الثلاثاء، 11 يونيو 2019

5 Credit Tips For New College Grads

Source CBNNews.com http://bit.ly/2ZpLjcN

This Company Will Give You $50 If It Can’t Find You Cheaper Car Insurance

When’s the last time you compared car insurance rates?

Rates can change month to month — even day to day.

Of course, there are those personal factors that affect your rate, including age, years of driving experience, marital status and credit history. Then, there are factors that are out of your control, like chances of extreme weather, how many other drivers in your area make claims and the algorithms used to forecast pricing.

That’s why experts encourage consumers to exercise their power and compare rates at least once a year — if not every six months.

This is one of those chores that seems way more difficult than it actually is. Shopping car insurance rates actually doesn’t need to take more than about five minutes if you use a mobile insurance brokerage like Cover.

Just download the Cover app (iOS or Android), and request a free quote.

Oh, and if you live in California or Texas, and Cover doesn’t find you a better rate than what you already have, it’ll give you a $50 gift card. Win-win!

Check Car Insurance Rates in 5 Minutes or Less With This App

Got five minutes? Here’s how to compare car insurance rates with Cover:

- Download the free Cover app.

- Create an account.

- Scan the barcode on the back of your license. (This speeds up the process a ton!)

- Enter information about you, your current insurance plan (if applicable), your vehicle and any other drivers on your plan.

That’s it. Cover compares more than 30 car insurance carriers and spits out its best estimate for you. Scroll down to review what’s included in the policy and get all the details.

If you like the rate, awesome. You’ll receive a text from a Cover adviser who’ll answer your questions. Then, hop on a quick phone call, and your adviser will apply any additional discounts and finish setting up your policy.

Californians and Texans: Can’t Find a Better Rate? Get $50

If your current rate is better than what Cover can find for you, then Cover’s ready to give California and Texas residents a $50 Amazon gift card.

When chatting with your adviser, mention this promotion and they’ll prompt you to send over your current insurance declaration pages for proof. Cover will review to make sure you meet the qualifying criteria.

For California residents:

- No accidents or violations in the past three years; no major violations in the past 10 years.

- A valid license for more than three years (with the last 18 months in the U.S.).

- No prior experience with Cover.

In Texas, you must meet the above requirements, plus:

- At least six months of continuous insurance with the same provider.

- No claims on your driving record.

- Are 22 years or older.

If you meet all the criteria, you’ll get your gift card via email in the next day or two.

Pro Tip

Checked your rates with Cover? Awesome! If you didn’t find what you were looking for this time, set a reminder on your phone to check again in six months, since rates constantly fluctuate.

Once you’ve taken care of your auto insurance, use Cover to compare homeowners and renters insurance, too.

See? That wasn’t so bad!

Carson Kohler (carson@thepennyhoarder.com) is a personal finance writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2Wy8Yps

Twelve Enemies of Good Spending Habits

It’s really easy to have good spending habits if you’re sitting in a comfy chair in your living room reading a book from the library. It’s really easy to have good spending habits if you’re in the midst of a hike in the middle of nowhere. It’s really easy to have good spending habits if you spend the day in the garden.

The problem is that our lives don’t always guide us into those situations all the time. We’re not always in a situation where we’re free of influences that can nudge us away from good spending choices. In fact, much of modern life is full of things that nudge us toward bad spending habits and away from good financial practices.

Here are twelve of these things and how to watch out for them and minimize them in your life.

Sales

Something that you don’t need that happens to be on sale is still something you don’t need. If you don’t need something or don’t strongly want it (and have given that desire some time to be considered rather than just relying on impulse), then spending money on that thing is a waste of your money, no matter how great the bargain is.

Sales exist to tempt you into buying things you don’t need and don’t really want. They show off big discounts to convince you that the item really is a bargain – and maybe it is, solely in terms of the sticker price. However, if you don’t have a genuine use for that item, the money is better off sitting in your bank account rather than in the pockets of that retailer.

A much better strategy is to, on your own, maintain lists of things you need and things you really want. Before you even look at a sale, go through those lists and make sure you actually need the things on the need list and actually really want the things on your want list, and remove anything that doesn’t match up. Then, look at the sale, but only take action on items that actually match your lists. Everything else is basically a waste of your money.

Social Media

While social media can be really useful in some ways, such as keeping in touch with family and friends and professional contacts as well as finding people with similar interests, it’s also an incredibly efficient tool for nudging you to spend more money.

For starters, virtually every social media platform has lots of advertisements and, more importantly, advertisers who inject their marketing messages right into what you’re reading. As you scroll through social media, you’ll see lots of “sponsored” posts mixed right into the content so that your mind will often see them as content unless you look closely. Quite often, people actually choose to follow the social media feeds of companies, which inject more marketing right into your feed, and there are a lot of people on social media who are there primarily as influencers, which means they’re trying to sway you to buy certain things. It is very difficult to browse social media without a lot of companies, ad agencies, and “influencers” convincing you to buy stuff.

Beyond that, you have a lot of people you actually do know, except those people are trying to show the “highlight reel” of their life, which often involves their most expensive stuff and their most expensive experiences. They’re dressed well, while you’re wearing sweatpants. They’re on some amazing trip, while you’re in your ten year old couch. It can very easily make you feel envious, and envy often drives people to spend money to “keep up.”

So, what’s the strategy here? It’s simple – take a social media break and then only restore what actually provides value to your life. Just delete all of the social media apps from your phone, perhaps after posting a message saying you’re taking a break and for people to contact you via text if they need you, and leave them off of there for thirty days. Restore them only if you actually feel a need. The first few days might be hard, but after that, you’ll barely notice they’re gone.

Online Messageboards

Virtually everything that can be said about social media also extends to online message boards of any kind. Sites like Reddit, comment sections of websites, message boards devoted to specific topics – all of them have the same issue. Advertisements are spliced right into the content, many of the anonymous people on there are actually marketers trying to sell you things, and even people who aren’t marketers are often just indirectly promoting stuff you don’t need.

A further problem with online message boards is that they tend to congregate very like minded people who tend to move in a very elitist direction. They’ll often try to outdo each other in terms of their knowledge of the topic and this often turns into recommendations for very specific and very expensive products that are far beyond what you – or anyone else – actually needs. I’ve personally witness

The same strategy is useful here: take a break from such sites and message boards. If you wish, post a message saying you’re taking a break. If there are individual users you want to keep in touch with, you can give them alternate contact information, but this should be a pretty rare occurrence. Then, just walk away for at least thirty days. Find other uses for your time. It’s very likely you’ll never look back, or if you do, you’ll see it as more of a reference tool for specific questions.

“News” Reports on Products

Surprisingly often, “news” stories on news websites and channels seem to mostly exist to promote some new product that’s on store shelves. This new item will solve all your problems! This new item is amazing!

That “news” doesn’t help you in any way with your life. If you had an actual need for something, you’d start by finding something that filled that need. News stories like this try to create a “need” that doesn’t actually exist so that you’ll buy a product you don’t actually need.

Sometimes such stories are innocuous. At other times, they’re just a rewrite of a company’s press release. In some cases, it’s literally a paid placement. In any case, they’re not useful to you.

How do you combat this? Spend less time with the news. Drastically reduce your time watching news channels or reading news websites. When you want to be informed about an issue, seek out good long form journalism on that topic. The vast majority of headline news have almost nothing to do with your actual life, so cut them out.

Spending Time in Stores, Online and Off

People wind up in brick and mortar stores for all kinds of reasons. They’re bored. They’re going there for a social reason. They think they might want something. They’re burning time while waiting for someone or some other event.

People wind up in online stores for all kinds of reasons, too. They clicked a link and it took them there. They want to look at new releases. They’re just clicking around.

In both cases, people are willingly putting themselves in situations where they’re giving their time and attention to a business whose primary goal is to use every trick in the book to extract cash from your pocket.

The solution here is simple: don’t go to stores without a specific purpose. Unless you are intending on buying at least one specific item, don’t go to stores, online or off. They’re merely places to convince you to buy, and they’re using almost every trick they can to nudge you toward doing so.

Shopping Without a List

As I mentioned earlier, it’s not a good idea to shop without the intention of buying something you genuinely need or want. Yet, for things like food or basic household supplies, you can definitely wander into the store with an intent of buying something you need or really want and find yourself putting a bunch of stuff in your cart that you didn’t intend to buy. Remember, stores are really good at convincing you to buy stuff – that’s what they’re designed to do.

There’s a simple solution here: whenever you do go shopping for anything, make up a list beforehand and stick to it when you’re in the store. Take the decision to buy out of the store so that you’re making the decisions outside of the temptations and marketing influence of the store itself.

Not only does making the buying decisions outside of the store help you with maintaining good spending habits, having that list also gives you something to focus on when you’re in the store. You can look at your list when considering what to look for next rather than wandering the aisles and looking all over the place.

Your Friends

How can your friends be considered an enemy of good spending habits? We often tend to be much like the average of our closest friends, and if our closest friends are avid shoppers and consumers, it’s very likely that this behavior influences us to be avid shoppers and consumers, too.

