are doubts over whether people will engage with the new technology at all. Since the introduction of the seven- day switching service for current accounts in 2013, engagement has been low. Data from Bacs, the company that runs Direct Debits in the UK, shows that just 931,956 of the more than 60 million accounts in the UK were switched during 2017.

Victor Trokoudes, chief executive of money management app Plum, says that while initial progress is likely to be slow, in a matter of years open banking will transform the way consumers interact with their finances.

“We expect that in three years’ time we will have entirely switched to a holistic platform to manage money, beyond traditional banking,” he says.

“Enabling customers to manage all of their finances in one place will remove complexity and, with the application of artificial intelligence (AI) and automation, people will be able to grow their money in the best way, without hassle.”

Open banking could also have a ripple effect on other areas of the finance industry, even if the rules do not directly apply to those products. In future, your data could be used by mortgage lenders to judge affordability as it will document your monthly income and outgoings.

Richard Hayes, chief executive of digital mortgage broker Nuvo, says that third party firms could use open banking data for everything from basic tasks – such as filling in forms automatically – to working out whether lenders are likely to accept your application.

“Open banking means access for brokers and lenders to more accurate information about a customer’s financial situation,” he says.

“This, in turn, speeds up the approval process, as very often delays in decisions are because of inaccurate or incomplete information. It will significantly reduce the amount of documentation and checks that need to be completed too.

“Also, by having access to accurate data on a person’s spending habits, calculating affordability will be much more robust, leading to better decision making.”

The same principles can be used when applying for other types of financial products, such as credit cards and personal loans.

Staying safe

Many people remain sceptical about the benefits of open banking. Moneywise’s poll found that 73% would not use open banking, with most of this group saying they would be unwilling to let a third party access their financial data.

But these concerns may be overblown, according to Francesco Simoneschi, chief executive of financial data firm TrueLayer. He says that the regulator’s checks are in line with other areas of financial services.

“It isn’t surprising that many people are reluctant to share their data with third parties under open banking. A lot of scare stories have been written about the security surrounding it,” he says.

“People should always be careful how and with whom they share their personal information. However, it’s important to note that there is a big difference between sharing personal data freely with an organisation such as a retailer or social media site, and with a third party via open banking.

“The reality is that for a company, app or service to use personal financial data through open banking it needs to pass rigorous security and compliance procedures, including regulatory licensing. The entire process is overseen by the Financial Conduct Authority (FCA) and results in companies having a level of security akin to banks and other financial institutions.”

Consumers can make sure they are dealing with FCA-regulated firms by checking the Financial Services Register at Register.fca.org.uk.

Mr Trokoudes argues that, in time, customers will feel the benefits of open banking. It will force banks to up their game, as consumers with poor products will be more likely to switch.

“More often than not, when it comes to switching, people fail to get the best deal when comparing products or services because they tend to stick with the financial institution they are familiar with and already have an existing relationship.

“With open banking, the banks’ whole approach to selling financial services – not to mention the way they use data – will be forced to change to prioritise the interests of the consumer, rather than their balance sheets.”

Section

Free Tag

Related stories

- Five banks fail to meet open banking deadline

- ‘I wouldn’t use open banking’, say three in four Moneywise users

- Open banking arrives in the UK – what does it mean for you?

Source Moneywise http://ift.tt/2sVHn8l

Questions About Food Inflation, Craigslist, Costco, Principles, and More!

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Finding health insurance

2. Dealing with food inflation

3. Thinking about job offer

4. Enough shopping around?

5. Return of premium life insurance

6. Craigslist scammer

7. Debt after death

8. Costco math

9. List of principles

10. Rolling over 401(k)s

11. Frugal solution to car salt

12. Reflecting on spending mistakes

I’ve had a rip-roaring winter cold the last few days, the first one I’ve really had in a long while. As I write this, I mostly just want to go right back to bed and get a good batch of sleep.

I wish I had some sort of magic formula for feeling better until a winter cold has passed, but I simply don’t. It just takes a few days until your body’s immune system figures it out and eliminates it.

Until then, misery.

On with the questions.

