Running a contest or a promotional giveaway is one of my favorite ways for a company to connect with their customers.

But like so many other aspects of business, I see too many people doing this wrong.

That’s OK – for now.

While it may sound simple, promotional campaigns like this aren’t as easy as just picking a name out of a hat.

You want to run a giveaway that creates brand awareness and generates a profit for your company.

When done correctly, this won’t cost much at all.

Contests can even generate some free advertising for your brand.

This is especially true if you use social media as the platform for your giveaways.

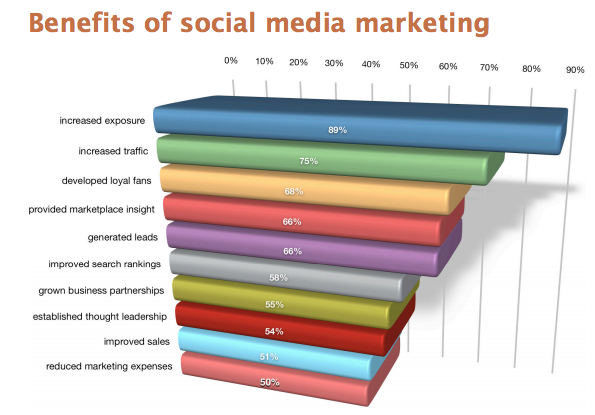

89% of marketing experts said that social media increased exposure for their company.

In addition to exposure, social media marketing:

- generates leads

- increases website traffic

- improves customer relationships

- helps search rankings

That’s what you need to remember.

Giveaways are a marketing tactic.

So if you’re not using these tools to promote your brand and ultimately increase profits, you’re doing it wrong.

I’ve got plenty of experience in this space.

I’ll show you how to run a profitable giveaway and provide some examples for you to follow as well.

Figure out what kind of contest you want to run

All promotional contests are not the same.

There are three main types of promotions that you can do.

- Contest

- Sweepstakes

- Lottery

If you’re running a contest, it means that the participants are doing something that requires some sort of skill and effort to win a prize.

Some popular contests may include a photo, video, essay, or caption.

The winners are selected by some sort of vote or judgment.

Here’s an example.

The picture that has the most likes will win this contest.

A sweepstakes, on the other hand, requires no skill, and it’s based completely on chance.

Winners get determined randomly.

Purchases, payments, and other considerations cannot determine the winner of a sweepstakes.

A lottery means that contestants made some sort of purchase or monetary consideration in order to participate.

For example, buying a ticket for a chance to be selected would count as a lottery.

Don’t do this.

In fact, state and federal laws have restrictions against these kinds of giveaways.

So it’s in your best interest to just stick to contests and sweepstakes.

Before you get started, ask yourself if you want to just give something away randomly or if you want there to be skill involved.

There’s nothing wrong with a sweepstakes, but personally, I think contests are more effective.

When your customers know that their efforts will increase their chances of winning, it gets them more engaged with your brand.

Choose the right platform

Now that you’ve decided whether or not you’re going to run a contest or sweepstakes, it’s time to figure out how where you plan to host it.

- Facebook

- Twitter

- Instagram

- Your website

- Email

All of these are viable options.

In fact, you could potentially run the same contest through multiple platforms.

Select a winner on each one.

That could get your customers to participate more than once and increase your brand exposure even more.

Here’s an example of a website contest from Fairmont Hotels & Resorts.

It’s very professional and well written.

With that said, you don’t want to limit yourself by running a giveaway solely on your website.

How often do people visit your site?

Probably not as often as they use social media platforms.

That’s why I recommend using social media as the primary platforms for your giveaways.

It’s a great way to establish brand loyalty.

The people who follow you on social media are already interested in your business.

Running a giveaway here will peak their interest even more.

Plus, any actions that they take such as liking, commenting, posting, or sharing will get viewed on the newsfeed of all of their friends.

Set a deadline

It may sound simple or obvious, but you would be surprised how often I see this mistake.

Your deadline needs to be clear, for a few reasons.

Let’s say a customer or prospective contestant wants to enter your giveaway.

If they don’t see a posted deadline, it could turn them away.

This person may just assume that the deadline has passed, even if you haven’t chosen a winner yet.

