الاثنين، 30 أبريل 2018

New Medicare Cards: What Medicare Beneficiaries Need to Know

Source CBNNews.com https://ift.tt/2rbORzF

BBVA Compass Bank Review

When you are comparing banks, you likely seek out the ones you know by name first.

While that is, of course, just fine, you may want to keep your eyes up if you want something specific from your bank or lending institution, especially personal loans, savings accounts, and business accounts.

BBVA Compaass Bank is one of those you may want to research a little further.

About BBVA Compass Bank

BBVA Compass Bank was founded in 1964, and is headquartered in Birmingham, Alabama.

BBVA Compass Bank was founded in 1964, and is headquartered in Birmingham, Alabama.

It has over $86 billion in assets, and 672 branches, mostly in Texas, but also in Alabama, Arizona, California, Florida, Colorado and New Mexico.

In fact, it’s the second largest bank in Alabama, the fourth largest bank in Texas, and the fifth largest in Arizona.

BBVA Compass Bank is a full-service bank, with a strong online banking platform.

They offer the full range of checking and savings accounts, as well as CDs, money markets, credit cards, personal and auto loans, and home loan financing.

BBVA Compass Bank Features and Benefits

Accounts Available. In addition to CDs, and checking and savings accounts, BBVA Compass Bank also offers traditional, Roth, SIMPLE and rollover IRAs, as well as Simplified Employee Pension Plans (SEPs). They also provide 529 plans and Coverdell Education Savings Accounts (CESAs).

ATM Access. You will have access to 44,000 BBVA Compass and Allpoint ATMs across the U.S., all with no ATM fees.

Overdraft management. Among other strategies, BBVA Compass Bank enables you to set up account alerts so you always know what's going on with your accounts. Key alerts can be set up for account management including account balances, account summary, and insufficient fund alerts.

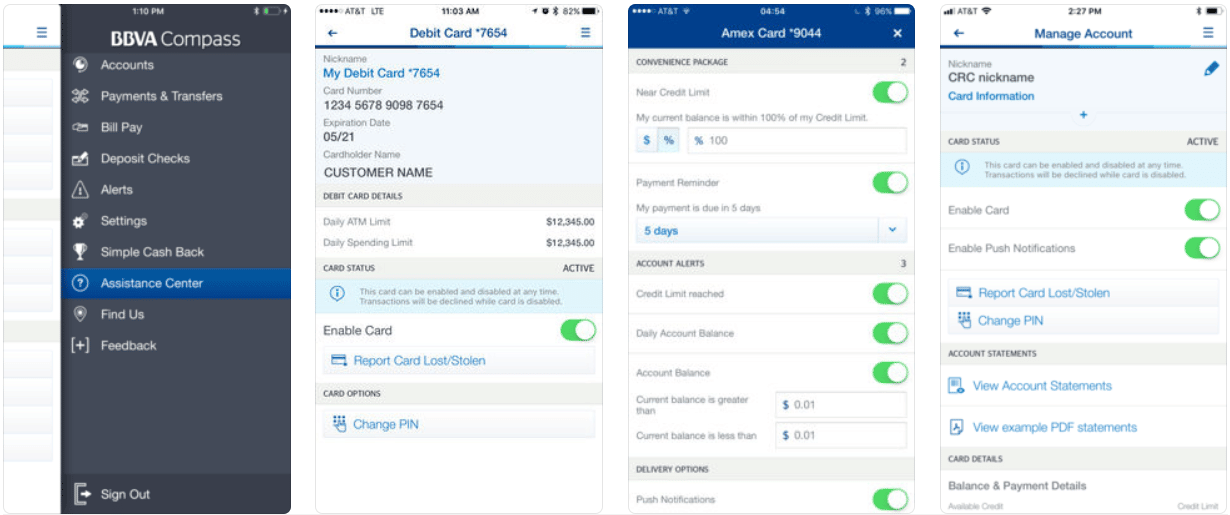

BBVA Wallet. This feature gives you convenient access and control over your payment cards, and includes the following benefits:

- Keep track of all your purchases in real-time and keep them organized on the go

- Activate BBVA Compass debit and credit cards

- Make your BBVA Compass Credit card payments

- Change the PIN on your BBVA Compass cards from your Wallet app

- Report a lost or stolen card in a flash or temporarily block transactions if you misplace your card

- Redeem rewards in real-time at any merchant

- Receive custom offers to earn cash back based on how you spend with Simple Cash Back

You can download BBVA Wallet from Google Play or the App Store.

Customer Service. BBVA Compass Bank can be contacted by phone or by message via Online Banking (24 – 48 hour response time). They have a third method – Request a Call.

By clicking the “Request a Call” button on the website, a bank representative will contact you by phone. That will keep you from having to navigate the phone system.

Customer Service is available Monday – Friday, 7:00 AM to 10:00 PM, and Saturdays, 8:00 AM to 4:00 PM, Central Time.

But, they also have a cool contact option with Video Banking…

Video Banking. With this service, you can connect to a live teller, 24 hours a day, seven days per week.

You can do virtually anything with Video Banking that you can with a visit to a local branch.

That includes making transfers, asking questions, making deposits and withdrawals, getting cash back, printing monthly statements, reordering checks, making payments, or issuing a stop payment.

Mobile Banking. BBVA Compass Bank’s Mobile App enables you to take advantage of Mobile Bill Pay, Picture Bill Pay, as well as to transfer money between your own bank accounts, or to other parties.

It also offers Mobile Deposits, where you can make a deposit by taking a photo of your check, and then submit it for processing.

You will also receive real-time alerts, daily activity notices, and periodic account alerts.

BBVA Compass Bank Security. The Bank uses a combination of online and mobile banking alerts, as well as online security.

They also offer BBVA Compass ClearBenefits that can provide you with benefits in the event that you are a victim of identity theft. Those benefits include:

- Identity theft restoration, which is available 24/7 to investigate fraudulent activity, issue fraud alerts to state agencies and financial institutions, and more.

- Identity theft insurance, which provides up to $25,000 to cover lost wages, legal expenses, and defense costs for civil and criminal lawsuits.

The fee for the ClearBenefits program is $5 per month.

FDIC Insurance on all Deposits. As an FDIC participating bank, BBVA Compass Bank provides $250,000 coverage per depositor on all savings products.

BBVA Compass Bank Checking Account Offers

BBVA Compass Bank offers three different checking account options:

ClearConnect Checking Account

This account can be opened with as little as $25, and has no monthly service charge.

It comes with the following features:

- Complimentary Online Banking and Mobile Banking, Bill Pay and online statements

- No ATM withdrawal fees at any BBVA Compass or Allpoint ATMs

- A BBVA Compass Visa Debit Card you can personalize with your favorite photo

- Easily keep track of your purchases and get instant transaction alerts on the go with BBVA Wallet.

The ClearConnect Checking Account is highly recommended.

Free Checking

This is a free checking account with full-service features.

Once again, it can be opened with as little as $25. It comes with free online banking, mobile banking, and Bill pay; free online and paper statements, and unlimited check writing.

There are no monthly service charges and no ATM fees for using the Bank’s ATMs.

Interest Checking

Like the other checking account options, Interest Checking can also be opened with as little as $25.

But in this account, you also earn interest on your balance. You also enjoy certain benefits including:

- Tiered interest rates on your checking balance

- Unlimited check writing

- Complimentary Online Banking, Mobile Banking, and Bill Pay

- Complimentary Premium checks and 50% off other styles

- Automatic rebates on ATM fees charged by other banks (two per statement cycle)

The account has a Monthly Service Charge of $25, but this can be waived under certain conditions, including if you maintain an average daily collected balance of at least $5,000 in the account.