Obviously, one solution is to seek new friendships with people who aren’t avid consumers and who don’t choose a lot of behaviors that encourage bad spending habits. You can do this by getting out there in the community and building new friendships by going to community events, meetups, and other activities.

However, most people don’t want to jettison all of their friends just because they shop a little. For most people, a better approach is to recognize what’s happening in the moment and steer conversations and social events away from shopping and spending money. If the conversation is about buying stuff or the latest consumer goods, steer the conversation elsewhere. If the suggested activity requires an outlay of money, suggest a cheaper alternative. If no one has suggested an activity, suggest an inexpensive one, like a potluck dinner or a movie night at someone’s house or a game night.

The only time to really be concerned with your circle of friends is when every inexpensive suggestion is vetoed and the conversation constantly steers toward spending money and buying expensive stuff.

Short Term Thinking

Humans are designed to think about things in the short term. Most of the time, we don’t give any real concrete thought to what’s going on beyond the next week or so. This means that we overvalue the short term benefit of buying something and undervalue the long term benefit and consequences of buying something. This often results in us spending money on perks and treats and things that are nice right now but are quickly forgotten, like a fast food meal or an item from a convenience store or something you bought impulsively while shopping with friends or something you clicked on Amazon.

Obviously, that kind of thinking is costly, and it’s why people often get a sense of not knowing where their money is going. If you’re buying things on the spur of the moment and then quickly forgetting about them (because they’re utterly forgettable), you can quickly lose all sense of what’s happening with your money.

How can you stop this? Every time you think of spending a dime, consciously step back and consider what you will think of this purchase five years from now. Will you remember it in any way? Will you be kind of sad that you just wasted this money on something so forgettable? This trick quickly separates the meaningful and worthwhile purchases from the forgettable ones and strongly discourages the forgettable expenses.

Procrastination

That kind of short term thinking takes another form in procrastination. We have a tendency to put off important things until the last minute (because they’re finally entering our short term radar), and then we’re in panic mode, rushing around and doing things as quickly as possible, usually with inadequate planning. How many of us have found ourselves a day or two before a holiday event scrounging for gifts?

Procrastination can pay off sometimes. For example, for many people, the pressure put on us by procrastinating generates efficient and high quality performance when trying to finish up a big task or a project.

However, for spending money, procrastination almost always bites us in the rear end. It means that we don’t have the time to do the best research. It means we’re unable to effectively shop around. It means that we can’t wait patiently for sales. In the end, procrastination usually means paying full price for a suboptimal item.

What’s the solution? As soon as you’re even aware of an upcoming need, start shopping for it. Start shopping now for upcoming birthdays and holidays. Come up with good ideas for everyone now and then patiently watch for sales on those items. This also gives you plenty of time to make gifts if you want. If you know a big bill is coming, start putting money aside for it now rather than later. In fact, it’s not a bad idea to just automate savings for those irregular bills by having an automatic transfer at your bank from your checking to your savings each week.

Lack of Self-Control

We all have that inner voice, that monologue inside our head that wanders off thinking about all kinds of things. Often, that voice encourages us to do things on impulse that, when we’re thinking about it, we know we shouldn’t do, but we do it anyway because we’re letting that subconscious train of thought run the show. It’s in those moments that we exhibit a lack of self control – we let our basic impulses, as bad as they are, run the show, even when we might know it’s not the right choice.

This can be very hard to counter, and the best strategy I know of for countering one’s lack of self-control works best when using a lot of other strategies in this article. It relies on some degree of good behavior against other enemies of good spending habits.

What’s that best strategy? Remove temptation and the ability to act on it from your life as much as possible. Avoiding shopping – or any place where you might spend money – is one part of it, but there are many more steps you can take. Another good tactic is to delete your credit card information from online merchants. Another good strategy is to leave your credit card at home unless you’re going out specifically for a need, and only carry a little cash with you. Not only are you removing temptations themselves, you’re also removing the ability to act on them.

Advertising and Marketing (Especially If You Think You’re Immune)

Advertising and marketing are pervasive. They prey on normal human psychology, our inner wants and needs. Sometimes they try to insert an idea in our head that stays there forever, like a good advertising jingle. Sometimes they aim to be so subtle that you never notice the insertion into your subconsciousness, like a clever product placement in a program. The techniques and tactics are endless. And they work. There’s a reason that, when you go to a store, there are tons and tons of brands that you instantly recognize.

These techniques work on everyone, regardless of whether you believe yourself to be “immune” to advertisements or not. In fact, people who think that they’re immune to marketing often lower their guard against the more subtle forms of marketing, making them, in some ways, even easier to market to. Here’s a good summary of that phenomenon.

So, what can you actually do, besides be aware of it? One good strategy is to spend less time with things once you realize they’re being used to market to you. Spend less time with things filled with ads and with product placement and more time with things free of ads and product placement. Modern people can never avoid it entirely, but they can certainly trim down the influence. Read more books and spend more time in nature. Watch less television and use the internet a little less.

Programs with Lots of Product Placement

I’ve hinted at this in previous sections, but I think this needs a section entirely on its own. Product placement – where a particular product is placed into a scene in a dramatic or comedic program that has nothing whatsoever to do with the product, just so it’ll subtly slip into your consciousness a little more – is incredibly pervasive on television and Youtube. Once you start watching for it, you see it everywhere. There are brand name products in the background of many scenes and often featured in various ways without being too intrusive.

My favorite example of product placement in the last several years was the use of cars on The Walking Dead. Here, you have this grimy post-apocalyptic setting where society has fallen apart, but look! They’re driving this beautiful shiny SUV (full of gas, of course) and the camera just happens to pan right over the brand logo. (If you’re wondering, it was a Hyundai Tucson.) It just stuck out at me as being incredibly egregious, and after that, I can’t help but see the products everywhere in television programs and many Youtube videos.

My solution for this is simple: watch less television. Be really selective in terms of what you watch and be aware of product placement. It’s when you’re not aware of it that it’s particularly effective.

Final Thoughts

The modern world wants you to spend recklessly and not save for the future. The influences to spend, spend, spend are everywhere, from the entertainment we enjoy to the social occasions we choose, even to the thoughts in our head.

While there is no perfect solution for escaping all of it aside from moving to a mountain cabin completely cut off from the world, you can be aware of those enemies of good financial behavior and you can fight them. The most powerful tool you have is your attention and time – use it more wisely and you’ll fend off a lot of temptation.

Good luck!

The post Twelve Enemies of Good Spending Habits appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2KdlmJF

SiteGround Web Hosting Review (2019)

SiteGround is one of the most popular web hosting services available on the market today. It’s a safe and reliable way to host your website in 2019.

More than 2 million active domains are hosted with SiteGround.

One of the reasons why this service is so popular is because they offer hosting options and plans suitable for a wide range of websites and businesses. Small personal websites, business websites, and large ecommerce sites alike can all use SiteGround.

For those of you who are looking to find a hosting provider for your new website, SiteGround is definitely a top option for you to consider.

It’s also a great choice for anyone who wants to switch hosting providers for their existing website since SiteGround has plans with a free site transfer. But we’ll talk about this in greater detail as we continue.

I’ll give you a better understanding of the plans, types of hosting, and top benefits offered by SiteGround. You can use this guide to make an informed decision to determine if SiteGround is the best web hosting plan for your needs.

SiteGround Web Hosting Plans

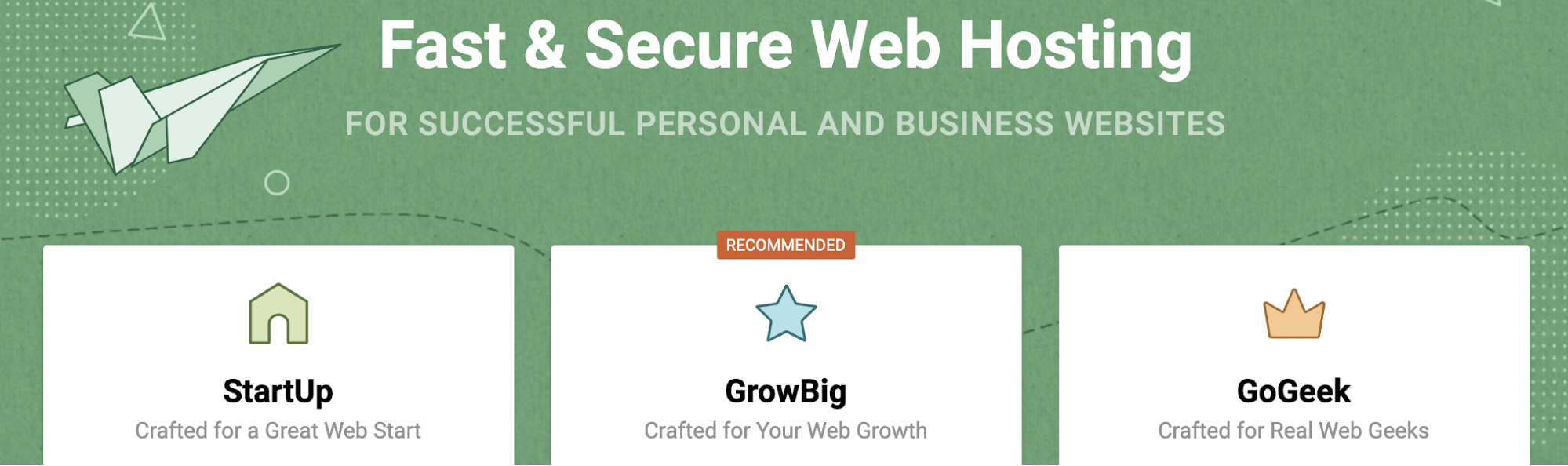

Like most web hosting services, SiteGround offers different plans for websites with varying needs. In this case, there are three tiers for most of their hosting types.

