الجمعة، 7 يونيو 2019

Barnes & Noble sold to hedge fund for $638 million

Source Business - poconorecord.com http://bit.ly/2IloqA4

When Net Worth Calculation Fails You

Megan writes in with a great question:

As per your earlier suggestions, I have been using net worth to track my financial improvement over the last five years. The spreadsheet shows a nice monthly upward trend almost every month. But this month I noticed an interesting problem. My net worth went down even though I was spending a lot less than I earn. If you’ve looked at the stock market you know why. The S&P 500 has went down about 200 points in the last month, causing my retirement to lose about 6% of its value. Because my retirement savings is now such a large part of my net worth, a stock market drop means my net worth drops even though I am doing the right thing. Do you have any suggestions for how to correct for this? That red number on my spreadsheet looks bad even though I know it actually looks pretty good. This happened in December too.

This exact same thing has happened to me several times over the years. Although I’m saving money and contributing to retirement, my net worth for the month goes down simply because I have quite a lot saved up compared to my monthly contributions.

Let’s spell this out with an example. Let’s say I contribute $1,000 a month to my retirement account. After six months, I have $6,000 in there. The stock market goes down 10%, leaving me with only $5,400, but then my $1,000 monthly contribution comes in, I’m at $6,400, and my net worth is still going up. That’s because I just started investing and the amount I’m investing each month is still a fairly large portion of my overall investment.

Now, let’s move five years down the road. My investment is now worth $80,000, and I’m still contributing $1,000 a month. Over the next month, the stock market drops by 10%, leaving me with $72,000. Even when my $1,000 contribution for the month is added, my balance is still $73,000, meaning my net worth went down by about 8%, even though I was doing the right thing.

Here’s the important thing to remember: your net worth is a very useful number in many ways, but it’s not the only number that matters. It’s a single number that just gives you a snapshot of your overall financial state, and by comparing it to the past, you can see how your overall state compares to various points in your past.

When you do month-by-month comparisons and have a large investment in something volatile like the stock market, there are going to be months where the value of your investment drops significantly and no matter what good moves you made in your life, your net worth is going to drop compared to one month prior. There’s nothing wrong with this, but, as Megan notes, it can be unsettling when you’re working hard to keep the trend moving upwards.

So, are there better metrics that take this into account? Here are four other things to measure that might provide more value.

First, if you have enough data, consider looking at year-by-year comparisons of net worth rather than month-by-month. For instance, you would compare your net worth for June to your net worth for June a year ago. If you’re being smart with your finances and don’t have many multiples of your annual income in investments, this should virtually always be a positive number outside of exceptional periods like late 2008. Even a 10% drop in the stock market over the course of a month will likely be overshadowed by the savings contributions and growth over the course of a full year.

It’s easiest to see this as an example. Let’s say you calculate your net worth each month for a full year and it looks like this:

January, Year 1 – $100,000

February, Year 1 – $105,000

March, Year 1 – $110,000

April, Year 1 – $115,000

May, Year 1 – $120,000

June, Year 1 – $125,000

July, Year 1 – $130,000

August, Year 1 – $135,000

September, Year 1 – $140,000

October, Year 1 – $145,000

November, Year 1 – $150,000

December, Year 1 – $155,000

January, Year 2 – $110,000

Wow, that December Year 1 to January Year 2 drop is significant. A -$45,000 change in a month looks awful in your net worth calculations. On the other hand, if you’re using year-over-year comparisons instead of month-over-month numbers, it’s actually a +$10,000 change.

Second, if you have enough data, consider using a moving average of your net worth rather than a month-by-month comparison. A moving average means that, rather than worrying about your net worth right at this moment, you’re more concerned about your average net worth over the last year. You just add up your monthly net worth calculation for each month over the last year and divide by twelve. Then, next month, you do the same thing, except it’ll include that month’s data and the data from a year ago will drop out.

For example, with the data above, the twelve month moving average in December is $127,500 – just add up all of those numbers and divide by twelve.

In January Year 2, even though that month was clearly horrendous, the twelve month moving average still goes up from $127,500 to $128,333.

Using a twelve month moving average allows you to see the overall trend in your efforts with a lot of the volatility in a single month muted. It means that a really bad month won’t cause a big decline, but it also means that an exceptional month won’t cause a big jump.

Third, consider focusing on your monthly savings rate rather than your monthly net worth. This allows you to focus on your own individual efforts to save rather than the volatility of your investments.

To calculate your savings rate, simply add up the amount of money you saved this month for long term goals – usually your retirement savings, but perhaps savings for other goals – and then divide that amount by your total income before taxes for the month. So, let’s say you saved $1,000 this month and earned $8,000, your savings rate is 0.125, or 12.5%.

Ideally, you want this number to stay steady over time or, even better, creep upwards a little bit. For example, you might see your savings rate staying steady over time and you might choose to bump up your contributions by 1% or so, which will definitely help your savings rate.

This number might be kind of boring – after all, it only changes when either your income changes or the amount of money you save in a given month changes (and if everything’s automatic, this probably won’t happen often) – but it shows you clearly that everything’s moving along as planned.

