Increasing conversion rates is essential for every business.

Even if your current numbers are satisfactory, there’s always room for improvement.

The problem I see is that too many companies are using the same old and boring strategies.

Those methods get stale fast, and they don’t entice your customers to change their behaviors.

Implementing scarcity tactics is a viable way to boost conversions, increasing sales.

The best part is you can do this without acquiring new customers.

It’s a great method for ecommerce sites to grow sales and for anyone with a website to get their visitors to take a certain action.

If you’ve never used scarcity as a marketing tactic, you need to tread carefully.

You don’t actually want to scare your customers.

This will backfire.

But the right approach can get them to act fast.

I’ll show you how to tastefully implement scarcity into your marketing campaign.

Here’s what you need to know.

Create a sense of urgency

Take a minute to put yourself in the shoes of a customer.

They have many options to choose from when they’re shopping online.

Think about all your competitors, both local and international.

It’s easy for someone visiting your website to think they can find a better deal somewhere else.

Sure, the product or service may not be exactly the same, but it’d be close enough.

In some instances, the product may be identical.

Unless it’s something they need right away, they can always find an excuse to put off the purchase.

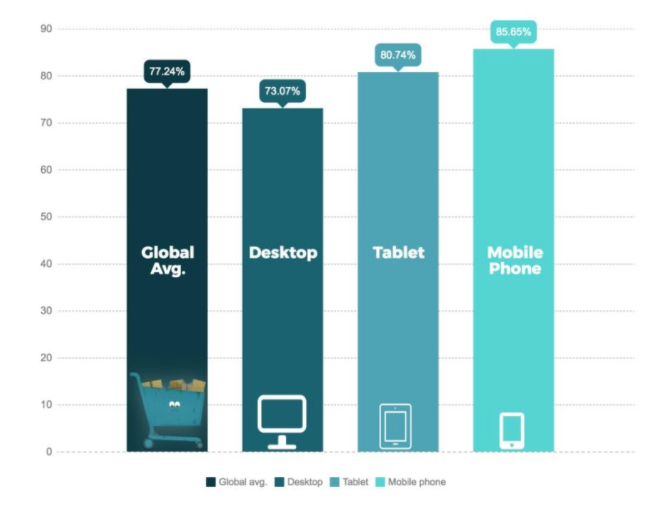

This is partially why shopping cart abandonment rates are so high.

This holds true on a global scale across all platforms.

Shoppers can just wait to find what they’re looking for when it goes on sale or buy it from another retailer.

That’s why you need to create a sense of urgency.

Urgency will force them to act quickly.

It will give them the impression this is the best deal available and they won’t have the same opportunity to make this purchase again.

A few ways to do this include setting a deadline, show a limited quantity remaining, or improve your value proposition for a limited time.

I’ll give you some tips on these methods in greater detail as we move forward.

We’ll even take a look at some great examples of how other companies do this so you can see how it works for yourself.

Use the fear of missing out (FOMO) to influence an impulse decision

You need to realize some people are just browsing.

They may be on your website, even adding items to their shopping carts, without any intention of actually making a purchase.

Take a look at some of the top reasons for cart abandonment:

Two of the most common reasons involve customers who had no intention of making a purchase at the time of browsing.

FOMO can change this.

By now, the consumer has at least identified they’re interested in what you’re offering.

But what if they won’t have another chance to get it?

It’s human nature to want what we can’t have.

I found an interesting study in the Journal of Experimental Social Psychology that illustrates this.

A group of women was shown a photograph of a man.

Half of the test sample was told the man was in a relationship, while the other half was told he was single.

The results were astonishingly different.

When women thought the man was single, 59% of them expressed interest in the man.

But among those who thought the man was in a relationship, a whopping 90% expressed interest in him.

It’s the fear of missing out on something that drives desire.

Here’s a more relatable example for our purposes.

Let’s say you’re shopping for headphones.

Amazon implements this strategy as good as anyone:

You found what you’re looking for on their website, and it’s offered at a reasonable price.

But you realize there are only 2 items left in stock.

Now what?

The fear of missing out on something can cause the consumer to make an impulse decision even if they weren’t planning on it when they started browsing.

You can use this on your website too, especially if you have an ecommerce platform.

I know what you’re thinking.

You have plenty of items in stock, so this strategy won’t work for you.

Think again.

Look, I’m not saying you should flat out lie to your customers.

But you can still use this scarcity tactic.

Do you think if those 2 pairs of headphones from Amazon are sold, there won’t be any available for purchase anymore?

I doubt it.

But the illusion of scarcity is enough to impact the buyer’s decision.

Don’t do this for every item on your site, or else it won’t have the same impact.

You can also use FOMO to elicit an impulse decision from a customer using price.

Airlines use this strategy all the time.

Take a look at this example I saw on JetBlue when I was browsing flights from Seattle to New York City:

I knew I wanted to travel on this day and leave Seattle around noon.

