Let’s be honest. Creating pulse-quickening, super-engaging content that blows the socks off every single reader 100% of the time probably isn’t realistic.

It would be nice, yeah. But it just doesn’t happen.

This is especially true for companies in so-called boring industries—micro-niches with very few people having an overwhelming interest in the subject matter.

But if you’re always boring your audience to tears, this will obviously have a negative effect on your traffic, leads, conversions, brand reputation, and—ultimately—profitability.

Basically, boring content is awful. Boring content is worse than no content at all!

If you think your content marketing campaign is in a death spiral, it’s important to resolve the situation ASAP.

I used to write some pretty boring crap. Once I figured it out, I changed my ways. Today, I’m not necessarily channeling J. K. Rowling all the time, but I do know when (or if) my audience is bored.

How do I know?

I’m about to tell you.

But first, let me spill the beans (well, sort of) upfront: it’s about data—the warning signs are in the data.

Whether you’re a marketer, SEO, or content creator, data is your friend. But don’t worry, I won’t tell you to buy some expensive analytics software. Nearly all the data I cite in this article is free.

Here are telltale signs that your audience finds your content boring.

Your bounce rate is abnormally high

What’s bounce rate?

Here’s how Google defines it:

Bounce Rate is the percentage of single-page sessions (i.e., sessions in which the person left your site from the entrance page without interacting with the page).

Basically, someone looks at your site and leaves.

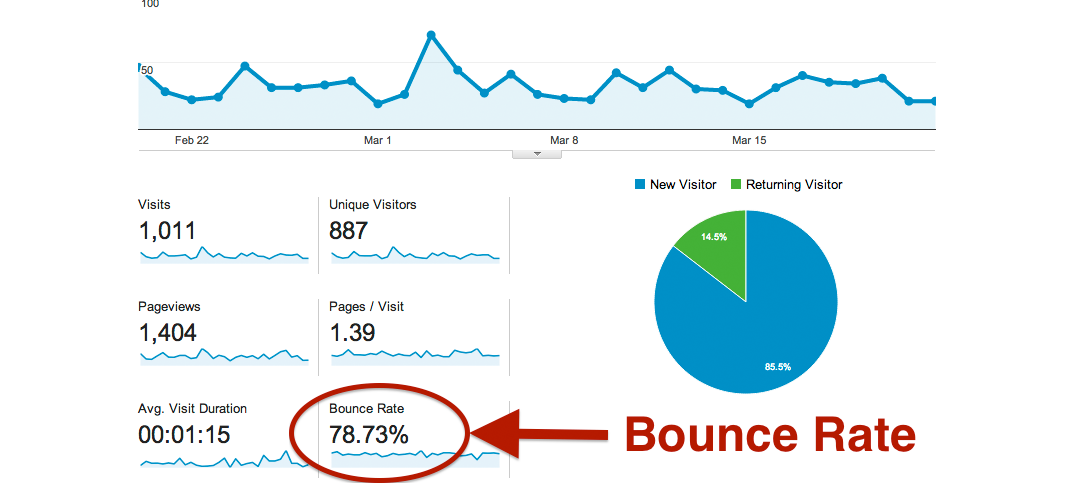

You can find your bounce rate in Google Analytics.

How do you know if your bounce rate is awful or not?

Here are some benchmarks, according to the type of site you have:

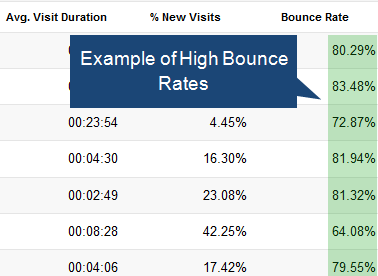

Multiple issues can contribute to a high bounce rate.

Slow page load time, ugly web design, annoying pop-ups, or a crappy mobile experience are just a few of these reasons.

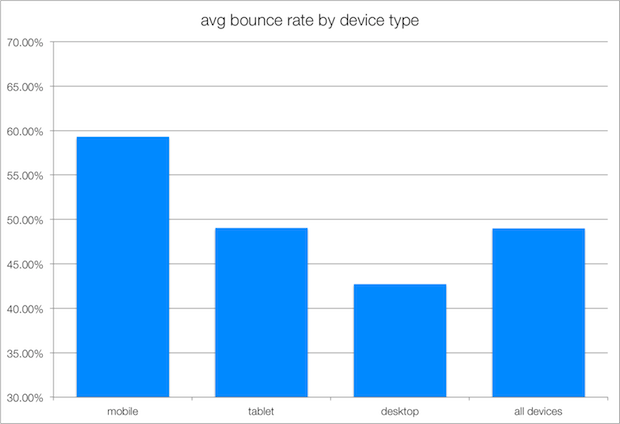

For example, mobile bounce rates are typically higher because of the less-than-optimal mobile design of some sites.

However, it can also simply be because readers are less than thrilled with your content and they’re abandoning ship before even making it halfway through.

If your bounce rate is over 70%, there’s probably cause for concern. If it’s over 90%, it’s a serious issue.

When there’s no other discernible reason, lackluster content could very well be the culprit.

