الأربعاء، 18 يوليو 2018

Postponing Retirement For Months Just As Good As Years Of Saving More

Source CBNNews.com https://ift.tt/2uHDOjD

This New Program Gives New York City Residents Free Entry to 33 Museums

The passes are a particular bargain in a city where adult tickets have soared to $25 at several of the most popular museums, including the Museum of Modern Art, the Whitney Museum of American Art and the Solomon R. Guggenheim Museum.

If you’re a resident of one of the five boroughs and you have a library card, you can soak up all that culture for free under a new program called Culture Pass — which will grant access to 33 cultural institutions in the city.

The New York Public Library, Brooklyn Public Library and Queens Library announced this week that the passes can be reserved online — and were promptly deluged by requests, causing the Culture Pass website to crash, said Queens Library spokeswoman Elisabeth de Bourbon.

The site was up and running again after the first day, and people have since been snatching up reservations to the historical, cultural and art museums and gardens on the list. They span all five boroughs and include diverse offerings such as the New York Transit Museum, the Children’s Museum of Manhattan and the Brooklyn Botanic Garden.

The program’s cultural destinations are donating 58,000 passes a year, and the libraries have a grant from three foundations to administer the program.

A new batch of about 5,000 passes will be released on the first of every month, said Fritzi Bodenheimer, a spokeswoman for the Brooklyn Public Library. So reserving early seems to be a better strategy than waiting.

Just enter your library card barcode number and pin on the Culture Pass website and either print the passes on your computer or show them on your cellphone when you get to the museum or garden.

Patrons 13 and older can call dibs through the website up to two months in advance, and each one-day pass will admit two to four people, depending on the institution.

If your favorite museum or garden isn’t on the list, check back in the next few months because the program intends to add more. Libraries across the country offer similar passes to museums in their areas, so check with your branch for the local rules.

A welcome side effect of Culture Pass is that the libraries have seen an increase in applications for new library cards. Queens, which has about 800,000 cardholders, had more than 400 sign-ups on Monday — the first day for Culture Pass — a 37% increase compared with the previous Monday, de Bourbon said. The New York Public Library, with 2 million cardholders, received more than 2,000 new card applications online Monday — seven times more than usual, spokeswoman Nora Lyons said.

“We’re thrilled that so many people are taking advantage of the passes and… becoming cardholders,” she said. “It’s a great entry point to New York City’s libraries and to their cultural institutions.”

Susan Jacobson is an editor at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2Jxwe0s

Who Wins and Loses in a Trade War?

Source Business & Money | HowStuffWorks https://ift.tt/2Lf7ter

Who Wins and Loses in a Trade War?

Source Business & Money | HowStuffWorks https://ift.tt/2Lf7ter

Whistle While You Work: Disney World Is Filling Jobs (With Bonuses)

As part of a summer hiring event, Disney World is holding a housekeeping job fair, and it’s offering new hire bonuses of $1,250 to all you Snow Whites out there ready to clean up after those messy dwarves.

Bonuses will be given out after training and 30 days on the job.

Disney has scheduled its housekeeping job fair for July 25 at the Walt Disney World Casting Center in Lake Buena Vista, Florida.

If you’re hired for one of the full-time jobs, you’ll also be eligible for the company’s benefits package, which includes health insurance, vacation and sick leave, a retirement plan and an employee stock purchase program.

Starting pay for full-time positions is $10.50 per hour. It is $10.15 an hour for part-time positions. There’s no indication whether you are required to whistle while you work.

Other departments are also hiring as part of the Disney’s Sun-sational Hiring Event:

Culinary Jobs at Disney

Try the gray stuff, it’s delicious! Don’t believe me? Ask the culinary chef assistant.

So the name wouldn’t exactly roll off Lumière’s tongue, but among the job openings in Disney’s culinary world, it’s the cooks who earn the hiring bonuses.

They’re also the jobs that require a minimum of three years of line cook experience.