Finally, consider focusing on your discretionary spending rather than your monthly net worth. Simply add up all of your spending that wasn’t used for basic needs. Include things like gourmet foods, entertainment services, and so on. You may want to use discretionary spending as a percentage of your income (if you’re okay with some lifestyle inflation if your income goes up) or as a raw dollar number (if you want to keep your lifestyle the same).

This is a really good number to use with a moving average, as described above, so you even out changes in your spending over the course of a year.

It’s also the best way I know of to see if lifestyle creep is happening in your life, which can be an early sign of financial troubles to come. If your discretionary spending is consistently going up, particularly at a pace that’s greater than increases in your income, you’re probably slowly headed toward financial difficulties and hard choices. It’s much easier to head this off when it is small and hasn’t created a ton of bad habits and a big financial hole yet.

So, which one do I use? I actually use all of them. Once you have a system for calculating a particular number, it’s not hard at all to start making comparisons. Once you’re calculating your net worth every month, it’s easy to do a month-over-month comparison once you have two months of calculations – just subtract last month from this month. Switching to year-over-year is simple once you have a year of data – just subtract last year from this year. Even a moving average isn’t hard at all – just add up the last twelve numbers and divide by twelve. All of this can be automated with a spreadsheet like Google Sheets – once things are set up, it’s mostly just a matter of typing in your numbers for the month and everything is added up for you. If you want a basic tutorial on how to set up a net worth calculator, I wrote one several years ago that works well for Google Sheets.

Good luck!

The post When Net Worth Calculation Fails You appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2ZelAnr

13 Common WordPress Mistakes to Avoid in 2019

WordPress is one of the most popular CMS platforms on the planet.

In fact, according to a recent study from Kinsta, 33.6% of all websites are powered by WordPress. Furthermore, the platform controls 60.5% of the CMS market share worldwide.

That’s the number one ranking position for both of those categories.

Since WordPress is so popular, it’s only natural that you might be using it to manage your website. Some of you might already be using WordPress. Regardless of your situation, you can benefit from this guide.

When it comes to creating and managing a website, you’re going to make mistakes. This is inevitable.

I’ve made mistakes as well, and I’m sure I’ll make more moving forward—that’s life.

But with that said, I’ve realized that some mistakes are avoidable. I’ve seen so many WordPress users make the same blunders time and time again, which is what inspired me to write this guide.

Whether you’re a WordPress beginner or if you’ve been using WordPress for years, you’re not immune to error.

Once you read this list, you’ll be able to stop mistakes before they happen. If you realize that you’re already making some of these mistakes, you can take the proper steps to fix them.