You get few comments or no comments at all

Are you creating blog posts, guest posts, social media updates, etc. that are consistently getting little to no reaction?

Maybe you’re even asking open-ended questions at the end and begging for readers to chime in to spark a discussion.

What’s happening?

If nothing, take this as a warning sign.

In my early days of blogging, about ten years ago, I didn’t get many comments on my articles.

This one post (about postcards?!) received only 17 comments and basically no social shares:

I could have gotten all depressed about that.

But instead, I learned a lesson. Maybe my audience gets bored by stuff about postcards.

So, maybe I need to change my game a little bit.

I changed my game, and I really homed in on the topics and style my audience wanted. As it turns out, a post like this got hundreds of comments:

Comment counts are a great thermometer of the interest level of your audience.

If you write a sizzling-hot article on a sizzling-hot topic, the number of comments will reflect it.

But if you write a complete snoozer, no one will comment.

This is the kind of information that tells you exactly what you need to know about your content’s bore score.

Your content isn’t getting socially shared

I personally think that social shares are one of the most simple yet informative metrics in content marketing.

A quick glance at the number of likes, tweets, and other shares a piece of content receives often serves as a basic litmus test to see how favorably (or unfavorably) your audience has responded.

For example, it’s fair to say that if “Blog Post A” received 250 total shares and “Blog Post B” received only 12 total shares, Blog Post A was received by the readers significantly better.

While it wouldn’t be realistic to expect every piece of content to be a home run, a continually low number of social shares often indicates audience boredom.

The readers are simply not captivated by your content and don’t feel it warrants being shared.

The only caveat would be if you’re fairly new to the scene and haven’t really established an audience yet.

But if you used to receive a reasonable number of social shares and those numbers are noticeably dropping, boring content could definitely be the reason.

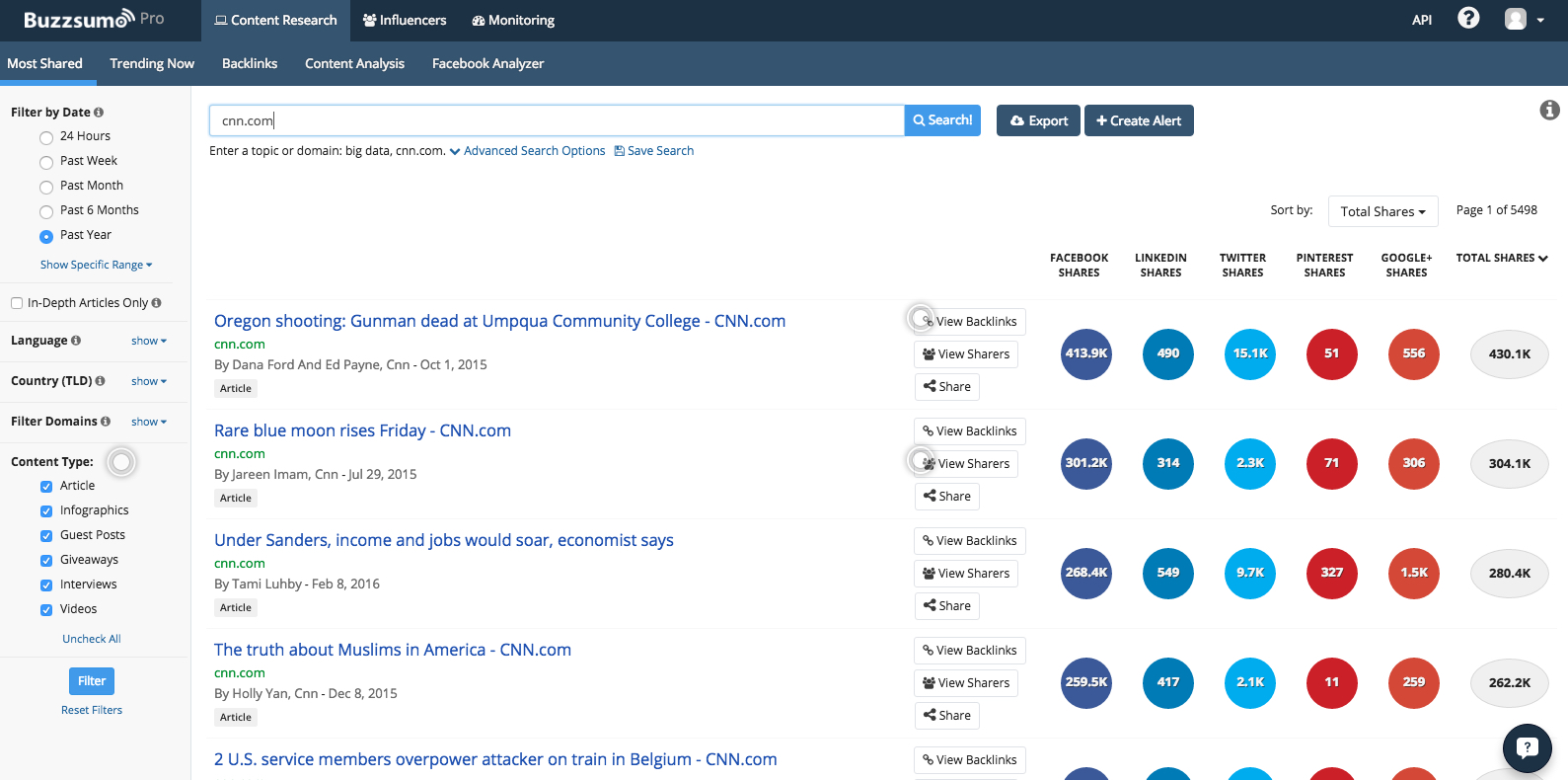

There’s a simple way to measure how your content is being shared.

