Given that Google changes its search algorithm 500-600 times each year, it’s not surprising marketers get confused sometimes.

Speculations about the latest SEO trends run rampant and are a breeding ground for many myths.

For this reason, it’s sometimes difficult to tell fact from fiction.

Of course, the Internet provides the perfect framework for misinformation to spread at an alarming rate.

As a result, many marketers waste their energy and resources implementing useless tactics that don’t get any results.

Or worse, some implement harmful techniques that get them penalized.

It’s a bad deal either way.

In this post, I’d like to address some particular SEO trends I see many marketers fall for that are really nothing but a waste of time.

Here we go.

Keyword density is a huge ranking factor

Remember the days when jam-packing content with a targeted keyword phrase would send it soaring to the top of the SERPs?

Kind of like this monstrosity:

It made for some lackluster content and provided very minimal (if any) real value to readers.

Thankfully, those days are long gone.

Panda put an end to that back in 2011.

Since then, any SEO marketer in their right mind made sure they weren’t doing any keyword stuffing.

But here’s the thing.

It left a lot of questions regarding proper keyword density.

Obviously, keyword stuffing is a bad idea. That’s a given.

But many SEO marketers still seem to think that keyword density is a huge ranking factor.

They end up putting a lot of time and effort into getting it just right.

Just hit that perfect keyword density, and you’re good to go.

But this isn’t the case.

While it is true that keyword density is a ranking factor, it’s by no means as important as it once was.

There’s no reason to stress about it.

It’s something that you should be conscious of, but it shouldn’t command all your attention.

In other words, there’s no need to drive yourself crazy trying to reach the optimal keyword density.

This line from Backlinko summarizes it perfectly:

You have to use exact match keywords

There’s another keyword-related myth I would like to put to rest.

And that’s the idea that you should use only exact match keywords.

Let me reference the red apples example one more time:

Beyond the annoying keyword stuffing taking place here, take a look at how every use of the keyword is an exact match.

It sounds ridiculous and unnatural!

That’s not how humans talk.

If it’s unnatural, it’s not adding quality.

And if it’s not adding quality, it’s not contributing to the user experience.

The bottom line is you should use exact match keywords only when it makes sense and sounds natural.

If it makes your content sound clunky, you’ll want to ditch it or use a variation of the keyword.

The concept of always using exact match keywords is extremely antiquated and dates back to when keyword stuffing was acceptable.

But neither has a place in current SEO best practices.

Pop-ups are an automatic deal breaker

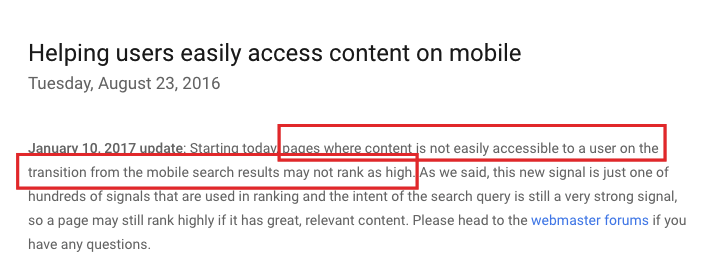

In January 2017, Google launched an update known as the “Intrusive Interstitial Penalty.”

Here’s a snippet from the Google Webmaster Blog regarding this update:

The primary purpose was to provide a better experience for mobile users, ensuring their browsing doesn’t get disrupted by ungodly pop-ups like these:

This created an uproar in the SEO community with people being deathly afraid to use any type of pop-up on their sites.

And it’s easy to see why.

Why would you want to risk it?

It was an update for which Google gave a warning several months in advance, which in and of itself is pretty rare.

I even wrote an article in late 2016 called “What Are Interstitials, and Are They Hurting Your SEO?” to give my readers advanced warning.

At the time, it seemed like a very legitimate concern.

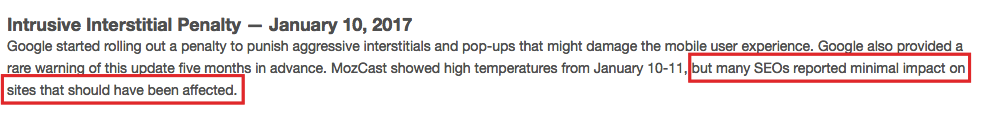

But now that some time has passed and the dust has settled, it appears it’s not that big of a deal after all.

