As of 2017, the overwhelming majority (89%) of B2B marketers use content marketing in some form.

As you can imagine, how well marketers execute their campaigns varies quite a bit.

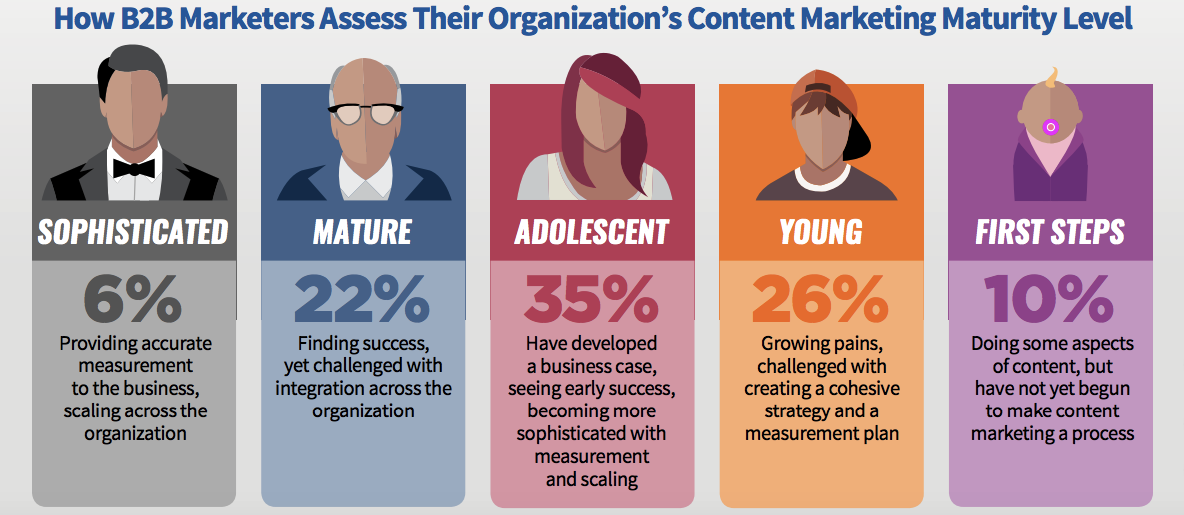

Or, as The Content Marketing Institute would put it, there are differences in “content marketing maturity levels.”

As you can see, a fairly small number (28%) would be considered either mature or sophisticated.

The rest could definitely use some improvement, and there’s a lot of room for growth for many content marketers.

One thing I’ve noticed (especially when it comes to those new to the game) is that many brands engage in tactics that could be considered turn-offs.

This doesn’t necessarily mean being unethical or using black-hat techniques.

It means unknowingly using tactics that annoy site visitors and slowly but surely drive a wedge between the company and its audience.

At best, this results in diminished engagement, a lower follower count, etc.

At worst, it can lead to dwindling traffic numbers, fewer leads, decreased sales, and diluted brand equity.

The bottom line is you don’t want to kill your audience’s vibe with content marketing turn-offs.

Here are some common mistakes I see marketers make and how to avoid them.

Fatiguing your audience

The amount of content on the Internet is mind-boggling.

According to Marketing Profs, roughly two million blog posts are written every single day.

If you really want to get a sense of how much content is being created, check out Every Second on the Internet. It’ll really put this phenomenon into perspective.

Here’s the thing.

Everyone is trying to outdo one another to claim their piece of the pie and get traffic.

What’s the result?

Many content marketers are grinding out content.

They have the mindset that if they slap up enough content, the leads will come.

They end up flooding their blogs with mediocre content and their social media followers’ feeds with sub-par updates.

This all results in one thing. Content fatigue.

They fatigue their audiences as well as themselves in the process.

Don’t get me wrong. Fresh content is great.

Of course, you want to post new content consistently.

But I know I feel overwhelmed when someone I follow is constantly blasting me with new content just for the sake of having new content.

I don’t have the time to consume it all.

What I suggest is to chill out with the frequency of your content creation.

Don’t worry so much about constantly populating your blog and social media with new content.

Instead, focus on creating fewer but higher quality pieces.

Try to find the sweet spot between updating your content regularly and giving your audience time to catch their breath.

The sweet spot will differ depending on the nature of your brand and the platform you’re using. Finding it requires a certain level of experimentation on your end.

I also suggest checking out this post from Buffer for advice on this topic. It will give you a better idea of how much you should be posting and how much is too much.

Being too content-centric

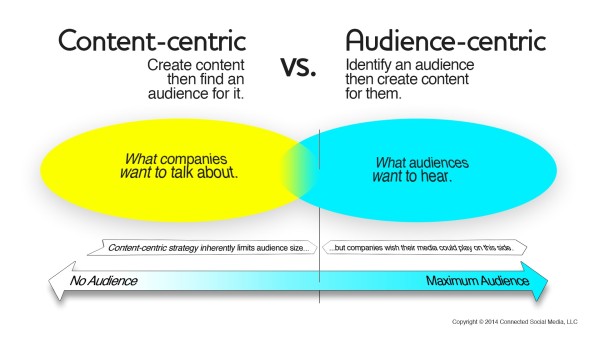

I love this graphic that illustrates the difference between being content-centric and audience-centric:

The difference between the two is to whom your content caters: yourself or your audience.

Here’s an example.

Let’s say your brand is passionate about obscure industry trends, so you frequently write about these topics.

That’s all well and good, but if those topics don’t resonate with your audience, you’re unlikely to gain any real traction.