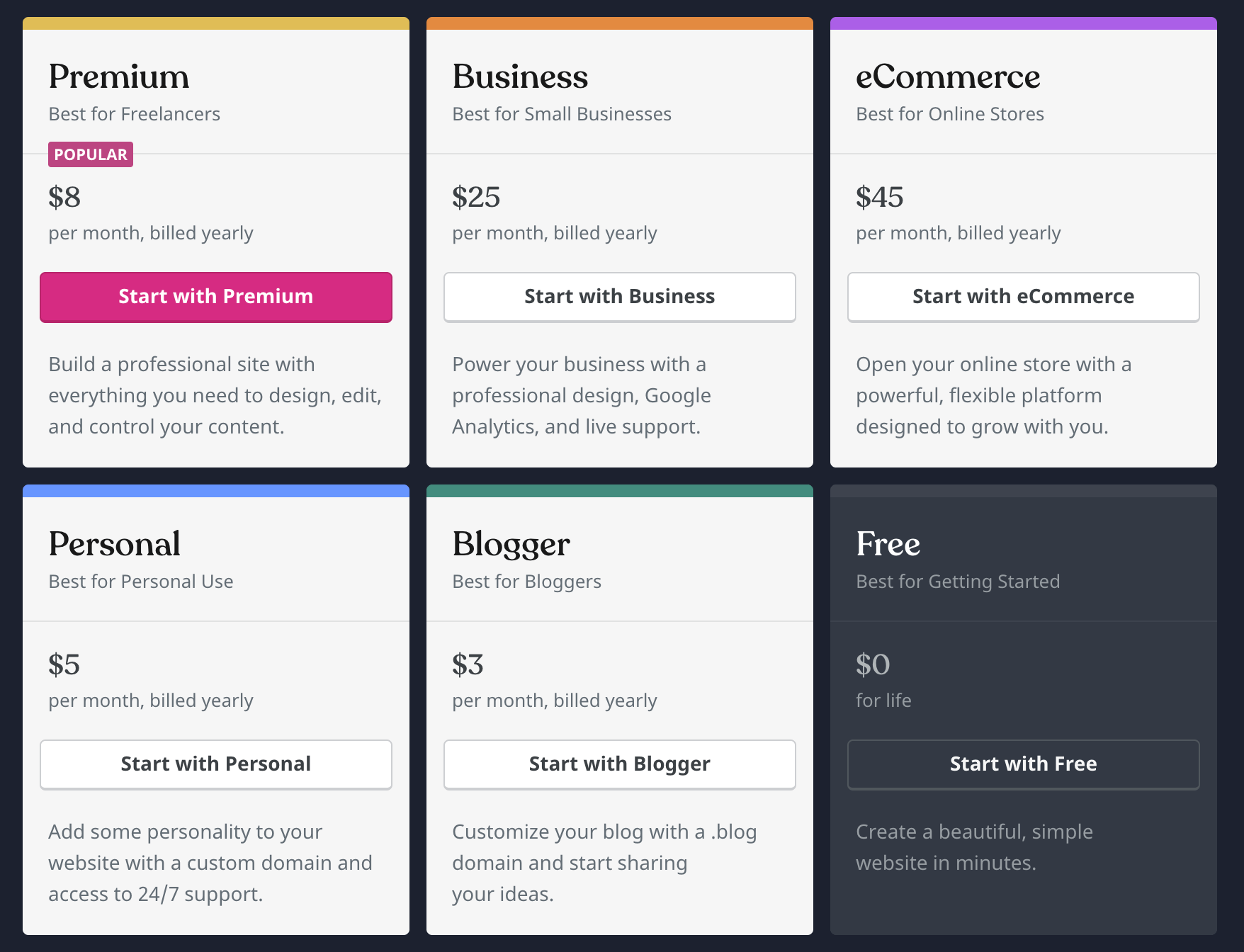

1. Overpaying

In order to get your website off of the ground, you need to have a domain name and web hosting service.

But I see so many new website owners fall into the trap of spending money on features that they don’t need. Domain registrars will always try to upsell you on additional services.

If you’ve never been through this process before, you may think that some of these add-ons are requirements since the pitches are presented so well. I’m referring to things like extra email accounts, enhanced privacy, and boosted security.

Depending on your situation, you don’t need the extras. You can save that money and spend it on other features of your website and business. It may not seem like a lot of money right now, but it adds up over time, especially when you’re being billed on a monthly basis.

It’s also important for you to choose the right WordPress plan for your needs.

If you’re just blogging right now, there’s no need to pay more than ten times that price for an ecommerce plan just because you’re thinking about potentially selling something down the road.

You can always upgrade your plan when you’re ready to scale your site.

2. Not backing up

“It won’t happen to me” is the wrong mindset to have.

The last thing you want is to wake up one morning to learn that your site has been compromised and all of the data has been lost. Whether the server crashed or the site itself was hacked, you’re going to have major problems.

Time to start all over from square one, right?

That will be your only option if you’re not properly backing up your content. You need to set up automated backups on WordPress.

I’ve seen so many people lose everything on their website. This could have been easily avoided if they just had backups.

One of the best ways to backup your site is with plugins. Check out my guide on the best WordPress backup plugins to help you find one.

Always use cloud storage services. If you’re not using a remote location and just backing up content on the hosting server, you’re going to lose everything if the server crashes or gets compromised.

3. Not integrating Google Analytics

It’s impossible for your website to operate at peak performance unless you’re analyzing data.

I’ve consulted with countless website owners that don’t know basic information about their website such as traffic sources, conversions, top performing content, how people navigate, and things of this nature.

The best way to gain more insight into your website is with Google Analytics.

I highly recommend installing a Google Analytics plugin on your WordPress site. The best plugins give you reports on your audiences.

You’ll learn more about their behavior, events, shopping cart data, and conversion metrics. Then you can use this information to improve your website and target your traffic accordingly.

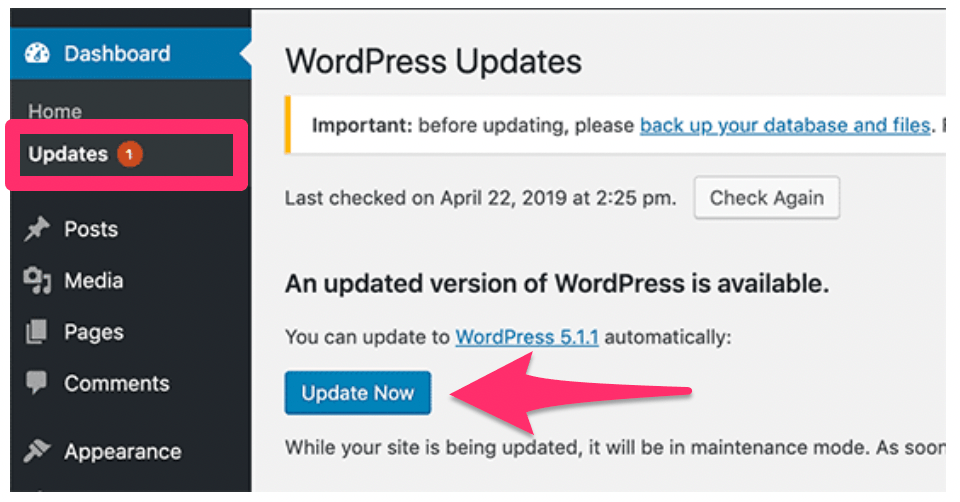

4. Ignoring updates

When you’re on your WordPress dashboard, you’ll probably notice an update notification from time to time. Here’s what it looks like.