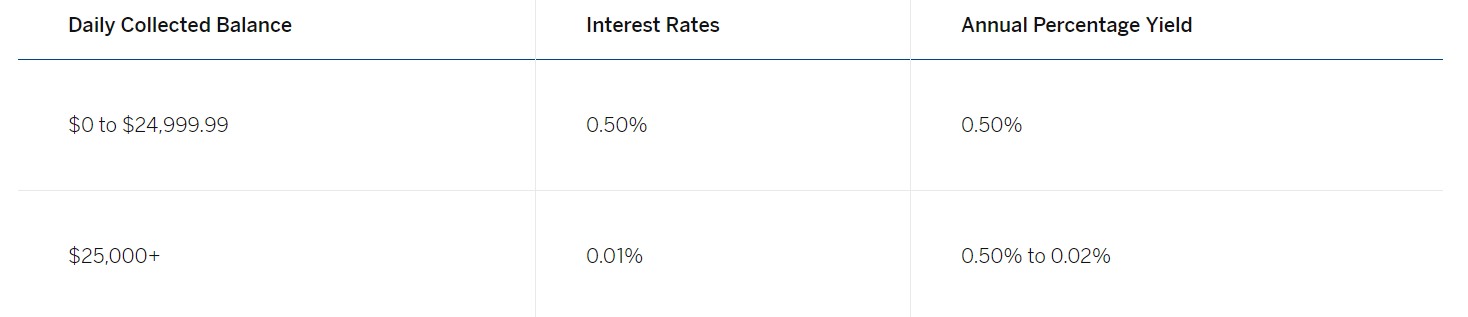

Interest rates paid on Interest Checking are as follows:

BBVA Compass Bank Savings Products and Rates

BBVA Compass Bank offers at least three different savings accounts, as well as a money market account and certificates of deposit (CDs).

BBVA Compass Build My Savings

With this account you can earn a Match Bonus on regular transfers.

How much you will receive in bonus will depend upon the amount of your opening balance, your regular transfers to the account, as well as the term of your plan.

The term can be six months or 12 months.

6-month plan: With an opening balance of $25 and a monthly contribution of $25, you can earn a match of $1.75; with an opening balance of $2,350 and a monthly contribution of $25, you can earn a match of $25 (maximum).

OR, with an opening balance of $25 and a monthly contribution of $415, you can also earn $25.

12-month plan terms: With an opening balance of $25 and a monthly contribution of $25, you can earn a match of $3.25; with an opening balance of $4,700, and a monthly contribution of $25, you can earn a match of $50 (maximum).

OR, with an opening balance of $25 and a monthly contribution of $415, you can also earn $50.

The account requires a minimum $25 opening balance and has an interest rate of 0.05% APY.

BBVA Compass ClearChoice Savings Account

This account requires a minimum opening balance of $25 and has an APY of 0.050%.

The account provides you with easy access to your money, 24/7 access to online and mobile banking, and linking to your checking account for overdraft protection.

The account does come with a quarterly service charge of $15.

However, that charge can be waived if you have automatic, recurring monthly transfers of $25 or more into the account from your checking account, or if you maintain a minimum daily collected balance of $500 or more.

BBVA Compass ClearConnect Savings Account

With this account, you earn interest on your balance but pay no quarterly service charge.

It requires a minimum opening deposit of $25 and has an APY of 0.050%.

It has all of the benefits of the ClearChoice Savings Account.

BBVA Compass ClearChoice Money Market Account

With a minimum opening balance of just $25, you can earn an APY of 1.25%. You can access your money whenever you need it, and enjoy access to both Online and Mobile Banking.

You can also link the account to your checking account to provide overdraft protection.

The account does have a monthly service charge of $15.

However, that charge can be waived if the minimum daily collected balance for the quarter is $10,000 or more, or if you have automatic, recurring monthly transfers of at least $25 from your checking account into the Money Market Account.

Certificates of Deposit (CDs)

With a minimum opening deposit of $500, you can earn the following rates of return on BBVA Compass Bank CDs:

- 12-month CD – 1.40% APY

- 18-month CD – 0.25% APY

- 36-month CD – 0.40% APY

There are no monthly service charges or other fees associated with BBVA Compass Bank CDs.

BBVA Compass Bank Investments

BBVA Compass Bank offers both Self-Directed Investments and Full-Service Investments.

Self-Directed Investments

You can hold your investments through a self-directed brokerage account, that will enable you to trade in equities, mutual funds, exchange traded funds (ETFs), and options.

You can also establish a margin account.

Full-Service Investments

With this account option, you can have your investments professionally managed. There’s even a wider selection of investments available with this option.

Those include mutual funds, unit investment trusts, fixed and variable annuities, equity linked CDs, fixed income securities, and professionally managed portfolios.

You can even have 529 plans and other college savings programs managed through this option.

BBVA Compass Bank Student Banking

BBVA Compass offers its ClearChoice Free Checking account in combination with its ClearSpend Prepaid Card.

With ClearChoice Checking students have no monthly service charge, free online and mobile banking with Bill Pay and account alerts, free online and paper statements, and a free Visa Debit Card, which you can personalize with your favorite photo.

By paying a small monthly fee, you could also get no-fee use of other bank’s ATMs.

With the ClearSpend Prepaid Card, you will have the benefit of no purchase transaction fees, no overdraft fees, and no monthly service charge as long as you load at least $400 onto the account each calendar month (otherwise a $4 monthly service charge will be assessed).

There are no load fees when you add money to the account.

No credit score check will be required in order to get the card.

You will receive real-time transaction alerts, as well as the Built-in Budget Tracker feature. This feature enables you to manage your finances and to eliminate overspending.

Second Chance Banking

This is a program designed for people who have past credit problems, and need a fresh start.

It will provide you with an opportunity to rebuild your credit.

Benefits include:

- No monthly service charge with BBVA Compass ClearChoice Free Checking

- Easy budget management with the BBVA Compass ClearSpend Prepaid Visa Card

- A secured credit line with the Optimizer Credit Card

- Earned interest on your savings account balance with BBVA Compass ClearChoice Savings

The Optimizer Credit Card is designed to help you rebuild your credit. See details in the next section.

BBVA Compass Bank Lending

The bank also offers unsecured personal loans, as well as auto loans.

The auto loans come with same-day decisions on most loans, as well as free online insurance quotes.

BBVA Compass Bank Home Loans

Home Equity Line of Credit (HELOC). The loan has a variable rate APR that’s based on the Prime Rate, plus 0.38% to 2.74%. The current rate ranges from 4.63% to 6.99%, but they are currently offering a 12-month introductory rate at Prime MINUS 1.51%. Loan proceeds can be used for any purpose.

Home Equity Loans. Like a HELOC, you can use home equity loans for just about any purpose. They have fixed rates, terms and monthly payments. Rates currently start at 4.94%.