With the exception of cloud hosting and dedicated server hosting, the prices of these three plans will remain the same across the board for shared hosting, WordPress hosting, and Woocommerce hosting. We’ll dive deeper into those plans later in this guide.

For now, I’ll focus on the pricing and features of the three most popular plan options offered by SiteGround.

StartUp

As the name implies, the SiteGround StartUp plan is ideal for new websites. With rates starting at $3.95 per month, this plan is suitable for websites with less than 10,000 monthly visits.

You can only host one website with the StartUp plan, and it comes with 10 GB of web space. Other top features include:

- Free site builder

- Free SSL and HTTPS

- Free email accounts

- Free CloudFlare CDN

It’s a basic plan, but definitely appropriate for new websites that are starting from scratch. For those of you who want more features and better performance, you’ll need to upgrade. You’ll also outgrow the StartUp plan as your traffic increases (which is a good thing).

GrowBig

The GrowBig plan starts at $5.95 per month. This is ideal for medium-sized websites averaging up to 25,000 monthly visits. GrowBig has 20 GB of web space and can host an unlimited number of sites.

Unlike the StartUp plan, GrowBig has enhanced caching ability. The SiteGround Supercacher has three levels.

- Level 1 — Static content caching

- Level 2 — Dynamic data caching

- Level 3 — Database queries caching

StartUp only caches at the first level, but GrowBig caches on all three levels.

If you sign up for the middle-tier plan offered by SiteGround, you’ll also get free on-demand backups, a free site transfer, as well as a staging feature for WordPress and Joomla sites. I’d say that the GrowBig plan will be suitable for most of you who are reading this guide.

GoGeek

GoGeek can accommodate up to 100,000 monthly visits and has 30 GB of web space. Obviously, this plan is made for bigger websites with high volumes of traffic.

Rates for GoGeek start at $11.95 per month, but the plan comes with all of the bells and whistles. In addition to everything that’s available in the GrowBig plan, GoGeek offers:

- Advanced priority support (expedited customer service to the most experienced agents)

- PCI compliant servers (necessary for those of you who process payments online)

- Git pre-installed (for creating repositories on your site)

The name for this plan was inspired by technology geeks. So it’s made for those of you who want more control of your site. If you don’t understand some of the tech lingo that’s being mentioned in the GoGeek plan, it’s probably not for you. The only other reason why you’d need to upgrade to GoGeek is if you’re getting tons of monthly site traffic.

WordPress hosting

SiteGround offers hosting options specifically designed for WordPress users. This will save you time since you won’t need to manually download, install, and configure WordPress.

With SiteGround, you can take advantage of their automated process that’s as simple as clicking a button. This plan also makes it easier for you to customize your WordPress site by choosing a theme, picking your site functionalities, and installing marketing tools.

The WordPress Starter Kit from SiteGround is a great added feature for new WordPress sites. You don’t need any technical knowledge or experience to set this up.

If you have an existing WordPress site, SiteGround offers a free WordPress transfer. The SiteGround Migrator plugin takes care of everything for you. This is a secure way to transfer your site.

Alternatively, if you have a GrowBig or GoGeek plan, you can get your WordPress site migrated by one of the experts at SiteGround. This is a free service for one website before rates start at $30 per site.

WooCommerce hosting

SiteGround also has hosting options for ecommerce shops using WooCommerce.

The quick install and integration with WooCommerce is an easy way for you to create a professional theme for your online store. You can get the site up and running in minutes.

Just migrate your WooCommerce site using the migrator plugin. Just like WordPress hosting, WooCommerce migrations done by a SiteGround expert is free for one website if you’re on the GrowBig or GoGeek plan. Then you’ll have to pay $30 per each additional site.

If you have WooCommerce, you’re going to need to the GoGeek plan anyways, since that comes standard with PCI compliant servers.

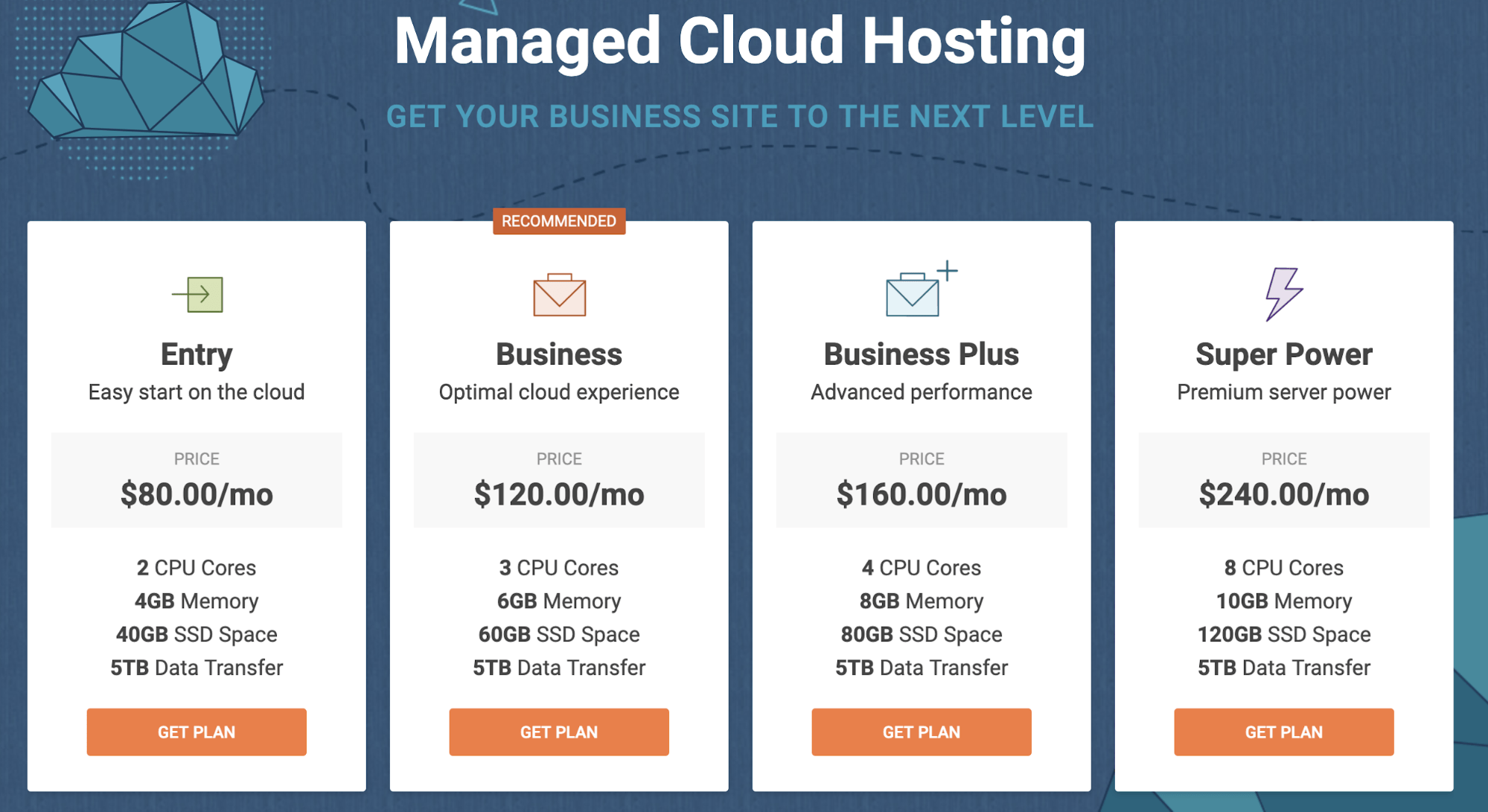

Cloud hosting

Cloud hosting is a new way to host websites. The process uses multiple remote servers and is a great option for those of you who have websites that have outgrown the shared hosting plans.

With cloud hosting, SiteGround gives you guaranteed resources to meet your needs. Your own RAM and CPU won’t be shared with any other websites.

It’s also easy for you to scale your website with this type of web hosting.

You can upgrade your RAM, CPU, and disk space on-demand at any time. You don’t need to get approval to do this, and it happens without any website downtime.

Rather than always doing this manually, you can set up automatic scaling with SiteGround. It will adjust your CPU and RAM to meet the needs of unexpected traffic surges, but you still have control of all the parameters.