You can use a tool such as Buzzsumo. Simply enter the URL of your website or blog, and click “Search!”

You’ll see a screen of results like this:

Granted, you may not have 430k shares on a single post like CNN does. Ideally, though, you’ll see at least a few.

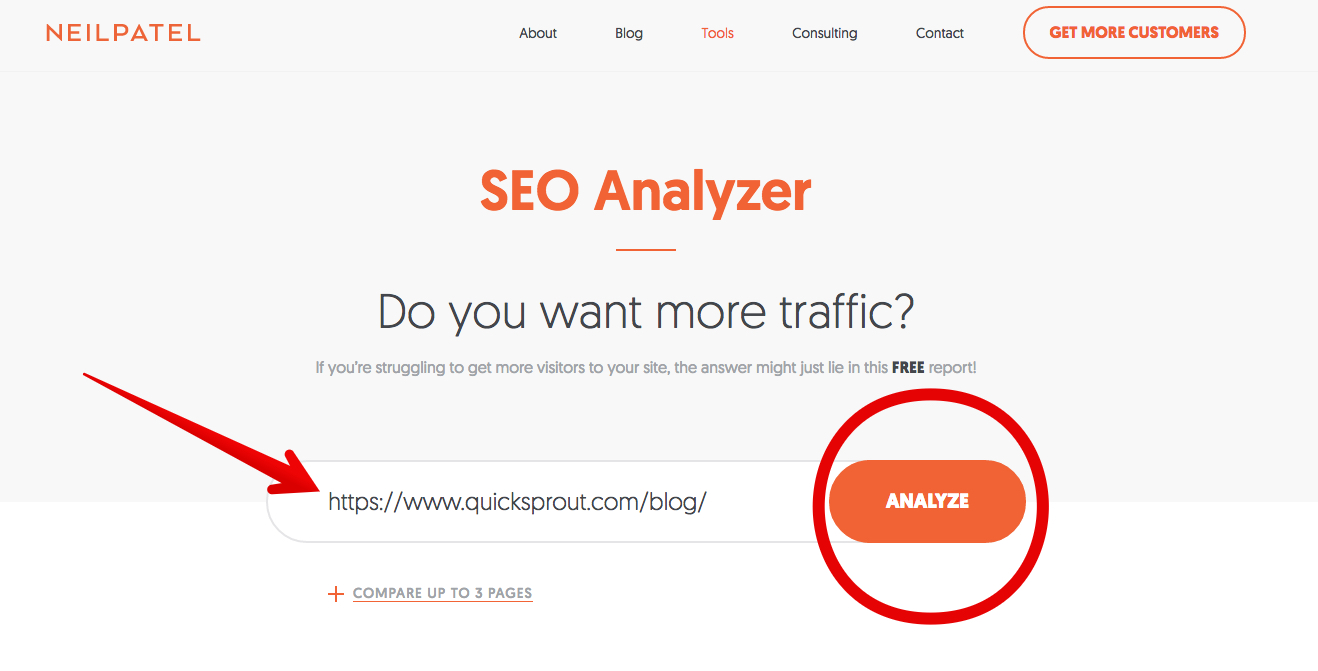

Another free tool you can use is on my blog, NeilPatel.com.

To use this tool, enter your blog’s URL, and click the “Analyze” button.