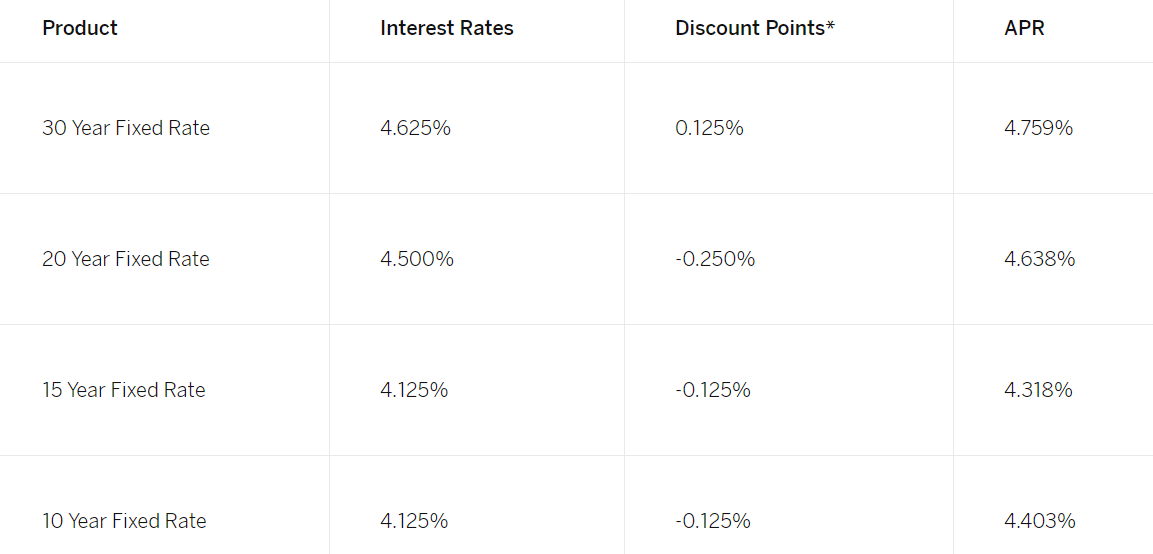

Mortgages. Fixed or adjustable rate mortgages that are available for refinancing your current mortgage, cash-out refinancing, or to buy, renovate or build a new home.

Current mortgage rates look like this:

BBVA Compass Bank Pros and Cons

Pros

- The Bank offers several checking account options. Many online banks don’t offer checking, forcing you to maintain a second banking relationship.

- Video Banking enables you to connect to a live banker, 24 hours a day, 7 days per week.

- Second Chance Banking provides a real opportunity for someone with impaired credit to develop a banking relationship and rebuild their credit.

- The Build My Savings plan offers an excellent return on a small deposit, or on committed regular contributions.

Cons

- Interest rates on most savings plans are on the low side for online banks.

- Except for the 12-month term, interest rates on BBVA Compass Bank’s CDs aren’t competitive.

- The rates on the ClearChoice Money Market are competitive, but the $15 per month fee reduces that return. It completely nullifies the rate on smaller account balances.

- Some savings products have a $25 “Early Account Closing Fee” if you close the account within 180 days of opening it. That’s a steep fee on an account that has an APY of only 0.5%.

Should YOU Use BBVA Compass Bank?

BBVA Compass Bank will work best for smaller deposits, particularly on the Money Market Account and the 12-month CD.

Their rates on other accounts, as well as for larger deposits or longer-term CDs are not competitive.

But some of their products are innovative, particularly the Second Chance Banking program, that gives you access to both a checking account and a secured credit card so that you can rebuild your financial life following credit troubles.

If you’d like to get more information, or you’d like to open an account, visit the BBVA Compass Bank website.

The post BBVA Compass Bank Review appeared first on Good Financial Cents.

Source Good Financial Cents https://ift.tt/2raLkSh

Money Girl Podcast: 3 Simple Steps to Choosing the Right Retirement Accounts

That’s the good news. And, sometimes, it’s the bad news.

You know you need to save for your golden years. Really, you do. But with all the resources out there, figuring out where to begin can feel overwhelming.

So, let’s try to banish some of that information overload in 30 minutes or less.

3 Steps for Choosing the Right Retirement Account

Laura Adams of the Money Girl podcast wants to help you gain clarity. In her latest episode, “Choose the Right Retirement Accounts in 3 Simple Steps,” she offers advice for choosing the best account — or accounts — based on your situation.

Here’s a brief summary.

1. Know the Restrictions

Not all accounts are created equally. The IRS imposes restrictions on certain IRA (Individual Retirement Arrangement) accounts. For instance, there’s an income limit for a Roth IRA and deduction limit for a traditional IRA.

2. Explore Your Options

Retirement plans fall into three basic categories: employer-sponsored, self-employed and individual. Examples of each include a 401(k) (employer-sponsored plan), a solo 401(k) (self-employed) and a traditional IRA (individual).

3. Choose Your Tax Types

After deciding on the retirement plan (or plans) for you, determine your tax type: traditional, Roth or a combination of both. Your decision depends on factors such as your income tax rate in retirement and whether or not you want penalty-free access to your account before punching your time card for the last time.

Listen to the entire episode on the Money Girl podcast and check out the accompanying blog post for more information on retirement accounts.

And if you want some money-making tips to bulk up your nest egg, you’re in luck! Lisa Rowan, senior writer and producer at The Penny Hoarder, shares a couple of ways you can cash in at home in the episode.

Kathleen Garvin is an editor for The Penny Hoarder. She currently has enough retirement savings to live in poverty for one year. You can follow her on Twitter @itskgarvin.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2JH2L4B

Goodwill to All: Find a Job at One of the Charity’s Career Fairs, May 6-12

Goodwill Industries is holding a series of career fairs across the country through its community-based agencies as part of its Goodwill Industries Week, May 6-12.

Many local Goodwills will host job fairs in person and virtually throughout the week, according to Malini Wilkes, public relations and multimedia manager for Goodwill Industries International.

The events vary by location, with some designed specifically for one employer while others offer career advice like interview techniques and resume development.

There are 162 Goodwill organizations across the United States and Canada and each organization operates independently, Wilkes said in an email. So check your local Goodwill’s website or social media page for the career fairs in your area.

Tiffany Wendeln Connors is a staff writer at The Penny Hoarder. She wishes you all a Happy May Day.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2r9qkLy

Make More Than $15/Hr With These Seasonal Work-From-Home Nordstrom Jobs

Fans of the department store chain know the Anniversary Sale is a big event. On the flipside, the Nordstrom staff knows this sale means all hands on deck and a call for reinforcements. If you’re looking for seasonal work but don’t want to deal with the crowds, then you’re in luck.

Nordstrom is looking for work-from-home customer service care specialists in the Seattle and Cedar Rapids, Iowa, areas to assist during the Anniversary Sale, which is July 20 through Aug. 5. These full-time, seasonal gigs pay more than $15 per hour and offer employee discounts on merchandise.

Customer service specialists serve as Nordstrom’s first point of contact for customers on the phone, email, live chat and social media. Reps will service Nordstrom, Nordstrom Rack and HauteLook.

Training is paid and will last three weeks, with classes starting in June. Work schedules will be set in advance, but employees must be willing to work overtime and during peak hours.

If you’re not interested in this job, don’t worry. Check out our Jobs page on Facebook. We post new opportunities there all the time.

Seasonal Customer Care Specialist at Nordstrom

Pay: $16.85 per hour (Seattle), $15.15 per hour (Cedar Rapids)

Responsibilities include:

- Respond to incoming calls, emails and live chats with customers across the U.S.

- Answer customer questions and provide proper solutions

Applicants for this position must:

- Have six months experience in customer service (preferred)

- Have the ability to work a set schedule and be willing to work overtime when asked

- Have the flexibility to work during peak hours

- Be comfortable working in a fast-paced environment

- Keep composure while dealing with customers and use conflict management skills

- Understand computer systems and troubleshoot technical issues

Benefits include:

- Medical, vision and dental coverage

- Employee discount on Nordstrom merchandise

- Employer-matched 401(k) plan

Apply here for a seasonal customer care specialist position at Nordstrom in Seattle, and apply here for a position in Cedar Falls.