Q1: Finding health insurance

My husband will be switching to a small business which does not offer healthcare. I’m not sure I would be considered a freelancer (I occasionally work as a locum tenens type healthcare provider: my work is intermittent and irregular). Either way, we’ll be losing out health insurance and we don’t know where to find anything that is actually affordable: the only healthcare.gov option in our state is $2500 monthly with a $12,000 deductible [which equates to paying $42,000 a year before the insurance company will pay a dime and we’re healthy, we won’t even come close to meeting that deductible]. We’ll have four kids but our income is too high to qualify us for any kind of discount through the website. Is there any other way to approach finding affordable healthcare? Blue Cross Blue Shield dropped individual plans in our state and I’m finding dead ends every other way. Any suggestions? What are your thoughts on the Christian Health Ministries? It’s really the only affordable option I can find right now and even then I don’t like the idea of paying for well child checks and vaccinations out of pocket.

– Alicia

Unfortunately, health care options in this country are disastrous, especially with people who do not have employer-backed coverage. The fundamental problem of insurance is that people who do not have employer-backed insurance are perceived to be a greater risk than those who do, thus actually finding someone to ensure you when you don’t have such coverage is expensive. The mandate to have insurance wrapped in the ACA was an attempt to fix that, but it only marginally worked.

There really is no good solution in your case. Options for people in your situation are pretty limited. They’re either expensive or limited in most cases.

Christian Health Ministries is an interesting case. While the rates are low, it’s basically a cost sharing service where you’re putting money into an escrow account to pay for the medical expenses of members as they occur, but there is no guarantee of payment and, as you note, what they do and don’t cover is a bit quirky. They do pay out what they have, but if it’s not enough to go around, they simply don’t cover everything. It’s far better than nothing and it is very low cost, but it is not a virtual guarantee of coverage, although it does seem to qualify as coverage for the provisions of the ACA.

Q2: Dealing with food inflation

How do you deal with the cost of food going up when your income is the same? I get a COLA on my pension every year but food goes up a lot more than that and that means I have less for other stuff.

– Esther

Cost of living adjustments these days often don’t match the changes in the cost of food. In some years, food definitely goes up more than a typical COL adjustment. In other years, they’re the same. Your observation is probably true if you live in an area where there is significant growth happening and the overall cost of living is going up faster than the national average.

So, what can you do about it? You can move to an area with a lower cost of living, for starters. That will immediately give you a lot more breathing room in your budget. You can also simply learn to budget your money more wisely.

Another thing I would encourage you to watch out for is a slow elevation in your food tastes. Are you really buying the same stuff you were buying five years ago, or have you slowly slipped into buying more “premium” versions of everything, like coffee or creamer or dishwashing detergent or ketchup? Take a look at the brands you regularly buy now and what you used to buy and see how the prices compare.

Q3: Thinking about job offer

I am 43/M married to 40/F, no kids, paying down a mortgage but no other debt. I make $70K (systems analyst) and she makes $45K (teacher). I like my job well but the pay is not super competitive. Last week, I was contacted by a friend of a friend who offered me a job at his company – I have to apply and interview but the job is basically mine if I want it. Similar work to what I’m doing now, but pay bumps to $93K starting out. New company culture seems fine – a couple of friends say they like it there and I can’t find any horror stories online. What should I do?

– Jeff

Decide what it would take for you to unquestionably stay where you are, then go talk to your current boss about it. Simply tell him or her the truth – you like where you are at, but you have friends who are making more than you for similar work. Don’t mention the job talks. Open with the fact that you’re happy here and stress that you really want to stay, but $25K a year is $25K a year and that’s hard to ignore. State that you want to work together to put a plan in place to get you to a competitive salary. See what the response is.

If the response sees you getting the salary bump you want to the level that would convince you to stay, then you should stay. If you get a negative response or if you get a very minimal offer to stay, pursue the other job offer.

That’s how I’d handle it. If you’re happy where you are, you should definitely tell them what’s going on and give them a chance to match or come close to matching.

Remember, salary isn’t everything and you know you’re happy where you’re at. While you may want the salaries to be closer, don’t just go to where the salary is highest.

Q4: Enough shopping around?

My wife and I decided it is time to move to another bank. Our current bank charges fees for almost anything you can imagine and it’s ridiculous getting hit with $40 in fees each month for normal banking services.