Most experts agree:

And I can’t even begin to tell you the number of pop-ups I still get hit with whenever I’m exploring the web or doing research.

In fact, I’m a little disappointed because I hate being disrupted by mindless pop-ups when I’m in the zone and trying to find important information.

Apparently, having pop-ups on your site isn’t the kiss of death.

But if you do decide to use them, be responsible about it.

Don’t go out of your way to interrupt the user experience, and try to make pop-ups as seamless as possible.

It’s all about inbound links

We all know links are super important.

I’ll be the first to say a great looking link profile is a thing of beauty.

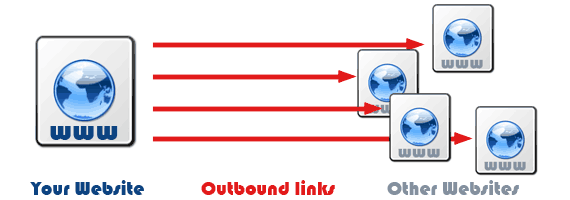

But it seems too many marketers are too fixated on just inbound links and forget about outbound links.

Of course, you want authoritative and relevant sites to link to you!

But don’t ignore outbound links:

I mentioned in a post on NeilPatel.com that “outbound links or links that point to external web pages from your own site can actually impact your blog authority. Make sure the pages your links point to are relevant, useful and have good standing with Google.”

And there are plenty of experts who agree.

In fact, Backlinko listed outbound link quality as #31 of Google’s 200 ranking factors.

That’s fairly high.

But isn’t it a disadvantage when people exploring your site are directed to an external site?

Wouldn’t it adversely affect your bounce rate and average time spent on your site, not to mention your conversions?

Well, as we all know, Google’s top priority is an awesome user experience and great content.

If you include super helpful outbound links that expand on a topic, you’ll be rewarded.

What I’m trying to say here is all links are important.

Instead of focusing solely on acquiring inbound links, you should link out to awesome resources as well.

Make it a habit.

Note: make your outbound links open in a separate tab. This increases the chance that readers will return to your site, and I find it creates an overall better user experience.

Jamming your site with affiliate links is no big deal

Ah…affiliate links.

What website owner/blogger wouldn’t want to cash in on them?

It’s one of the most efficient ways to get a nice payday with minimal energy expended.

Don’t get me wrong, I like affiliate marketing. I really do.

In fact, a lot of people completely crush it with affiliate marketing.

Just take a look at what Pat Flynn of Smart Passive Income made in a single month:

This isn’t to say that making over 80 grand in a month is the norm.

But it does go to show the potential affiliate marketing has.

So, of course, some people will go overboard and stuff their content with affiliate links, assuming it’s no big deal.

And this might have been the case a year ago.

But if you’re familiar with the Google “Fred” update that took place in March 2017, you know going crazy with affiliate links is tempting fate.

Barry Schwartz of Search Engine Land took the time to analyze roughly 100 sites affected by the update, and here’s what he found:

I would say experiencing a 50-90% drop in traffic is cause for concern, and you should proceed with caution for the foreseeable future.

This isn’t to say including a few affiliate links here and there will kill your traffic, but it’s definitely something to be aware of.

Having an abundance of affiliate links signals to Google that making affiliate sales is the main purpose of your content, which could negatively affect your rankings.

Conclusion

I’ll be honest.

SEO can be maddening at times.

There are always some kind of adjustments being made to Google’s algorithm.

Some are major; some are minor. But this constant tweaking often leads to speculation.

This speculation leads to rumors, and rumors lead to persistent myths.

That’s why I thought I would clear the air about some of the most pervasive SEO trends that are actually quite useless.

I hope that putting things into perspective for you will help you focus on what really matters and help you avoid investing your time and energy into tactics that won’t bring any results.

It should also reduce your odds of incurring any ugly penalties.

In your opinion, what’s the biggest SEO myth that marketers continually fall for?

Source Quick Sprout http://ift.tt/2we8qJv