We live in a digital age.

Each day we’re bombarded with an endless stream of online ads via social media, websites, search engines, videos, and so on.

Marketing companies spend billions upon billions each year researching, analyzing, and pushing ads to consumers.

But you know what?

No matter how sophisticated and streamlined digital marketing becomes, it still pales in comparison with the power of good old-fashioned word of mouth marketing (WOMM).

According to in-depth studies from Nielsen, “WOMM recommendations still remain the most credible.”

Just look at this graph that ranks consumers’ trust, depending on the form of advertising and the action it produces.

Positioned right at the top as the number one trust factor is “recommendations from people I know.”

It heavily shapes consumers’ opinions on brands/products/services, and this is unlikely to ever change.

Here are a couple more stats that demonstrate the power of WOMM:

- “74 percent of consumers identify WOMM as a key influencer in their purchasing decision.”

- “WOMM has been shown to improve marketing effectiveness by up to 54 percent.”

Just think about it.

Would you feel more comfortable buying a product recommended by a close friend or by a marketing message shoved down your throat by some slick marketing guru?

I would bet the former.

The full impact

There’s another important detail I’d like to point out.

It has to do with the long-term impact of acquiring new customers through WOMM.

According to the Wharton School of Business,

a customer you acquire from WOM has a 16 – 25 percent higher lifetime value than those you acquire from other sources.

This means you’re far more likely to get repeat business from an individual who’s acquired through WOMM than otherwise.

They also have a higher likelihood of becoming brand advocates or even brand ambassadors.

Consumers trusting other consumers

And there’s one more thing.

You don’t necessarily need to have a person recommend your brand to someone they know directly to benefit from WOMM.

In fact, the overwhelming majority of consumers trust recommendations from other consumers.

According to Nielsen,

68 percent trust online opinions from other consumers, which is up 7 percent from 2007 and places online opinions as the third most trusted source of product information.

Bright Local also reports,

88 percent of people trust online reviews written by other consumers as much as they trust recommendations from personal contacts.

The way I look at it, old school WOMM has meshed with the digital age.

Many people now turn to other online consumers, whom they don’t actually know, to find out whether a brand is worth purchasing from.

If you can impress a handful of consumers and turn them into brand advocates, it can have a domino effect: they spread the word, which can lead to a surge in sales.

It can set off a chain reaction.

Have we forgotten about WOMM?

There’s a paragraph in a Forbes article I really like:

The problem is that for the last few years, marketers have been focused on ‘collecting’ instead of ‘connecting.’ In other words, brands are too caught up in collecting social media fans and they are forgetting to actually connect with them.

I think this really hits the nail on the head.

Many marketers (myself included) are guilty of it to some extent.

I feel we’ve gotten so caught up in the latest and greatest marketing techniques that we sometimes forget about what good business is founded on in the first place: relationships.

Before there was social media, SEO, PPC, or even radio/TV commercials, most businesses gained new customers from old school person-to-person recommendations.

But it’s never too late to cash in on WOMM.

However, it does require a slightly different approach from the one used in the past.

The great thing is there are some really potent resources and platforms out there to streamline WOMM and maximize its impact.

I’d now like to discuss some fundamental tactics you can use to make your digital business explode using WOMM in the modern age.

Focus on your core audience, not the masses

The first step to making this strategy work is to understand who your core audience is.

Founding editor of Wired Magazine, Kevin Kelly formulated what I think was a brilliant hypothesis in 2008—the 1,000 true fans theory.

His idea was that any artist, business, etc. could survive on having only 1,000 true fans and that “returns diminish as your fan base gets larger and larger.”

In other words, you’re more likely to have success if you focus on gaining 1,000 true fans rather than tens of thousands, or even millions, of lukewarm fans.

Tim Ferriss has actually embraced this idea, and it has been a key part of his meteoric rise to fame.

Ferriss even talks about the concept of 1,000 true fans in-depth in his new book, Tools of Titans.

And I think this is a good approach to take in WOMM.

You’re far more likely to create brand advocates if you focus on truly connecting with your core audience rather than trying to appease the masses.

This basically goes back to Pareto’s 80/20 principle, which applies to many different areas of life and business.

The premise is that 80 percent of your customers account for 20 percent of your sales and 20 percent of your customers account for 80 percent of your sales.

What you need to do is put most of your attention on “wooing” the 20 percent and deepening your relationships with them.