In the digital world, we get update notifications like this all of the time.

I’m sure you see messages like this on your phone, computer, and tablet. You can even get update notifications on your smart TV or refrigerator.

In those scenarios, it might be fine to just ignore them. But that’s not the case for WordPress updates.

It seems like people are afraid to install an update for the fear that it will cause their site to crash or something like that. But that’s just a misconception.

Certain themes and plugins will have problems if you don’t keep your WordPress version up to date. So it’s in your best interest to stay on top of these updates whenever you see that notification.

5. Choosing the wrong theme

It’s common for new website owners to struggle when it comes to designing their website.

If you don’t have design experience, I can see why this would be tough for you. However, the design is going to have a huge impact on the success of your website.

If visitors struggle to find what they’re looking for, it’s going to crush their user experience. So you need to take advantage of the themes offered by WordPress.

But there are thousands of WordPress themes. It’s overwhelming, to stay the least.

That’s why I see so many people just pick a theme for the sake of moving forward. Then they constantly play around and change the theme until the find the right one. This is a problem.

Rather than having to rebuild your site several times based on the theme, you’re much better off picking the best theme right from the beginning.

Pick a theme that looks good on desktops but is also mobile-friendly. It needs to be customizable and flexible based on your needs.

Make sure the theme you choose is compatible with plugins you’re using or plan to use. The theme must be optimized for peak performance and website speed.

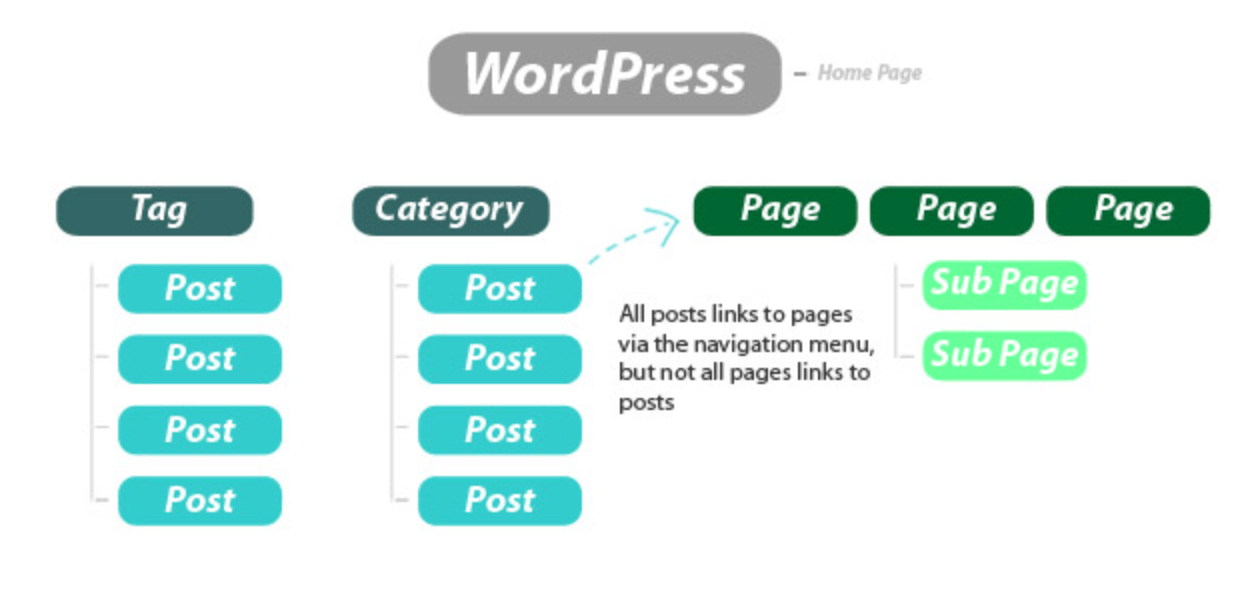

6. Using posts instead of pages

When you’re creating content on your site, it’s important to know the difference between posts and pages. I’ve seen so many WordPress beginners using posts to create important pages on their site.

But posts and pages behave differently in terms of your website architecture.

If you don’t distinguish the difference between the two from the beginning, things will get messy and confusing for you down the road as you publish more content and your website scales.

Here’s what you need to know.

Basically, pages are for timeless content. These are the pages that you won’t be changing frequently.

- Contact page

- Privacy policy

- Pricing

- Services

- About us page

Posts, on the other hand, will be for things like articles, blogs, and news updates. These are time-based pieces of content on your site.

You need to know when to use a page vs. a post for SEO purposes on WordPress.

7. Ignoring SEO

If you’re just designing your site and adding content without thinking about SEO, you’re doing it wrong. This is another common mistake for WordPress beginners.

Without SEO, you won’t get people landing on your site to begin with. That’s why you need to learn SEO best practices.