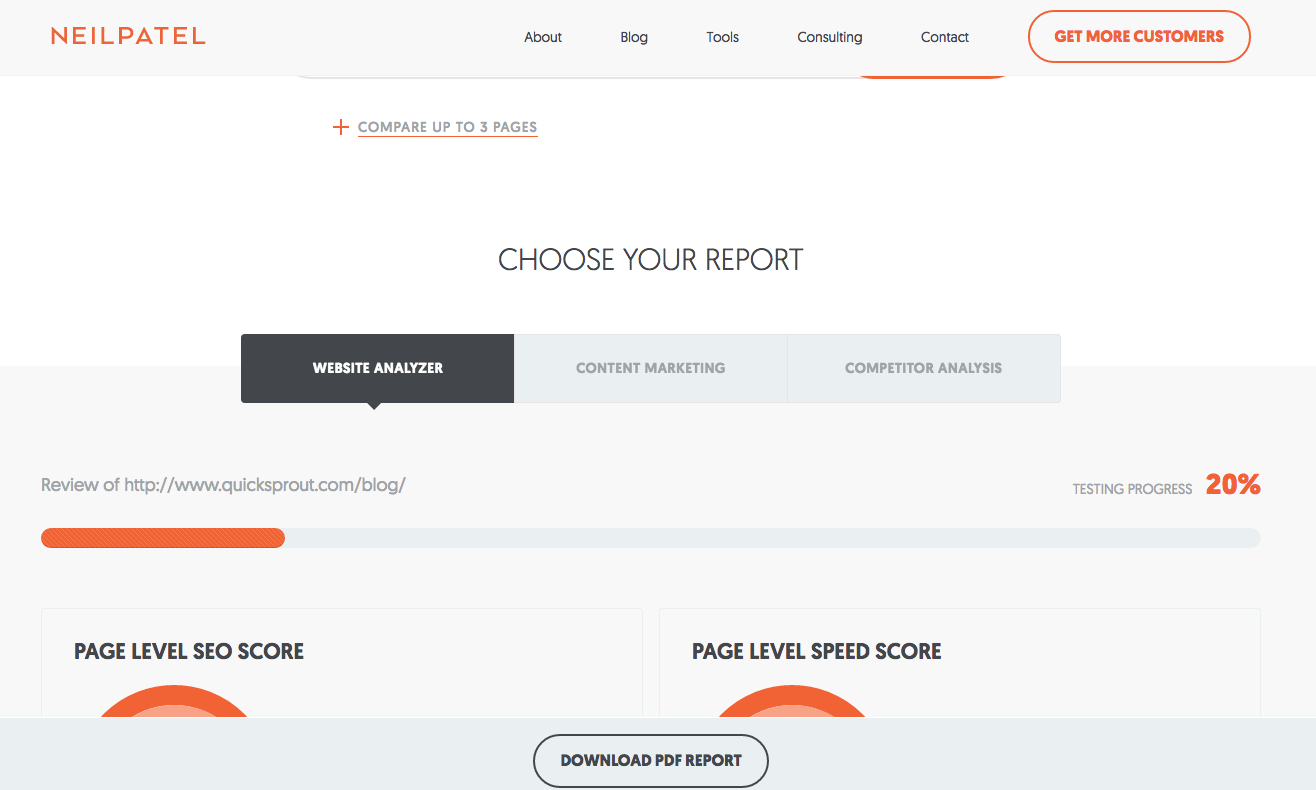

The report takes just a minute or two to generate—you’ll see a progress bar, telling you where the analysis is at.

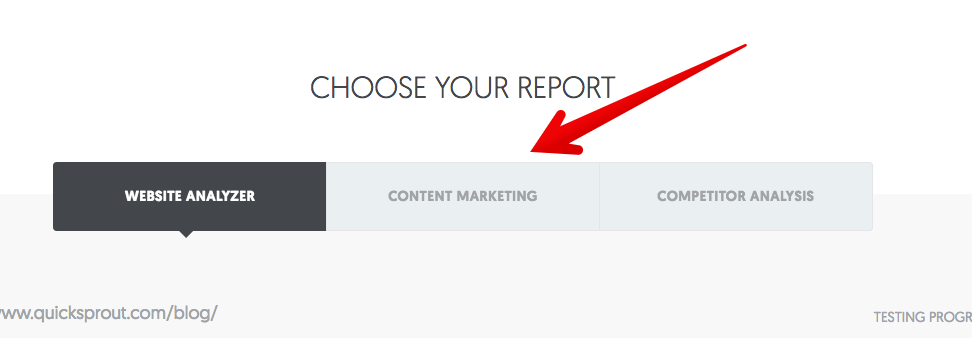

When the report is complete, click “Content Marketing.”