There are four plans for SiteGround Cloud hosting. As you can see from the image above, the plans range from $80 to $240 per month. So there’s definitely plenty of options to choose from.

I’d say that the business plan will likely be a suitable choice for most of you who are using a cloud hosting service for the first time.

Dedicated servers

For those of you who don’t want to use cloud hosting or shared hosting, SiteGround offers dedicated server options as well.

This is perfect if you don’t want any restrictions in terms of the software you use on your website. You’ll also be able to make changes directly to your server if you go with this route.

All servers are managed by the experts at SiteGround. They also offer software designed to boost the performance of your server and provide added functionality.

You can also choose the location of your data center.

- United States

- Europe

- Asia-Pacific

There are three dedicated server plans offered by SiteGround:

- Entry Server

- Power Server

- Super Power Server

These plans start at $269 per month, $349 per month, and $729 per month, respectively.

Benefits of SiteGround for web hosting

There is plenty of upside to using SiteGround as a web hosting service. I just want to quickly highlight and explain why this platform stands out from its competitors.

High uptimes

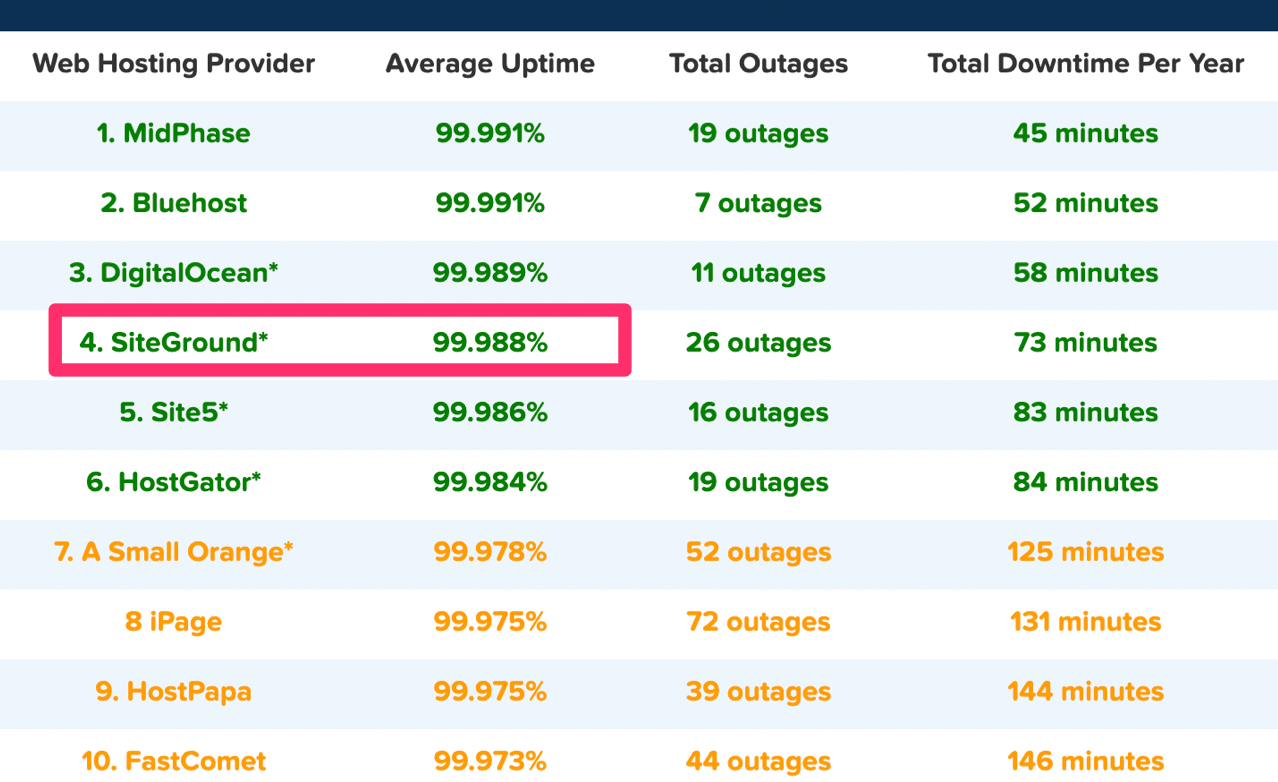

When it comes to measuring how good a web host is, uptime is the ultimate metric. By definition, this is the amount of time that a server stays up and running.

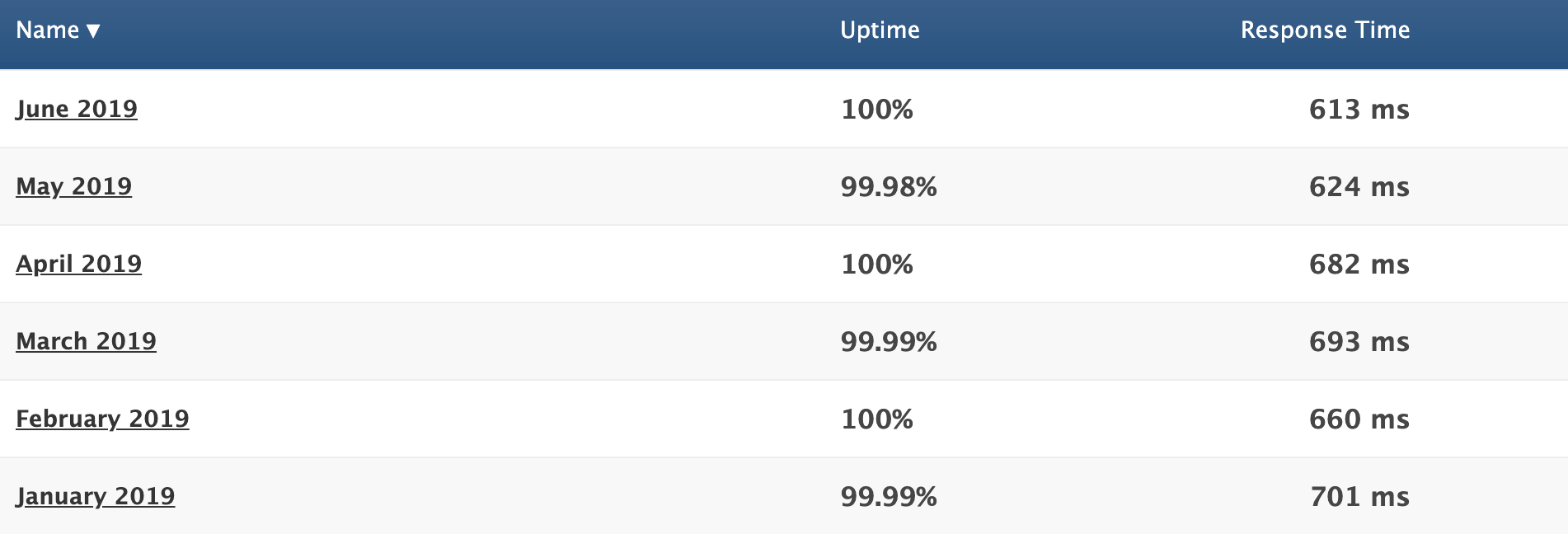

A recent study shows that SiteGround has exceptionally high uptimes, on average, over a twelve-month stretch.

In 2018, SiteGround ranked fourth compared to other web hosts judging by average uptime. As you can see, they were just barely beat out for the third place spot by a one-thousandth percentage point.

Overall, the average uptime for the 32 shared web hosting services in the study was 99.59%. SiteGround was significantly higher than the average and near the top of the list.

High uptimes ensure that your site will nearly always be up and running around the clock.

Fast load times

Just because your site is up, it doesn’t always mean that it will be fast. But take a look at the response time for this SiteGround test website that was set up by Hosting Facts.

We already talked about the great uptime, but now you can refer to the response time column.

The average response time for the first six months of 2019 was 662 ms. That’s phenomenal. In addition to using a good web host, you should also know the other top principles that boost website loading times.

Great customer support

Hopefully, you don’t have any issues with SiteGround. But in the event that you run into a problem, have a question, or need some assistance, it’s nice to know that they provide excellent customer support.

You can access phone support as well as live chat 24/7. As I mentioned earlier, you’ll have priority support if you have a GoGeek plan. This means that you’ll be connected with the most experienced SiteGround technicians whenever you need help.

Free features

Web hosting services will always try to hit you with add-ons at an upcharge. But SiteGround throws in some great features at no extra charge.

Your membership comes with one free site migration. This can be done with their migrator plugin, which we talked about earlier. If you have the GrowBig or GoGeek plan, a SiteGround professional will do the migration for you.

SiteGround plans also come with a free CDN and free SSL certificate.

Cloudflare CDN keeps images, videos, and other large files off of your server. As a result, your server is always fast. Since SiteGround users servers all over the globe, the CDN makes sure that files are stored closer to website visitors for fast delivery.

The SSL certificate is required for all websites. It protects private information being transmitted between devices and websites. SiteGround throwing this in for free is a nice touch since you’d need to get one regardless.

Flexible

Nearly any website can be hosted on SiteGround.