The culinary chef assistant can earn a bonus of $3,000 on top of the $13.95 to $14.73 per hour pay rate, while a culinary cook 1 can cook up a $1,000 bonus in addition to the $12.95 to $13.21 per hour pay rate.

Bus Driver Jobs at Disney

I have run out of Disney references — apparently, not a lot of princesses arrive at the ball on a bus.

But driving an air-conditioned bus would definitely be a plus, considering the Florida heat.

Disney also upped the bonus from its spring hiring event — from $500 to $2,000. Starting pay for bus drivers is $12.65 per hour.

You do not need a commercial driver license, but you do need a valid Florida driver license.

None of these jobs your dream come true? Disney has posted additional jobs — although none of those promote any bonuses. But maybe you can request some mouse ears.

Tiffany Wendeln Connors is a staff writer at The Penny Hoarder. She’ll C-ya real soon.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/2JncE7a

How to Increase the Profitability of Your Nonprofit Organization

The primary purpose of a nonprofit company is to help a certain cause.

These organizations’ missions usually differ from those of traditional businesses.

If you operate a nonprofit business, I commend you. It’s great to see entrepreneurs helping other people and providing aid to charitable organizations.

But just because your motive for running your business is to help a greater cause doesn’t mean you shouldn’t be trying to generate a profit.

At the end of the day, your nonprofit organization is still a business. From a business perspective, this company needs to be run with the same principles as every other company.

You need to keep up with the latest marketing trends. Research your industry, and analyze your competition.

Learn about the wants and needs of both your customers and donors.

I see this problem all too often when I’m advising nonprofit companies. They are still operating the same way they were 20 years ago.

Sure, they might have a website now, but they aren’t always using the most recent technologies.

For example, check out these numbers related to nonprofit organizations and mobile devices:

Times have changed. Your nonprofit needs to adapt if you want to survive and thrive.

If your nonprofit company is struggling or could use some fresh ideas, you’re in luck. I’ll explain what you need to do to boost profits for your nonprofit.

Promote customer acquisition

If you’ve been operating for a while, you probably have a solid base of customers and donors. That’s great news and something to be proud of.

But what steps are you taking to continuously grow this number?

Relying on the same customers isn’t a sustainable business model.

If you rely on mass direct mail or cold calling houses for donations, I’m guessing you’re having trouble acquiring new customers.

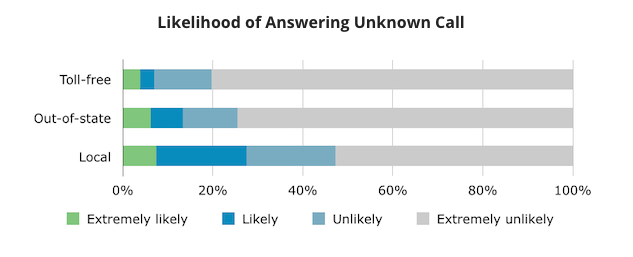

That’s because people are not very likely to answer the phone if they don’t recognize the number.

Just 7% of people say they’ll answer a toll-free call from an unknown number.

Furthermore, research shows that the average conversion rate for cold calls is roughly 2%.

With such a small percentage of people answering their phones and an even smaller percentage actually converting, those numbers aren’t appealing.

You need to find other ways to promote your brand so that it can be exposed to the widest possible audience:

- promote your website

- stay active on social media

- build an email marketing list

- encourage referrals

These are the types of tactics you need to implement if you want to get more customers and donors. We’ll discuss these concepts in much greater detail as we continue through this guide.

Drive traffic to your website

Your website needs to be the top priority for your nonprofit organization and your marketing efforts.

We’re living in a digital age, and you need to recognize that the best way to get discovered is through the Internet.

But just having a website isn’t enough. You need to make it as easy as possible for visitors to buy and donate through this platform.

