الخميس، 13 ديسمبر 2018

Whole Foods is officially breaking up with Instacart

Source Business - poconorecord.com https://ift.tt/2GcMO9m

Here’s How to Stay Jolly and Make Money if You’re Alone for the Holidays

Back when I was a struggling 22-year-old, I had a job working the night shift. Since I had the least seniority, I also had to work weekends and holidays.

Christmas was a drag that year, and don’t even get me started on New Year’s Eve.

I basically spent the holidays alone.

This was in the days before the internet, so all there was to do during my off hours was read, watch TV and build tiny snowmen on the window ledge of my second-floor apartment.

If you’re flying solo this holiday season, you’ve got a lot more options than I did, and you can even make some cash while you’re at it.

Here are some of our favorite ways to make extra money if you’re alone on Christmas.

Rent Your Spare Room

The holidays are peak travel time, and that means people need a place to stay. Why not list your spare room, or even your couch, to travelers who need a place to crash?

If you’re a good host with a desirable space, you could add hundreds — even thousands — of dollars to your savings account with Airbnb.

And there’s no reason you can’t be creative. We even found a guy who listed a backyard tent on Airbnb as a joke back in 2015 and ended up earning $1,380 a month.

Get to Know Your Neighborhood

The holidays are a great time to learn more about your neighborhood and pick up a little money at the same time.

Download the Shopkick app to make some passive income while you’re wandering around town checking out local shops, parks and attractions.

Once you sign up, the app pays you in “kicks†for walking into certain stores (including Walmart, Target, T.J.Maxx and more). You can redeem them for gift cards to a number of retailers, including Amazon, Target, Walmart, Starbucks, Sephora and Best Buy.

It pays you even more kicks for photos of receipts that include qualifying items you purchased in-store with a connected credit or debit card. You can also earn kicks for online purchases. You don’t have to do anything; your linked cards will automatically apply your kicks.

But don’t make the mistake of buying things you don’t need just for kicks. You know better than that.

If you’re working on dropping a few pounds and will be walking around anyway, be sure to sign up with HealthyWage before you head out the door. You could win up to $10,000 just for meeting your weight loss goals.

Lend a Hand

If you’re alone on Christmas, but want to spend time around other people during the holidays, learn how to market yourself as available to help lend an extra hand this time of year.

Some families hire senior concierges to drive seniors to doctor appointments and errands, assist with minor housework or simply keep them company during the hectic holiday season.

For parents dealing with school breaks, last-minute holiday shopping and grown-ups-only year-end parties, baby-sitting services are in high demand during the holidays.

Pet sitters and house sitters are invaluable to people traveling or away from home for long stretches.

For an easy way to find and arrange these types of gigs, check out Care.com, a nationwide company that connects family members to independent home care providers.

Browse the site to read notifications from families seeking a caregiver to provide one or more home-based services, including:

- Child care.

- Adult and senior care.

- Errands and odd jobs.

- Pet care.

- Special-needs provider.

- Home care.

Create a profile outlining your skills and qualifications, then search for jobs in your area of interest. Families review applicants, check references, interview candidates and hire caregivers right through the platform.

Whatever the reason you’re on your own over the holidays, take it from me: Getting out of the house and making some extra cash beats idly building tiny snowmen on a window ledge to pass the time. Â

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2BgzoDv

3 Little-Known Steps to Take When You Get a Big Medical Bill

Hospitals are money pits.

A trip to the emergency room or any surgical procedure can leave you facing huge medical bills. Enormous, gigantic, massive medical bills.

When you get a bill for thousands and thousands of dollars, it’s practically enough to give you a coronary and land you back in the hospital.

Little-Known Strategies to Pay off Medical Debt

Millions of Americans have medical debt. We’ve got some advice you might not hear anywhere else.

Here are three little-known steps you should take to pay down those bills.

1. Let This Company Help You Pay off the Debt

When you think about how much overall debt you have, you might feel a little anxious. All those payments can be overwhelming when you start to juggle medical bills.

That’s where a company like Fiona can be helpful. It can help you find personalized lending options to refinance or consolidate your credit card debt to potentially save thousands dollars in interest.

Fiona will show you all the lenders willing to help you pay off your credit cards and eliminate the headache of paying bills by allowing you to make one payment each month.

You can borrow up to $100,000 (no collateral needed) and compare interest rates, which start at 4.99%. The idea is to secure a loan at a lower interest rate, potentially helping you save thousands. Repayment plans range from 24 to 84 months.

Take, for example, Katherine, who faced $12,000 in credit-card debt. Holding her back? The 15.24% interest rate. By refinancing with a 5%-interest, seven-year personal loan, she saved $12,000 in interest.

If she’d kept on the same road, she would have paid something like $14,000 in interest alone over 25 years. Yikes.

So even if you’re simply curious about what’s out there, know that checking rates on Fiona won’t hurt your credit score — and can probably save you in interest.

2. Protect Your Credit From Bill Collectors

Are unpaid medical bills hurting your credit score? Your credit report will tell you.

Get your credit score and “credit report card†for free from Credit Sesame. This website breaks down exactly what’s on your credit report in layman’s terms, how it affects your score and how you might address it.

And don’t worry: If you can’t pay off your medical bill immediately, you’re not alone.

More than 43 million Americans have medical debt, according to the Consumer Financial Protection Bureau.

Not only that, but one in five Americans who have medical insurance have unpaid, past-due medical bills, according to a FINRA Investor Education Foundation study.

If you’re one of them, Credit Sesame can help you keep an eye on your credit. More than half of all collections that are listed on credit reports are associated with medical bills.

3. Negotiate Your Medical Bills

If you’re facing a staggering, scary number, you probably don’t have to pay as much as they’re asking. You can negotiate the price of treatment with your both your provider and your insurance company, and you can approach the negotiation from a number of angles.

If you simply state the total is too high for you to afford, you might be able to score a discount if you can pay a large chunk of the bill up front or in cash.

Even if your provider says no, your lowball starting move primes the negotiation for a lower endpoint. And with the ridiculous premiums charged, 10% to 20% off the bill isn’t much to the provider, even if it’s a sizeable chunk of your lifetime savings.