It’s a great web hosting service for beginners and experienced users alike. You don’t need to be too tech-savvy to understand how the platform works and get your site hosted. But on the other hand, if you like to be more hands-on with the server and take advantage of certain features, SiteGround has plans with you in mind.

There are also enough options on SiteGround to accommodate different web hosting needs, such as shared hosting, dedicated server hosting, and cloud hosting.

They have plans suitable for a wide range of average site traffic as well. So as your website scales, you can always upgrade to a plan that will meet your needs.

Money back guarantee

SiteGround offers a 30-day money back guarantee for their shared hosting plans. This shows that they stand behind the services that are offered.

Dedicated servers and cloud hosting plans have a 14-day money back guarantee, which is still enough time to tell if you’re happy with your service.

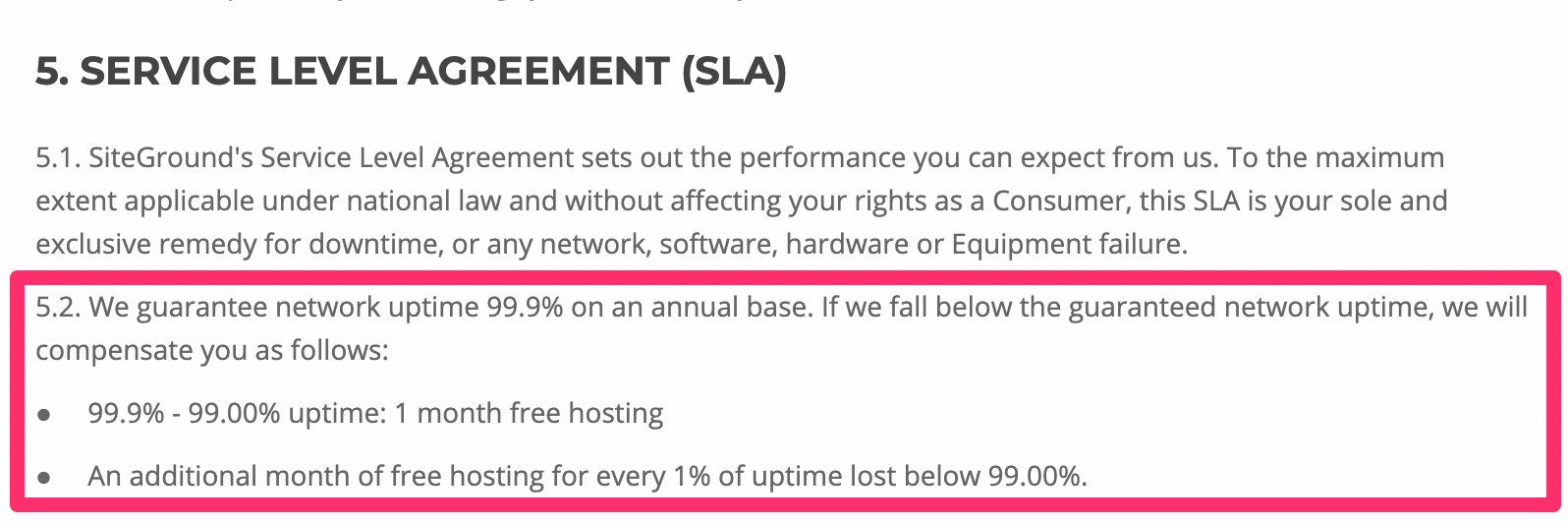

SiteGround will also refund you if they fail to meet a 99.9% uptime rate. This is clearly written in their terms of service.

This relates back to what we talked about earlier, in terms of their high uptime rates. There’s a reason why it’s so high—SiteGround has a promise to stand behind.

Other considerations

There’s no such thing as a perfect web hosting service. While SiteGround is great, there are a few downsides that you should be made aware of before you proceed.

Setup fee

SiteGround charges a one-time setup fee for $14.95 with all of their plans. It’s not a deal breaker by any stretch, but it means you can’t just sign up for their lowest plan and be out the door for $3.95.

Renewal rates

At first glance, SiteGround’s pricing is very attractive. But those are only promotional rates.

When you renew, your rates will jump as follows:

- $3.95 to $11.95 per month

- $5.95 to $19.95 per month

- $11.95 to $34.95 per month

The cost essentially triples across the board. So I’d recommend locking in the longest contract possible when you first sign up, which is 36 months. This will guarantee you a low rate for a while before you’re forced to renew.

Limited budget plan

For those of looking for the best cheap web hosting service, SiteGround’s StartUp plan for $3.95 per month is definitely attention-grabbing.

It’s a great choice for those of you with smaller websites, but it’s fairly limited for anyone who plans on getting more than 10,000 visitors per month. You may have to upgrade faster than you anticipated if you start with their lowest priced web hosting plan.

No free domains

While SiteGround throws in a fair amount of free features, a free domain isn’t on the list.

That’s a bit surprising, considering that this tends to be the standard with other reputable web hosting services. At the very least, the cost of the domain is covered for the first year. But again, SiteGround doesn’t offer that.

Conclusion

I’ll get straight to the point—I would definitely recommend SiteGround for web hosting.

This platform offers a wide range of hosting types and plans to accommodate the needs of nearly any website, large or small. SiteGround stacks up well compared to its competitors in terms of features and performance.

While the hosting service it’s perfect, it still gets the nod from us here at Quick Sprout. I’m confident that it will fulfill your web hosting needs.

Source Quick Sprout http://bit.ly/2KHKat2

How a Big Emergency Fund Can Lower Your Insurance Bill

Paying monthly insurance bills, whether it’s for a home, renters, or auto insurance policy, is one of life’s least enjoyable chores.

Not only is it an expense we often see little return on, but the cost of car insurance, in particular, has been increasing for years—with the largest insurers increasing their average car insurance premiums between 2.3% (Nationwide) and 15.38% (Travelers) in the last three years.

The good news is that if you’re able to sock away more money in an emergency savings account, it’s possible to save on your monthly insurance costs without taking on much more risk. This approach hinges on increasing your insurance deductible, which in turn should bring down the premiums you pay month after month. Here’s a closer look at this strategy and how it works.

The Logic at Work

Your insurance deductible is the amount of money you’re required to pay out of pocket in the event of a claim before your insurance kicks in. For example, if your deductible is $500, and a fender bender causes $2,500 in damage to your car, you pay the first $500 and the insurance company covers the remaining $2,000.

By raising your insurance deductible, you’re agreeing to take on more of the financial risk in the event of a claim: Double your deductible in the above example, and you’d owe $1,000 while the insurance company would pay $1,500.

In exchange for this increased risk, you’ll often pay lower monthly premiums for your coverage, explained Misty Lynch, CFP, and head of financial planning at John Hancock Digital. This typically holds true for products like auto, home, and health insurance.

In the case of car insurance, in particular, a 2016 study found that increasing a deductible from $500 to $1,000 reduced premiums an average of 8.5% across the country. Those making a bigger change, shifting deductibles from $500 to $2,000, could save an average of nearly 15%.

But the key to making this shift without taking on too much risk is to build up your emergency savings account so you can easily cover the higher deductible.

Action Items: Laying the Groundwork

If you opt to increase your deductible to save money on insurance, it’s best to set aside the new deductible amount in an emergency savings or checking account.

For instance, if you increase your homeowners insurance deductible from $1,000 to $2,000, then you need to make sure you have $2,000 you can readily access, said Brandon Tritten of JBLB Insurance Group.

“As an insurance professional I make sure I’m clear about what it means to increase your deductibles,” Tritten added. “Sometimes a person sees ‘savings’, but they don’t have enough money set aside for their deductible. So, increasing their deductible doesn’t make sense.”

Before making such a change, it’s also a good idea to shop around and carefully run the numbers, ensuring the savings from an increased deductible are truly worth it, adds Paul Moyer, founder of SavingFreak.com.

“I live in South Carolina and if I were to increase my homeowners deductible from $500 to $1,000, it will drop my premiums about $120 per year,” explained Moyer. “This means that I have to go just over four years without a claim for that difference in premiums to pay off.”

“Whenever I advise someone on raising their deductible, I tell them to make sure they get new quotes from multiple carriers, compare the rates for their current deductible and the larger deductible and do the math to make sure the extra risk isn’t bringing such a small premium decrease it will not likely benefit you,” added Moyer.

And finally, along with bulking up your emergency fund, if you increase insurance deductibles it’s a good idea to stay up to date on routine maintenance, whether it’s a home or car, says Tritten. Take the time to engage in preventative measures.

“Sometimes you can deter claims with a little time and elbow grease,” said Tritten.

Advantages of a Higher Deductible

The biggest advantage of increasing your deductible is the savings you’ll see over time, says Clint Haynes, a certified financial planner and owner of NextGen Wealth.

“It can add up to hundreds of dollars every year, and thousands of dollars over a lifetime,” said Haynes. “This is something I always recommend to my clients when going through the financial planning process. As long as they have enough saved in their emergency savings account and are able to ‘self-insure’ themselves up to a $1,000 deductible for auto and possibly even higher with homeowners, then they can typically save in the 10% to 20% range on their annual premiums every single year.”