We live in the Chicago area and there are a lot of banks. We have called around to several with local branches and found one or two that are strictly better than our current bank.

How many banks should we contact before we pull the trigger on the best one?

– Steve

You’ve hit upon a good point. A person can basically spend unlimited hours shopping around for a new bank or for other similar things like insurance. When do you stop?

When I am shopping around, I usually keep calling places until I find one that seems like the right one to me. When I find that my attention and focus is drawn back to one particular option, I know I’m close to being done.

At that point, I usually sit on it for a few days, then look through the options again. If I still find that the same option is on top, and I usually do, I go with them.

I don’t have a set number, but there’s almost always one option that starts really looking like the right one.

Q5: Return of premium life insurance

I am looking at life insurance and one company offers a “return of premium” insurance policy. It’s like a normal term life insurance except at the end you get your premiums back if you didn’t die. It costs a lot more than the regular term policy. What’s the catch here?

– Devin

A “return of premium” policy is exactly what you describe. You pay, say, $100 a year for a 30 year term policy and at the end of 30 years, if you’re still alive, they cut you a check for $3,000.

Compare that to a normal term policy that might have a $50 a year premium instead.

Now, the question is, if you just the second policy, can you invest the extra $50 a year well enough to make it to $3,000 by the end of 30 years? By my math, if you put it in the stock market in a broad based index fund returning an average of 7% per year, you would be money ahead with the normal term policy.

There’s a catch, of course: would you actually invest that $50 per year or not? If the answer is truthfully “no,” then there are worse things to do with your money than a “return of premium” life insurance policy.

Q6: Craigslist scammer

I think someone just tried to scam me on Craigslist. They wanted to buy something from me with a check from a local bank. Something about it seemed wrong so I said no and they got really upset. I think they were trying to bounce a check off of me. How do you avoid scammers on Craigslist?

– Julia

You basically don’t avoid scammers on Craigslist. Instead, you just have a few policies that sweep most scammers aside.

For example, have a policy where you only accept cash at the time of sale as a form of payment. You do not accept checks or PayPal or gift cards or anything else. Cash, period.

Stop by your local office supply store and get a pen that’s good for detecting counterfeit cash and take that to the sale with you. Mark some of the bills that they try to use with that marker and make sure they’re legit.

Those two little steps will avoid a lot of the typical scamming going on on Craigslist.

Q7: Debt after death

I was reading an article today about the average American dies with 61k in debt. What happens to this debt? Are relatives supposed to pay the debt?

– Anna

Most of the time, that debt is applied to the estate of the person who died. Their assets are sold off and the proceeds are used to pay off those debts. Anything that remains is then given to the survivors according to the estate plan.

So, let’s say Aunt Marjorie dies and has $61K in debt. You sell off her house and her car and her possessions that weren’t specifically left to anyone and then the proceeds from those sales are used to pay off those debts. This might leave, say, $30K, and that’s then distributed to the beneficiaries of the estate.

This is assuming that all debts are strictly in the name of the deceased person, of course.

Q8: Costco math

We recently renewed our membership at Costco. They now offer two memberships – one for $60/year that’s juts normal and one for $120/year that gets you 2% off everything you buy. My wife just instantly said that we wanted the normal membership and I didn’t make an issue out of it but I went home and ran the numbers and I am not sure that it is a bad deal. Could you help me figure out whether it’s worthwhile?

– Jeremy

For that higher priced membership to be worthwhile, it has to save you more than $60 an a year. To save $60 in a year, that means that you have to buy enough stuff so that 2% of the amount you buy is $60. That amount is $3,000.

So, if you’re going to spend more than $3,000 in the coming year at Costco, the more expensive membership is better. If not, then the less expensive membership is better.

The kicker with Costco – and the reason I lean toward the $120 membership – is that if you save less than $60 over the course of a year, they’ll refund you the difference.

The only real drawback to the $120 membership is the additional up front cost. That $60 may have been more useful to you elsewhere.

Q9: List of principles

In your recent blog post “12 Key Principles for Financial Success in Today’s World” you indicated that you\’ve been making “a giant list of all of…principles”. From your writings, I’ve come to deeply appreciate your life philosophy, not just about personal finance. So would you mind sharing your “giant list” of principles with me?