I knew I wanted to travel on this day and leave Seattle around noon.

Although I was just browsing, I realized I had to buy the ticket now if I wanted to get the best price.

I know from experience that you don’t want to call an airline’s bluff when it comes to scarcity.

The price will actually go up after those limited quantities of tickets get sold.

If your company runs on a similar type of supply and demand, you can easily change the prices accordingly and let the site visitors know this by counting down the limited quantity.

That’s how you can turn a browser into a shopper and boost conversions.

Set a deadline when sending email promotions

We just saw how scarcity works with quantity, but it works with time as well.

Deadlines are a great way to get customers to act fast.

That’s because deadlines encompass some of the concepts we just discussed.

They create urgency and the fear of missing out.

But in this case, instead of missing out on the product itself, customers would miss out on a particular discount.

Think about this next time you’re sending a promotional email.

Say you want to offer 25% off everything on your site.

You’re sending out the campaign on December 1st.

I like your thought process so far.

Discounts in December are a great way to build hype for the holiday season.

But you set the promotion to expire on December 31st.

That’s where you lose me.

Why?

There’s no urgency.

If the customer has the whole month to take advantage of your sale, they have no incentive to act fast.

Create tighter deadlines to create scarcity.

Here’s a great example from the Macy’s website:

It’s a one day sale.

Customers can get $10 for every $50 spent online through the end of one day and in stores through the end of two days.

That’s it. After that, the promotion is over.

It’s much more effective than running this promotion all month.

Take this strategy, and apply it in your next email.

I’m a big fan of using flash sales because they create urgency.

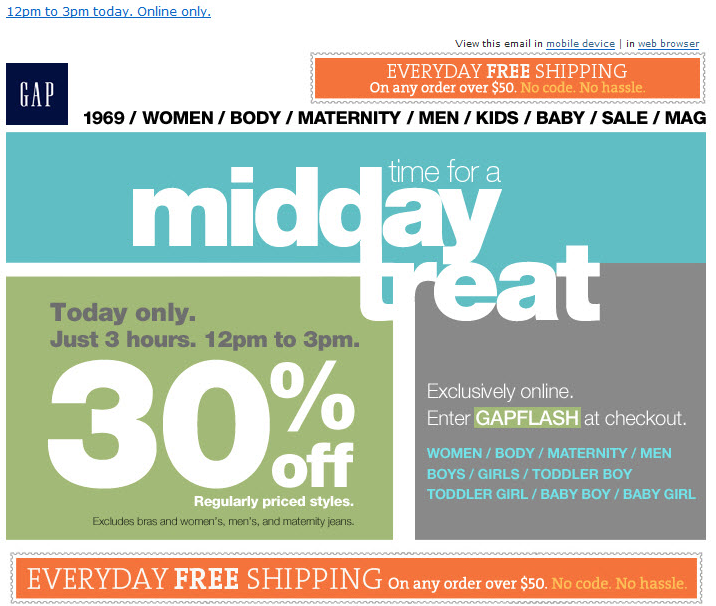

Let’s look at an offer Gap sent to their email subscribers:

They take urgency and scarcity to a whole new level.

Rather than having a discount that expires after a day or two, they offer a deal that’s valid for only 3 hours.

Customers can get 30% off if they shop online between noon and 3 PM.

After that, the deal’s over.

I love this method with email because your subscribers are already familiar with your brand, products, and services.

It’s likely they’ve already made a purchase on your site.

If not, they were interested enough to provide you with their contact information, so a flash sale could end up being the factor that gets them to finally convert.

The key is knowing when to run these and how often to do it.

If you run a flash sale every day, it won’t be very effective.

Your subscribers aren’t dumb, and they will catch on fast.

They’ll know that if they wait, another flash sale will be available in a day or two.

It just gives them an excuse to keep putting their shopping off, which is the complete opposite of what you’re trying to accomplish.

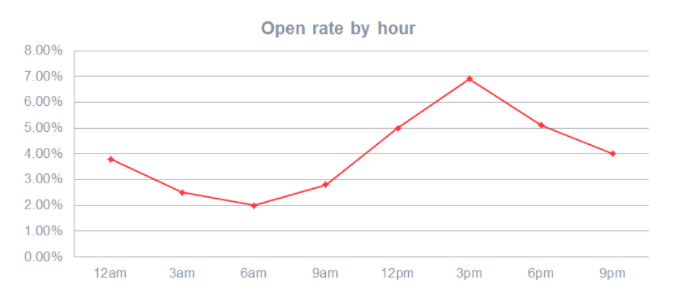

Another factor to take into consideration is the timing of the flash sale email.

If you’re anything like me, sometimes you work odd hours.

Just because you’re awake and creating a flash sale email at 2 AM doesn’t mean it’s the best time to send it to your subscribers.

Studies show the best time to send an email is in the afternoon.

Open rates tend to peak at around 3 PM.

Schedule your flash sale email delivery accordingly.

