الثلاثاء، 4 ديسمبر 2018

End Of Year Financial Planning: A Nine-Point Checklist to Get Your Finances in Order

Source CBNNews.com https://ift.tt/2RuKhsi

7 Ways To Get Free Checked Luggage When You Fly: How to still Check Bags for Free

Source CBNNews.com https://ift.tt/2EcTORT

24 Unique and Fun Ways to Make Money From Home

When I started looking for work-at-home opportunities back in 2007, I just wanted to make an extra $500 – $700 a month, so that my daughter and I could freely attend and participate in all of the activities that were available to us. Luckily, I stumbled upon blogging and social media marketing, and I haven't looked […]

The post 24 Unique and Fun Ways to Make Money From Home appeared first on The Work at Home Woman.

Source The Work at Home Woman https://ift.tt/2PlsTV4

The Best Domain Registrar

The best domain registrars make it quick to search and buy a great domain name, then easy to configure it and manage it over time. They will also have excellent customer service (both live support and a robust knowledge center) and a spotless reputation — you don’t want your domain registrar to be going out of business.

There are thousands of accredited domain registrars. The best one is Namecheap. We prefer it over other top registrars NameSilo, Google Domains, Gandi, and Hover. Namecheap has great prices and is really easy to use. It’s the registrar we go to, and the one we recommend to our family and friends who are building their websites.

Our Top 5 Picks

- Namecheap – Quicksprout Favorite

- NameSilo

- Google Domains

- Hover

- Gandi

We wholeheartedly do not recommend 1&1 or GoDaddy. And although you may be tempted to bundle domain registry with your web host, we suggest keeping them separate. These are two different competencies, and it’s best to use expert providers for each.

How the Best Domain Registrars Compare

Our Favorite: Namecheap

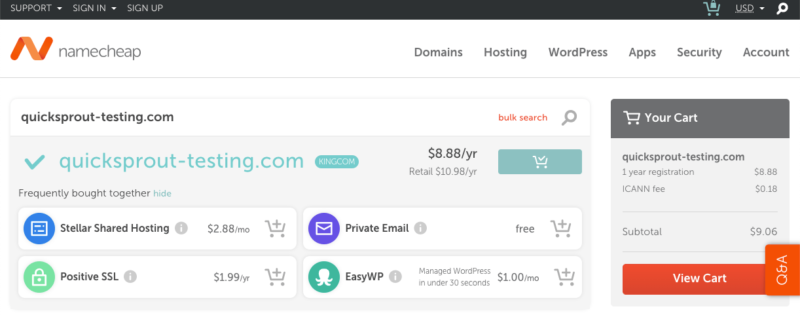

Namecheap’s checkout process is simple, with very limited upsells. Once you’ve purchased your domain, the dashboard is clearly laid out. We’ve found Namecheap’s knowledge base to be thorough, helpful, and even charmingly human — often there’s a simple “That’s it!” at the end of an article that actually makes us smile. Great documentation is key: buying and setting up a domain isn’t part of most people’s expertise. If you need more support, Namecheap have 24/7 live chat help and a 2-hour ticket response time.

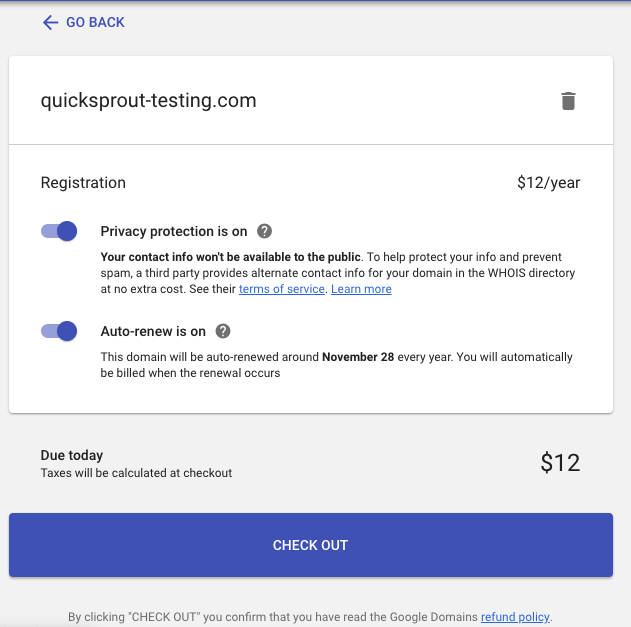

The Namecheap purchase flow is simple and straightforward.

Namecheap’s $0.18 Fee

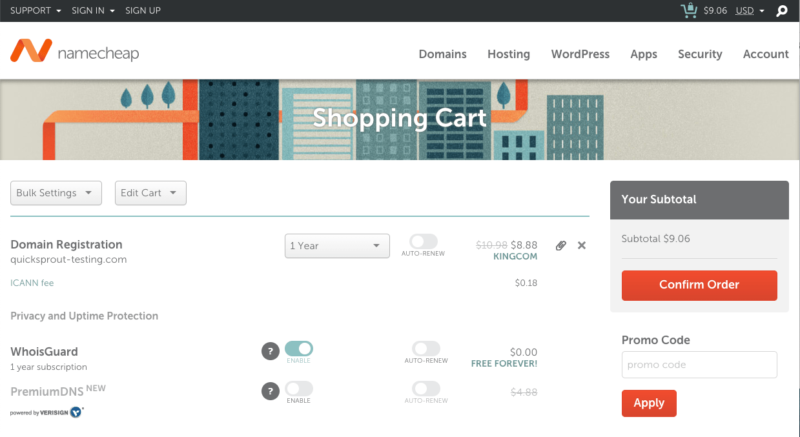

That $0.18 ICANN fee is a mandatory charge from the Internet Corporation for Assigned Names and Numbers, for each domain registration, renewal, or transfer. It’s negligible, although noticeable, especially considering other registrars, including NameSilo, absorb the fee.

Free Domain Privacy

Namecheap provides a WhoisGuard subscription for free forever. You definitely want WhoisGuard. It’s a privacy protection that prevents your personal contact information from being displayed in the publicly accessible Whois database. (If you don’t have protection, you get spam. So much spam. We skilled WhoisGuard once years ago and are still getting spam phone calls…) As long as your domain is with Namecheap, you’ll never pay for WhoisGuard. GoDaddy, on the other hand, charges $10/year and most web hosts that offer domain registration charge $12/year. Note: Privacy is also free with Hover, Google Domains, NameSilo, and Gandi.

With Namecheap, WhoisGuard protection is free forever.

