الجمعة، 14 يونيو 2019

MMA gym intends to kick it up a notch

Source Business - poconorecord.com http://bit.ly/2KVR5ip

While other retailers are shrinking, Burlington is adding stores

Source Business - poconorecord.com http://bit.ly/2RlcaUC

Hospice House to reopen to public June 20, pending approval

Source Business - poconorecord.com http://bit.ly/2IgJjxR

New Whataburger owners plan to expand popular fast-food chain

Source Business - poconorecord.com http://bit.ly/2XVvVnS

Best Cash Isa rates this week

If you're a UK taxpayer it's always worth considering a Cash Isa, even though most people can now get some savings interest tax-free.

The personal savings allowance means basic rate taxpayers can earn £1,000 interest tax free without using their Isa, and people who pay the 40% rate can get £500. Read our round-up of the best savings rates to find out more.

But remember that wrapping your money in an Isa means you won't need to worry about a future tax bill because your savings pot has grown and you're earning more than the tax-free threshold.

Everyone aged over 16 can save up to £20,000 in an Isa during the 2017/18 tax year.

Unless otherwise specified, all these banks are individually licenced by the FCA, so your savings will be covered by the Financial Services Compensation Scheme (FSCS) up to £85,000. All interest rates are AER - the annual equivalent rate.

Each week we select our Moneywise Best Buys, highlighting the best Cash Isas on the market.

Top easy access Isas

When picking an Isa, the first thing to decide is whether you want to fix your interest rate or opt for more flexibility with a variable rate. If you want to make additional deposits beyond the upfront opening deposit, or make withdrawals, then a variable rate Isa with easy access is probably most suitable for you.

Coventry Building Society Easy Access Isa 1.50%

Open this account online with a deposit of just £1. Note rate includes a 0.32% bonus until 31 August 2020.

Virgin Money Double Take E-Isa Issue 6 1.50%

Open this account online with £1. Note - you are limited to two withdrawals per year.

Shawbrook Bank Easy Access Cash Isa 1.43%

Open this account online with a deposit of £1,000.

Best notice account Isas

Notice accounts need you to plan withdrawals in advance, but the rates can be higher than those offered by instant access in some cases.

Earl Shilton Building Society 90 Day Notice Cash Isa 1.30%

You can open this account online with a minimum investment of £10.

Kent Reliance Cash Isa - 60 Day Notice - Issue 18 1.20%

Open this account with an initial deposit of £1,000.

Aldermore 30 Day Notice Cash Isa 1.3%

Open this account online with a £1,000 minimum deposit. 30 days notice required to withdraw cash.

Top fixed rate Isas

If you want to secure the interest rate you earn on your savings, and are happy to lock your money away for a set period, then a fixed rate Cash Isa might be for you.

Best one-year Isas

Al Rayan Bank Fixed Term Deposit Cash Isa 1.61%

Open this account with a minimum deposit of £500. Can be opened online. Note, this account's rate is an expected profit rate (EPR). Find out what this means in our guide.

Aldermore 1 Year Fixed Rate Cash Isa 1.60%

Open this account online with a deposit of £100.

Secure Trust Bank 1 Year Fixed Rate Cash Isa 1.60%

Open this account with an initial deposit of £1,000.

Top two-year Isas

Virgin Money 2 Year Fixed Rate Cash E-Isa Issue 379 1.82%

Can be opend online with a minimum initial investment of £1.

Al Rayan Bank Fixed Term Deposit Cash Isa 1.81%

Open this account online with a minimum deposit of £1,000. Note, this account's rate is an expected profit rate (EPR). Find out what this means in our guide.

AA Isa Fixed Rate issue 14 1.80%

Open this account online with £500.

Best three-year Isas

Aldermore Three Year Fixed Rate Cash Isa 1.9%

This account can only be opened online and requires an initial minimum deposit of £1,000. The rate is fixed for 36 months at 1.91%.

Paragon 3 year fixed rate Cash Isa 1.86%

Open this account online with an initital deposit of £500.

Metro Bank 3 Year Fixed Rate Cash Isa 1.85%

Open this account online with a minimum deposit of £1.

Top five-year Isas

Metro Bank 5 Year Fixed Rate Cash Isa 2.10%

This account can be opened online for a five-year fixed rate of 2.10%. The account requires a minimum initial deposit of £1.

Coventry Building Society Fixed rate Cash Isa 2.10%

This account can be opened online or in-branch and requires an initial deposit of £1. It has a fixed rate of 2.1% and matures on 31 May 2024.

Newcastle Building Society Five Year Fixed Rate Isa 2.10%

Open this account online for a five-year fixed rate tax-free. Requires an initial deposit of £500.

Best Junior Isas

If you're looking to put some cash aside for your kids, Junior Isas are a great way of doing so. These accounts are available to anyone under 18 and tend to offer much higher rates than adult accounts, but there are some restrictions. Read the Moneywise guide to Junior Cash Isas to find out more.

Coventry Building Society Junior Cash Isa 3.6%

Accounts can be opened with a pound in branch, over the phone, online or by post. Interest is paid annually on 30 September. Minimum balance is £1.

Danske Bank Junior Cash Isa 3.45%

Minimum balance is £1. This account is available to all and can be opened over the phone or in Danske Bank's branches across Northern Ireland. Savings are fully protected up to £85,000 by the FSCS.

How are Moneywise Best Buys selected?

We look across as much of the market as possible to find the best deals using industry data from Defaqto.

All our picks are nationally available - online, by post or by phone. We try and pick products that are available to both new and existing customers, but we’ll highlight some offers for existing customers if they’re much better than what else is on offer.

Unless rates are significantly higher than on other accounts, we avoid products that pay an initial bonus (which is normally a euphemism for a rate cut after 12 months), or those with tiered rates (these may not pay the advertised interest rate if your balance rises above or falls below a set amount).

Deals only available to particular age groups or for “additional subscriptions” are also not included.

All these savings accounts are covered by the FSCS unless otherwise specified. We will prioritise deals from UK-based banks. If your bank is licenced by another European country, savings up to €100,000 will be protected, but by the government where the bank is headquartered, rather than the UK authorities.

We reserve the right to use our discretion at all times.

This article was first published on 12 May 2008

Section

Free Tag

Related stories

- Best savings rates this week

- The Financial Services Compensation Scheme: a beginner's guide

- Best Help to Buy Isas - which account should I get?

Old NID

1 024Workflow

Source Moneywise http://bit.ly/2uRdZNe

Buyer’s Remorse and Forgotten Things

Open up your closet door, dig past the first things you see, and look at ten things you happen to find in the back (or everything, if you want). Out of those ten things, how many of them fill you with buyer’s remorse? How many of them had you completely forgotten?