Using This Tactic for Disability Insurance

Establishing an adequate emergency fund can also save consumers money on disability insurance, says Raymer Malone, a certified financial planner and owner of High Income Protection Insurance Agency.

With such policies, the deductible is essentially time, Malone explained.

“Known as a waiting period or elimination period, your policy won’t begin paying benefits when you’re unable to work for a predetermined number of days,” Malone explained. “The typical disability insurance policy has a 90-day elimination or waiting period. However, one can normally select an option as short as 30 days or as long as 365 days, in some cases even longer.”

Without an emergency fund, an individual living paycheck to paycheck may opt for a shorter waiting period, perhaps 60 days. Alternatively, someone who has six months of expenses socked away in their bank account, may instead be able to opt for a 180-day waiting period on disability insurance, which will translate into a less costly policy.

“The savings on a disability insurance policy with a 180-day wait can be almost 50% less expensive than one with a 60-day wait,” said Malone. “Those with the resources to opt for a longer elimination period will see substantial savings on their policies over those who don’t.”

The Bottom Line

Increasing your deductible to save money on your monthly insurance premiums requires taking on a certain amount of risk, something you should be mentally and financially prepared for.

“You need to determine where your comfort with risk is,” Tritten said. “How much are you willing and capable of handling on your own?”

In addition, it’s a good idea to think carefully about how likely you are to file a claim, adds Lynch, of John Hancock Digital.

“If you feel there’s a low risk of needing to use your coverage, a high deductible plan might work well for you,” she said. “However, choosing a high deductible plan could be an expensive mistake if you need to use your insurance often.” For example, even if you have enough extra savings set aside to cover your $1,000 car insurance deductible in the event of an accident, you could get stuck if you need to file another claim just a few months later.

Still need help deciding whether this approach makes sense for you? Talk with an independent insurance agent, said Tritten, who can help determine if increasing your deductible, in conjunction with an increased emergency savings account, could be beneficial for you.

Read more:

- The Best Homeowners Insurance

- Don’t Make These Seven Car Insurance Mistakes

- How Car Insurance Can Save Your Retirement

- The Best Car Insurance Companies

Mia Taylor is an award-winning journalist with more than two decades of experience. She has worked for some of the nation’s best-known news organizations, including the Atlanta Journal-Constitution and the San Diego Union-Tribune.

The post How a Big Emergency Fund Can Lower Your Insurance Bill appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2XCUvtD

How to Get Started Working at Home as a Personal Concierge

Do you want to launch your own home-based business, but you’re not sure what type of business to start? Then consider working as a Personal Concierge, or sometimes called, a Personal Assistant. Not only does this allow you to work-from-home, but it falls under the most basic human needs of not having enough time and […]

The post How to Get Started Working at Home as a Personal Concierge appeared first on The Work at Home Woman.

Source The Work at Home Woman http://bit.ly/2MF9ylP

Give yourself a mortgage MOT

Your mortgage may be your biggest regular outlay. If you're not sure how healthy yours is, a check-up could save you a mint – and mortgage newbies can work out how to secure the home of their dreams

Chances are you spend very little time thinking about your mortgage – yet it is probably the biggest bill you have to pay month in, month out. If you think your home loan could be in better shape, try our ‘Mortgage MOT’ and see if you could trim your costs. Or, if you are yet to buy your own home, find out what you can do to take that elusive first step on to the property ladder.

Switch from SVR

Almost one million borrowers are paying their lender’s standard variable rate (known as SVR). This is the default rate you roll on to after an initial fixed or tracker rate deal (a rate that tracks the Bank of England base rate) comes to an end.

But with the average SVR at 4.89%, according to independent data compiler Moneyfacts, and some SVRs even higher than 6%, there are big savings to be made by switching. By comparison the best short-term fixed rates are less than 2%.

Dig out your mortgage paperwork and check if you are still in a ‘deal’ – a fixed or tracker rate – or if you are paying your lender’s SVR. Find out your interest rate and what, if any, penalties there might be to switch. Those tied into a deal will typically have redemption penalties to switch away, but those on SVR are usually free to move without incurring any fees.

The savings can be significant. A borrower with a £100,000 repayment mortgage over 25 years paying an SVR of 4.89%, for example, would have monthly repayments of £578. By switching to a two-year fixed rate at 2% they could cut this to just £424.

Even if there is an arrangement fee on the fixed-rate deal (fees of around £1,000 are typical) there will still be a saving of more than £2,600 over two years compared to paying your current lender’s SVR.

“Competition is fierce in the mortgage market so the majority of borrowers on SVR can make substantial savings by switching,” says David Hollingworth, associate director of communications at London & Country Mortgages.

Even so-called ‘mortgage prisoners’ should consider discussing their options with a mortgage broker. These borrowers are stuck on high interest loans with defunct lenders such as Northern Rock and Bradford & Bingley who have previously struggled to meet affordability criteria with rival lenders.

In March this year the regulator, the Financial Conduct Authority, published a report into the mortgage market, and among its recommendations were plans to make it easier for these borrowers, where they were meeting monthly repayments, to find a new mortgage deal.

“Many borrowers in this situation are meeting their monthly repayments but are paying way over the odds on high SVRs,” says Mr Hollingworth. “It is great news that lending criteria is being relaxed to enable these homeowners to shop around and find a better rate.”

Use a broker to find a better deal

Searching for a new mortgage can be daunting, which is why so many borrowers end up paying their lender’s SVR for so long. But there is help to navigate the market and switch to a better deal – a process known as remortgaging.

A good mortgage broker can search across the market to find the best deals – looking at different interest rates and set-up fees to work out the total cost.

Different deals might suit your needs depending on the size of your mortgage, the amount of equity (part of the property that you own) and your credit rating. And there is not usually a fee to use a broker, with most brokers taking their commissions instead from lenders.

Richard O’Reilly, mortgage expert, at online mortgage broker Habito, says: “Remortgaging may sound complicated but it doesn’t have to be. A broker will search the market to make sure that you get the best deal out there and that the savings are worth the effort.”

Moneywise Mortgage Awards 2019

Whether you are a first-time buyer or a last-time buyer, buying a home or an investment or simply remortgaging onto a better deal, get the lowdown on the best mortgage offers for you with Moneywise Mortgage Awards 2019.

Lock in security

Long-term fixed rates are attractive to homeowners because they give certainty over exactly how much your mortgage repayments are going to be in the longer term.

Many people opt for this security, even if it costs them more each month when compared to a short-term fixed rate or tracker.

However, if interest rates fall you may not be able to take advantage of a better deal if you have locked into a fixed rate. Borrowers need to weigh up their priorities and whether they would be able to afford the mortgage at different rates.

“With rates at historic lows five-year and even 10-year fixed rates have grown in popularity,” says Mr O’Reilly. “Due to increased competition the difference in rate between five-year and two-year fixed rates has narrowed, so it means more borrowers have decided to take the longer-term option.”

Overpaying to prepare for the next rung

Charlotte and Matt Lenton from Boston, Lincolnshire, have their eye on a house move soon and are trying to build up equity in their current home. Charlotte, 24, who is studying for a master’s degree in gender studies, and Matt, 28, a car mechanic, pour all their disposable income – £500 a month – into the mortgage, on top of their regular repayment of £270 a month.

Charlotte and Matt have deliberately remained on their lender Santander’s ‘Follow-on rate’, at 4% (even though they could get cheaper fixed deals elsewhere) as there are no penalties to make unlimited overpayments.

This Santander rate is variable and tracks at 3.25% above the Bank of England base rate (which is currently 0.75%).

“We hope to be able to buy a new place once I graduate and am working full time – hopefully next year,” says Charlotte.

“We know it is important to get ourselves into as strong a position financially to be able to climb up the property ladder. So we are budgeting hard now to be able to overpay on the mortgage.”

Overpay on the mortgage

If you have any spare cash left each month, overpaying on your mortgage is an excellent option. It speeds up the repayment of your mortgage and reduces the interest you pay.

“It’s important to keep a buffer of savings in a bank account for emergencies,” says Dilpreet Bhagrath, mortgage expert at digital broker Trussle. “But once that buffer is in place, overpayments on the mortgage are a fantastic, tax-efficient way of maximising your additional disposable income and making considerable savings.”

Most mortgage deals allow up to 10% of the mortgage balance to be paid off in overpayments each year without penalty. But always check with your lender. And remember, it is not usually possible to get the overpaid money back.

On a £150,000 repayment mortgage over 25 years with a 2% fixed-rate mortgage, the monthly repayments would be £636. If the borrower overpays £100 a month they would clear their mortgage four years and two months earlier – and save £7,301 in interest. The calculation assumes the interest rate remains the same throughout the mortgage term.

Problems with repayments? Don’t bury your head in the sand

Getting into payment difficulties with your mortgage can be extremely stressful – but taking early action can help stop the problem from escalating.