Skip the Upsells

-

- Stellar Shared Hosting ($2.88/month) – Skip it

You shouldn’t get your hosting from your domain registrar. They’re two very different competencies and we don’t know of any one company that nails them both. (If you’re after hosting, we’ve written a review of the best web hosts. TLDR: Our top pick for beginners is InMotion Hosting; for everyone else it’s SiteGround.)

- Stellar Shared Hosting ($2.88/month) – Skip it

-

- Private Email (two months free, then $9.88–$49.99/year) – Skip it

If you want a business email, it’s always free to forward emails from Namecheap. If you’d like cloud storage for that email, or to send emails from your domain name, we recommend not buying it from your registrar. Our universal recommendation is G Suite ($5/user/month), which includes Gmail, Drive, Docs, Sheets, Calendar, and Hangouts.

- Private Email (two months free, then $9.88–$49.99/year) – Skip it

-

- Professional Gmail ($5/user/month) – Probably skip it

This is the going price for G Suite, so you can buy it here now, or add it later, but we think it’s simpler to keep you billing for G Suite directly with Google. That way, if you ever leave Namecheap, you won’t have to get them to transfer you G Suite account back to Google.

- Professional Gmail ($5/user/month) – Probably skip it

-

- PositiveSSL ($1.99/year) – Skip it

You’ll need an SSL certificate if you plan to accept payments or collect other sensitive information on your website, but not this one. The PositiveSSL Namecheap is upselling here is just a Domain Verification. We recommend getting your SSL from your web host.

- PositiveSSL ($1.99/year) – Skip it

- EasyWP ($1/month) – Skip it

You’re here to buy your domain name and only your domain name. If you want managed WordPress hosting, we recommend using a top web host, focused on hosting and only hosting. SiteGround and Dreamhost both have some good managed WordPress built into their shared hosting plans.

Other Top Domain Registrars to Consider

NameSilo

At first glance NameSilo is laughable, especially compared to its competition. Its aesthetic seems to be late 90s Power Point — although a new site is thankfully in beta testing. (We suspect this is in large part due to NameSilo being acquired in early 2018 by software company Brision Innovations.)

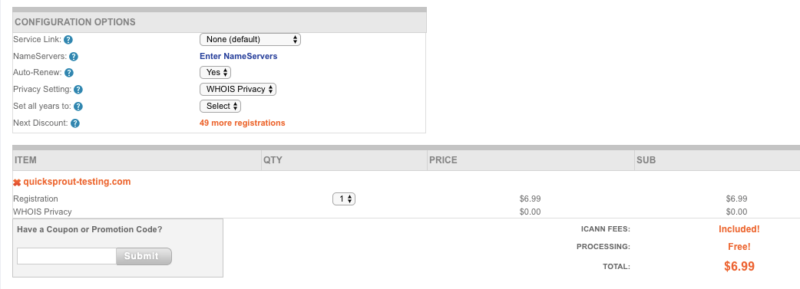

What we appreciate about NameSilo: it’s a domain registrar and that’s it. It’s really cheap (even cheaper than Namecheap), throws in domain privacy for free (though you’ll need to opt-in by selecting it in your cart), and offers a full-blown discount program for bulk domain purchases. There are virtually no upsells and you can start configuring your domain in checkout — linking it to a third-party service (like a website builder) and entering custom NameServers. Customer support is also comparable, with a rich knowledge base and 24/7 live chat. If you don’t mind some (hopefully temporarily) outdated interfaces, NameSilo is a great option.

Outdated aesthetics are a real trust-breaker with NameSilo. But a new site is on its way!

You can start configuring your domain name during NameSilo’s checkout flow. Don’t forget to opt-in to WHOIS privacy.

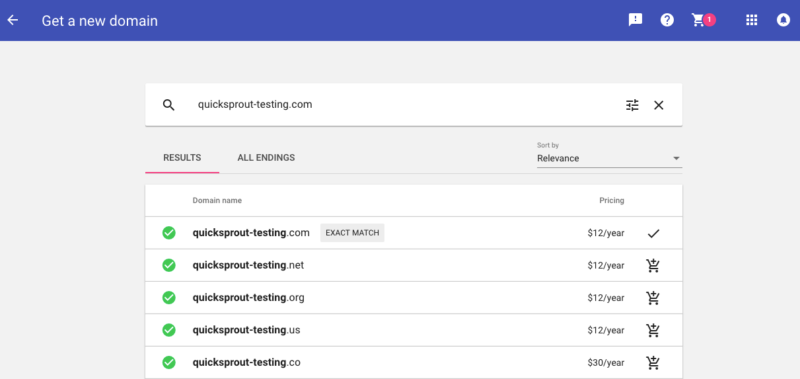

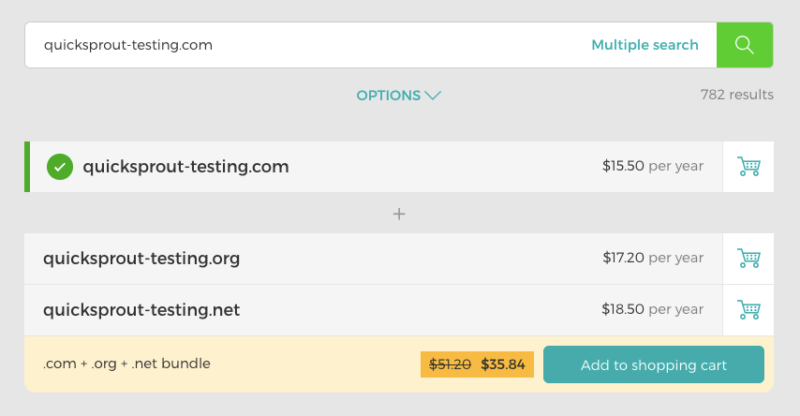

Google Domains

We like the familiar and simple Google-style interface: there are literally no upsells at all, and absolutely zero flourish. But: most web developers prefer not to share more information with Google than is absolutely necessary. There’s also very little documentation. If you need help, you won’t be able to dig into a rich knowledge base. There is chat, email, and phone support in English, 24 hours a day, and in French, Spanish, and Japanese with more limited hours.

You’ll recognize the familiar Google styling: clean and straightforward.

Google Domains makes no fanfare of its free privacy protection. Just make sure you turn it on.