Look at the last ten purchases on your Amazon account (or all of them, if you want). How many of them fill you with buyer’s remorse? How many of them had you completely forgotten?

Find an old grocery store or department store receipt. How many items on that receipt fill you with buyer’s remorse? How many of them had you completely forgotten?

Look at your credit card statement. Take a look at the first ten items on the list (or every item, if you want). How many of those items fill you with buyer’s remorse? How many of them had you completely forgotten?

Here’s the truth: no one is perfect at this test. I’m certainly not. Whenever I dig into my closet or look at my Amazon history, I usually find items I’ve forgotten or have buyer’s remorse about. Why on earth did I buy this?

I find that examining things like this can be painful, but it can be really insightful as to the actual quality of my buying decisions. Frankly, they’re not perfect. Frankly, I can do a lot better.

At the same time, it’s far better than it was before we started our financial turnaround and actually even significantly better than it was a few years ago in the midst of our turnaround.

There are a lot of reasons for that shift.

For starters, I do this type of self-examination regularly. I want to feel that buyer’s remorse. I want to see the items I’ve forgotten about or wish I’d never spent money on. I genuinely want to feel like I’ve screwed up my finances.

Why? For me, such feelings are a strong reminder that I’m nowhere near financially perfect, and those feelings are rocket fuel for me to continue to improve. That sense that I can still muck things up so badly isn’t disheartening, but rather it is motivation to further hone my purchasing habits.

This type of review of my purchases usually points me directly toward where I’m making mistakes. I can usually point directly to a few specific causes that cover a lot of the mistakes that I observe, and that gives me something specific to work on in order to improve my spending habits going forward.

For example, I might notice when I examine my credit card statement that I made four or five stops in the last month at a coffee shop. I like to keep such visits at one or possibly two per month. Why did that happen? Am I unsatisfied with my current home coffee making? What can I change to get this back down where I want to be?

I might notice that I made a few forgotten visits to a convenience store. When did they happen? Why? What did I buy? I might need to work on my routine of never getting in the car without a water bottle and always keeping a few snack bars in the glove box.

Maybe I noticed that I overstepped my hobby budget one month. Did I forget to keep track of that? Furthermore, am I really making sensible hobby-related purchases?

The sense of forgotten expenses and the sense of buyer’s remorse leads me directly into asking these kinds of questions, and asking these kinds of questions leads me directly into adjusting my own behavior. There’s clearly a reason why I’m choosing in the heat of the moment to make these choices. What is that reason and how can I fix it to continue to have a great enjoyable life in the short term while still building the future I want in the long term?

I might recognize, for example, that part of the reason I stop at the coffee shop is that I have fallen out of a routine of taking coffee with me when I do a morning work session at the library. I genuinely do love my own home-brew coffee, but on mornings when I’m headed to the library and I don’t happen to have coffee with me, I want some, and stopping for a decent cup of coffee means $5 down the tubes (while the as-good-or-better homemade coffee costs me about $0.60). The solution I’ve found is to simply start a new 32 ounce batch of cold brew coffee each morning by transferring yesterday’s batch to my larger pitcher or, if the pitcher is full, pouring myself a cup directly from the cold brew coffee maker, and only not making a batch if there is coffee actually in the maker because the pitcher is full. That’s the new routine I’m working to establish, so that I always have the kind of coffee I like ready to go (which is black cold brew coffee).

My convenience store stops were usually doe to being thirsty, and that’s due to a change in the seasons. I’m more active outside in the spring, summer, and fall than I am in the winter, and that means that I’m much more often away from home doing something active, like wandering around at Ledges or going geocaching or something like that. I’m usually thirsty when I’m done and if I finish my water bottle on the way home, I’m very prone to stopping for a beverage. What can I do to stop that? The easy trick is to just fill up my water bottle at a water fountain before I leave a park, which I need to try to adopt as a habit. That simple move would keep me away from most spring, summer, and fall convenience store stops.

What about things I find in the closet? I probably don’t need to buy things like that again for a while. If I’m finding forgotten and barely-worn clothes, I don’t need to buy clothes again for a long while. If I find hobby-related objects, I don’t need to be spending money on those hobbies for a long while. You get the idea.

What about things I find on my grocery store receipt? It’s a sure sign that I need to be shopping with a grocery list. Almost always, my grocery store receipts have a lot of unplanned purchases that are quickly forgotten if I don’t have a list, and the receipts have very few such purchases if I’m using a grocery list. I simply make a grocery list before I go to the store and this won’t happen.

What about things on my Amazon account? Unwanted purchases there are a sure sign that I need to visit Amazon less often and make purchases less convenient. I need to delete some bookmarks, but I also need to wipe my credit card info from my Amazon account so that purchases are much slower, thus giving me the opportunity to think more carefully about them before I actually click the “buy” button.

The issue, of course, is that poor choices like this are often forgotten or are tinged with mild regret, and it’s only through looking back through one’s spending history that they come to the surface so that you can really figure out what’s going on and build a better life, both now and going forward.

I encourage you to do a few of those buyer’s remorse checks mentioned at the start of this article. Here they are again, so you don’t have to scroll back up:

Open up your closet door, dig past the first things you see, and look at ten things you happen to find in the back (or everything, if you want). Out of those ten things, how many of them fill you with buyer’s remorse? How many of them had you completely forgotten?

Look at the last ten purchases on your Amazon account (or all of them, if you want). How many of them fill you with buyer’s remorse? How many of them had you completely forgotten?

Find an old grocery store or department store receipt. How many items on that receipt fill you with buyer’s remorse? How many of them had you completely forgotten?

Look at your credit card statement. Take a look at the first ten items on the list (or every item, if you want). How many of those items fill you with buyer’s remorse? How many of them had you completely forgotten?

What do you find when you do those tests? How can you change things so that the forgotten purchases vanish (as they deserve to)? How can you change things so that you’re no longer feeling buyer’s remorse? The better your answers to those questions, the closer you get to a perfect balance of meaningful spending and financial planning.

Good luck!

The post Buyer’s Remorse and Forgotten Things appeared first on The Simple Dollar.

Source The Simple Dollar http://bit.ly/2IjJBUJ

Dear Penny: I Have $84K in Student Loans. Can I Retire Next Year?

Dear L.,

I doubt it will bring you any comfort to know how many of your peers are facing the same struggle. But indulge me while I share just one scary stat.