If you don’t have a lump of cash to hand over in exchange for a deduction, you can probably get on a payment plan with the hospital. Although doing so may not lower your total significantly (or at all), you’ll avoid a negative factor on your credit report and have a concrete, manageable plan for getting rid of your debt.

Mike Brassfield is a senior writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2Qx065q

How This Busy Mom Made $1,000 in Cash Back From Her Online Purchases

Aimee B. juggles a corporate 9-to-5 career and manages a blog while raising her son.

Sometimes she’s forced to trade bedtime stories for business dinners, but she’s always sure to video chat her “little man†to say goodnight.

“My time is worth a lot,†Aimee says. “An hour of my time saved is absolutely worth its weight in gold.â€

So she does the majority of her shopping online — about 90% of it, she estimates. She stocks up on groceries, clothes and household necessities without leaving home.

She’s always after a bargain, too. Actually, in the past two years, Aimee has recouped $1,000 while shopping online.

How?

She signed up for Paribus, a price-adjustment tool that helps you get money back for your online purchases when an item’s price drops.

How to Claim Cash Back You’re Owed

Many retailers have price-adjustment policies. That means if you’ve purchased an item and its price drops during a designated timeframe, you’re entitled to compensation — typically a refund of the difference.

Say you buy a toaster for $19.99, and its price drops to $14.99 a few days later. Depending on the retailer, you’re entitled to that $5 difference.

But here’s the catch: Aimee, like many of us, is busy. She doesn’t have time to keep a log of her online purchases and each retailer’s price-adjustment policy.

That’s where Paribus steps in. It tracks your online purchases for you.

When Aimee heard about Paribus from Capital One® , she wanted to give it a try. All she had to do was sign up with her email address. Easy enough.

Since then, she hasn’t had to do a whole lot to earn that $1,000 cash back.

When Paribus detects a price drop, it sends her an email. It’ll either let her know it’s already claimed the difference for her and that her card will be credited, or it’ll outline simple instructions on how to contact the retailer.

“It’s kind of a no brainer,†Aimee says. “I gave somebody [Paribus] my email, and over the last two years they have given me a thousand dollars.â€

Paribus is totally free to sign up for and use. There’s nothing to lose — just cash back to gain.

Brought to you in partnership with Paribus. To sign up for Paribus, use the email address you use for online shopping receipts. Paribus scans your inbox for receipts from stores they monitor. Savings may vary based on purchase type and merchant.

Carson Kohler (carson@thepennyhoarder.com) is a staff writer at The Penny Hoarder.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2EqRAOM

These Steps Will Help You Pay Off Debt When You Make Less Than $50,000/Year

Lots of us make less than $50,000 a year. We’re not doctors or lawyers or CEOs. We’re not the people who are buying luxury cars, first-class airline tickets or bottle service at the club.

We have to think twice every time we buy new shoes or a steak dinner.

And that makes it tougher to pay off our debts. Because the cost of living is so expensive, we rarely have much left to pay down the balances on our loans and credit cards.

You can still do it, though. We have some ideas for you.

Most of Us Earn Less Than $50K

A lot of us are in the same boat, you know. Roughly 70% of American workers earn less than $50K, according to the Social Security Administration. The average salary is nearly $47,000, but that average is a little skewed by the high earners who are pulling in six figures. The median salary — the one right in the middle — is more like $30,000.

Here’s a more painful statistic:

The average household with credit card debt has a LOT of it: $16,748, according to a survey by NerdWallet.

How can you possibly pay off your debts?

We’ve got tips for how to come up with the extra money you’ll need.

1. Let This Company Pay Off Your Credit Cards

When you think about how much debt you have, you might feel a little anxious — especially if you’re earning less than $50,000.

That’s where a company like Fiona can be helpful. It can help you find personalized lending options to refinance or consolidate your debt to potentially save thousands of dollars in interest.

Fiona will show you all the lenders willing to help you pay off your credit card and eliminate the headache of paying bills by allowing you to make one payment each month.

You can borrow up to $100,000 (no collateral needed) and compare interest rates, which start at 4.99%. The idea is to secure a loan at a lower interest rate, potentially helping you save thousands. Repayment plans range from 24 to 84 months.

Take, for example, Katherine, who faced $12,000 in credit-card debt. Holding her back? The 15.24% interest rate. By refinancing with a 5%-interest, seven-year personal loan, she saved $12,000 in interest.

If she’d kept on the same road, she would have paid something like $14,000 in interest alone over 25 years. Yikes.

So even if you’re simply curious about what’s out there, know that checking rates on Fiona won’t hurt your credit score — and can probably save you in interest.

2. Find Out if You’re Paying Too Much for Car Insurance

You’re probably overpaying for car insurance. And how would you know, really?

Have you shopped around lately? Have you compared rates from the 20 largest auto insurers that do business in your area? That sounds kind of difficult and time-consuming, doesn’t it?

Fortunately, a service called Gabi will do it for you, and you don’t even have to fill out any forms. Simply link your insurance account and provide your driver’s license number, and Gabi will go to work.

Once you link your insurance account to Gabi, it will:

- Scan your existing insurance plan.

- Analyze what coverage you have.

- Compare the major insurers’ rates for that same coverage.

- Help you switch on the spot if it finds you a better rate.

Gabi says it finds an average savings of $720 per year for its customers.

It is a true apples-to-apples comparison at the same coverage levels and deductibles you currently have. Once you sign up, you never have to shop again. Gabi’s software has your policy on file and keeps on monitoring for savings as your life changes.

3. Find Some Hidden Cash

Before you start hashing out a plan to tackle your debt, it might make you feel better to find areas in your life where you can save. Then you can funnel that money directly toward those outstanding balances.

Sure, a lot of us know how to save money on groceries, but what about everything else?

For consistent savings, download Truebill, an app that’ll negotiate your bills, cancel unwanted subscriptions and refund your bank fees. On average, Truebill customers get $12 in credits off their cable bills each month.

You can also try digging up some extra cash with Paribus — a tool that gets you money back for your online purchases. It’s free to sign up, and once you do, it will scan your email for any receipts. If it discovers you’ve purchased something from one of its monitored retailers, it will track the item’s price and help you get a refund when there’s a price drop.

One of our favorite ways to save on everything is with Ebates, a cash-back site that rewards you nearly every time you buy something online. For example, Ebates gives you 10% cash back on online purchases at Walmart. Plus, you’ll get a free $10 gift card to Walmart for giving the site a try.