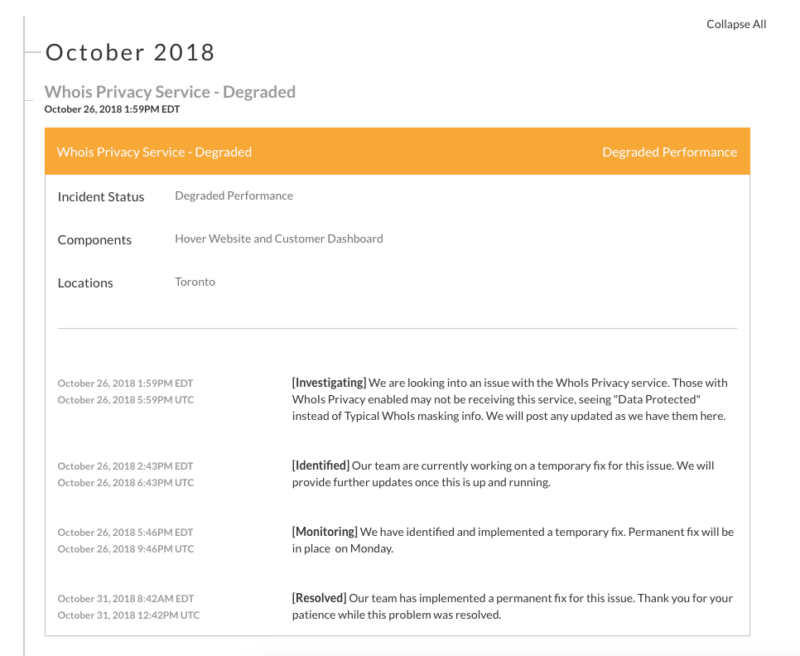

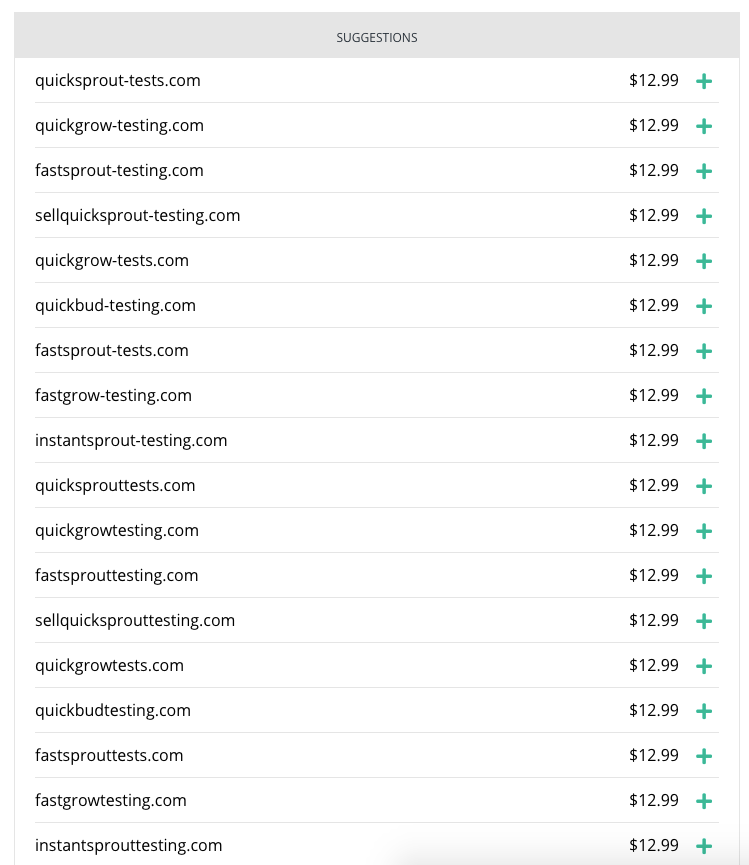

Hover

We appreciate Hover’s recommendation engine in principle, but we think that choosing a brandable domain name is important enough that you shouldn’t be playing around with automated suggestions at the last minute. If you’re still tinkering with your URL, you’re probably not ready to buy. (Need help deciding? Read our guide on We do like that there are limited upsells in Hover’s purchase flow, and privacy protection is included (like with Namecheap). Email forward isn’t free though; it’s $5/month. Our biggest worry with Hover ultimately is its backend. Browse through Hover’s outage history and you’ll find hours-long outages are frequent.

Hover’s Whois Privacy Service was degraded for days and the outage report is not robust.

Hover spit our domain name request through a thesaurus.

Gandi

For over $15/year for the same domain we can get for $10–12/year, we want to see more from Gandi. It has a beautiful interface, and is well-regarded amongst developers, but there’s not much it offers that Namecheap or even Google Domains doesn’t: free domain privacy, free SSL for one year, email hosting. One standout is its domain bundles. You can score a deal if you want to buy multiple TLDs at once.

If you want to bundle popular TLDs, Gandi will give you a good deal.

Domain Registrars We Don’t Recommend

Avoid any registrar with a bad reputations and histories of poor customer support and billing practices. That includes Spamhaus’ entire list of worst domain registrars, as well as GoDaddy and 1&1, based off of tips from users on Reddit. (GoDaddy is even suspected of throttling outbound transfers. Not great.)

What to Know When Buying a Domain Name

Keep your domain separate from your web hosting provider.

A domain registrar should be just that: a domain registrar. While many web hosts and website builders offer domain registration as part of their services, typically as a step during the signup process, we generally recommend keeping those services separate. (And we’re not the only ones.)

Hosting your domain with a registrar and your website on a web host gives you a lot more flexibility and control should you ever decide to switch web hosting providers. It also makes managing multiple domains a lot less of a headache, and provides an additional layer of security should one service be compromised — if someone hacks your web host, they won’t be able to touch your domain, and vice versa.

It’s not a terrible thing to bundle your domain and hosting, especially if you’re only working on one website. It’s convenient, and web hosts and websites builders often promote a free domain as part of their hosting package, which can be tempting. Just know those offers usually only last for the first year, and web hosts will almost always have a higher domain renewal fee than a good domain registrar. And, if you ever want to move to a different web host, there’s a chance it’s going to be a major hassle. Make sure you read the fine print of your web host’s domain policy to make sure they’ll allow you to transfer it, should the need arise.

You definitely want domain privacy.

Always opt-in to domain privacy. Most domain registrars include it for free; those who don’t usually charge about $12/year. Buy it. It’s what keeps your personal information (including your name, phone number, email address, and mailing address) from being listed in the Whois public database — and therefore out of the hands of spammers. This may not be the case forever. Since the EU’s General Data Protection Regulation (GDPR) went into effect in May 2018, some registrars are not publishing their customer’s information to avoid liability, and many people suspect the entire Whois protocol will be overhauled in the near future. But, for now, it’s still our recommendation.

Beware of price jumps.

Domain registrars like to play around with promotional pricing — maybe you get the first year for a lower price, then it renews for its “regular” or “renewal” price. Anyone who has bought cable is familiar with this pricing structure. Buying a domain up front for long period of time (ICANN caps it at 10 years) will lock you into that renewal price, which comes in handy if you know you want that domain and can afford it. Domain registries can alter prices at their whim, like when Uniregistry jacked up the price on a handful of TLDs in early 2017. In one day, .hosting domains went from $20 to $300 and .blackfriday increased from about $10 to $100.