The number of people age 60 and up with student loan debt quadrupled between 2005 and 2015, according to Federal Reserve Bank of New York data. Included in their ranks are people who went into debt to further their education and those who took out or co-signed a loan for a child or grandchild — or a combination in many cases.

You asked about how to “tackle” your $84,000 balance, and unfortunately there are no easy answers. Student loans are rarely dischargeable even in bankruptcy, as I’m sure you’re painfully aware.

Since you’re already struggling with payments while you’re still earning a paycheck, I’m concerned about your risk of defaulting, which could result in part of your Social Security checks being garnished if you have federal loans. Or that you’ll have to put your basic expenses on a high-interest credit card to stay current on your loans.

If you’re determined to retire next year — and we’ll get to your timeline in a minute — the goal of wiping out $84,000 in debt isn’t realistic. A better question is: How can I mitigate the pain of retiring with student loan debt? That’s where you do have options.

First, make it a priority to get your monthly payments as low as possible.

The best way to do this if you have federal student loans is to enroll in an income-driven repayment plan.

These plans cap your monthly payments at 10% to 20% of your discretionary income, and your remaining balance is forgiven after 20 or 25 years.

If your income is below 150% of the federal poverty level, you might not have to make any payments to stay current.

You can apply at the U.S. Department of Education’s website, studentaid.gov.edu, or by a form you can get through your loan servicer.

Just know that you’ll often pay more interest in the long term because you’re extending the payback period, and you’ll owe taxes on the amount forgiven.

Contact your lender for specific options if you’re struggling to make payments on a private loan. A private lender won’t be as flexible as Uncle Sam, but the good news is that private lenders can’t garnish Social Security and other government benefits if you default.

But ultimately, my question for you is this: Can you afford to retire in a year? If you have health challenges, caregiving obligations or mandatory retirement, that date is probably out of your control.

If you have wiggle room in your time frame and a plan to survive on half your income — for example, if one year from now, you’ll have paid off your mortgage and car loan — working for a couple more years while living like you’re retired will pay off immensely.

Your No. 1 priority is a happy and healthy retirement. Even with student loan debt, there is a way to get there.

Robin Hartill is a senior editor at The Penny Hoarder and the voice behind Dear Penny. Send your questions about student loans to askpenny@thepennyhoarder.com.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder http://bit.ly/2RfGaB2

8 Common Email Marketing Mistakes to Avoid in 2019

It doesn’t matter what type of business you have or what industry you’re in; everyone needs to incorporate email campaigns into their marketing strategy.

There’s a common misconception that email marketing is dead. That’s just simply not the case.

So for those of you who are struggling with your email strategy, there’s a good chance that you’re making some mistakes. Don’t get me wrong—I’m not saying this to discourage you.

This is actually good news. All this means is that you need to make some adjustments with your approach to have more success.

One of the reasons why email marketing is so useful is because it delivers a high ROI. For every $1 you spend on email campaigns, you can expect an average return of $32.

81% of small business owners say they rely on email as their primary customer acquisition method. Additionally, 80% of small businesses say that email marketing is their primary method for customer retention as well.

Even if you’ve been having decent success with your email marketing campaigns in the past, you can still benefit from this guide.

Without even realizing it, you might be making mistakes that are holding you back. So if you’re ready to take your email strategy to the next level, review and correct these eight mistakes that should be avoided at all costs.

1. Not welcoming your subscribers

You just added a new subscriber to your email list. That’s great news!

This person was navigating through your website, made their way to a landing page, saw your email value proposition, and filled out the form fields required to sign up. They took a lot of steps, so clearly they’re interested in your website and brand.

Now what?

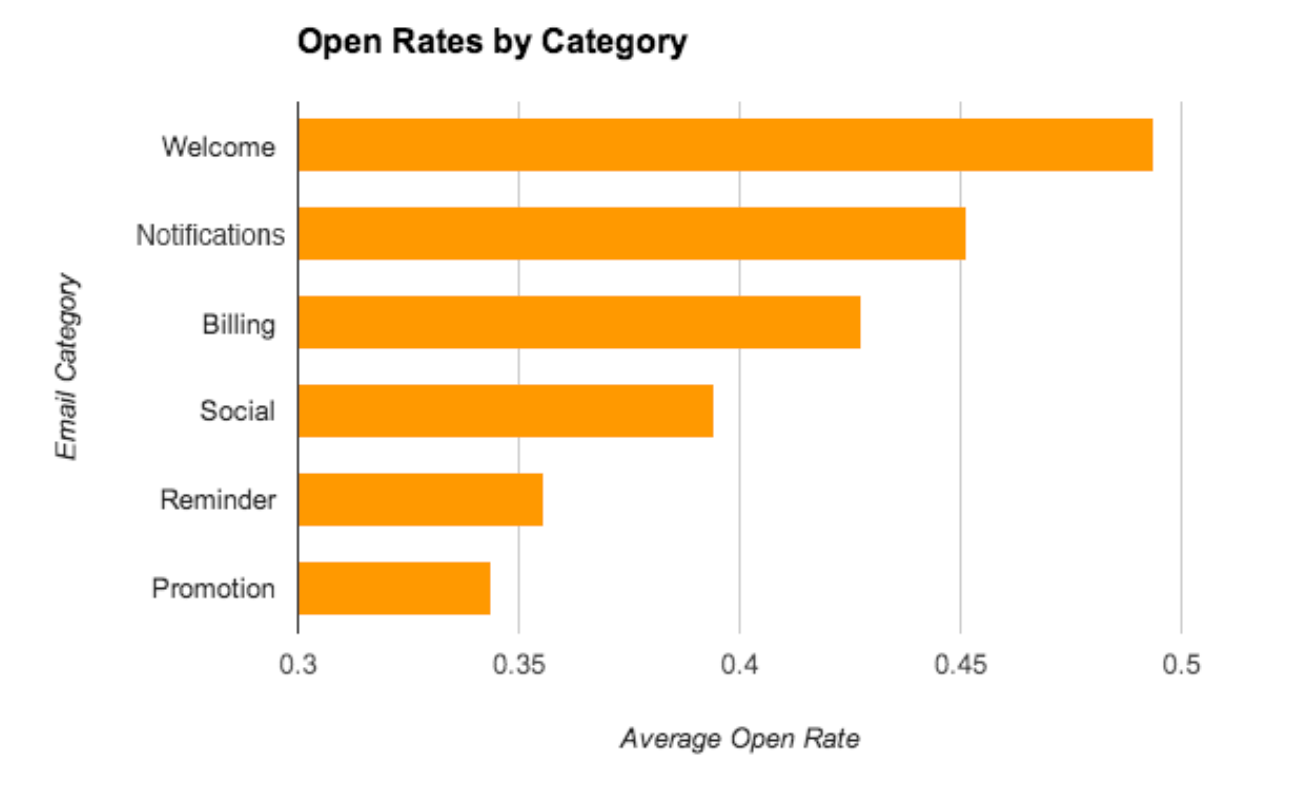

If you’re not planning to contact them until you send your next newsletter or coupon, then you’re making a big mistake. Welcome emails should be triggered immediately after a sign-up. That’s because they have the highest open rates compared to every other email category.