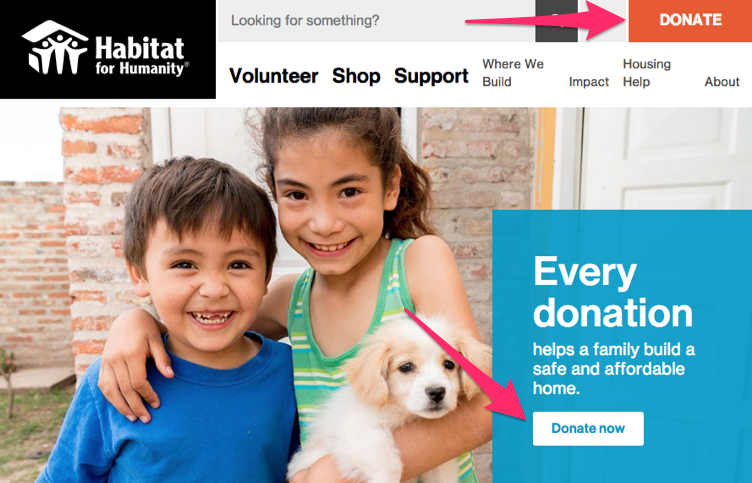

It’s imperative you have a clear call-to-action on each page of the website. This will be the best way for you to generate donations and ultimately increase your profits.

Here’s a great example of this concept on the Habitat for Humanity homepage:

As you can see, the “donate” CTA buttons are clearly displayed in several places on the site.

All your marketing promotions should lead people to your website. If someone hears about you or clicks a link, they’ll know exactly where to find you and what to do.

They won’t have to pick up the phone or mail in a check. They will simply visit your website and donate directly from there.

One of the best ways to drive traffic to your website is by blogging.

Blogging adds fresh content to your site on a regular basis, which helps improve your SEO ranking.

This will make it easier for your nonprofit to be discovered when people search for related topics on Google.

Blogging allows you to include internal links to other pages on your site. You should also add external links to websites with high authority rankings, especially if those sites support your cause.

More importantly, a blog gives people a reason to keep coming back to your site.

Think of it like this. How often does the same person donate or buy something from your nonprofit? I’m willing to bet the answer is “not every single day.”

But if you can establish a steady audience visiting your blog on a daily or weekly basis, it will increase the chances of getting conversions simply because your site traffic is higher.

Prioritize email marketing

When someone visits your website, trying to get them to buy something or make a donation shouldn’t be your only goal.

You can effectively market yourself without forcing visitors to spend any money.

You need to collect email addresses.

This will be the best way for you to stay in contact with your customers, donors, and volunteers. Eventually, this email list will help you generate more money.

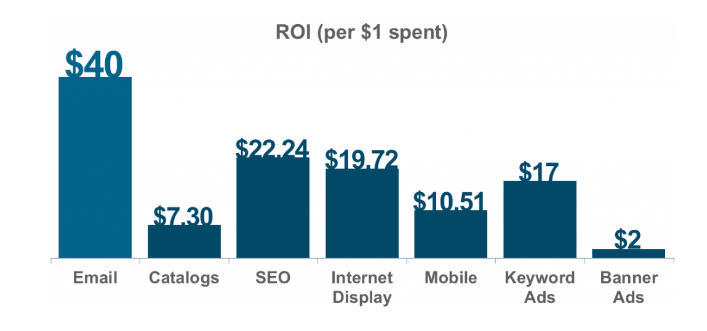

Email marketing has a high return on investment compared to other marketing tactics:

That’s because the costs associated with these campaigns are low. You’ll pay only a flat monthly or annual rate for your email software based on the number of subscribers you have.

Think about how much money it costs you to send direct mail letters to homes asking for donations.

You’ll pay just a fraction of that cost by sending emails instead.

Plus, the best part about your email list is you know you’re contacting people genuinely interested in your organization. That’s why they signed up to receive these messages in the first place.

Someone who opts in to receive your promotional content is much more likely to spend money than a person receiving a call from an unknown number.

Improve your credibility and security

Scammers have always tried to trick people. The modern age is no exception.

It’s a sad reality, and it’s unfortunate it happens often.

As a result, consumers protect their information. If they’ve never heard of your nonprofit organization, they may not feel comfortable donating to you or buying from you for the fear your organization is not legitimate.

