To some, email marketing can seem antiquated and even prehistoric when compared to more cutting-edge tactics such as SEO, social media, and mobile optimization.

Although it may not be the sexiest of strategies, there’s no denying that it still gets results.

In fact, “email is 40 times more effective at acquiring new customers than Facebook or Twitter.” Just take a look at how it compares with other methods:

Also, you are six times more likely to get a click-through from an email campaign than you are from a tweet.

What about ROI?

For each dollar spent, email has an average ROI of $38. Impressive. Here’s how Adobe paints the picture:

And it gets better.

Email marketing is easy.

Check out this data from MarketingCharts.com:

Email tops the list of “most effective” digital marketing tactics. But look! It’s also easy!

Results? ROI? Easy? Effective?

Email marketing is killer. It works. It’s awesome. You need to do it.

But in order to truly harness the power of email marketing, it’s important to understand the psychology behind it and to know how to write emails that get results.

The statistics say that email marketing is effective. But statistics tell only part of the story. Statistics can’t predict whether your email marketing efforts will be effective.

In order to create a successful email marketing campaign, it’s crucial to know the tricks of the trade. Getting people to notice your emails, open your emails, click on the stuff in your emails, and respond to your emails is tricky.

Here are the fundamentals of what I’ve learned over the years.

1. Getting emails opened

Half the battle is getting prospects to open your emails.

Research from HubSpot found that companies with 1-10 employees typically receive a median open rate of 35.3% and companies with 26-200 employees receive a median open rate of 32.3%.

Here’s another look at the stats from SmartInsights. Find your industry in the list, and see how your open rates compare:

These numbers aren’t exactly staggering.

I’ve found that the key to maximizing my open rate is making my emails as personal and interesting as possible.

For instance, I suggest using your first name as your from address.

Why do I suggest this?

The data says so. In one survey, researchers asked “What most compels you to open a permission based email?”

I know what would get me to open an email: the from line!

Do I trust the sender? Do I want to hear from them? Do I like what they write? Is it going to help me in some way?

The best way for me to find that out is by looking at who sent the information.

Just take a look at these numbers. The from line is leading the subject line by double!

Most people are already drowning in emails and don’t want to open something from some questionable corporate entity. But many are willing to open something from a real person, who is reaching out to them one-on-one.

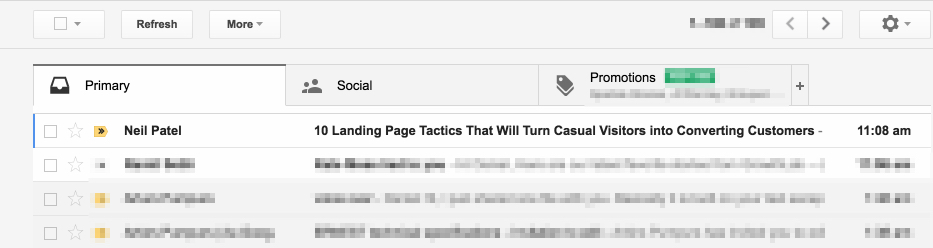

If you are signed up to receive emails from me, you expect to see “Neil Patel” in the subject line.

I wrote the email, so I might as well be the one sending it.

Besides, it gives you, the reader, the authentic sense that you’re hearing from me as a person, not some disembodied email marketing software.

2. Writing a captivating subject line

If your subject line is uninteresting, uninspiring, or mediocre, your email is likely to get passed over. Also, if it gives off a spammy—used car salesman—kind of vibe, it’s probably going in the trash.

How do you grab attention with the subject line?

I’ve found that addressing a common issue or concern works well.

For example, you might promise that the contents of your email can help solve a problem, provide readers with valuable information to improve their lives, or make them happier.

Buffer knows that their audience wants to hear about social media tips. That’s why they use subject lines like this one:

Throwing in some power words that stimulate readers and appeal to their emotions can have a tremendous impact as well.

Here are just some of the power words you can use:

- amazing

- mind-blowing

- jaw-dropping

- blissful

You get the idea. I recommend that you check out this list of 317 power words from Smart Blogger for more ideas.

Here’s something I do to save time and effort and increase effectiveness of my email campaigns: I use or repurpose my blog article titles as my email subject lines.

This doesn’t work for every industry or email marketing campaign, I know. But it works for me. The goal of my email marketing efforts is to help people with great content. That content, of course, lives on my blog. So, I might as well use the title of my article as my subject line.

3. Pique their curiosity

Finally, you’ll want to make it so that readers are so intrigued by the subject line that they can’t resist opening your email.

You’ll want to pique their curiosity and leave an information gap that can be filled only by clicking.

For instance, a B2B company might use a subject line such as “How to Double Your Sales in Just 30 Minutes.”

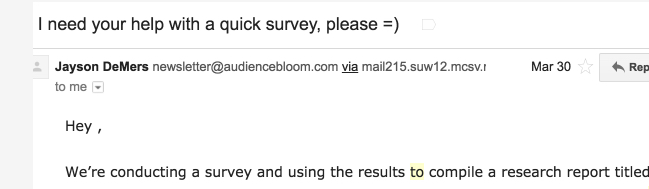

One of my highest open rates came from an email I sent asking for people’s help. I genuinely needed and wanted the response of my readers.

When I asked for readers’ help, it created an information gap between my request and the point of my request. Why did I need help? The result was an insane level of open rates.

I’ve seen other great marketers do the same thing. Jayson DeMers, for example, created this email subject line that caught my attention:

He even used a smiley face.

4. Writing a killer opening line

Now that you’ve gotten readers to open your email, you need to draw them in deeper with an awesome opening line.