This makes a lot of sense. Think about it for a second.

Why did this person sign up?

Maybe you have an ecommerce shop and you promised something along the lines of exclusive discounts or offers for people who opt-in to your email list. Obviously, this visitor wants to buy something.

They’re on your site right now, and probably still have the browser open. But if you wait a day or a week to send that email, it’s going to be extra steps for that person to go back to your site and make a purchase. By now, the want or need for whatever you’re offering might be out of their mind.

On a per email basis, welcome emails generate 320% more revenue than other marketing messages. With that in mind, you can refer to my guide on how to generate sales with welcome emails.

Furthermore, welcome messages have a 336% higher transaction rate as well as a 196% higher click-through rate than any other email you send.

You need to take advantage of this. Yes, ideally you want this subscriber to be engaged with all of your emails down the road. But there’s no reason for you to wait. Get them to convert now by triggering a welcome as the first message in a drip campaign as soon as they sign up.

2. Forgetting a call-to-action

You think about your business and website all day, every day. Nights, weekends, holidays, it doesn’t matter; your business is always on your mind.

While it would be nice to think that your customers feel the same way as you do, that’s just not the case. So sending them a “hello” or “just checking in” message for no reason doesn’t add any value to their life.

All of your emails need to have a purpose and include a clear CTA that drives your goal home.

Otherwise, what do you expect the recipient to do with the message? Even if you’re sending a newsletter or some type of breaking news update, there should still be something in the message that entices conversions.

That’s not the only CTA mistake I see people make. On the flip side, instead of forgetting to include a CTA altogether, some site owners will go overboard and have four or five in the same message.

- Shop now

- Join our loyalty program

- Forward this message to a friend

- Share this on social media

- Sign up for our upcoming event

Alone, all of these CTAs are just fine. But when you add all of them to one message, the reader will get overwhelmed. Too many conflicting CTAs will just confuse your subscribers and end up hurting your conversion rates.

The content of the message should be priming and setting up the call-to-action. For example, if you’re releasing a new product, the CTA should be about buying. If you’re hosting an event, the CTA should be about signing up. For those of you who want to promote both of these, it needs to happen in two independent email campaigns.

3. Sending too many emails

Just because someone subscribed to your email list, it doesn’t give you the right to bombard them with messages all day.

The average person who works in an office receives 121 emails per day. That’s more than 44,000 emails each year!

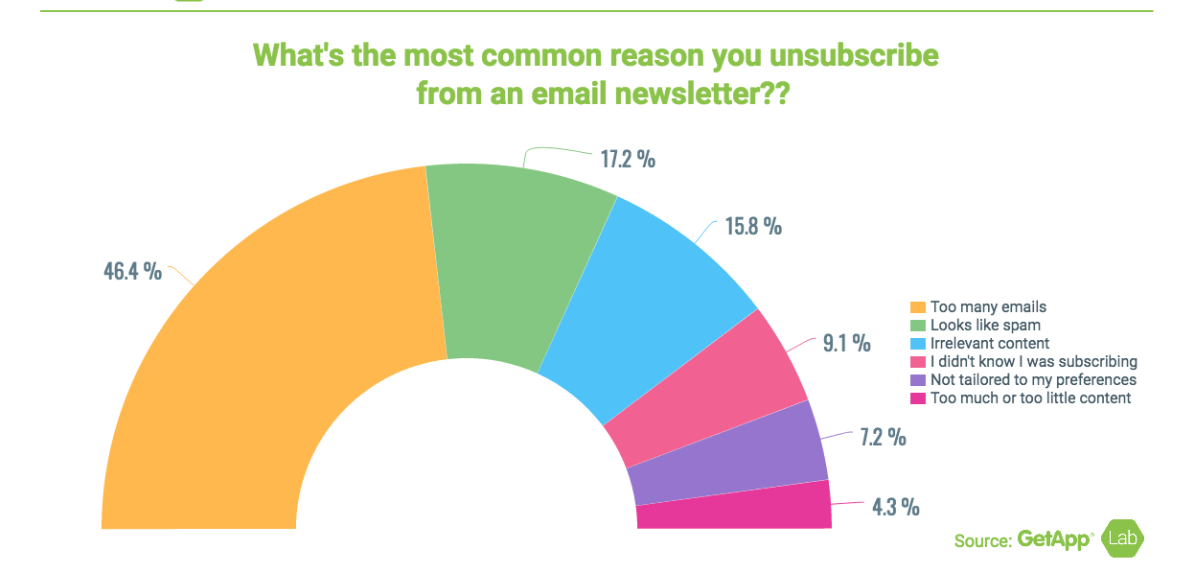

So it’s no surprise that the number one reason why people unsubscribe from email lists is because they get too many messages.

Think about this for a moment. Put yourself in the shoes of a consumer.

How often do you check your emails and feel annoyed about all of the messages you have? This drives me crazy.

You don’t want people to have that association with your website and brand.

They should be happy when they get a message from you, not feel annoyed. Remember, they signed up to get messages from your website, so they obviously have some interest in your content.

Realistically, people aren’t going to shop every day or visit your website every day. This is something that you need to accept.

So I would limit your email promotions to once per week at the most.

You can even allow subscribers to set up their preferences when they sign up. Ask them the communication frequency that they want, as well as the type of messages that they prefer. Then segment your subscribers accordingly based on their answers.

4. Not segmenting subscribers

If you have one long master email list where every subscriber receives the same content at the same time, you’re doing it wrong. This is a huge mistake.

I just briefly explained during my last point how some people may want messages more or less frequently than others. Some subscribers may only want promotions and coupons, while others want your newsletter. Everyone has different needs and preferences.

For example, let’s say you run an ecommerce shop. A 20-year-old male subscriber isn’t interested in the same products as a female subscriber in her 50s. So sending them the same message is not a winning strategy.