Disclosure: Paribus compensates us when you sign up using the links we provide.

4. Earn Rewards When You Repay Your Debt on Time

When you were a kid, your mom probably gave you an allowance for washing the dishes and sweeping the floor. Now all you get for doing that is a kitchen that’s clean for, like, 15 minutes.

Now that you’re a grown-up, you no longer get rewarded for just doing the things that are expected of you — like, for instance, paying bills on time.

Not until now, anyway. MoneyLion, a free app for managing your personal finances, will reward you for things like paying your bills and monitoring your credit — even just setting up an account in the app.

Much like that childhood allowance, it’s basically bribing you to be good.

You’ll earn points in the app’s rewards program, and you can redeem them for gift cards to more than 15,000 retailers, including places like Walmart, Applebee’s and Amazon.

If you want to take it a step further and work on paying down debts, for example, MoneyLion can help with a loan to consolidate your debt and potentially reduce your interest rates. And it’ll reward you for that, too!

5. Start Saving Without Trying

Saving money is tough. So what if you could do it in a way where you wouldn’t even notice?

Digit makes that possible.

This innovative app automates saving for you. Simply link it to your checking account and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

Bonus: Penny Hoarders will get an extra $5 just for signing up! Additionally, savers will receive a 1% bonus every three months.

Using this set-it-and-forget-it strategy, one Penny Hoarder saved $4,300 without noticing — read his Digit review.

If you need that money sooner than expected, you’ll always have access to it within one business day.

Digit is free to use for the first 30 days, then it’s $2.99 per month afterward.

Bonus: Make Extra Money Hanging Out With Pups

If you’re looking for a flexible, independent way to earn money — and you love hanging out with dogs — Rover might be your perfect gig.

The online network connects dog walkers and sitters to local dog owners through its 4.9-star-rated app, so you don’t have to staple flyers on every utility pole across town.

Rover says sitters can earn as much as $1,000 a month.

Rover dog-sitter requirements vary by location. In general, you must:

- Be 18 years or older.

- Pass a background check.

- Have access to the Rover app (iOS or Android).

Here’s how it works: You’ll create an online sitter profile where you’ll answer questions about your experience with puppers and your schedule availability.

You can choose to offer a variety of services, including dog walking, overnight boarding at your home or theirs and daycare. Boarding is the app’s most popular service, so offering it can get you more gigs. You set your own rates. (Rover keeps a small percentage as a service fee.)

Dog owners will reach out to you. Accept which gigs you want, then start snugglin’ pups. As soon as you complete a service, you’ll be paid within two days.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2PC9I9s

This Company Can Help You Pay off Your Credit Debt Faster and Save Money

When you think about how much credit card debt you have, you might feel a little anxious.

A lot of us are being crushed by credit card interest rates north of 20%. That means if you can only make minimum payments every month, your balance is going up and up with high interest.

It’s like you can never get a break.

Let This Company Help You Pay off Credit Card Debt Faster

If you’re in that boat, consolidation and refinancing might be worth a look.

That’s where a company like Fiona can be helpful. It can help you find personalized lending options to refinance or consolidate your debt to potentially save thousands of dollars in interest.

Fiona will show you all the lenders willing to help you pay off your credit card and eliminate the headache of paying bills by allowing you to make one payment each month.

You can borrow up to $100,000 (no collateral needed) and compare interest rates, which start at 4.99%. The idea is to secure a loan at a lower interest rate than you’re paying on your credit cards, potentially helping you save thousands of dollars. Repayment plans range from 24 to 84 months.

Take, for example, Katherine, who faced $12,000 in credit card debt. Holding her back? The 15.24% interest rate. By refinancing with a 5%-interest, seven-year personal loan, she saved $12,000 in interest.

If she’d kept on the same road, she would have paid something like $14,000 in interest alone over 25 years. Yikes.

So even if you’re simply curious about what’s out there, checking rates on Fiona won’t hurt your credit score — and can probably save you money.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2QvfYFl

6 Simple Steps to Paying Off Up to $100,000 in Credit Card Debt

Many of us carry credit card debt.

It’s an unfortunate fact, and it’s becoming more and more commonplace in today’s society.

But getting rid of your debt doesn’t have to be this huge life event. It doesn’t have to take days and days of strategizing, years and years of strict budgeting or even decades and decades of payments.

Trust us: You can — and you will — make it out.

You just have to know where to start.

6 Simple Steps to Get Rid of Up to $100,000 in Credit Card Debt

The key to paying off your debt is to not become overwhelmed. It’s easy to build it up in your head until it’s this huge, mountainous task that’s impossible to scale.

Nope! Don’t let that happen. Instead, take away the stress and follow these simple tips to embark on your debt-payoff journey.

1. Let This Company Pay off Your Credit Cards Upfront

When you think about how much debt you have, you might feel a little anxious.

That’s where a company like Fiona can be helpful. It can help you find personalized lending options to refinance or consolidate your debt to potentially save thousands of dollars in interest.

Fiona will show you all the lenders willing to help you pay off your credit card and eliminate the headache of paying bills by allowing you to make one payment each month.

You can borrow up to $100,000 (no collateral needed) and compare interest rates, which start at 4.99%. The idea is to secure a loan at a lower interest rate, potentially helping you save thousands. Repayment plans range from 24 to 84 months.

Take, for example, Katherine, who faced $12,000 in credit card debt. Holding her back? The 15.24% interest rate. By refinancing with a 5%-interest, seven-year personal loan, she saved $12,000 in interest.

If she’d kept on the same road, she would have paid something like $14,000 in interest alone over 25 years. Yikes.

So even if you’re simply curious about what’s out there, know that checking rates on Fiona won’t hurt your credit score — and can probably save you in interest.

2. Start Trimming Your Monthly Bills

If you can cut down your monthly bills, it will leave more money to pay down your debt faster. But we’ve all got inescapable monthly bills. In terms of fixed expenses, your car insurance bill probably ranks right up there with your rent or mortgage payments.

Well, we’ve got some good news and bad news about car insurance: You’re probably overpaying.

But how would you know, really? Have you shopped around lately? Have you compared rates from the 20 largest auto insurers that do business in your area? That sounds kind of difficult and time-consuming, doesn’t it?