High search engine rankings will result in more website traffic.

WordPress has some SEO tools built in, but you can always add plugins. Check out my list of the best SEO plugins for WordPress.

8. Confusing categories with tags

You can organize your content on WordPress with categories and tags. However, so many WordPress users don’t do this correctly.

I’ve seen websites with dozens of tags and no categories. On the flip side, I’ve also seen people with nearly 100 categories and zero tags. Neither of these approaches are correct.

Categories are the most general way to group content on your WordPress site. Tags are a bit more specific.

So a blog post may fall into one category but have multiple tags. For example, let’s say you run a news website. Some categories could be:

- Politics

- Sports

- Weather

- Local

- Celebrity

- Breaking news

While tags for a particular post could be “NBA finals” or “basketball” or “Golden State Warriors” for an article within the sports category.

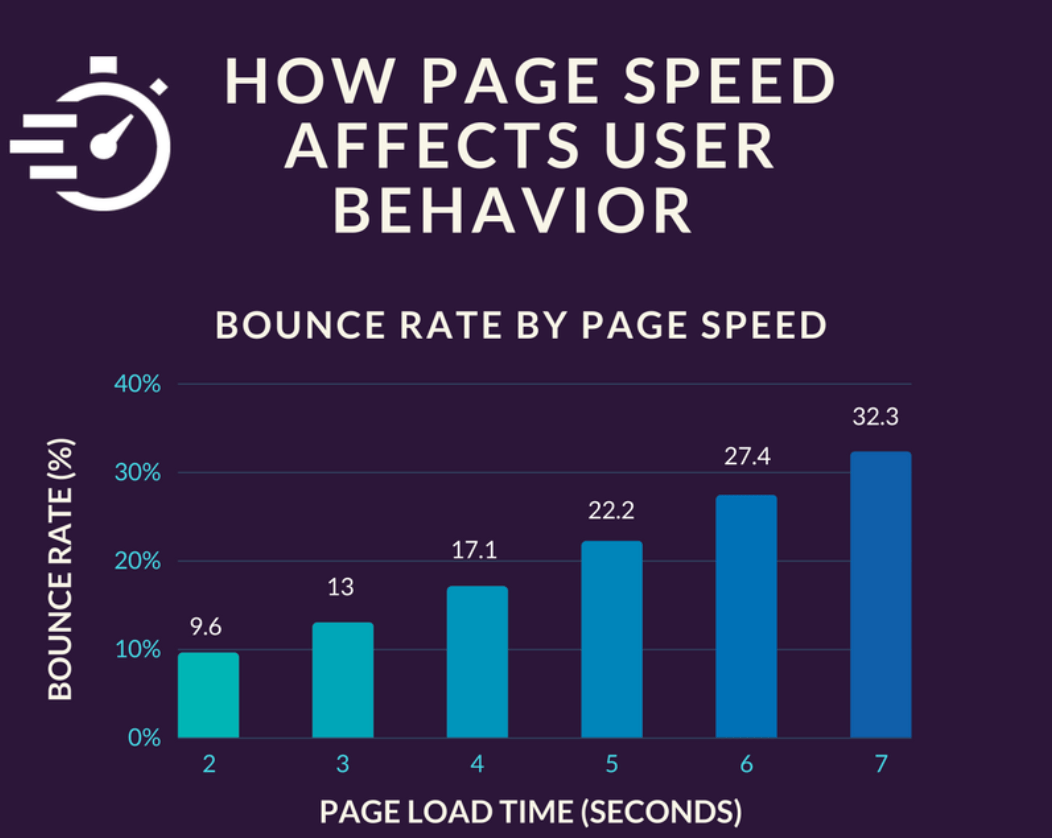

9. Not monitoring speed and performance

I’ve seen WordPress users install hundred of plugins. They add different features and functions to their site while simultaneously adding hundreds of images, videos, and other interactive content.

But they do all of this without seeing how it impacts their site’s performance.

If your website is taking too long to load, then it’s going to have a huge impact on your bounce rates.

On the flip side, website visitors view more pages when your content loads faster.

Websites that load in two seconds or less get nearly nine page views per session. This compares to just three page views per session for sites that take eight seconds to load.

That’s why you need to take advantage of tools and resources that will monitor the speed and performance of your WordPress site. Review my updated guide on how to make sure your website is optimized for speed.

10. Poor security

Earlier I explained how WordPress was the most popular CMS platform. So it makes sense that it’s also the most popular target for hackers.

More than 90,000 websites are hacked each day. 83% of those sites are using WordPress.

If you’re not taking steps to increase the security of your WordPress site, you’re vulnerable to hackers, brute force attacks, and malware.

Any of these things would be detrimental to your site. Imagine the consequences of hackers stealing data from your company and customers. It would ruin your reputation, crush SEO value, and cause you to lose customers.

This is definitely something you want to avoid. That’s why I recommend installing one of the best WordPress security plugins.

11. Forgetting to remove demo content

When you first install WordPress, your site will automatically have a default page called “hello world.” Then there’s some default text on there as well that’s just basically a quick template for how your site can look.