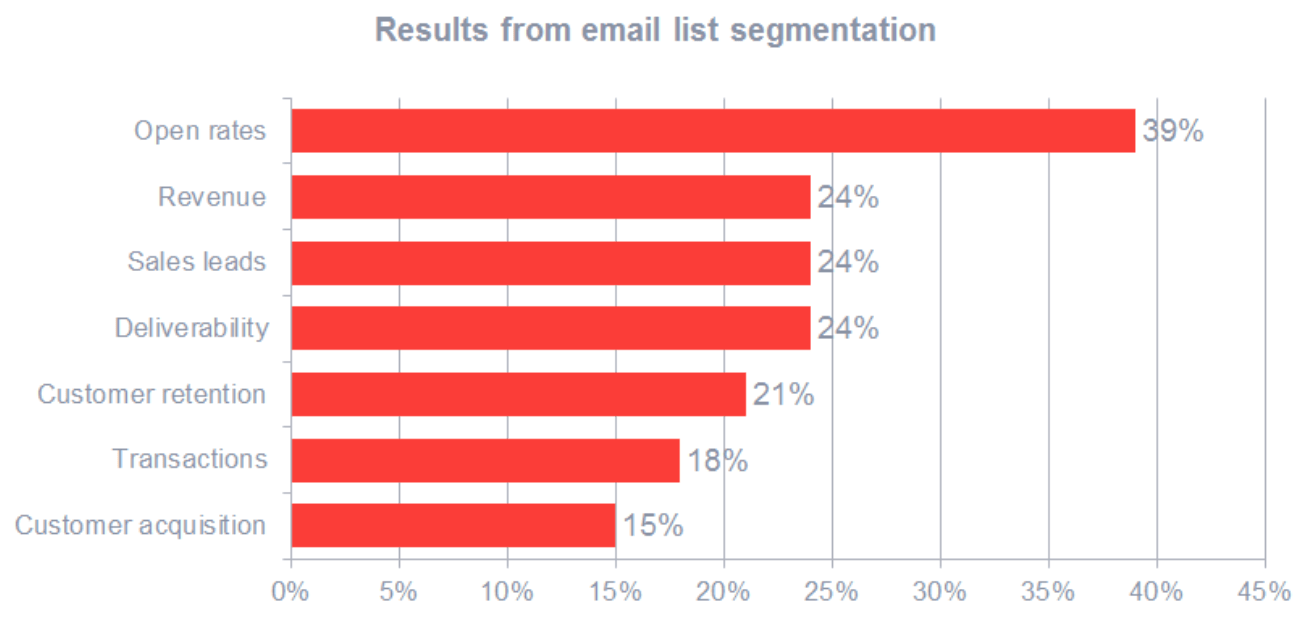

Take a look at how these marketing metrics increase as the result of segmenting emails.

You’ll get more opens, revenue, and leads, while simultaneously increasing customer retention, acquisition, and transaction rates.

Furthermore, studies show that 60% of people will delete an email that they find irrelevant. 27% of people unsubscribe from irrelevant emails and 23% mark them as spam.

That’s right. Even if you’re not sending emails too frequently, your subscribers can still unsubscribe. But segmenting subscribers decreases the likelihood that your content will be perceived as irrelevant.

- Location

- Age

- Sales cycle

- Language

- Lifetime value

- Interests

- Browsing behavior

- Previous purchases

These are all common starting points for segmenting your email lists. Learning how to deliver relevant content by segmenting your email subscribers needs to be a priority.

5. Delaying campaigns

I regularly consult with lots of different website owners and businesses. When we talk about email marketing, lots of them have the wrong impression about when email campaigns should be sent.

Let me give you an example. I’ll use nice and round numbers to make it easy.

Say you have 1,000 email subscribers currently on your list. You sent out a message to all of them last week. You’re ready to run a new campaign this week, but you only gained ten new subscribers since your last campaign.

That’s not an excuse to put off the campaign.

But all too often I see business owners delay campaigns until they get more subscribers. As long as you’re not sending the messages too frequently, you can still deploy a new campaign to the same people, regardless of how many subscribers you gained or lost in between messages.

Your current subscribers are already familiar with your brand. The probability of selling to a current customer is 60 to 70%. But the chances of selling to a new customer is just 5 to 20%.

Based on these numbers, there’s no reason for you to hold off. Plus, any new subscriber should be getting a welcome email, which we discussed earlier in this guide. So you’ll be able to target them with an offer right away. For everything else, pick a schedule and stick to it. Stop coming up with excuses for delaying new campaigns.

6. Neglecting mobile users

I’m assuming that most of you will be using a computer to craft your email marketing messages. On these devices, everything looks great.

Time to send it out to your subscribers, right? Not so fast.

You need to check and see how your message looks from mobile devices. Most email marketing software out there will have mobile-optimized features.

But the best way to do this is by sending a test email to yourself. I have a category on my email marketing list for office and executive. Basically, it’s just a few of my email addresses. I always send content to this group first, so I can check everything before it goes out to the masses.

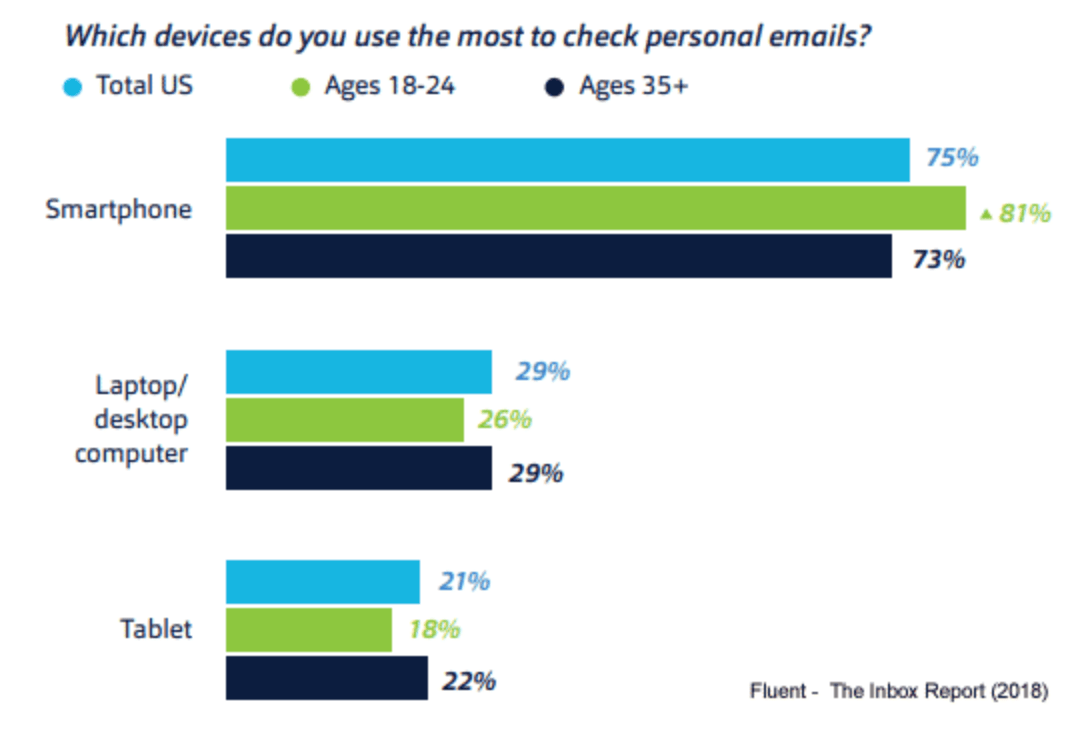

Look at which devices people use the most to check their emails.