What is ICANN?

ICANN is the Internet Corporation for Assigned Names and Numbers. It’s a non-profit that’s responsible for coordinating the unique, specific names and numbers that identify your online presence — also known as domains and IP addresses. ICANN doesn’t own or operate domains and IP addresses; rather, it coordinates with domain registries and domain registrars, and acts as a central repository for IP addresses, to implement universal operating procedures that keep the internet running. It’s not unlike how cities manage naming streets and assigning home addresses: the city doesn’t own your house, but someone has to keep track of what it’s called. ICANN also requires domain registrars to provide accurate contact information for the owner of each domain, and to make that information publicly available through Whois.

Remember to turn on automatic renewal.

In a lot of businesses, auto-renewal is sneaky — a way to charge you for something you never use and forgot you bought in the first place. But when it comes to domain names, we absolutely recommend it. Forgetting to re-up means your site will go down, which happened to automated marketing powerhouse Marketo in 2017. Even worse, if you have a covetable domain name, it might get scooped up. That’s what happened to Google.com back in 2016.

Domain registrars don’t all have access to every domain name.

For the most part, if a name is available, you will probably be able to purchase it through any of the best domain registrars. But some accredited registrars only offer limited top-level domains (TLD). (A TLD is the stuff that comes after the dot.) This is especially common in smaller registrars, or providers that over domain registration as a secondary service, like a web host. (For example, InMotion Hosting, one of our favorite web hosts, can only register .com, .net, .org, .biz, .us, and .info domains.)

That’s because registrar is different than a registry. Registries are who actually hold the TLD and their associated names — for example, VeriSign controls all .com and .net domains while PIR controls all .org and .ngo domains. Registrars manage the reservations of the names provided by the registries, and have to act in accordance with each one they are involved with. Not all registrars work with all registries, which is why some only have access to specific TLDs.

How come some registrars charge more than others for the same domain?

Registrars are middlemen between you, the customer, and domain registries, who hold all the domains. It’s similar to how department stores are the middlemen between shoppers and clothing manufacturers. The registries set their prices — the equivalent of wholesale prices — and registrars add their fees on top. That’s how they make money. A registrar selling a domain for more money than its competitor is just making more money off the sale of the same product. (Some registrars are making headlines for registering domains “at cost,” including Cloudflare, the content delivery network provider. )

Recap: The Best Domain Registrar

You should buy your domain name from a registrar (not a web host) and you should not buy anything else from your domain registrar. You’re here for one thing and one thing only.

There are a number of registrar-only options including Google Domains, Gandi, Hover, and NameSilo — but we recommend Namecheap.

Namecheap has good prices and is the easiest to use. It’s what we use. There are a few upsells, but you can skip them, since the only one you really need is included for free: privacy protection.

Source Quick Sprout https://ift.tt/2SrneP9

Frugal Gift Ideas for This Holiday Season

It’s early December, and that means my mailbox is full of requests from readers for frugal gift ideas for the holidays, both in terms of inexpensive gifts that will be appreciated and gifts to give a frugal person.

I usually address this question in some form or another each holiday season, but I update the ideas each year because I discover new things and older ideas tend to fall out of date, though many are timeless. Here’s my list from last year and the year before that and the year before that and the popular article from several years ago that seemingly started this trend of people asking me for frugal gift ideas.

Each time, rather than going back and reviewing every item on previous lists, I start from scratch, making a list of several things that frugal people might want to give and several things that frugal people might want to receive. The goal is not to encourage a bunch of useless buying, but rather focus on good practical gifts and inexpensive gifts that will truly be appreciated. So, you might see some repeats from previous years, along with some new things.

Let’s dig in!

If You’re Giving to a Frugal Person, Think Practical

For this part of the list, I usually think of myself because, as a pretty frugal person, I tend to think of the types of things I want to receive as being very in line with other frugal people. I know that the things I tend to appreciate as gifts are things that are appreciated by friends of mine that are also incredibly frugal.

In short, frugal people tend to appreciate practical things, things that they’ll actually use regularly or consume in short order. Usually, frugal people would rather have something well-made and carefully chosen rather than a “gift set” or something bought on impulse – they’d rather you spend less and be thoughtful than spend more and just click “add to cart.”

With that in mind, here are eight items that a frugal person might enjoy as a gift.

Something that respects their wishes. If a frugal person says that they don’t want a particular type of gift, respect that. You’d be giving them something that they have no use for whatsoever. You might think that the person is just telling you something so that you won’t “splurge” on “what they really want,” but trust me, if a frugal person is telling you they don’t want something, they don’t want it, and you’re far better off just respecting their wishes.

Something you made yourself, especially if it matches the other items on this list. If you have a particular skill for making something, especially if it’s consumable or if it strongly matches another idea on this list, that handmade gift will almost always be appreciated. For example, my sister-in-law made some gorgeous handmade Christmas ornaments one year that probably cost her a dollar worth of supplies to make, but they were made with such care and were so beautiful that I was thrilled to get them and they’ve been used for decorating for many years.

A high quality food item of a type they like. If the person you’re gifting has a penchant for a particular food item, finding a high quality or unusual version of that food item makes for a really great gift. It’s consumable, so it won’t really take up space in their home, and it’s something that’s chosen particularly for them. This does not mean a “gift box” or something like that. You’re far better off finding a single high quality item than a gift assortment. This is an example of where a little bit of homework can go a long way. Put in the time to Google something like “best hot sauce 2018” and order a bottle of that rather than snagging some random “gift box” at a store. It’ll be far more appreciated and probably be less expensive.

High quality footwear, including socks This sounds almost goofy, but trust me – a pair or two of true high quality socks will make almost any frugal person smile. Socks that are comfortable and long lasting and work in a variety of weather are almost always welcome. I usually point to the socks made by Darn Tough as an example. Shoes can be another good option, but you need to know the person pretty well in terms of their footwear and what they like – if you’re going to buy high quality shoes, make sure it’s going to be something they’ll like and wear.

Good food storage containers, particularly if you notice they have beat-up plastic ones Frugal people tend to make lots of meals at home and often in large quantities, so leftover containers are always valued, particularly when they’re both freezer and microwave safe and they’re rugged enough to last for a while. A good example of this are these Snapware containers – they’re made of a really sturdy Pyrex-like glass and work in the freezer, the fridge, and the microwave without a problem, and they won’t eventually crack like cheaper ones do.