Fortunately, a service called Gabi will do it for you, and you don’t even have to fill out any forms. Simply link your insurance account and provide your driver’s license number, and Gabi will go to work.

Once you link your insurance account to Gabi, it will:

- Scan your existing insurance plan.

- Analyze what coverage you have.

- Compare the major insurers’ rates for that same coverage.

- Help you switch on the spot if it finds you a better rate.

Gabi says it finds an average savings of $720 per year for its customers.

It’s a true apples-to-apples comparison at the same coverage levels and deductibles you currently have. Once you sign up, you never have to shop again. Gabi’s software has your policy on file and keeps on monitoring for savings as your life changes.

3. Clean Up Your Credit Cards and Find Some Hidden Cash

Have you ever asked yourself: “Where the heck does all my money go? How is my credit card bill that high again this month?â€

It’s time to take a few minutes to clean up your tab. You can negotiate your bills, cut unnecessary subscriptions and wipe out bank fees with a service called TrueBill.

Yup. Download TrueBill, and it’ll negotiate your bills, cancel unwanted subscriptions and refund your bank fees for you. On average, TrueBill says it helps customers save more than $700 a year.

You can also try digging up some extra cash with Paribus — a tool that gets you money back for your online purchases. It’s free to sign up, and once you do, it will scan your email for any receipts. If it discovers you’ve purchased something from one of its monitored retailers, it will track the item’s price and help you get a refund when there’s a price drop.

Another way to save money? Shop through Ebates, a cash-back site that rewards you nearly every time you buy something online. For example, Ebates gives you 10% cash back on online purchases at Walmart. Plus, you’ll get a free $10 gift card to Walmart for giving the site a try.

Disclosure: Paribus compensates us when you sign up using the links we provide.

4. Earn Rewards When You Pay Off Your Debt on Time

When you were a kid, your mom probably gave you an allowance for washing the dishes and sweeping the floor. Now all you get for doing that is a kitchen that’s clean for, like, 15 minutes.

Now that you’re a grown-up, you no longer get rewarded for just doing the things that are expected of you — like, for instance, making payments toward your debt on time.

Not until now, anyway. MoneyLion, a free app for managing your personal finances, will reward you for things like paying your bills and monitoring your credit — even just setting up an account in the app.

Much like that childhood allowance, it’s basically bribing you to be good.

You’ll earn points in the app’s rewards program, and you can redeem them for gift cards to more than 15,000 retailers, including places like Walmart, Applebee’s and Amazon.

If you want to take it a step further and work on paying down debts, for example, MoneyLion can help with a loan to consolidate your debt and potentially reduce your interest rates. And it’ll reward you for that, too!

5. Start Saving Without Even Trying

Although you’re taking strides to pay off a chunk of debt, you can’t forget about your emergency savings. If something were to happen, you could land in another pile of debt — and the cycle would sadly continue.

But here’s a simple way to save money while paying off debt: Use Digit, an innovative app that automates saving for you. Simply link it to your checking account, and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

Bonus: Penny Hoarders will get an extra $5 just for signing up. Additionally, savers will receive a 1% bonus every three months.

Using this set-it-and-forget-it strategy, one Penny Hoarder saved $4,300 without noticing — read his Digit review.

If you need that money sooner than expected, you’ll always have access to it within one business day.

Digit is free to use for the first 30 days, then it’s $2.99 per month afterward.

6. Increase Your Income if Necessary

If you’re still struggling to make payments toward your debt, consider taking on a flexible side gig. Plan to put your extra income directly toward your debt.

One fun option that will take your mind off your debt? Playin’ with pups!

Rover just might be your perfect gig.

The online network connects dog walkers and sitters to local dog owners through its 4.9-star-rated app, so you don’t have to staple flyers on every utility pole across town.

Rover says sitters can earn as much as $1,000 a month.

Rover dog-sitter requirements vary by location. In general, you must:

- Be 18 years or older.

- Pass a background check.

- Have access to the Rover app (iOS or Android).

Here’s how it works: You’ll create an online sitter profile where you’ll answer questions about your experience with puppers and your schedule availability.

You can choose to offer a variety of services, including dog walking, overnight boarding at your home or theirs, and day care. Boarding is the app’s most popular service, so offering it can get you more gigs. You set your own rates. (Rover keeps a small percentage as a service fee.)

Dog owners will reach out to you. Accept which gigs you want, then start snugglin’ pups. As soon as you complete a service, you’ll be paid within two days.

Carson Kohler (@CarsonKohler) is a staff writer at The Penny Hoarder. She’s a very anxious person, so she totally understands how big financial to-do tasks can quickly become overwhelming.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

source The Penny Hoarder https://ift.tt/2SJMqR1

Apple plans new $1 billion Texas campus, 5,000 more jobs

Source Business - poconorecord.com https://ift.tt/2UFa6rz

How to Buy a Domain Name

Your domain name is very important. It would be a mistake to gloss over the process of coming up with a name. If you take your project seriously, then you need to start off on the right foot with your name. After all, it’s going to be with you for the lifetime of whatever business or project you intend to use the domain for.

Many of the guides on how to buy a domain name or how to build a website tend to gloss over this process as well. It is often assumed that the best approach is to just register whatever domain name is available and call it a day. I think this is a big mistake.

There’s nothing wrong with registering a domain name that is available, as long as you’ve thought it through and are intentional about it. In fact, I would encourage that. The issue is that in many cases, people don’t even realize that there are other options. Getting your hands on the optimal name is more doable than you might think.

In this guide, I want to walk you through my process for buying a domain name, starting with how I go about coming up with a name in the first place.

Understand the Cost of a Domain Name

First and foremost, I suggest that you do put some budget behind your domain name — especially if it’s for your business. If your budget is tight, then you’ll be more limited in what you can do.

There are two options when it comes to getting your domain name

- Register a name that isn’t already currently registered.

- Acquire a name that is already registered from the person or company that owns it.

Regardless of which option you go with, you’ll still need to pay the annual registration fee of $7–$15/year on average.

The cost of acquiring a domain name will vary widely: You can easily spend 4–5 figures on a name. In some cases you can find a good one for hundreds of dollars. Some domain names aren’t for sale at all, while others have sold for millions of dollars.