Smartphones are by far the most popular devices for people of all ages.

So even if your message is technically mobile-friendly based on the test run through your email software, there are other things you should keep in mind.

Avoid long blocks of text. Something that’s two or three lines on a desktop computer could up being ten lines on a 4-inch smartphone screen.

Your email should have visuals, but don’t rely too heavily on images. Here’s what I mean by this. Some email apps won’t automatically display images. So if your entire message is based on the context of your picture, you might be out of luck.

To fix this mistake, you’ve got to know how to boost sales by accommodating the needs of mobile users.

7. Sending unprofessional messages

Earlier I explained why you shouldn’t delay campaigns. But with that said, emails shouldn’t be sent in a matter of minutes either. Take the same approach that you would if you publishing a blog or adding anew landing page to your website.

Plan it out. Create an outline. Write the copy. Put it through some editing software. Proofread, and then proofread it again. Slang, spelling errors, and improper formatting will not reflect well on your business.

Imagine getting an email from a high-end brand trying to sell you a $2,500 watch. But the message is filled with type-os and grammar mistakes. Are you going to buy that watch?

Probably not. It looks like a poor reflection of that company as a whole.

People think that if you don’t take the time to do something as simple as writing an email, what other shortcuts are you taking?

The reply to address for the email should be your business. Not your old screen name @hotmail.com. You should also A/B test all of your emails for formatting purposes. All of this will ensure that your messages look as professional as possible.

8. Not prioritizing sign-ups

Your email marketing campaigns will only be as good as your subscriber list.

It doesn’t matter if you have great content in your mobile-optimized message with the perfect CTA and professional design. If you only have 30 people to send it to, you can’t expect great results.

I realize that email lists don’t get built overnight, but this needs to be something that you’re always working at. No number is ever high enough.

If you just have “sign up for our emails” buried somewhere in the corner of your website, it won’t generate subscribers.

Remember, people are getting bombarded with nearly 1,000 emails per week. They won’t be signing up to receive more unless they have a good reason.

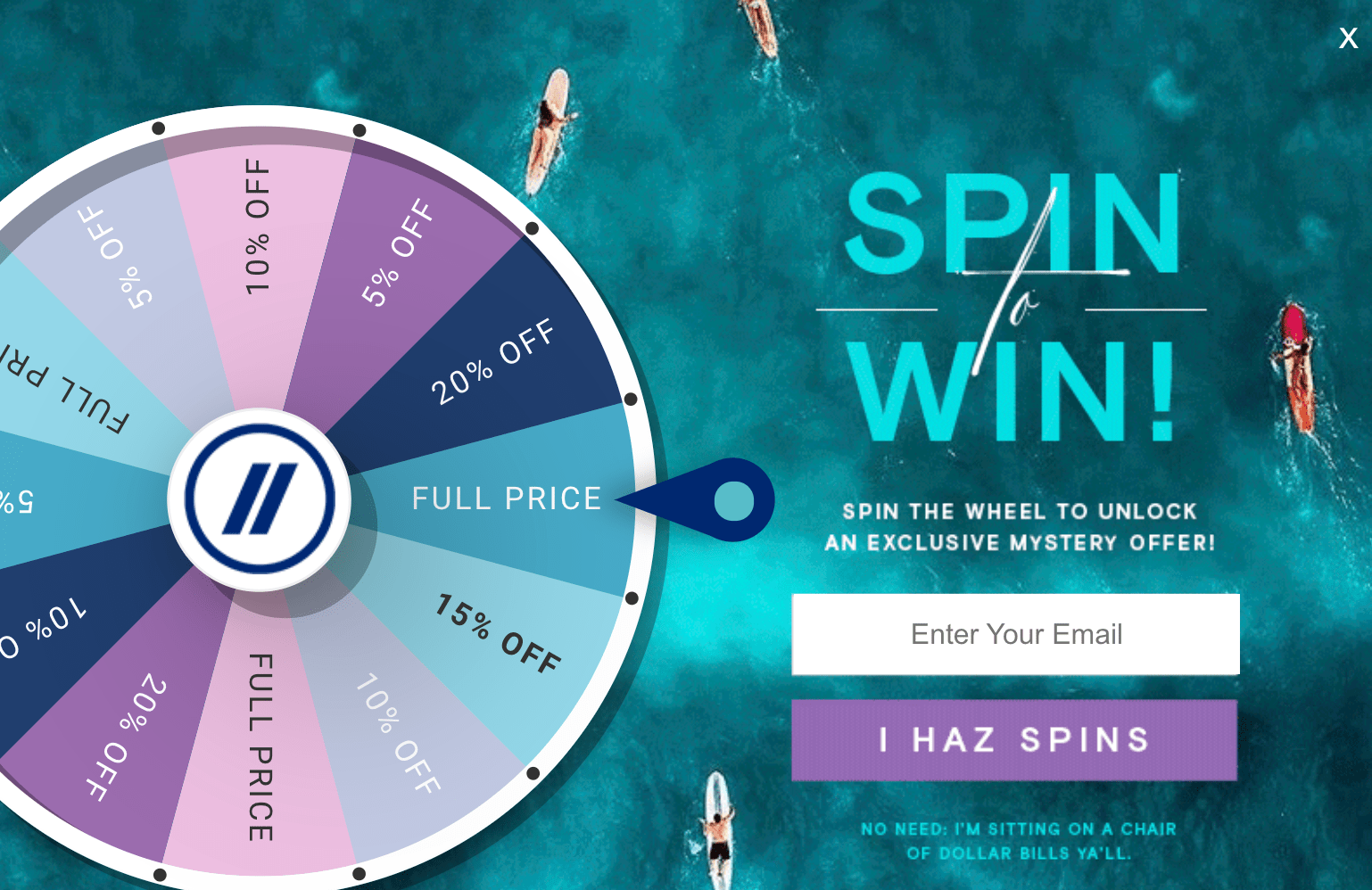

Check out his popup from the Blenders Eyewear homepage.

