Email marketing is an essential component of every business.

But it’s even more important for your ecommerce website.

Why?

It’s one of the best ways to communicate with your customers.

As an ecommerce business, you don’t have the luxury of seeing your customers face to face like you would if you were a brick-and-mortar company.

Sure, there are other ways you can communicate with your customers.

They can call your customer service department or reach out to you on social media.

But marketing experts agree that email is the most effective digital marketing tactic.

With that said, your strategy is only as effective as your message.

If your previous campaigns aren’t getting much of a response, you might need some help writing your emails.

Luckily for you, I can coach you through that.

No more bad emails.

I’ll show you how to write an ecommerce email that won’t leave your readers shaking their heads.

Start with a goal

Before you do anything, you need to establish a clear objective for your message.

What do you want your reader to do once they receive the email?

If you can’t figure that out ahead of time, there’s no way the recipient will take the action you want them to take.

Here are some examples of goals you may want to consider:

- launch a new product

- promote a special event or sale

- upsell on a previous purchase

- send shopping cart abandonment messages

The list goes on and on, but this is a good place to start.

Make sure each message focuses on one goal.

Don’t overwhelm the reader.

If you give them too many options, they may get confused and end up doing nothing.

The message should have a clear call to action.

Here’s an example from Fab:

This message has a clear and concise goal.

Fab is trying to get their subscribers to download their mobile application.

That’s it.

They aren’t offering a discount. There’s no special event.

The reader won’t be confused by this message.

Obviously, Fab wants to start promoting sales on their app.

That may be an undertone of the company’s overall marketing campaign.

However, the email doesn’t need to get into all that.

It’s short, sweet, and actionable.

A 2017 report on mobile usage found that 90% of mobile media time is spent on apps, which means Fab’s campaign is smart.

Ultimately, I’m sure they believe this will help increase conversions and revenue.

But for the time being, the message is strictly to drive downloads.

Start with a goal, and make sure your message represents that objective.

Your message needs to deliver value to the reader

Don’t just send an email because it’s been a week since your last message and you think it’s time to send another.

While sending a message once a week may be a viable strategy, each email needs to offer value to the subscriber.

If you’re not offering any value, the reader may consider your message as spam.

Here’s an example from Huckberry:

This message encourages the subscribers to invite their friends to the Huckberry community.

Why would anyone do this?

Because their campaign adds value.

Huckberry is going to give away prizes to people who share this message with friends and family.

If the message just said “invite your friends” without offering an incentive, the subscriber wouldn’t see any value. The email would be useless.

Can you promote your product while providing value?

The answer is: it depends.

For example, DODOcase was able to hype their product before launching it by promoting it to potential customers. As a result, it sold $7 million worth of products within 90 days of their first product launch.

What else offers value to your customers?

Look again at our first example of Fab.

Even though they were promoting their mobile app, the message still provided value. It offered:

- free shipping

- free returns

- best price match

We know that 87% of Americans say price is the most influential factor in their purchasing decisions.

And 80% are influenced by the cost of shipping and delivery speed.

Discounts influence 71% of American shoppers.

What do these three statistics have in common?

Value.

That’s what your customers want, so that’s what you need to give them.

Make sure your ecommerce email focuses on the value you’re offering.

Your subject line is important

What’s the first thing your subscribers see when they get an email from you?

The subject line.

Your subject line is one of the top reasons why people would open your message:

You have to put just as much thought into your subject line as you put into the rest of the message.

If your subject line can’t hook the recipient, they will never see the content of your email.

Here are some guidelines for writing a subject line that will increase your open rates:

- create urgency

- use breaking news

- tell a story

- stimulate curiosity

- personalize it

- send an offer

Those of you who struggle with catchy, creative, or actionable subject lines can refer to these points for inspiration.

Look at how Eddie Bauer creates a sense of urgency with this email:

It’s the last day to get 50% off your fleece purchase.

If the customer doesn’t act now, they will miss out on the deal.

Use this technique for your subject line.

- Sale ends tonight

- 48 hours left

- Limited quantity remaining

You can use these phrases when creating a subject.

I also highly recommend using storytelling in your email subject line:

“Here’s how I did XYZ…”

Say something to that effect.

Stories engage the reader.

Creating engaging content is a top priority for marketers in 2017.

Content marketing experts recognize the importance of stimulating the customer’s curiousity.

Accomplishing this in your subject line puts you on the right track to converting the reader with the rest of your message.

Focus on your call to action (CTA)

Earlier, I talked about the importance of establishing a clear goal for your campaign.

The CTA needs to mirror that objective.

Use words like:

- Buy now

- Save today

- Claim your reward

- Become a VIP member

- Choose the style you want

- Reserve your seat

- Earn rewards

- Click to reveal my coupon

- Upgrade my service

Don’t overwhelm your customers with the CTA.

Pick one and go for it.

Use a button instead of a hyperlink.

Buttons can increase conversion rates by 28% compared to a hyperlink.

Check out this CTA button from De Beers Jewelers:

It’s clear, unique, and creative.

It doesn’t just say something boring like, “Click here.”