– Connie

Quite a few people wrote in and asked about this “list of principles” that I’m making. I will probably use it as a Saturday post at some point – on Saturdays, I tend to stray a bit further away from strictly writing about personal finance than I do on other days.

The list of principles is something I’m compiling as part of my ongoing effort to write journals for each of my kids. I’m in the process of writing a journal for each of them that contains a lot of material – reflections on who they are as people, family history, my own life history, advice for life problems that they might face, and a lot of principles to live by. I intend to give them to them when they reach adulthood and are old enough to appreciate it.

I want to convey to them the principles I live by and why so they can hopefully understand me more as a person and also find useful life advice to draw upon if something were to happen to me.

Once I’ve really codified that list, I’ll share it here in a post.

Q10: Rolling over 401(k)s

Item #5 in Helaine Olen’s “Single Retirement Planning Basics” at the end of the article “Retirement Planning for Singles Can Be Extra Tough” (https://amp.usatoday.com/story/83257058/) doesn\’t make sense to me. Assuming the 401(k) contributions are pretax, I prefer to consolidate accounts from different jobs whenever possible with direct rollovers to a single IRA. What do you think? “5. Don’t roll over your 401(k) if you change jobs; just let it be. This will keep the cost basis of your investment lower.”

– Gerry

I think that the issue here is that Helaine is making an extra assumption that’s going unsaid in order to keep the article short, which is a real issue for many publications that aim for a very short word count.

The issue that Helaine is trying to address (I think) is people considering rolling a 401(k) into a Roth IRA, which can cause a tax issue at a time when many people can’t afford that tax hit.

In other words, there are some specific situations where a rollover makes sense, and others where it doesn’t, and this little phrase isn’t nearly enough to explain the difference.

I think that this is a point that should have been explained with more length and it was probably trimmed to hit a word count target. This often happens when an article tries to fit in too many ideas in too small of a word count.

In short, I don’t think you’re doing it wrong, nor do I think the advice is necessarily bad, just under-explained.

Q11: Frugal solution to car salt

What can a person do to keep car wear from road salt from happening? I wash my car constantly during the winter and it’s at just 130K miles and there are already spots of rust on it.

– Jenny

As a lifelong resident of the upper Midwest, the only thing I’ve ever found that keeps rust from winter road salt at bay is constant washing – and I mean constant. If you don’t wash your car after every single winter storm of any kind, you’re basically begging for rust to eventually hit your car.

The only preventive trick I’ve found is to go get your oil changed in the months before winter and ask for an undercarriage coating. They spray on an oil-based solution that helps with keeping rust at bay under your car.

Other than that… just wash it frequently. That road salt is some vicious stuff.

Q12: Reflecting on spending mistakes

You talk about how you reflect on spending mistakes when you’re driving places. Can you elaborate on that a little bit because I’m not really clear on what you mean?

– Derek

I basically apply something known as an after action review to spending choices I made that I regret or at least want to carefully consider to make sure I made the right choice. The idea of an after action review is to carefully consider an action you took in the past and decide both whether it was the right action to take and what is the best action to take going forward.

With an after action review, the first thing you do is you identify what exactly you wanted to happen in that situation. For example, if I bought a big bottle of Gatorade at a gas station, I think through what I ideally wanted to happen when I stopped. I needed gas and I was thirsty and I wanted to solve both of those problems. What would I have ideally done to solve that problem? If everything had been perfect, I would have bought the best bang for the buck gas and I would probably have just filled up a water bottle at a water fountain or from a tap.

Then, you acknowledge what actually happened. I think through what I actually did, step by step. I bought gas that was probably the best bang for the buck gas, then I headed inside without a water bottle. Instead of figuring out what my cheapest option for purchase was, I just grabbed a Gatorade and bought it.

Three, you try to learn from the experience. Where did I deviate from my ideal and why? Well, my big mis-step was heading in without a water bottle in hand. Most gas stations have some way to fill a water bottle, so heading in without one was a mistake. Even without that bottle, I could have found a better bang for the buck beverage than a bottle of Gatorade.