Brainstorm Concepts and Ideas

Before you even think about buying a domain name, you’ll need to do some ground work.

Get creative, because it’s time to do some brainstorming.

Your domain name is going to be used for something. Maybe a business, or a campaign, or maybe just a blog. And you probably already have some ideas around what it’ll be called, so you’ve already started the process.

Create a Concept List

I like to call this a concept list. It’s the list before your final name list. It isn’t necessarily names, but for now, just concepts.

Take your project and write down of all the words, descriptors, phrases, ideas, mantras, etc. that come to mind. Come up with as many words as possible. Use a thesaurus to help.

I personally find a mind map useful for this process.

Create a List of Potential Names

Once you have a thorough concept list, you can develop a more refined list of potential names. Start by listing all the names that you like. Since you might not have an unlimited budget, make sure you dig deep here. You can’t be too picky yet, because that will end up limiting your options. Write everything down that you think might work.

Narrow Down The List According to Viability

You can narrow your list down quickly just by typing in the .com for each name that you like. Type it into your browser and see what is there.

- If there is an established website built on the domain name, cross that off your list. It is very unlikely to be a viable option.

- If nothing comes up at all, then keep it on your list. That could mean that the domain name isn’t registered yet, which is great!

- If a landing page with ads comes up, that means the domain name is parked. It is owned by someone already, but might be an acquisition target. Keep this on your list.

- If the domain name is for sale, then that is the best case scenario. That’s exactly what we are looking for. Keep it on your list, and take note of the listed price if there is a listed price.

I find that my best domain names are generally ones that are for sale (as opposed to unregistered). I recommend browsing through the following websites to get more ideas. You might get lucky and find something you like just by browsing. If you do, add those to your list as well.

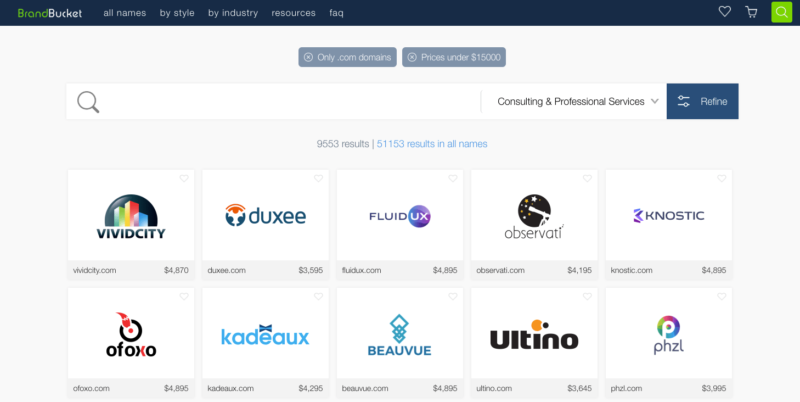

BrandBucket — They put together more creative, brandable domain names and then sell them. I’ve found a lot of names here that I would not have thought of on my own.

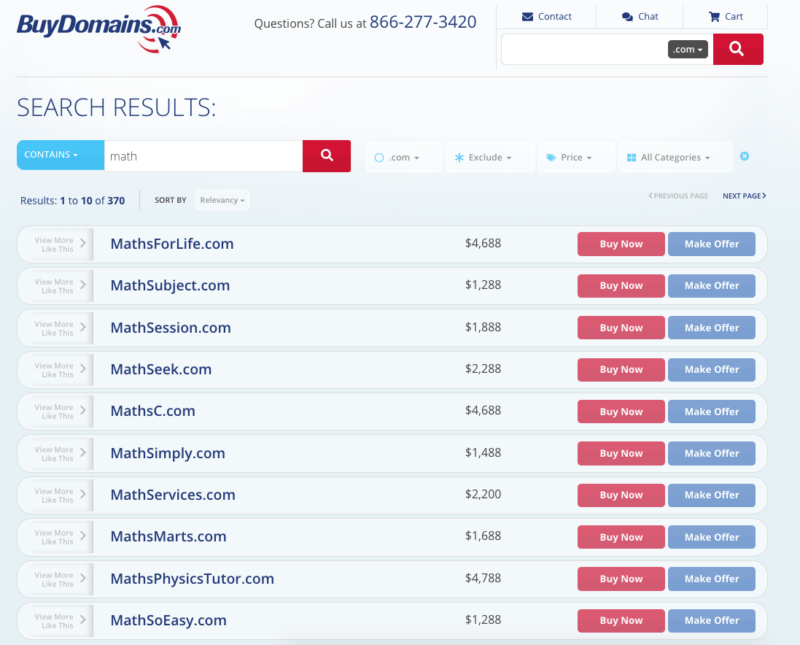

BuyDomains.com — They have a huge selection of domain names for sale. They have transparent pricing and offer a seamless experience. This is always my starting point, and preferred approach to acquiring a domain name.

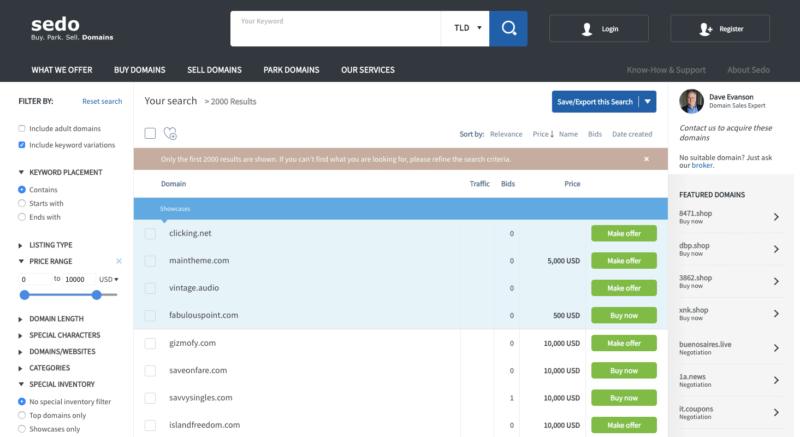

Sedo.com — Probably the biggest selection of domain names and the most well known place to acquire a name.

BuyDomains.com and Uniregistry are the biggest players in selling domains. More times than not, if a domain name is for sale when I type it into my browser, it is one of those two companies that is behind the sale. I find them to be the most reasonable. HugeDomains.com is another one that I have bought from.