Matt Reinstetle is a staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2HHE7QL

MoviePass Users: Here’s What You Should Know About Subscription Changes

The app-based, movie-ticketing service allowed customers to see one movie a day for the flat fee of $9.95 per month, or $6.95 a month with an annual subscription.

The subscription model has seen many iterations, including tiered and unlimited options ranging from $15 to $30 a month. However, it looks like the good ol’ unlimited viewing days are over… for now.

What Changed in the MoviePass Subscription

The biggest blow is that MoviePass discontinued its unlimited movie plan for new subscribers on April 13. New customers will no longer have the option to see a movie every single day. Instead, they are limited to seeing four movies a month for the same $9.95 price tag. Plus, they have to pay for a full three-month subscription up front and then pay quarterly after that.

To make matters worse, MoviePass updated its terms of service and made it so all MoviePass customers can only see the same movie one time.

That pretty much stops the Marvel and Star Wars super fans right in their tracks and forces them to use their pass to see something different, aka MoviePass promoted movies.

And the icing on the cake? Some users now have to upload pictures of their ticket stubs to safeguard against abuse and fraudulent activity — otherwise they risk permanent cancellation of their subscription.

To soften the blow, MoviePass bundled a three-month iHeartRadio All Access trial subscription with the offer.

Additionally, existing unlimited customers who signed up on the old plan will be unaffected by the changes to new subscribers, according to TechCrunch.

Is MoviePass Still a Good Deal?

At the end of the day four movies a month — or one per week — for $10 is still a good deal — if you don’t buy movie snacks. Most folks can’t buy a single movie ticket for less than $10 outside of some special matinee pricing.

Essentially, the old plan was 30 movie tickets for the price of one. How could that even be sustainable long term, especially with two million subscribers? Needless to say, many are not surprised.

Everyone seems to be Finding Emo right now, when really it’s not that big of a deal.

MoviePass reports that 88% of its users see fewer than two movies a month. No harm, no foul for the majority, but a possible deal breaker for the minority.

Maybe this new approach will help keep MoviePass afloat until it work outs some growing pains and finds the best movie model for fans and their finances.

Plus, it’s unclear if the unlimited plan is gone for good, so keep your eyes open for its reincarnation or the next chapter in the ongoing MoviePass saga.

Stephanie Bolling is a staff writer at The Penny Hoarder. She had a MoviePass for six months and only tried to use it once — but the app was down.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2FtYy1J

Auto Bits: Do your eardrums vibrate when you open your sunroof?

Source Business - poconorecord.com https://ift.tt/2raMDkl

The Top 10 Platforms for Effectively Managing Social Influencers

Social media is evolving. Brands need to do more today than just have active profiles on different marketing channels.

Successful businesses are increasing their presence by leveraging relationships with social influencers to create brand awareness.

We’re seeing an increase in the use of micro influencers, which made my list of the top marketing trends to look for in 2018. So for those of you who haven’t implemented this strategy yet, it’s time to get your feet wet.

You may be surprised to hear how big of an impact influencer marketing campaigns can have on your company. In fact, 30% of people say they are more likely to buy a product if a non-celebrity influencer recommends it to them.

The results will vary by generation.

For example, if you are marketing to Generation Z, you’ll need to know that 70% of this group say they can relate to YouTube creators more than to traditional celebrities.

This means you don’t have to find pop culture icons like Kanye West or Shaquille O’Neal to promote your brand. It’s great news because this will obviously be more cost-effective for your marketing budget.

But since influencer marketing at this scale is relatively new for most businesses, it can feel as if you’re entering uncharted waters.

Where do you find social influencers? How much should they be paid? Do they have enough followers to have an impact on your business?

Fortunately, there are online platforms to help you get connected with social influencers. I’ve narrowed down the top 10 platforms for managing these relationships.

Review my list to see which ones fit the needs of your brand before you decide.

1. Klear

When it comes to getting connected with social influencers, Klear is a top choice for you to consider.

That’s because their software allows you to fully customize the profile of an influencer you’re looking for based on a variety of factors.

You’ll get to decide which social channels you want to promote on, such as Instagram, YouTube, Twitter, or even blogs.

Then you can select which type of influence you want people to have. This ranges from novices all the way up to celebrities.

Once you click on a prospective influencer’s profile, you’ll get to see insights based on their audience. This will help ensure their reach matches your goals.

Just because an influencer fits your target market doesn’t mean their followers do too. Klear helps you distinguish between these factors.

The dashboard of this software makes it easy for you to manage your campaigns and relationships with multiple influencers at the same time.

You’ll also get detailed reports for each campaign you run to see if you’re getting the results you need to get a high ROI.

Now, you can easily track your success and continue relationships with your best influencers. On the flip side, these analytics can give you a data-driven reason to cut ties with influencers who aren’t helping your cause.

2. TweetReach

Depending on your business and marketing campaigns, you may be looking for tools to help you with specific marketing channels.

The TweetReach software can help you get connected with the top social influencers on Twitter:

Here’s how it works. To find influencers, you’ll need to manually search for a topic related to your brand.

Simply input a keyword or hashtag into the query to see which tweets have the highest engagement.

If you find some people who have a big following and powerful voice within your industry, you can reach out to them directly and work out a deal for them to promote your brand via Twitter.

Furthermore, you can use TweetReach to search for specific accounts. You may have some influencers in mind, but you want to see some analytics before contacting them.

TweetReach provides you with exposure information based on your search terms in specific locations as well. This is useful if you want to get connected with influencers in a certain geographic market area.

3. Buzzsumo

I like Buzzsumo because they have a wide range of marketing solutions for businesses.

They have tools for things such as competitor analysis, brand monitoring, and content discovery. But they also have specific tools for your influencer marketing goals.

Their platform helps connect you with the right influencers. You can find an influencer based on topics or locations.

Once you have an initial list of influencers, you can filter those results based on things such as engagement, reach, influence, and authority. This gives you the ability to pick the most qualified people for your marketing goals.

You will also have reports based on the type of content and domains these influencers share the most.

Most influencers won’t work for one brand exclusively. This information is vital to making sure your influencers aren’t doing anything that may negatively affect the reputation of your company.

All the analytics, data, and reports from Buzzsumo can easily be exported as CSV or Excel files.

This makes it easy for you to manage your results on platforms you feel comfortable with. You can also combine this exported data with information from other software for comparison purposes.

4. Brandwatch Audiences

The Audiences research feature from Brandwatch gives you access to a huge database of social influencers.

The reason why this tool is so helpful is because it ranks influencers based on factors that matter the most, such as the ability to drive conversions.

This is much more important than their number of followers and reach. The software connects you with influencers based on niche markets as well.

If someone has an authoritative voice on a particular topic or within a certain industry, Brandwatch can help you find them.

It’s a great tool to use if you prefer working with up and coming influencers, such as micro influencers, as opposed to people who are nearing celebrity status on social media.

5. BuzzStream

BuzzStream is another great option to consider because their platform can help you get connected with bloggers in addition to social media users.

Don’t underestimate the power of a blogger’s voice and the positive impact it can have on your branding strategy.

All you need to do is search for a specific topic through this platform. You’ll see a list of prospective bloggers that fit your brand or industry.

You’ll have access to reports about their websites and social media pages. This snapshot will tell you exactly how many followers they have on each platform as well as their posting frequency and activity level.

BuzzStream also provides you with engagement statistics for each prospective influencer.

In addition to managing your relationships with influencers, the BuzzStream software specializes in digital PR, link building, and content promotion. All of these features can be used to complement your social influencer campaigns.

