You hear the term viral all the time.

I’m regularly reading Internet content that has “gone viral” or watching the latest viral video post. I research virality, and I read articles about content virality.

Virality is a big deal. If you think about it, viral content is what shapes our culture.

The idea of viral content has become rooted in Internet culture. It’s obviously something that most bloggers and marketers strive to achieve with their content.

Viral content can come in many forms and mean different things to different people.

For example, by some standards, I’ve written several “viral” articles—articles that were viewed by millions and shared by thousands. But when I compare my little blog article to other viral pieces of content, I see that its reach is tiny.

The underlying quality of a viral piece of content is that it circulates rapidly across the Internet and reaches a widespread audience in a short period of time.

It can go from obscurity to mass exposure overnight.

Whether it’s a meme, video, blog post, or commercial, viral content has a way of capturing the attention of people from all walks of life.

There’s something exceptional about it even if you can’t necessarily put your finger on it.

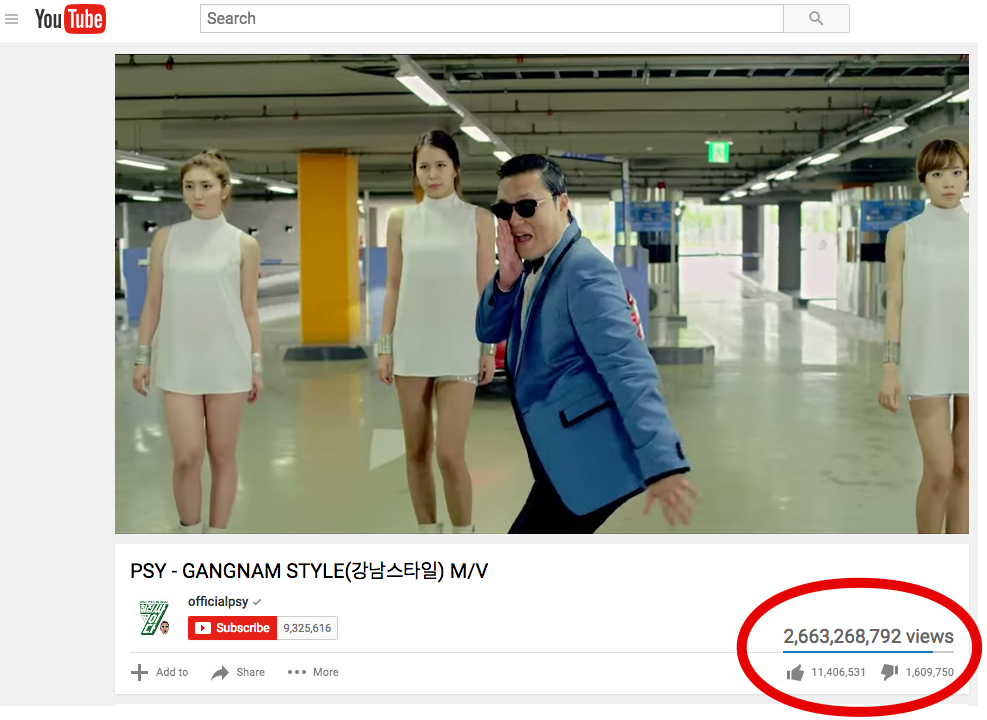

Although there’s no magical recipe that instantly makes a blog article epic and uber-sharable, there is certainly a formula you can follow to achieve virality. After all, virality is a scientific phenomenon, even if achieving insane levels, like 2.5 billion views, isn’t predictable.

You can engineer virality to a certain degree. You start by understanding a few factors and elements that unite viral content.

Here’s a sequence you can follow to engineer the perfect viral blog article.

Content type

First things first. Which types of content receive the most shares?

I think you’ll agree that it’s easier to watch a four-minute music video, for example, than to read a 2,000-word article.

I’m interested in written content for the purposes of our discussion, so I’ll stick to long-form articles.

OkDork and Buzzsumo analyzed over 100 million articles to uncover underlying patterns that contribute to virality.

Here’s what they found in terms of what content was shared the most:

When it comes to blog content, you’ll notice that list articles performed the best overall by a fairly large margin.

This is followed by “why posts,” “what posts,” and “how-to articles.”

So, in theory, you’d have the best odds of your article going viral if you created a list—more specifically, a 10-item list because it increases your odds even more.

According to OkDork, “10 item lists on average received the most social shares—on average 10,621 social shares. In fact, they had four times as many social shares on average than the 2nd most popular list number: 23.” The next best performing articles were lists of 16 and 24 items.

The exact number isn’t as important as the fact that it’s a list. BuzzFeed, the king of listicles, regularly produces viral listicles. When I checked on Buzzsumo the most popular articles in the past year, two of the top five were listicles.

The number seems a bit arbitrary. But the fact that it’s a list? That’s the appeal.

Keep this in mind when deciding on the number of items to include on a list.

Content length

The word count of an article is another huge factor in determining the potential for virality.

There’s a common misconception about long content.

It goes like this:

- If the content is long…

- …then nobody will read it.

Guess what? That’s totally false.

Obviously read is a slippery term, so I won’t get into the mechanics of what reading means to people.

Here’s what I do know: longer content gets more shares, backlinks, views, and all the good things that great content deserves.

Here’s what the study mentioned above revealed:

By analyzing this graph, it’s clear that the higher the word count, the better the likelihood of a blog article going viral: 3,000-10,000 words generated the highest overall number of shares.

And this totally makes sense if you think about it.

I’ve definitely noticed a pattern where long, well-researched, in-depth content kills it, while your average, run-of-the-mill 500-word articles achieve only marginal results.