If you forget to remove this from your website, it means that the content will be crawled and indexed by search engines.

Google will perceive this as low-quality and duplicate content since it’s all over the web from other people who forgot to delete it as well. That’s bad for SEO.

It’s also not a good impression for your site if someone visits and sees default content that isn’t supposed to be there. So before you start adding pages and publishing posts, removing the demo content should be one of the first things you do.

12. Not monitoring comments

Giving people the ability to comment on your blog posts and articles is a great way to keep your website visitors engaged.

After they read your opinion, they might want to join in on the discussion as well. People can even communicate with other users through the comments as well.

But there’s a problem with this. Comments sections have become a breeding ground for spam.

You definitely don’t want this to happen on your website. That’s why you need to monitor the comments.

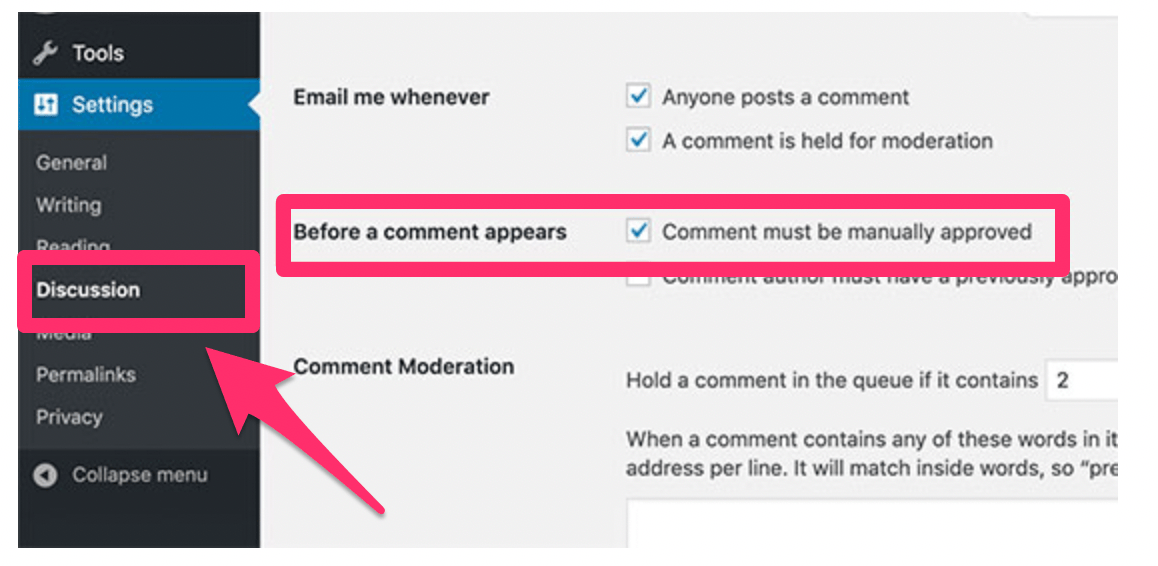

Head to the discussion menu from your WordPress dashboard.

Then set it up for manual approval. You’ll get an email whenever someone posts a comment that needs your review. It will be easy for you to spot a legitimate comment from something that’s spam or unrelated.

13. Keeping your website public while you’re building it

Just because you have a WordPress site, it doesn’t mean that anyone should be able to view it before it’s complete.

Websites take time to build. A site that’s “under construction” shouldn’t be available for public access.

Again, public sites can be crawled and indexed by search engines. So if a site is under construction then it’s not going to be optimized for SEO.

Plus, you don’t want your customers or competitors to see your unfinished website. The best way to avoid this is by putting your WordPress site in maintenance mode while you’re building it.

Conclusion

Using WordPress to manage your website is a great idea.

While WordPress can be a powerful tool, it’s also a platform that’s easy to make mistakes on, especially if you’re a beginner.

Don’t fall victim to these common mistakes. Review this guide before you use WordPress and refer back to it frequently to ensure that you’re steering clear of these errors.

Source Quick Sprout http://bit.ly/2I1KP6z

Dear Penny: We Have Bad Credit. Is There Any Hope for a Debt Consolidation Loan?

Dear D.,

When you have a smorgasbord of debts, life feels like a juggling act. So many due dates, so many interest rates, so many terms and conditions to keep track of.

Then you see the claims in the ads for debt collection loans. Get rid of high-interest credit card debt today! One low monthly payment!

It sounds like a magic little pill that will cure all your financial ailments, right? If only it were that simple.

Unfortunately — as you’ve learned — the people who could benefit most from a debt consolidation loan often don’t qualify. Most lenders require a credit score of at least 620.

You could try applying through a credit union, though membership is required. Unlike big banks, credit unions tend to look beyond your credit score at your overall financial health when you’re seeking a loan.

You can also use websites like Credible, Even Financial or Fiona to shop around for loans. (No, none of them paid me to say that.) But keep in mind that many of the lenders these sites partner with will also require a credit score in the 600s.