An item related to a hobby that you know they have. If the hobby doesn’t have obvious consumable things, then look for a specialty retailer related to their hobby and give that person a gift certificate to that retailer. Just make sure they can either buy online with that certificate or have local access to the store. It’s usually a bad idea to buy “permanent” gift items for a hobby unless you know the hobby well, so a targeted gift card so that they feel fine expanding their hobby a bit in the way that they choose is perfect. For example, I’m a tabletop gaming enthusiast, so a gift card to a place like Game Surplus is a great idea.

Flannel bedsheets, particularly if they live in a colder climate This is pretty much the definition of “practical gift,” but it’s one that most frugal people, particularly those who live in a climate with a colder winter, will really appreciate. I highly recommend these sheets, as they’re very cozy and come in a variety of basic colors that will work well with most room decors.

An “experience” gift Think of something like concert tickets or amusement park passes or museum passes or a certificate for a massage. These are things that frugal people will enjoy but often won’t spend the money on.

If You’re a Frugal Person Giving to Others, Think Value and Meaning

As a frugal gift giver, there are two things I consider when giving to others: value and meaning.

When thinking of value, I try to seek out items that the person will actually use and get value from for the minimum price. This generally moves me in the direction of consumable gifts or gifts that take up minimal space that actually fit the recipient’s tastes while also having a relatively low price tag. This takes some time, but that time is usually well rewarded.

When thinking of meaning, I try to think of something that will actually mean more to the recipient than the “typical” gift. Often, that means something I invested time in or something with a personal touch. I find that listening is often the best source of gift ideas. If you pay attention to what a person is saying, you can usually figure out what they really want, and you can use that as the backbone of a meaningful gift.

Here are seven items I often consider for gift giving occasions.

A handmade item you made yourself (particularly if you’re good at it) In years past, Sarah and I have made things like handmade soaps, handmade stationery, a crocheted hat and scarf, and many other things to give away as gifts. I think our most popular gift that we’ve made to give away was vanilla extract, made when we found a great bargain on vanilla beans and had some small bottles to use. The point? Make something. Make a craft (if you have any crafting abilities). There are infinite things that you can make, and many of them also involve learning a skill along the way.

Sarah and I really like making food items for people. Sarah is a master of desserts, as she can whip up amazing cookies and bars out of seemingly nothing at all. I love making savory items of all kinds. Unsurprisingly, these things often turn into great gifts.

An organized photo archive A frugal friend of mine once gave several relatives cards for Christmas. Taped on the inside of each one was an SD card. On that SD card was a curated and organized collection of their digital photo archives, organized by date and then, in another folder, organized by person with shortcuts. It took quite a bit of time to organize all of those images, choose the ones worth saving, and organize them in folders by date and by who was in the picture. It included a lot of older pictures from the pre-digital era, too. The cost was minimal but the meaning was very high.

A family recipe book Collect some of the recipes that have been used frequently at family events and family dinners over the years and put them in a notebook. Take some old photo prints that you have laying around and paste them to the pages and add some handwritten memories. This can take some time, but it’s an amazing gift for siblings or other family members with whom you have a lot of overlapping family history.

A “book club box” This is an amazing idea that a friend of mine gave to her sister last year as a gift. They used to read books together when they were kids, so she simply checked out used book stores and yard sales, accumulated two copies each of twelve different used books that she thought they’d both like, and gave one set of twelve to her sister, along with a schedule of eating lunch together at her home to talk about the books and catch up. The books were maybe $0.25 or $0.50 each and were easily re-donated afterwards, but the magic was in the thought, the curation, and the planning.

A notepad or notebook with an addition One of my good friends once received the wonderful gift of a notepad with a handwritten sentence on the bottom of each page. Each one was a meaningful quote for that person or a reminder of a shared event or a really positive affirmation. The notepad came with strong encouragement to actually use it for notes and then read the affirmation on the bottom. The only cost was that of an inexpensive notepad, but it was really meaningful.

Their favorite hard-to-find treat If you know that a person has a particular treat that they love that’s just hard to find any more, investing some time to actually track down that item and give it as a gift can be really meaningful. I have personally witnessed someone being brought almost to tears by a six pack of soda that they loved when they were a kid that they didn’t realize was even still being made (it was “Big Red,” by the way). I once made it a point to pick up a six pack of Cheerwine for a friend when I was traveling in the southeastern United States – it was probably the most excited for a gift that I had ever seen and it only cost me four or five bucks.

Help with the holiday event Simply tell the person that your holiday gift this year will be to do the “grunt work” for the big holiday event. You’ll handle the unwanted jobs, bring a good side dish, move around furniture, and take a big part of the cleanup. This allows the host to actually be the host of the event while taking a lot of stress off their shoulders and it allows you to have a bit of extra time with the host both before and after the event. Just send an email now offering your services – you’ll make a key side dish or two and bring them with you beforehand and then take care of any and all last minute tasks both before and after the event.

Final Thoughts

Gift giving is actually pretty simple: being thoughtful about a gift makes up for any spending shortfall. If you don’t have the money to spend or don’t feel like you should spend on an expensive gift but you still want to convey to the other person that they mean a lot to you, be thoughtful. Consider that person carefully. What do they like? What do you share? Use those thoughts as a source to come up with something meaningful, either something you make yourself or something you can find inexpensively with a little hunting.

Remember, frugal is not cheap. Frugal means getting the best value for your dollar, and when it comes to gifts, giving (or receiving) something thoughtful or something you’ll actually use provides far more value (even if it costs far less) than something given with little thought.

Good luck!

The post Frugal Gift Ideas for This Holiday Season appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2UflfiP

Good Driver? Prove It, and This Insurance Company Will Give You a Lower Rate

You watch your speed. You don’t mess with your phone while you’re behind the wheel. Heck, you even use your turn signal when changing lanes.

As a good driver, you’re less likely to get into an accident, right? Because part of what you pay for with car insurance is the cost of claims, shouldn’t your policy cost less if you’re less likely to file a claim?

We think so — and we found a company that thinks so, too. It’s called Root Insurance.

Take a Drive With the App

Just how good a driver are you, and what kind of savings could you bank? It’s easy to find out.

Step one: Download the Root Insurance app.

Step two: Take a two- to three-week test drive. Everything happens in your smartphone. You don’t need to turn on the app or anything; it just runs in the background and tracks your acceleration, braking and other driving metrics.

After two to three weeks, your test drive is complete, and if you qualify, you’ll get an insurance quote from Root with a recommended policy. And you can customize the coverage to suit your needs. Bottom line: The better you drive, the more you could save.

Don’t Pay for Bad Drivers

We all know certain groups, including teenagers, pay more for insurance because, statistically, they’re considered high-risk drivers. But is that fair? What if you or your child falls into a high-risk category but you’re responsible drivers?