Four, adjust your behavior. When I’m thirsty at a gas station, my goal should be to refill a water bottle from my car, and doing that requires me to keep a water bottle in my car and to remember it at gas stations.

I basically follow that model when reflecting on spending experiences or almost any experience I have in life that I want to reflect on and improve. I use it for social experiences, leadership experiences, and many other things. It not only helps me define a better path forward, it also does a good job of embedding that better set of choices in my head.

Got any questions? The best way to ask is to follow me on Facebook and ask questions directly there. I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours.

The post Questions About Food Inflation, Craigslist, Costco, Principles, and More! appeared first on The Simple Dollar.

Source The Simple Dollar http://ift.tt/2orleKi

Craft Jobs for Stay-at-Home Moms

By Holly Reisem Hanna Are you creative? Do you love to sew, paint, draw, or scrapbook? Great news! There are lots of great work-at-home opportunities for artisans and crafters. The market for DIY products and homemade works has never been better for stay-at-home moms, particularly with the growing availability of online resources. From selling your […]

The post Craft Jobs for Stay-at-Home Moms appeared first on The Work at Home Woman.

Source The Work at Home Woman http://ift.tt/2F3vmm3

Too old for a mortgage?

Moneywise helps a reader whose uncle has been threatened with repossession of his home.

My uncle is 72 and has ended up in a punch-up with his mortgage provider. He has never defaulted on a loan and can demonstrate that he can easily afford to continue to pay a mortgage. However, the term of his interest-only mortgage is up on his home in Maidenhead and the bank wants him to clear it. He went into a branch to propose an extension, but it refused.

Now the bank has begun the process of repossession, sending my uncle an alarming and threatening letter. Our lawyers are involved, but the whole thing has become needlessly stressful. Can you help us resolve the situation?

AW/Devon

I suspect your uncle isn’t the only person in this situation. The latest figures suggest that around 1.9 million people have an interest-only loan and mortgage rule changes that came into force in 2014 have meant that lenders are much tougher on these borrowers.

For younger borrowers with a fairly long term still left on their mortgage, switching to a repayment mortgage – and at a stroke reducing the interest-only risks – is an obvious solution.

Older borrowers with shorter mortgage terms don’t have that opportunity as repayments would rocket to ridiculous levels.

I haven’t named the lender involved here as I’m still negotiating with it, but for anyone in ˙a similar position I would advise approaching a local building society to see about switching mortgages. In fact, I have put AW in touch with one society, which says it should be able to help him.

That’s because the smaller lenders still seem keen to try and help borrowers, while large high-street lenders close their books to all but the most straightforward of loans.

For others facing the same position, there are 14 building societies that have no age limit for borrowers. They are Bath, Buckinghamshire, Cambridge, Chorley, Cumberland, Dudley, Family, Harpenden, Holmesdale, Leek United, Loughborough, Monmouthshire, Saffron and Vernon.

Section

Free Tag

Related stories

- Lenders must act to help struggling interest-only mortgage borrowers, regulator warns

- The interest-only mortgage time bomb… and how to defuse it

- Regulator looks to ease pressure on older interest-only borrowers

Source Moneywise http://ift.tt/2oy0nEj

Three Reasons New Parents Shouldn’t Stress About Saving for College

Just about every new parent I’ve ever worked with has told me that saving for college is one of their top financial priorities. And I always have some mixed emotions when they say it.

On the one hand, it’s great that they want to prioritize saving for their child and giving him or her all the opportunity in the world. It’s especially admirable given that their budget is likely tight due to all the new expenses that come with young children, and that any savings would therefore require some kind of sacrifice.

On the other hand, I know that I’m going to have the tough job of convincing them that saving for college is probably not the right move. That they should be prioritizing their own needs over their child’s college education.

That may sound selfish. And the truth is that saving for college is a great idea IF you have the money to do so.

But when resources are limited, saving for college should usually be near the bottom of your list of financial priorities. Here are three reasons why.

1. There Are Many Ways to Pay for College

While having savings available to pay for college generally provides your child with the greatest number of choices, the fact of the matter is that there are many ways to pay for a college education.