While you might be able to consolidate with a lower credit score, you’ll often pay astronomical interest rates — sometimes as much as 30% — which kind of makes the cure as bad as the disease.

But here’s the thing about debt consolidation: Often the benefit is more psychological than mathematical. Sure, life would be a lot simpler with a single monthly payment, but if you can’t lock in a lower interest rate, debt consolidation won’t save you money.

You say you want to consolidate to improve your credit score. If you have enough money to make at least your minimum payments, you’ll gradually see your score increase as you make on-time payments and lower the percentage of your credit you’re using.

Consider speaking with a credit counselor, especially if you can’t afford your minimum payments. The world of debt relief is rife with scammers, so make sure any counselor or organization you work with is a nonprofit that’s accredited by the National Foundation for Credit Counseling.

A credit counselor will help you figure out how to manage your money and debts. The counselor may work out a debt management plan where you make a single payment each month to the counseling organization, which will pay your debts on your behalf. They might be able to lower your monthly payments by negotiating lower interest rates or a longer repayment period, though they generally won’t be able to reduce what you owe.

Avoid companies that offer to work out a debt settlement plan, in which you’ll stop making payments so the company can negotiate to reduce your debt. Not only will these plans kill your credit, but you’ll also owe taxes on the amount that’s forgiven.

It’s easy to get discouraged when you’re deep in debt and low on options for rebuilding your credit. But keep in mind that while a debt consolidation loan might improve your credit somewhat in the short term, it won’t fix the underlying causes of your debt.

Building good credit doesn’t happen quickly. You have to figure out a way not to rely on credit, and to spend less than you make. It requires discipline and a commitment to financial health. And there’s no magic pill for that.

Robin Hartill is a senior editor at The Penny Hoarder and the voice behind Dear Penny. If you have a question about debt, write Dear Penny and you might see your question answered in an upcoming column.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2IveQuv

Top affordable hotels: how to bag a budget bed for the night

Budget hotels can fit the bill if you want a cheap bed for the night before an early flight, work meeting or seeing friends

Premier Inn, Travelodge, ibis budget and easyHotel all offer no-frills style accommodation. But if you want rock-bottom room rates, you may have to downsize, which can mean staying in a room without windows.

So, what can you get for your money when it comes to creature comforts on a budget?

Premier Inn

It promises a ‘Good Night Guarantee’, which means you can get your money back if you don’t enjoy a good night’s sleep. But as you might expect, there are a few exclusions, so you won’t be entitled to a free night if you’re disturbed by thunderstorms or power cuts.

Prices start from £35, according to the website, but room rates vary according to when and where you’re staying. Rooms in Aberdeen and Yeovil, seaside towns like Whitley Bay or cathedral cities such as Worcester, for example, are available for £29 midweek and weekends, and on ‘flex’ rate (so you can pay for the room in full on booking or on arrival).

The best value rooms go more quickly, so it can be tricky to find rooms for the advertised £35 rate, especially in city centre locations, therefore early booking is advisable.

When checking recently I found a room in Wigan for £36 for a midweek overnight stay, and one for £34.50 at Dover Central, but that meant booking for a midweek stay in October.

Staying in the city centre is usually more expensive than the town outskirts – so with Premier Inn’s ‘hub’ locations, in Edinburgh and London, you can opt for a room a size smaller, which can save you money compared with standard room rates.

Standard rooms come with a king-size Hypnos bed, free wi-fi, tea-and-coffee-making facilities and Freeview TV. At hub outlets, you’ll only get a double bed, though a 40-inch smart TV and wi-fi are included. Hub rooms are usually half the size of standard rooms, but what you sacrifice in size, you can save in price. The Kings Cross hub, for example, costs £47 for a room midweek in May but its standard Premier Inn, also in Kings Cross, costs more than double the price at £100 for the same night.

Smaller still is its new Zip hotel, opening in Cardiff in March, with more in the pipeline. These pod-style rooms start from £19 – but while you’ll get a bed, there’s no guarantee you’ll get a window. Rooms are allocated randomly on booking and if there’s no window, you’ll have a lightbox. When it comes to crash-pad potential, expect twin singles that can be pushed together to make a double.

“I just want to be able to turn up and get free parking and a decent night’s sleep when I’m working the next day”

Nick Davies, 50, is owner and director of the Warwickshire School of Hypnotherapy. He regularly uses Premier Inns across the country from York to Kent.

“I’m self-employed so value for money is very important to me along with a good night’s sleep. With a Premier Inn, I know what I’m going to get. I like the familiarity, I know how the room’s laid out and I find the beds more comfy than at Travelodge. I usually book out-of-town locations rather than city centre ones, because they’re cheaper – I once paid more than £100 to stay in the centre of York.”

Some hotels operate ‘dynamic pricing’ – the price can go up even in a few hours

Travelodge

Rooms start at £29, depending on location. In addition to standard rooms there are also PLUS, and SuperRooms, which are typically £10 to £15 more per night than the standard option.

At the booking stage, you can choose between a cheaper ‘saver’ rate or the more expensive ‘flex’ rate, which typically costs around £25 more than the Saver rate and offers free cancellation up to noon on the day of arrival.