That’s why Root is cool. Everyone has the opportunity to prove their own driving skills and be rewarded with insurance rates that reflect their awesome ability behind the wheel. You don’t have to pay more just to help cover the cost of all of those wild drivers.

The better you drive, the lower your rate could be. Pretty simple, really.

Take Your Good Driving Habits to the Bank

Download the Root app to get started with its quick sign up. (The company says it takes just 47 seconds!) Even if you aren’t sure you want to switch insurance companies, don’t you want to know that you’re a good enough driver to qualify? You’ve got nothing to lose.

Root is available in 21 states* and is growing fast. If it’s in your state, you can save up to 52%. That’s some serious cash. Car insurance can be difficult to understand. Root makes it simple. The price you pay is based primarily on your test drive results.

Plus, when you see that jerk speeding and cutting in and out of traffic, you’ll have the satisfaction of knowing you’re paying less for your car insurance than he is. That’s better than honking your horn any day.

*Root Insurance is available in Arizona, Arkansas, Delaware, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Montana, New Mexico, Nebraska, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Texas and Utah.

Disclaimer: Savings based on national reviews reported by actual customers. Form 1. ROOT RESERVES THE RIGHT TO REFUSE TO QUOTE ANY INDIVIDUAL A PREMIUM RATE FOR THE INSURANCE ADVERTISED HEREIN.

Tyler Omoth is a senior writer at The Penny Hoarder who loves soaking up the sun and finding creative ways to help others. He’d probably get the “Grandpa Driver” discount if there were such a thing. Catch him on Twitter at @Tyomoth.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2RvoBME

What a Financial Trainwreck Can Teach Us: Six Mistakes to Learn From

A married couple recently confessed to some horrifying money blunders in an interview on the WealthSimple website. In their mid-40s and the parents of three kids, the pseudonymous Kate and Tom bring in $160,000 a year through their day jobs in insurance, with additional funds whenever Tom moonlights as a bartender for private parties.

Yet they have always spent more than they earned, and cannot seem to learn from previous mistakes. A few examples:

- After wiping out their credit card balances a decade ago, they charged them back up even higher.

- They have postponed paying back Kate’s law-school loans, which are now up to either $120,000 or $140,000 (she isn’t sure – and incidentally, she has never practiced law).

- They spend “insane amounts” of money on groceries at places like Whole Foods (where one of their kids likes to snack on $15 sushi).

- They bought their son a tux at prom time, because they couldn’t afford the rental fee but hadn’t yet maxed out the Nordstrom card.

Clearly this couple is a financial trainwreck. But they have something to teach us, if we’re willing to listen.

It’s easy to scorn the protagonists as entitled or clueless. You’d never be that foolish. You’d never go into debt, get yourself out, and then go back in. You’d never borrow from family members, or cash in a 401(k), or use a credit card to put your kids in private school.

Maybe you wouldn’t. Or maybe scorning other people’s mistakes keeps you from having to look too hard at your own behaviors.

If you’ve absolutely got a lock on your dollars, good for you. But keep in mind that all across the country, otherwise intelligent and rational people are spending more than they earn.

Losing Sight of What Matters

Some debtors have little choice. For example, someone going through a serious health issue or a protracted divorce can’t just check out of the ICU early or stop paying for legal representation.

Others, like Kate and Tom, have simply lost sight of the big picture in favor of short-term gratification: sushi, private school, a big house in a nice neighborhood.

This skewed perspective happened in such a gradual, boiling-the-frog way that they didn’t notice they couldn’t really afford the lifestyle enjoyed by their wealthy neighbors and the parents of their children’s classmates.

They’ve postponed the day of reckoning thanks to the availability of credit, including taking out loans online vs. having to face a loan official at a local bank. “We ask them for it, and they give us money. It’s ridiculous,” Kate said.

All of these are terrible decisions. Terrible, human decisions. As a species, we’re superb at ignoring the things we don’t want to face.

What Kate and Tom Can Teach Us

Kate and Tom didn’t set out to ruin themselves financially. Their wedding vows didn’t include a promise to “spend ourselves to the brink of bankruptcy, racking up so much debt we can’t sleep at night or even think straight.” Yet that’s what happened.

They messed up big-time and they’re finally admitting it. Coming clean publicly (if anonymously) is a huge service to others, because financial trainwreck stories are a reminder to examine our own lives.

Debt can be like quicksand in that you don’t know you’re sinking until it’s really hard – or maybe impossible – to escape. Rather than make fun of the couple for their massive foul-ups, consider them an object lesson. Learn from their mistakes.

Specifically, be honest with yourself: Could you wind up making the same kinds of mistakes? Or are you making them already?

Mistake #1: Believing Debt Just Sort of Happens

Here’s how Tom described their situation: “I think education loans probably started us on this path. But credit cards got us in trouble.”

Notice the detachment: An external force got us going and then another external force did this to us. He doesn’t say, “We overspent on education – especially on the law degree that Kate doesn’t even use – and then we bought too many things on credit.”

Ever hear yourself say stuff like, “A lot of 10-year-olds have smartphones these days – we can’t let our child feel left out,” or, “Someone in my line of work should drive a high-end car?” If so, take a hard look at your life and your values. You’re in charge — don’t let other people make decisions about your money.

- Read more: What You Can Control

Mistake #2: Minimizing Your Actions

Although deeply in debt, the couple adopted two dogs. Later, when one needed to be euthanized, they couldn’t afford to pay the vet; like so many other expenses, it went on a credit card.

In 2007, while expecting their third child, the couple had a $360,000 house built with two mortgages (since refinanced). After 11 years, they still owe $360,000. “I knew from the beginning it was a stretch,” Tom says. “It was the freewheeling times and so they would do anything to get you into a house.” (There’s that passive, “we’re not to blame” voice again.)

Kate says they shop at Goodwill and garden for vegetables. Yet she also shops for organic and vegan items at expensive specialty stores. “It would not kill our kids to eat a sleeve of ramen noodles every once in a while,” she said. “It’s kind of crazy that we haven’t reeled this in.”

You don’t say.

If you find yourself making lame excuses for poor decisions, stop. Just stop. Even if it’s late in the game – your kid loves that $15 sushi and expects it every time you shop – you must start making choices that reflect not just your values, but also your financial reality.

Yeah, it’s hard to put an end to the good times. Do it anyway.

And yeah, a little ramen won’t hurt anybody, especially if you add some of those veggies from the garden.

Mistake #3: Minimizing Your Inaction

Kate doesn’t know how many credit cards they have. Tom thinks it’s “10 or 11.” Picture that for a moment: They don’t know how much plastic they use.

However, Tom does know that eight of the cards are maxed out.

They have no plan in place to pay them off, but they know they can get more credit if necessary because new offers arrive all the time.