You’re missing out on a chance of getting more exposure if this customer was going to share the information on their social media platforms.

Another reason you’ll need to post the deadline is to avoid late entries.

Pretend you’re running an Instagram contest where the winner is selected by the most number of likes on a photo.

You choose a winner but a few days later someone posts a picture that gets more likes than the one you selected.

This contestant contacts you for their prize.

Now what?

You’re put in a tough situation, and overall it’s not a good look for your company.

Adding a deadline to your giveaway is too easy for you to forget.

Look at the example above.

See how easy that was?

Next time you run a promotional giveaway, make sure the deadline is clearly posted.

It will save you some headaches down the road.

Make sure the rules are clear

Piggybacking off of my last point, you don’t want to have any confusion while you’re running the contest.

Depending on your location, rules may vary from state to state.

So you’ll want to make sure that whatever you’re doing falls within legal regulations.

Here are some things are commonly included as rules for a contest:

- Eligibility (age, location, etc.)

- No purchase required

- Purchases don’t increase chances of winning

- Dates (winner chosen and winner notified)

- Judging criteria (for contests)

- Privacy laws regarding the winner identity

- Odds of winnings

If you’re running a contest on a specific platform, make sure that you’re compliant with those rules and regulations as well.

Here’s a link to the Facebook guidelines for running a promotion, which is definitely something that I recommend you review before getting started.

For example, you must acknowledge that your promotion is not endorsed, sponsored, or affiliated with Facebook (the company) in any way.

Facebook also prohibits using phrases like:

- “share on your timeline to enter”

- “post this on a friend’s page to enter”

- “tag your friends to increase chances of winning”

So while you want to encourage posts and shares, just make sure you do it within the rules.

Here’s a snippet from TMZ’s contest rules and regulations.

The full page is much longer, but they clearly and thoroughly post everything to avoid any potential confusion, liability, or legal trouble.

If you have a long page of rules, consider providing a link to your website for a full explanation.

That’s more efficient than trying to post something as long as the above example as your Instagram caption.

The prize needs to be relevant

What are you giving away?

It needs to be related and appropriate for your brand and image.

Let’s say you’re a company that specializes in snowboarding and ski equipment.

Running a contest that gives the winner round trip tickets to the Bahamas doesn’t really speak to your audience.

Flying them out to a ski lodge in Colorado would make much more sense.

If you’re giving away a physical product, include a photo of it.

Telling the contestants that you’re giving away a new camera isn’t as effective as showing them the camera.