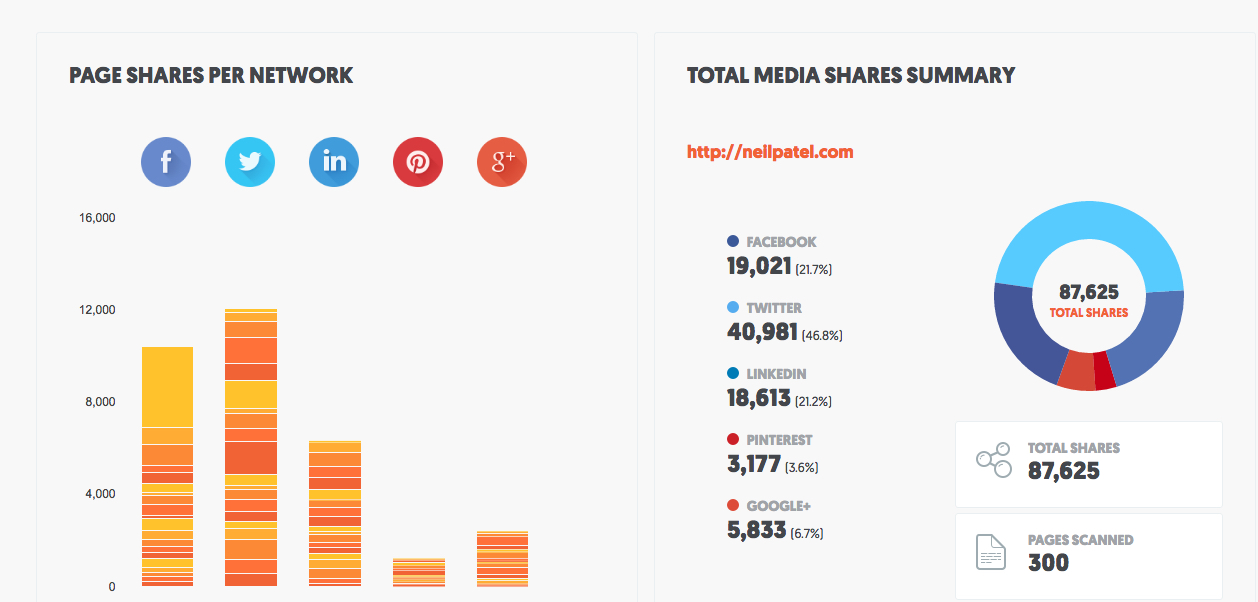

The content marketing report shows you the social share counts across your whole website.

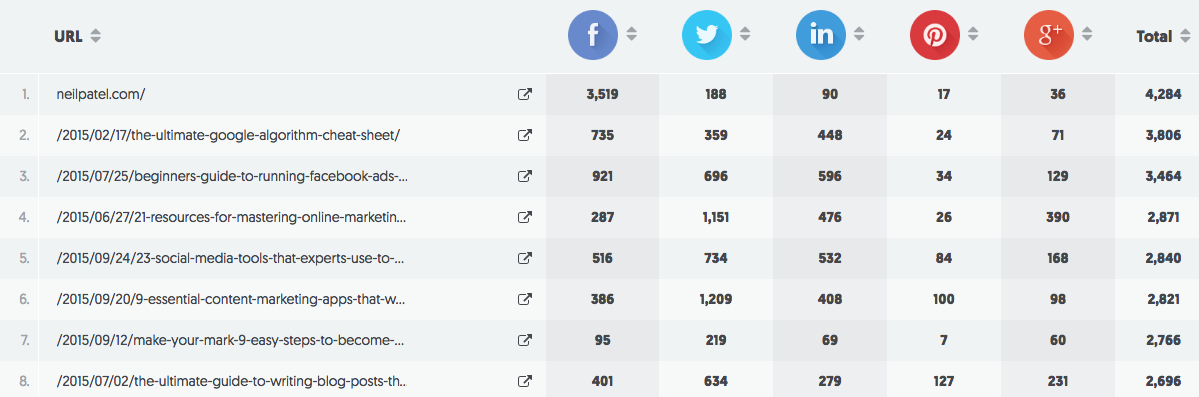

Here’s a summary of the social shares on my blog:

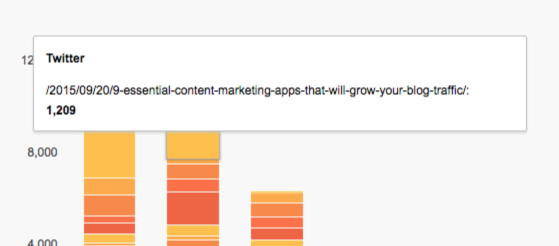

The “page shares per network” statistic tells you which individual pages were shared and the number of shares each page received:

You can also see the number of shares each page received according to the social network:

Using this tool allows you to get a very real sense of whether or not your readers are digging your content.

Look, if people are not sharing your content, they probably aren’t too impressed with it.

But let’s be realistic. If your traffic is low, your shares will be low too. No one is going to share your content if no one is seeing it to begin with.

Don’t beat yourself up over your low share counts unless you have really high traffic combined with low share counts.

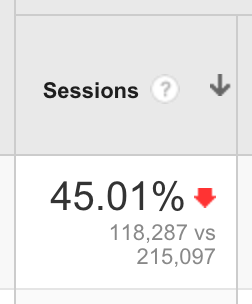

There are usually several reasons why social sharing fluctuates and/or nosedives. Even a content marketing juggernaut such as Buffer admitted, “We’ve lost nearly half our social referral traffic in the last year.”

They even showed their numbers to prove it:

Kevan Lee, Buffer’s content creator, tried to come up with a few reasons why it happened.

Here are his maybes:

- Maybe we need to hire a full-time social media manager to really devote some time and energy to doing great work on social media.

- Maybe I’m no good at social media marketing.

- Maybe our sharing ratio is off: Too much content, not enough conversation.

- Maybe everyone else is failing, too!

- Maybe we need to post more often.

- Maybe we need to post less often.

- Maybe, maybe, maybe …

So, while low share counts can be an indication of boring content, they are not the only measuring stick.

You have low Twitter engagement

Although it’s not always easy to determine what your exact engagement level is on all social media platforms, Twitter makes it incredibly transparent.

Twitter Analytics makes it super easy to get a feel for your engagement levels on its platform.

Here’s what I do.

I compare the number of impressions my content has received with the number of engagements, which includes retweets, favorites, link clicks, and so on.

Take a look at an example of this in Twitter Analytics.