They have no plan to stop the merry-go-round of unaffordable house and lifestyle, either, although Kate does suggest that “what we probably should’ve done is move.”

You can’t go back in time and make smarter decisions. But you can start making decisions now. If your own financial situation is too paycheck-to-paycheck for your liking, talk to someone at the National Foundation for Credit Counseling (help is provided on a sliding scale, and no one can be turned away for inability to pay).

If you bought too much car, look into selling it in favor of a reliable used car. Look for a side hustle. Get ruthless about your grocery bills, since food is the budget category with the most wiggle room; in fact, get ruthless about all unnecessary spending.

It’s unlikely that any single action will fix your budget woes entirely. Aim for a gradual lifestyle shift, and remember that the things you do – or don’t do – will have a major impact not just now, but in the future. The longer we put off our own days of reckoning, the greater the impact on our long-term money goals.

- Read more: The Gap Between Your Goals and Your Actions

Mistake #4: Rationalizing

Just about everyone is guilty of this from time to time, but Tom has turned rationalizing into an art form.

Thanks to their huge debt burden, they get “a good deal” on the $32,000-a-year private school. Yet they have to take out annual loans to pay the tuition.

“We try to save money wherever we can,” he says, citing the example of trading a $405-a-month minivan lease for a $208-a-month car. However, Tom neglects to add up the amount they’ve spent on multiple years of leasing.

Two years back, he cashed in his 401(k) thinking that it could be “the answer to all our problems.” He paid off three cards and – get this – a $12,000 loan he’d taken out using the 401(k) itself as collateral. Then he used the rest of the cash to have “a pretty good Christmas that year.”

But wait! There’s more! Tom underestimated the tax penalties, and wound up owing $20,000 to the state and federal governments. While the IRS will create payment plans, “it was impossible to make a payment plan with the state,” Kate says. So she paid the state tax bill by – you guessed it – opening up yet another credit card.

Rationalization is a fancy word for “coming up with a reason to do something I know I probably shouldn’t be doing.” Listen to the words that might come from your own mouth. Would you call shenanigans on your brother or your best friend if they said stuff like:

- “Yes, I eat lunch out every day but it’s always takeout so I don’t have to tip.”

- “Sure, I spend a lot on clothes every year but in my profession you need to look sharp.”

- “I work hard – I deserve this [whatever-it-is].”

Note: If you can budget for these things and still meet other financial goals (emergency fund, retirement planning, and such), more power to you. If not, call yourself out on your own self-delusion as needed. And if you can’t, ask bro or BFF to do it for you.

Mistake #5: Magical Thinking

Previous solutions – borrowing from relatives, cashing in that retirement account, working with a shady-sounding credit counseling agency – were poorly planned and did not lead to any lasting change. Yet the couple keeps believing that a debt escape plan exists, and keeps on spending.

Toward the end of the interview the two quip bitterly about how the solution could be life insurance. If one of them drops dead from the stress, the other partner will use it to clear the slate. You get the feeling that they aren’t kidding.

Reading between the lines of the entire interview, it’s easy to infer that Kate and Tom really, truly don’t know how this got out of control. After all, they were living the way everyone else does. Since things seem to work out fine for everyone else, maybe it will for them, too.

The one thing that actually might make sense – talking with a bankruptcy attorney – is something Tom utterly refuses to do. His reasoning is that if he ever needs to change careers, the job application might ask if he’s ever filed for bankruptcy.

Wow.

Don’t be like Kate and Tom. Don’t delude yourself. If your spending feels out of control, put on the brakes (hard!) and revisit both your budget and your life goals. Should it turn out you’re in the hole, stop digging – and start planning ways to pull yourself back out.

Don’t wait, like Tom did. If he’d talked to a financial counselor 10 years ago and was told to declare bankruptcy, he and Kate would still have his 401(k) to help them later on. As it is, they will likely have to file anyway – and the retirement money is long gone.

- Read more: Personal Finance and Magical Thinking

Mistake #6: A Privileged Attitude

Six years ago Tom leased a Toyota Corolla, which at some point sustained a broken mirror. He wasn’t sure what they’d charge him for returning it even slightly damaged, so he just kept the car after the lease – at a “huge” interest rate.

“This is the kind of thing poor people do,” he said. “And I’d consider myself that.”

That statement carries a strong scent of both arrogance and self-pity: “Poor” people do dumb things – but waaahhhh, now I have to think of MYSELF as poor!

As though poor people are somehow less valuable as human beings. And as though his own behaviors had nothing to do with the fact that he’s broke.

In addition, Kate and Tom seem to believe they deserve the good life – expensive food, fancy home, private schools, lots of nice clothes – even if they can’t pay for them. They seem to think that their near-bankruptcy is due to bad luck rather than bad decisions.

At the risk of sounding like your dad: The world doesn’t owe you a living. We get what we need (and want) by working, planning, and, yes, sometimes going without until we can afford them.

Sometimes we can’t get what we want right away (or maybe at all) because of issues that come out of nowhere, such as unemployment or serious illness. That’s why financial experts recommend tactics like building a robust emergency fund, getting an early start on retirement planning, driving a car until the wheels fall off, cooking from scratch, keeping gift-giving to a minimum and, most of all, knowing the difference between wants and needs. When tough times come, you’ll be better positioned to handle them.

You are not entitled to anything in this world, but you can improve your chances by making careful life choices. If you aren’t doing that already, The Simple Dollar archive is full of articles that can help.

And if you think you’re already doing everything right? Stay humble, friend. Never assume that you’re way too smart to make mistakes like Kate and Tom did. Otherwise you might end up in the same kind of financial quicksand, wondering how things went so wrong.

Award-winning journalist and veteran personal finance writer Donna Freedman is the author of “Your Playbook for Tough Times: Living Large on Small Change, for the Short Term or the Long Haul” and “Your Playbook for Tough Times, Vol. 2: Needs AND Wants Edition.”

More by Donna Freedman:

- Save Your Finances (and Maybe Even Your Marriage): Invite Your Partner on a Money Date

- Stop Wasting Food: Creative Ways to Use Every Last Bit You Buy

- Social Media Will Try to Bankrupt You – Here Are Four Tactics to Stay Solvent

The post What a Financial Trainwreck Can Teach Us: Six Mistakes to Learn From appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2SsT0v3

Speak your mind and get paid for it

From mystery shopping to reviewing restaurants, there’s money to be made from giving your opinion – here’s how

Your opinion could be worth thousands of pounds if you know how to monetise it. Customer feedback can be invaluable to companies who want to know how to target or improve products. As a result, the internet is filled with websites and apps that are designed to put market research companies in touch with consumers.

Much of this work can be done on your commute to work, while you are out shopping or when you are sat in front of the television.