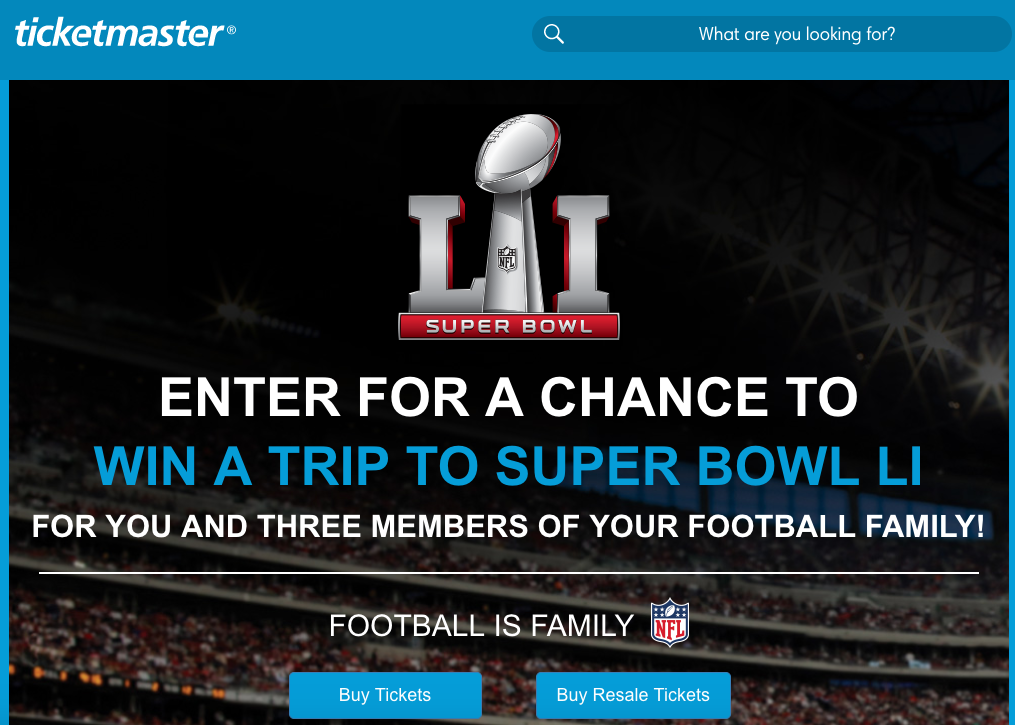

Here’s an example of a giveaway from Ticket Master.

It’s relevant.

You can buy tickets to sporting events on their website, so they’re giving customers a chance to win a trip to the Super Bowl.

Although they didn’t include an image of the actual tickets, the Super Bowl logo is just as effective.

Visuals speak to people more than words.

That’s why it’s important to incorporate them into your promotion.

Create a customized hashtag for your giveaway

Hashtags are one of the best ways to promote your brand on social media.

So come up with something unique that speaks to your company as well as the promotion.

If you’re having trouble coming up with something, you can use an online resource like Hashtagify to come up with related tags and trends for your industry.

Use that as a guide to create your own, but make sure nobody else has used it before, so there’s no confusion.

For those of you who already use hashtags successfully to promote your brand, make sure you come up with a new one for each contest.

Here’s a great example of how High Society Freeride used a unique hashtag to promote their giveaway.

Notice how they effectively used capitalization, so the hashtag pops and is easy to read.

#OneLifeMakeItCount reads much better than #onelifemakeitcount.

The hashtag can be the way you find a winner of a contest.

Just click on the hashtag to view all the pictures, videos, and posts.

That’s the easiest way to review and judge which entries were the best.

The hardest part about using a hashtag is just coming up with a creative one in the first place.

After that, it doesn’t require any effort or money from your company.

Hashtags can also increase engagement and make it easier for you to spread the word about your giveaway.

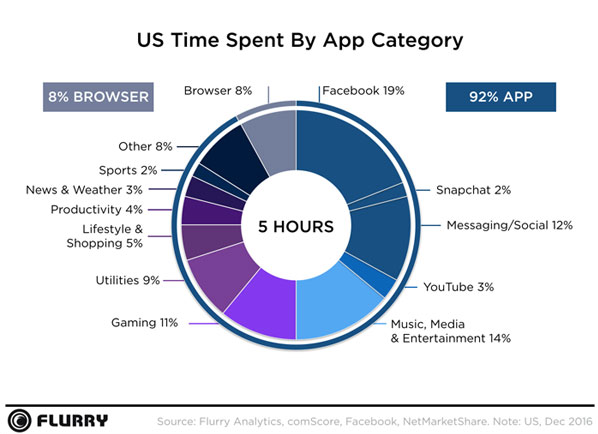

Make sure mobile users can access and participate in your contest

I mentioned earlier that you shouldn’t just run a giveaway through your website.

Keep mobile users in mind when you’re coming up with this marketing strategy.

Mobile users spend the majority of their time using apps.

So consider using platforms that are strictly for apps.

Instagram is a top choice for this.

Facebook and Twitter also have mobile applications, which is why earlier I recommended social media platforms as the top resource for giveaways.

If your company has its own mobile app, run your giveaway through there as well.

You can send users who downloaded the app notifications of the promotion directly to their phones.

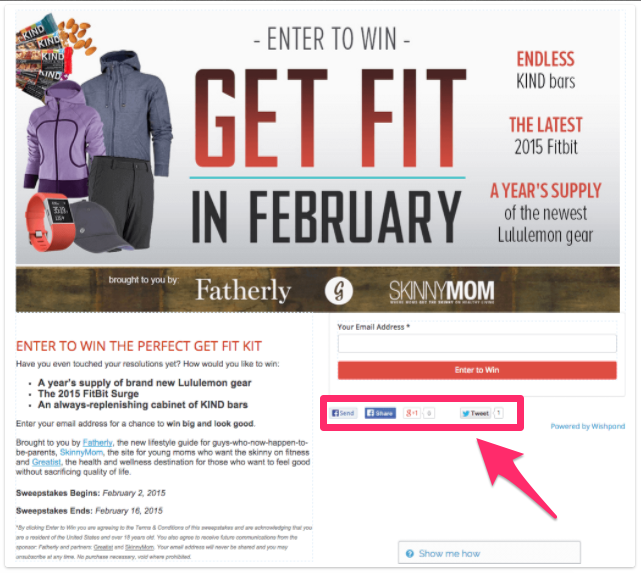

Allow contestants to share the contest with friends and family

To get the most exposure, your giveaway needs to be shareable.