But you can do a few things to change that. Understand the top elements that add credibility to your website:

For starters, you need to make it easy for people to contact you through:

- phone numbers

- email address

- physical address

- links to social media pages

- live chat

All of these need to be easily accessible.

Make sure you include security badges on your website as well. Proofread your site for grammar issues and typing mistakes. Such errors can make you appear unprofessional.

Your checkout and donation processes need to be secure. I’ll talk more about the way you accept payments shortly.

Increase your social media presence

Both your current and prospective customers are active on social media. The same holds true for your donors and volunteers.

You need to be active on these platforms.

If you don’t have profiles created on social sites, you need to do this as soon as possible. Facebook. Twitter. Instagram. YouTube. These are the best places to start.

Check out the Facebook page for Save the Children:

As you can see, the organization uses this marketing channel to promote events and raise money for specific causes.

Post content on your social media profiles on a daily basis.

Try new strategies to increase the number of your social followers. Interact with these followers. Run promotions and giveaways to create exposure.

Social media platforms are great places for you to explain your cause.

Also consider using social media platforms to encourage customer referrals.

Accept multiple payment options

Let’s say someone decides they want to buy something or make a donation on your website. That’s great news.

But they see you accept the payment only through mailed checks or over the phone. That’s no good.

You need to accept payments online. But take your online payment concept one step further.

Accepting only Visa and Mastercard won’t maximize your profits. You can’t assume everyone has those cards. Even if they do, the cards may not be their preferred methods of payment.

You need to accept all major credit cards and debit cards.

Furthermore, you need to accept alternative payment options as well, such as PayPal, Apple Pay, and Venmo.

The more options you have available, the more likely people will buy and donate.

Tell your story

Master the art of storytelling.

The whole idea behind your nonprofit needs to be the driving force of your sales. Sell your story, not your product.

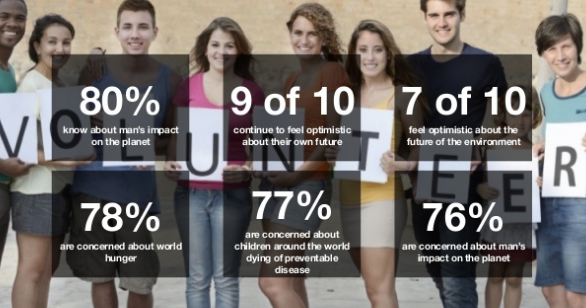

You’d be surprised how impactful your story can be. People care about the world. Just look at these numbers based on a recent survey of Generation Z:

Younger generations are especially aware of social concerns across the globe.

That’s why 70% of Millennials say they are willing to spend more money on brands supporting a cause.

Explain why you got into business in the first place. Whom are the proceeds helping? How will donations help those in need?

Elicit an emotional response from people who hear your story. The message needs to be loud and clear.

This story needs to consistent on all your marketing channels. Feature it on your website, social platforms, and email newsletters.

You should also give people the opportunity to share their stories. This will help create a sense of community and give people a reason to constantly visit your website.

For example, let’s say your nonprofit helps people who have a certain illness. Let people currently suffering from that illness share their stories. They can connect with other people in the same position.

Family members and friends of those with the illness can contribute as well.

By creating this community of people with unique stories, you will encourage more people to support your cause.

Go mobile

Your nonprofit organization needs to have a mobile website. As we saw earlier, more than half of nonprofit website traffic comes from mobile devices, and one in five nonprofit event registrations occurs on a mobile device.

If your site isn’t mobile-friendly, you’ll have high bounce rates and won’t get high conversions.

But if your site loads quickly and is mobile-optimized, you’ll have a better chance of making more money.

Take your mobile marketing efforts one step further by creating a mobile app for your nonprofit.