Here are a few of the options you have available to you:

- Cash flow: You might be able to pay for some or all of your child’s tuition as if it was just another bill. This is a big reason why some people argue for paying off your mortgage over saving for college. If you time it right, you could get rid of your mortgage payment just as your child reaches college age, freeing up room in your budget for at least some of the bill.

- Lower-cost schools: While the average cost of a college education continues to rise, there are many schools offering a quality education at a fraction of the cost of the most expensive universities. A good middle ground might be spending a couple of years at a community college before transferring to a more prestigious college, allowing you to save a lot of money and your child to get a degree from the school he or she desires.

- Scholarships and grants: There are all kinds of scholarships and grants available these days. Applying for this money might be a good project for your soon-to-be college student.

- Part-time job: You certainly don’t have to bear the responsibility of paying for college alone. Your child could work either before or during college, or both, to help pay the bills.

- ROTC: ROTC programs can pay for the entire cost of school, as long as your child is willing to commit to military service after graduation.

- Student loans: Done thoughtfully and within reason, student loans can provide a good return on investment, since a college degree can increase your lifetime earnings potential. Regardless, they’re available as an option when other routes fail.

The bottom line is that while saving for college is great if you can afford it, you won’t be left without options if you can’t afford to do so.

On the other hand…

2. Other Financial Goals Require Money Now

Most other financial goals do not have that kind of flexibility. They require you to either spend or save money right now, or risk not being able to reach them.

Retirement is a big one. Beyond Social Security, you are completely dependent upon your own savings in order to support yourself once you either want to or have to stop working.

And given that increasing your savings rate is by far the best way to increase your odds of reaching your retirement goals, focusing on that now over saving for college makes a lot of sense, even if it feels selfish.

Here’s another way to think about it: When you’re on a plane, they always tell you that, in the event of an emergency, you should put on your own oxygen mask before helping your children. You have to stabilize yourself before you’re truly able to help your children.

The same logic applies to saving for retirement over saving for college. By stabilizing your own financial future, you’re putting yourself in a better position to truly be able to help your children with whatever they need down the line.

But retirement isn’t the only consideration here. Things like insurance and estate planning are critical tools for protecting your family’s financial well-being, and they require you to either spend money now or go without them.

Even things like traveling to see friends and family, or changing careers or starting a business, have real value and won’t happen unless you dedicate resources now.

Unlike paying for college, most of these other big goals can’t be handled any other way.

3. There Are Other Ways to Invest in Your Child

For some reason, our culture has a laser focus on college as THE way to invest in the future of your children. And while a college education is certainly valuable, it is only one four-year period of your child’s life and is by no means the only way to prepare him or her for the future.

Simply spending time with your child is one of the best investments you can make, and doing so might require working fewer hours, making less money, and therefore having less available to save. And in many cases, that trade-off will undoubtedly be worth it.

There are also plenty of opportunities to help them explore their interests and develop their skills long before college is even an option. In fact, research shows that early education in particular has a number of significant benefits, so it may actually make sense to focus more on that time period than on college.

Regardless of how you do it, just remember that your child has a long life with lots of opportunities available to him or her. And while college may be an important part of that life, it will only ever be one part, and there are many other ways to invest in your child’s health and development.

Don’t Feel Guilty About Making College a Lower Priority

The urge to start saving for college right away is a good one. It means that you care about your child and that you’re willing to make sacrifices in order to secure his or her future.

But you shouldn’t feel guilty about making it a lower financial priority. The fact of the matter is that other responsibilities require more of your money now, and that by handling those responsibilities you’re actually building a stronger foundation that will allow you to more sustainably help your child later on.

Choosing not to save for college right now doesn’t make you bad parent. It might actually make you a good one.

Matt Becker, CFP® is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families.

Related Articles:

- Roth IRA vs. 529 Plan: Which Is Best for College Savings?

- Nine Employers That Will Help You Pay Off Your Student Loans

- Two-Sided Coin: Is College Worth the Cost?

- What I Wish I Knew Before Taking Out Student Loans

The post Three Reasons New Parents Shouldn’t Stress About Saving for College appeared first on The Simple Dollar.

Source The Simple Dollar http://ift.tt/2HLuSPQ