Participants can earn anything from a few quid to hundreds of pounds a month, depending on time investment and the ability to complete assigned tasks.

Carry out tasks on your commute or in front of the TV

Within a few minutes, you can sign up to an organisation and before long your email inbox will be full of polls to complete or shopping assignments to carry out.

In fact, it is worth setting up a separate email account to filter these messages as some companies can send around 10 a day.

It is also important to declare these additional earnings, as they are taxable and must be declared to the HMRC via self-assessment.

Go undercover as a mystery shopper

This can be one of the biggest earners, paying £5 to £100 depending on the task. It will usually involve travelling to a shop or business and either taking photographs, secretly recording an experience or buying something and completing an online survey afterwards.

It is a way for companies to evaluate their customer service covertly without staff being on their best behaviour for a visit from a senior manager.

It can also be a great way to get items free that you would normally buy – and be paid on top.

Some of the top websites are Market Force, International Service Check, Ragdoll Research, Red WigWam, Proinsight and GfK, and you can sign up and select jobs near to where you live. There are also apps such as Field Agent and BeMyEye. Watch out for scamming apps – it should always be free to sign up for mystery shopping.

Money blogger Lynn James of Mrsmummypenny.co.uk says the best rates come from mystery shopping at banks, which can pay up to £100 for an hour’s work.

“It could be opening an insurance product or a credit card or even buying a mortgage. You go in with a recording device and then you send it off afterwards. You don’t have to complete a survey, so it’s really easy. And it doesn’t affect your credit rating as everything is wiped clean.”

Refer a friend and earn £5 or £10 per person

These types of assignments can be harder to come by, but there are plenty of supermarket tasks, restaurant reviews and shopping jobs readily available. However, it is always a case of weighing up the time it will take you versus the money.

“If you are going shopping anyway, it is a good way to make a bit of extra cash but sometimes they do take a lot of time. I did one where I drove round to four different Morrisons and it took five to six hours and I got £45 after tax. But a great one was a free spa day with a treatment and they paid me £10,” adds Ms James.

If you live in a remote area and cannot access mystery shopping spots, there are other ways to make money from shopping.

ShopandScan is a market research survey that measures the buying habits of people in the UK. By scanning your weekly shop, you can earn points which can be redeemed at a wide range of retailers including Amazon, Next and Cineworld.

Complete surveys and studies

This can be one of the easiest ways to start earning extra income and can be done anywhere, anytime via apps and websites such as CitizenMe, OhMyDosh, Opinion Outpost and YouGov.

The amount you earn from a survey or study will all depend on the time it takes to complete, with two quick questions earning you 10p to a 45-minute questionnaire paying out around £10. Some websites, such as 20 Cogs, only pay once you have completed a series of 20 tasks, which can be very time consuming but can pay over £150.

One of the most profitable ways of making money from surveys is by referring friends, which could earn you a reward of £5 to £10 per person.

Idle time on your commute to work could be turned into cash, and you could potentially make £200 a month completing surveys on the bus or train each weekday.

“I log in on my phone and do them while watching TV or cooking or drying my hair. I don’t do it every day but I make £50 a month from surveys,” says personal finance guru Emma Drew of Emmadrew.info.

You can even complete video surveys and give your feedback on a product via your phone or webcam with apps VoxPopMe and Mindswarms, which can pay up to $75 (£58).

Join a focus group

Getting paid to watch TV and comment on it sounds too good to be true but it is a genuine way of making money.

Some lucky customers are selected by Amazon Prime to take part in their Preview research, which can pay £5 in Amazon vouchers for a quick survey to £10 an hour for watching and feeding back on a pilot show before its release.

But if you are not picked for this previewing service, then a good alternative is The Viewers, a new market research company focusing on television that can pay up to £70 for a 90-minute group discussion.

These focus groups often take place in hotels or client offices.

Focus groups can pay £40 an hour for your opinion

You may be asked to watch something, complete a task or even take part in a one-to-one interview with a researcher.

Focus groups can be pretty lucrative, paying £40 an hour for your opinion of a new product, but it often means travelling to London or a large city. Sometimes travelling expenses will be covered but taking part can be time consuming.

An increasing number of companies are, however, shifting to online focus groups enabling you to log in to a forum, answer questions and discuss products with other members from the comfort of your own home.

Lily Canter writes for Metro, The Guardian, The Telegraph and The Times

“I saved £100 a month and earned £50 on top from mystery shopping”

Avid mystery shopper Emma Jordan, 41, (pictured left) organised her social life around assignments for two years, meaning she could eat and drink out for free in Plymouth.

“When I worked in the city centre, it really fitted with my lifestyle. If I was meeting friends or family, I would suggest a place where I knew there was an assignment.

For each job, she would be given a budget and a list of things to feedback on such as cleanliness, communication of promotions and whether staff wore name cards.

“It had to be anonymous, so I would write notes on my phone and then go online afterwards and fill in a questionnaire. I had to upload photos and also a copy of my receipts.”

Each visit would have a budget of around £15 to £20 maximum and earnings of around £2 to £5 which would be reimbursed and paid monthly like a salary.

“There is no limit on how many you can do. I was doing two to three a week, mostly in coffee shops. I was reimbursed around £20 to £30 a week and earning £10 to £15 a week.”

Now that she works at home as a digital writer, Emma finds it more difficult to fit in the mystery shopping but would definitely recommend it to others.

“I am a keen shopper anyway, so I really enjoy making sure the customer service is good. The mystery shopping meant I could meet friends and not have to pay for meals and I had a pot of money at the end of the month for treats for me or my family.”

“Online polls made me £1,000 to save towards a house deposit”

When Jessica McDonnell (pictured above), 27, and her husband were given a year to buy their rented accommodation in Huddersfield, they had to come up with a deposit fast.

Mrs McDonnell spent her evenings in front of the television completing surveys and found academic research company Prolific particularly profitable.

“It is high paying and quite rewarding as you are helping people do university research, so the work is interesting. You test out different things or you might play a game that someone has created. I earned £300 in the past year from it,” says the public relations officer.

She also made £100 from clicking on online adverts, using the app Qmee.

But negotiating the best apps and websites does take some trial and error.

“I much prefer authoritative websites such as YouGov, so you aren’t tricked into signing up for unsuitable stuff. Vox Pop Me is also good. You do a video recording of an answer to the question of the day,” she says.

In 2017 Jessica made £1,000 from a variety of survey sites, which she funnelled away towards her house deposit.

“If you need the money for something important, you will invest the time in it.

“With surveys, if a job pops up and you have a spare 10 minutes you can just do it. It’s easy and convenient and as a little side thing the money isn’t bad.”

Section

Free Tag

Source Moneywise https://ift.tt/2Snw4xk