If you have a change of circumstances, such as illness or job loss, which is going to affect your ability to meet your mortgage repayments speak to your lender. Under guidance set out by the regulator all lenders are required to treat customers in difficulties sympathetically and to offer solutions. Depending on your situation it may be possible to switch your mortgage to interest-only repayments for a short time to alleviate the pressure, for example.

Lenders should also be able to set up a regularly reviewable payment plan with you based on what you can afford. This will give you some breathing space.

“Pre-empt any issues and talk to your lender as soon as possible,” says David Hollingworth, associate director, communications at London & Country Mortgages. “It is always better if you can flag up difficulties early and work with your lender rather than ignore the problem, which will usually make the debt situation much worse.”

For independent debt advice visit nationaldebtline.org (0808 808 4000) or contact citizensadvice.org.uk.

Consider an offset loan

For borrowers who also have savings, an offset mortgage offers another way to get those cash savings to work harder. With an offset loan – providers include Barclays, First Direct, NatWest, Scottish Widows Bank and Yorkshire Building Society among others – your savings are offset against your mortgage so you only pay interest on the balance.

So if, for example, you had a £150,000 mortgage and £30,000 in savings you would only pay interest on £120,000. This can significantly reduce your monthly repayments, and borrowers retain access to their savings at all times.

However, most borrowers use offset loans as a way of reducing the term of the loan – so they keep their repayments the same and effectively overpay, clearing the mortgage years early and saving thousands in interest.

The flexible features of offset mortgages are appealing but borrowers may pay a premium compared to the best fixed and tracker-rate deals available, so be sure you will use the offset facility if you go for this type of mortgage.

First-time buyers: get help on to the property ladder

Save as much as possible to be able to access the lowest fixed rates. Although deals have improved for those with just a 5% deposit, fixed mortgage rates improve significantly for those with a 10% deposit or more to put down on their first home.

Many people will be lucky and have help from the bank of Mum and Dad. Research by savings provider Foresters Friendly Society shows that almost one-third of parents intend to contribute toward a deposit on their child’s first home.

Tax-efficient savings schemes such as the Help to Buy Isa and Lifetime Isa are also good places to start, offering a government bonus to add to your savings towards a first home.

Taking your mortgage over a longer term can make monthly repayments more affordable. Most lenders will allow a mortgage to be taken over 30, 35 and even 40 years, depending on your circumstances, compared to the historic standard 25-year term.

But the downside is you will pay much more interest over the term if you do not reduce it at a later date.

Mr Hollingworth says: “Most borrowers will try to cut the term further down the line when finances might have changed. This is always advised where possible to avoid paying a lot more interest.”

Tori Hull, 23, and her partner Ollie Hensberg, 24, a project engineer, have decided to do this to keep their repayments down. They have taken a mortgage with Accord at 3.21%, putting down a 5% deposit on their new home in Devizes, Wiltshire, with a term of 35 years. It means the monthly repayments on the £170,500 loan will be £677, compared to £827 if the mortgage was taken over 25 years.

“Taking the loan over 35 years instead of 25 is what enabled us to buy the property. Otherwise the repayments would have been unaffordable,” says Tori, who works in training for the Ministry of Defence. “We are young so we are not worried about the loan term being over 30 years. It is our plan to reduce the term at a later date when we remortgage. But we’re not in a rush.”

JO THORNHILL is a personal finance journalist who has written for Money Observer and thisismoney.co.uk.

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2MEW0qt

Moneywise Mortgage Awards 2019

Which mortgage providers have shone brightest, been truly innovative and given outstanding service in the face of ever challenging market conditions?

The competition was fierce, as always, but the results are finally in – here are the winning lenders in the Moneywise Mortgage Awards 2019

Brits are property obsessed. We watch people buy, sell and renovate their homes on TV, and check out what our neighbours’ properties have sold for online. And when the conversation runs dry after we’ve exhausted the state of the weather, there’s always the state of the property market to fall back on.

But for many people the reality of buying and financing property can be pretty stressful. From difficult buyers to tardy solicitors or problematic surveys there is often something that throws a spanner in the works.

However, with the right mortgage from the right lender, financing your property purchase shouldn’t be an additional headache.

Whether you are buying your first home or your last home, purchasing an investment or want to get a better deal on your current loan, the Moneywise Mortgage Awards are here to help you find the right lender for you.

Across 12 categories, our awards go to lenders who don’t just offer excellent rates, they also provide top-notch customer service and strive to come up with the solutions to better tackle your borrowing needs.

Best lender for fixed rates

Winner: HSBC

- Top deal: 1.84% five-year fix

- Max LTV: 60%

- Fee: £999

Highly commended: Barclays

Fixed rate mortgages offer you the certainty that your mortgage payments will not rise during the specified period, irrespective of what happens to interest rates. Deals are typically for two or five years, but longer term 10-year deals are also available.

With interest rates remaining low since the 2008 financial crisis, borrowers have become used to cheap mortgages and are wary of rates rising. With this in mind, it’s not surprising that the vast majority of borrowers now take out this type of mortgage and competition between lenders is fierce.

Our winner for the third consecutive year is HSBC. David Hollingworth, judge and associate director, communications at London & Country says: “The consistency of its pricing is hard to ignore and puts it at or near the top of the best buy charts, week in week out. It’s not just at low LTV [loan-to-value] bandings either; it also adds to the strength of its offering with free valuation and free basic legal work for remortgages as standard.”

For the second year in a row, our runner-up is Barclays. Judge Andrew Montlake, director at mortgage broker Coreco says:

“It has been consistent all year with good rates.”

Judge Cassie Stephenson, vice president operations at Habito meanwhile noted that it is particularly competitive in the help to buy market.

Best lender for discount mortgages

Winner: Accord Mortgages

Highly commended: Leeds Building Society

Fixed rates might be the preferred choice of most borrowers, but there is still a market among some borrowers for discounted rates. These offer a discount from the lender’s standard variable rate but as the rate is not fixed it may change if interest rates rise or fall.

Our winner this year is Accord – the broker-only subsidiary of Yorkshire Building Society, which won the same category in 2018. Judge Aaron Strutt, product and communications manager at Trinity Financial Services says: “Accord has offered some incredibly cheap discounted mortgage rates over the past year, undercutting the price of many fixed deals. They have been available to a wide range of borrowers, and these mortgages complement the overall suite of products. Most borrowers do not think about discounted rates because they typically take a fixed rate but they can be an attractive option.”

He adds: “Accord’s discounted mortgages have also been designed so borrowers can lock into a fixed rate at any point without paying an exit fee.”

Coming in a close second place is Leeds Building Society. Mr Hollingworth says: “A thorough range of competitively priced discounted rates on offer in the core areas. It typically offers a range of fee options to broaden the suitability to a wider audience.”

Best lender for offset mortgages

Winner: Scottish Widows Bank

- Top deal: 1.99% five-year fix

- Max LTV: 60%

- Fee: £1,499

Highly commended: Accord Mortgages

Offset mortgages enable you to use any savings you might have to reduce the level of interest you pay on your home loan. So, for example, if you had a £100,000 mortgage, linked to £25,000 in savings, you would only pay interest on the difference – £75,000. This can save borrowers thousands of pounds, either by reducing monthly repayments or by repaying their mortgage early. Mr Strutt says: “If more people were aware of the benefits of offset mortgages they would be tempted to take them rather than leaving cash in savings accounts generating small returns. There are lots of calculators online that can demonstrate how they work and how much you could save.”

Not only does Scottish Widows Bank take the award for an impressive fifth year in a row, it was also the unanimous choice of our judges. Mr Montlake says: “They have been brilliant all year with low rates and a good offset offering, especially on remortgages. So good I remortgaged to them myself!”

Mr Hollingworth adds: “It’s unique in making offset standard across the entire range and has been highly competitive at times. Famously flexible for higher earners, Scottish Widows’ proposition is very well structured for their target market.”

Our runner-up is Accord Mortgages. Mr Strutt says: “Accord has had a real push on its offset proposition, making it more widely available to borrowers including first-time buyers. Brokers are turning to the lender because it consistently offers mortgages when other banks or building societies have refused applications.”

Best lender for buy to let

Winner: Barclays

- Top deal: 1.47% two-year fixed rate

- Max LTV: 65%

- Fee: £1,795

Highly commended: The Mortgage Works

As rules and regulations become increasingly punitive for landlords, it’s becoming even more important for landlords and property investors to make sure they are on the most competitive rate possible and working with a lender that can help them navigate the market.

For the second year on the bounce the award goes to Barclays. Mr Hollingworth says: “Barclays is a great example of what can be achieved by looking beyond conventional wisdom. Its full affordability assessment underwrites the borrower rather than the property, which makes them particularly good for smaller-scale landlords in high-value areas who might otherwise struggle to meet pure rental tests. Good product pricing and incentives add up to a compelling offer.”

This year the runner up is The Mortgage Works (TMW) – the specialist lending arm of Nationwide Building Society. Mr Hollingworth says: “TMW is a major buy-to-let player but has not rested on its laurels and continues to develop and enhance its proposition. TMW’s launch into the limited company buy-to-let market has helped to shake that market up but it continues to look after the smaller landlords too. Higher 80% LTV options, strong incentives, a wide range of fee options and competitive rates make for an excellent overall package.”