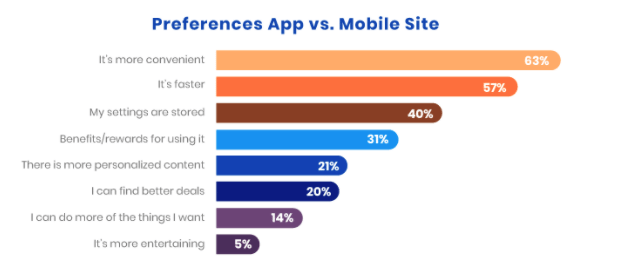

As you can see from the data above, consumers prefer mobile apps to mobile websites for several reasons:

- convenience

- speed

- personalization

These are the components you need to focus on if you want to drive sales and donations through your mobile app.

Creating a mobile app also improves your legitimacy, which I discussed earlier. It will be easier for people to find you when they browse for related content in the app store.

You can use your nonprofit mobile app to accept payments.

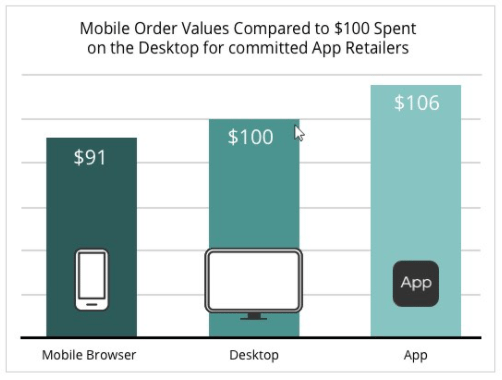

People spend more money on mobile apps than they do on mobile browsers and desktop devices.

This strategy will not only increase the number of donations you get but also the amount of each donation.

Partner with sponsors and influencers

Leverage relationships to expose your brand to a wider audience.

Get a well-known brand to sponsor an event or partner with your company. Lots of businesses will be willing to do this because it shows they are charitable as well.

Their customers can ultimately become donors for your nonprofit. You can accomplish this in many ways. It depends on what your sponsor is willing to offer.

For example, if people make a donation through your website, they could get a discount or gift card to the sponsor’s business.

You should also partner with social influencers and celebrities.

This is another great way to add credibility to your organization. Social media promotions from well-known personalities promoting your nonprofit will help you drive sales and donations.

Try to find someone who has a direct connection to your mission and cause. These people will be much more willing to help you.

Conclusion

Nonprofit organizations still need to make money.

You can do this without straying away from your primary company’s goal and mission. All this means is your cause will get even more support from your brand.

Focus on new ways to acquire customers and donors. Take advantage of digital marketing tactics to do this.

Drive traffic to your website, and encourage donations through that platform. This will be easy to do if you establish credibility.

Build an email subscriber list. Stay active on social media. Leverage your mission statement and story to drive donations.

Make sure you have a mobile website. Launch a mobile app to take donations from there as well. Accept as many payment methods as possible.

Find a celebrity or social influencer willing to support your cause and promote your nonprofit.

If you follow these tips, you’ll see an increase in sales, donations, and volunteers for your nonprofit organization. This will ultimately boost your profits.

How is your nonprofit organization using digital marketing tactics to increase profits?

Source Quick Sprout https://ift.tt/2NZ3YXV

The Quantified Spender: How Keeping Careful Track of Your Spending Behavior Is Valuable

Recently, I attended a community lecture about the idea of the “quantified self,” something I’ve vaguely touched on before here on The Simple Dollar.

The “quantified self” simply means that you keep track of information related to yourself in as many ways as possible, ideally in passive ways, and then you use that accumulated data to make decisions about what you’re going to do going forward.

Here’s a prime example of this, if you’re familiar with The Simple Dollar: recording every dime you spend and then categorizing it all once a month.

It’s simple. Just use a pocket notebook (or a smartphone app like Evernote) and jot down every dime that you spend for a month. If you spend any money at all, write it down in that notebook. Keep every single receipt that you get, too.

At the end of the month, pull out your bank and credit card statements and your receipts and that record of your expenditures and try to figure out where every single dime went. Split all of those expenses into categories – basic food, luxury food, eating out, pet care, entertainment, books, and so on – just define categories that are meaningful for you and put every expense into one of those categories. You might have to go through longer receipts – like your grocery receipt or a receipt from Target – one item at a time.