6. Kred

This platform is a bit different from all the other options on our list so far.

That’s because Kred is designed for influencers as opposed to brands looking to get connected with influencers.

But that doesn’t mean you can’t still use this platform to your advantage. There are plenty of ways you can go about this.

First of all, if your business is tied to your personal brand, you definitely need to use Kred. Working with other brands can be an easy way for you to build credibility for your company.

For example, let’s say you’re in the modeling business. Rather than looking for social influencers to promote your brand, you should be getting connected with brands to promote their products.

That way, you can earn some extra cash while increasing the exposure for your personal brand and business at the same time.

Kred is also great because it helps connect influencers with other influencers.

Businesses can use these tools to their advantage to discover their Kred score, which is basically a report of how strong their online influence and outreach is on various channels.

7. GroupHigh

GroupHigh is another top choice for brands looking to connect with social influencers and bloggers.

They have a database with over 15 million influencer profiles.

You can search for influencers based on different reach metrics, location, and social presence. GroupHigh also has an option for finding influencers based on their expertise in niche topics or industries.

If you are managing social influencers on multiple platforms, GroupHigh can help you stay organized.

That’s because the software allows you to import all the information regarding other influencer relationships into their system. Now you can manage everything from one location. It’s easy to contact your influencers with just a click once you import their info.

There are lots of different communication options with influencers based on the preferred method of both parties.

You can also see reports on all your social mentions to give you a better understanding of your ROI from different influencer marketing campaigns.

8. Followerwonk

Followerwonk is software offered by Moz. It’s an influencer marketing tool specific to Twitter.

Unlike the majority of options on our list, Followerwonk has a free version you can take advantage of.

This tool helps you search for keywords found in users’ Twitter bios. You’ll get to see information pulled from their profiles, such as the number of followers, account age, tweets, and social authority scores.

In addition to using this tool to help you find new influencers, you can use it to track your existing relationships.

You want to make sure the influencers representing your brand on Twitter still have a strong authority. Otherwise, you may be wasting money on a marketing campaign that won’t work.

9. Onalytica

If you’re looking for a platform that helps you connect with new influencers and manage them at the same time, Onalytica is a viable option to consider.

You have several options to search for new influencers. Onalytica lets you search based on categories, so you can get connected with people who specialize in specific fields.

You can also find influencers based on their demographics.

If you’re looking to market your brand to a specific audience, it makes sense to work with influencers who fit that demographic as well.

But what really makes Onalytica one of the top influencer marketing platforms is the option to search for influencers based on topic and content. You can find people who use similar language to that of your recently published content.

All you have to do is upload something you created, such as a newsletter or blog post, and the Onalytica content matching tool will provide you with a list of prospective influencers.

10. Traackr

Last on my list, but certainly not least, is Traackr.

This platform has a wide range of solutions to help businesses manage their influencer marketing campaigns.

They make it easy for you to communicate with influencers on a daily basis so that you can effectively get your message out to the consumer.

You can also upload influencer lists from other platforms to this software to help you manage everything in one centralized location. That way, it’ll be easier for you to track and compare your conversions, helping validate the success of specific campaigns.

Traackr also has tools to help compare your brand’s total social influence compared to that of your competitors. It also tracks your improvement over time.

All this information is helpful when it comes to measuring your reach and ROI.

Conclusion

For your business to survive and prosper in today’s digital age, you need to increase your social media presence.

To do this effectively, you’ve got to develop relationships with social influencers on multiple distribution channels.

Rather than just blindly scrolling through your follower lists to try to come up with a qualified candidate, you can use online tools to discover, manage, and analyze your influencers.

Refer to my list above to help you find what you’re looking for. Some of the options are more platform-specific, helping you connect with either bloggers, for example, or influencers on Twitter.

It all depends on your marketing goals.

But one thing is for certain, you need to get on the social influencer train now before your competition beats you to the punch.

What types of platforms does your company use to manage relationships with social influencers?

Source Quick Sprout https://ift.tt/2HGrHIW

Questions About Drying Laundry, Blogging, Birthday Parties, Job Offers, and More!

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Is it time to retire?

2. Money for parties at work

3. Boyfriend kicked me out

4. Great job offer… but scared

5. Dental plans for self-employed

6. Laundry drying strategy

7. Cheap children’s birthday parties

8. Finding people dedicated to saving

9. Starting a free blog

10. Exit interview questions

11. Ending credit card dependence

12. Different writers

My latest frugal experiment is to try to figure out a low-cost balm to use after shaving. For many years, I have applied a small amount of Nivea after-shave balm to my cheeks. A single bottle lasts for a long time, so I don’t think it’s a big expense, but I was curious as to whether I could make something myself for less expense.

Turns out… I can’t. I have tried a few different recipes and mixes and I haven’t found anything that doesn’t either sting like crazy or smell like alcohol.

Although I like to experiment with frugal solutions, sometimes I just can’t find anything that really works better than what I was already doing.

On with the questions.

Q1: Is it time to retire?

I’m 58 and can retire in 2 years. My husband is 59 and can leave now with full retirement (he has to retire in 2.5 years). We have about $800,000 in deferred comp savings plans and will both have pensions when we retire. We have no debt but anticipate replacing 20+ year old vehicles soon and might buy/build a home that fits our needs as we age and use current home as a rental to cover the new home’s mortgage. We’re both in decent health now but anticipate health issues in the next 10 years with high health costs due to family histories. How do we know when it’s okay to retire? We’ve lived well below our income and thought we’d feel confident about retirement. And while we’re far ahead of the norm for retirement savings, we don’t really know if now is the time. What do we need to know/have in place before we walk away from high stress jobs that pay really well.

– Erica

If I were you, I would take advantage of your health insurance and go to each of your doctors and request a very thorough physical, as much as you can get, to assess your current health and the likelihood of major health problems in the next decade or so.

Then, I’d use that assessment to figure out the next step. If you’re very healthy, then I would consider making the leap to be much more safe.

The thing to remember is that you will have Medicare when you retire, and you can buy Medicare supplemental insurance. Your key should be to avoid periods of minimal insurance unless you are strongly assured of your health.

Q2: Money for parties at work

How do (or I guess did) you handle money for parties at work? Like when someone is having a baby and they throw a little baby shower for her at work and ask everyone to contribute $20 for a big gift like last week at work when everyone chipped in for a breast pump machine? Or when they have a retirement party and want everyone to chip in? Or when someone has their kid do a fund raiser? Do you just say no all the time? What about the social backlash? Worth it?

– Emma

I viewed such expenses as the cost of being in an office environment, unfortunately. There are a ton of little expenses like this that come from working in an office – the cost of commuting, (often) the cost of parking, the cost of eating out for lunch with coworkers, the cost of matching office dress code, and so on. I consider little expenses like these to be part of that.

If I were you, I’d budget and plan for such expenses, viewing them as part of professional networking. In the end, that’s really what you’re doing – you’re maintaining relationships at work at a cheap cost, so that Jim from human resources or Nancy from accounting doesn’t think you are a jerk and will work easily with you in the future and won’t spread negative gossip about you.

This is one financial perk of working at home – you don’t have to deal with any of those costs any more.

Q3: Boyfriend kicked me out

I am 26/F and work as a waitress. My boyfriend and I had a big fight before work last week and he said we were through and I thought he was just blowing off steam but I came home and the locks were changed. I got the police and landlord to let me in to gather up my personal belongings but he still have a lot of stuff that is shared and I am living out of my car. I do not make enough to afford an apartment and I have no living relatives to stay with and no friends good enough that I could move in. What do I do?