It’s a creative approach to collect emails.

First of all, you can’t miss it because it takes up nearly the whole screen while a user is browsing. Since they operate an ecommerce site, it’s safe to assume that the visitors are interested in their products.

By offering a discount in exchange for an email sign up, they’re essentially killing two birds with one stone.

- Add an incentive for purchases

- Gain email subscribers

Refer back to what we discussed earlier in terms of a welcome message. When a visitor signs up in a situation like this, it’s absolutely necessary that they are welcomed with the discount immediately.

Even if you don’t have an ecommerce shop, you still need to prioritize sign-ups and add value to potential subscribers. Offer them free downloads, video tutorials, or other types of exclusive content for email opt-ins.

Conclusion

Email marketing is still alive and thriving. Everyone needs to make this a priority.

But some people are doing email marketing wrong. After reviewing this guide, you might have just realized that you fall into that category.

Don’t worry. These common mistakes are fairly easy to correct.

Identifying them is the hardest step. But now that you know what needs to be done, you can make those adjustments and apply the changes to your email marketing strategy moving forward.

Source Quick Sprout http://bit.ly/2Rh0AcO

My money lessons: Getting hitched put our finances into focus

With a baby on the way, Moneywise reader Owain Williams and his wife, Hannah, set about using digital banking apps to keep their finances on the straight and narrow

As my fiancée (now wife), Hannah, and I were rowing across a perfectly still Lake Windermere, tears in our eyes and a brand new ring on her finger, we were blissfully unaware of the impact marriage can have on money. Believe it or not, on that perfect day when we decided to spend the rest of our lives together, we didn’t discuss our finances once.

It didn’t take long, though. After retelling the story of the proposal over and over to all who were interested, I would invariably ask them: “How do you do your money?” The answers were surprisingly varied.

Marriage advice is broadly standardised and consistent: don’t go to bed angry, make compromises, and so on, and it’s always dispensed with such confidence. Answers to my money question, however, lacked any of that cohesion. Evidently, the correct way to manage money in a marriage had not yet been universally agreed upon.

My now-wife and I are in our 30s. We have no great debt, we rent a three-bedroom semi in Salford and are both in full-time employment. We have two cars, two rabbits and a baby on the way.

Neither of us had been particularly bad stewards of our money. However, the only thing that would stop us from buying a new pair of jeans, for example, would be a declined card at the checkout. It took a serious case of matrimony to make us realise that this couldn’t continue. We were, in fact, on a perfect trajectory toward deeper debt.

So we sat down one night, switched the TV off and sorted it. With the help of digital banking apps, we are today living in the financial freedom we both always wanted.

It started with a few basic decisions.

Married couples who use joint accounts seem to neatly fall into one of two camps. Either deposit the exact amount needed to cover monthly bills and pocket the rest. Or put your combined wages directly into the joint account and filter the rest back into said pockets. We decided early on that every penny we earned or owed belonged to both of us. So we chose the latter.

It is then, after all our bills are covered, that the real work began.

Owain and Hannah Williams plan to get their finances under control with the help of technology

These wonderful new app-based banks are nothing short of remarkable. They are incredibly easy to use and have features and customer service that make you wonder what all the big banks have been doing all these years. We chose Monzo, which, like other apps such as Starling or N26, has built-in budgeting tools.

The modest amount of money that we have left after our monthly bills have been paid is distributed to one joint account and two personal app-only accounts.

The amount deposited into our joint Monzo gets split between monthly spending and what we call ‘short-term saving’. The app allows you to save like this using saving ‘Pots’ for which you can set targets. We have Pots for many things, including holidays, car repairs, birthdays and Christmas. These have been a revelation.

No longer do we have to worry in the run-up to Christmas, or get caught out by a flurry of birthdays. Holidays are now genuinely more enjoyable because we are not eating into our monthly budget, while drinking on the beach.

The spending allowance is also neatly rationed. We can tell it exactly how much we would like to spend as a couple each month within a variety of categories: groceries, eating out, transport, and so on. It seems so simple, but without these little guides, we would be spending blind, back on that dangerous trajectory. With the app, however, the helpful graphics clearly show us both if we are spending too quickly or in the wrong places.

There is then the curious case of our ‘personal’ Monzo accounts. Some of our friends who discouraged us from going ‘all in’ with our money made the point that you can’t be truly romantic or spontaneous if all the money is entirely shared and so keenly controlled. It is a good point, but we have so far found our system works to avoid this.

Our personal accounts, which receive the remaining 5% of our income, have not only allowed us to remain generous and spontaneous, but they have negated any grounds for disagreement.

If she wants to treat herself to a £50 ceramic spoon, that’s fine. No questions asked. If I want to spend £100 on a Lego rocket, I can, and I did. It’s bliss.

This is no great folk tale, merely a humble example of how small changes and a little app has helped us to navigate our first year of financial cohabitation.

All we have done is find an easy way to look after the pennies, allowing the pounds to stay in line.

Do you have a lesson you’ve learnt about money you’d like to share? Please email editor@moneywise.co.uk

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2FafuNv

When love is in the air don’t let money come between you

If you meet your soulmate when you’re in your 50s or 60s, then it’s likely that you will both come with some financial baggage. Here’s our guide to the six things to think about to enjoy those golden times together without future woes

More of us are finding love in later life, with the number of over-65s tying the knot up by nearly 50% over the past decade, according to the Office for National Statistics (ONS). But while romance can bring happiness and security, a new partner at this stage can also bring its fair share of financial headaches.

With decades of adulthood under your belt, it’s highly likely that you and your partner will have different wealth, health and family situations.

“Merging two different financial situations can be complex, both technically and emotionally,” says Joe Roxborough, chartered financial planner at Ascot Lloyd.

“As well as different financial situations, each party might have commitments to children and ex-spouses that all need to be taken into consideration.”

On the rosy side, marriage offers some significant tax breaks. Being able to transfer assets between you can save on income, capital gains and inheritance tax.

Ken Dodd’s decision to marry his partner of 40 years, Anne Jones, just two days before he died in 2018 meant that he saved her having to pay an inheritance tax bill of up to £11 million on the £27.5 million estate he left her.

While many people marry because of the tax breaks, Julie-Ann Harris, partner and head of family law at legal firm Coffin Mew, points out that savings can be outweighed by other financial issues.