When you’re done, total up those categories.

You might be shocked as to where your money is going – or you might be expecting it. In either case, you have real data upon which to make decisions about how to get better with your spending going forward. Maybe you really do need to cut back on eating out. Maybe you’re spending way more on gas than you thought, so what can you do about that?

That’s an example of the “quantified life” with a very finance-oriented application.

Naturally, you can apply this idea to other areas of your life. Use a calorie counting app to record every single calorie you ingest for a month. Use a Fitbit to track every step that you take. Use a GPS app on your phone to keep track of your running habits. You get the idea.

There are a number of benefits to keeping track of information in the areas of your life that you’re concerned about.

First, the idea that you’re tracking said information is often enough to nudge you to better behavior. During the periods when I’ve been serious about tracking my expenses, I did not want to write down silly expenses in that notebook that I would just regret at the end of the month. It was much easier to be frivolous with my money if I wasn’t really thinking about it. If I have to stop and think for long enough to write down the expense, I’m less likely to actually engage in frivolous spending.

Second, the data you’ve produced enables you to make better decisions about how you should be changing your behavior and how to move forward. Having a clear picture of exactly how you spend your money makes it much easier to identify exactly where you should be cutting back. Having a clear picture of your exercise patterns helps you figure out when and where and what kind of exercise is most effective for you. Basically, data reveals what the most effective strategies are for your specific situation.

Third, data over time lets you see that you’re actually changing things, even if it’s not showing up like you expected. Data lets you set goals that are oriented around the process rather than the results, and that’s important because results don’t always show up right when you expect them, especially in the short term. There are almost always factors involved that you didn’t consider that can alter the results. What really matters is that you have a process for getting those results and are sticking to that process, and that’s what keeping track of your behavioral data can show you.

Finally, data is more reliable than hunches. You might have a gut feeling abut what changes you need to make to be truly effective, but actually looking at the real numbers will show you the reality of what’s actually happening. Sometimes your hunches will like up with the data and that’s great, but when they’re not in alignment, you can realize that perhaps your gut instinct isn’t guiding you in the right direction, or perhaps that the data and your gut feelings are both telling you something important.

How can you start applying quantification easily in your financial life? As I noted earlier, writing down every expense as you go along is a very effective way of accumulating data on your spending. It’s something that I do for short periods – I’ll do a “30 day challenge” at least once a year to track that information.

But it’s not the only way.

There are a number of apps that take care of much of the bookkeeping for you. I want to highlight the three that I consider to be the best in the pack.

Mint is an obvious starting point. It’s a smartphone app that aggregates financial data from your bank accounts and credit cards to give you a realistic picture of your spending without having to lift a finger. However, it lacks in two areas. First, it doesn’t provide that “pushback” against bad choices that manual recording of your spending can provide, as noted earlier. Second, it doesn’t do a good job of breaking down purchases from retailers into appropriate categories – you have to identify what kind of purchase you’re actually making at Amazon, for example. Mint has a lot of nice features and it’s free, but the software is subsidized by ad support and some degree of sponsored content, which I find frustrating. In terms of features per dollar, though, it’s the best option out there.

You Need a Budget is another great smartphone option that nicely integrates your spending habits into a clear picture of your monthly budget. It’s focused around making sure that every dollar that goes through your life has a purpose and really hammers that message home. I consider it a more effective tool than Mint; however, it has the drawback of being subscription based software, whereas Mint is free. It still somewhat lacks in terms of actually tracking your expenses, as noted with Mint, but I find that YNAB does a better job of nudging you toward good behavior anyway. This is the best option, in my opinion, but I do not like the subscription model.

That’s when we turn to the third option, PocketGuard. PocketGuard is a simpler view of your financial state than the other three, but it’s also free and it doesn’t bug you with “offers.” It just does its job without a ton of extra bells and whistles, and thus overall it’s my favorite choice of the three.

In summary, YNAB is the best of the three but it’s the most expensive by far, Mint has the most bang for the buck but has a lot of seemingly sponsored content mixed in, and PocketGuard is more basic in terms of features but shows you what you need to know.