– Katie

Unless you have some clear documentation of what is yours and can demonstrate that ownership, it’s probably a lost cause to reclaim it at this point. You can make a list of shared items and request that he turn over enough to equal out the value, but if he won’t, your only recourse is to get a judge’s order, which will likely have legal costs especially if you don’t have clear documentation.

As for what to do next, you should consider looking for waitressing work in a lower cost of living area, perhaps one that’s closer to friends where you could “couch surf” for a while as you pick things up and figure out what’s next. This might involve moving to another city, but it sounds like you have no ties where you’re at, so it’s not a big deal.

If I were in your shoes, I’d try to get a few shared items from your ex, sell off what you can’t easily fit in your car, then head to another town where you know people and the cost of living is more palatable.

Q4: Great job offer… but scared

I am 26 years old and live in a house that I rent cheaply from my parents. I started working at my current job shortly after graduation and make about $38K per year. I took it because the experience is tremendous in my field.

My boss has been actively helping me find a better job (yes he’s that kind of guy) and he got me an interview with [a large engineering firm]. I figured I had zero chance but they gave me a job offer. $80K starting, killer benefits, great opportunity to move up from there. My boss says I should negotiate a bit for salary and then take it.

The thing is, i don’t want to take it. I do not know anyone in that city or anywhere close to there. The job seems exciting but really intimidating. I have no family or social structure there. I am afraid my life would become nothing but work and I will burn out and hate my life.

I feel like I want you to talk me into taking this job but I don’t know what to do.

– Steve

OK, ignoring all of the factors outside of the job (not knowing anyone in the city, basically), is this a job you’d be happy with? In other words, if you could magically do this job where you live now, would you take that job?

If it’s a “yes,” then you need to at least give this job a shot. Go there, give it a year, and see how everything works out. If you’re really worried about it failing, talk to your current boss and see whether you can work out a situation where you come back to something like your old job if it doesn’t work out.

When you take this job, go in there with a plan. First of all, take maximum financial advantage of it – contribute to the retirement plan, get every drop of matching, etc. Live in a small apartment. More importantly, make it your goal to find people that you’ll enjoy hanging out with that will become a social circle or “family” for you. Start by hitting Meetup.com and seeing if you can find any groups in that city that might match your interest. Try to make a big healthy list, then check them all out shortly after getting there. Keep going to the ones that click (or seem like they might click) and don’t sweat the others. If you’re religious, definitely join an appropriate group for that.

Do everything you can to start building an independent social circle and life for yourself in this new city. Make it a daily – or at least several times a week – requirement that you’re building a new life for yourself in this city. Put everything you can into not feeling alone and feeling like there’s more to life than just going to work in this city.

If, after a year, it doesn’t work out, well, take advantage of that parachute and return home.

If you don’t do this, you will always wonder “what if,” and that kind of regret isn’t something you need to have for the rest of your life.

Q5: Dental plans for self-employed

We are self-employed. Do you have any suggestions for what to do for when we need to take a trip to the dentist? Are dental plans a good idea?

– Ava

I’m going to be honest: most dental plans are very limited on what they cover and how much of it that they cover to be worthwhile for most people if they’re paying out of pocket. They usually only step in for disastrous coverage unless you have a very expensive plan.

If I were you, I would “self insure” for dental work. I’d settle into an annual checkup routine paid out of pocket, and then I’d triple that annual cost for both of you and divide it by 12. I would automatically put aside that much for “dental insurance” so that you can pay for dental care out of pocket. Just keep up with routine maintenance on your teeth (brushing, flossing, annual checkups) and you’ll usually be fine. On average, this is far more cost efficient than a dental insurance package out of pocket.

Ava had a second question.

Q6: Laundry drying strategy

Also, I like hanging laundry out to dry if weather permits. Do you know if line-drying laundry instead of using the dryer is significantly cheaper?

– Ava

The energy cost of a dryer load is somewhere around $0.60, although it varies with the age of the dryer and the size of the load and the efficiency of the dryer.

Having said that, there are a couple of additional factors to consider.

One, tumble dryers are hard on clothes and are likely to damage them far more than line drying. In other words, if you line dry, your clothes will last longer. That lint trap in the dryer is little bits of your clothing, after all.

Two, dryers eventually fail and then you have to pay for a replacement. Let’s say you can get 10 years of daily use out of a $500 dryer. The replacement cost of that dryer is somewhere around $0.15 per load in additional cost. That cost disappears with line drying.

Given those factors, you’re likely saving a dollar or two for every load you hang out on the line, or more if you’re hanging out some fairly pricy garments.

Q7: Cheap children’s birthday parties

What are some good ideas for cheap birthday parties for kids? I have a four year old and a two year old and soon birthdays are going to be more than just having grandma over for cupcakes and a couple of presents. Our oldest has already received a couple of invites for parties at the park and she will want something similar when she turns five. How can one keep this cheap but let her have fun with her friends?

– Olivia

One word: sleepover.

Most of our children’s birthday parties have been in the form of sleepovers with a few of their friends. They’ll have several friends come over to spend the night and we basically have a fun dinner of their choosing (often it’s homemade pizza) and then we let them plan out what else that they want to do (a few simple activities or else just free play). We fill up the family area in the basement with sleeping bags and let them watch movies or play video games until late in the night. It’s a super inexpensive party but our children love it.

If we do something more extravagant than that, it is considered one of their birthday gifts and they receive noticeably fewer gifts. We generally only give a few gifts for their birthday anyway, as we tend to lean toward a small number of “good” gifts than a lot of lesser ones, and if they do something besides a normal sleepover, it’s considered at least one of their gifts. Occasionally our children will choose a more expensive activity, but usually they prefer a sleepover.

Sleepovers are fantastic. If you do something like homemade pizza and a simple activity or two, the cost is pretty minimal and the children all seem to have fun. We recently had a sleepover for our youngest child’s birthday in which we just had pizza for supper, a couple of really simple activities, and then let the children just play together and stay up late, and every single child had so much fun that they literally didn’t want to go home the next morning. It’s inexpensive and every single child seems to enjoy it. So, that’s my recommendation for cheap children’s birthday parties.

Q8: Finding people dedicated to saving

How do you find other people who earn a high income and are dedicated to saving a large portion of their income? I make $80K per year and save about 50% of my income. I would like to find friends on a similar career path who don’t spend all of their money.

– David

The best success I’ve ever had at finding people with a similar financial perspective as my own is by going to free cultural events in my area, particularly ones that give windows to socializing.

Book clubs are great, especially ones run by the library so you can just check out the books. Presentations and speeches at local universities and libraries are great. Meetup groups are great. Civic organizations can be great, though they vary a lot in my experience.

Basically, if it’s a social event that doesn’t involve spending money and offers at least some direction toward self-improvement, you’re probably going to find like-minded people there. It’s never a guarantee, of course, but the people in the room are much more likely to be of a “saver” mindset than you’ll find elsewhere.

Q9: Starting a free blog

Where and how can I start a free blog?

– Nancy

I would recommend starting with either WordPress.com or Blogger.

WordPress is a much better tool for blogging. It’s just more robust in terms of actually writing posts and designing your blog than Blogger is, and you’ll find support to be much better, too.

So why use Blogger? WordPress.com is fairly difficult to monetize, especially when you’re starting. In other words, unless you’re fairly popular, you won’t make any income with a WordPress.com blog. (It’s worth noting that WordPress is also a software package; WordPress.com is just a site that lets you have a free blog using the WordPress software. If you later on decide to host the site yourself, then you have much more freedom when it comes to ads.)