Once you have the narrowed down list. The next step is to dig even deeper to determine what your final options will be.

Choose Your Name

You’re ready to go through the process of choosing your domain name.

Some high level rules:

- Don’t worry about SEO or keywords. That doesn’t matter.

- Avoid hyphens.

- Stick with a .com only. If you are in the UK, Australia, etc. then of course a .co.uk, .au, etc. is also good.

- The shorter the better, generally speaking.

Quick checklist for your domain name options

- Do you feel good about the name? Do you like it? Are you confident when you say it? Does it feel good when you write it down? When you read it?

- Is it brandable? Is it unique, easy to remember and meaningful? Is it easy to read and spell?

- Does it pass the google test? Google the name. Ideally there are not any other organizations that pop up. If there are, you at least want to make sure they are not in the same industry, or even in a closely related industry.

- If it passes the Google test, you are probably good to go, but just in case, you also want to check for trademarks.

A Note on Social Handles

In a perfect world, you’d pick a domain name whose social handles are also available. This isn’t a perfect world. My take on this is that it’s hard enough to get a good domain name. Don’t make it even harder or nearly impossible by also adding this criteria. When it comes to picking up the social handles, you’ll have options. You can get creative, or even potentially acquire the handles from the current owners.

It’s a good idea to consider social handles when making your final decision, but don’t let that alone stop you from picking the right name.

The Starter Domain Approach

An approach that I am a fan of is to use the starter domain approach. The idea here, is that you can start with a domain name with the intention to move to another one down the road.

Let’s say you identify a domain name that you really like, but it is out of range for your budget. For example, when I was coming up with a name for my latest company, I really liked GoodLife.com. Someone else owns it, and isn’t necessarily looking to sell it. If I wanted to buy it, I would have to offer a lot of money — a lot more than I was ready to pay. If I wanted to take the starter domain approach, I could have gone with the name Good Life Media, and acquired GoodLifeMedia.com which is for sale for $24,500. (That price must have gone up, because it wasn’t that high when I was actually considering this as an option.)

Anyway, I could start with GoodLifeMedia.com and eventually try to acquire GoodLife.com. It would be very easy to rebrand from Good Life Media, to Good Life. Internally, we would just go by “Good Life.” The day that we eventually acquire GoodLife.com would be a huge milestone and would create a built-in company goal that we could go after as a team.

If you want a real life example, The Wirecutter just recently rebranded to WireCutter.

Considerations for the starter domain approach

- Make sure it will translate cleanly. The two names have to be very closely related, and you could ideally even use the desired name everywhere outside of the actual domain name, including in your logo.

- Remember that there is no guarantee your desired target domain name will be there when you are ready.

- I recommend getting into discussions with the broker or domain owner of your desired name as soon as possible. Even if you know there isn’t any chance you can afford it today. They don’t need to know that. This is actually a huge advantage for you, because it is common that over time the owner will drop the price as they realize their high price isn’t going to happen.

Acquire And/Or Register Your Domain Name

At this point you should have a narrowed down list of viable options for your domain name. The next step is to own it.

Each of your options should fall into one of three categories.

- The domain name is available and unregistered.

- The domain name seems to be acquirable, but it is not clear.

- The domain name is clearly for sale.

What to Do If the Domain Name is Unregistered

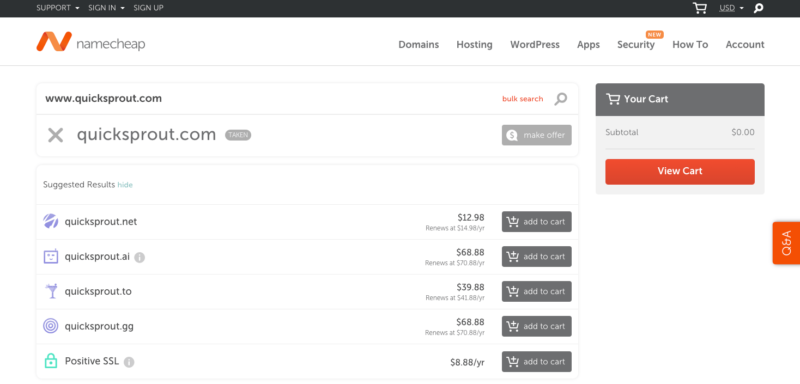

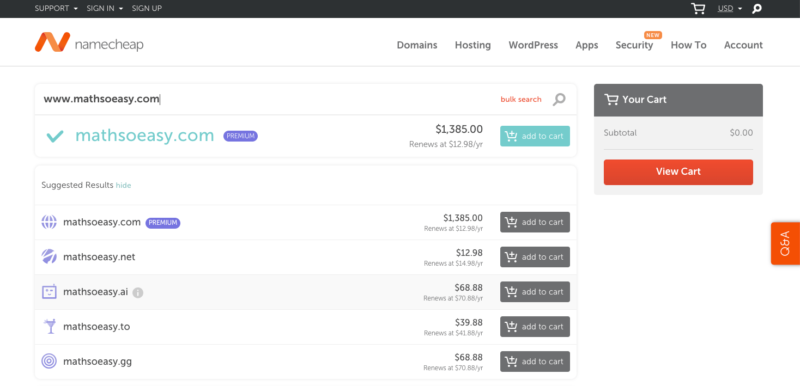

In this case, all you need to do is go to NameCheap and register the domain name. You’ll find out for sure if that is an option or not once you type it into the search bar on NameCheap.

Our domain isn’t for sale…

But www.mathsoeasy.com is for sale — for less than $1,500.

You’ll go through a straightforward process here. Don’t buy any of the add ons or worry about web hosting or any of that yet. You want to use NameCheap to simply register your domain name. That’s it. They are the best domain registrar, and I use them exclusively. I do not use them for anything else, because there are other companies that I use for the rest of my web needs.

After you finish registering the domain name, that’s it. You are officially the proud owner of your new domain name. All you have to do moving forward, is be sure to renew the domain name each year. If you fail to renew it, then someone else will be able to replace you as the owner.

What to Do If the Domain Name Seems Acquirable

If the domain name seems acquirable, but it isn’t clear — you have two options. Either you can try to figure out who owns the domain name yourself and reach out to them. Or, you can hire a broker to do it for you.