A king-size bed, en-suite shower, TV and tea-and-coffee-making facilities are all standard. But while Premier Inn offers smaller rooms with its hub and Zip locations, Travelodge has gone the other way, claiming to offer more for your money.

Its PLUS hotels – in London, Edinburgh, York, Gatwick and Brighton – include blackout curtains, LED lighting and bedside charging points. Top of the range is the SuperRoom with a coffee machine, adjustable 3jet shower, 32-inch Freeview TV, hairdryer, iron and ironing board. While the Plus and SuperRoom versions aren’t the cheapest, in some cases forking out less than £20 for the upgraded room can be worth it.

Breakfast costs extra with all bookings and starts from £8.75 for an unlimited buffet breakfast.

ibis budget

ibis offers its ‘blue’ budget range of hotels in locations including London, Manchester and Edinburgh, with rooms starting at £29. With the budget end of the ibis chain you get a room with a double bed, flat-screen TV and free wi-fi. Unlike the traditional red branded ibis outlets, with ibis budget breakfast isn’t included, although for £5.80 you can enjoy a continental buffet breakfast.

I checked out both London and Manchester for a midweek budget stay in May and the cheapest price I could find in central London was £82 at ibis budget London Whitechapel. By comparison, the same midweek stay in May in Manchester comes in at a very pocket-friendly £23 for the budget option at Salford Quays, which saves more than £20 on the £44 rate you would pay for a room at its standard ibis budget in Manchester city centre.

ibis also offers a cheaper Advance Saver rate across ibis, ibis Styles and ibis budget, if you book at least 15 days in advance; or a more expensive ’flexible’ rate.

The option to cancel your booking can boost the price

easyHotel

There are 11 ‘owned’ easyHotels in the UK, including London, Croydon, Glasgow, Birmingham and Manchester, and a further 25 ‘franchised’ hotels in locations including Luton, Edinburgh, Reading and Belfast. Prices start at £15.59 a night, according to the website, and you can choose from twin, double, triple or a family room that sleeps four.

All rooms have air-conditioning but not all have windows. However, you do get the chance to book a room with a window at the booking stage, but this will cost an extra £5.

Expect the basics here – there is no free wi-fi, tea or coffee making, or bar or restaurant, although there may be vending machines on-site and some hotels offer a breakfast box for around £5.

You can check in from 3pm and check out by10am. Earlier and later options may be available at an extra cost.

How can you find the best overnight deal?

This is a tricky one because room rates vary according to location and date, even within the same chain.

Additionally, some hotels, including the Premier Inn and easyHotel chains, operate a ‘dynamic pricing’ system. This means prices are flexible and based on demand so if lots of people are booking the date you want, the price can go up, even within just a few hours.

I discovered this to my cost when trying to book a room at the Gatwick Airport Premier Inn before an early flight. The date I wanted produced a ‘saver’ rate of £45, and after checking my flight times and airport parking, I went back to book – to find the rate had jumped up nearly 25% in 24 hours, to £55.50. After booking, I found the rate had dropped slightly to £53.50.

“I’m not looking for luxury if I’m only going to be in a room for a few hours before a 4.30am start”

Retail area manager Barry Compton, 52, opts for an ibis budget or Premier Inn if he’s got an early flight for work or when going on holiday.

“If I fly from Luton I stay at the ibis budget as it’s just minutes from departures, and for Gatwick or Heathrow I use a Premier Inn. They’re easy to book, you know what you’re going to get, and it saves hunting around for a decent hotel or checking how easy it is to get from the hotel to the airport in the early hours.”

For nights out, Barry usually looks for budget options. He booked a room at the local Travelodge after a friend’s wedding in Norwich. “It was cheap and clean and I was only in the room for about eight hours anyway,” he says.

Any extras?

If you are driving, check parking options before booking – some locations have free parking. However, none of the Premier Inn hub locations have car parks, and with some city centre locations, you’ll have to fork out yourself.

Stay at the Norwich Central Travelodge, for example, and you’ll have to pay for parking at the NCP multistorey carpark next door, although you can claim back half of the overnight rate by showing your ticket at reception.

Flexible cancellation

The option to cancel your booking can boost the price.

Travelodge has a flexible, but more expensive, rate that allows you to cancel up to noon on the day of arrival; ibis budget also offers a cheaper Advance Saver rate or a more expensive Flexible rate.

Premier Inn has both a Saver and a Flex rate, where the flexible option typically costs around £20 more, but means you can pay on arrival and change or cancel your booking up to 1pm on the day of arrival.

Luggage storage

This is an important point if you don’t have a car and want to avoid dragging your suitcase to meetings after checkout.

With Travelodge, luggage facilities are ultimately at the hotel’s discretion and subject to the space available, so is not guaranteed. With other chains, such as easyHotel, a luggage storage option is only available at some locations, and there is typically a £5 additional charge.

Sue Hayward is a personal finance journalist who writes for publications including The Guardian and LoveMoney.com

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2Z8ekcP