For me, though, there are two benefits to simply jotting down expenses in a notebook that keep me sticking with that. One, the fact that I’m mindful of each expense as I’m writing it down helps me make better choices. Two, I’m not sharing my financial data with anyone but myself, as it’s all in my pocket notebook in my own weird shorthand. Yes, figuring out what it all means can take some time at the end of the month, but I usually learn a lot from that process.

In the end, the message is simple: finding some way to track your spending in detail and then looking at what that data means in terms of you making better choices going forward is a valuable thing to be doing. There are tools that automate a lot of this, but I personally find value in keeping track of each expense myself.

Give it a try. I encourage you to spend August doing a 30 day challenge where you track every single dime you spend in whatever way you’re comfortable with, then sitting down with that data and looking at the patterns. How much did you spend eating out? How much did you spend on your hobbies? Then, ask yourself whether you’re happy with those numbers or whether it’s a sign that you need to make some changes.

Good luck!

The post The Quantified Spender: How Keeping Careful Track of Your Spending Behavior Is Valuable appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2uI0wbd

Strategies for Fighting Frugality Fatigue

While there is no such thing as a “magic formula” for building wealth, living below your means is by far the closest thing. When you spend less than you earn and save the rest, you will build wealth — and savings — by default. And, if you just so happen to invest that money and avoid debt in the process, you can even grow rich over time.

But, there is definitely a balance to be achieved when it comes to spending less than you earn. You definitely want to hit your savings goals, but you have to live, too. And sometimes, finding a happy medium can be extremely hard — especially if you’re living frugally in order to save for a home or pay off soul-sucking credit card debt.

Seven Ways to Beat Frugality Fatigue

The reality is, too many people who embrace frugality to improve their finances take on too much too soon and end up burning out. They approach frugality as if it were an “all or nothing” scenario, and they forget there are different shades to frugal living and a lot of levels in between extreme frugality and negligent overspending.

Ideally, you should strive to build a frugal lifestyle that is restrictive enough to help you reach big financial goals while also allowing for some fun.

If you’re struggling from frugality fatigue or just trying to find a balance, here are some tips that can help:

#1: Set up targeted savings accounts for specific goals.

If you’re living frugally so you can save a larger percentage of your income, saving without a tangible plan can get extremely old. This is especially true if you’re saving for a goal that could be a decade or more away — like retirement. Saving month after month without any reward can be boring when you don’t get to enjoy the fruits of your labor for a long time.

To help ward off this type of frugality and saving fatigue, it can help to set up targeted savings accounts for different goals. Maybe you want to retire early and travel, but you also plan to remodel your kitchen once your kids leave the nest. In that case, setting up a few targeted savings accounts for your home remodeling project and future travel lifestyle could add enough substance to your savings plan to keep you on track.

#2: Create a slush fund.

Maybe your savings goals are totally reasonable, but you’re just tired of the frugality grind. You’ve been bringing lunch to work, making coffee at home, and avoiding the mall like the plague, and you’re desperate to have some fun.

Even if you’re trying to pay down debt or save up for a big goal, it can make sense to have a slush fund you can spend however you want. If you reward yourself with the occasional “want” and still hit your goals, you may be able to keep up with your frugal lifestyle for a longer stretch of time — and maybe even forever.

- Related: Depriving Yourself Doesn’t Work

#3: Embrace a new style of budgeting.

There are several different budgeting methods to consider, and each one has their pros and cons. If you’re on a bare bones budget that doesn’t allow for any extras, for example, it may be time to switch to a new strategy that leaves you with some wiggle room each month.

One type of budget we advocate for here is the zero-sum budget. This type of budget can be extremely effective because it forces you to “give every dollar you earn a job.” However, zero-sum budgeting can also be extremely flexible since it lets you create any budget categories you want. So, if you wanted some freedom to spend on fun each month, you could just add a “miscellaneous” or “fun money” category to your zero-sum budget.