If you hire a domain broker, there isn’t much risk. Typically, the only way you will have to pay a fee is if you buy the domain name. The downside is that you do have to pay a fee if you buy the domain name.

Sedo is a good place to start if you want to hire a domain broker.

In the case of doing it yourself, you can start with a WHOIS search to try to figure out who owns the domain name. Googling the domain name and seeing if it is tied to any social media profiles or other websites is also a good approach.

More times than not, I will fail at finding out who owns the domain name myself. It is common for people to use privacy features that hide their contact information. Most domain registrars offer this for free, so people tend to do it by default.

The benefit of a domain broker is that they have a huge network. They almost always know who owns what, and if they don’t, they have ways of figuring it out. Back to my GoodLife.com example. There is no way I ever would have figured out who owns that domain name if I didn’t have a broker to figure it out for me. Of course, I still do not know who owns that domain name, but at least I have a broker who does.

Another benefit of a broker is that you do not have to deal with the awkwardness of negotiating price. You have a middle man who can be the bad guy for you.

What to Do If the Domain Name Is Clearly for Sale

Domain names that might be acquirable, as outlined above, can be challenging. I much prefer to focus on names that are clearly for sale. These are easy.

If the name is already for sale, then the process is straightforward. The only thing you really need to think about is negotiating price.

Negotiating Price

There is often opportunity to negotiate price. Depending on who you are dealing with, there could be some room to get the price down.

I don’t recommend pushing too hard or overthinking this. That might just lead to wasting time and potentially losing out on the name. However, there is no harm in giving it a shot and doing some level of negotiating.

After The Acquisition

Once you acquire the domain name, the next step is to transfer to your domain registrar. Again, I recommend NameCheap. You can see the process for transferring your domain name here. It also helps to understand how domains work.

Regardless of how you acquire your domain name, the final step is to see it sitting inside of your NameCheap account. That is when it’s official!

Source Quick Sprout https://ift.tt/2QS0mv5

Looking Up the Ladder: A Different Perspective on Spending

A few years ago, I wrote an article entitled Looking Down the Ladder: A Different Perspective on Spending. The article covered the idea of a spending ladder, and I’m going to quote the explanation of a spending ladder here:

One idea that really stuck with me, though, was his idea that one’s preferred level of spending constitutes a rung on a ladder. The idea of a “spending ladder” is easier shown by example than by explaining it, so let’s hop right to an example.

One might look at the money one spends on housing through this type of ladder, where housing options are listed by monthly cost:

– A mansion

– An above average house in an expensive neighborhood

– An average house in an expensive neighborhood

– A below average house in an expensive neighborhood

– A very high end apartment

– An above average house in an average neighborhood

– An average house in an average neighborhood

– A high end apartment

– A below average house in an average neighborhood

– An above average house in an inexpensive neighborhood

– A below average apartment

– An average house in an inexpensive neighborhood

– A below average house in an inexpensive neighborhood

– A rented trailer

– A small hardbody camper

– A popup camper

– A tent

– A car

– Couchsurfing

– Sleeping under the stars

You can add many, many more rungs to this with options like condos and townhouses, and they might vary a little depending on the area you’re in and other factors, but this should make the idea clear.

When a person looks at a ladder like this and identifies which rung they’re on, several thoughts might run through their head.

A person might look at higher rungs on that list with envy. Some may wish they had a nicer or bigger house in a nicer area and thus, when they see this list, they feel envy because of all of those options out there that they don’t have.

A person might look at lower rungs on that list with relief and, perhaps, pride. A person might feel relieved that they have the housing that they have and that they don’t have to “settle” for less housing. […]

Instead, when I look at this kind of “ladder,” I look for the lowest rung that meets my needs. Then, I ask myself why I’m not at that rung. If I am at that rung, great. If not, why not?

So, let’s look back at that list of housing options. I’d probably describe our house as a slightly below average house in an average neighborhood. There are definitely neighborhoods with smaller and older homes in our area and neighborhoods with much bigger and nicer homes.

As I noted at the end of the quote, I tend to look at the lowest rung that meets my needs and, if I’m not at that rung, I ask myself why I’m not.

So, for me personally, I would want some sort of permanent shelter over my head. I’d probably consider a car or a tent to be the lowest rung that meets my needs. This isn’t as strange as it might seem – after all, a Major League Baseball pitcher lived in his own car for years by choice. It met his needs and, for me personally, it would meet my needs.

- Read more: The Daniel Norris Code for Success

Yet, I’m not living in a tent. There are many rungs between where I actually live and where I could theoretically do so.

Why is that gap there? If I would be okay living in a much simpler place, why do I have a pretty average house in an average neighborhood?

I find that answering that question seriously – and answering virtually the same question about any other spending ladder in my life where I’m currently sitting at a higher rung than I actually need to be – digs up some interesting and difficult things to think about in my life.

I strongly invite you to do this exercise on your own. Look at that housing ladder I shared earlier in this post. Figure out exactly where you are on it. Then, figure out which is the absolute minimum option that would meet your needs. Why are they not the same?

For myself, I can make a list of reasons that explains that gap. Some of them are sensible and justifiable, other ones really aren’t. Let’s dig through some of my reasons.

I have a wife and children and that requires more living space. I suppose it would be possible to live in a large tent, but living in a vehicle would be incredibly difficult.

I live in a climate with very cold winters and family concerns make moving unlikely. Sarah and I live in central Iowa. We are within driving distance of both of our extended families. Sarah has a steady job in this area that requires physical presence. So, for the time being, we’re staying here in central Iowa. The climate here basically requires a warm living environment, so that nudges me out of the tent range at least to a hardbody camper or trailer.

Owning a decent home is an investment, as that home is likely to appreciate over time. The options close to the bottom of the ladder are going to depreciate in value, while the home I live in is going to appreciate in value even after maintenance costs.

Those are sensible reasons. Now, for some less sensible ones.

I have a lot of stuff, way more than I actually need. Storing that stuff takes space. If I had less stuff – and the same is true for the other people in my family – then I wouldn’t have a reason to have as much space as I do. It’s not as if we have a giant home, either – it’s less than 2,000 square feet. I simply realize that I had a pretty fulfilling life back in the late ’90s when I was able to live out of my backpack and a small plastic tub for a couple of years.