Blogger is a solid tool (not as robust as WordPress.com) but it does have the advantage of allowing you to do all kinds of things to monetize your site. It is worth noting that you won’t make much money at first no matter what – it takes a long time to build an audience and they won’t just magically appear.

My recommendation? Use WordPress.com, don’t worry at all about making money at first and focus entirely on building an audience, and then figure out what to do when you do have a healthy number of readers.

Q10: Exit interview questions

I recently turned in my resignation at work, telling my boss I would work as long as needed up until June 15. They’re using me the full time which is fine and they’re putting me on a lot of documentation tasks which is fine. My boss keeps asking me why I quit (better job, contacted by headhunter and got the new job quickly) and I know it will be asked in my exit interview. Do I have to say anything?

– Alan

Your goal with an exit interview should be to leave on a positive note with references and connections to the company intact. You should not be burning bridges on your way out the door no matter what went on there.

I don’t think you need to keep it a secret that you had a great offer from another organization unless there is some hidden legal issue that you’re not mentioning. Most companies will respect that.

I would encourage you to not worry about the exit interview and to be honest but positive during it. Don’t go scorched earth negative if the interviewer asks for criticism of the company – try to state both positive and negatives about your time there. Going strongly negative doesn’t benefit you or the company.

Q11: Ending credit card dependence

I am 26/M married with two kids. I pay for everything by credit card and sometimes overspend what we have and that means we now have about $12K in CC debt. Need to stop overspending with the card. Using only cash makes sense but seems awkward. Using only debit card makes sense but afraid of identity theft and having my bank account cleaned out. Solution?

– David

Cash is inconvenient, but it’s the best solution here. It forces you to stay within your means and it’s impossible to have your identity stolen with cash transactions. Just simply hit an ATM or visit a bank location before you shop for groceries or other needs.

Your goal here should be to train yourself on how to live within your means so that you’re not just racking up expenses on your credit card. For you, that means starting by being very careful about unnecessary expenses for a while until you get a firm grip on how money flows into and out of your checking account. You’re far better off letting a balance build up in that checking account than having it drain to empty every pay period.

You may eventually return to using a credit card, but for now, you should stick to cash and learn the lessons that cash can teach you.

Q12: Different writers

I was disappointed reading TSD’s email this morning. The use of the term mansplaning is offensive, even though the author mentions that it’s not about mansplaning… I knows this article wasn’t written by Trent, and it’s your business to run. But I might not be the only one.

– Troy

I receive an email like this about once a week, so I wanted to step in here and clarify a bit about how The Simple Dollar works.

I (Trent) started The Simple Dollar as a solo project in 2006. For the first several years, all articles on the site were written by me. By the end of 2011, the burden of running the site solo (with a couple of virtual assistants) was more than I wanted to deal with (in particular, Thanksgiving 2011 was a disaster, with a hacker attacking the site and thus directly attacking my family’s livelihood). So, I sold the site to its current owners, who retained me to write for the site for a very long period of time. I am under indefinite contract to write for The Simple Dollar with them, meaning I’ll probably keep writing until I decide not to (which, hopefully, means we’ve reached financial independence).

Now, the company that currently owns the site gives me a ton of free reign to write what I want to, as long as I write consistently. They just say, “You need to write 6 articles per week” and have a certain word count (so that I don’t write two sentence articles and call it good enough). Other than that, they give me almost no suggestion or direction in terms of what I write about aside from occasionally sending me links or suggested books to read in a “here’s something you may want to write about” or an idea for a post, but I’ve never been required to write about any of them.

However, TSD is a business, and having all of the site’s writing come from one person is a risk to that business. If I were to get hit by a truck and I were the only writer for the site, they’d be in a pickle. So, the site has a roster of other writers who post articles with some regularity. You can usually tell who wrote what because the author’s identity is identified at the top of the article (on the website) or the bottom (in the email newsletter). If it doesn’t have an identification, it’s usually written by me (Trent). The site owners simply need to have other writers ready to go in case I can no longer (or choose to no longer) write – it covers their risk.

Obviously, I’m not going to 100% perfectly agree with other writers, nor are they going to perfectly agree with me. We’re going to have different tones and different word choices and different experiences and different ideas. I write with a Midwestern earnest tone that has definitely earned me some good-natured teasing from other writers in the past. I generally write without irony or “snark” (though I definitely can use irony and “snark” if I so choose) and try to be as genuine as possible in what I write. Other writers may do things differently, both in tone and in terms of what they write about.

Rest assured, regardless of your feelings about other writers, I will be writing six articles a week for the site for the foreseeable future. I write a “reader mailbag” on Mondays and regular articles on Tuesday through Saturday, one per day. Though I know that many readers have tuned in to The Simple Dollar since it was a solo site and are mainly here for my articles, I hope that you’ll find things you like by the other writers as well.

Got any questions? The best way to ask is to follow me on Facebook and ask questions directly there. I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours.

The post Questions About Drying Laundry, Blogging, Birthday Parties, Job Offers, and More! appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2JFjwNo

Cashless payments: the pros and cons of going digital

“The writing looks to be on the wall for 1p and 2p coins,” wrote one personal finance analyst after the government published a call for evidence on the future of cash and digital payments in its Spring Statement.

Entitled Cash and Digital Payments in the New Economy, the government’s consultation, which also questions the future of £50 notes, seeks views on how the transition from cash to digital payments impacts on different sectors, regions and demographics.

So does this mean it’s time to go digital? The past decade has seen near-field communications (NFC) technology used to make payments not just by cards, but by smartphones, wristbands, key fobs and other gadgets too.

Garmin and Fitbit even offer wearable fitness trackers with contactless payment capability. You can be out for a run, stop to buy a bottle of water and pay for it with your watch.

A study by Visa found that just over a quarter (26%) of Brits have used a mobile device to make a contactless payment in a shop, rising to 36% for a contactless card. Kevin Jenkins, managing director of Visa UK & Ireland, says: “Our study shows the appetite for adopting new payment methods is greater than ever, and with mobile devices opening up myriad new ways to pay, the next 10 years looks set to see contactless payments become an even greater part of our day-to-day lives.”

Moneywise looks at the pros and cons of contactless payment methods.

Mobile phone payments

Smartphone users can make contactless payments with Apple Pay, Google Pay or Samsung Pay.

These systems allow you to store your credit or debit card details in a secure mobile wallet and make payments by holding your phone close to a contactless reader. The key advantages of paying with a mobile phone are speed and convenience.

Charlotte Ashton, 36, a PR agency director from south-west London, has been using Apple Pay on her iPhone for the past two years.

“I usually have my phone to hand so it’s super quick and easy to just pay through Apple Pay,” she says. “From my lunch to the weekly shop to the tube fare, I use it at least two or three times a day.”

Your ability to pay by smartphone depends on which phone you have and who your bank is. Apple Pay is only available on handsets from iPhone 6 onwards, while Samsung Pay is available on the Galaxy Note 8, S8/S8+, S7/S7 Edge and S6/S6 Edge/ S6 Edge+, as well as some versions of the A3, A5 and J5. It can also be used on the Samsung Gear Sport watch.

Google Pay works on any Android device with NFC technology and Android 4.4 KitKat software or above.

To set up mobile payments, you also need a debit or credit card from a supporting bank. Most UK banks support Apple Pay and Google Pay, although the latter is not supported by Barclays.

Samsung Pay is much more limited: only people with debit or credit cards from First Direct, HSBC, M&S Bank, MBNA, Nationwide and Santander can use it.

The biggest potential problem with relying on mobile phones to make payments is what happens when your phone breaks down or runs out of battery, leaving you unable to pay.