Although people may not read a long article in its entirety, they’re still likely to scan it. To me, that’s important. I try to create articles so people can get value from them even if they don’t read every word.

Aiming for at least 2,000 words per post is ideal if you want your content to get shared across a wide audience.

Evoking the right emotions

Next, there’s the issue of getting readers to feel certain emotions.

The same study from OkDork and Buzzsumo revealed which content received the most number of shares based on the emotions it evoked:

According to these findings, the top four emotions to target are:

- Awe

- Laughter

- Amusement

- Joy

What’s the underlying pattern of these emotions?

They’re primarily positive emotions.

Although awe could be positive or negative, laughter, amusement, and joy are all emotions that make people smile and bring about good feelings.

You’ll also notice that negative emotions, like anger and sadness, don’t perform as well. What’s the takeaway? Positive content has a far better chance of going viral than negative content.

Capitalizing on trends

Striking while the iron is hot is also important.

If you can create blog content based on something that’s wildly popular at the moment, the potential for virality increases exponentially.

Although this approach is likely to have a fairly short shelf life and probably won’t be evergreen, you can still generate some massive exposure for a little while.

And if your content is epic, there’s a good chance that many readers will return to your site to see what else you’ve been up to.

Buzzsumo offers a great example.

They mention an article on Fox News Travel from 2015 that talks about a zombie-themed “Walking Dead” cruise.

This article managed to generate a whopping 1.5 million shares and over 400,000 comments. Not bad for a piece about undead brain eaters.

The lesson here is that writing content based on current trends can definitely work in your favor.

Visuals

People love visuals. They make even the most mundane content come to life and bring the points of a blog article into a cohesive whole.

So as you might imagine, images play a considerable role in virality.

To put it simply, including images in your content increases your odds of getting shares.

Skipping images reduces those odds.

Here’s a graph that shows the impact images can have:

As you can see, articles with at least one image greatly outperform articles without any images.

In fact, having just one image will theoretically double your number of shares.

However, I wouldn’t stop at just one. The more visual appeal, the better.

That’s why I always make sure I include at least a handful of images in every blog article I write.

Author byline

There’s also the issue of a byline, which briefly tells the reader who the author of an article is.

In this case, that’s you.

OkDork and Buzzsumo found that this is also a factor in virality:

Overall, content with a byline/bio receives more shares than content without one.

While there’s virtually no difference in terms of shares on Facebook, it definitely makes a difference on Twitter, LinkedIn, and Google+.

But why?

It’s simple. Having a byline lets readers know who the author is, which adds to the article’s credibility.

More trustworthiness = more shares.

Do yourself a favor and make sure to include your byline with each article, ideally with a professional-looking headshot.

Posting at the right time

One factor that’s commonly overlooked is the day of the week a blog article is posted.

Research has found that the odds of content going viral are increased considerably when the article is posted during the weekdays. More specifically, Mondays, Tuesdays, and Thursdays are your best bets.

There’s a very clear drop off on the weekends, which makes sense, considering many people are out and about and less likely to be glued to the Internet.

For the best possible chances of your article going viral, it would be smart to post on a Tuesday.

The power of influencers

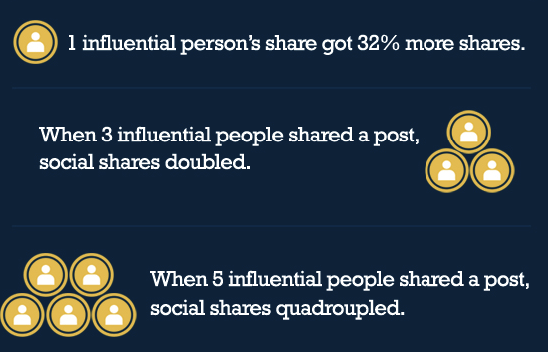

One last thing. If you can get influencers to share your content with their audiences, the potential for virality goes through the roof.

Here’s what I mean:

Even if you can get just one influencer to share your content, the results can be significant.

But if you can somehow get five influencers to do this, it can have a monumental, earth-shattering impact.

Of course, this is easier said than done.

But one strategy for getting an influencer on board is to first see which types of content they’ve shared in the past.

You can then base your article around a similar topic and reach out to the influencer once it’s completed.

Putting it all together

Here’s the deal.

You can never tell for sure whether or not any given piece of content will go viral.

There is a nearly infinite number of factors involved, and you can never fully predict how people will react.

However, you can follow a formula to give yourself the best possible chance.

Let’s recap.

- Create a “list article,” ideally with 10 items. Otherwise, lists with 23, 16, and 24 items work best.

- Make sure it’s a fairly long article with at least 2,000 words. However, the more words, the better. Pieces with 3,000-10,000 words receive the most shares on average.

- Try to stick with positive themes that evoke awe, laughter, amusement, and joy. Don’t kill the vibe of your audience with overly negative themes.

- Base your article around a popular trend that’s sweeping the world at the moment.

- Include visuals. One image is a must, but don’t be afraid to go a little crazy with your images. Your audience should respond favorably.

- Insert your byline/bio at the end of the article to boost your credibility.

- Post during the weekdays. Tuesday is ideal.

- Reach out to relevant influencers, and try to get them to share your article with their followers. If you can manage to get five influencers to share, your exposure will quadruple.

Conclusion

Just think of all the benefits a viral blog article can have.

You can create instant exposure for your brand, grow your social media following, generate a massive volume of leads, and increase your brand equity.

Along with this, it’s reasonable to expect that your sales numbers will increase significantly as well.

By understanding the key elements contributing to content going viral, you can devise a more effective strategy.

And once you “crack the virality code,” you can simply rinse and repeat.

What do you think the most important element of a blog article is in order for it to go viral?

Source Quick Sprout http://ift.tt/2eDj0Do