I enjoy having people over to my house and have room for many people to congregate. It would be prohibitively difficult to entertain and host people in a smaller home. It sometimes stretches even our current home to host the type of events I want to host.

I take a sense of indescribable personal pride in being a homeowner. When I think about that feeling rationally, it doesn’t make a whole lot of sense, but that feeling is still there. I think that some of it comes from the sense of pride my parents had in being homeowners.

I feel safer in my home than I ever did in an apartment, so I associate “safety” with a decent sized home. The real reason for this is that we chose an area to move to that was extremely low in terms of crime rates, which we wanted so that our children could play and explore some personal freedom without a strong threat of crime. After living here for a while, it feels safe, a feeling I now value and one I associate with owning a home. Of course, there are apartments within a few blocks of us, so it’s not necessarily a rational feeling.

I want my children to have their own bedrooms. For most of the time growing up, I didn’t have my own room. I shared a room with one of my brothers throughout most of my childhood, and sometimes I slept on the living room couch. One thing I really always wanted when I was little was a room of my own, which I did finally have when I was just a few years from moving out. I’m fully aware that I’m transferring those feelings onto my kids.

Those aren’t particularly rational reasons for owning a larger home than we need. They don’t move me toward my goals in life, and any sort of careful reflection shows those thoughts to be nonsensical, yet I’m not really considering moving, either.

I can repeat this exact experiment with almost any “spending ladder” I might decide to look at. Let’s look at transportation, for example. A “spending ladder” for transportation might look something like this:

– A private jet

– A high end new car

– A mid range new car

– A high end late model used car

– An entry level new car

– A mid range late model used car

– A high end old car

– An entry level late model used car

– A mid range old car

– An entry level old car

– A mass transit pass

– A bicycle

– A pair of shoes

– Bare feet

Again, there are definitely more rungs that could be added in each of these gaps, but it gives you an idea of what we’re working with.

On this ladder, I’d probably put us currently either an entry level or a mid range late model used car. Given where we live, an entry level old car would be the absolute floor for us; to go lower than that would likely require our family to move to the nearest large city with a metro system (Des Moines, in other words).

So, why is there a gap between what we could own (an entry level old car) and what we do own (a mid range late model used car)? Again, there are a lot of reasons, some sensible and some not so sensible. Here are a few.

I want a certain level of reliability, as getting to my destination on time virtually every time is of very high importance to me. I generally don’t want to own a car from a low reliability brand if I can avoid it. Also, in general, the older a car is, the less reliable it is.

I want a certain level of safety, as keeping my family safe while riding is of very high importance to me. I generally want to feel very confident in the safety of the car I’m driving, so I tend to prefer cars with strong safety records. Again, in general, the older a car is, the less safe it is.

There are a handful of comfort features that I really, really like in a car, though most other features don’t matter to me. For example, I like a decent audio system that can be adjusted so that the volume is different on different sides of the car. I like seats that can be widely adjusted, more so than is often found in entry level cars (my wife and I have more than a foot in difference in height). Those aren’t strictly needs, but they’re important to me, and they tend to add to the cost of the car.

Significant rust on a car makes me very worried that it’s about to become unsafe or unreliable. This isn’t exactly a rational viewpoint, as visible rust usually has little to do with what’s going on under the hood or inside the frame, but it leads me to feeling that the car is unreliable and less safe.

Again, as with my reasons for the housing ladder, there are some concerns that are very reasonable and there are some that are not. If I actually dig into why I would choose something higher up the ladder than what I actually need and I start listing out the reasons, I often start coming up with things that are more about personal feelings than objective reasoning.

Digging into those feeling-oriented reasons for doing something is really worthwhile, as it can help a person to let go of some of the less objective reasons for spending money, not just on the matter at hand, but on other things, too. This thought process alone has opened me up to a desire to really learn more about the effects of rust, to consider what features I really need in a car, to take a more sober look at my possessions, to consider how much “homeowner pride” is really worth to me, and to consider how much being able to host social gatherings is really worth to me. Those are great things to think about because they can help me figure out what’s sensible in terms of my spending and what isn’t, and doing this kind of thinking regarding many of my “spending ladders” is really useful in terms of exposing my less sensible spending motivations.

Furthermore, I’ve come to realize through looking at things through the lens of a “ladder” that it is much easier for me, and for most people (I believe), to look up the ladder than down it. Whenever we go down to a lower rung of a particular spending ladder, it usually feels like a loss, even if the reasons for doing so are completely rational and sensible. For example, if I were to choose to move into a smaller home right now, it would feel like I’m somehow losing something, even though I might have every reason to do so in terms of my broader life ambitions.

I think, as a frugal person, I’ve been much more successful at quashing my internal desire to look up the ladder and consider upgrading than I’ve been at nudging myself to look down the ladder and consider downgrading. I’ve been able to recognize my own desire to look up the ladder and I’ve been able to convince myself that most upgrades aren’t particularly useful in terms of my overall life goals and that I need to make a very strong case when upgrading.

So, what grand lessons can I really learn from all of this?

When I’m making a purchase I’m unsure about, I should absolutely aim for the lowest end possible. I should look for that item used. I should try to borrow that item. I should look for the store brand version. If I have no idea what I’m buying, I should trust the “bang for the buck” recommendations from trusted sources like Consumer Reports rather than their top recommendation.

I should keep on the same path when it comes to being able to resist looking up the ladder. I already have a very strong resistance to moving up the spending ladder on virtually everything, and that has guided me very well when it comes to saving money and keeping on track with my financial goals. I need to stick with that, because it works.

If I find myself almost compulsively drawn to a higher rung on the ladder than what makes sense at first glance, I need to back off and figure out why I’m making that choice. In both of the examples above, I explained why I felt that a certain rung was my “bottom rung,” yet when it came around to the actual spending decision, I aimed for a higher rung. Why did I do that? Digging into that question is a really worthwhile endeavor if you truly want to cut back on your spending.

I really encourage you to give this idea some thought in your own life. What’s the “bottom rung” for you on those ladders above, in terms of the minimum you actually need? What rung are you actually on? Then, most important of all, why does that gap exist? Figuring that out is really worthwhile.

Good luck.

The post Looking Up the Ladder: A Different Perspective on Spending appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2C9G0oR