This is probably more important than you might think.

Why do I say this?

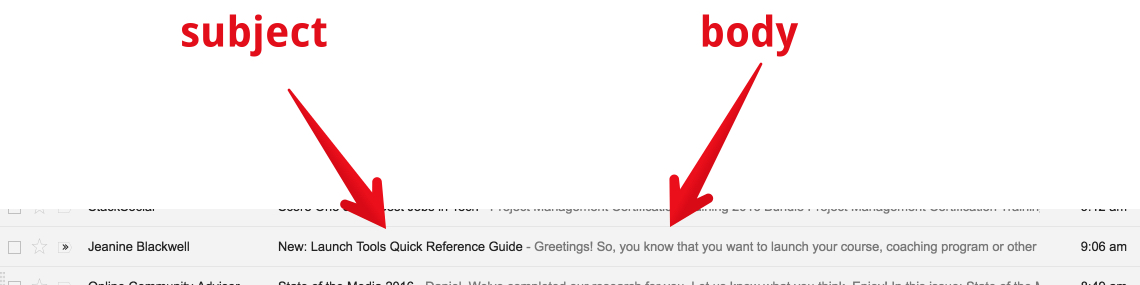

Because the subject line isn’t always the first thing that people see!

GASP!

Yeah, I know you’ve been told that the subject line is the most important element of an email. As I explained above, however, the from line seems to have a higher level of impact on whether or not the email gets opened in the first place.

But is that all? The from line and the subject?

No. The first line of the email is important too.

Most email browsers today display a portion of the message directly in the email browser. You don’t have to open the email to read a small section of it.

Depending on the length of the subject line (and the viewport of the browser), the body of the email has two or three times as much visibility!

It’s not just desktop email programs that do this, though. Don’t forget about mobile devices!

Most mobile email apps show the opening line.

So, what do you write in your opening line?

I like addressing each reader by their first name. This comes across as being personal and authentic, which is key for getting them to read on.

I also like to avoid the classic “Hi, my name is…” routine.

Instead, I prefer to opt for something like “I noticed that you…” or “I saw that we both…”

This approach helps the reader relate to me better and faster. I gain their attention by drawing upon a shared experience.

Make sure you get to the point of your email from the get go. Preliminary chatting might turn off people who simply want to find out what the email is about.

Just get right to the point so that you can make an instant connection.

Notice how Jacob McMillen did this in his email:

Writing like this will earn the respect of your readers. You value their time. You give them what they need. They get on with their lives.

5. The body

This is where it’s time to really connect with your reader. It’s your opportunity to show how your product/service can provide them with real value and improve their life.

I suggest keeping it short and simple and not overloading your reader with extraneous information.

Remember, the point here is to gain their attention and build some initial rapport. You’re just looking to warm them up to advance them through the sales funnel.

You’re not necessarily going for the jugular right away.

Be sure to break up text into short, digestible paragraphs.

I also suggest speaking in second person and using you when speaking to readers.

Ask personal questions to give your email an intimate feel as if you’re talking face-to-face.

I think HubSpot gives some good examples of this:

- Do you have unanswered questions about [topic]?

- How, if at all, would you like to improve your strategy?

- Is [benefit to them] a priority for you right now?

If you’ve ever read Ramit’s emails, you know he does a great job with this. The paragraphs are short. The tone is personal. And the whole point of the email is spot on: it’s filled with helpful, actionable information.

6. Nailing the closing

Besides the subject line, the closing is arguably the most important part of an email.

It’s the point where a reader will decide whether or not they want to act on your offer and proceed any further.

The goal here is to wind down and transition into a well-crafted call to action (CTA).

What do you want them to do next?

Maybe it’s to check out a landing page, sign up for a course, download an e-book, or straight up buy a product/service.

Whatever it may be, your CTA needs to be crystal clear.

Tell them exactly what you want them to do next, and make sure there’s no guessing what that action is.

Some of us have the mistaken idea that we need to sneak in the CTA or somehow hide it in the email so it’s not so obvious. Please don’t make this mistake.

Your CTA is the money of your email—the reason why you’re sending it in the first place. Make it strong, unmistakable, and absolutely clear.

This email from StackSocial, while not exactly personal, does have a great CTA. You can see it directly in the body of the email—the place where my eyes are first going to look.

7. Creating urgency

Here’s another thing I’ve learned.

Many people have a tendency to procrastinate. Maybe they’re wrapped up in something at the moment or just aren’t in the mood to complete your desired action right now.

This is no good because once they close an email, the odds they’ll come back to it are slim to none.

That’s why it’s vital to create urgency so that they feel compelled to take action right away.

Most marketers complain that the “most challenging obstacle” to their email marketing is getting people to take action by clicking on the call to action (or whatever the click goal of the email is).

I’ve found that setting a tight deadline tends to work well for this.

For example, you might say that an “offer expires tomorrow,” or “get it before it’s gone,” or “only 10 spots left.”

This is essential for getting a prompt reply.

Conclusion

The bottom line is that email still matters and can be just as effective as many of the newer marketing tactics.

It’s easy to get distracted by creating a sizzling-hot Twitter strategy, building a Facebook group, or starting your live video channel.

Those are all great things, and I don’t discourage you from implementing them.

But email still works—although not on its own.

To truly get results, it’s necessary to follow the right formula and understand the mindset of your readers.

By following these techniques, you should be able to increase both your open rate and response rate.

How does email marketing stack up against your other primary marketing channels in 2016?

Source Quick Sprout http://ift.tt/2b8iJVk