Upsell your customers with an improved value proposition

Once you’ve got the user to convert, you can upsell them before they finish checking out.

Earlier we looked at how Amazon created scarcity with a “limited quantity remaining” indicator on certain items.

As you navigate through their checkout process, you’ll see different shipping options.

Standard shipping for ecommerce products is usually 5 to 7 business days.

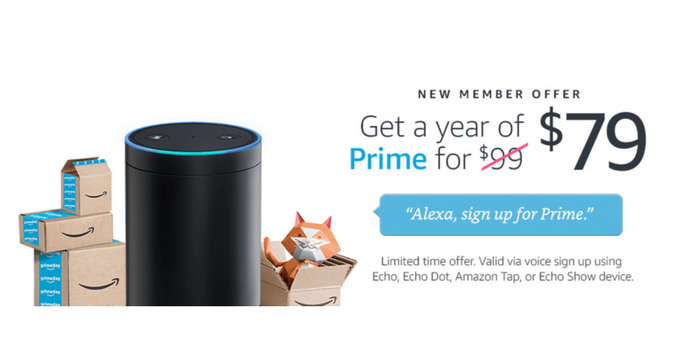

But Amazon gives their preferred customers 2-day free shipping with an Amazon Prime membership.

The annual cost is $100, and it comes with all sorts of other benefits.

But there are certain days of the year when Amazon offers discounted memberships:

If you offer memberships to your best customers, you can use the same strategy.

Take a few days out of the year, and offer new prospective members a price cut for their first year of payment.

Offers such as “buy two and get the third one free” or “free shipping on orders over $50” are common forms of improved value propositions for upselling.

If you combine those offers with words like “today only,” you’ll add scarcity as well.

This will get your customers to spend more money than they originally planned.

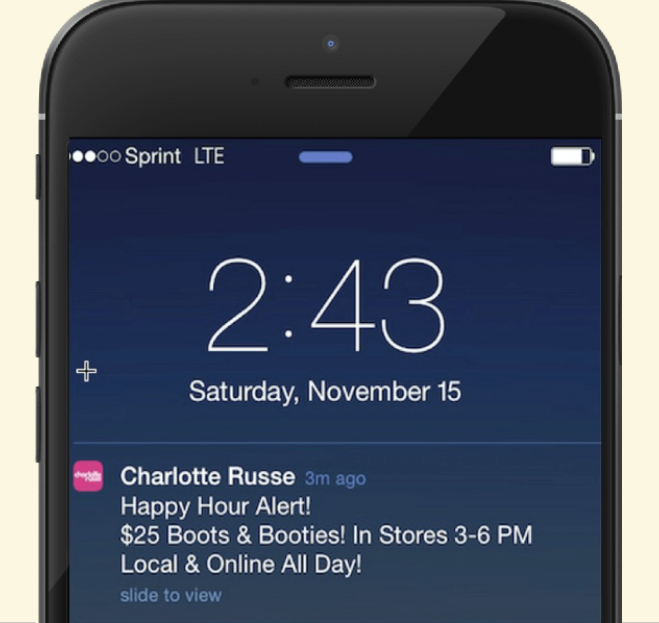

Use push notifications to entice mobile users

If your company has a mobile app, you want to take full advantage of it.

You have the ability to send notifications directly to the user.

It’s a great chance to implement the scarcity tactic.

Take a look at how Charlotte Russe accomplishes this:

This is similar to the email strategy we looked at earlier, but it has even greater benefits.

With email, you’ll need to worry about open rates.

But everyone who has your mobile app will see your message if they have push notifications turned on.

You can get this deal exposed to a larger audience.

You can also increase the chances of these customers spending more money on each conversion.

Look at how mobile ecommerce is trending:

This upward trend is great news for all of you who have mobile apps.

Apply these strategies, and focus them on your mobile customers as well.

It’s a recipe for success.

Conclusion

You need to come up with some new methods of increasing conversions if you want to improve sales.

Creating scarcity is one of my favorite ways to do this.

Just make sure it’s done tastefully.

Recognize not all users visiting your website came there with the intention of making a purchase.

Some are just browsing or conducting research.

But strategically causing them to experience FOMO can drive a sale.

Show a countdown of remaining quantities under certain items.

You can do this with prices too, similarly to how airlines create urgency on their websites.

Set a tight deadline when you’re emailing promotional discounts to subscribers.

Flash sales are more effective than longer deadlines because they give people a reason to act fast.

Use scarcity to improve your upselling tactics as well.

Don’t neglect mobile users.

If you have a mobile application, send push notifications to the app users to create urgency.

Following these steps will help you boost conversions fast.

What type of discount will you email your subscribers during your next flash sale?

Source Quick Sprout http://ift.tt/2BlV0kV

Patrick Grieve is a tight-fisted skinflint who can typically be found scrounging around in dive bars, empty baseball stadiums and second-run movie theaters. He’s also a writer, so The Penny Hoarder just felt like a natural fit for him.