“On one hand, being married gives you security, but it also opens you up to financial claims. Your new husband or wife will have a legal right to your assets,” she says.

“It’s not legally binding, but a prenup can offer some protection. With a bit of planning you can also put the right legal and financial framework in place to protect your interests.”

1. Estate planning

Unless both parties agree where their wealth will ultimately go, there can be all sorts of legal wrangling if other family members feel they have been overlooked. So estate planning is key.

While it’s possible to use a will to divvy up assets on death, the home can cause major issues. Ms Harris recommends checking how it’s registered.

“If you own your home as joint tenants, your share will automatically go to your spouse when you die. When they die, as it’s in their estate it could all go to their kids,” she explains.

If you would rather it went to your own children, or even to the local donkey sanctuary, this can be arranged without forcing some bizarre home-sharing experiment.

Julia Rosenbloom, partner at tax adviser Smith & Williamson, explains: “By setting up an interest in possession trust in your will, your spouse will be able to stay in the home until death, when your share will pass on to your kids or whoever you want.”

You will also need to change the way the property is registered, from joint tenancy to tenancy in common, adding a declaration of trust form to confirm the details.

Emily Deane, technical counsel at the Society of Trust and Estate Practitioners, says: “This allows you to stipulate what percentage of the property you own, and what happens on death.”

2. Minimising inheritance tax

The ONS says 92% of people getting married over 65 are divorcees, widows or widowers. So if you are on your second or third marriage, it’s quite possible you or your spouse have already inherited a transferable nil rate band (NRB) when a former partner died (where an unused IHT allowance is passed on to a surviving spouse). However, while this is useful, it’s important to note that you can only have a maximum of two NRBs, so up to £650,000 of assets can be passed on IHT-free.

“If your spouse already has two NRBs, don’t waste yours by leaving it to him or her,” says Ms Rosenbloom. “If you have a spare £325,000 of assets, leave these to other people to use your NRB. Where this isn’t possible, set up a discretionary trust in your will, diverting £325,000 of assets to this on death.”

Having a discretionary trust allows more control over when, how and to whom assets are distributed. As the trustees decide when the assets are distributed, this can work well if you don’t feel comfortable leaving large amounts to children or you’d like to provide for future grandchildren, as well as those already on the scene.

By ensuring you use all the NRBS available, you can save a significant IHT bill. For instance, say both parties have two NRBs – their own, plus a transferable one from a former spouse who died. Assuming the £325,000 allowance is still in force, leaving the full £650,000 of assets to beneficiaries other than the spouse on first death would save an IHT bill of £260,000 (40% of £650,000) on second death.

3. Life insurance and pensions

Ms Deane recommends reviewing any life insurance arrangements that you have in place.

“Some policies will automatically allocate the proceeds to the spouse, so make sure the insurer knows your wishes, especially where this isn’t the case.”

Pensions may also need to be reviewed to ensure that any death benefits are paid to the right person.

“You may have completed the ‘expression of wishes’ form years ago, which could mean the death benefits are still earmarked for a former spouse,” says Scott Charlish, senior financial planner at Brewin Dolphin.

It’s even more important where you have a defined benefit pension. This could include a pension for a spouse or civil partner if you die first, with some schemes also paying out a lump sum if you die in the first flush of retirement.

“Many schemes will pay 50% to 66% of your pension to a surviving spouse,” says Mr Roxborough.

“This might make marriage a particularly attractive proposition.”

Where there’s a considerable age or life expectancy difference, this can add further weight to the argument.

Mr Roxborough points to the case of Alberta Martin in the US. At the age of 21, she married an 81-year-old veteran, and she received payments from her husband’s civil war pension right up to her death in 2004 – nearly 140 years after the conflict ended.

4. Don’t forget about the lasting power of attorney

It’s also prudent to be prepared for the future, with a lasting power of attorney. This ensures that someone you trust can make decisions on your behalf if you become unwell and are unable to do so yourself.

There are two types, one for property and financial affairs and another for health and welfare.

Ms Deane says that everyone should consider these, regardless of age or relationship status.

“It doesn’t matter whether you’re married or not, if you’re not named on a power of attorney, it will be difficult to make decisions on someone else’s behalf, or access their finances unless it’s a joint account,” she says. “Without this, you’d need to apply for a deputyship order, which is more complicated and can take around six months to arrange.” It’s also considerably more expensive.

- Find out more about making and registering a lasting power of attorney at Gov.uk/power-of-attorney.

5. Wills

Wills are a must and are even more important when circumstances are a little more complicated.

“As families get less ‘vanilla’, having a will becomes even more significant,” says Ms Rosenbloom. “Also note that if you marry, any existing wills will be revoked.”

Without a legal will, your estate will be divided according to the rules of intestacy. This isn’t such an issue if you’re married. In this case, your spouse will receive as a minimum £250,000 of the estate and half the remainder, plus all your personal possessions.

However, if you’re cohabiting, all you’re legally entitled to is the deceased’s half of any property you held as joint tenants, which may come with the added sting of an IHT liability.

“The rules of intestacy rarely deliver what people wanted,” says Ms Deane. “If your wishes change, update your will – and if you remarry, then make a new one.”

6. Care fees

As well as being able to look after a loved one’s affairs if they’re unable to do so themselves, it’s also sensible to think about what might happen if one of you needs care.

“Local authorities look at an individual’s wealth when they assess care fees,” says Mr Charlish. “Rules vary between authorities, but although they’ll disregard the property if you both live there, half of any other joint assets will usually be taken into account.”

If you have a joint account, switching money into your own name to avoid it being spent on care fees won’t necessarily wash. Where a local authority believes you have deliberately removed some funds from the care pot – a practice known as ‘deprivation of assets’ – they will treat it as if it was still available to cover care fees.

One option for those who have their finances more entwined than they might want at this point is to purchase a care annuity. This takes into account the individual’s life expectancy and, in exchange for a lump sum, will pay a guaranteed amount for the rest of their life.

But whether deciding who benefits from your pension or where you leave your share of your home, talking about finances from the outset is key to avoiding hefty bills and considerable heartache later.

“Being upfront with your financial obligations and objectives is best to ensure you aren’t misleading, or being misled,” says Mr Roxborough. “Getting married isn’t always the best option financially. While it should always be a personal choice, make sure it’s an informed one.”

SAM BARRETT is a freelance financial journalist writing for FTAdviser.com, Insurance Post and Money Observer.

Section

Free Tag

Workflow

Source Moneywise http://bit.ly/2KX1gDp