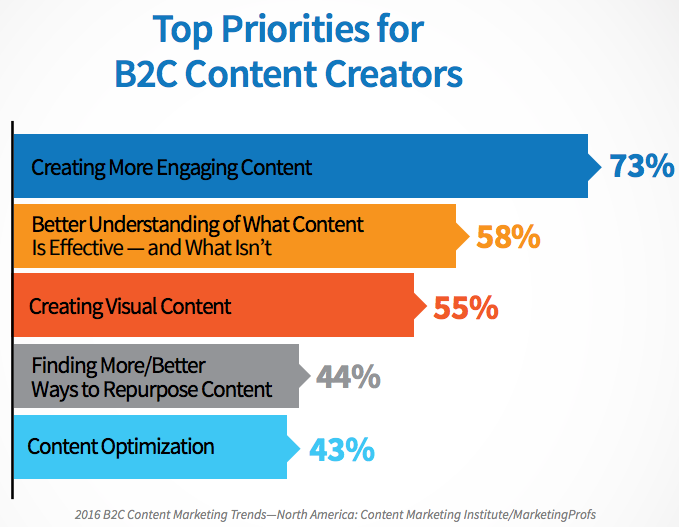

It’s a fairly widespread issue, considering that creating more engaging content is a top priority for 73% of content creators.

Over time, being too content-centric will minimize the impact of your campaign.

It hinders engagement, lowers readership, and gradually drives your audience away.

Make sure you’re on the audience-centric side of the spectrum— not the content-centric.

How do you accomplish this?

Two words: qualitative research.

If you’re unfamiliar with this term, let’s start with a definition:

Qualitative research is designed to reveal a target audience’s range of behavior and the perceptions that drive it with reference to specific topics or issues. It uses in-depth studies of small groups of people to guide and support the construction of hypotheses.

Rather than merely observing what’s happening, qualitative research seeks to understand why it’s happening.

This type of research enables you to put yourself in your audience’s shoes and be highly informed when creating your content.

I’m not going to launch into a long-winded discussion of every facet of qualitative research, but let me offer a few key strategies:

- Ask your blog readers what topics they would like you to cover.

- Use analytics to identify content trends. See which posts are getting more traffic and engagement.

- See which keywords your visitors are searching before landing on your blog.

- Pay close attention to readers’ comments. Look for direct feedback. Note the number of comments on a post—it’s usually indicative of interest level.

- Check your social media analytics. See what types of content are getting the biggest response.

I also recommend checking out two specific posts on this topic:

Go Beyond Analytics to Give Customers the Content They Crave from The Content Marketing Institute.

Find Out What Your Audience Wants Using Qualitative Research from Positionly.

Being pretentious

Does your content consist of a steady stream of douchey buzzwords and complicated industry jargon only a handful of individuals will actually understand?

If so, this is guaranteed to turn off your audience.

Don’t get me wrong.

You want to come across as being intelligent, knowledgeable, and generally knowing your stuff.

But I feel there’s a fine line between being smart and being pretentious.

It can be an issue especially for certain industries such as medical, legal, and finance, where complex subjects are routinely discussed.

If you’re not careful, you can easily launch into some needlessly complicated rant and lose the majority of your audience.

It makes you appear insincere, alienates your audience, and makes it much more difficult to get your point across.

To be totally honest, I have been guilty of it myself at certain times.

However, it’s something I seriously strive to avoid these days.

What’s the solution?

First, try to stick with a natural, conversational tone when it comes to your content.

I try to approach it as if I’m sitting down with someone face-to-face and having a conversation.

That seems to work for me.

Also, don’t try to jam-pack your content with big words just for the sake of using big words.

Always look for the most direct way to say something without using needless buzzwords and industry jargon.

I also recommend asking yourself the following questions when proofreading your content:

- Will my average reader understand what I’m saying?

- Am I writing in my own—unique—voice?

- Can I simplify what I’ve written?

- Did I use any overly annoying buzzwords?

Always going for the sale

Ever feel like a sleazy used car salesman when creating content?

It’s not a good path to be on.

In fact, this is perhaps the number one way to turn off would-be readers and lose the readers you’ve currently got.

No one wants to be bombarded with “Buy Now!” messages when they’re trying to kick back and read some content.

It’s distracting and detracts from the overall user experience.

Here’s the thing about content marketing.

It’s one of the more long-term inbound strategies.

It doesn’t typically involve going for an instant sale.

Content marketing is about building relationships, creating rapport with your audience, and establishing trust over time.

The mentality is that if you take the time to create awesome content that’s genuinely useful, you’ll be primed to make a larger volume of sales down the road.

Therefore, it’s important to have the right mindset when approaching your content.

Here are a few techniques that I recommend:

- Avoid using interstitials on your website. Google actually started penalizing certain sites that use them.

- Place your focus on educating rather than selling. Believe me. If you educate your audience and solve a problem for them, the sales will follow.

- Don’t plug your business or include a CTA until the end of your content.

- Work on building rapport and establishing trust before asking your audience to buy anything.

Conclusion

Content marketing has been proven to be less costly and get more leads than outbound marketing.

It also tends to yield higher conversion rates.

But using the wrong tactics and not understanding what your audience does and doesn’t want can marginalize the impact of your campaign.

You don’t want to kill their vibe unwittingly and create a rift between your brand and your audience.

But steering clear of the issues I mentioned above should prevent any missteps on your end and lead to deeper relationships and a more receptive audience.

What’s your number one content marketing turn-off?

Source Quick Sprout http://ift.tt/2p8lc8M