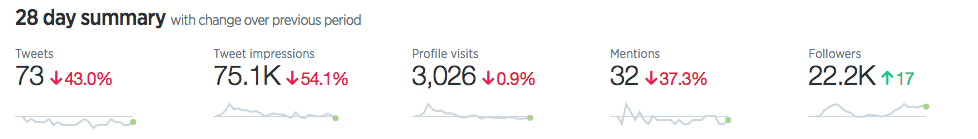

A 28-day summary of this particular Twitter account shows that the number of tweets is down, impressions are down, profile visits are down, mentions are down, and followers are up.

This kind of data shows an overall decline in Twitter engagement, which suggests that the level of content being published on the account is less than exciting.

Obviously, that’s not the whole story, but it provides a fairly clear snapshot of how my Twitter audience is responding to the content I post on Twitter.

Twitter Analytics is helpful in that it provides month-by-month accounting for your Twitter engagement levels. You can instantly find out:

- Your top tweet.

- The number of impressions your top tweet earned.

- Your top mention.

- The number of engagements your top mention earned.

- Your number of tweets.

- Your total number of tweet impressions.

- Your profile visits.

- Your new followers.

- Your mentions.

- Your top follower.

- The follower count of your top follower.

- Your top media tweet.

- The total number of impressions earned by your top media tweet.

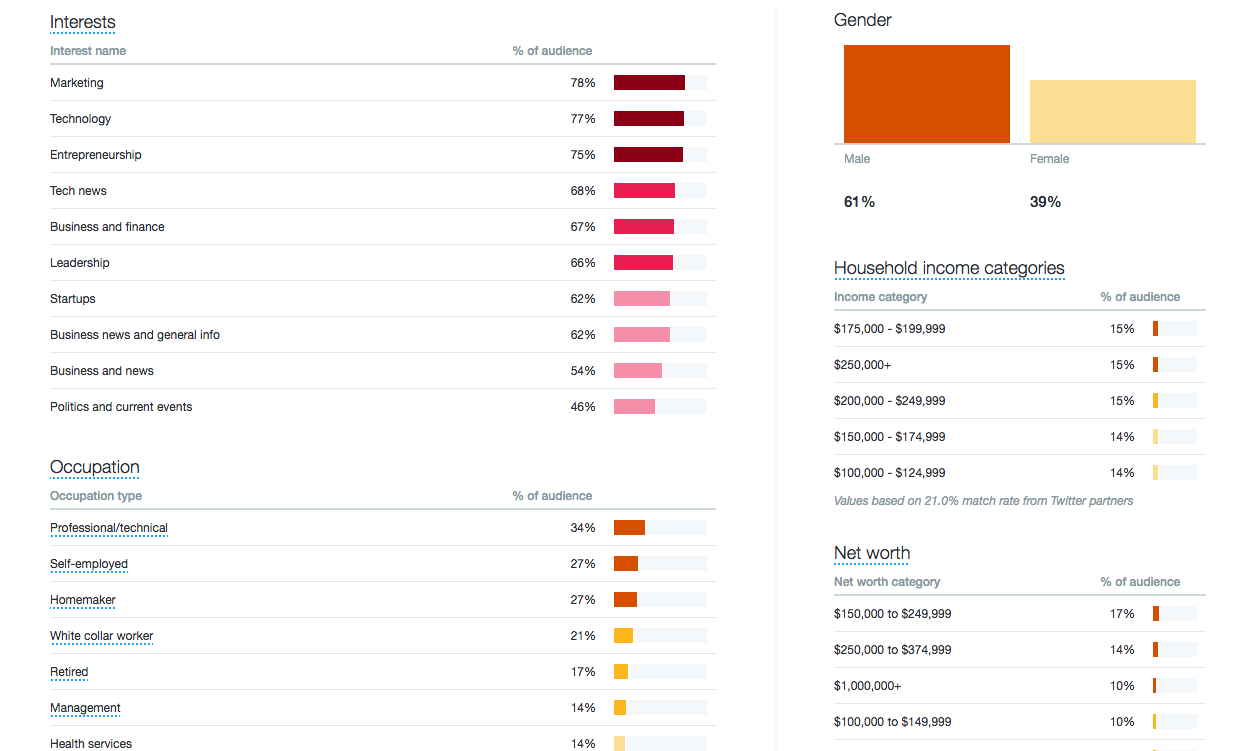

In addition, using Twitter Analytics, you’ll get a sharper perspective of who’s engaging with you. My Twitter followers, for example, are interested in marketing and 61% male. There’s plenty of juicy information here:

How does this data help me?

- I can understand how, why, and by whom my Twitter content is being shared.

- I can understand the demographics of my audience.

- I can retool my content to sustain higher interest.

In other words, all this data is serving a point: it helps me create more engaging content!

Your unfollow rate is climbing

Are your social media followers unfollowing left and right?

Is your audience shrinking rather than growing with each update?

This is obviously a sign that something is wrong.

Many social media users are particular about what pops up in their feeds, and they’re simply not going to keep following an account that’s not revving their engines.

There are a variety of free tools that show you who’s following and unfollowing you on various social media platforms.