You can use bright colors to draw attention to your CTA like Pizza Hut does:

Green has nothing to do with the Pizza Hut logo or brand, but it makes for a perfect CTA button.

This message also adds value, addressing the topic disccused above.

Pizza Hut sends a coupon code with an expiration date to create a sense of urgency.

The campaign encourages their subscribers to order food online.

Utilize drip campaigns

Drip campaigns make sense for ecommerce companies.

They are also known as marketing automation, lifecycle emails, or autoresponders.

Focusing on automation can make your life a lot easier.

What’s a drip campaign?

A drip campaign is a series of emails that get delivered in a predetermined order to your subscribers.

This is a perfect opportunity for you to contact your customers.

Here’s an example.

Let’s say someone makes a purchase on your ecommerce platform.

The first message of your drip campaign can say something like, “Your order is confirmed.”

Try something similar to this template from Fitbit:

The message assures the customer that their order has been placed.

You should always send a confirmation email to your customers.

People are cautious when they enter credit card information on the Internet.

Over the past 5 years, 46% of people in the United States have experienced credit card fraud.

If they don’t get a reassurance that their order went through safely, they could feel uneasy about your website.

Not everyone who orders from your site is an email subscriber.

But you should still ask for their email address to send them this information.

For those people, you can include a CTA button that encourages them to subscribe to your emails.

“Join our email list to receive 20% off your next purchase.”

The second and third phase of your drip campaign will be:

- Order shipped

- Order delivered

Again, both of these emails make sense to the recipient.

What will make your readers want to scratch their eyes out?

If they don’t know why they received a message.

Nobody will question this drip sequence.

Finally, you can send a fourth email in the drip campaign to follow up with the buyer.

Include a customer survey in the message to see if they are happy with their purchase.

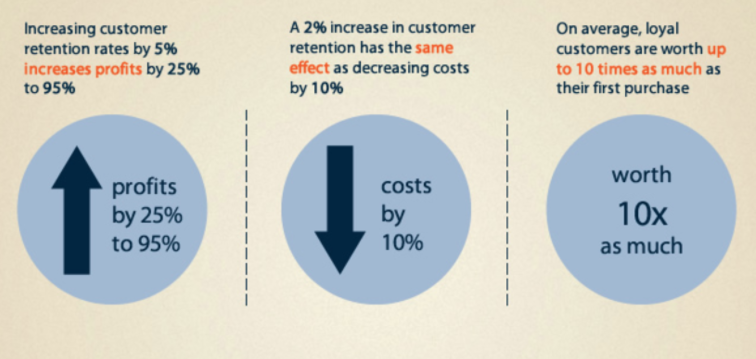

Surveys help create loyal customers, increase retention rates, and grow profits.

Using the drip campaign method allows you to email a customer four times for just one purchase.

All these messages will be informative and valuable to the recipient.

Don’t forget to send shopping cart abandonment emails

Similar to the last point, shopping cart abandonment messages make sense to the reader.

They won’t be asking, “Why did I get this message?”

The customer was shopping and was just a click or two away from finalizing the purchase until something stopped them.

A number of things could have caused this:

- unexpected costs like taxes or shipping

- they were just browsing

- website crashed or slow loading time

- didn’t feel comfortable submitting credit card information

These are just a few common responses.

But you still need to send the email to remind your customers to check out.

Sending this message will improve your conversion rate.

You need to include this strategy into your email marketing arsenal.

It’s essential for ecommerce websites.

The message has a clear goal: to finalize the sale.

If you want to add value for the customer, send a promotional code to discount the order.

Embed a video in your message

If you’re worried your readers might be scratching their eyes out because of your current email campaign strategy, I’ve got a solution: mix things up.

Turn your readers into viewers.

Don’t make them read anything. Instead, send a video message.

Your customers want to watch videos.

Don’t believe me?

Well, the numbers don’t lie.

In fact, 43% of people want to see more videos from marketers.

If you’re launching a new product for your ecommerce site, send your subscribers an informative video message.

SproutVideo improved their click-through rate by 60% when they added videos to their email marketing campaign.

Your ecommerce site can do the same thing.

It’s a great opportunity for you to do a product demonstration or a tutorial.

Conclusion

It’s great you’re utilizing email marketing campaigns for your ecommerce site.

This can’t change, but the content of your messages may need some improvement.

You don’t want your readers wondering why they received a message.

If you’re not adding value to the customer, they might unsubscribe, block you, or mark your message as spam.

How can you write a killer ecommerce email?

Start with your goal.

What’s the purpose of the message?

Once you define an objective, keep the message short and focused on that goal.

Emphasize your call to action.

Your CTA button should be big, bold, bright, and not boring.

Give the customer a reason to click.

Your subject line matters.

Customers won’t bother opening the message if the subject line is weak and doesn’t grab their attention.

If you’re unsure when to email your customers, set up a drip campaign that automatically sends updates after an order is placed.

Send out shopping cart abandonment emails to help improve your conversion rates.

Videos are a great way to turn readers into viewers.

Try to include videos and other interactive emails into your campaign.

Following these tips will help you keep your audience engaged instead of frustrated.

How will you alter the subject line of your next email to increase open rates?

Source Quick Sprout http://ift.tt/2zgizJE