Another budgeting method that’s fairly flexible is the 50-30-20 budget, also called “proportional budgeting.” With this strategy, you would spend 50 percent of your income on needs, 30 percent on “wants,” and 20 percent on savings. This type of budget gets you away from restrictive spending categories and still helps you save 20 percent of your earnings.

You may not reach your goals quite as fast if you embrace a looser style of budgeting or start setting aside some money for fun, but you will have more freedom in how you spend each month. If you want to live frugally for the long haul, it needs to be sustainable, and having some freedom can make all the difference.

#4: Loosen the reins for a while.

Taking a break for a while can also make sense — but only if you know you can get back on track. If you’ve been living on a bare bones budget long enough that you’re starting to reach some of your goals, taking a weekend or week off to live how you want won’t be the end of the world.

Maybe you want to plan a quick family getaway, or perhaps you just want a week where you can go out to eat and not cook from scratch at home. Maybe your kids have gone without long enough that you just want to treat everyone to dinner and a movie. Whatever it is you or your family needs, there’s nothing wrong with loosening the reins to a certain extent. Just make sure you don’t go overboard and that you’re prepared to get right back on the wagon, and you should be fine.

#5: Reward yourself or your family.

You can also consider setting up a one-time or ongoing system of rewards that will kick in each time you hit a savings goal or pay down a certain amount of debt. These rewards will help you stay motivated and, as long as they’re not overly expensive, shouldn’t keep you from reaching your financial goals over the long haul.

Let’s say the impetus of your frugal lifestyle if the desire to retire early. If you were to set aside some amount of money for a weekend away each time you saved $5,000 toward your retirement goal, you could motivate yourself to save at a faster rate and have some fun along the way.

The same strategy could work if you’re living frugally to pay down debt. If you rewarded your family with something everyone wants each time you pay off $1,000 or $5,000, you could keep everyone motivated and on track toward your ultimate goal – debt freedom.

#6: Remember why you’re frugal in the first place.

Sometimes all it takes is a look back at where you came from to remember why you became so passionate about where you’re going now. Maybe you began on the path toward a frugal lifestyle because you didn’t want to work until you were 70. Or perhaps you were sick and tired of forking over all your expendable cash toward credit card bills every month.

Look back to where you were and why you wanted to change so much. Try to remember exactly what it felt like to struggle — or to wish your finances were different than they are today.

Reading about frugality can also do the trick if you’re struggling to remember why you got started. Head to your library to read time-honored favorites like Your Money or Your Life or The Automatic Millionaire, and you may just find yourself energized again.

#7: Look for ways to earn more money.

Finally, don’t forget that there’s another path that can help you save more money without living on less. By earning more money, you can free up more cash to use towards goals like debt repayment, saving up to buy a home, and retirement.

There are all kinds of ways to boost your income in your spare time, including part-time or seasonal work. Some side hustles in the gig economy are extremely easy to start as well; for example, all you need to drive for Uber or Uber EATS is a newer car, insurance, and a clean driving record.

Whatever you decide to do to earn cash in your spare time, make sure you put that cash to work. Use it toward your savings or debt repayment goals — or use it for fun so you can continue using your regular income to get where you want to be without feeling deprived. Earning more money will always leave you better off provided you put your extra funds to use.

The Bottom Line

Even inherently frugal people can grow tired of their lifestyle sometimes, and that’s totally understandable. It takes a lot of self-discipline and fortitude to go against the grain and save money in a world where most people are doing the exact opposite with their money.

Sometimes setting yourself up for success means knowing you can’t be perfect every minute of every day. If you’re suffering from frugality fatigue, a little break may be all you need.

Holly Johnson is an award-winning personal finance writer and the author of Zero Down Your Debt. Johnson shares her obsession with frugality, budgeting, and travel at ClubThrifty.com.

Related Articles:

- How to Retire Quickly

- The Power of ‘Good Enough’

- Why I’m Only Focusing on One Half of ‘FIRE’

- Finding the Line Between Frugality and Deprivation

The post Strategies for Fighting Frugality Fatigue appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2L6BSMo