If you stick with this game plan, your core audience should grow even stronger, and you’ll be creating the perfect environment for WOMM to take place.

Be authentic and transparent

I know saying something like this may sound a little generic and cliché, but it’s still very important.

I feel many brands are out of touch with their audiences, and they end up suffering for it in the long run.

I believe authenticity and transparency are two of the most vital traits a brand can possess.

Most people can spot any ounce of pretentiousness from a mile away.

And with so many sleazeballs out there today, most consumers have developed a sense of skepticism that isn’t easy to stamp out.

I also realize that simply telling you to be authentic and transparent is a little vague.

You might be asking: how exactly does one accomplish this?

Of course, this is a huge topic to tackle, but I really like these suggestions from Copyblogger on how to get your customers to like you and build trust:

When it comes to transparency, it all boils down to being yourself and making it a point to engage with consumers.

You want to “humanize” your brand.

Check out this post from Vision Critical for more on this topic.

It highlights five specific brands that embraced transparency and found success as a result.

Leverage reviews

As I mentioned earlier, most consumers are receptive to online reviews and trust the opinions of other consumers even if they don’t know them directly.

If you can get your satisfied customers to leave positive reviews, you’re almost guaranteed to see a spike in sales.

So, I suggest doing everything within your power to encourage your satisfied customers to leave reviews.

This starts by “claiming” your business on some of the top review sites such as Google My Business, Angie’s List, and Yelp.

I won’t go into all the details of this process, but I recommend you check out an article I wrote on NeilPatel.com on how to get more online reviews.

This will provide you with an in-depth look at and tips on how to make this strategy a success.

I also suggest looking at this post from HubSpot that talks about 19 online review sites that can help your business get more reviews and gain traction.

Add fuel to the fire with a referral program

If you really want to expedite your WOMM, consider implementing some sort of a referral program.

When done correctly, it can lead to an influx of new customers while giving your brand equity a nice boost.

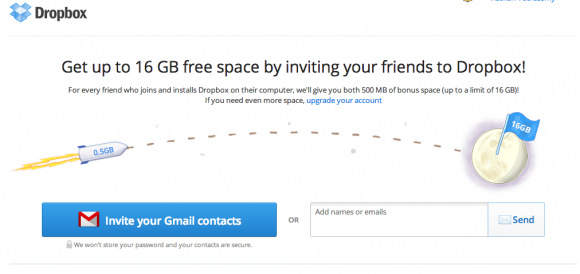

Here is a great example of a referral program that got it right.

Several years ago, Dropbox started a referral program that offered customers up to 16GB of free storage for “inviting a friend” to join.

What was the end result?

- The refer-a-friend feature increased signups by 60 percent

- Users sent 2.8 million direct referral invites

- Dropbox went from 100k to 4 million users in just 15 months

- This resulted in a 40x increase, or a doubling of users every 3 months

This just goes to show the power a referral program can have.

The key is to come up with some way to reward existing customers for referring your brand to a friend.

This could be a discount, freebie, cash back, or whatever.

As long as the reward has genuine value and isn’t going to kill your profit margins, it should work.

The specific reward program you’ll want to implement will depend largely on your industry or niche.

That’s why I suggest reading this post from Referral Candy.

It goes over 47 different referral programs that totally crushed it and should give you some ideas on coming up with an approach for your business.

I also recommend checking out this guide from Referral Rock, which tells you pretty much everything you need to know on the subject.

Conclusion

With all the cutting-edge, sleek, and sexy marketing techniques out there, WOMM sometimes gets overlooked these days.

And that’s unfortunate.

If you look at studies involving research on WOMM, it’s easy to see that it’s still alive and well.

In many ways, WOMM is more powerful than ever when you consider the ease with which consumers can share reviews with one another.

I know I usually find myself reading at least a couple of reviews before I purchase something on Amazon or especially before I book a spot on Airbnb.

The way I look at it, it’s never been easier to harness the power of WOMM than it is today.

It’s simply a matter of bringing this old school concept into the modern marketing era.

By using a handful of fundamental concepts like the ones I discussed, you can absolutely make your digital business explode using WOMM.

The best part is that many of the new customers you receive will be repeats and will even recommend your brand to their friends.

And this is the very definition of creating a sustainable business model.

How big of a role do you think WOMM plays in business today?

Source Quick Sprout http://ift.tt/2oGZaZH