Best lender for first-time buyers

Winner: Nationwide

- Top deal: 1.99% two-year fixed rate

- Max LTV: 90%

- Fee: £999

Highly commended: Halifax

Getting on to the property ladder can feel like something of a Herculean feat, and it helps when lenders can take a practical, sensible approach. This award is for those lenders that go above and beyond to help people buy their first home.

Once again it was very much a two-horse race, with high street giants Nationwide and Halifax taking first and second place as they did in our 2018 awards.

Commenting on our winner, Nationwide, Mr Strutt says: “Nationwide has made a strong commitment to first-time buyers to help them on to the property ladder. The lender has higher loan-to-value mortgages and provides terms of up to 40 years. At the moment it is taking an average of 10 days to produce mortgage offers and does not charge a valuation fee if you are purchasing a property and require a basic inspection.”

He adds: “Last year the lender increased its 95% loan-to-value loan size twice from £350,000 to £500,000 to make it easier to purchase property typically in London and the South East. It had already raised this limit from £250,000 to £350,000.”

Ms Stephenson says our runner-up, Halifax, is “good on affordability and offers a very quick turnaround time from application to offer”. Mr Montlake says it’s “always consistent, always reliable, the first-time buyer’s dream”.

Best lender for first-time buyers with family support

Winner: Barclays

- Top deal: 2.75% three-year fix (Family Springboard, which requires a family member to pay 10% of the purchase price into a linked savings account for three years)

- Max LTV: 95%

- Fee: £0

Highly commended: Bath Building Society

With increasing numbers of first-time buyers turning to parents and other family members for help in buying their first home, this award is for those lenders that have developed products to specifically target this market and incorporate financial support from a third party in its affordability calculations.

The award this year goes to Barclays – last year’s runner-up. Mr Hollingworth says: “Barclays has supported the Family Springboard product approach consistently, now offering deals all the way up to 100% LTV when a parent is able to support their child with 10% in cash as additional security. From the parents’ point of view it offers interest on the cash and access to their savings after three years.”

Runner-up this year is Bath Building Society, which has been offering its Parent Assisted Buying Scheme since 2008. It also offers loans to help university students purchase property. Mr Montlake describes the lender’s approach as “original and innovative”.

Best lender for lifetime trackers

Winner: First Direct

- Top deal: 2.74% (1.99% over BoE base rate)

- Max LTV: 75%

- Fee: £490

Highly commended: Santander

If you don’t want the hassle of remortgaging every few years and can cope with your mortgage repayments changing, it may make sense to go for a lifetime tracker. Rather than offering a fixed or discounted rate for a set period of time, these mortgages are set at a certain margin above the Bank of England base rate and move up and down when it does.

Unlike fixed and discount deals that tie you in for a certain period of time, there are not usually any penalties for switching.

For the second year in a row, the award goes to First Direct. Mr Strutt says: “First Direct is one of a limited number of lenders happy to provide Bank of England base rate tracker mortgages that are competitively priced with very low arrangement fees.

“The bank still has a great reputation for customer service and its products are available providing you have a 10% deposit. There are also a few offset rates.”

Taking the runner-up position is Santander. Mr Hollingworth says: “Santander is very good at targeting its products well and with good incentive packages to bolster the rates on offer.”

Best lender for remortgages

Winner: Barclays

- Top deal: 1.85% five-year fix including free valuation and legals

- Max LTV: 60%

- Fee: £999

Highly commended: HSBC

When you come to the end of the fixed or discounted rate on your mortgage, you’ll be switched to your lender’s standard variable rate and your monthly repayments will skyrocket.

However, you can avoid this by remortgaging to a better deal. Once you have come off your special rate there aren’t usually any penalties for switching. There will be arrangement fees on your new loan but these will be more than outweighed by the savings you make on lower repayments.

Taking the award once again is Barclays – the same winner as last year. Mr Strutt says: “Barclays is extremely active in the remortgage market and has an attractive proposition to tempt borrowers away from their existing lenders and avoid expensive standard variable rates.

“The bank has some great rates, low arrangement fees and generous affordability calculations, and even contributes to the valuation and legal costs of remortgaging. It can also provide a super-fast mortgage if you have a large deposit.”

Coming a very close second is HSBC, which was also runner-up last year.

Mr Hollingworth says: “HSBC is impossible to ignore, with consistent market-leading rates on offer and remortgage incentives across the board.

“The key areas of two and five-year fixes as well as two-year trackers have all been covered, making for a great remortgage option.”

Best lender for larger loans

Winner: HSBC

- Top deal: 1.49% two-year tracker (0.74% over base rate)

- Max LTV: 75%

- Fee: £999

Highly commended: NatWest

It’s crazy to think that wealth can hinder your ability to borrow, but the reality is borrowers in need of larger loans could see their options limited. It may be that they exceed the maximum loan size for the most competitive deals, or find that income from multiple sources complicates affordability assessments.

Our winner this year is HSBC, which was highly commended in this category last year.

Mr Strutt says: “HSBC has a wide selection of rates available to wealthier clients living in the UK and overseas. It also has a decent interest-only policy enabling clients to minimise their monthly payments.

“When people require larger loans they also often want a lender to make it as easy as possible to get agreed and the ability to be flexible when required. HSBC provides larger loans on its cheapest fixed and tracker rates and even has no early repayment charge trackers.”

NatWest is runner-up this year. Mr Strutt says: “NatWest offers multi-million-pound mortgages on its cheapest fixed rates as standard and has teams dedicated to producing fast mortgage offers. It can help a wide range of wealthy clients with unusual properties or complex financial situations. The bank has established itself as one of the go-to lenders for larger loans and is keen to help more people.”

Best lender for new-build

Winner: Barclays

- Top deal: 2.54% two-year fix with £1,000 cashback

- Max LTV: 90%

- Fee: £0

Highly commended: Halifax

If you are buying a new-build home, it can help to have a sympathetic lender. The property may not be fully built at the point you apply for your mortgage, or you might find that your developer imposes tight deadlines that require speedy action from your lender.

Our winner this year is Barclays. Mr Hollingworth says: “Barclays has been really strong in the new-build market and notably developed its Green Home mortgage – specifically designed to recognise the fact that new homes often offer better energy efficiency.”

Last year’s winner, Halifax, is runner-up this year. Mr Strutt says: “Halifax is good on affordability and regularly provides fast mortgage offers to help with tight exchange deadlines set by developers. Having a soft credit footprint at the initial dip stage is a comfort as many buyers are very concerned about their credit scores.”

Best lender for older borrowers

Winner: Family Building Society

- Top deal: 2.69% two-year fix

- Max LTV: 80%

- Fee: £999

Highly commended: Hodge Lifetime

Strict lending criteria and maximum age caps can make it difficult for older borrowers to take out a mortgage.

However, with more lenders increasing age caps, and taking a more pragmatic approach to underwriting and developing loans specifically for this market, the picture is improving.

For the second year in a row, the award goes to the Family Building Society.

Mr Strutt comments: “Family Building Society helps a lot of older borrowers and has acceptance criteria that is designed to make it easier to qualify for a mortgage if you have pension or investment income.”

Mr Hollingworth also points to the society’s Retirement Lifestyle Booster – a loan linked to your home that enables you to boost your income over a 10-year period – as an indication of its ability to innovate and respond to the needs of its target market.

Coming a very close second is Hodge Lifetime.

Mr Hollingworth says: “Hodge is a specialist in the equity release market and the company has brought that experience to bear well in the mortgage market. It already offered a mortgage product for those who are aged 55-plus but it has been quick to add a retirement interest-only option following the regulatory change.”

Innovator of the year

Winner: Barclays

- Top deal: Green Home Mortgage 2.13% two-year fix

- Max LTV: 90%

- Fee: £0

Lenders continually develop new products and services to improve their customer proposition. However, it’s often difficult to distinguish between marketing gimmicks and genuine innovation. This award rewards those lenders that are genuinely responding to the needs of their target market.

This year our winner is Barclays, which is helping the ever growing new-build market with its Green Home Mortgage.

“It rewards buyers of energy efficient homes with a keener rate,” explains Mr Hollingworth. “A nice idea to put the focus on energy efficiency, something that will be a strength of new-build.”

The mortgage is open to people buying a new-build from a range of developers with an energy efficiency rating of 81 or above or which is in an A or B band with discounts on its fixed rate mortgages.

The Judges

Moneywise Mortgage Awards 2019 were judged by:

David Hollingworth, associate director, communications at London & Country

Andrew Montlake, director, Coreco

Aaron Strutt, product and communications manager at Trinity Financial

Cassie Stephenson, vice president operations, Habito

Methodology

Trinity Financial compiled our shortlists, based on best buy data over 12 months (supplied April 2019). Shortlists of lenders with the best rates were given to the judges, who voted for winners and runners-up, looking at rates, fees, penalties, flexibility, service and treatment of new and existing customers. Judges voted for their innovator of the year, but the Moneywise editorial team made the final decision.

Tags

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2KbAh7c