Earlier I mentioned that some platforms, such as Facebook, prohibit you from using certain statements to encourage sharing.

With that said, you can still include social sharing icons on your website.

Here’s a great example of how Fatherly did this to promote their sweepstakes.

Again, the whole idea behind this giveaway is to turn a profit for your company.

Allowing users to share this content will drive more traffic to your site and potentially improve conversions as well.

Notify everyone when you’ve selected a winner

This relates back to what we talked about earlier about establishing a timeline.

Take your deadline one step further.

For example, the date for participants to enter your promotion may be the last day of the month.

However, it could take you up to a week or two to go through all of the entries and select a winner, especially if it’s a contest with lots of participants.

So make it clear when a winner has been announced.

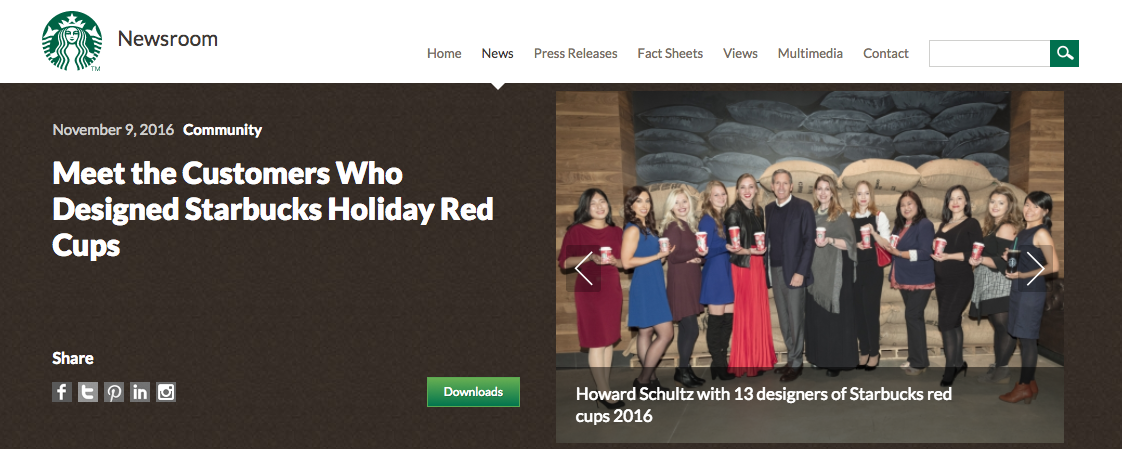

Look how Starbucks does this to announce the winners of their red cup contest.

Make sure you have the winner’s consent if you’re going to reveal their identity.

All of that should be clearly outlined in the rules (which we discussed earlier) to avoid any problems or confusion.

Conclusion

Don’t run a giveaway without a clear goal or reason.

Like every other business decision you make, this will require some thought and planning.

First, you need to determine which kind of giveaway you’re going to run.

If you want the winner to be completely random, you should hold a sweepstakes.

Contests are better if you want there to be some sort of skill, voting, or judgment involved in determining the winner.

Run the contest on multiple platforms.

Social media works best for establishing customer loyalty and increased brand awareness. It also makes the promotion more shareable.

Set a deadline and clearly post all of the rules for your giveaway.

Make sure your prize is relevant to your brand.

Creating a unique and customized hashtag will help you promote your brand and get more recognition.

When it’s over, make sure you announce to everyone that a winner has been selected.

What do you do after that?

Continue to run more contests!

If you follow these tips, it will be profitable for you every time.

What unique hashtag will you come up with to promote your giveaway on Instagram?

Source Quick Sprout http://ift.tt/2hlMIjY