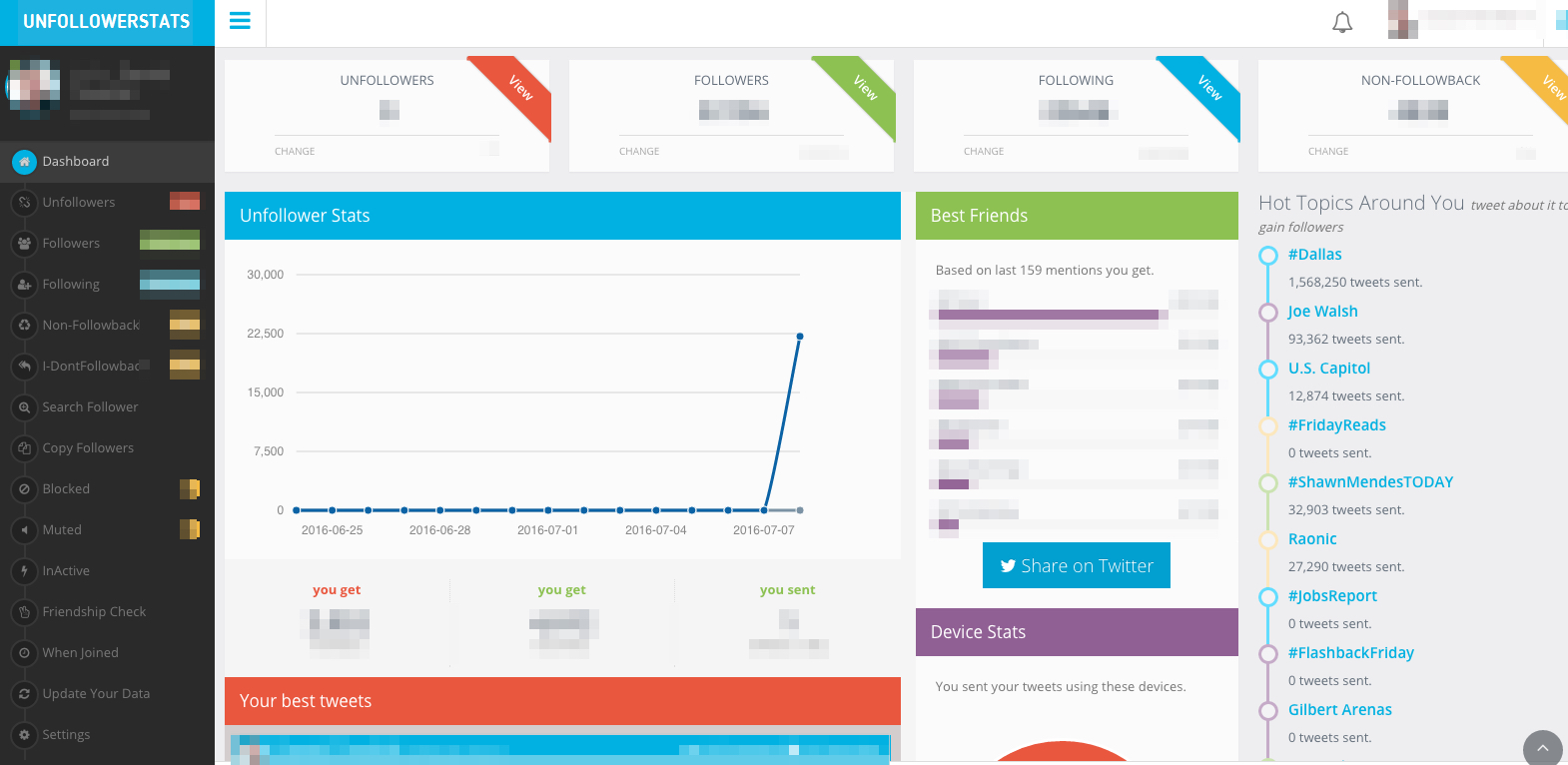

A platform like Unfollowerstats gives you detailed reports on who’s following, unfollowing, etc., on Twitter.

Another Twitter tool is Tweepsmap.