Smartwatch payments

If you want to pay with a smartwatch, you need one that’s compatible with the payment wallet on your smartphone. For example, Apple Watch wearers will need an iPhone set up with Apple Pay.

Garmin Pay and Fitbit Pay are the two new players in this area. Like Google, Apple and Samsung, they both offer mobile wallets which can be linked to compatible devices.

Garmin Pay is currently only compatible with two smartwatches, the Vivoactive 3 and the Forerunner 645. In the UK it can only be used by Danske Bank customers, although it plans to add more banks in the future.

Fitbit Pay is available on the Fitbit Ionic and Fitbit Versa and can be used in the UK with Danske Bank and app-only bank Starling.

The limited number of supporting banks is an issue for people who want to pay with a Samsung watch, as only 11 banks work with Samsung Pay.

Will McClay, 44, a personal fitness trainer from south-east London, says: “I hardly carry my wallet any more as I use contactless payments on my phone using Google Pay – it’s great. But you need Samsung Pay to pay with a Samsung Gear watch and my bank isn’t supported. I’m with Lloyds and it’s not on Samsung Pay.”

Barclays bPay

bPay from Barclays offers a much cheaper way to make card-free contactless payments.

The portable and wearable payment system uses a chip built into four devices: wristbands, key fobs, stickers and bPay Loops. The bPay Loop slides on to the strap of any watch, fitness tracker or anything else you might buckle to your wrist, effectively making it a contactless payment method. The stickers do the same thing and can be stuck on to a smartphone or any object you like.

Fobs and stickers cost £7.99, loops £8.99 and wristbands £10.99, or you can get a family-pack bundle with a wristband, fob and sticker for £19.99.

Barclays has also partnered with DS Automobiles to offer the UK’s fi rst integrated contactless payment car key. The two-in-one key will initially be included with the DS3 Connected Chic, available up to December 2018.

You don’t need a Barclays account to top up a bPay device; you can add money to your wallet with any UK-registered Visa or MasterCard debit or credit card.

Where are contactless payments accepted?

You can make mobile phone and wearable payments anywhere you see the contactless ‘radio waves’ symbol (see left) at the checkout, in the UK and abroad. This includes shops, pubs and restaurants and on all Transport for London and national rail services in the capital.

Contactless card payments have a limit of £30 per transaction, and some retailers apply this limit to mobile phone and wearable payments too. Those that allow higher payments on Apple Pay and Google Pay normally require users to authenticate the payment using a PIN, password or fingerprint.

Finally, one issue with relying on any non-card contactless payment method is what happens if a retailer doesn’t have a contactless payment terminal. Contactless cards can, of course, also be used in regular chip and pin card readers, but if you’re entirely relying on your phone or watch to make a purchase, you could end up stuck.

Section

Free Tag

Related stories

- Banking on the go: Tap into the latest ways to spend and save

- Take it easy and let your money take care of itself

- Should you join the open banking revolution?

Source Moneywise https://ift.tt/2rbE0FU

How to Use a Windfall to Supercharge Your 401(k)

There are a number of different reasons why you might suddenly find yourself with some extra money:

- Tax refund

- Bonus

- Cash gift

- Employee stock vesting (which you should often quickly sell out of)

- Inheritance

There are a lot of good things you could do that with money, and using it to turbocharge your retirement savings is certainly on that list. After all, your savings rate is the single most important part of your investment plan and anything you can do to increase it is worth some consideration.

And while you can’t directly contribute cash to your 401(k) – since contributions have to come out of your paycheck – there is a way to use that windfall to increase your 401(k) contributions without impacting your monthly budget. Here’s how to do it.

Meet Chloe

To show how this works, we’ll use Chloe as our example.

Chloe makes $60,000 per year and contributes 5% of her income to her 401(k). Since she’s paid twice per month, she ends up contributing $125 per paycheck. That’s $3,000 per year, which means that she has plenty of room to increase her contributions before she hits the $18,500 annual limit for 2018.

Chloe also has an incredibly generous grandparent who just gave her $4,000 for her birthday. Since she already has an emergency fund and her other short-term goals are on track, she wants to put this money away for retirement.

She could contribute it to an IRA, but she’s lucky enough to have a good 401(k) with even better, lower-cost investment options than what she could access on her own. So she’d like to put the money there if she can.

Here are the four steps she takes to do just that.

Step #1: Put the Windfall in a Separate Savings Account

First, she puts the money in a separate savings account. She wants it to be easily accessible, but she doesn’t want it mixed in with her day-to-day spending money or even her other savings that might be used in the near future for other goals.

Keeping it separate allows her to know that it will definitely be there when she needs it.

Step #2: Increase Her 401(k) Contributions

Chloe has 16 more paychecks the rest of the year and a $4,000 windfall, which means that she can contribute an additional $250 per paycheck. Including her current $125 contribution, that’s a total of $375 per paycheck for the rest of the year.

Given that her per-paycheck income is $2,500 – calculated as $60,000 divided by 24 – she needs to increase her 401(k) contribution to 15%. With that increased rate, she’ll end up contributing exactly $4,000 extra over the rest of the year.

Quick note: One thing to keep in mind here is that you need to stay within the annual 401(k) contribution limit, which is $18,500 for 2018 (or $24,500 if you’re age 50+). If Chloe had received a $20,000 gift instead of a $4,000 gift, she wouldn’t be able to use the entire gift this year since it would have put her over that limit.

Step #3: Calculate the Difference in Net Pay on Her Next Paycheck

With that change in place, Chloe is now contributing an extra $250 to her 401(k) every time she’s paid. But that doesn’t mean that she’s receiving $250 less than she used to.

Since 401(k) contributions are tax-deductible, that extra $250 will reduce her tax withholding, leading to a smaller difference in net pay.

Assuming that Chloe is in the 22% tax bracket, her net pay would only decrease by $195 per paycheck. Or to say it another way, Chloe will have $390 less than she used to have for her other monthly needs because of the increased contribution.

Step #4: Withdraw That Amount from Her Savings Account Each Time She’s Paid

This is where Chloe finally gets to use that $4,000.

Every time Chloe is paid from now until the end of the year, she can move $195 from her separate savings account to her main checking account. She can even set up automatic transactions between those accounts so that she never has to think about it past the initial setup.

With that in place, Chloe has ensured that she has the exact same amount of money to spend each month as she did before she increased her 401(k) contributions. She has indirectly transferred the $4,000 gift into her 401(k) without affecting her monthly budget at all.

Bonus Step #5: Figure out What to Do with the Extra Money

If you’re following along closely, you’ve probably already noticed that Chloe will have some money leftover in that separate savings account at the end of the year.

$195 over 16 paychecks adds up to $3,120, which means that she’ll still have an extra $880, which represents the tax savings from those 401(k) contributions.

At this point, she can do whatever she’d like with that extra money. She could keep her 401(k) contributions higher for a little longer. She could pay off debt. She could plan a vacation. Or she could put it towards another goal.

Get Creative with Your Windfall

In some ways, using a windfall to increase your 401(k) contributions is the best of all worlds. You get to turbocharge your retirement savings AND you receive a tax break that can help you make progress toward other goals at the same time.

It’s a win-win, and all it takes is a little creativity and some simple logistics.

Matt Becker, CFP® is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families.

Related Articles:

- Seven Life Changing Ways to Use Your Tax Refund

- 401(k) Vesting: What It Is and Why It Matters

- How to Start Investing on a Tight Budget

The post How to Use a Windfall to Supercharge Your 401(k) appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2FtxVtH