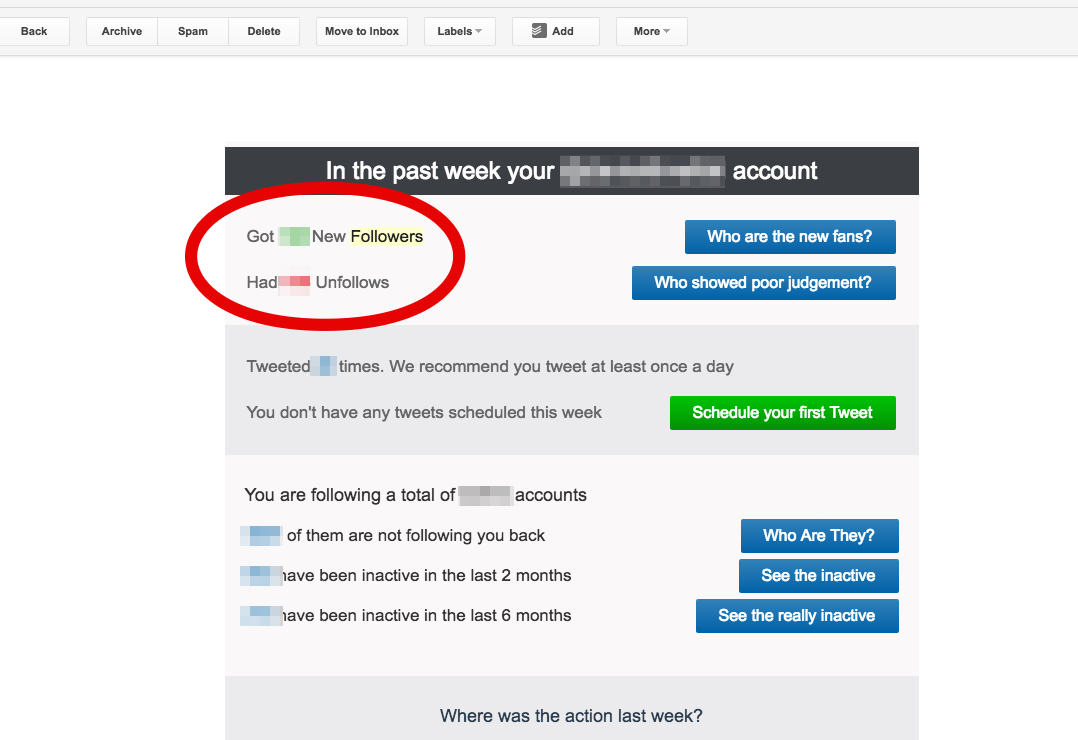

Tweepsmap sends you an email summary of the number of people who followed and unfollowed you each week.

Unless you posted something that’s highly offensive, a high number of unfollows usually points to uninspiring content overall.

Traffic overall is dropping

If you’ve noticed a steady decline or, even worse, a dramatic drop in overall traffic, this can also be a sign that your audience is losing interest.

While they probably don’t expect everything you post to be completely awe-inspiring, it’s pretty easy to spot a sinking ship. Many people simply won’t come back for more.

Over time, this can cause traffic numbers to plunge. If you’re noticing that your number of repeat visitors is diminishing, boring content could be the reason for that.

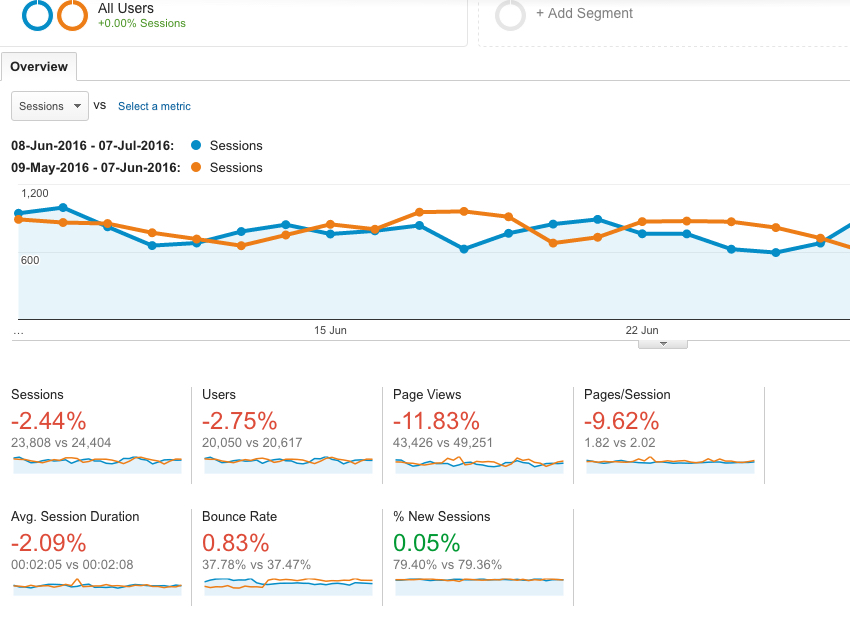

To analyze your content from this angle, do a quick survey of your traffic stats on Google Analytics.

I like to run comparison reports to see how my traffic for a current period ranks against my traffic from a previous period.

Sinking numbers are a sign that something is wrong. This website I recently checked is an example of that:

Data is a tricky beast to tame. If you’re not careful with it, you can come away with a false picture of what’s wrong.

Data only tells you what’s going on, but it doesn’t diagnose the problem.

If you suspect that boring content is a problem, work on fixing it, and see how things change.

Conclusion

Boring content isn’t good for anyone. It’s not stimulating your audience, and it’s not helping your brand grow.

But what do you do if your content just isn’t exciting? How do you fix this problem before it gets out of control?

I recently contributed a post to the Content Marketing Institute that offers some ideas on what you can do when your content is boring. This will provide you with some specific techniques for remedying the situation and spicing things up.

Remember, data is your friend. You can get a clear perspective of what’s happening and ways to fix it by constantly looking at your data, running your numbers, poring over the metrics, and staying on top of things.

What measures have you taken to make boring content more exciting?

Source Quick Sprout http://ift.tt/29Oy6A5